Article URL: https://www.ycombinator.com/companies/great-question/jobs/rbDFLOP-founding-engineer-rails

Comments URL: https://news.ycombinator.com/item?id=26799244

Points: 1

# Comments: 0

Article URL: https://www.ycombinator.com/companies/great-question/jobs/rbDFLOP-founding-engineer-rails

Comments URL: https://news.ycombinator.com/item?id=26799244

Points: 1

# Comments: 0

Article URL: https://www.ycombinator.com/companies/great-question/jobs/rbDFLOP-founding-engineer-rails Comments URL: https://news.ycombinator.com/item?id=26799244 Points: 1 # Comments: 0

With over 660,000 restaurants operating in the U.S. alone, digital food advertisement is an incredibly competitive market.

To stand out, you need to combine humor, design, strategy, and user engagement, all while keeping your audience hungry.

Without creative marketing campaigns, the food industry could be pretty dull. Luckily, there are so many ways to bring food to life in digital food advertisements.

What makes food advertisements unique is their ability to turn the mundane into excitement.

A simple burger on a plate can become a narrative story about your favorite sports game.

In order to create unbeatable food advertisements, you need to focus on high-quality ingredients.

Here are a few things to keep in mind when creating a unique food advertisement:

Great food advertisements should make your mouth water, your belly growl, and your heart warm.

Paired with intelligent marketing strategies, these food advertisements will help you create high-converting PPC campaigns that bring your brand to the global stage.

Here are some of our top picks for digital food advertisements.

Leveraging motion graphics in your digital food advertisement is a great way to catch the eye of your scrolling audience.

In this Jif Peanut Butter ad, a beating heart communicates the excitement and love that the world has come to feel for Jif. Branded in the signature Jif colors, it also delivers clear brand awareness and integrity. This is a big brand marketing lesson in a jar!

Staying up to date on trends, holidays, and seasons is a great way to deliver relevant food advertisements to your audience.

Also, adjusting your PPC campaigns seasonally will help you create important audience connections and let your followers know you’re paying attention.

In this Twitter ad, @GoldfishSmiles used narrative video to tell a classic St. Patrick’s Day tale of two little fish who drank a bit too much.

This food advertisement is funny, creative, quirky, and relatable. Plus, it’s short and sweet, which makes it perfect for your Twitter feed.

No Frills is a Canadian supermarket chain that has made its name in recent years with humorous social media advertising.

No Frills is most known for its meme-worthy content, taking inspiration from the internet’s latest trends and delivering them in dead-pan content across their social channels.

In this No Frills Facebook ad, No Frills takes advantage of the popular “expectation versus reality” meme while also advertising their in-house pancake batter brand.

The result? A resounding audience laugh, hundreds of likes and comments, and a food advertisement win for this growing brand.

Sometimes, all you need to create a high-quality food advertisement is a bit of color and simple movement.

In this Clevr food advertisement, the brand displays its Matcha Chai Latte and Chai Super Latte drinks.

Simple design, calming music, and pastel colors give the viewer a relaxing feel that evokes tranquility and calm.

Not only is the ad visually appealing, but it also offers diverse advertising usage. Clevr could easily use this food advertisement on a number of channels, from Twitter to Instagram and more.

This Panera Bread Facebook ad leverages the thing we love most about food advertisements: the food!

With an immediate appeal to our most natural human emotion (hunger), this food advertisement sets the stage for our cravings. From there, high-quality, macaroni-and-cheese imagery delights the senses.

It’s so delectable, you can almost taste it.

Another great thing about this food advertisement is that it uses a call-to-action at the end of the ad. In this way, Panera guides its audience directly to its desired end goal of purchasing some of their delicious macaroni.

Five Guys is one of those brands that always keeps it real. They do a few things really well, namely burgers, fries, and milkshakes.

With this kind of established brand identity, Five Guys can lean on the quality of their products more often.

In this ad, they are showcasing one of their best-loved products: the burger bun. The ad shows an image of the bun warming up, just waiting to be ordered.

They also use a creative call-to-action at the bottom, urging viewers to find their nearest Five Guys shop. This is a great tactic for brands who have a widespread presence and are looking to make sales in multiple locations.

Using a bit of humor, an appeal to emotion, and a simple yet effective image, this Instagram ad reminds customers that Five Guys knows what they’re good at, and they deliver it every time.

Legacy fast-food chains have had to get creative in recent years in order to capture the hearts of millennial viewers.

Burger King knows millennials love nostalgia, and what better way to appeal to that emotion than by bringing back their legendary chicken fries.

In this Burger King Twitter ad, the brand relates its chicken fries to some of the most essential human traits. This appeal, although absurd, delivers the right dose of comedy to the ad.

In addition, the use of a custom graphic design is eye-catching and fun. The design ensures that any millennial scrolling down will stop and stare, remembering chicken fries from days past.

This campaign garnered features in HuffPost and Time magazine, alongside bringing 380 tweets per minute into the Burger King ecosystem. This is millennial marketing done right.

There’s no doubt about it, IHOP is an American classic. When it was time for the brand to celebrate 60 years of successful business, they wanted to do it in style.

This IHOP Twitter ad uses music, design, and graphics to thank their loyal customers for 60 years of continued service.

The creative copy of the post offers comedic relief, stating that the brand has been operating “for 60 pancakin’ years.”

Also, they further entice viewers by hinting at a surprise announcement only available on a certain date. This use of a deadline to encourage conversions is a great way to maintain audience engagement over time.

This food advertisement immediately piqued the attention of IHOP’s viewers, bringing in more than 43,000 retweets.

What was the big reveal? We’ll let you visit the IHOP Twitter page to find out.

Emojis are part of the modern lexicon. Every day, the online world is full of these fun, little pictures that help us communicate over text.

Although emoji are always evolving, users often complain their favorite images aren’t available in emoji.

Taco Bell decided to flip this idea on its head and in 2015, they began petitioning for a taco emoji to be included in the emoji dictionary.

Not only did Taco Bell create a legendary advertising campaign, but they started a petition to lobby emoji creators, Unicode Consortium, for their cause.

The result? We now have a taco emoji.

This food advertisement campaign was one part passion and two parts humor, resulting in one of the most memorable creative marketing campaigns of the decade.

User-generated content is a great asset to your marketing strategy.

In this HelloFresh story ad, a human voice is heard listing off the benefits of the meal-delivery service in an honest and human way.

The quality of the video is less than what we would expect from a well-known company like HelloFresh, but it adds to the honest nature of the post.

By using social proof, HelloFresh manages to show its audience that its product is legitimate and trustworthy.

One of the easiest ways to appeal to audience emotion is to connect your product to a well-loved pastime.

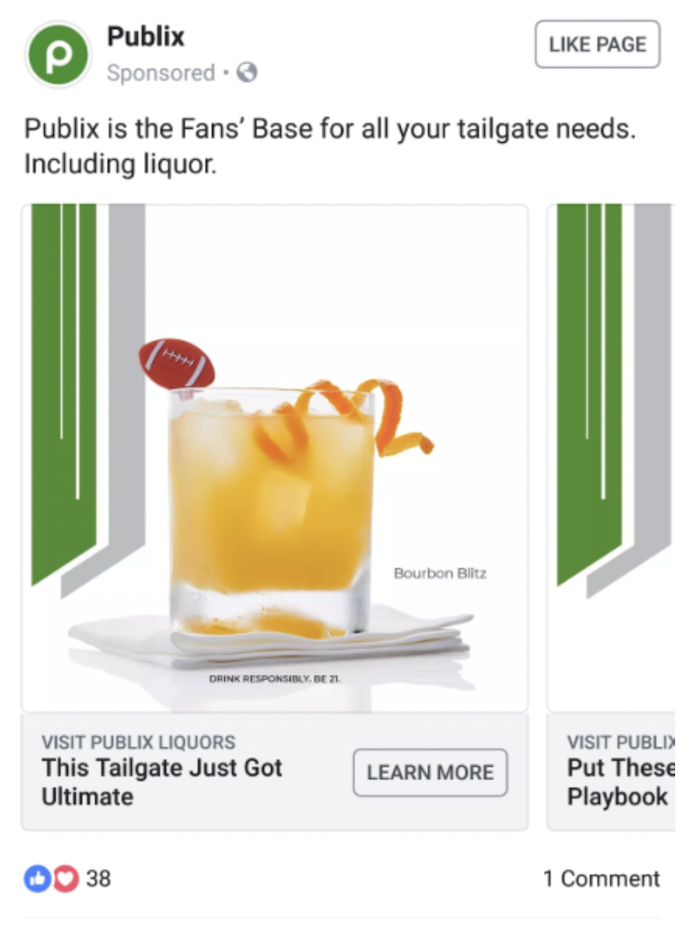

Publix knows America loves football. They also know no football game is complete without friends, drinks, and food.

This Publix Facebook Ad ran in the Southern U.S. during football season. It targeted southern users who were known to enjoy football and were ages 21+.

