11 Proven Hacks to Keep Your Customers Buying More

It costs 5X less to retain a customer than it does to acquire a new one.

That’s why customer retention is crucial to growing your Ecommerce business.

What is customer retention?

Customer retention is the ability to encourage customers to keep coming back to make purchases. Research shows that repeat customers spend more than once-off customers, making retention a priority for any Ecommerce business that wants to grow. With research showing that retail Ecommerce sales are set to be more than $548 billion by 2024, you’ll want your customer retention strategy to be solid enough to get you a piece of that pie.

This post will dive into the strategies you can use to boost your customer retention rates. We’ll also look at foundational principles like attracting and converting customers. So, let’s get to it, shall we?

5 Customer Retention Strategies and Corresponding Tools for Ecommerce Companies

Many businesses make the mistake of investing heavily in customer attraction. Sure, if you don’t attract new customers, there’s a possibility your business may fold. However, attracting custoTapymers is not the key to business growth.

The key to business growth is customer retention.

That’s why you must develop strategies that will help you retain the customers you attract. You also need to have the right tools for the job.

Why is customer retention so important?

I’ll give you a few good reasons:

- boosts loyalty

- helps drive referral marketing

- increases ROI

- increases average order value (AOV)

Speaking of ROI, research shows that a mere 5 percent increase in customer retention can boost your revenue by over 25 percent, depending on the industry, product, and other factors.

With that said, let’s dive into the five customer retention strategies you can use to grow your Ecommerce business.

1. Understand the Customer Journey and Optimize Your Customer Experience Accordingly

One of the first steps to designing a customer retention strategy that works is to understand the customer journey. The heart of customer retention lies in meeting or exceeding the expectations your customers have.

To do that, you must understand the customer journey and optimize it for positive customer experiences (CX) at every step.

If you can keep your customers happy, they’ll keep coming back for more.

How do you do that?

Understand Your Audience

Understanding your audience allows you to know how to craft personalized messaging and experiences at every stage of the journey. Personalized experiences are essential in driving return sales. To better understand your audience, use:

- Audience research tools like surveys and quizzes to gather demographic and psychographic data on your target audience.

- Social media platforms and tools like Facebook’s Audience Insights tools to better understand your audience demographics.

- Tools like HubSpot to build buyer personas.

To build and optimize customer journeys that effectively retain your customers, you must first understand who your target audience is and what they want. This way, you can ensure each touchpoint is meaningful, resulting in a positive CX and, ultimately, higher customer retention rates.

Design an Effective Customer Loyalty Program

Part of your customer journey must include creating a customer loyalty program.

Customer loyalty is your customers’ willingness to keep buying from you. Loyalty programs encourage them to do just that and help increase their customer lifetime value (CLV). Designed and executed well, it increases sales and, most importantly, improves your customer retention rates. Here are a few tips and tools to help you design an effective customer loyalty program:

- Know what rewards are meaningful to your customers.

- Define the rules of your loyalty program. This includes which actions get rewarded and the kinds of rewards tied to each action.

- Use tools like the Net Promoter Score to gauge your customers’ loyalty. This will help you know how effective your customer loyalty program is and how much work is needed to improve it.

- Leverage customer loyalty programs like ReferralCandy to build and execute customer loyalty programs.

Designing a customer loyalty program must never be an afterthought; it must be an integral part of your customer retention strategy.

Running a hybrid B2B/B2C business?

My partner for this post, BigCommerce B2B Edition, makes it easy for you to offer different price lists and products to your different customer segments. You can also tailor your customer loyalty program to each customer category.

2. Follow Up After the First Transaction Is Completed

For most, a sale is the ultimate goal of running an Ecommerce business. However, to retain your customers, you must follow up after the first transaction is completed. Some follow up strategies you can implement include:

Use Email to Build Meaningful Relationships

Many Ecommerce businesses send a thank you email after a transaction. To retain your customers, though, you must do more than just thank them. You must build meaningful relationships with them.

