Three people were injured in a shooting in the parking lot of Six Flags Great America in Gurnee, Illinois, Sunday night. A spokesperson for the amusement park confirmed to Fox news Digital that shots were fired from a single car in the parking lot that immediately drove off. Two people were taken to an area … Continue reading Six Flags Great America shooting: 3 injured in parking lot of Illinois amusement park

Tag: Great

Ashby (YC W19) hiring Europe Product Eng in low-meeting, great devex culture

Article URL: https://www.ashbyhq.com/careers?utm_source=hn&ashby_jid=7dcbfb52-f465-46b2-adbb-b6caccafbe0a

Comments URL: https://news.ycombinator.com/item?id=32408595

Points: 1

# Comments: 0

'A great future awaits': Meet the player who could shake up the WNBA draft

Sika Kone is only 19, but she has prospered in Spain and excelled on the world stage since leaving Mali.

The post 'A great future awaits': Meet the player who could shake up the WNBA draft appeared first on Buy It At A Bargain – Deals And Reviews.

Great Question (YC W21) Is Hiring Full-Stack and Backend Engineers (Rails)

Article URL: https://www.ycombinator.com/companies/great-question/jobs/AokShrj-full-stack-engineer Comments URL: https://news.ycombinator.com/item?id=29819615 Points: 1 # Comments: 0 The post Great Question (YC W21) Is Hiring Full-Stack and Backend Engineers (Rails) first appeared on Online Web Store Site.

Great Question (YC W21) Is Hiring Full-Stack and Backend Engineers (Rails)

Article URL: https://www.ycombinator.com/companies/great-question/jobs/AokShrj-full-stack-engineer Comments URL: https://news.ycombinator.com/item?id=29819615 Points: 1 # Comments: 0

Why Hamilton vs. Verstappen has been one of F1's all-time great rivalries

Lewis Hamilton and Max Verstappen’s title fight has been incredible. Ahead of their winner-takes-all showdown, here’s all the reasons why the stars aligned for an epic battle this year.

The post Why Hamilton vs. Verstappen has been one of F1's all-time great rivalries appeared first on Buy It At A Bargain – Deals And Reviews.

The Great Resignation, Business Credit and Financing, and You

The Great Resignation: a Definition and an Explanation

Everywhere you look in the news, it seems to be there. It’s on TV and social media, and your friends may be talking about it. It’s the Great Resignation. It has caused people to start businesses and has disrupted our economy.

But…what is it?

The Great Resignation is the confluence of several different events, all happening at the same time. People are leaving their jobs in droves. As in, 20 million US workers between April and August of 2021.

Causes of the Great Resignation

The Pandemic

First is of course the pandemic. The sudden removal of over 700,000 Americans from our society was bound to create problems. A little under 190,000 of these deaths were among people aged 18 – 65. Even if not everyone could work, that leaves at least 150,000 people out of the workforce, due to dying from Covid-19.

This doesn’t account for those with ‘long Covid’. In the UK (US percentages should be similar), the percentage of people of working age to get long Covid runs about 1 – 2%. Over 48.5 million cases in the US translates to about half a million people of working age with long Covid in the US. Some of them may be considered disabled or have taken early retirement.

As a result, there are job openings.

But what about everyone and everything else pertaining to the Great Resignation?

Depressed Wages

Since the 1970s, wages have been depressed in the US, often not keeping up with inflation. This is particularly true in the service industry.

In contrast, during the worst of the lockdowns, the only employees who could not work from home were in the service industry.

There are some employers who have realized they can’t hire enough people back until they raise wages and improve perks (which is likely to be fueling inflation). Others don’t seem to have gotten the memo yet. Hence there are workers who would have taken those jobs not two years ago. But now? With an ever-present concern about Covid-19 and perhaps a feeling that wage hikes are only temporary, those jobs are going unfilled.

Politics, Ill Treatment, and Being Fed Up

As the disease, vaccines, and mask wearing all became more politicized, businesses were forced to police mask usage in their stores. This policing often fell to the lowest paid workers, in jobs like cashiers. With irate, sometimes violent customers, many workers felt they were being asked to put their own personal safety on the line. But with no added compensation.