If you were planning your weekend with a tailgate party and you saw this ad, it would immediately remind you to stock up on your favorite beer and snacks at your local Publix. This is emotional targeting at its finest.

Another great paid advertising tactic is to offer a deal or use a coupon strategy.

In this Wendy’s Instagram ad, the brand uses a creative flatlay to promote their 4 for $4 summer deal.

This ad is effective because it creates a story for the viewer. Once you see this image, you can immediately picture yourself sitting poolside with a cheap meal, enjoying your best summertime life.

Wendy’s manages to promote their sale, appeal to emotion, and create a narrative, all with a few pieces of cardstock paper and a chicken burger. That’s impressive!

When creating digital food advertisements, it’s important to leverage every tool available to you.

When you advertise using paid social, there are so many ways to get creative, encourage audience interaction, and show off your products at the same time.

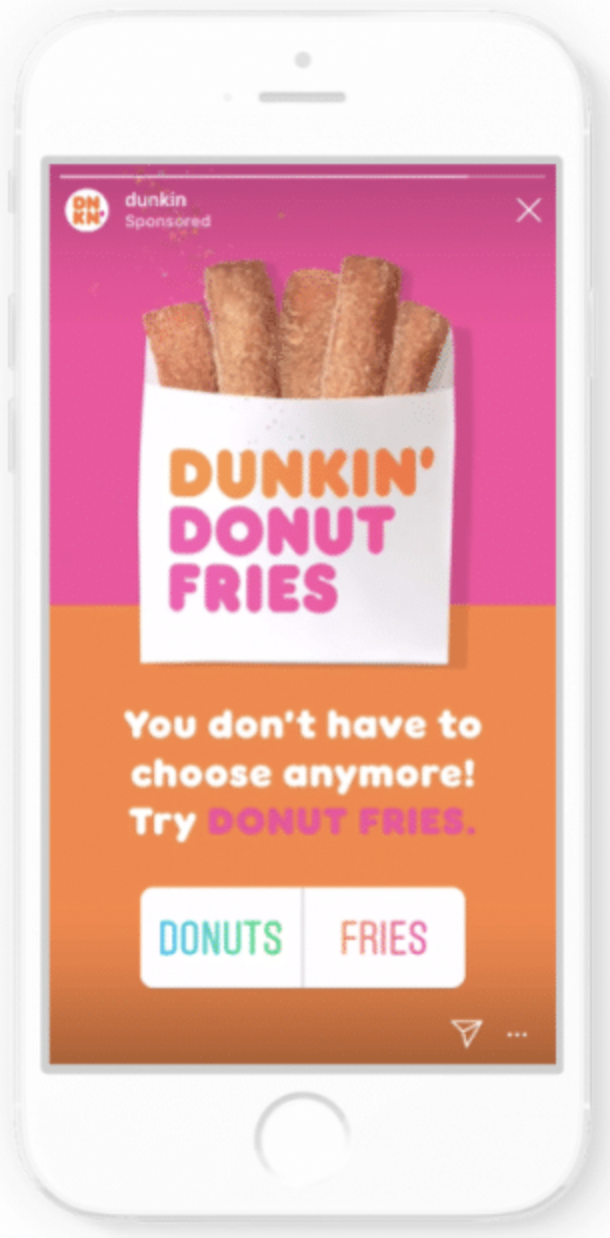

Take this Dunkin’ food advertisement as an example. Dunkin’ is promoting their iconic donut fries.

To build hype around the release, they created an interactive Instagram story using the poll feature. This allowed their audience to vote on what they liked better: donuts or fries.

(Spoiler, the correct answer is donut fries).

While A/B testing these ads, Dunkin Donuts found that stories with a poll had a 20% lower cost per view than those without.

Not only was this a creative way to boost user engagement, but the brand gathered important data to inform their future campaigns.

Beverages and food go hand in hand. There’s nothing like a cold Dr. Pepper alongside your favorite meal.

Dr. Pepper wanted to capitalize on the way their customers pair their drinks with other foods.

In this Diet Dr. Pepper advertisement, the brand uses fun motion graphics and design to show all of the different snack foods and meals that go well with the popular drink.

The use of music in the ad also adds a fun, youthful element to the viewing experience.

The end result? Viewers are both thirsty, hungry, and looking forward to cracking open their next Dr. Pepper.

Mochi Foods is a gluten-free, Hawaiian food maker that creates pancake mixes, breads, waffles, and more which use rice flour instead of wheat.

In this fun Mochi Foods social media ad, they show viewers what they can create with one pack of Mochi Food mix.

This ad is a great example of showcasing a product in action. Although a bag of Mochi Food mix might seem a bit boring, the product takes on new life once we see how it can be transformed into a delicious stack of fresh pancakes.

This ad can be used on a variety of platforms, which makes it diverse and multifaceted.

After watching it, you’re immediately hungry, which is the sign of an effective food advertisement.

To create successful digital food advertisements you need to come up with unique campaign ideas and maintain a cohesive brand image.

It’s also important to harness your social media marketing tactics across all channels, appeal to your audience’s emotions, leverage storytelling, and showcase your products in action are great ways to create food advertisements that stand out.

Because the food advertising marketing is so saturated, it may be hard to develop a paid ad strategy that actually gets you noticed. If you’re struggling to create or find success with your paid ads, our agency is here to help!

What tactics do you use when creating great food advertisements?

People always ask me the same question about AdWords:

“What’s a ‘good’ cost per click?”

My response back to them is always the same:

“Why do you care?”

See, most people have AdWords wrong. They obsess over the costs.

They know that more and more competitors are advertising on the platform, which drives up prices.

So they’re zeroed-in on how much they’re going to have to spend.

That’s the wrong approach.

Instead, they should be concerned with what they’re going to get back in return.

I know this sounds counterintuitive. However, I almost never worry about the Cost Per Click for keywords.

In fact, I almost always ignore them.

I’m going to show you why CPC’s don’t matter in many cases. I’ll show you how worrying about keyword costs can mislead you time and time again.

Then, I’ll show what you should be analyzing to make sure you’re not leaving tons of money on the table.

Each year, companies analyze the most expensive keywords in the country.

These are typically competitive phrases in law or insurance and can cost as much $50 for just a single click.

The insane thing is almost none of those clicks will turn into customers immediately.

Instead, they’ll usually opt-into a form, first.

That means you might have to front the bill for 50 or 100 clicks before someone ever converts.

We’re talking thousands of dollars for a single customer.

It makes sense on the surface; CPC ultimately determines how much you need to spend.

WordStream, for example, always releases an annual update on Cost Per Click benchmarks across industries.

The businesses I own are all software-related. But we work with clients across different industries. So it’s always interesting to look at these cost breakdowns.

Average ecommerce CPC’s might only be around a dollar, while law might run up to around six dollars (these are higher than most Bing Shopping campaigns, which should be considered for e-commerce businesses as well).

To be honest, though, I don’t obsess over costs, alone.

The first reason comes down to what the study says at the top: Averages.

Average CPCs don’t really mean all that much.

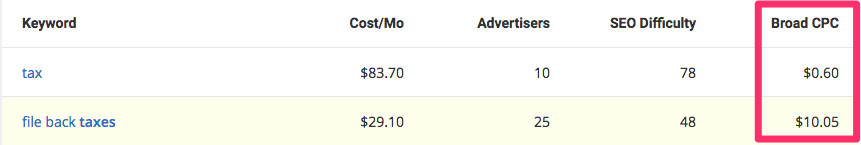

Popular, generic terms aren’t usually all that expensive.

Only a tiny percentage of the people who ever click on those will convert. Whereas, a more commercial long-tail keyword will be incredibly expensive.

Just compare the difference in costs between “tax” and “file back taxes”:

See? It’s not even close.

That makes it hard to use a standard, “industry average benchmark” for any in-depth analysis.

There’s another reason why I don’t like to just look at costs — because you’re often forgetting the other side of the equation.

Conversions ultimately have a much bigger impact than costs.

