Tips and also Simple Guidelines On How To Calculate Payroll Taxes Handling an organisation tiny, tool or huge needs you to pay your tax obligations, as well as your workers tax obligations. State as well as government tax obligations are really stringent as well as you do not desire the IRS battering on your door …

Tag: Guidelines

Tips and also Simple Guidelines On How To Calculate Payroll Taxes

Tips and also Simple Guidelines On How To Calculate Payroll Taxes

Handling an organisation tiny, tool or huge needs you to pay your tax obligations, as well as your workers tax obligations. State as well as government tax obligations are really stringent as well as you do not desire the IRS battering on your door since of some blunders. Maintain your pay-roll documents as well as tax obligation repayments as your recommendation so you have evidence of the settlements as well as reductions you have actually done.

Pay-roll tax obligations are the tax obligations that every company are needed to subtract from the staff members income as well as pay to the state and also the federal government, you are needed to do this in part of your workers. Apart from keeping state as well as government tax obligations, social safety as well as medicare tax obligations are subtracted likewise from the wage as needed by legislation.

In mentioning to compute pay-roll tax obligations, each of your worker needs to finish an IRS kind W-4. In the W-4, you can determine the quantity of the government earnings tax obligation, and also due to the fact that a lot of states have earnings tax obligation frameworks that are based on the government tax system, you might additionally utilize this type to determine the state tax obligation to be subtracted from the income of your workers. Required to determine pay-roll tax obligations are the percent presently utilized for the social safety and security and also medicare.

Apart from those, the regulation needs the company to pay government and also state joblessness tax obligation; this is component of the pay-roll tax obligations. Federal and also State joblessness tax obligations (FUTA and also SUTA) are based on the quantity of joblessness insurance claims that are submitted by workers that you have actually launched or discharged.

For some organisation proprietors, doing the pay-roll as well as to determine pay-roll tax obligations simply obtains in the method of the day to day company he or she has to do. While for some this is worth the cash, little organisations with a little labor pressure must simply do their very own pay-roll. What they obtain is the high-end of focusing much more on their organisation without the demand to stress concerning exactly how to determine pay-roll tax obligations.

Taking care of a service tiny, tool or large needs you to pay your tax obligations, as well as your workers tax obligations. Pay-roll tax obligations are the tax obligations that every service are needed to subtract from the staff members wage and also pay to the state as well as the federal government, you are called for to do this in part of your workers. Apart from holding back state as well as government tax obligations, social safety and security and also medicare tax obligations are subtracted additionally from the income as called for by legislation. In the W-4, you can compute the quantity of the government earnings tax obligation, as well as since the majority of states have earnings tax obligation frameworks that are based on the government tax system, you might likewise utilize this type to determine the state tax obligation to be subtracted from the income of your staff members. Apart from those, the legislation needs the company to pay government and also state joblessness tax obligation; this is component of the pay-roll tax obligations.

The post Tips and also Simple Guidelines On How To Calculate Payroll Taxes appeared first on ROI Credit Builders.

Tips and also Simple Guidelines On How To Calculate Payroll Taxes

Tips and also Simple Guidelines On How To Calculate Payroll Taxes

Handling an organisation tiny, tool or huge needs you to pay your tax obligations, as well as your workers tax obligations. State as well as government tax obligations are really stringent as well as you do not desire the IRS battering on your door since of some blunders. Maintain your pay-roll documents as well as tax obligation repayments as your recommendation so you have evidence of the settlements as well as reductions you have actually done.

Pay-roll tax obligations are the tax obligations that every company are needed to subtract from the staff members income as well as pay to the state and also the federal government, you are needed to do this in part of your workers. Apart from keeping state as well as government tax obligations, social safety as well as medicare tax obligations are subtracted likewise from the wage as needed by legislation.

In mentioning to compute pay-roll tax obligations, each of your worker needs to finish an IRS kind W-4. In the W-4, you can determine the quantity of the government earnings tax obligation, and also due to the fact that a lot of states have earnings tax obligation frameworks that are based on the government tax system, you might additionally utilize this type to determine the state tax obligation to be subtracted from the income of your workers. Required to determine pay-roll tax obligations are the percent presently utilized for the social safety and security and also medicare.

