Do you know how to find grants for small business startup? There are a number of grant programs out there for those wanting to start a business. Even those already operating but still in the startup phase can benefit. However, grants for small business startup are highly competitive. Funds are often limited. It’s rare to get enough from a grant to fund an entire startup without needing other options.

There are Grants for Small Business Startup, But You Need More

What are options other than grants that offer free money? I mean, that’s the best thing about a grant. You do not have to pay the money back. Also, bad credit doesn’t matter when it comes to grants. There are not a lot of other options that great. However, there are a few.

Why Use Grants for Small Business Startup

The truth is, grants for small business startup are rarely enough. You are going to need more funding. That said, you definitely should apply for any grants you might qualify to get. Just be careful. Be sure you meet the eligibility requirements before you begin the application process.

The process of applying for grants can be tedious and lengthy. That isn’t always the case, of course, but you don’t want to spend a lot of time on something you have no chance of getting. By being intentional and finding the opportunities you can actually take advantage of, you increase your chances of approval and decrease your chances of wasting time.

Any amount you receive, even if it is a few hundred dollars, can help reduce the amount of debt you have to take on. Also, winning a grant can help your business look more viable to lenders.

So, which grants do you qualify for? It depends. Many grants are designed specifically for a certain type of business or business owner. Some are not. Here are a few possibilities to help get you started, along with some resources to do your own research.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

Grants for Small Business Startup: Available for All

There are grants options that can work well for anyone.

FedEx Small Business Grant

This grant is the company’s way of working to strengthen small business innovation. There are 10 grants the company awards each year. They range from $15,000 to $50,000, and if you’re a minority owned business with a cutting-edge product, this could be the grant for you.

A business must use the FedEx website to submit entries. There are a few questions to answer about your business. In addition, there is a requirement for an elevator pitch about what makes your business special. Also, you have to explain how you would use the grant funds. A 90 second video submission is optional.

NASE Growth Grants

The National Association for the Self-Employed (NASE) has small business Growth Grants of up to $4,000. They are for micro-businesses, and proceeds can be used for a number of things. They can be utilized for marketing, advertising, expansion, and even to hire employees. These grants are open to everyone. However, you do have to be an NASE member to apply. Membership fees vary based on the membership level chosen.

USDA Value Added Producer Grant

The USDA’s Value-Added Producer Grant (VAPG) program offers grants for small businesses. It includes minority owned business. Grants range up to $250,000. They are specifically to help agricultural producers with activities that add value to their products. As a result, grants are open to those in rural areas. They must be operating as one of the following:

- Cooperative

- Farmer

- Rancher

- an independent agricultural producer

- or an agricultural producer group

Grants for Small Business Startup: Minority Business Owners

Here are some minority grant options to consider. There are certainly others out there. However, they are not always well advertised. This means you need to be sure to do your own research.

First Nations Development Institute Grants

The mission of this group is to offer grants that help Alaska Natives, Native Hawaiians, and Native Americans. They offer assistance in the application process in addition to funds.

Not only that, but there are a wide range of opportunities from the First Nations Development Institute. New ones initiate as old ones retire. There is a mailing list you can join to receive information about new opportunities as they become available.

National Black MBA Association Scale-Up Pitch Challenge

Also known as NBMBAA, the Scale-Up Pitch Challenge has cash prizes ranging from $1,000 to $50,000. The associate states its purpose is to help newer businesses that have an African founder that maintains equal ownership.

A business must be a member of the NBMBAA to compete. There is a $10 monthly membership fee. After that, there is an online application. If chosen, you must submit a three-minute pitch. Then, finalists go on to compete at the NBMBAA annual conference.

Grants for Women Business Owners

For female business owners, there are several grant opportunities. These are just a few.

Eileen Fisher Women Owned Business Grants

The clothing brand Eileen Fisher awards $100,000 per year to 10 women-owned businesses. To qualify, a woman must have at least 51% ownership, and the business must be in operation for at least three years. Also, it must bring in less than $1 million per year in revenue and have a focus on environmental or social change.

Amber Grant

The Amber Grant awards $500 to $1,000 per month to a woman-owned business. One of the recipients also receives an additional $10,000 grant at the end of the year. Applicants only need to tell their story and turn it in with a $15 application fee.