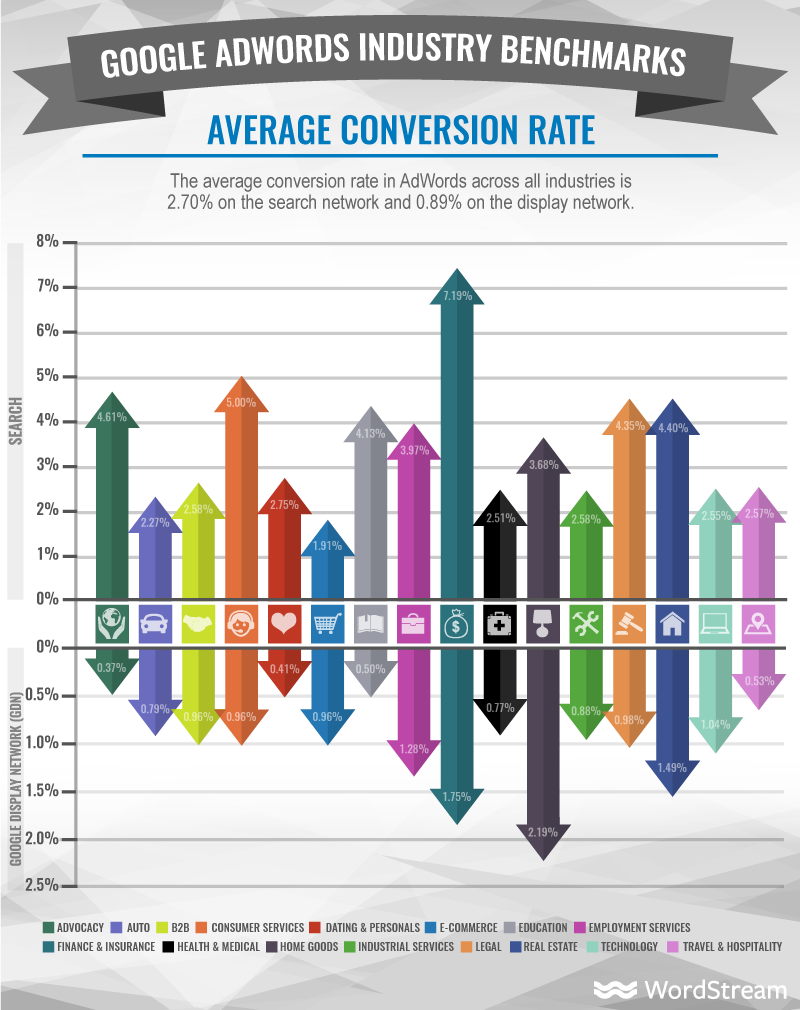

Now, let’s check out those industry average conversions from the same study:

Ok, now we’re getting a little closer.

If you remember, the industry average CPC for ecommerce was only around a dollar. In fact, it was one of cheapest CPC’s on the entire list.

But if you now look at the average conversion rates, you’ll see why.

Their conversion rates are also among the lowest.

What does it matter if CPCs are ‘inexpensive’ if the conversions are equally low?

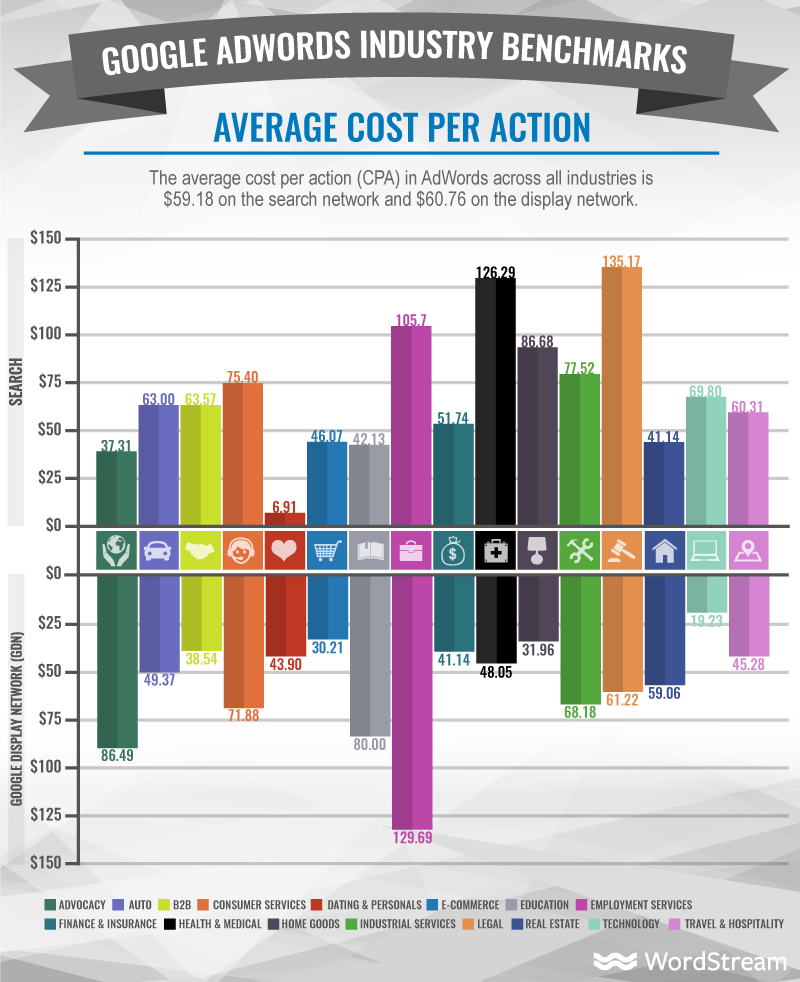

That’s why you often want to look at the Cost Per Action (or Acquisition) when putting together advertising estimates.

This is the effective price you pay to generate a lead, for instance.

It’s a performance ratio. It starts to take into account things like costs vs. conversions to help you determine a much better figure: ROI.

The industry average Cost Per Action for ecommerce lines up with education on the search network.

So from an ROI standpoint, there’s almost no difference.

This is why CPC is almost meaningless.

Yes, it’s important to a point because it drives things like your Cost Per Action.

However, what’s ultimately more important is the revenue you can generate.

It doesn’t matter whether we’re talking about Google AdWords, Facebook, or even Twitter ads. The message is still the same.

Digital Marketer once ran a Twitter Lead Gen campaign, testing the effective Cost Per Action (or Lead).

One campaign was able to see a $7.81 cost per lead.

They then ran the same study with the same ad and audience targeting. But this time, they optimized the campaigns to increase conversions.

It generated a $1.38 Cost Per Lead, which came out to a five time lead increase on the same ad budget.

They were able to 5X conversions simply by focusing on conversions and Cost Per Lead. They didn’t even have to touch the CPC.

You can see this time and time again.

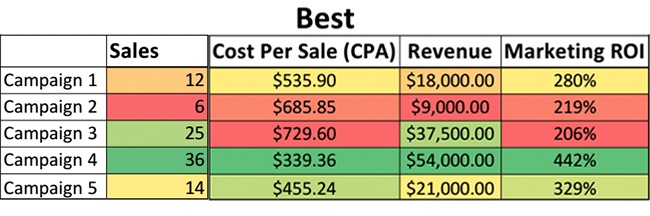

Jacob Baadsgaard of Disruptive Advertising confirms that the best PPC metrics are revenue-focused. They track lead data all the way through to closed sales.

Then, and only then, will they make a decision about which ad campaign is best.

It’s not that costs don’t matter. They do, of course. But they only matter in context to how much revenue you can generate from it.

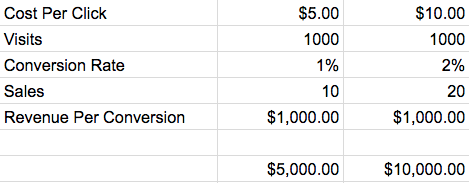

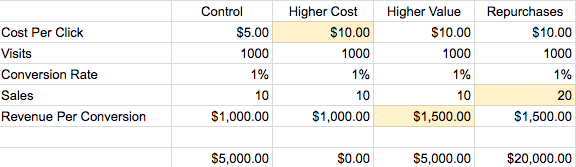

Here’s a very simple example to illustrate.

Let’s say you run two ad campaigns side-by-side.

The Cost Per Click for the second campaign is twice as much as the first. But because the conversion rate is 2% instead of 1%, you’re able to double revenue.

Would you pay twice as high a Cost Per Click to generate twice as much revenue? Of course you would!

This is after reducing revenue by your ad costs. So it’s already accounting for the higher ad budget.

At the end of the day, you’re still doubling revenue. It’s totally worth it!

Obsessing over CPC doesn’t just leave money on the table. It can also make you waste a ton of what you’re already spending.

Here are a few examples.

There are many things that separate big companies from small ones.

But here’s one of the biggest: Big companies spend more on advertising than small ones do.

Duh, right? Of course big companies have bigger budgets.

We’re not just talking about dollars spent, but percentage of revenue

Salesforce, the world’s biggest CRM company, spends up to 46 percent of their budget on marketing and advertising!

Crazy, right?

The question is why?

Why don’t small companies spend more on advertising?

In my experience, I find that they’re often too risk averse.

They don’t have the same access to capital. So they tend to obsess over costs, as opposed to revenues.

The classic scenario is when a business owner spends a few hundred bucks on new Facebook ads, only to conclude that they “Don’t work” five days later.

So they pull the plug too early.

In almost all cases, they just need to let the campaigns run longer.

Jennifer Shaheen found that campaigns should run at least 45 days before stopping. And that makes sense when you think about it.

Look at it this way.

How many sales do you need to break even? Let’s hypothetically say two or three.

So what are the chances that those two or three sales land in the first few days?

Pretty slim!