In the medical field, there has been a nursing shortage for years, and it is projected to continue into 2030. With hospitals overloaded with Covid patients, anti-vax patients denying their symptoms, and again the threat of violence, many nurses have decided to throw in the towel. This has made the nursing shortage worse, and it has also affected Covid care.

Trillions of Dollars in Aid Programs

The prior and current presidents introduced programs like stimulus checks. This was with the best of intentions. They have led to many in the middle class beefing up their savings. Another big use for these checks has been paying down personal debt. This is from credit cards, car loans, and/or mortgages.

People with some discretionary money may end up being more choosy about employment. Not being desperate provides an opportunity to strive for longer term goals and more money.

Gen X and Younger Boomers Lead the Way in the Great Resignation

Surprised? It seems like quitting your job is a very millennial thing to do. Yet the Harvard Business Review said, “Employees between 30 and 45 years old have had the greatest increase in resignation rates, with an average increase of more than 20% between 2020 and 2021.” Employees with some work experience under their belts are more likely to be part of the Great Resignation.

But What Does The Great Resignation Have to do With Business Financing and Business Credit?

Quitting your job or being laid off can sustain you for just so long. For many Americans, time off and the ready availability of accessible technology led them to start a new business. A good 4.4 million new businesses were started in 2020, and half a million new businesses in January 2021 alone.

As these new businesses have aged, stimulus money has dried up, and the boost in savings is gone for their owners. These business owners—and you may be among them—have been looking for new ways to get money.

And if they (or you) have turned to banks, then there’s a good chance that they’ve gotten a denial.

New business owners are less likely to know about business credit, and how it can get them funding. And they may not be aware of the many alternatives to traditional lending that are out there. Because banks aren’t the only places to get business money.

Business Credit and the Great Resignation

Business credit is credit in the name of a business. It attaches to the business’s EIN (Employer Identification Number), not the owner’s Social Security Number. As a result, business credit relies on the ability of the business to pay its bills—period. A business owner can have poor personal credit yet have excellent business credit.

Building business credit is a great way to transition from bootstrapping to getting a company to fund itself.

Fundability

Fundability is the ability of a business to get funding. Building business credit starts with building what’s called a fundable foundation. Your business can look legit to credit providers and lenders—or not so legitimate. There are proactive steps you can take to improve fundability, even if you haven’t done these before.

Start to Build a Fundable Foundation (Your Business Name, NAICS and SIC Codes, and Your Business Entity)

Fundability starts with your business name. If your business name includes the name of a high-risk industry, this could tank any funding application from the start. Frank’s Gas Station can instead be called Frank’s.

NAICS and SIC codes exist to show lenders, credit providers, and the IRS how risky your business is. If your business can fit under more than one NAICS code, then pick the one which is less risky. There’s nothing unusual or underhanded about this.

Your business entity is sole proprietorship, partnership, corporation, and the like. To build business credit right, incorporate your business. This is because incorporating creates an entity separate from you, the owner. It adds a layer of protection over your personal assets when it comes to corporate debts and corporate wrongdoing. Plus, to build credit in the name of your business, it won’t separate from your own credit history if you and your business are still joined at the hip.

Enhance Fundability With an Excellent Online Presence (Your Website and Email Address)

Lenders and credit providers will look for information on your business online. With your own website, you can control a lot of the narrative. Without one, you’re at the mercy of whatever they can Google—which may not be too flattering.

Putting some of your earlier profits into a website is a smart business decision. It does more than improve fundability. It also makes your business more attractive to customers and prospects.

Purchasing your own domain name is the highest standard for fundability. Very often hosting providers will kick in a free email address on the same domain. Keep it professional with a name like info@yourbusinessname.com.

Grow Fundability With a Professional Offline Presence (Your Business Address and Phone Number)

Business lenders and credit providers also pay attention to your offline presence. Your business address needs to be a brick and mortar building where mail can be delivered—so a PO box or a UPS box is out. Technically, it can still be your home. But you may want to get a virtual address for job interviews or meetings. And if you are a retail business, you are going to need a separate address.

Your business phone number needs to be different from your personal phone number. This is because the listing for your personal phone number is you or your family. A separate, dedicated phone number is far more fundable. And it prevents your family from accidentally picking up on sales calls.

Protect Fundability By Following the Rules (Your Business Licenses and Getting a D-U-N-S Number)

Many industries require some form of licensing. Make sure you have all the licenses your business needs by checking with your Secretary of State. Being fully licensed can also be a way to assure customers and prospects.

