Article URL: https://www.mux.com/jobs?j=srplatform Comments URL: https://news.ycombinator.com/item?id=37329067 Points: 1 # Comments: 0

Author: Joyce Bryant

New comment by mistercheph in "Ask HN: Who wants to be hired? (March 2023)"

Location: Baltimore, Maryland Remote: Yes Willing to relocate:Yes Technologies: C, C++, GTK, TCP/IP, Ruby, PHP, Typescript, Git, RHEL/CentOS, MySQL, React, HTML/CSS Resume: https://drive.google.com/file/d/1dNQbtzTcTlZrjmMn6YdBBNLSOoi… Email: davidzgumberg@gmail.com I am a self-taught developer whose experience is in reading and writing my own software, tinkering with and contributing to open source software, and a few short bouts of freelance … Continue reading New comment by mistercheph in "Ask HN: Who wants to be hired? (March 2023)"

Tesorio (YC S15) is hiring a senior front end engineer and support engineer

Article URL: https://jobs.lever.co/tesorio

Comments URL: https://news.ycombinator.com/item?id=32876819

Points: 1

# Comments: 0

Miranda Devine: Biden's '60 Minutes' interview was 'embarrassment' to CBS

Fox News contributor Miranda Devine shared her key takeaways from President Biden’s recent ‘60 Minutes’ interview on” The Ingraham Angle.”

MIRANDA DEVINE: Well, I guess I’m biased, but the Hunter Biden question was just extraordinary. You know, to have the opportunity to ask Joe Biden finally in-person about all the revelations over the past two years about his son Hunter’s business dealings that he assured us before the election he knew nothing about.

BIDEN INJECTS SOME UNCERTAINTY INTO 2024 WITH HIS ‘MUCH TOO EARLY’ RE-ELECTION COMMENT

And it was just a softball and an acceptance of an outright lie. I mean, in his own words, Joe Biden says, ‘I never observed anything untoward.’ But he told us he didn’t know anything about the business dealings. So how would he know what to observe or what not to observe? It was ridiculous and really an embarrassment to ’60 Minutes’ and CBS.

CLICK HERE TO GET THE FOX NEWS APP

WATCH THE FULL SEGMENT BELOW:

Stacker (YC S20) Is Hiring a Head of Engineering

Article URL: https://apply.workable.com/stackerhq/j/FAC2417239/

Comments URL: https://news.ycombinator.com/item?id=31628699

Points: 1

# Comments: 0

Why Hamilton vs. Verstappen has been one of F1's all-time great rivalries

Lewis Hamilton and Max Verstappen’s title fight has been incredible. Ahead of their winner-takes-all showdown, here’s all the reasons why the stars aligned for an epic battle this year.

The post Why Hamilton vs. Verstappen has been one of F1's all-time great rivalries appeared first on Buy It At A Bargain – Deals And Reviews.

How to Run Effective eBay Ads

You want to get your products in front of the people who are going to buy them. When you get your products on eBay, you’re putting them in front of an audience of 185 million people, but with competition from over 1.7 billion listings, how can you make sure you stand out from the crowd?

One way to ensure you’re getting your products in front of the right audience is to make use of eBay ads. These are extremely easy to set up and can help propel you to the top of the search results, even in the most competitive categories.

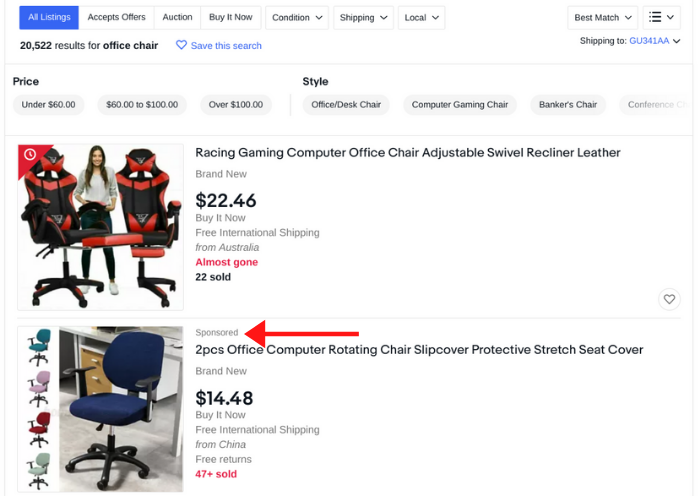

How Do eBay Ads Work?

eBay ads can boost the visibility of your products by allowing them to feature at the top of the listings. With millions of products on the platform, eBay is a competitive place, and if you’re competing against hundreds of sellers all selling the same product, it can be difficult to stand out.