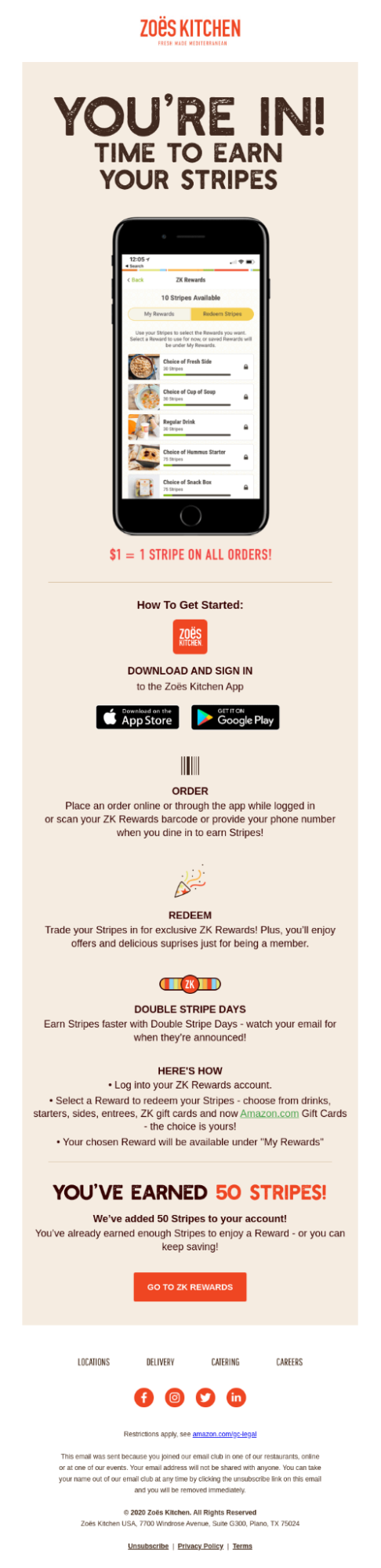

That’s why following up after a transaction is essential. Here’s an example from Zoe’s Kitchen:

Following up after a transaction helps you build meaningful relationships with your customers. For your follow-up to be effective, you must show your customers that you can provide more value. You do that by sending post-sales emails like:

- product updates

- cross-selling and upselling emails

- feedback surveys

- promotional emails

- informational emails

This is where Ecommerce platforms like BigCommerce come in handy. It has many features you’ll get to help you grow your business. One of them is the automated email tool and integrations that will help you run follow-up campaigns. Coupled with BigCommerce’s fully customizable email templates (using code or the text editor), creating follow-up campaigns couldn’t be easier. That’s especially since you can add discount codes and coupons to your email templates to encourage conversions.

Be Proactive With Customer Onboarding

Customer onboarding is one of the most crucial steps to ensuring that a first-time customer becomes a repeat buyer. Onboarding refers to all the steps you take to gain customers’ trust until they become loyal customers. A few tips to enhance your customer onboarding include:

- Use email marketing to welcome and nurture new customers.

- Invest in interactive content to engage customers and get more data to create hyperpersonalized experiences.

- Where necessary, create a tutorial to educate your customers on how best to use your product.

Customer onboarding is an essential follow-up process that allows you to show your customers that you value their success. Once they see that, it becomes easier for you to retain them.

3. Segment and Target Existing Customers for Customer Loyalty Programs

By this time, your interactions with your customers have opened up a gold mine of data. Every interaction helps you paint a better picture of each customer.

This is precious data you can use to segment your customers.

Segmentation is crucial in helping you create targeted and personalized campaigns. When it comes to customer retention, segmentation plays an integral role in creating effective customer loyalty programs for your existing customers.

Segmentation is key to increasing your chances of creating a customer loyalty program that will help you retain your existing customers.

For your loyalty program to work, you must create tailored rewards and experiences for the different segments as their needs are different. Examples of segments you can consider creating among existing customers include:

- high spenders

- cart abandoners

- coupon lovers

- one-time buyers

This is another area in which platforms like BigCommerce shine. It has a built-in tool that allows you to create loyalty groups, making it easy to target particular segments of your customer base for your customer loyalty program.