#GIRLBOSS Foundation Grant

Specifically for woman-owned businesses in fashion, music, and art, the #GIRLBOSS small business grant awards $15,000. They also offer exposure via the Girlboss website and social media platforms. Judges rate those applying on creativity, business savvy, planning, innovation in the field, need, and where they plan to work.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

Cartier Women’s Initiative Award

The Cartier Women’s Initiative Award is $100,000 for first place and $30,000 for second place. They award the grant to 18 female business owners from around the world each year. Women business owners who are just getting started may qualify. Look over the complete application for more information.

All of the finalists get to attend the INSEAD Social Entrepreneurship 6-Day Executive Program (ISEP). They will also have the opportunity to participate in workshops on entrepreneurship and business coaching seminars, as well as be exposed to networking opportunities.

Grants for Small Business Startup: Other Grant Resources

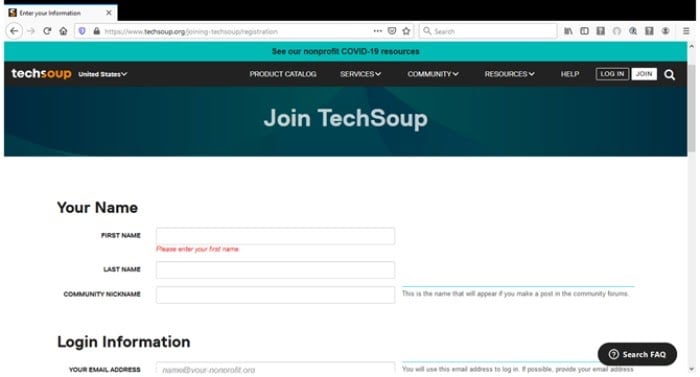

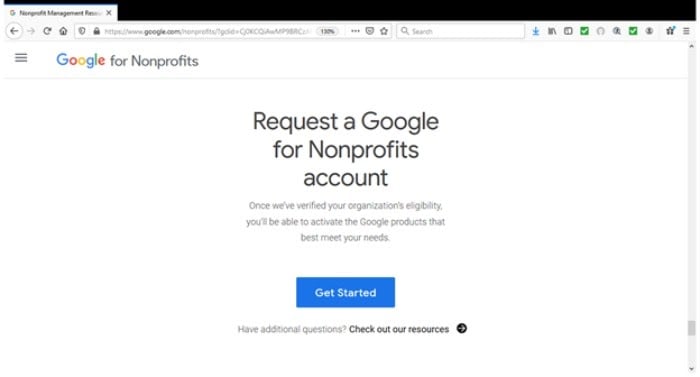

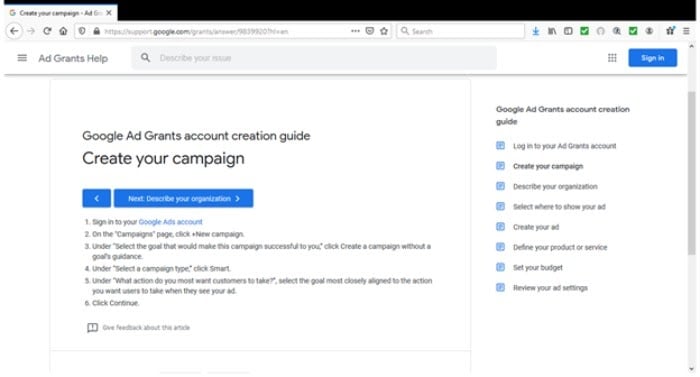

Of course, new grant opportunities open all the time. During the COVID-19 pandemic, many local agencies have stepped up to help small businesses, including offering grant opportunities. Sometimes, more funding becomes available allowing for new grants to open. Here are some resources to help you find more grants for small business startup.

Other Debt Free Options

Of course, debt free is best, so you are probably wondering if there are other options, besides grants for small business startup, that will help you fund your business debt-free. Yes, there are. However, much like grants, they are a long shot and do not always fund your business completely.

The two main options you have are crowdfunding for startups and angel investors. Crowdfunding basically involves convincing several micro-investors to fund your business a few dollars at the time. If you have a successful crowdfunding campaign it can be very effective. Also, it’s not as easy as it sounds.

