Article URL: https://jobs.lever.co/juniperplatform/4295e9c0-57a2-45a5-b120-75b065b2a492

Comments URL: https://news.ycombinator.com/item?id=38723115

Points: 0

# Comments: 0

Article URL: https://jobs.lever.co/juniperplatform/4295e9c0-57a2-45a5-b120-75b065b2a492

Comments URL: https://news.ycombinator.com/item?id=38723115

Points: 0

# Comments: 0

Combining much-needed oversight with a federal backstop would yield good results.

The post The Private Market Can Add Discipline to Deposit Insurance appeared first on #1 SEO FOR SMALL BUSINESSES.

The post The Private Market Can Add Discipline to Deposit Insurance appeared first on Buy It At A Bargain – Deals And Reviews.

The post The Private Market Can Add Discipline to Deposit Insurance appeared first on BUSINESS DEMO WEBSITES.

The post The Private Market Can Add Discipline to Deposit Insurance appeared first on Buy It At A Bargain – Deals And Reviews.

A business credit score tends to not be necessary to apply for an insurance policy. But insurers may ask to access your business data after you apply. High credit scores correspond with low premiums and vice versa. That doesn’t mean you should ignore financials in favor of improving your credit score. Rather, if you improve your company’s credit history by paying down debt or working on payables management, then this could help you save money on business insurance premiums.

Getting ready to apply for business insurance is like preparing to apply for financing. You need to know certain details about your business. If you must have certain coverage before signing a lease or contract, understanding the required coverage will also be key before applying. Doing your due diligence beforehand will save you time and maybe even money.

Part of due diligence is looking for an agent. Make sure you work with an agent who understands your business needs and the best options for you. Then the process can go much more smoothly. It is best practices to find an agent specializing in your industry. Their expert advice can be helpful in the process.

Data your insurer uses revolves around correlation. Poor credit tends to mean a higher risk. Insurance is all about probability, and the data shows a higher chance of frequent claims and overdue payments, when insurers cover someone with bad credit.

Having no business credit score won’t prevent you from buying general liability insurance. And it won’t keep you from getting a decent premium. But a good business credit score might get you solid discounts. So, it makes sense to start building PAYDEX and other business credit scores.

Many business owners have no idea their insurance rate is affected by their credit report. But let’s consider personal credit for a moment. And, since Experian business scores (in part) come from personal credit scores, it does apply to your business credit.

Statistics show that people with high personal credit scores file fewer claims than those with low credit scores, and those with higher scores are less likely to have traffic accidents and traffic violations. Additionally, history in a credit report can show if a business or an individual will pay insurance premiums on time or at all. For that reason, federal law lets insurance companies look at items from your credit report. Carriers do not have to tell you they are using your credit report.

Rates are based on a narrow set of information in your credit report. Carriers can only use those specific types of information; this information together is your insurance credit score. The insurance credit score does not include your FICO score.

The score does include items like the pattern of monthly bill payments, collection activity, total number of outstanding loans, and total number of credit cards. Under the law, your rates cannot increase if you do not have enough credit history to calculate a credit score. If you want to see what your personal insurance credit score is, you can buy a copy of the report from True Credit, a division of Transunion.

It’s smart to review your insurance credit report and make certain everything in it is correct. It is important that you do this to get the best rate you can find.

Only some items on your business credit report are considered when you apply for business insurance. The insurance credit score only considers areas of your credit report which apply to the insurance industry. It is against the law to deny an insurance policy based on a lack of credit history.

The items your business carrier will look at include:

Items that insurance companies CANNOT use when checking an insurance credit report include:

It matters because you can’t get by with no business insurance! Every small business owner needs certain insurance policies to protect them in case the worst happens.

Differing industries will have different degrees of risk. Examine your risks and put together a business insurance plan based on that information. Shop around and find the right carrier for your small business. There are nine basic types of business insurance every small business may need to protect a business.

Every business needs general liability insurance. It will cover:

The type of your business, its size, assets, and corporate structure will determine the amount of coverage you need. But this policy won’t cover motor vehicles.

