The Best Help Desk Software (In-Depth Review)

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

Unorganized support teams are a nightmare for everyone involved.

From two agents wasting time on the same request to customers or employees sitting around for hours waiting on an answer, things can get really hectic without the right tools and software. And it could even damage your reputation forever.

You don’t want that and I don’t want that for you, either.

However, choosing the best help desk software for your team isn’t an easy task. There are hundreds, if not thousands, of options to choose from.

So to help make your life a bit easier, I looked at dozens of the top options on the market and narrowed it down to my top six recommendations.

From small customer support teams to IT services and mobile field support, this guide covers it all. By the end of this post, you’ll know exactly which help desk software is right for you, regardless of your situation.

The Top 6 Options For Help Desk Software

- Freshdesk – best for small to midsize businesses

- Hubspot – best all-in-one customer service CRM

- Zoho Desk – best for fast-growth businesses

- Freshservice – best for IT service management

- Happyfox – best for mobile and field support teams

- Cayzu – most affordable help desk software

How to Choose The Best Help Desk Software For You

Before we dive into my top recommendations, let’s talk about what makes these tools great and what to look for when deciding which help desk software is right for you and your team.

There are tons of options to choose from, so don’t forget to keep these considerations in mind as you go through the process.

Your use cases

Help desk software exists for a number of reasons, like internal employee support and external customer support. Furthermore, different tools include varying features depending on your use cases.

So, it’s essential to consider how you plan to use the software before making a decision.

Number of agents

How many support agents do you have? Most help desk software charge by the agent, so you need to have a good idea of the number of seats you need.

Some providers also impose agent limits on specific plans, so you’ll have to upgrade to a higher tier if you need to add more agents to your account. This upgrade can be extremely pricey, especially if you’re not expecting it.

So, make sure to choose a plan that offers a bit of breathing room as you grow.

Ticket management

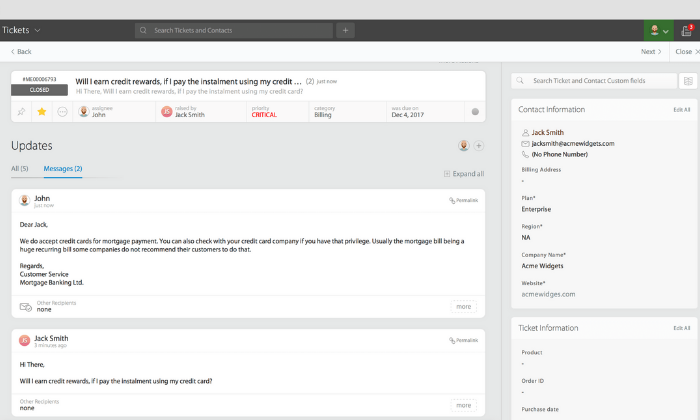

Tickets help you organize, route, and store help desk inquiries. So, you should make sure your software includes basic ticket management systems to help make the process faster and easier.

Furthermore, some software includes ticketing features for a wide variety of support channels, including email, live chat, social media, instant messaging, SMS, and more.

An efficient ticketing system is crucial, from automatic ticket creation and organization to smart routing and everything in between.

However, some of the options on this list limit the number of tickets you can create daily or monthly, which may be too limiting for large teams. And you may be better off choosing an unlimited plan instead.

So, keep this in mind as you make your final decision.

Support channels

What channels do you use to provide support?

Internal support teams may use instant messaging, live chat, or email while customer service teams may utilize social media, SMS, and phone calls.

Regardless of the channels you use, it’s crucial to implement software that handles everything you need.

If you already have systems in place, make sure the help desk software you choose plays well. And if you don’t, consider where your customers/employees hang out and the communication methods they’re most comfortable with.

Furthermore, you should also think about internal communication tools. One agent may need to pass an inquiry on to someone else, or they may need help answering someone’s questions.

So, it’s important to think about how your agents communicate with each other and how you plan to share information from one department to another, as well.

Other features

The best help desk software includes a variety of helpful features beyond ticketing and communication. And it’s essential to consider which features you need to streamline and optimize your support systems.

Some typical features and extras include:

- Knowledgebase and self-service support

- Escalation levels to the right people

- Automated workflow creation

- Open API integrations

- Internal chat software

- Cross-department collaboration

- Client and contact management

- Analytic dashboards

- Role-based access

- Ticket sorting

- Time tracking

It’s also crucial to consider the specific features you need for your use cases.

Internal teams need different things than customer support teams, so keep this in mind as you go through the decision-making process.

Analytics and reporting

Data helps managers and owners understand how your service agents perform and what your customers are asking. Advanced ticket tagging and categorization can also help with the latter.