Apart from those, the regulation needs the company to pay government and also state joblessness tax obligation; this is component of the pay-roll tax obligations. Federal and also State joblessness tax obligations (FUTA and also SUTA) are based on the quantity of joblessness insurance claims that are submitted by workers that you have actually launched or discharged.

For some organisation proprietors, doing the pay-roll as well as to determine pay-roll tax obligations simply obtains in the method of the day to day company he or she has to do. While for some this is worth the cash, little organisations with a little labor pressure must simply do their very own pay-roll. What they obtain is the high-end of focusing much more on their organisation without the demand to stress concerning exactly how to determine pay-roll tax obligations.

Taking care of a service tiny, tool or large needs you to pay your tax obligations, as well as your workers tax obligations. Pay-roll tax obligations are the tax obligations that every service are needed to subtract from the staff members wage and also pay to the state as well as the federal government, you are called for to do this in part of your workers. Apart from holding back state as well as government tax obligations, social safety and security and also medicare tax obligations are subtracted additionally from the income as called for by legislation. In the W-4, you can compute the quantity of the government earnings tax obligation, as well as since the majority of states have earnings tax obligation frameworks that are based on the government tax system, you might likewise utilize this type to determine the state tax obligation to be subtracted from the income of your staff members. Apart from those, the legislation needs the company to pay government and also state joblessness tax obligation; this is component of the pay-roll tax obligations.

The post Tips and also Simple Guidelines On How To Calculate Payroll Taxes appeared first on ROI Credit Builders.

Google’s New Link Building Guidelines

In case you missed it, Google has just changed up the rules for link building.

It used to be that when people link to you, the link would either be a dofollow link or a nofollow link.

Well, that’s now changed.

They are now introducing 2 more link types that will affect

SEOs.

Now before we get into the 2 new link types, make sure you read the whole post. Because not only will I explain Google’s requirements, but I will break down what this means for SEOs.

The current landscape

The current SEO landscape is simple… especially when it comes to link building.

The more dofollow (regular links) links you can get the better your search rankings.

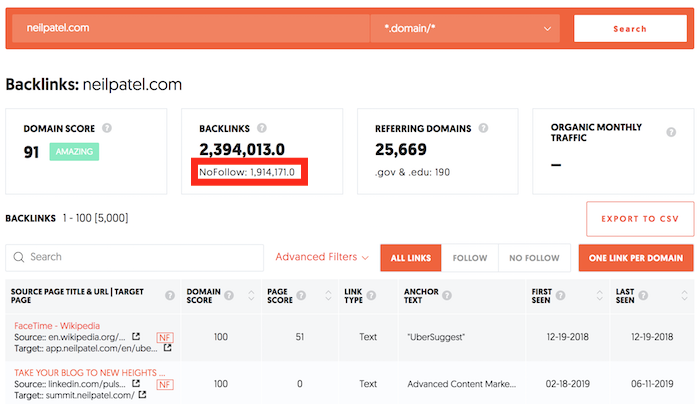

If you are unsure of the number of links you have or the type, just go here and enter in your domain.

You’ll see a count of total backlinks along with the total amount of nofollow links pointing to your site.

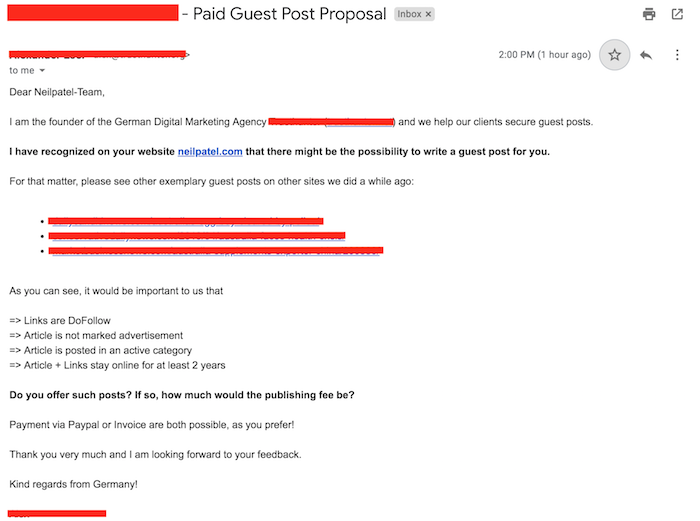

Now, when you are link building, if you are paying for links or leveraging tactics like guest posting, Google wants you to nofollow those links because they don’t think you should be leveraging tactics like guest posting to manipulate rankings.