Many industries require some form of licensing. Make sure you have all the licenses your business needs by checking with your Secretary of State. Being fully licensed can also be a way to assure customers and prospects.

D-U-N-S numbers are the way your business is identified in the system of the world’s largest business credit bureau, Dun & Bradstreet. D&B will give you a D-U-N-S number for free once you sign up for one on their website. You need a D-U-N-S to start to build business credit.

Go to the Next Level of Fundability (Get a Separate Business Bank Account and Get Set Up With the Business Credit Reporting Agencies)

A separate business bank account helps keep you from commingling funds. This increases the chances that your business is in compliance with all IRS requirements. You also need a separate business bank account to open a merchant account. A merchant account allows your business to take credit cards. Study upon study has shown that people spend more if they can pay by credit card.

You also need to get set up with the business credit reporting agencies. If you have your D-U-N-S already, then you’re set up with Dun & Bradstreet. Check the Experian and Equifax websites for a listing for your business.

Building Business Credit

Business credit building means buying on credit from vendors. Pay your bills on time and have the payments report to the business credit bureaus. Almost no vendors report positive payment experiences. So, it pays to work with a business credit specialist like Credit Suite.

If you are part of the Great Resignation and have a new business, business credit makes your business more attractive to funding sources.

Business Financing and the Great Resignation

Banks are not the only place to get business financing. When you are getting money for your business, you must leverage one or more of the following:

- Personal credit

- Collateral

- Cash flow

- Your time and attention

- Equity in your business

- Or business credit

Personal Credit

Your personal credit scores are dependent upon a few factors. One is credit utilization, which is the amount of credit in use divided by total available credit. Once this percentage gets high (above 30%), it starts to harm your personal credit score.

Business needs tend to be more expensive than personal needs. Business credit limits reflect that. Hence you can exceed that 30% fast by financing your business with personal credit. You might even max out your personal credit cards.

Collateral

Another way to get business financing is by leveraging collateral. For real estate transactions, that can be land. For equipment financing, it can be the equipment. And for other types of lending, it can even be your retirement funds.

Cash Flow

New businesses tend to have erratic cash flow, and so they aren’t likely to be able to leverage theirs. But once your cash flow becomes more predictable, you can use it as a way to get business money.

Your Time and Attention

With crowdfunding and grant proposals, you don’t have to give the money back. But you do have to spend time trying to get it—often with a low success rate.

Equity in Your Business

Business equity is a share in your business. You can sell yours to venture capitalists (if they’re interested), or to angel investors. This gets you business money in the short run. But in the long run, you’ll be sharing decisions and profits with anyone who owns equity.

Business Credit

Only business credit lets you keep all your equity. You don’t have to spend so much of your valuable time. And your cash flow doesn’t have to be stable yet. Plus, you won’t max out your personal credit cards and tank your utilization rate. And finally, it can help you avoid putting collateral on the line, or even enhance what you can get with the collateral you have.

The Great Resignation, Business Credit, and You: Takeaways

If yours is one of the over four million new small businesses that arose during the pandemic, you have options for business financing. Building business credit can help you succeed, and turn your part of the Great Resignation into a great new direction in life.

The post The Great Resignation, Business Credit and Financing, and You appeared first on Credit Suite.

Get Cash Flow Financing for Your Business – It Can Be a Great Way to Get Credit and Funding…

Can Cash Flow Financing Help YOUR Business?

For going concerns with some time in business, cash flow financing can be a good way to fund expansion, growth, or everyday needs. But what IS cash flow financing? And where do you get it?

Fundability, Cash Flow, and Your Business

Fundability is the ability of a business to get funding. It covers all the points a lender or credit provider will check when trying to figure out if you’ll pay back a loan or credit extended to you. These include details you may not have thought about or might think aren’t so important. But they are!

The 3 Cs Capital Acquisition Formula

When you think like a lender, you come to understand that all they want is to be sure that you’ll pay them back. Lenders look at one of three things for loan approval: cash flow, collateral, and/or credit. The more of these “Cs” you have, the more funding options are available. Let’s look at how cash flow financing can help your business.