From there, you can optimize your support process and work on building a self-service knowledge base or in-depth how-to guides to quickly and efficiently answer common questions.

This frees up agents and gives them more time to handle less-common requests.

Furthermore, reports and data visualization help display information in a way that’s easy to understand. This can give you a birds-eye view of your support system and may even help you know how to better serve your team and customers.

The Different Types of Help Desk Software

There are several different types of help desk software. The best type for you depends on various factors, including the size of your business, your budget, customization, and security requirements.

Cloud or web-based — this is the most common type, and it’s often referred to as a SaaS tool because the user pays a monthly subscription to continue using the software.

Furthermore, everything is stored on the cloud or the provider’s server, so the user doesn’t need additional infrastructure or dedicated IT. Plus, the vendor is in charge of managing and maintaining the software, making it an easy and affordable option for businesses of all sizes.

All of the recommendations on this list offer a cloud or web-based solution.

On-premise — unlike cloud or web-based software, on-premise systems are installed on the user’s servers. Typically, the end-user purchases a license for the software and they’re in charge of management and maintenance.

While they’re harder to install and manage regularly, they tend to be more secure and customizable. So, it’s an excellent option for high-security industries and anyone interested in a hyper-customized solution.

However, this means a dedicated team is required to update and maintain the infrastructure.

Enterprise-grade — these are built specifically for extremely large businesses. They come with a ton of hyper-customizable features and solutions to suit the needs of enterprise businesses with massive budgets.

Enterprise help desk software comes in all shapes and sizes, from single-location businesses to international conglomerates operating worldwide.

For most users, this type of software is 100% overkill.

Open-source — this type of software is best for developers or companies with knowledgeable IT departments because you get access to its source code. This means you can modify how the software works to meet your unique requirements.

Essentially, it’s a more affordable way to get a highly customizable solution, as long as you have the skills and know-how to make it work for you.

#1 – Freshdesk Review — The best help desk software for small to midsize businesses

If manual email and social media customer service are becoming too much for your team to manage, Freshdesk is a great way to ease the burden.

Its ticketing system is straightforward to use, and it comes with numerous helpful features.

Plus, it’s incredibly affordable, and there’s a limited free forever plan with unlimited agents to try it out before you invest a single penny.

With Freshdesk, you can streamline conversations across channels in one place, create contextual conversations with anyone, automate repetitive processes to save time, automatically share solution articles, and easily monitor your team’s performance.

Furthermore, you also get access to countless support features, including:

- Multi-channel team inbox

- Agent collision detection

- Custom ticket statuses

- Scenario automations

- Canned responses

- Shared ownership and huddles

- Linked tickets

- Time tracking

- Scheduling dashboard

- Event and time-based automations

- AI-powered chatbots

- Knowledge base capabilities

On top of that, they also offer several educational courses and a fully-staffed customer support team to help you and your team get the most out of your new software.

Freshdesk has five different help desk plans to choose from, including:

- Sprout — Free with limited features

- Blossom — $15/agent per month

- Garden — $35/agent per month

- Estate — $49/agent per month

- Forest — $99/agent per month

You can start with the free plan to try it out, but I highly recommend upgrading to a paid plan when you can justify it to gain access to more of their advanced features.

Each plan comes with a free 21-day trial to test the waters before making your final decision.

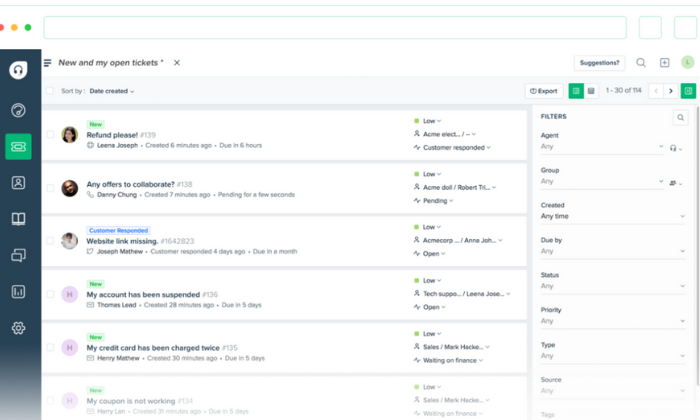

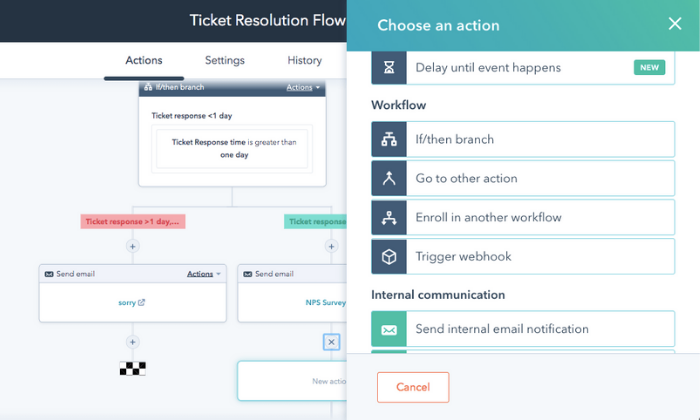

#2 – Hubspot Review — The best all-in-one customer service CRM

If you need a full-blown customer relationship management (CRM) tool to go along with your help desk software, Hubspot is a smart choice.