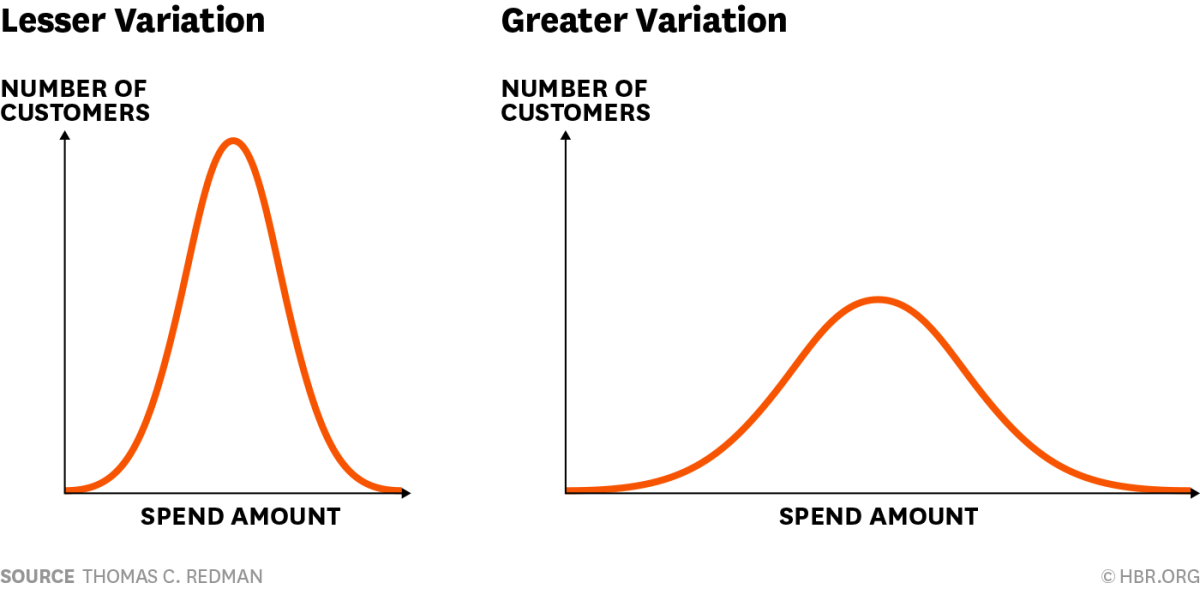

It’s the law of averages at work. You need a big sample size before numbers start to meet projections.

It’s going to take a few weeks, at least, to get statistically significant numbers. Otherwise, you’re just guessing.

All of this assumes that you know the ‘right’ ad campaign variables ahead of time. Which, in all likelihood, you don’t.

Not because you’re not smart. But because it takes awhile to figure these things out!

Here’s the other thing:

Many times, you actually need to increase ad spend.

Yes, you heard me right.

Listen, the reason you spend money on advertising is to make money — not save it.

That means you need to get to statistical significance as quickly as possible.

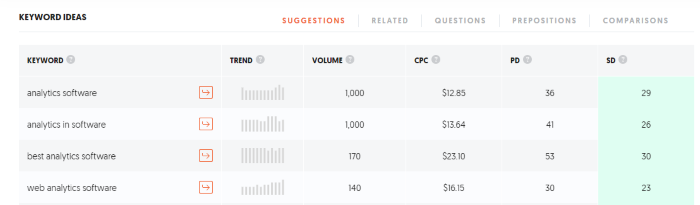

For example, go check out a few CPC ranges for keywords you’re about to bid on.

I like to use Ubersuggest to get a this data:

The average CPC for “analytics software” is estimated to be around $12.85 Ok, not bad I guess.

Let’s use that as the upper limit. We can create automated rules in the Facebook Business Manager.

If you’re having a hard time hitting those numbers, you can set a rule to actually increase CPCs.

That will make sure I get better placement over the competition and as many conversions as possible.

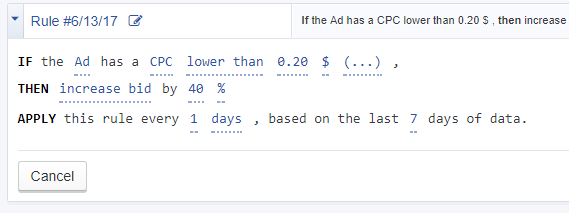

Here’s how that might look inside AdEspresso:

Of course, this approach isn’t ideal.

Because you still might leave a lot of money on the table.

If your CPCs start edging up, the campaigns will back off or stop.

Then your lead flow will stop, too.

That’s why I like using CPAs as targets if possible, instead of CPCs.

Cost Per Action is a better performance than Cost Per Click.

It’s not as good as Revenue, though–and there’s the problem.

CPAs can still be subjective.

Is a ‘high’ CPA bad? Maybe, maybe not.

If your CPA is over $100 in ecommerce, that might be bad.

Almost every single campaign CPA will be over $100 in law, for example. So it’s not bad at all.

Its still a much better metric to control ad campaign performance, though.

You can still figure out an upper range that starts to make ad campaigns unprofitable. You’ll base this on your average sale per customer. (More on this later.)

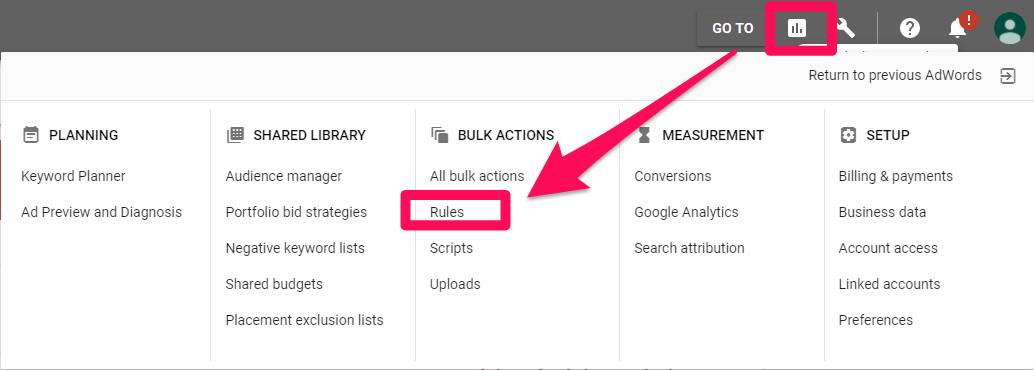

For starters, you can set automated rules to increase or decrease the total budget based on your CPA.

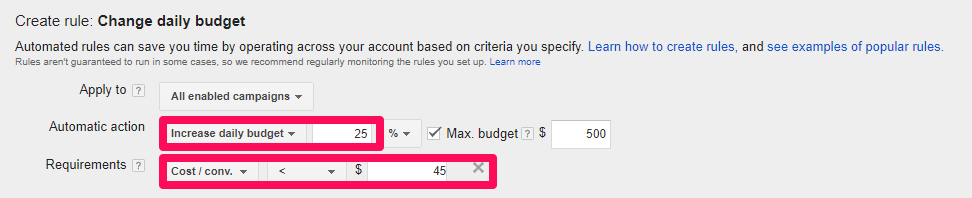

Inside AdWords, you can go to “Bulk Actions” and create new “Rules” for these ranges:

Under “Change budgets,” you can set an automated rule to either increase or decrease budgets based on cost per conversion numbers.

This tells AdWords to automatically increase your daily budget 25 percent if the CPA is within a certain dollar range.

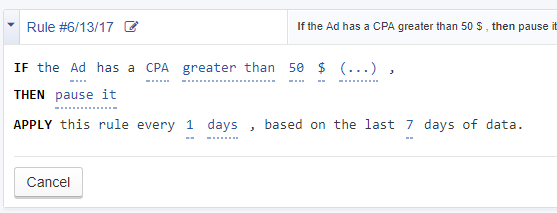

You can do this same exact strategy inside Facebook, too.

You’ll set a rule to increase, decrease, or stop a campaign if the CPA hits a certain threshold.

Managing ad campaigns by CPA can net you more customers and revenue.

There’s still one big section we’re forgetting.

Keyword pricing or competitive pressure aren’t the only factors to worry about.

Many times, your customer base could be going through their own issues, and that’s not something you can change.

That’s why focusing on revenue is always the best approach.

Spearmint Love is one my favorite success stories.

They went from a baby blog to growing revenue over 991% year over year, and they did it almost exclusively through Facebook and Instagram ads.

The craziest part is that it almost didn’t happen.

They were growing like a weed, until…everything just stopped.

Results were declining across the board and they couldn’t figure out why.

Until, one day while on a walk, it dawned on one of the co-founders.

Parents will buy baby clothes until that baby grows up. In other words, their customers were kind of ‘moving on’ from the company.

The ad campaign decline had nothing to do with costs or his ad campaigns per se.

It had everything to do with their customer base.

How on Earth do you solve this problem?

By focusing on increasing revenue — not touching costs.