This is where eBay ads come in, allowing you to pay for your listing to feature at the top of the search results.

In this sense, it’s a lot like advertising on Google. You set up your ads, and your product can be featured higher in the search results, based on the quality and relevance of your listing and how much you bid.

One interesting difference with eBay’s main ad option, promoted listings, is you only pay if your ad is successful. Unlike many platforms where you pay every time your ad is clicked, with eBay, you only pay for your promoted listing if it results in a sale within 30 days of someone clicking the listing.

This allows sellers to get a clear picture of their return on investment (ROI) and is a big benefit of selling on eBay.

3 Types of eBay Ads

eBay offers a few different types of ads to suit your business needs.

Promoted Listings

Promoted listings are used by over 940,000 sellers and are the most common way of advertising on eBay. They’re an excellent way to get your product listing to the top of the search results.

To be eligible for promoted listings, you must:

- be in good standing (meeting eBay’s terms and conditions)

- have “above standard” or “top-rated” seller rating

- have recent sales activity

One of the most important aspects of selling products online is getting people to view your listings, and this ad type is a great way to gain access to eBay’s 185 million active users. By featuring at the top of the search results, you will bring more people to your product page, and then it’s up to you to optimize your product page to make the sale.

eBay offers great analytics to help you get the most out of your advertising, and the nice part is you only pay for your promoted listings once you’ve sold an item.

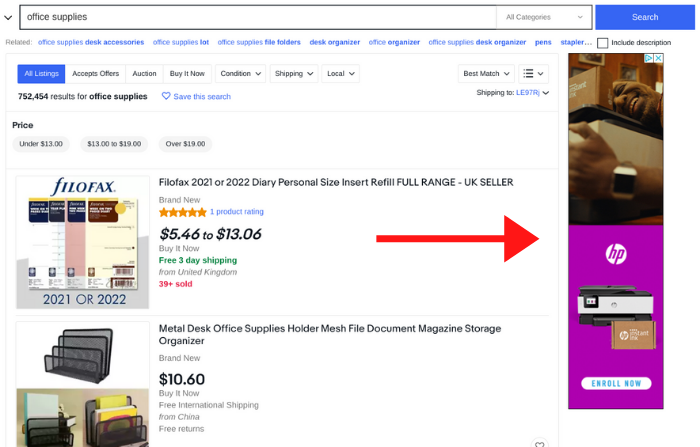

Display Ads

eBay now runs display ads across its network, giving you another way to reach your target audience. Similar to the display ads you can run on Google Ads, eBay’s display ads allow you to target users with interests in certain categories to drive more traffic to your listing:

- business, office, and industrial

- cars, motorcycles, and vehicles

- clothes, shoes, and accessories

- computers, tablets, and networking

- garden and patio

- health and beauty

- home furniture and DIY

This expands your advertising options, meaning you’re not just limited to reaching people through the search function.

Display ads aren’t available through the seller hub; instead, you can speak directly to eBay about this option.

Classified Ads

Classified ads are a good option for people who want to take advantage of eBay’s reach but sell a product that isn’t necessarily suited to selling on the platform.

These ads are available in several categories:

- business, office, and industrial: $9.95 for a 30-day listing

- specialty services: $9.95 for a 30-day listing

- travel: $9.95 for a 30-day listing

- real estate: $150 for a 30-day listing

Your ad is shown, the user clicks on it, and then eBay puts you in contact with the buyer to negotiate the sale outside of the platform. This means you’re paying only for the ad, not the fees for selling on eBay, but it also means you don’t get any of the protections you get as an eBay seller.

eBay Advertising for Large Brands

eBay also offers a more bespoke advertising service for large brands.

This option offers big advertisers branding solutions to help optimize their product pages and acquire in-depth insights into customer motivations to help brands get the most out of the platform.

This option might offer great benefits, but it requires a big commitment to advertising spend to be accepted. If you’re a large brand looking to make eBay advertising an essential part of your marketing, then it’s worth reaching out to the eBay team and exploring the option further.