If you have a physical address, you should carry commercial property insurance to cover losses of business or personal property. This type of policy usually covers damage to the structure and inventory or property within it from damage from storms, fire, theft, or vandalism. Dovetailing with commercial property insurance, it might also make sense to look at a business owners’ policy (BOP) depending on the size and assets of your business.

Insurance companies will sometimes offer a BOP to small and medium-sized businesses. A BOP policy will usually combine general liability, property insurance, and business interruption coverage. You can often add riders to such a policy. It can be more affordable to bundle the coverage you already need.

If property sustains damages, you may not be able to keep your business open during repairs. Hence business interruption insurance can help cover financial losses. It can cover your employee payroll, taxes, operating expenses, debt repayment, and sometimes the cost of a temporary location. Many business owners used business interruption insurance during the height of the Covid-19 pandemic when they had to close their doors.

If you hire employees to work in your business, you’re legally required in most states to get workers’ compensation insurance. Workers’ comp protects you and your employees if they’re injured or become ill at work. It can cover an employees’ medical expenses and lost wages while recuperating. If an employee agrees to accept workers’ compensation as part of their hiring package, they often waive the right to sue you for an incident at work.

If you use a vehicle for business purposes, then you need commercial auto insurance. Because if you get in an accident while doing business-related work, your personal car insurance may not cover it. Some insurers will require separate policies for dump trucks and semis.

If you manufacture or sell any type of product, you can be held liable if that product injures someone, damages their property, or makes them sick. Product liability insurance can help cover associated medical costs, replacement of the purchased product, and even legal fees and settlement costs if your business is sued. Distributors and sellers can be the subject of product liability lawsuits, so, they should consider this form of coverage.

If your business is the subject of a data breach and customer information was accessed or stolen, cyber liability insurance can:

Some insurers call this data breach insurance. Anyone who stores customer information electronically should get it, as your general liability policy won’t cover this.

If you run a business where you offer professional advice or are responsible for completing projects—such as a doctor, lawyer, or architect—you need to carry professional liability insurance. It’s also called errors and omissions insurance. This policy can protect you and your business if you’re accused of negligence (or were negligent), missed deadlines, undelivered services, or breach of nondisclosure/copyright insurance. Doctors and other professionals often must carry a specialized type of professional liability—malpractice insurance. But even plumbers, realtors, and event planners can use professional liability coverage.

At times, it can be more affordable for a small business to purchase an umbrella policy, instead of increasing the limits of an underlying policy. An umbrella policy may also cover business risks that an underlying policy excludes. Hence, if the policy limits of your general liability policy are exhausted, umbrella insurance can step in to cover whatever remains. But umbrella policies can’t and won’t cover everything.

You may be wondering if any of this can apply to you. You may not have a physical business location. But your homeowners’ insurance will only cover some of any damage to business property. And most if not all the other insurance policies apply, too.

A small business may do well to consider key person insurance. With key person insurance, if there’s one person—this could be you—key to the operation of your business, the business won’t grind to a screeching halt if that key person were out for a long time (say, with Covid). This coverage can help cover any associated monetary losses for a certain time until your business replaces this person, or they return to work.

Two other types of consider are commercial crime insurance, and equipment breakdown coverage. Crime insurance can protect your business if you’re robbed (even by an employee). It can help cover financial losses other types of insurance may not. Equipment breakdown covers damage to or the loss of your A/C systems, boilers, furnaces, and computers and other electronics, if damaged by power surges or they break down.

If you’ve got employees, then you may be thinking about offering employee benefits. Often, depending on the size of your business, you must provide disability insurance, health insurance, and other insurance, like life insurance, to help protect your employees. But with good business credit, you may be able to save on all these types of insurance.

It’s best practices to take time to revisit your policy, especially if you change parts of your business and need new coverage. Experts say you should search every three years or so for a new policy. This is to make sure you’re not only staying current on your coverage but getting the best rate.