Cash Flow Financing

Cash flow financing is a loan made to a company is backed by a company’s expected cash flows. A company’s cash flow is the amount of cash that flows in and out of a business. This is within a specific period. Cash flow financing or a cash flow loan uses generated cash flow as the way to pay back the loan. It’s one of the smarter financing activities you can do if you’ve got a going concern with predictable income.

Cash Flow Financing: Terms and Qualifying

Much of the time, you must have a few years in business. You may need a certain minimum credit score. You must prove historical cash flow, and present your accounts receivables and accounts payables, so the lender can determine how much to loan to your business.

Account Receivable Financing

You can use outstanding account receivables as your collateral for business financing. Receivables should be with the government or another business. If you also have purchase orders, you can get financing to have those filled. You won’t need to use your cash flow to do so. Get an accounts receivable credit line with rates of less than 1% with no consumer credit requirement.

Account Receivable Financing: Terms and Qualifying

Use your outstanding account receivables for financing. Get as much as 90% of receivables advanced ongoing or more, in less than 24 hours. The rest of the accounts receivable are released once the invoice is paid in full. Factor rates as low as 1.33%.

Terms are for Credit Suite account receivable financing. The only collateral necessary is your account receivables. Loan amounts run from $10,000 to $10 million. Up to 95% of receivables can be advanced within a week. Rates start at prime rate 2%. You must have a FICO score of 500 or better.

Receivables must come from another business or government agency, not an individual. Business must be open for at least one year to qualify. Medical receivables must have $1 million in annual sales or more. For the deal submission, you must provide the application, a breakdown of existing receivables, and a sample invoice.

Purchase Order Financing

Purchase order financing is advanced to a business with a large purchase order or contract, but the business is unable to fulfill it. A lender then loans the funds necessary to complete the order and charges a percentage for the service. Then the company can fulfill its order or contract.

The difference between purchase order and accounts receivable financing is purchase order financing involves a company lending you money to fulfill purchase orders. But accounts receivable financing involves a company buying your outstanding invoices. Still, they are both, at bottom, based on cash flow.

Purchase Order Financing: Terms and Qualifying

Terms are for Credit Suite purchase order financing. For approval, lenders will often review your outstanding purchase orders that need filling. They want to be sure the purchase orders are valid, and the suppliers you are dealing with are credible.

If so, then you can get approval, regardless of personal credit history. Rates tend to range from to 4%. In some instances, you can get 95% of your purchase order financed.

Demolish your funding problems with 27 killer ways to get cash for your business.

Business Revenue Lending

This is a way to raise capital from investors who get a percentage of the enterprise’s ongoing gross revenues, in exchange for money invested. In a revenue-based financing investment, investors get a regular share of business income until a predetermined amount is paid. Often, this predetermined amount is a multiple of the principal investment. It is often between 3 to 5 times the original amount invested.

Business Revenue Lending: Terms and Qualifying

Since repayment of the loan is comes from revenues, the time it takes to repay the loan will fluctuate. The faster revenue grows, the quicker you’ll repay the loan, and vice versa. The percentage of monthly revenues committed to repayment can be as high as 10%. Monthly payments will fluctuate with revenue highs and lows and will continue until you’ve paid back the loan in full.

All terms are for the Credit Suite business revenue lending program. Necessary collateral is consistent revenue verifiable through bank statements. Loan amounts run from $5,000 to $500,000. Terms are for 3 to 36 months. Pay a factor rate of 1.10 to 1.45%. Credit you must have a 500 credit score or higher, with no recent bankruptcies.

Business must earn annual revenue of $120,000 or more per year. You must be in business for a year or more. The business must do over 5 small transactions each month. Financial services industries are prohibited, damaged credit is acceptable. Or business must bring in at least $15,000 monthly revenue with 6 months’ time in business. To get this deal, you must provide the application and 6 months of business bank statements.

Fundbox

Get a line of credit from Fundbox. Fundbox just wants to know about your cash flow when deciding whether to fund your business. Fundbox will connect straight to your online accounting software. That’s all you need to do. You can get a revolving line of credit for up to $100,000. Fundbox will auto debit your weekly payment from your bank account. You don’t need to show a particular personal credit score. And you don’t need to show a certain time in business.

Fundbox: Terms and Qualifying

Pay in equal installments over the course of a 12 or 24 week plan. Available credit replenishes as you pay. There are no penalty to repay early. Your business must be American. You must have a 600 or better personal FICO score, and $100,000 or more in annual revenue. Also, you must have a business checking account. Ideally you must have 6 months in business or more.