And the best part? You can get everything you need to get started for free.

With their free Service Hub, you get ticketing, meeting scheduling, reporting, a team inbox, live chat + chatbots, email templates, and team email connections.

So, it includes everything you need to start optimizing your customer support process.

But you also get several other features like tasks and activities, email tracking, contact website activity, contact management, custom fields, and more.

While Hubspot’s free plan is excellent, their paid plans offer a fantastic suite of amazing features you can use to improve your entire support system further.

Each pricing tier adds more advanced features, but their most affordable plan ($40 per month for two users) includes:

- Eight hours of VoIP calling and recording

- Conversational bots to create and route tickets

- Simple open and close automations plus internal notifications

- 1,000 canned responses for frequently asked questions

- Up to 1,000 email templates

- Ten reporting dashboards

- 1,000 documents

- Conversation routing

- Two ticket pipelines

- Up to five currencies

So, it’s quite a step up from Hubspot’s free plan. However, if you meet those limits, you have to upgrade to a higher-tiered plan. The next tier starts at $320/month, so it’s quite pricey.

Alternatively, you can opt for their Starter Growth Suite, which includes the starter plan for Hubspot CRM, the Marketing Hub, the Sales Hub, and all the service features above.

It starts at $50 per month, so it’s a super affordable way to get access to a ton of different marketing, sales, and CRM features if you need access to all of them.

Note: this is special COVID-19 pricing with regular rates starting at $112.50 per month.

#3 – Zoho Desk Review — The best help desk software for fast-growth businesses

Zoho provides countless business tools to businesses of all sizes in every industry you can imagine.

All of their software is fantastic, and their help desk software is no exception.

From affordable plans at every level and a robust free plan to incredible support features, you can rest assured that Zoho Desk has the ability to scale alongside you as your business grows.

At its core, Zoho Desk is a multi-channel ticketing system. So, you get top-of-the-line ticketing features that let you organize and streamline support inquiries, whether they’re coming from email, social media, live chat, phone, or an online form.

And as your business grows, the need for a self-service knowledge base increases. With Zoho Desk, you can quickly turn support requests into knowledgebase articles in just a few clicks to continuously grow your database.

On top of that, you also get access to a wide variety of features designed to help improve and consolidate your support processes. Some of the most popular features include:

- Zia, an AI-powered digital assistant

- Help center tools to design and create your knowledge base

- Several ticket views and automatic ticket organization/prioritization

- Advanced response editor with canned snippets

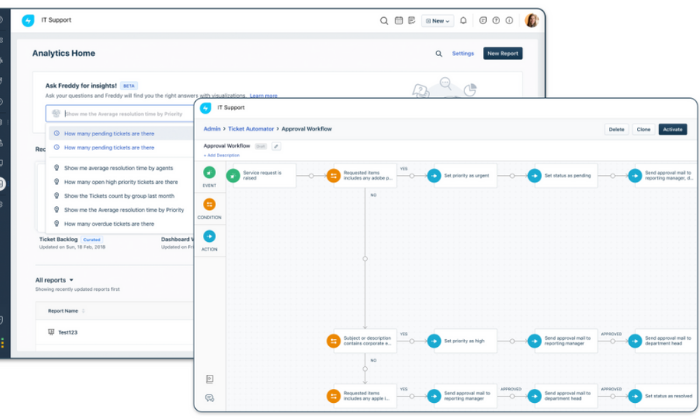

- Visual process automation builder

- Customization via APIs and built-in integrations

- Dashboard headquarters for analytics and reporting

- Custom field options for web forms

With that said, it’s important to note that lower-tiered plans don’t include every feature. So, be sure to look through each plan’s features before choosing one.

And keep in mind that you may have to upgrade to a higher plan to get what you need.

Zoho Desk plans include:

- Free — For up to three agents with email ticketing and limited features

- Standard — $12/agent per month with social channels, workflows, and dashboards

- Professional — $20/agent per month with BPM, time tracking, and ticket sharing

- Enterprise — $35/agent per month with Zia, live chat, and advanced customization

Sign up for a free trial to see which plan is right for you and your team today.