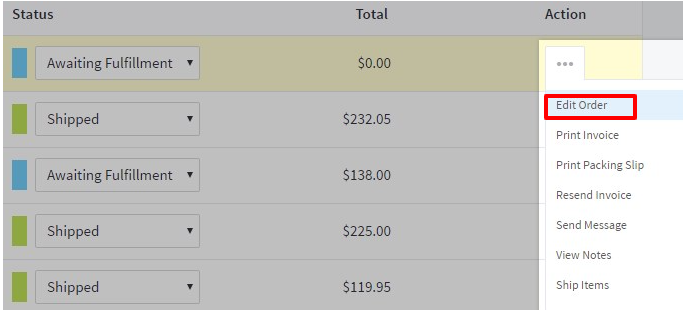

4. Allow Changes to Orders

Customer retention hinges on creating memorable experiences for your customers. One way to do that is to allow your customers to change their orders once they’ve made a purchase. For example, a customer may change their mind and want a product that’s a different size, color, etc. For BigCommerce users, allowing customers to change their orders is a cinch. That’s thanks to the order editing functionality the platform provides.

When that happens, allow your customer to swap their purchase for the one they really want.

One of the results of this is that your customers will trust you more. It shows that you have their back and are willing to bend over backward to make them happy. Of course, that kind of trust can only lead to one thing—higher customer retention rates.

5. Offer Outstanding Customer Service

Customer retention is a function of the experiences your customers have with your brand. Besides the shopping experience, customer service is one of the biggest elements of ensuring you serve your customers exceptionally well.

That’s why you must offer outstanding customer service.

When you solve your customers’ problems in a friendly and efficient manner, they’ll see you as a reliable partner. Although they had an issue with your product, you’ll have earned their trust and loyalty.

How do you ensure your customer service is good enough to bolster your customer retention strategy?

- Offer omnichannel customer service: Make it easy for your customers to reach you by being available on multiple communication channels. MobileMonkey is one of the best customer service tools that will help you create a cohesive experience across multiple channels.

- Assign the right agent to the right customer: Assess your customer’s needs and assign the agent most qualified to handle them.

- Learn from your competitors: Research how your competitors handle customer service issues like returns, faulty products, faulty charges, etc. Also, read customer reviews and call their customer service line to see what the customer service experience is like.

- Help your customers help themselves: Some people prefer to troubleshoot and solve their problems. Creating an easy-to-navigate knowledge base using tools like HelpJuice will help you do just that.

Creating an outstanding customer service experience will undoubtedly help you win your customers’ loyalty. People want to know that they can depend on you to help them fast and efficiently if anything goes wrong. On the other hand, poor customer service will cost you customers and, ultimately, your business.

Customer Retention Bonus Tips/Pro Hacks

Customer retention is all about creating memorable experiences for your customers. Here are a few more ways you can do that:

Ask Customers to Set Up Profiles

Creating profiles offers a platform where customers can input important dates like anniversaries and birthdays. Doing this allows you to send reminders and personalized product recommendations for the special occasion.

Create an Affiliate Program

Create an affiliate program where satisfied customers can begin promoting your products and earn a commission. Besides the potential to earn revenue, an affiliate program makes your customers feel like part of your brand. The result is heightened customer loyalty.

Create a Community

People love being part of a special group. That’s why creating a community around your brand is an excellent way of boosting customer retention. An example of this would be creating an exclusive Facebook group where you share content surrounding your brand.

Now that you know how to retain your customers let’s briefly take a step back and look at how you can attract and convert your customers.

How to Attract Customers to Your ECommerce Businesses: 3 Strategies

While customer retention is one of the main pillars of business growth, you can’t have retention without attraction. So, let’s briefly look at a few ways you can attract customers to your Ecommerce store.