Demolish your funding problems with 27 killer ways to get cash for your business.

PayPal Working Capital Loan

You can get a loan from PayPal. But you must already have a PayPal business account. There is no personal guarantee. Loan amounts and eligibility depend on your sales via PayPal. So applying won’t result in a credit check.

PayPal Working Capital Loan: Terms and Qualifying

The maximum loan amount depends on your PayPal account history. To be eligible, you must have a PayPal Premier or Business account for 90 days or more. Also, you must process at least $20,000 in annual PayPal sales if you have a Premier account, or at least $15,000 in annual PayPal sales if you have a Business PayPal account. Pay off any existing PayPal Working Capital loan.

Since automatic repayments get deducted as a percentage of each PayPal sale, the amount you repay each day changes with your sales volume. The more you sell, the more repayment progress you’ll make that day. On days without sales, you’ll make no payments, but you must repay something at least every 90 days.

Depending on the loan terms you choose, you must pay at least 5% or 10% of your total loan amount (loan + the fixed fee) every 90 days. The 5% minimum applies to loans estimated to take 12 months or more for repayment. This has a basis in your business’ past PayPal sales and other factors. The 10% option applies to loans estimated to be repaid within 12 months.

Square

You can get loans through Square. Applying will not affect your personal credit score. Loan eligibility comes from several factors related to your business, including its payment processing volume, account history, and payment frequency.

You can get $300 to $250,000. Borrowers get a customized offer with a basis in their card sales through Square. Then they choose their loan size. You will pay no interest, just an ongoing flat fee

Square: Terms and Qualifying

There are no ongoing interest charges. Instead, you will pay one fixed loan fee to borrow the loan. The fixed fee is the difference between the total owed amount and the initial loan amount. The fixed fee will never change, regardless of how fast or slow the loan is repaid. It is automatically deducted until you pay back your loan in full. If sales are up one day, you pay more; if you have a slow day, you pay less. At least 1/18 of the initial balance must be repaid every 60 days.

They don’t want collateral for business loans of $75,000 or less. For loans amounts over $75,000, they take a security interest in your business assets. Then they will file a UCC statement with the Secretary of State where your business is organized. There is no personal guarantee.

Demolish your funding problems with 27 killer ways to get cash for your business.

Cash Flow Financing: Takeaways

There are several options for business funding that depend on your cash flow. Some are available through Credit Suite. There are also online options, such as through PayPal and Square. Contact us today for help with your options.

The post Get Cash Flow Financing for Your Business – It Can Be a Great Way to Get Credit and Funding… appeared first on Credit Suite.

30 Great Franchise Business Ideas

If you’re a new entrepreneur looking for profitable business ideas with minimal risks, a franchise business can be a great place to start.

A franchise business carries the success, credibility, and popular associations of established brands, reducing the need for extensive marketing and brand building for you as a franchise owner. This can save you much time and money as you focus on making your business more profitable.

A franchise business model can also help you scale rapidly because you inherit the operation processes and framework from the licensing company.

Think about it this way: What would be easier?

Starting a company from scratch, working on branding, operations, funding, and marketing—or buying a license for a pre-established company?

In most cases, it’s the latter. That’s why entrepreneurs are so eager to buy into franchise businesses.

What Is a Franchise Business?

A franchise business is a licensing model of business where a successful company allows you to run a version of its business using its logo, processes, and in-house resources.

Think of the many fast-food stores you see worldwide.

These “franchise” businesses exist in multiple locations, selling the same products under the same branding, which helps build loyal customers and instant brand recognition. Some examples of worldwide franchises include McDonald’s, Domino’s Pizza, and Subway.

Option #1: Start a “Home Services” Franchise Business

Home service franchises offer services related to moving and housing. These work best for regional companies as most people prefer using local home repair and renovation services to save time and money.

Painting Franchise Business

As more and more houses are built every year, the demand for painters keeps growing. You can cash in on this growth by launching a painting franchise business.

Companies like CertaPro Painters let you start your own business under their name, so you can begin offering painting services using the CertaPro branding.

Repair Services

No matter where you live, there is always a need for repairing services.