#4 – Freshservice Review — The best for IT service management

If you’re looking for a better way to handle IT support, Freshservice is one of the top options on the market. Like Freshdesk, it’s a Freshworks product, so you have a massive brand behind the software.

However, it’s built specifically for IT teams, rather than customer service.

With more people working from home, strong IT support is more critical than ever before. And you may even see an influx of inquiries coming through as people adjust.

Which… is where Freshservice comes in and saves the day. They offer everything you need, including multi-channel support, hardware and software records, contract management, and a top-rated mobile app for iOS and Android.

Furthermore, you can automate agent assignments and approval workflows to help streamline the process. Plus, you also get access to powerful features like:

- Incident, knowledge, and SLA management

- A user-friendly service catalog

- Self-service portal and knowledgebase

- Internal contextual collaboration

- Problem, change, and release management

- Project dashboards and analytical reports

- Asset and inventory management

- Lifecycle management

- Asset auto-discovery

- Interactive visualizations

And you can easily integrate any Freshworks software with Freshservice, along with tons of other third-party software integrations as well.

So, it’s an excellent choice if you already use or plan on using any of their other business tools.

Freshservice offers four different plans to choose from, including:

- Blossom — $19/agent per month with essential features

- Garden — $49/agent per month for growing teams

- Estate — $79/agent per month for large teams

- Forest — $99/agent per month for enterprises

These prices indicate annual pans paid in advance. They also offer monthly plans for a higher fee, except for the Forest plan.

Try Freshservice free for 21 days to see if it’s right for you!

#5 – Happyfox Review — The best for mobile and field support teams

Field agents have a unique set of challenges vs. support teams in the office or one set location. As such, you need a specialized tool that adapts to meet your needs.

Happyfox is a field service software designed to help you track agents, schedule work, and leverage real-time communications with a fully-featured mobile interface for seamless use on the move.

When agents are continuously traveling from one job to the next, they must have an easy way to share and track status information from one agent to the next.

And the good news is that Happyfox does just that, with a wide range of features like:

- Ticket ques, statuses, and categories

- Multi-channel ticketing capabilities

- Ticket threads and attachments

- Canned actions and responses

- Searchable and customizable knowledgebase

- Agent collision detection

- Built-in asset management

- Auto-assignments and smart rules

- Simultaneous routing rules

- SMS support

And dozens of other helpful features specifically for mobile teams.

Unlike the other options on this list, Happyfox doesn’t display their pricing online. But they offer standard per agent pricing and special packages for unlimited agents, making it suitable for field service teams of all sizes.

For agent-based pricing, they offer four plans with varying feature sets.

And each plan automatically includes SSL security, unlimited tickets, smart rules, knowledgebase capabilities, multilingual support, rich text formatting, and mobile applications.

However, their unlimited agent plans cap the number of tickets you can have in a year. So, you have to decide which option makes the most sense for your situation.

Schedule a live demo to see if Happyfox is right for you and your team today!

#6 – Cayzu Review — The most affordable help desk software

If you’re looking for a budget-friendly cloud-based help desk software, Cayzu is exceptionally affordable with paid plans starting at $4 per agent per month.

It’s also straightforward to use. With that said, it’s not the most feature-rich option, but you sacrifice some of the advanced features for an incredibly affordable price.

At just $4 per month, you get access to all the essential features you need, including:

- Secure data protection

- Automatic backups

- A mobile application

- Unlimited customer support

- Ticketing system

- Canned responses

- Knowledgebase capabilities

- Email ticket creation

- Multi-language support

- Open APIs and rest APIs

- Support widget

Or you can upgrade to one of the higher plans for just a few dollars ($9 per agent per month) and get time tracking, assignment rules, basic automations, due dates, custom SSL certificates, and more.

And they also offer a freedom plan (up to 70 agents) if you’re interested in an easy way to get all of their features. It starts at $469 per month, but it’s probably overkill for most users.

Plus, over 20,000+ companies (including Verizon, Yahoo, and PBS) trust Cayzu with their help desk needs. So, you’re not alone and you’re in good company when you sign up.

Sign up for a free trial to see if Cayzu’s right for you today!

Wrapping things up

Freshdesk, Hubspot, and Zoho Desk are my top recommendations for most users. They all offer numerous powerful features at affordable prices for businesses of all sizes.

However, they’re not perfect for everyone. Different situations call for different solutions.

So, don’t forget to use the criteria we talked about as you sort through choosing the best help desk software for you, your team, and your customers.

What’s your go-to help desk software?

The post The Best Help Desk Software (In-Depth Review) appeared first on Neil Patel.