1. Have Great SEO to Attract Organic Traffic

Paid ads are a great way to gain traction, especially for a new Ecommerce store. However, if you want to play the long game, you must invest in a robust SEO strategy. The main reason being SEO is one of the best ways to attract organic traffic. A few tips to help you with your Ecommerce SEO include:

Let the Pros Take Care of It

If you have the budget, one of the easiest ways to boost your SEO is to hire an agency to take care of it for you. Besides freeing up your time to run your business, hiring an SEO agency has the advantages of:

- Access to the right tools, resources, and human resources.

- Agility to change strategy to align with the ever-changing SEO landscape.

Learn SEO and Take a DIY Approach

No budget for an SEO agency?

Then you could DIY your SEO.

While this approach will require time and commitment, learning the ins and outs of e-commerce SEO will help you better understand what it takes to attract the right traffic to your store. So, invest in a couple of SEO courses or teach yourself the art and science of driving traffic to your Ecommerce store.

Leverage an Ecommerce Platform Designed With SEO in Mind

An essential aspect many entrepreneurs overlook when picking an Ecommerce platform is the SEO aspect. Always consider the SEO features of a platform before investing in one. This is one of the reasons BigCommerce is one of the best platforms on the market. Here are a few SEO-centric features you can expect:

- Fully customizable URLs.

- Access to editing robot.txt files.

- 301 redirects and URL rewrites to reflect any changes in product names.

- CDN to increase site speed.

- Microdata and schema markup to enhance your search result listings.

BigCommerce also offers in-depth guides like this one and this one to help ensure your store’s SEO is on point.

2. Create Engaging and Targeted Paid Ad Campaigns

As said, SEO is about the long game—it takes time to see results. To drive traffic to your site quickly, you’ll need to leverage targeted paid ad campaigns. Research shows that 46 percent of the most visited Ecommerce stores spend up to $1,000/month on paid ads. The top 16 percent spend upward of $20,000 per month, so yes, if you want to drive traffic to your store, you must invest in paid ads. While paid ads may cost you, they have several advantages that include:

- Drive hyper-targeted traffic.

- Generate sales faster.

- Boost brand awareness.

The main advantage of paid ads is the speed at which they produce results. So, if you’re running a promotion or simply want to boost your monthly sales, paid ads could help you drive the traffic you need.

For your ads to be effective, though, you must ensure they’re engaging and targeted. To do that:

- Understand your target audience and develop an ideal customer profile (ICP).

- Choose and understand the platform you’re advertising on and follow best practices.

- Thoroughly research your keywords and negative keywords (Ubersuggest is an excellent tool for this).

- Craft personalized ad copy.

- Determine the ad format you’ll use (video, text, etc.)

- Use a campaign management tool like AdEspresso to create, manage, and optimize your paid ads.

- Optimize your landing pages for better conversions.

It can be quite scary to put money in paid ads. After all, the ROI is never guaranteed. Creating engaging and targeted ads helps make your ads more effective, ensuring that you drive relevant traffic to your products.

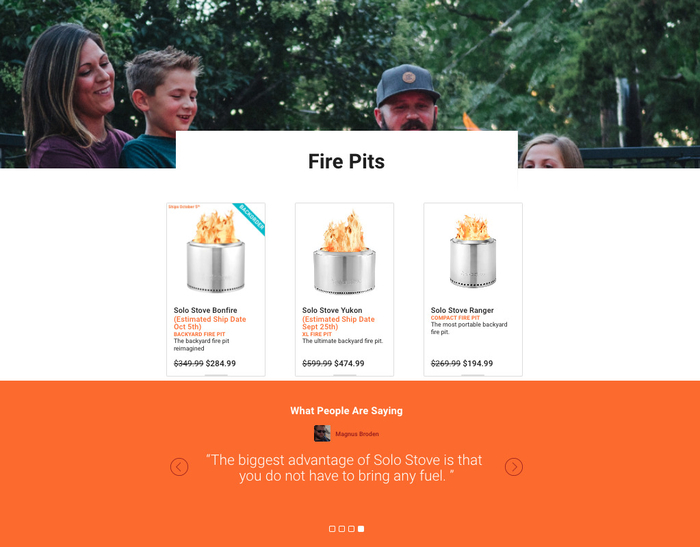

3. List Your Products On as Many Channels as Possible

Today’s buyer is spoilt for choice regarding the platforms and channels they consume content on.