If the CPA is ‘too high’ to make your numbers work, start by increasing average order values.

Upsells are easy, for example, when you bundle similar products.

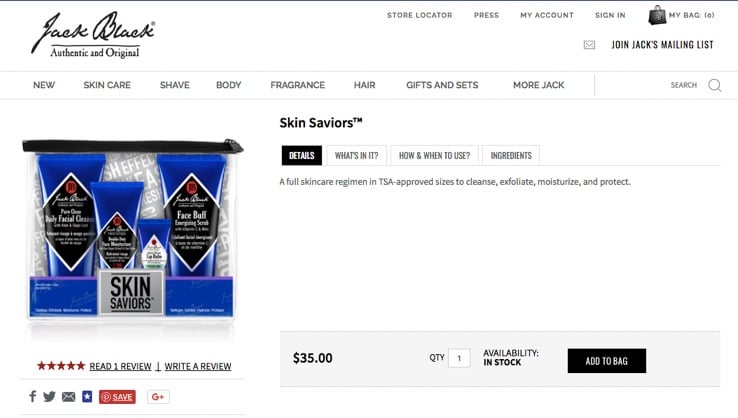

Think about the last time you flew somewhere. Chances are, you bought a travel-sized product at a store before going through TSA.

But that product probably only cost a few bucks, right?

Check out what Jack Black does here, bundling several travel products together.

You arguably need all of these products if you’re flying somewhere.

Instead of only charging you a few bucks each, they’re charging you $35 for the whole pack!

Simply bundling similar products allows them to charge 10x more. Which means you can afford a much higher initial advertising cost now, too.

You can also cross-sell products to try and raise the average order value.

For example, right underneath this travel bundle, Jack Black offers a few related products to take with you:

One interesting thing to note is the price of all three items. They’re all slightly less than the initial $35 purchase.

Why?

They’re using price anchoring effect to make these additional products seem less expensive.

The Economist included a middle pricing tier for a print-only subscription. It was the same exact price as the ‘big’ plan for both the print and web editions.

Most people chose the combined third option because it seemed like the best deal.

Removing the middle plan on a subsequent test, however, led people to overwhelmingly pick the cheap option, instead.

Price anchoring changes someone’s perception of cost vs. value.

That’s why you should lead with the more expensive option. Then, showcase a few related products to cross-sell that are slightly less expensive.

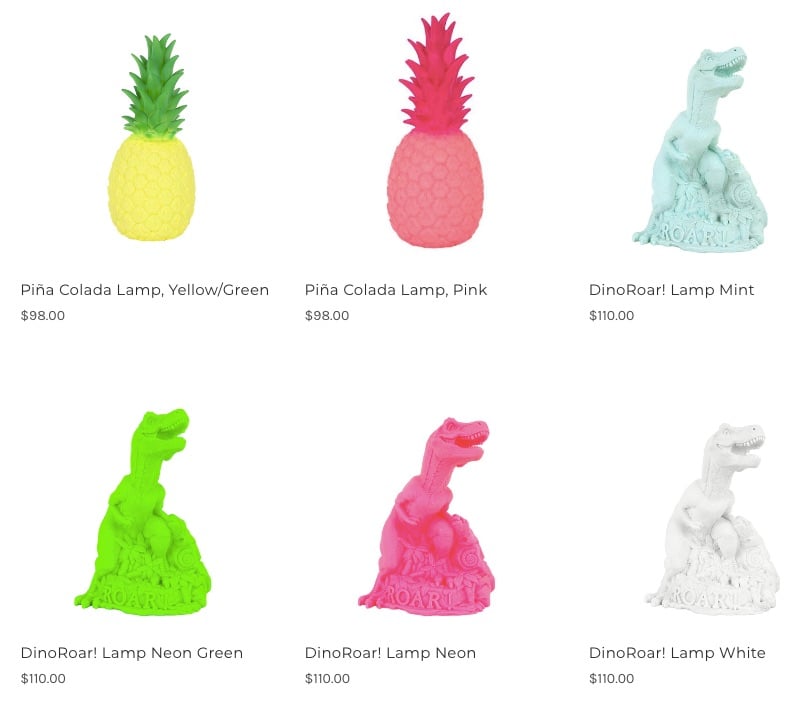

Spearmint Love also expanded their product line to increase average order values.

They came out with decor pieces, like hundred-dollar baby lamps.

The age of a child mattered less in this type of purchase. So it kept the company relevant longer in their eyes of their customers.

After increasing average order values, you should increase the lifetime value of each customer.

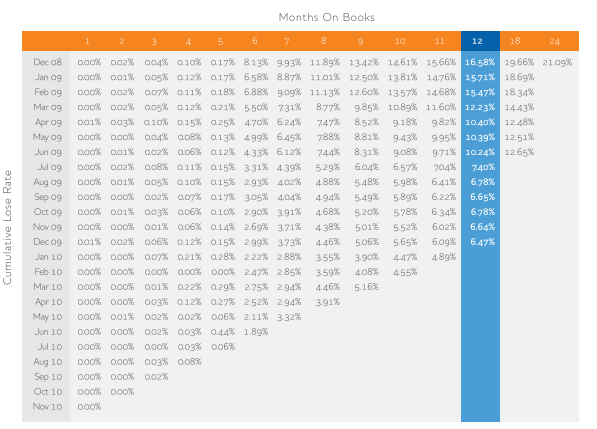

One technique is a vintage analysis, which shows you which customer cohorts are worth the most already.

This way, you can identify trends or patterns.

You can see what the most lucrative customers are doing and then apply those lessons across the board.

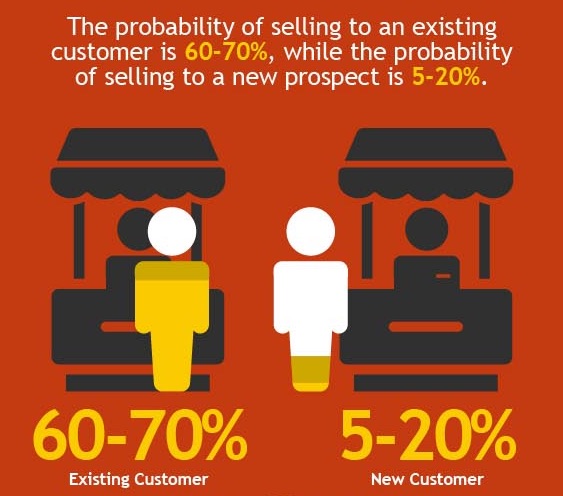

Constantly acquiring new customers is expensive. You have to spend a lot more to get them to buy.

Increasing repurchases from your existing customers has a massive impact on your bottom line.

Let’s revisit that initial ad model to see why.

Keep in mind this is a simplistic example. But I think it still does a decent job showing how this works.

The first campaign has a higher initial cost; you’re barely breaking even.

This is what most companies are scared of. They worry about spending more money on keywords.

As a result, they completely neglect optimizing conversions, average order values, or repurchases.

So yes, they might bring in a few sales. But the higher costs deplete their ad budget before long.

The end result is a wash.

The second campaign has a higher average order value.

In this case, you’re not even getting more conversions. All you’re doing is bundling a product, for example.

Already, you’re back in the black. Not bad.

However, the third campaign?

Not only are the average order values higher, but you’re getting more repeat purchases, too.

You’re basically generating more purchases from the same number of customers. Many times, you don’t even have to spend a single dollar to get them.

All you have to do is send out an email campaign. These loyal customers don’t take a lot of extra persuading.

More sales, without increasing ad costs, skyrockets revenue.

You make several times the other few campaigns.

Best of all, you didn’t sweat a single CPC. You willingly paid at the top-end of the budget range to maximize your opportunities.

Then, you doubled-down on the other side of the equation.

Increasing conversions and revenue spent can act as a lever to double or triple ad campaign ROI.

There’s only one reason to spend money on ads at the end of the day: to make money.

Chasing the keywords with the lowest CPC is a losing proposition.

If anything, you should be spending more money. You should actually search out the highest CPC’s in your industry.

Why?

Often, they offer the most potential. You want to maximize the most sales per dollar spent.

So you know all those “industry benchmark CPC” numbers? Don’t worry about them.

Instead, start focusing on CPA. That’s the number it costs for you to acquire each new customer.

It’s not perfect by any stretch. But it’s a better number to optimize around than CPC.

From there, try to dig into revenue numbers.

Can you bundle a few products to raise the average order value? Can you cross-sell recommended products and use price anchoring to lower their perceived cost?

Then, figure out how you can keep customers around longer.

That might mean introducing new, related product lines. Or it might mean introducing ‘consumable’ products that people need to repurchase again and again and again.

The point is to drive up the lifetime value of each customer as high as possible.

When you do that, CPC will matter even less.

There will be so much revenue generated per customer that you can afford to spend almost anything to get them in the first place.

How have you boosted ad campaign performance by focusing on conversions instead of costs?