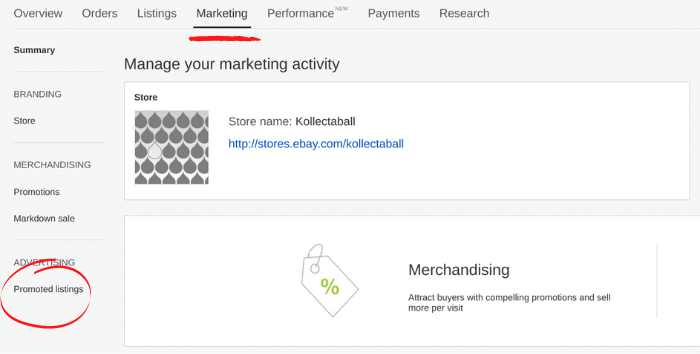

How to Set Up Your eBay Ad Campaign

Setting up eBay ads is quick and simple. In just five steps, you can create promoted listings and boost your product’s visibility at the top of the search results.

1. Log in to Your Seller Hub

Your seller hub is where all your product listings live, and this is where you can create your eBay ad campaigns. Go to https://www.ebay.com/sh/, select “Marketing,” then “Promoted Listings” from the sidebar.

2. Click “Create Your First Campaign”

If you’re new to promoted listings, you’ll be brought to a landing page that explains what they are and how they work. Click “Create Your First Campaign” to get started.

3. Choose How to List Your Promotions

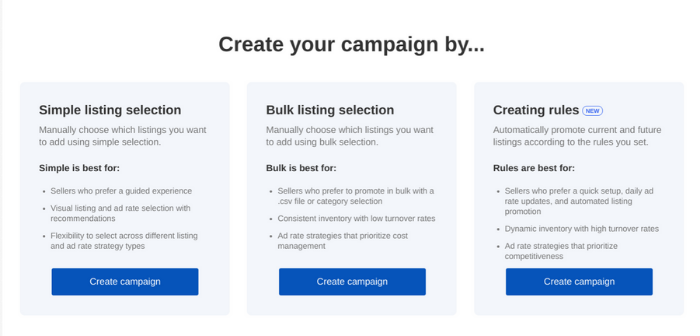

You have three different ways to list your promotions:

- Simple listing selection: This allows you to promote your products individually, making good use of eBay’s smart recommendations.

- Bulk listing selection: This option is for people who want to promote lots of products with consistent stock and low turnover rates.

- Creating rules: Rules allow you to automatically promote current and future products. This option works well for sellers with dynamic inventory and high turnover rates.

4. Apply Your Ad Rate

This is where you choose how much you wish to pay for your eBay ads. Represented as a percentage of the total sale value, you’ll notice that eBay gives you a recommended ad rate for your product.

These are normally a good place to start, but if you want to change it, you can use the slider to set it to anywhere between 1-100 percent of your sale’s value.

5. Review and Launch

Lastly, you need to name your campaign and review the details. You can also set a date for the campaign to begin and end. Once you’re happy with everything, click “Launch.”

Tips for Creating Effective eBay Ads

As with any form of advertising, it’s important to have a good return on ad spend (ROAS), and the way to achieve this is through optimization. It doesn’t matter how many people your ad reaches if you’re not using the right keywords or your listing is of poor quality. There are several elements you need to get right.

Use Relevant Keywords

Choosing the right keywords to reach your target audience is extremely important. People don’t always search in the ways you expect they might, so you need to understand your audience and do your keyword research.

As with Google Ads, it’s important to match user intent with your ads, which means getting the right keywords in your titles, descriptions, and throughout your product listings. Slight differences in your keywords can make a big difference in the success of your ads, so make sure you’re optimizing to meet the demands of your target audience.

While it’s important to make sure you’re using the right keywords, it’s also important to remember not to keyword stuff. eBay’s algorithms are smart, and they understand when you’re using language naturally and when you’re stuffing keywords solely for SEO purposes.

Include High-quality Images

It’s proven that high-quality images lead to more sales than average images.

When someone walks into a shop and buys a product, they get to see it with their own eyes and feel it in their hands. When they buy online, they don’t get this benefit. Instead, they’re reliant on your images and words to give them a good feel for your products. This is why your images are so important and can make a significant difference in the success of your ads.