That’s why, when creating your Ecommerce paid ad strategy, you must advertise your product on as many channels as possible.

You must adopt an omnichannel approach to advertising.

Omnichannel marketing will ensure that you meet your customers where they are. It makes it easier for you to create ads that will appeal to your customers—ads that convert.

What exactly is omnichannel marketing?

It is an approach to marketing where you anticipate that your customers may start their journey with your brand on one device or platform and continue on another. With omnichannel marketing, you create a cohesive and unified experience for your customers across all platforms and at every touchpoint.

The result is a positive CX that results in more conversions and, ultimately, higher customer retention rates.

This is important as research shows that over 73 percent of online shoppers use multiple channels when shopping. A few tips to help you create an effective omnichannel strategy for your Ecommerce store include:

Make Every Touchpoint a Shopping Experience

Thankfully, with Ecommerce platforms like BigCommerce, your customers can easily buy from other channels (like social media) other than your store. You can also leverage external social media payment processing solutions to sell products directly on social media.

Offer Omnichannel Customer Support

Being available for your customers on their preferred channels helps you create a positive experience that will get them hooked to your brand.

Create a Mobile App

It’s no secret that mobile has overtaken desktop in terms of usage. Creating a mobile app helps you create tailored experiences for your customers on multiple platforms. It also helps you put your store in your customers’ pockets.

Listing your products on multiple channels is a great way of getting them in front of a larger audience. As a result, you’ll drive more traffic to your store and generate more sales on the different platforms you leverage.

Customer Attraction Bonus Tips/Pro Hacks

Besides the three main customer attraction strategies mentioned above, you can use other more advanced ones. Here are a few of them:

- Leverage AI: AI can help you create accurate buyer personas and serve users personalized product recommendations.

- Create viral content: Understand your audience’s pain points and aspirations and create your content around these. Also, make sure to meet search intent.

- Distribute your content: Effective content distribution results in your content being published on the right platforms and being seen by the right audience.

- Partner with influencers: Partnering with influencers is a great way of tapping into a large demographic that’s a perfect fit for your ICP. The followers are more likely to be interested in your products, and thus the chance of them visiting your website (and converting into customers) is higher.

Developing a strategy to attract customers to your Ecommerce store is an essential step to customer retention. If you can attract an audience in the right way, it improves your chances of them converting and, ultimately, becoming loyal customers.

How to Convert Customers: 3 Strategies

There are three steps to growing a loyal customer base:

- Attracting the right audience.

- Converting traffic into paying customers.

- Retaining your customers.

We’ve already dealt with attracting and retaining customers. Now let’s take a quick dive into how you can convert visitors into customers.

First—what is a conversion?

A conversion in Ecommerce is any visitor who purchases one of your products. Conversion rate, therefore, is the percentage of visitors to your store who turn into customers.

The higher your conversion rates, the more sales you make. Don’t take our word for it. Check out LARQ’s case study. After partnering with BigCommerce, their conversions lifted by 80 percent and they enjoyed a 400 percent average increase in YoY revenue.

How do you improve your conversions?

- Create Outstanding Landing Pages

Your landing page is an important element of your sales funnel as it’s usually the one that does the heavy selling. That’s why you must ensure you create outstanding ones that convert.

Here are a few tips to help you do that:Keep it simple: Your landing page must be easy to read and understand at a glance. To do that, keep your design clear and uncluttered.

Have only one objective: Your landing page must only have one goal—conversion. Keep it focused on that.

Personalization is crucial: From meeting search intent to using language and visuals that appeal to the visitor, personalize your landing page as much as possible.

Add detailed product descriptions: Your landing page is meant to sell, and one of the best ways is to give visitors a detailed description of what they’re buying. Include high-quality images.