Angel investors are not a new idea. If you can find one, you are golden. These are just one or two, or a small group, of investors that invest large sums. They usually do so in return for equity in your business, meaning they want some of the future profits. That means it’s not totally free money, but it is money for your business that you can get without being tied down by debt. Anyone can be an angel investor, even your mom!

An Awesome Non-Grant Option

Now, the truth is, it is virtually impossible to start a business debt-free. Financing in some form is almost always necessary. What you need is the most effective and flexible option for financing with the lowest interest rates.

If you have top notch personal credit, that is probably going to be a traditional business loan. However, many capable business owners do not have the personal credit score necessary. Not only that, but you don’t want your personal credit to bear the brunt of your business debt. You need business credit as well. There is a debt option that you can access with a lower personal credit score than what is required by traditional lenders. Furthermore, it will help you build business credit at the same time.

Credit Line Hybrid

A credit line hybrid is essentially an unsecured line of credit. It allows you to fund your business without putting up collateral, and you only pay back what you use. The funds can be used for many things, including startup costs.

It’s super easy to qualify. You need a personal credit score of at least 680, which is lower than what is required by many banks. Additionally, you can’t have any liens, judgments, bankruptcies or late payments. Also, in the past 6 months you should have less than 4 credit inquiries. You should have less than a 45% balance on all business and personal credit cards as well. It’s also preferred that you have established business credit in addition to personal credit.

Here is the beauty of it. If you do not meet all of the requirements, it’s okay. You can take on a credit partner that meets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding.

Benefits to Using a Credit Line Hybrid with Grants for Small Business Startup

There are many benefits to using a credit line hybrid. First, it is unsecured, meaning you do not have to have any collateral to put up. Next, this is no-doc funding. That means you do not have to provide any bank statements or financials.

In addition, typical approval is up to 5x that of the highest credit limit on the personal credit report. Often, you can get interest rates as low as 0% for the first few months. This allows you to put that savings back into your business.

With the approval for multiple credit cards, competition is created. This makes it easier to get interest rates lowered and limits raised every few months. The process is generally quick, especially with a qualified expert to walk you through it. Also, you can build fast business credit because some of the accounts involved report to the business credit reporting agencies.

SBA Loans

While federal grant money is preferred, other types of federal funding are available. This is another option for startup funding when grants for small business startup are not enough. The Small Business Administration offers federally guaranteed loan programs that can help fund a business at any stage. The applications are processed and funds disbursed through traditional lenders. However, the requirements are easier for many businesses to meet. This is because of the government guarantee that they have.

You can find a lender that offers SBA loan programs using the lender match tool. Here are just a few of the programs they offer. Which one may be right for your business will depend on a number of variables.

7(a) Loans

The minimum credit score to qualify for this one is 680, just like the credit line hybrid. There is a down payment requirement of at least 10% if you are using the funds for the purchase of a business, commercial real estate, or equipment. The minimum time in business is 2 years, but if you are a startup, business experience equivalent to two years will fill the requirement.

504 Loans

Funds from 504 loans can buy machinery, facilities, or land. Generally, these are used for expansion. They work especially well for commercial real estate purchases.

They require a minimum credit score of 680 as well, and they are collateralized by the asset being financed. There is also a down payment requirement of 10%, which can increase to 15% for a new business.

There is also a requirement you be in business at least 2 years, or that management has equivalent experience if the business is a startup.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

Microloans

These loans work well for starting a business, purchasing equipment, buying inventory, or for working capital. Community based non-profits administer microloan programs as intermediaries, with financing coming directly from the Small Business Administration.

The minimum credit score is 640, and the collateral and down payment requirements vary by lender.

The thing to remember about all loans and lenders, including those related to the Small Business Administration, is that details such as interest rates, terms, and eligibility requirements can change frequently. Be sure to check with individual lenders for the more up-to-date information.

Grants for Small Business Startup: Are They Worth the Time and Energy?

If you find one for which you meet all the eligibility requirements, yes, absolutely it is worth it. Any amount you get that reduces the amount of debt you need to fund your business is worth it. That said, remember it is unlikely you will get out of having to use financing at all. So, be sure to find the type of financing that will work best for you. The credit line hybrid will work for almost anyone, and has many benefits, including helping to build business credit!

The post Grants for Small Business Startup: Will It Be Enough? appeared first on Credit Suite.