The post The Great CPC Hoax: Why Cost Per Click Doesn’t Matter for High-ROI Ad Campaigns appeared first on Neil Patel.

The novel coronavirus has changed our economy. And it continues to do so. You may be thinking you cannot qualify for any great recession vendor accounts to build your business credit. But you can! Let us show you how to get the credit and cash your business needs – now, more than ever.

Are you looking for 5 great recession vendor accounts that build your business credit? We’ve got them right here. Get the easiest business credit card!

When you are first starting to build business credit, your first step should be vendor or trade credit. You want to get into good credit habits. So this is everything from not borrowing too much, to paying your debts back on time. And it includes staying on good terms with your sources of credit.

You will need to start a business credit profile and score with what are called starter vendors. Starter vendors are ones who will give your small business initial credit. So they will do so even if your company has no credit, no score, or no trade lines.

Note that most stores like Staples will not give you initial starter credit, so don’t even try applying with them.

Here are 5 great recession business credit vendors that build your business credit. You can get a starter business credit card. This is the vendor credit tier, and these are our top 5 business credit cards for new businesses.

Learn more here and weather any recession. Get started toward getting up to 7 vendors that build your business credit.

You can find Uline’s website here. They sell shipping, packing and industrial supplies, and they report to Dun & Bradstreet and Experian. You must have a D-U-N-S number and an EIN before starting with them. They will ask for your business bank information. Your business address must be uniform everywhere. You need for an order to be $50 or more before they’ll report it. Your first few orders might need to be prepaid initially so your company can get approved for Net 30 terms.

You need the following to qualify:

Here’s how to apply with them:

Crown Office Supplies is an additional true starter vendor. They sell a variety of office supplies and take helping clients seriously. They state, “just starting your business, or maybe have an existing business, but you have a question regarding office supplies… we are here to help!” And they report to Dun and Bradstreet, Experian, and Equifax.

There is a $99.00 yearly fee, though they do report that fee to the business credit reporting bureaus. For other purchases to report, the purchase must be at least $30.00. Terms are Net 30.

Apply online.

You can find Grainger Industrial Supply here. They sell hardware, power tools, pumps and more. They also do fleet maintenance. And they report to Dun & Bradstreet.

To qualify, you need the following:

If your business doesn’t have an established credit, they will require additional documents like accounts payable, income statement, balance sheets, and the like.

Apply online or over the phone.

Supply Works is a great recession vendor. Visit them at: www.supplyworks.com. They are a part of the Home Depot. They offer integrated facility management solutions. Virtual addresses are not accepted. They report to Experian. Terms are Net 30.

To qualify, you need to have:

Apply online or over the phone.

Find out why so many companies are using this to weather any recession and improve their business credit – and check out even more vendors (7!) to help you build business credit.

Check out Strategic Network Solutions. Visit them at: https://stntsol.com. They offer technology training and tech support. A credit limit will start at $1000 for new businesses. It increases by an $500 increment if balances are paid in full and on time. They report to Experian and Credit Safe.

In order to qualify for business credit with Strategic Network solutions, you will need the following:

Apply online.

Marathon Petroleum Company provides transportation fuels, asphalt, and specialty products throughout the United States. Visit them at: www.marathonbrand.com. Their comprehensive product line supports commercial, industrial, and retail operations. They report to: D&B, Experian, and Equifax. Terms are Net 22.

You can give a $500 deposit instead of using a personal guarantee if you have been in business for less than a year.

To qualify, you need:

Apply online.

Getting vendor accounts for business credit means that you are on your way to getting good business credit. Get three or more vendor accounts. You want them all to be reporting with at least one bigger business credit bureau. And then you can start trying to get store credit.

Once there are three or more vendor trade accounts reporting to at least one of the CRAs, then move onto revolving store credit. These are businesses such as Office Depot and Staples. These companies have even more of the goods you need.

You will always have to use your Social Security Number and date of birth for verification purposes. But use the small business’s EIN on these credit applications when it comes to credit check services small business.

Are there more accounts reporting? Then move to fleet credit. These are service providers such as BP and Conoco. Use this credit to buy, fix, and take care of vehicles.

Use your Social Security Number and date of birth for verification purposes. But make certain to apply using the company’s EIN for credit checks.

Have you been sensibly managing the credit you’ve gotten up to this point? Then progress to cash credit. These are service providers like Visa and MasterCard.

Use your Social Security Number and date of birth for verification purposes. And apply using the company’s EIN for credit checks.

These are typically MasterCard credit cards. If you have even more trade accounts reporting, then these are attainable.

If it were all left up to you, how would you improve weathering any recession and working with 7 vendors to help you build business credit?

Know what is happening with your credit. Make sure it is being reported and deal with any inaccuracies ASAP. Get in the habit of taking a look at credit reports; so dig into the details, and not just the scores.

So we can help you monitor business credit at Experian and D&B for 90% less than it would cost you at the business credit reporting agencies.

Update the details if there are mistakes or the information is incomplete. So at D&B, you can do this at: https://iupdate.dnb.com/iUpdate/viewiUpdateHome.htm.

And at Experian, go to: http://www.experian.com/small-business/business-credit-information.jsp.

Finally, for Equifax, go to: http://www.equifax.com/business/small-business.

What’s all this monitoring for? So it’s to challenge any errors in your records. Errors in your credit report(s) can be fixed. But the CRAs normally want you to dispute in a particular way.

Get your PAYDEX report for DNB small business at: http://www.dnb.com/about-us/our-data.html.

You can get your company’s Experian report at: http://www.businesscreditfacts.com/pdp.aspx?pg=SearchForm.

And get your Equifax business credit report at: http://www.equifax.com/business/credit-information.

Disputing credit report errors typically means you send a paper letter with copies of any evidence of payment with it. So these are documents like receipts and cancelled checks. But never mail the originals. Always send copies and keep the original copies.

Disputing credit report errors also means you precisely spell out any charges you dispute. Make your dispute letter as understandable as possible. Be specific about the concerns with your report. Use certified mail so that you will have proof that you sent in your dispute.

Dispute your or your company’s Equifax report by following the instructions here: http://www.equifax.com/small-business-faqs/#Dispute-FAQs.

You can dispute errors on your or your business’s Experian report by following the directions here: http://www.experian.com/small-business/business-credit-information.jsp.

And D&B’s PAYDEX Customer Service telephone number is here: https://www.dandb.com/glossary/paydex/, to help you with disputes. It’s the only way they’ll let you dispute a DNB.com credit report.

Always use credit responsibly! Don’t borrow more than what you can pay off. So monitor balances and deadlines for payments. Paying off punctually and in full will do more to increase business credit scores than nearly anything else.

Establishing small business credit pays. Great business credit scores help a company get loans. Your lender knows the company can pay its financial obligations. Because they know the small business is authentic. The company’s EIN links to high scores and loan providers won’t feel the need to require a personal guarantee.

And soon you’ll be able to move onto the top ten business credit cards – and beyond! Because no matter how it feels right now, the COVID-19 situation and recession will not last forever.

Discover this new way to weather any recession and find 7 (!) vendors to help you build business credit.

The post Check Out 5 Great Recession Vendor Accounts To Build Your Business Credit appeared first on Credit Suite.

The Great Back Door Secret to Creating Wealth

There are some actions of prep work you do not desire to miss out on if you’re interested in producing riches. While there is a terrific back entrance key to producing riches, the roadway to finding that secret varies from one person to another. Allow’s check out some basic methods you can get going on that particular roadway as well as just how these actions relate to your day-to-day live.

Research concerning Attracting Wealth

This could appear evident, yet possibly among the very best methods to produce wide range is to research exactly how others have actually done it in the past. Pick meticulously whose life as well as which techniques of producing wide range you examine. Some individuals have actually developed riches with not-so-honest methods, as well as you’ll most definitely wish to remain satisfied as well as truthful while drawing in riches in your life.

Look for their “excellent back door trick” to bring in riches. Maybe they began going door to door as salespersons or begun as a staff and also functioned their means up to the setting of head of state or vice head of state of a huge firm. You can discover lots of publications composed by well-off males as well as ladies or go online to check out regarding just how to be effective.

Identify What Brings You Happiness

Riches indicates absolutely nothing without joy. The fantastic information is you can do both. Why not do what you enjoy most while all at once bring in wide range?

Establish Goals for Financial Freedom

Establish some objectives for your organisation by making a note of the earnings you want to gain this coming year, in 5 years, and also 10 years from currently. Make sure to develop objectives for both the short-term and also long-term, and also compose a service strategy with the actions required to get to the objectives. Develop a spending plan for your brand-new endeavor to figure out investing for advertising and marketing, stock (if relevant), as well as regular operating costs.

Producing Wealth by Helping Others

You will certainly bring in riches as you assist others understand their desires. You can do this by locating out the troubles and also issues others might have in organisation or also in their individual lives, and also after that produce options for them. If you’re interested in wellness and also physical fitness, you can establish solutions or items to aid others lead a much healthier life.