Use multiple CTAs: Include the same CTA at different places on your landing page. Doing so makes it easier for your visitor to click-through and purchase whenever they’re ready.

Use a tried, tested, and proven landing page builder: If you’re a BigCommerce customer, you can use the built-in Page Builder tool to quickly and easily build landing pages.

Your landing page is an essential part of your sales funnel. Besides helping you target specific customer segments, they also help you drive higher ROI for your paid traffic. That’s why you must invest in creating optimized ones for your Ecommerce store.

- Ensure Your Site Is Secure to Make Users Feel Safe Making Purchases From Your Shop

Another crucial factor that helps boost your conversions is site security. Your customers want to feel safe when handing you their details during the checkout process, especially with the recent spike in data breaches. To ensure your site is secure, you must:

Use a Secure Ecommerce Platform

The first step to securing your Ecommerce store is to use a platform designed with security in mind. For example, platforms like BigCommerce offer sitewide HTTPS and other security features like firewalls, intrusion detection, and much more. A secure platform makes your customers feel safe to transact with you. It’s essential to boosting your conversions.

Support Multiple Payment Methods

Your customers will have different preferences when it comes to how they want to pay for your products. They feel more secure using a payment gateway they’re familiar with.

Using multiple payment methods is a great way of giving your customers more options. Besides, it also enables you to offer multi-currency options—a crucial ingredient to improving your CX for global customers.

While supporting multi-currency payment options may seem like a daunting task, with a platform like BigCommerce it isn’t. That’s because BigCommerce natively supports over 140 local currencies and over 65 payment gateways.

Closely Review and Monitor All Plugins and Third-party Integrations

When installing third-party solutions to enhance your store, you must make sure they’re from a trusted source. It’s also essential that you monitor them to ensure they’re regularly updated. Once you have no use for one, remove it from your store. You must keep third-party applications on your store to a bare minimum as they can create vulnerabilities in your store.

Stay on top of your Ecommerce store’s security by using tools like FreeScan to check for vulnerabilities and TrustWave for threat detection regularly. A secure store will not only protect you from cyberattacks, but also helps boost your conversions. Just make sure to invest in a secure Ecommerce platform and additional security tools if necessary.

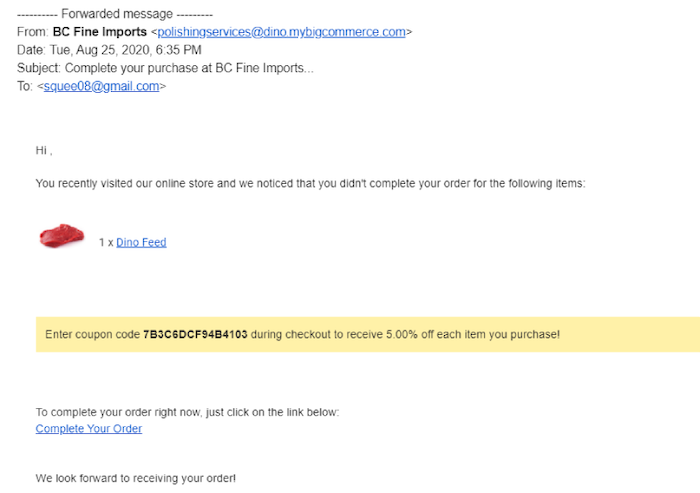

- Use an Abandoned Cart Saver

Cart abandonment is an aspect of Ecommerce you can’t avoid. Research shows that, on average, close to 70 percent of carts are abandoned at checkout. That’s why, if you’re to improve your conversions, you must address this issue.

One of the best ways to do that is to use an abandoned cart saver.

An abandoned cart saver is a feature that allows you to send an email to customers who loaded their carts but didn’t complete the transaction.With BigCommerce’s Abandoned Cart Saver, the emails are fully customizable, allowing you to create personalized invites (with discount codes or coupons) to encourage customers to complete their purchases.

Other Customer Conversion Pro Hacks

Besides the three conversion strategies discussed above, here are other tips for increasing your customer conversion rates:

- Run targeted ads: Targeted ads appeal emotionally to your target audience. They also make your product seem like the perfect solution to their needs.