The strength of business credit scores like PAYDEX can affect the price of your policies. Insurance carriers tend to look at open debts and collections, and how quickly your business pays its bills. Paying on time and keeping accounts out of collections can help both your business credit scores and what you’ll pay for premiums—for any type of business insurance.

The post Does a High PAYDEX Drive Down My Business Insurance Premiums? appeared first on Credit Suite.

One of the nation’s biggest, oldest and best-known property-casualty insurers has made a preliminary proposal to acquire another storied name in the industry.

The post Insurance Giant Chubb Offers to Buy Rival Hartford first appeared on Online Web Store Site.

The post Insurance Giant Chubb Offers to Buy Rival Hartford appeared first on ROI Credit Builders.

One of the nation’s biggest, oldest and best-known property-casualty insurers has made a preliminary proposal to acquire another storied name in the industry.

The post Insurance Giant Chubb Offers to Buy Rival Hartford first appeared on Online Web Store Site.

House Insurance And Selling Your Home With any luck you have actually thought about working with an actual estate representative to assist you with all the great information if you are marketing your house. Otherwise– reach function! The procedure of selecting the appropriate realty representative can be equally as tough as it is very important. … Continue reading Residence Insurance And Selling Your Home

House Insurance And Selling Your Home With any luck you have actually thought about working with an actual estate representative to assist you with all the great information if you are marketing your house. Otherwise– reach function! The procedure of selecting the appropriate realty representative can be equally as tough as it is very important. …

The post Residence Insurance And Selling Your Home first appeared on Online Web Store Site.

The post Residence Insurance And Selling Your Home appeared first on ROI Credit Builders.

Article URL: https://jobs.lever.co/newfrontinsurance/1ef7d406-b918-4232-a816-337856cdbc33

Comments URL: https://news.ycombinator.com/item?id=24898341

Points: 1

# Comments: 0

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

Every business needs insurance. Depending on your business type and industry, some of you will need more protection than others.

Without insurance, you could be liable for potentially hundreds of thousands or even millions of dollars.

What happens if one of your vehicles is involved in an accident? How will you pay for the damages of a fire or flood in your office? What if an employee or customer slips and falls on your property?

You need to have insurance, or you’ll be paying these costs out of pocket.

But finding the best business insurance package for your organization can be tricky. On the one hand, you want to make sure that you’re covered, but on the other, you don’t want to overpay on premiums.

The best way to start your search is by choosing a reputable business insurance provider—I’ve narrowed down the top business insurance companies in this guide.

There is no “one-size-fits-all” plan for business insurance. Every organization is unique, so you’ll need custom protection based on your needs. Certain insurance providers are definitely better for specific types of insurance, as well as other factors.

As you’re browsing and getting quotes from different providers, make sure you keep the following considerations in mind:

Some insurance providers have more experience covering businesses within certain industries.

For example, a restaurant would have very different insurance needs from a construction company. A dental practice won’t have the same needs as an ecommerce website. You get the idea.

So as you’re evaluating a potential provider, take a look at their existing clients and industries served. Do they have experience covering businesses in your industry? If not, look elsewhere.

If you have to submit a claim, you want to make sure that your insurance provider has your back. When you pick up the phone, will someone answer?

Any delay in the claims process will cost your business money. Let’s say there is a flood at your retail storefront. If your insurance company drags their feet, you might not be able to re-open. How soon will someone come to evaluate the property? How quickly can they approve a contractor to repair the damages?

Choose an insurance company that will go the extra mile to serve your business in times when you need their help the most—that’s what you’re paying them for.

There are literally thousands of insurance companies in the United States. Some are brand new, some have been around since the inception of insurance, and many fall somewhere in between.

In most cases, I prefer to go with an older insurance company with a long-standing reputation. These providers have seen it all, and they’ve survived the test of time. You run some risk if you go with a newer company. Let’s say you have some obscure or rare situation with a claim. It could be a first for a new company, and they might not know how to handle it.

We’ll talk about the different types of business insurance in greater detail shortly. But in a perfect world, you’d like to get all of your business insurance coverage under one roof.