If you’re looking for a steady business with minimal market shocks, start a repair service franchise. This model is fairly stable because houses need recurring repairs—meaning you have the opportunity to develop long-term customers.

Some popular options include Paul Davis Restoration, Mr. Handyman, and 911 Restoration.

Moving Services

Another popular home service franchise business opportunity lies in the moving industry. Beyond moving series, these franchises offer temporary storage and junk removal services. You can find franchise business opportunities with companies like UNITS Moving & Portable Storage.

Although, it’s important to keep in mind that managing a moving business can be incredibly tricky because there’s a greater degree of responsibility involved.

House Cleaning Services

As the average citizen moves towards continuously busier lifestyles, the need for house cleaning services has grown significantly over the past few years. You can benefit from this booming trend by launching a housecleaning franchise business with companies like Chem-Dry and Merry Maids.

Option #2: Start a “Retail Franchise” Business

When people think about shopping, retail is one of the first industries that come to mind.

Retail franchise businesses come in many shapes and sizes. This way you can focus on an industry that truly matches your interests and skillset.

Fitness Franchise

The fitness industry, and especially sportswear, is thriving.

It’s one of the few sectors that saw huge growth throughout the pandemic, with people paying more attention to their health than ever before. From training shoes to yoga accessories, people have an ongoing need for fitness products.

Starting a fitness franchise business with companies like Anytime Fitness and Planet Fitness can help you target these customers and scale your business.

Real Estate Franchise

Real estate is a tricky but lucrative market for aspiring entrepreneurs. It has a steep learning curve but can help you build a profitable business with a generous cash flow—if done right.

Companies like HomeVestors of America are a great place to start a real estate franchise business.

Car Wash Franchise

Car wash franchises with strong branding can benefit from repeat-purchase loyalty, helping you attract new customers and build long-term relationships—keeping your business profitable.

Some great car wash franchise options include Prime Car Wash, Tommy’s Express, and Mr. Clean.

Sports Franchise

If you have a passion for sports, consider investing in a sporting business. Companies like Soccer Shots offer great franchise opportunities with a mission-driven business model.

You can also focus on companies selling sporting goods, offering training spaces, sports club memberships, and other sport-adjacent activities.

Furniture Franchise

Similar to the growing popularity of housing services, furniture stores are seeing a surge in demand. From selling individual furniture pieces to offering rental packages, franchises in the furniture industry offer a wide range of scaling opportunities.

You can work with franchises like Bloomin’ Minds and Slumberland Furniture.

Option #3: Start a “Food Franchise” Business

People love food, especially fast food. So if you’re looking for a hot-selling, customer-favorite franchise business, start a food franchise. These are super popular, tend to do well economically, and carry great brand recognition across a wide geographic region.

Pizza Franchise Business

Popular food items like pizza have the potential to sell well, offering you a chance to build a profitable franchise business. This is one of those categories where there’s tight competition, but great growth potential.

You have many options to choose from including Domino’s Pizza, Pizza Hut, and Papa John’s.

Coffee Franchise Business

Coffee is another hot-selling item, literally.

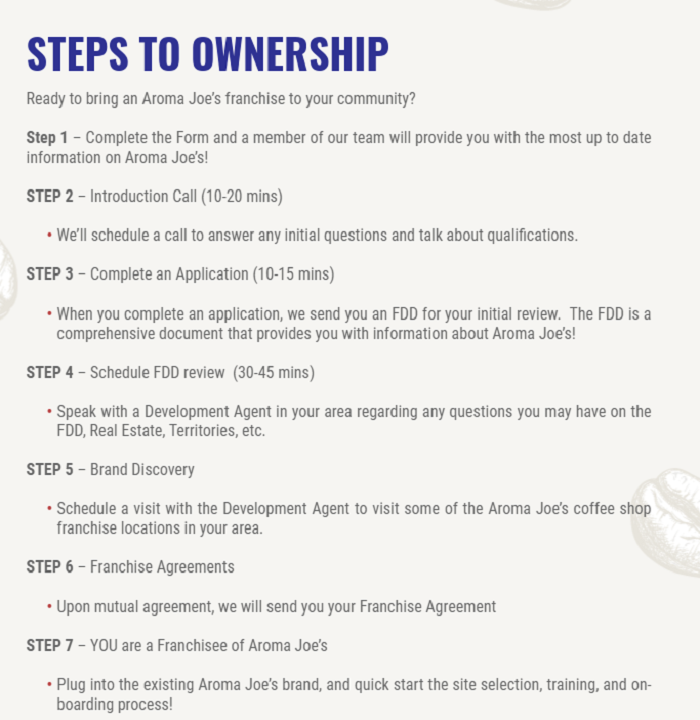

If you’re a fan of the beverage and have a desire to manage a consistent business, starting a coffee franchise can be a great option for you. Consider working with companies like Dunkin’, Aroma Joe’s Coffee, and Scooter’s Coffee.