And as for buying links, you shouldn’t do that as it is a simple way to get penalized or banned from Google.

So don’t send emails like this if you are trying to build links… it’s a big no, no.

How does Google look

at links?

Google’s algorithm is smart. Sure, they ideally want you to nofollow links if they are bought or not naturally earned (such as from guest posts), but many SEOs break the rules.

They aren’t going to say it publicly but they do these things. And because Google isn’t dumb, they also know.

Google can easily

identify when a post on these big news sites aren’t earned because many of them

have signs all over them that Google can detect.

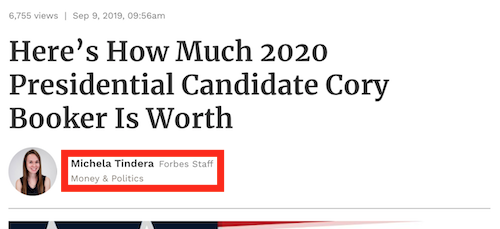

For example, here is

an example of a guest

post from me.

Forbes, of course, uses nofollows links, but it wasn’t always that way.

Google can easily detect it is a guest post through verbiage on the page like “former contributor” or “guest contributor”.

And even if they didn’t label me as a guest contributor, Google can use other signals to figure out that this link shouldn’t be given much weight when it comes to SEO just by reading the URL structure of that article on Forbes.

Let’s take a closer

look at the URL

https://www.forbes.com/sites/neilpatel/2016/12/26/my-biggest-regret-in-life-going-to-college/#5f74f3a91ac7

Do you see the big

issue with the URL?

It’s clear that an author can have their own subsection on Forbes through the “site” folder structure. Now that doesn’t mean all “Forbes sites” are bad, but they clearly know which one is from staff writers because they are clearly marked.

Those signals (among others) that Google probably won’t disclose (nor should they) make it easy for Google to determine if a link is natural or earned.

If Google doesn’t want to count a link from a specific author, they can just ignore it on their end.

So, whether it is nofollowed or followed, on their end they can systematically control whether a link should help your rankings or if it shouldn’t.

As John Mueller from Google once said, in the context of bad links…

If we recognize them, we can just ignore them – no need to have you do anything in most cases.

Now keeping that in

mind, here are the changes Google wants webmasters to make.

Google’s new link

policy

If someone pays you

for a link or you are buying a link, Google now wants you to mark it as sponsored.

Not just in the text of the site, but more so through the link attribute:

Rel=”sponsored”

And if you build links through user-generated content, they want you to mark the links with the attribute:

Rel=”ugc”

The same goes for site owners. For example, if you have a forum on your site because the content is user generated, the links that people place should contain a rel=”ugc”.

You can still use the nofollow attribute or if you want you can use a combination of the above. For example, if you have a paid link you can use:

Rel=”nofollow sponsored”

So, what’s the

purpose of this change?

Well, here is how

Google puts it:

All the link attributes — sponsored, UGC and nofollow — are treated as hints about which links to consider or exclude within Search. We’ll use these hints — along with other signals — as a way to better understand how to appropriately analyze and use links within our systems.

Now if you are wondering what that means, Google is pretty much saying that adding these attributes will give them a better idea on if they should crawl the link or not. Or how they should analyze the link when it comes to indexing or SEO.

This change goes into effect March 1, 2020, and don’t worry because you don’t have to make modifications to your old links. The ones that were nofollow can just be left as nofollow.

And even in the future, if you decide to just use nofollow instead of “sponsored”, you’ll be fine.

What does all of this mean for SEOs?

As I mentioned

earlier, I would provide my own insights and opinions on why Google is doing this.