Getting property insurance from one provider, vehicle insurance from another, and general liability from a third company is just too confusing. So look for an insurance company that has a wide array of coverage options that accommodate your needs.

Getting proper coverage is obviously important, but how much is this going to cost you?

If you choose the cheapest plan you can find, you’ll probably be exposed to some more out of pocket costs. But if you choose the most expensive plan on the market, do you actually need all of that coverage?

Look for a balance between these two extremes. When it comes to insurance, I typically like to be a bit more conservative. I’d rather overpay a little bit than risk not being fully covered. But this all depends on your individual risk tolerance.

There are dozens of different business insurance types. But for the purposes of this guide, I’m going to focus on the ones that are the most common and applicable to the masses.

General liability coverage protects you from risks like bodily injuries and property damage. This typically includes medical payments if someone is hurt on your company’s property. General liability can also protect you from lawsuits related to things like libel, slander, privacy violations, copyright infringement, wrongful evictions, and more.

Most businesses will need some type of general liability coverage.

Professional liability and general liability are often confused with each other, although the two are not one in the same.

Professional liability insurance is also referred to as errors and omissions (E&O) insurance. This protects businesses sued by clients claiming damages for professional services that you provide. Things like an accountant making a mistake on a tax return or a web developer making mistakes on a site that they manage would be examples where professional liability insurance is necessary.

Business owners insurance (better known as BOP) is a policy that combines liability and property into one package. It’s very common for small and mid-sized business owners across a wide range of industries. Most contractors will carry some form of BOP insurance as well.

BOP packages do not cover your employees—it’s specific to business owners.

Once you hire your first employee, workers’ compensation should be immediately added to your business insurance policy. Most states require workers’ comp insurance by law.

The coverage pays for things like medical expenses and disability for employees who were injured on the job. This could include minor slip and fall injuries to long-term conditions (like carpal tunnel) or even death.

This type of insurance will protect your company if your operations are interrupted during some type of disaster or catastrophic event. Organizations with physical locations that could lose income due to these types of interruptions can benefit from a business interruption policy.

Your business can be compensated for lost income in these types of scenarios.

This type of business insurance policy is pretty-self explanatory. Just like you need insurance for your personal vehicle, you’ll need to cover any vehicles used for business purposes. If an accident occurs with one of your vehicles (whether you’re driving or not), you’ll need this type of coverage.

Whether you own or lease physical space, you need to have property insurance. Again, it’s similar to the type of insurance you’d have to protect your home or apartment.

This type of insurance will protect your business from events like fires or theft. Your equipment, inventory, furniture, etc. should all be covered in this policy. However, it’s worth noting that some types of natural disasters, like earthquakes, aren’t always covered in a standard property insurance policy. You might have to pay extra for this type of coverage, depending on your area and the insurance provider.

If your company manufactures products that are sold to the general public, you must have product liability insurance. This coverage will protect your company from lawsuits related to damages caused by your products.

For example, if someone is injured using one of your products, they could sue your company directly for their medical expenses. That’s when product liability insurance would kick in.

Chubb is one of the most reputable business insurance providers on the market today. They are known for exceptional customer service.

This provider has a wide range of plans for small businesses, commercial insurance, industry-specific policies, and more.

Compared to other insurance providers on the market, Chubb has one of the most extensive coverage portfolios that you can find. Some examples of these policy categories include:

Chubb has over 200 years of experience in the business insurance space. Just be aware that their premiums tend to be a bit higher than other options—but you’re paying for the best.

CNA is another reputable provider in the business insurance world. They have 120+ years of expertise in this field.

With CNA, you’ll benefit from a custom insurance package to help manage your risks and liabilities.

There are certain industries that CNA has the most experience working with; these include construction, education, manufacturing, healthcare, real estate, wholesale, technology, professional services, finance, and more.

Here’s a quick glance at some of the types of business insurance offered by CNA:

I like CNA because you can pick and choose which types of coverage you need, and get them bundled into a single policy that’s custom fit to your needs.