Ice Cream Franchise Business

If you’re looking to target the frozen foods market, consider starting an ice cream franchise business. Brands like Baskin-Robbins have a huge customer base that you can leverage with a franchise business model.

You can also consider companies like Kona Ice which are smaller than the top industry names but offer great variety and opportunities for reaching new customers.

Burger Franchise

When we talk about franchise businesses, we often picture McDonald’s, which is still popular decades after its launch. If you’re looking for that kind of growth, consistency, and brand power, choose a burger franchise.

You can also choose other companies like Wendy’s, Burger King or Carl’s Jr.

Noodle Franchise

Starting a noodle franchise business can offer a great breakfast and snacking option for local residents. You, as a business owner, can build relationships, expand locations, and still remain consistent in your offerings.

You can work with companies like Nothing But Noodles and Noodles & Company to launch noodle franchise businesses.

Option #4: Start a “Professional Services” Franchise Business

If none of the options so far appeal to you and you want to take a more personalized approach, consider launching a professional services franchise business. These offer the greatest potential for customization, adaption, and variation compared to other franchise business models.

With a professional service franchise business, you have a multitude of customer retention opportunities that can be quite profitable in the long run.

Shipping and Mailing Franchise

Nearly every company and residential community needs a shipping and mailing service today. This rising demand offers promising potential for franchise owners.

Established brands like The UPS Store can help you find your customers faster and retain them for decades to come.

Such franchise business models also offer a huge expansion potential as shipping and mailing companies continue to expand the geographical areas they serve.

Printing Franchise

Just like shipping and mailing companies are a cornerstone of work-life across several industries, printing businesses are also a key component of modern living.

The best part of starting a printing franchise business is that it’s easier to set up and manage. It’s relatively low-maintenance, carries low risk, and has much potential to grow, making it an ideal option for new entrepreneurs.

Look for companies like Minuteman Press for launching a successful printing franchise.

Staffing Franchise

Another popular corporate franchise option is a staffing franchise business. Companies like Spherion and Express Employment Professionals help other companies fill their staff positions by connecting them to people looking for jobs.

These franchise business models can help you build positive relationships with major companies in your industry while making a decent profit.

Training Franchise

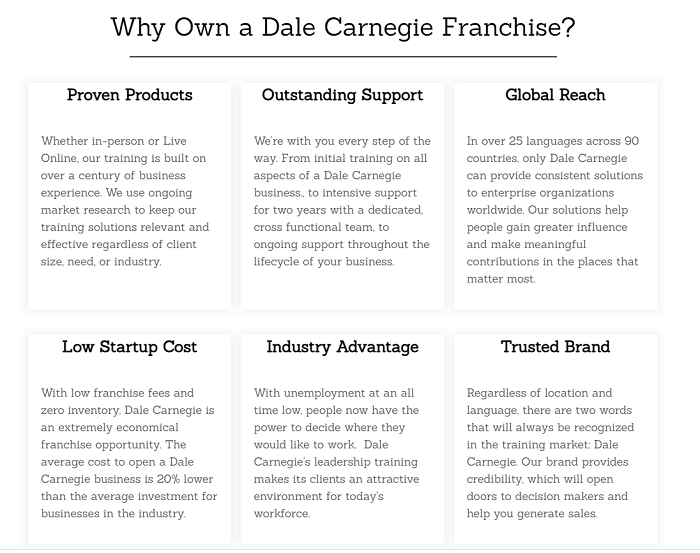

Along with staffing agencies, companies also need training providers to help upskill their staff. Whether it’s quarterly seminars or yearly upskilling boot camps, working with companies like Sandler Training and Dale Carnegie can help you establish an impactful thought leadership and corporate training franchise business model.