High-quality images are likely to get more clicks and help boost your conversion rate.

Promote the Items That eBay Recommends

eBay faces huge competition for your advertising money. If it doesn’t deliver results, it knows you can easily go to Google, Amazon, Walmart, or any other number of advertising platforms to boost your sales.

To ensure this doesn’t happen, eBay uses its vast amount of data to recommend which items you should think about advertising. These “handpicked” recommendations are the products eBay believes are most likely to benefit from a promoted listing and have a “Recommended” tag next to them in your campaign manager.

Perfect Your Listing Title

When someone sees your ad in the search results, they don’t have a lot to go on. All they see is your title, a thumbnail image, pricing, and some details about shipping.

There aren’t many opportunities to earn someone’s click.

This means small details can make all the difference, and your title is a huge part of this. If you can create concise titles that match user intent, you can give yourself a much better chance of getting the right people to click your ad.

Sometimes people create product listings or blog content, and the title is an afterthought, but this is the first thing everyone looks at. They might just be a few words, but titles play a massive role in whether someone clicks your link and reads through your product listing.

Review Your Performance

One of the great things about advertising online is you have access to so much data. Information is power, and when you make the most of your analytics, you’ll find ways to optimize your eBay ads.

Head to the “Performance” tab in your promoted listings dashboard and make use of metrics such as impressions, clicks, and sales to evaluate how your eBay ads are performing. If you’re not getting the results you want, consider making changes to your titles, product page, bid price, and images. Make sure you keep checking the performance until you find the formula that works.

Conclusion

eBay ads give you an excellent opportunity to reach a targeted, engaged audience of buyers.

However, as with any e-commerce platform, there’s a ton of competition, and you need to be able to find ways to stand out from the crowd. eBay ads give you this opportunity, but you’ve still got to be creative with your titles and make sure your product listings are perfectly optimized to create sales.

For most sellers, promoted listings are going to be the best option to allow them to reach more customers, and they’re easy to set up and very effective. One of the nice things about this ad format is that you don’t pay until you see results, so you’ve got plenty of opportunities to optimize your process and make sure your eBay ads are working for you.

If creating your own ad strategy and optimizing your product descriptions or website isn’t up your alley, reach out to our agency. We can help!

Have you had success with eBay ads?

Trump predicts coronavirus vaccine will be available to all Americans by April

Trump predicts coronavirus vaccine will be available to all Americans by April

The post Trump predicts coronavirus vaccine will be available to all Americans by April appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND.

The post Trump predicts coronavirus vaccine will be available to all Americans by April appeared first on Buy It At A Bargain – Deals And Reviews.

How Does Your Garden Grow? Best Business Line of Credit in a Recession

The COVID-19 pandemic caught the world by surprise and turned the economy upside down. If you are a business trying to make it during this time, we can help. The Federal government has approved funding through The CARES Act, including the Paycheck Protection Plan. In addition, many states and local organizations are offering their own COVID-19 relief options. Beyond that, we can help you find the best business line of credit in a recession.

A Business Line of Credit is Like Miracle Grow for Your Business

A business line of credit can be an incredible tool for your business, even in a recession. You don’t want just any line of credit however. You want the best one for your business needs.

Not all businesses are the same, and not all lines of credit are best for all businesses. Different limits, rates, and terms work better for some than others. How do you ensure you are getting the best business line of credit in a recession?

What’s a Line of Credit?

It can help to get a quick rundown of exactly what a line of credit is. The most basic definition is that it is a revolving line of credit, similar to a credit card. You have a limit and continuous access to that limit while making payments only on the portion you use each month.

For example, if you have a $10,000 line of credit, you can use however much of those funds you need each month for whatever you want, unless your lender issues some sort of restriction. If you use $2,000, then when you get your statement your payment will be based on $2,000 plus the interest, rather than a payment plus interest on the entire credit line.

If you were to pay $1,000, then spend another $500, you would pay on the $1,500 balance the next month. Your payments change as your balance changes. Just like with a credit card.

Access is most typically granted through checks or a card connected to the line of credit account. Electronic draws and transfers are also popular.

Learn bank rating secrets with our free, sure-fire guide which can even help during a recession.