- Retargeting: Use social media ads, apps, banner ads on websites, or email to retarget customers who viewed products on your store.

- Use easy-to-fill forms: A/B test different form designs on your landing page to find out which works best for your customers. Test the number of form fields, copy, placement, etc.

- Offer free shipping: Free shipping is another great incentive to encourage visitors to your landing page to convert into customers. Make sure to display this benefit.

- Optimize your checkout page: Optimize your checkout page by eliminating distractions, showing trust signals, offering multiple payment options, etc. These will encourage customers to go through with their purchases.

Attracting the right kind of traffic is always the first step to customer retention. The next critical step is converting that traffic into customers. Be deliberate about both.

Frequently Asked Questions About Ecommerce Customer Retention Strategies

Still have a few questions concerning customer retention strategies you can use to boost your Ecommerce business?

Let’s quickly clear the air on some of the most common ones:

What Is Customer Retention?

Customer retention is the ability for a business to generate repeat customers from visitors to their business. Therefore, customer retention rate refers to the percentage of your customers that continue to buy from you over a given period.

How Can I Improve My Customer Retention?

Improving your customer retention rate is dependent on many factors. However, at the heart of a good customer retention strategy lies creating positive customer experiences at each touchpoint.

What Are Some Examples of How You Retain Customers?

There are several activities you can undertake to retain customers. Here are a few examples: creating loyalty programs, using email to build relationships with your customers and designing outstanding customer service experiences.

What Is a Good Customer Retention Rate for ECommerce?

Customer retention rates are affected by many factors such as industry, product, and others. However, the average customer retention rate for Ecommerce is said to be around 30 percent.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What Is Customer Retention?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Customer retention is the ability for a business to generate repeat customers from visitors to their business. Therefore, customer retention rate refers to the percentage of your customers that continue to buy from you over a given period.”

}

}

, {

“@type”: “Question”,

“name”: “How Can I Improve My Customer Retention?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Improving your customer retention rate is dependent on many factors. However, at the heart of a good customer retention strategy lies creating positive customer experiences at each touchpoint.”

}

}

, {

“@type”: “Question”,

“name”: “What Are Some Examples of How You Retain Customers?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “There are several activities you can undertake to retain customers. Here are a few examples: creating loyalty programs, using email to build relationships with your customers and designing outstanding customer service experiences.”

}

}

, {

“@type”: “Question”,

“name”: “What Is a Good Customer Retention Rate for ECommerce?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: “Customer retention rates are affected by many factors such as industry, product, and others. However, the average customer retention rate for Ecommerce is said to be around 30 percent.”

}

}

]

}

Summary of Ecommerce Customer Retention Strategies

One-time sales are good, but they don’t grow your business.

For your Ecommerce business to be successful, you must encourage your customers to keep coming back.

That’s why designing a customer retention strategy is crucial.

Using the tips above, growing your business by attracting, converting, and retaining customers is no longer a lofty dream. Putting the tips into action will turn your dreams of growing your Ecommerce brand into reality.

And remember, your choice of Ecommerce platform also plays a huge role in your success in retaining customers. Platforms like BigCommerce that come with in-built customer retention features (like single-page checkout, coupon and discount codes, etc.) are your best bet.

Which customer retention strategies and tools have worked well for your business?

A business credit profile is different. You have to work intentionally to establish it and build your score. Just because you have a card that says “business credit card” on it does not mean it is in your business name. It isn’t necessarily reporting to your business credit report. It could, and in fact probably is, reporting to your personal credit if you haven’t taken some steps to separate your business from yourself.

A business credit profile is different. You have to work intentionally to establish it and build your score. Just because you have a card that says “business credit card” on it does not mean it is in your business name. It isn’t necessarily reporting to your business credit report. It could, and in fact probably is, reporting to your personal credit if you haven’t taken some steps to separate your business from yourself.  Hack #2: Add Accounts That Report

Hack #2: Add Accounts That Report