Hiscox is my top recommendation for small business owners. Their policies are affordable, while still providing you with enough coverage to protect your organization from a wide range of potential scenarios.

When I say that Hiscox is great for small businesses, I mean ALL small businesses. They’re currently providing protection to organizations in 180+ different industries.

The list of coverage types offered by Hiscox isn’t quite as extensive as some of the other options on the market today. But they still have more than enough options to accommodate the needs of most businesses.

Hiscox is an established name in the business insurance world. They’ve been around since 1901 and insure 300,000+ small businesses across the US.

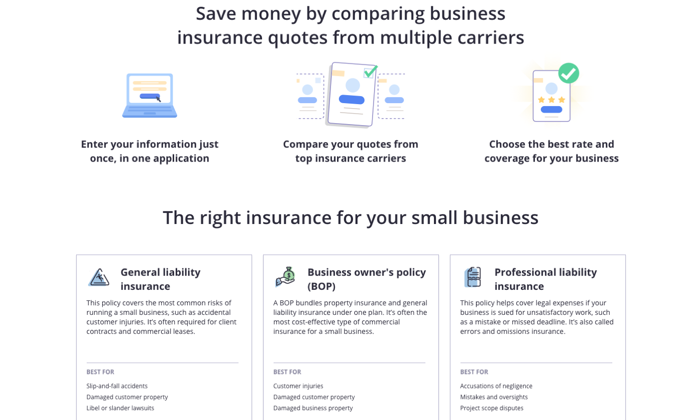

Technically speaking, Insureon isn’t actually an insurance provider; it’s an online marketplace for business insurance.

But this robust platform definitely deserves a spot on my list. Insureon is super easy to use, and it’s the best way to compare coverage options from different providers in a single place.

If you’re looking to get the best possible rate, I strongly recommend Insureon. Otherwise, you’d have to get quotes from different providers individually, which is much more of a hassle.

Insureon allows you to compare free quotes from some of the top-rated and well-known business insurance providers on the market today (including some of the options on our list).

The list goes on and on. You can browse policies for professional liability insurance, cyber liability insurance, BOP policies, general liability insurance, commercial property insurance, workers’ compensation insurance, and more.

Insureon is typically geared toward smaller businesses. But it’s used across a wide range of different industries.

Progressive is an industry leader in the commercial auto coverage space.

With 45+ years of experience, they aren’t quite as old as some other players in the industry. However, Progressive is definitely a well-established and trustworthy provider for commercial auto policies.

Here’s a list of some common types of business vehicles insured by Progressive:

It’s worth noting that there are certain types of vehicles that Progressive will NOT insure. This includes emergency vehicles (like fire trucks and ambulances), golf carts, double-decker buses, monster trucks, race cars, wheelchair buses, and a few others.

In addition to the commercial policies, Progressive also has coverage for general liability, BOP, professional liability, workers’ comp, and more.

For those of you who don’t know, Hartford, Connecticut is known as the “insurance capital of the world.” So it’s no surprise to see The Hartford (named for its headquarters’ namesake) on our list.

This company was founded more than two centuries ago, back in 1810. To say they are a well-established name in the business insurance industry would be a drastic understatement.

The Hartford has an extensive list of product offerings for business insurance. Some of their most popular policies include:

Overall, the workers’ comp coverages provided by The Hartford are second to none. If you want to give your employees the very best protection, look no further than The Hartford.

In a market saturated with business insurance options, there are really only six choices that I’d consider.

If you choose one of the names reviewed above, you can rest easy knowing that your business is being protected from a well-established and reputable provider.

Be sure to use the methodology I described earlier as you’re shopping around and evaluating different options. That’s the only way to get the best possible business insurance policy for your company.

The post Best Business Insurance appeared first on Neil Patel.

Article URL: https://jobs.lever.co/newfrontinsurance/51c08b9c-f5ed-4714-8787-b1a2b1059ead

Comments URL: https://news.ycombinator.com/item?id=24355214

Points: 1

# Comments: 0