Once you find your very own abilities as well as possibility, producing wide range is not so challenging. This excellent back entrance key is easy to recognize, however lots of people are so active treking along in their present work that they never ever make an initiative to much better themselves. Maintain a favorable frame of mind as you grab your objectives and also you’ll quickly be bring in wide range like never ever prior to!

If you’re interested in developing riches, there are some actions of prep work you do not desire to miss out on. While there is a wonderful back door key to producing wide range, the roadway to uncovering that secret varies from individual to individual. Pick very carefully whose life as well as which techniques of developing wide range you examine. Some individuals have actually produced riches via not-so-honest ways, as well as you’ll absolutely desire to remain satisfied as well as sincere while drawing in wide range in your life.

Producing riches is not so tough once you find your very own abilities and also possibility.

The post The Great Back Door Secret to Creating Wealth appeared first on ROI Credit Builders.

The Great Back Door Secret to Creating Wealth

There are some actions of prep work you do not desire to miss out on if you’re interested in producing riches. While there is a terrific back entrance key to producing riches, the roadway to finding that secret varies from one person to another. Allow’s check out some basic methods you can get going on that particular roadway as well as just how these actions relate to your day-to-day live.

Research concerning Attracting Wealth

This could appear evident, yet possibly among the very best methods to produce wide range is to research exactly how others have actually done it in the past. Pick meticulously whose life as well as which techniques of producing wide range you examine. Some individuals have actually developed riches with not-so-honest methods, as well as you’ll most definitely wish to remain satisfied as well as truthful while drawing in riches in your life.

Look for their “excellent back door trick” to bring in riches. Maybe they began going door to door as salespersons or begun as a staff and also functioned their means up to the setting of head of state or vice head of state of a huge firm. You can discover lots of publications composed by well-off males as well as ladies or go online to check out regarding just how to be effective.

Identify What Brings You Happiness

Riches indicates absolutely nothing without joy. The fantastic information is you can do both. Why not do what you enjoy most while all at once bring in wide range?

Establish Goals for Financial Freedom

Establish some objectives for your organisation by making a note of the earnings you want to gain this coming year, in 5 years, and also 10 years from currently. Make sure to develop objectives for both the short-term and also long-term, and also compose a service strategy with the actions required to get to the objectives. Develop a spending plan for your brand-new endeavor to figure out investing for advertising and marketing, stock (if relevant), as well as regular operating costs.

Producing Wealth by Helping Others

You will certainly bring in riches as you assist others understand their desires. You can do this by locating out the troubles and also issues others might have in organisation or also in their individual lives, and also after that produce options for them. If you’re interested in wellness and also physical fitness, you can establish solutions or items to aid others lead a much healthier life.

Once you find your very own abilities as well as possibility, producing wide range is not so challenging. This excellent back entrance key is easy to recognize, however lots of people are so active treking along in their present work that they never ever make an initiative to much better themselves. Maintain a favorable frame of mind as you grab your objectives and also you’ll quickly be bring in wide range like never ever prior to!

If you’re interested in developing riches, there are some actions of prep work you do not desire to miss out on. While there is a wonderful back door key to producing wide range, the roadway to uncovering that secret varies from individual to individual. Pick very carefully whose life as well as which techniques of developing wide range you examine. Some individuals have actually produced riches via not-so-honest ways, as well as you’ll absolutely desire to remain satisfied as well as sincere while drawing in wide range in your life.

Producing riches is not so tough once you find your very own abilities and also possibility.

The post The Great Back Door Secret to Creating Wealth appeared first on ROI Credit Builders.

Microsoft Great Plains FA

Microsoft Business Solutions Great Plains is marketed for mid-size business in addition to Navision (which has excellent placements in Europe as well as arising markets where it can be quickly local).

Great Plains Fixed Assets Management component is a durable device that can aid you handle your properties successfully. It incorporates flawlessly with various other Great Plains components like General Ledger, Purchase Order Processing, and also Payables Management making sure precision while minimizing repetitive information access.

Great Plains’ user-friendly visual individual interface makes it very easy to accessibility sustaining information on properties, publications, and so on. The most recent variations of Great Plains Fixed Asset likewise comes with an overall of 16 devaluation techniques covering varied markets for compatibility with firm choices.

Functions:

Easy Asset Setup– Manage and also develop and also endless variety of publications of possessions for each and every business, consisting of company, government tax obligation, alternate minimal tax obligation, as well as a lot more.

Personalized Setup– Add up to 15 user-defined areas to track any type of industry-specific details that you require. You can additionally establish layouts and also defaults to satisfy company requirements.

Possession Tracking– Track extensive info regarding possessions utilizing user-defined or common areas, in several amounts or by a possession part like master ID number or property suffix.

Possession Classes– Define property courses to establish defaults for a team of possessions, in addition to established features such as devaluation or property retired life for several properties at once.

Balancing Conventions– Utilize a range of balancing conventions for taking care of properties consisting of averaging by half year, mid quarter, complete month, complete duration, complete year, as well as others.

Devaluation Management – Use any one of 16 devaluation approaches such as straight line, continuing to be life, and also amortization, and also anticipate your devaluation expenditures for monetary job.

Property Review– View and also examine comprehensive details concerning properties on-screen consisting of possession account, individual, insurance coverage, or lease information, or pierce to the coming from deal to take a look at higher information.

Possession Manipulation– Manage possessions with effective devices for including or transforming possessions such as retired life, transferals, as well as making mass modifications to numerous possessions.

Coverage Flexibility– Share info with a variety of common records such as devaluation journals, residential property transfer, stock checklist, and also property retired lives. Produce personalized records making use of SmartList, Report Writer, as well as Crystal Reports.

All the best with modification, application as well as assimilation and also if you have worries or concerns– we are right here to aid! If you desire us to do the work – provide us a phone call 1-630-961-5918 or 1-866-528-0577! help@albaspectrum.com

This is helpful for dropping, retiring, or merely transforming the details for a collection of properties with a solitary click. Great Plains’ instinctive visual customer interface makes it simple to accessibility sustaining information on properties, publications, and so on. The newest variations of Great Plains Fixed Asset additionally comes with an overall of 16 devaluation approaches covering varied sectors for compatibility with business choices. You additionally have the alternative to back devaluation out, recalculate, include extra depreciable quantity, as well as task devaluation for years in advance for any kind of number of possessions in your publication.

The post Microsoft Great Plains FA appeared first on ROI Credit Builders.

Microsoft Great Plains FA

Microsoft Business Solutions Great Plains is marketed for mid-size business in addition to Navision (which has excellent placements in Europe as well as arising markets where it can be quickly local).

Great Plains Fixed Assets Management component is a durable device that can aid you handle your properties successfully. It incorporates flawlessly with various other Great Plains components like General Ledger, Purchase Order Processing, and also Payables Management making sure precision while minimizing repetitive information access.

Great Plains’ user-friendly visual individual interface makes it very easy to accessibility sustaining information on properties, publications, and so on. The most recent variations of Great Plains Fixed Asset likewise comes with an overall of 16 devaluation techniques covering varied markets for compatibility with firm choices.

Functions:

Easy Asset Setup– Manage and also develop and also endless variety of publications of possessions for each and every business, consisting of company, government tax obligation, alternate minimal tax obligation, as well as a lot more.

Personalized Setup– Add up to 15 user-defined areas to track any type of industry-specific details that you require. You can additionally establish layouts and also defaults to satisfy company requirements.

Possession Tracking– Track extensive info regarding possessions utilizing user-defined or common areas, in several amounts or by a possession part like master ID number or property suffix.

Possession Classes– Define property courses to establish defaults for a team of possessions, in addition to established features such as devaluation or property retired life for several properties at once.

Balancing Conventions– Utilize a range of balancing conventions for taking care of properties consisting of averaging by half year, mid quarter, complete month, complete duration, complete year, as well as others.

Devaluation Management – Use any one of 16 devaluation approaches such as straight line, continuing to be life, and also amortization, and also anticipate your devaluation expenditures for monetary job.

Property Review– View and also examine comprehensive details concerning properties on-screen consisting of possession account, individual, insurance coverage, or lease information, or pierce to the coming from deal to take a look at higher information.

Possession Manipulation– Manage possessions with effective devices for including or transforming possessions such as retired life, transferals, as well as making mass modifications to numerous possessions.

Coverage Flexibility– Share info with a variety of common records such as devaluation journals, residential property transfer, stock checklist, and also property retired lives. Produce personalized records making use of SmartList, Report Writer, as well as Crystal Reports.

All the best with modification, application as well as assimilation and also if you have worries or concerns– we are right here to aid! If you desire us to do the work – provide us a phone call 1-630-961-5918 or 1-866-528-0577! help@albaspectrum.com

This is helpful for dropping, retiring, or merely transforming the details for a collection of properties with a solitary click. Great Plains’ instinctive visual customer interface makes it simple to accessibility sustaining information on properties, publications, and so on. The newest variations of Great Plains Fixed Asset additionally comes with an overall of 16 devaluation approaches covering varied sectors for compatibility with business choices. You additionally have the alternative to back devaluation out, recalculate, include extra depreciable quantity, as well as task devaluation for years in advance for any kind of number of possessions in your publication.