Design Franchise

From rebranding to interior decor, design teams are a key player in most major industries.

If you’re passionate about art, decoration and understand the fundamentals of marketing design, you can work with companies like Closets by Design and Decorating Den Interiors to launch a design franchise business.

Frequently Asked Questions About Starting Franchise Businesses

Here are some common questions new entrepreneurs ask when they’re planning to launch a franchise business.

Do I own the rights to a franchise business name?

When you buy a franchise business, you’re only buying the license to use the company’s resources and not the rights to own or manage the company itself. This means, you can own and control the franchise but the original company still remains an independent entity.

Do I have to pay a royalty when I sell through the franchise?

The payment structure for each franchise business depends on the agreement you have with the owning company. For instance, a company may choose to accept royalties for every purchase in addition to a licensing fee. Companies can also work with a fixed-fee payment structure for each franchise location.

What is the difference between a franchise fee and a royalty fee?

While both the franchise fee and royalty fee are necessary to own a franchise, the two are not the same. The franchise fee is the cost of buying a license to use the owning company’s branding and resources. A royalty fee, on the other hand, is a revenue-based fee you pay based on your sales and profits.

An easy way to remember this is to keep in mind that franchise fees are one-time payments for buying the trading license, while royalties are ongoing payments based on your revenue.

Can I sell a franchise?

If you’re not happy with your franchise business, you always have the option to sell it. Franchise exits are pretty common, especially in larger cities where multiple businesses are vying for consumer attention.

However, it’s important to check your agreement before making any selling decisions. Your owning company may not allow you the rights to sell their franchise outside of their organization.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “Do I own the rights to a franchise business name?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “When you buy a franchise business, you’re only buying the license to use the company’s resources and not the rights to own or manage the company itself. This means, you can own and control the franchise but the original company still remains an independent entity.”

}

}

, {

“@type”: “Question”,

“name”: “Do I have to pay a royalty when I sell through the franchise?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “The payment structure for each franchise business depends on the agreement you have with the owning company. For instance, a company may choose to accept royalties for every purchase in addition to a licensing fee. Companies can also work with a fixed-fee payment structure for each franchise location.”

}

}

, {

“@type”: “Question”,

“name”: “What is the difference between a franchise fee and a royalty fee?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “While both the franchise fee and royalty fee are necessary to own a franchise, the two are not the same. The franchise fee is the cost of buying a license to use the owning company’s branding and resources. A royalty fee, on the other hand, is a revenue-based fee you pay based on your sales and profits.

An easy way to remember this is to keep in mind that franchise fees are one-time payments for buying the trading license, while royalties are ongoing payments based on your revenue.”

}

}

, {

“@type”: “Question”,

“name”: “Can I sell a franchise?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “If you’re not happy with your franchise business, you always have the option to sell it. Franchise exits are pretty common, especially in larger cities where multiple businesses are vying for consumer attention.

However, it’s important to check your agreement before making any selling decisions. Your owning company may not allow you the rights to sell their franchise outside of their organization.”

}

}

]

}

Franchise Businesses Conclusion

Starting a franchise business has many benefits to offer entrepreneurs at all levels. New business owners may find it easier to run a pre-established business than starting a new brand from scratch.

Mid-level entrepreneurs can also use a franchise to pivot their career, especially if it’s an industry change.

Finally, senior entrepreneurs can hugely benefit from the brand recognition the owning company has built.

Most franchise brands have thousands of loyal customers who become a source of recurring revenue for the business. If you’re able to leverage this reach for further growth, it can be easier to scale your franchise business rapidly.

Which franchise business idea best suits your needs? Which idea would you like to try first?

Great Question (YC W21) Is Hiring a Founding Engineer (Rails) (Remote, PST-Ish)

Article URL: https://www.ycombinator.com/companies/great-question/jobs/rbDFLOP-founding-engineer-rails Comments URL: https://news.ycombinator.com/item?id=26799244 Points: 1 # Comments: 0

The post Great Question (YC W21) Is Hiring a Founding Engineer (Rails) (Remote, PST-Ish) first appeared on Online Web Store Site.

The post Great Question (YC W21) Is Hiring a Founding Engineer (Rails) (Remote, PST-Ish) appeared first on Buy It At A Bargain – Deals And Reviews.