We all know their algorithm is sophisticated and hard to game. But, just like any other algorithm or computer, it isn’t perfect.

By webmasters and SEOs labeling the type of links they are building and the purpose of them, it will make it easier for Google to learn how we use different link types and it will help their algorithms more quickly and easily identify link types and the context they are used in.

For example, if thousands of people use rel=”ugc” for links generated through guest posts, it may help train Google’s algorithm that these links were actually created by random people instead of the webmaster and they should be discounted.

Of course, Google already can identify wikis, forum, and other types of user-generated content, but this helps them tighten things up and make things more accurate.

They can also decide to take a more relaxed stance on certain link types. For example, maybe they will decide to count UGC links when it comes to link building, but they may decide to only give it 1/3rd the weight of a naturally earned link.

In addition to that, this also provides them with more signals on if the URL linked to should be potentially crawled or ignored.

But in the long run, as their algorithm becomes more accurate, it’s safe to say that the real solution to winning is putting the user first.

Their goal isn’t to rank a site at the top that has “perfect SEO”. They want to rank the site that people love the most.

Hence, you’ll want to focus on creating an amazing user experience, building a great product/service, creating mindblowing content, and anything else your competition isn’t doing.

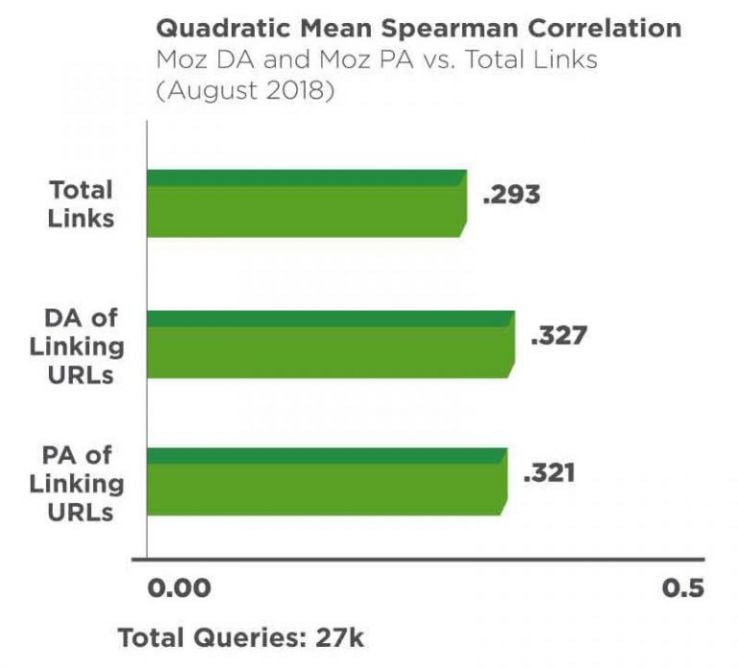

As for link building though, links will always be hard to come by, so they will be part of their algorithm for the foreseeable future. And as the data shows, there is a strong correlation between links and rankings.

So one thing I would recommend is that you build as many links as possible, even if they are user-generated links. As long as they are from relevant sites, the referral traffic can generate you sales or leads. And if Google starts placing some value on these user-generated links, it can help boost your rankings.

Now that doesn’t mean you should go out to forums and spam your link everywhere. It means you should go find all of the user-generated content sites, provide a ton of value, AND ONLY IF IT MAKES SENSE, add a link back to your site when it benefits the reader.

Conclusion

Over the next year or so you’ll see adjustments in how SEOs build links.

First off you’ll start seeing companies like Ahrefs and the SEMrush show you nofollow, dofollow, UGC, and sponsored backlinks. This one change will help SEOs build better links and spend their effort on the links that actually help with rankings.

Secondly, my hunch is UGC links will eventually carry some weight. Probably not a ton, but more than 0 as long as they are from relevant sites, the link is within context and it provides value to the end-user.

And lastly, most webmasters probably won’t use sponsored or UGC attributes anytime soon. It will probably take another year before they really catch on, which means for now you will just have to focus your efforts on dofollow links.

So, what do you

think about the new change?

The post Google’s New Link Building Guidelines appeared first on Neil Patel.