The post Microsoft Great Plains FA appeared first on ROI Credit Builders.

COVID-19 got you down? It’s not going to last forever. In the meantime, you can build recession business credit. Get a jump on then competition and use this pause in our lives to get ahead.

Every entrepreneur asks this same question: how do I build recession business credit?

The United States’s economy has been through any number of changes throughout the years. Our economic fortunes can depend on breakthroughs in modern technology, diplomatic ties (or cutting those ties), the weather, and a lot more. Business credit, luckily, is an asset which you can build even during economic recessions. Nevertheless, you may need to get a little imaginative with it, and with other forms of company funding.

Business credit is credit in a company’s name. It doesn’t link to a business owner’s consumer credit, not even when the owner is a sole proprietor and the sole employee of the company.

As such, a business owner’s business and consumer credit scores can be very different.

Due to the fact that recession business credit is separate from individual, it helps to safeguard a business owner’s personal assets, in the event of a lawsuit or business insolvency.

Also, with two distinct credit scores, a small business owner can get two separate cards from the same merchant. This effectively doubles purchasing power.

Another advantage is that even new ventures can do this. Going to a bank for a business loan can be a recipe for disappointment. But building small business credit, when done properly, is a plan for success.

Consumer credit scores rely on payments but also other components like credit utilization percentages.

But for company credit, the scores actually only hinge on if a business pays its invoices on time.

Growing company credit is a process, and it does not occur automatically. A small business has to proactively work to establish business credit.

However, it can be done readily and quickly, and it is much swifter than establishing consumer credit scores.

Merchants are a big part of this process.

Doing the steps out of order will lead to repetitive rejections. Nobody can start at the top with company credit. For example, you can’t start with retail or cash credit from your bank. If you do, you’ll get a rejection 100% of the time.

A small business needs to be fundable to lenders and vendors.

Hence, a business will need a professional-looking website and e-mail address. And it needs to have site hosting bought from a supplier like GoDaddy.

And also, company phone and fax numbers ought to have a listing on ListYourself.net.

At the same time, the company phone number should be toll-free (800 exchange or comparable).

A business will also need a bank account dedicated solely to it, and it has to have all of the licenses essential for running.

These licenses all have to be in the particular, accurate name of the small business. And they must have the same small business address and phone numbers.

So keep in mind, that this means not just state licenses, but potentially also city licenses.

Learn more here and get started toward establishing small business credit. Get money even in a recession!

Visit the Internal Revenue Service web site and get an EIN for the small business. They’re free. Pick a business entity like corporation, LLC, etc.

A small business may get started as a sole proprietor. But they absolutely need to change to a form of corporation or an LLC.

This is to diminish risk. And it will take full advantage of tax benefits.

A business entity matters when it involves tax obligations and liability in the event of a lawsuit. A sole proprietorship means the owner is it when it comes to liability and tax obligations. No one else is responsible.

The best thing to do is to incorporate. You should only look at a DBA as an interim step on the way to incorporation.

Start at the D&B web site and obtain a totally free D-U-N-S number. A D-U-N-S number is how D&B gets a company in their system, to generate a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s sites for the business. You can do this at www.creditsuite.com/reports. If there is a record with them, check it for correctness and completeness. If there are no records with them, go to the next step in the process.

This way, Experian and Equifax will have activity to report on.

First you must establish tradelines that report. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can begin to get credit for numerous purposes, and from all sorts of places.

These types of accounts often tend to be for things bought all the time, like marketing materials, shipping boxes, outdoor workwear, ink and toner, and office furniture.

But first of all, what is trade credit? These trade lines are credit issuers who give you starter credit when you have none now. Terms are generally Net 30, instead of revolving.

Therefore, if you get approval for $1,000 in vendor credit and use all of it, you must pay that money back in a set term, such as within 30 days on a Net 30 account.

Net 30 accounts have to be paid in full within 30 days. 60 accounts need to be paid fully within 60 days. Unlike revolving accounts, you have a set time when you have to pay back what you borrowed or the credit you made use of.

To launch your business credit profile the right way, you ought to get approval for vendor accounts that report to the business credit reporting bureaus. As soon as that’s done, you can then use the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Not every vendor can help like true starter credit can. These are vendors that grant approval with marginal effort. You also want them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

As you get starter credit, you can also start to get credit from retailers. This is to continue to prove you are reliable and pay in a timely manner. Here are some stellar choices from us: https://www.creditsuite.com/blog/5-vendor-accounts-that-build-your-business-credit/

Uline is a true starter vendor. You can find them online at www.uline.com. They offer shipping, packing, and industrial supplies, and they report to D&B and Experian. You MUST have a D-U-N-S number and an EIN before starting with them. They will ask for your business bank information. Your company address must be uniform everywhere. You need for an order to be $50 or more before they’ll report it. Your first few orders may need to be prepaid initially so your business can get approval for Net 30 terms.

Quill is an additional true starter vendor. You can find them online at www.quill.com. They sell office, packaging, and cleaning supplies. And they also sell toner, office furniture, and even shipping and school supplies. They report to Dun and Bradstreet every quarter.

To apply, you MUST have a D&B PAYDEX score. If not given a Net 30 they will ask you to do prepaid orders of $100.00. Normally any prepaid order won’t report but you would need them to have given you a Net 30 account. Net 30 accounts require $50.00 purchase to report.

New business or businesses with no credit history may need to prepay purchases until Net 30 approval. Terms are Net 30.

Apply online or over the phone.

Grainger Industrial Supply is likewise a true starter vendor. You can find them online at www.grainger.com. They sell hardware, power tools, pumps and more. They also do fleet maintenance. And they report to D&B. You need to have a business license, EIN, and a D-U-N-S number.

Your business entity must be in good standing with the applicable Secretary of State. If your company doesn’t have established credit, they will require additional documents. So, these are items like accounts payable, income statement, balance sheets, and the like.

Apply online or over the phone.

Non-Reporting Trade Accounts can also be helpful. While you do want trade accounts to report to a minimum of one of the CRAs, a trade account which does not report can still be of some worth.

You can always ask non-reporting accounts for trade references. And credit accounts of any sort will help you to better even out business expenditures, thereby making budgeting simpler. These are companies like PayPal Credit, T-Mobile, and Best Buy.

Store credit comes from a variety of retail companies.

You must use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, use the small business’s EIN on these credit applications.

Fleet credit is from companies where you can purchase fuel, and fix and maintain vehicles. You must use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, make certain to apply using the business’s EIN.

Learn more here and get started toward establishing small business credit. Get money even in a recession!

These are businesses such as Visa and MasterCard. You must use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, use your EIN instead.

These are often MasterCard credit cards.

And there are tons of ways these business credit cards can help residential real estate agents.

Learn more here and get started toward establishing small business credit. Get money even in a recession!

Know what is happening with your credit. Make certain it is being reported and take care of any mistakes ASAP. Get in the practice of taking a look at credit reports and digging into the details, and not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less than it would cost at the business CRAs.

At Equifax, you can monitor your account at: www.equifax.com/business/business-credit-monitor-small-business.

Update the relevant information if there are inaccuracies or the information is incomplete. At D&B, you can do this at: https://iupdate.dnb.com/iUpdate/viewiUpdateHome.htm. For Experian, go here: www.experian.com/small-business/business-credit-information.jsp. So for Equifax, go here: www.equifax.com/business/small-business.

So, what’s all this monitoring for? It’s to dispute any inaccuracies in your records. Mistakes in your credit report(s) can be fixed. But the CRAs often want you to dispute in a particular way.

Disputing credit report errors typically means you mail a paper letter with copies of any evidence of payment with it. These are documents like receipts and cancelled checks. Never send the originals. Always mail copies and retain the originals.

Fixing credit report inaccuracies also means you specifically itemize any charges you dispute. Make your dispute letter as crystal clear as possible. Be specific about the concerns with your report. Use certified mail so that you will have proof that you sent in your dispute.

Always use credit smartly! Don’t borrow more than what you can pay back. Keep track of balances and deadlines for payments. Paying off on schedule and fully will do more to elevate business credit scores than nearly anything else.

Establishing small business credit pays off. Great business credit scores help a business get loans. Your lender knows the small business can pay its debts. They understand the company is bona fide.

The business’s EIN attaches to high scores and credit issuers won’t feel the need to demand a personal guarantee

Business credit is an asset which can help your small business for years to come. Learn more here and get started toward establishing small business credit. The COVID-19 pandemic is not going to last forever.

The post Here’s a Great Question from Residential Real Estate Agents: How Do I Build Recession Business Credit appeared first on Credit Suite.