Line of Credit vs. Credit Cards

The question is always asked what the difference is between a line of credit and a credit card, and why is one better than the other? The truth is that in some cases, a credit card may be the better option. There is a choice to make based on several different factors.

The main difference between the two that most borrowers need to know is that a line of credit typically has a consistently lower interest rate. Also, there are no perks like 0% interest or cash back that you sometimes see with credit cards.

What Signifies the Best Business Line of Credit in a Recession?

The best business line of credit in a recession is going to be the one with the best rates and terms that your business can qualify for. That makes finding it a little more involved. You have to know where you stand and what various lenders offer and require.

It will take some leg work on your part to pull together the information needed for application. You will also need to understand that the best business line of credit in a recession may not come from the same place you would have gotten a business line of credit pre-recession. You might have better luck with online lenders or smaller banks over larger traditional banks during an economic downturn.

A Word of Warning

Before you apply for the best business line of credit in a recession, remember that balance is important. Recession times are by default, hard. A line of credit can ease some of the burden, but be careful not to let the credit line itself become a burden. Know your limits as far as what you can pay.

If you do not make payments on-time, you could end up with more trouble than you already had.

How to Find the Best Business Line of Credit in a Recession?

There are several steps to this process.

1. Why do you need a business line of credit in a recession?

Figuring this out could be the most vital step in finding the best business line of credit for your needs. You have to understand why you need a credit line in the first place. Here are some examples of how a business may use a line of credit.

- Take advantage of a sale on inventory, raw materials, or supplies. This can reduce the cost of goods sold and consequently, increase the bottom line.

- Purchase or repair minor equipment when needed. This would be like a new printer or laptop. It would not include items like an industrial oven or delivery truck. Larger equipment would best be purchased with an equipment loan.

- Bridge temporary cash gaps or continuous, known cash gaps due to timing issues. An example of this would be several bills that are due at the beginning of the month when you know your largest contracts pay at the end of the month. The money is coming, but the bills come due before the money gets there. You can pay the bills with the line of credit, then pay off the line of credit when the contracts pay.

Another example of this is a seasonal line of credit for a business that does the majority of its sales during a certain time of the year. A florist does a large percentage of sales during Valentines day, so a seasonal line of credit can come in handy to bridge the cash gap during other times of the year.

2. Determine your options.

Shop around with various financial institutions to determine which ones offer the best business lines of credit in a recession. You will want to look at factors such as interest rate and credit limit in relation to what you need and can afford.

Check with various types of lenders to get a feel for which ones offer what you need. Check with larger commercial banks, small local institutions and credit unions, and alternative lenders such as those that operate exclusively online.

Pay specific attention to eligibility requirements to avoid wasting your time with those you do not qualify for.

Learn bank rating secrets with our free, sure-fire guide which can even help during a recession.

3. Know where you stand.

Your ability to get approval for the best business line of credit in a recession will be directly related to your business credit. Traditional banks pay more attention to personal credit, but they crack down a lot on lending when there is a recession. Non-traditional lenders may also consider income and cash flow. They may, in addition, rely heavily on your business credit score when making an approval decision about a line of credit.

A lower business credit score does not necessarily mean you can’t get approval. It could greatly affect your interest rate and credit limit however.

Consider signing up for a credit monitoring service that lets you keep tabs on your business credit and what is affecting it each month. The one offered by CreditSuite.com is easy to use and cost effective.

Once you have a handle on why you need a business line of credit, what is available, and what you may actually be eligible for, you can make a decision as to where you are going to apply and which product you are going to apply for.

Determining which of these lenders has the best business line of credit in a recession for you goes back to knowing what you need, who has it, and who will approve you for it.

When Is a Line of Credit Better than a Credit Card?

If you are going to need to make payments, a line of credit is a better option. The reason is pretty simple. The credit rate is almost always lower. The few exceptions are those cards that offer 0% APR for a short period of time.

If you are going to use a credit card to make regular purchases you intend to pay off immediately, that’s another story. Especially if you qualify for a card with perks such as cash back. In that case, you may find that you can benefit from using a credit card over a line of credit.

An example would be if you wanted to use your business credit card to make your monthly supplies purchase each month and then pay it off in the following month. You could take advantage of the cash back and reduce your overall cost.

To float a cash flow gap or make significant purchases that you will need to pay out over a short amount of time, a line of credit is almost always the best choice.

Where to Find the Best Business Line of Credit in a Recession

Some small businesses will have a hard time getting approval from a traditional lender due to poor credit or a lack of sufficient credit history. We found examples of what alternative lenders are offering currently. Keep in mind these offerings can change, so make sure to visit the lender and verify.

Kabbage

Kabbage offers a credit line of up to $150,000 with no credit score required. The catch is that the interest rate is between 32% and 108%. The business must have been in existence for at least one year and have revenue of at least $50,000.

The interest rate is very high. This is really only an option for those businesses that cannot get financing due to a low or nonexistent credit score and need funding immediately.

StreetShares

There is a credit line available here of up to $100,000. A business must have what they consider to have “reasonable credit.” It also must be in business for at least one year and have more than $25,000 in revenue. Repayment is weekly.

Due to the lower revenue requirement, this is a good option for smaller businesses with okay credit scores but lower annual revenue. Also, the interest rate minimum is lower, with the low end at 9%.

OnDeck

If you have a credit score of at least 600 you can get a credit line of up to $100,000 with OnDeck. There is a $20 per month maintenance fee and weekly repayment. The interest rate is a little higher here than with those that require a higher credit score minimum. It ranges from 13.99% to 39.99%.

Again, due to the higher interest rate, this should only be an option if you cannot meet the higher credit score requirement.

Lending Club

The credit line offered by lending club goes up to a limit of $300,000. It requires a credit score of 600. In addition, at least one year in business and at least $50,000 in revenue are necessary. The repayment term is 25 months, and they require collateral for limits over $100,000.

This is a good option for those that meet the requirement as there is a higher limit available with collateral, and the interest rate can go as low as 6.25%. The repayment terms are much friendlier as well.

Credit Line Hybrid: Another Option

A credit line hybrid is revolving, unsecured financing. It allows you to fund your business without putting up collateral, and you only pay back what you use. It even works for startups.

What are the Qualifications?

How hard is it to qualify? It’s probably easier than you think. You do need good personal credit. That is, your personal credit score should be at least 685. In addition, you can’t have any liens, judgments, bankruptcies or late payments. Also, in the past 6 months, you should have less than 5 credit inquiries, and you should have less than a 45% balance on all business and personal credit cards. It’s also preferred that you have established business credit as well as personal credit.

If you do not meet all of the requirements, all is not lost. You can take on a credit partner that meets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding.

Business Credit in a Recession

When you apply for the best business line of credit in a recession, consider using your business credit rather than personal credit. Some lenders will require you to use both. If you can get a credit line on your business credit only, that is best. If not, strong business credit can help negotiate better terms and rates.

Learn bank rating secrets with our free, sure-fire guide which can even help during a recession.

Not sure what business credit is, if you have it, or how to get it? Here’s a quick rundown. Business credit is similar to your personal FICO, but it is for your business only. It is not attached to your name or social security number, but rather to your business name and EIN.

The most commonly used business credit reporting agency is Dun & Bradstreet, but there are others. With Dun & Bradstreet however, you must have a DUNS number to have a record with them. If you do not have one, you don’t have a D&B business credit report.

You can get a free DUNS number on the D&B website. Before you do, your business must be incorporated. It also must have dedicated, separate contact information that is not your personal contact information. You can find out more about incorporation options and how to get a free EIN on the IRS website.

It is Possible to Find the Best Business Line of Credit in a Recession

A business line of credit is a great financing option. It offers flexibility that isn’t always available with a term loan. Interest rates are often better than those offered by business credit cards. With alternative lenders in the mix, a line of credit is an option for most small businesses even during a recession.

The post How Does Your Garden Grow? Best Business Line of Credit in a Recession appeared first on Credit Suite.

New comment by pontifk8r in "Ask HN: Who is hiring? (September 2020)"

TruCentive | https://trucentive.com/jobs-trucentive/ | Senior/Lead Full-stack Engineer| REMOTE (only) | Full-time TruCentive is a fully-remote VC funded start up in the incentive automation and non-cash compensation accounting space. TruCentive is hiring for a fully remote senior/lead full-stack developer. Our stack is Ruby on Rails, JS, some React. Listing for this position, and others we may … Continue reading New comment by pontifk8r in "Ask HN: Who is hiring? (September 2020)"