Article URL: https://jobs.lever.co/juniperplatform/4295e9c0-57a2-45a5-b120-75b065b2a492

Comments URL: https://news.ycombinator.com/item?id=38723115

Points: 0

# Comments: 0

Article URL: https://jobs.lever.co/juniperplatform/4295e9c0-57a2-45a5-b120-75b065b2a492

Comments URL: https://news.ycombinator.com/item?id=38723115

Points: 0

# Comments: 0

Article URL: https://www.ycombinator.com/companies/gym-class-by-irl-studios/jobs/ADcM4ZV-lead-backend-engineering Comments URL: https://news.ycombinator.com/item?id=37757516 Points: 1 # Comments: 0

The post The False Abe Fortas Analogy appeared first on Buy It At A Bargain – Deals And Reviews.

Pep Guardiola only had to worry about Liverpool in the past, but now Arsenal and Manchester United are threatening to return to former glories.

The post Guardiola feels the strain as Arsenal, Man United reawaken with his own proteges appeared first on Buy It At A Bargain – Deals And Reviews.

The NYPD is searching for a suspect in the random stabbing of a 16-year-old girl that occurred in broad daylight outside a juice bar in Brooklyn on May 22.

The Ringer’s Bill Simmons is joined by Rob Mahoney to discuss the playoff seeding for the Western Conference, the increasingly scary Mavericks, the steady Suns, the stumbling Warriors, Clippers rumors, and more (7:26). Then Bill talks with Jay Caspian Kang of the New York Times about the upcoming Final Four showdown between Duke and UNC (31:49). Finally Bill is joined by Warren Sharp to discuss the current NFL landscape for the 2022 season, the wide-open NFC, the super-competitive AFC, big trades and free-agent signings, the top five easiest and hardest 2022 schedules, what to look for in NFL futures bets, and more (56:10).

Host: Bill Simmons

Guests: Rob Mahoney, Jay Caspian Kang, and Warren Sharp

Producer: Kyle Crichton

Learn more about your ad choices. Visit podcastchoices.com/adchoices

The post Here Comes Luka, a UNC-Duke Showdown, and Possible NFL Sleepers With Rob Mahoney, Jay Caspian Kang, and Warren Sharp appeared first on Buy It At A Bargain – Deals And Reviews.

President Volodymyr Zelenskyy on Tuesday thanked Prince William and Kate Middleton for pledging their support for Ukraine amid Russia’s invasion.

funding for law firms

When you consider hanging your shingle and starting your own law practice, you have to think about a lot of things. One thing you may think about is funding. Every business needs funding. There is no business in the world that can run without money.

So, how do you get the business funding you need when you need it? You may think a legal practice would have no problem getting funding. However, even a law firm has to be fundable, particularly because rainmaking can take time — and it isn’t always dependable. Strong fundability is necessary for any business to get financing.

There is an added benefit for legal practices when it comes to fundability. Fundability aligns rather closely to all of the little things a firm does to attract, impress, and retain clients.

When you are just starting out with your own practice, clients may be few and far between. Not only that, but the cases you get are not likely to be huge. You need a way to make payroll and pay other bills and obligations until cash flow catches up. This is where fundability comes into play.

Fundability is any business’s current ability to get financing. Now, don’t make the mistake of thinking that you’ll be able to get the funding just because of the type of business you own. It may help. Still, before lenders approve funding for law firms, they want to make sure the business is fundable.

Regardless of the type of business, there are 5 core principles of fundability that it must have. Each core principle is affected by a number of factors. Sadly, many business owners never realize that those factors can affect their ability to get business funding.

The fundable foundation starts where every foundation starts, at the beginning. Likewise, it has everything to do with how you set your business up.

A business needs its own phone number and address. A business phone number should not be your own, even if you are a sole practitioner. You can use a separate line or VoIP and have it forwarded to your personal phone. Just do not list your personal phone number as your business number.

As for an address, it has to be a physical address where you can receive mail. A P.O. Box or UPS Box will not work. Of course a virtual office is an option. However, realize that some lenders will not accept a virtual office address.

Your law firm needs an EIN as well. Lenders want to see your business is legitimate and credible. If you apply for business funding and do not have an EIN, it looks unprofessional. Likely, this is even more true for an attorney. The number is free and easy to get on the IRS website. An EIN has the added bonus of keeping your personal Social Security number private.

Of course, attorneys know the importance of incorporating for liability purposes. But, incorporating your business is an important step in separating a business from the owner personally which also increases fundability. The state you are in will determine which type of corporation is allowable for legal practices. In California, for example, if you opt to become a professional corporation, liability protection will not cover acts related to professional malpractice. You could instead form a California Legal Liability Partnership (LLP) and you would not be vicariously liable for the malpractice of other members.

Other states, like Massachusetts, will allow a firm to become a professional legal liability corporation (PLLC). In the Bay State, a PLLC won’t protect you from vicarious liability for the malpractice of other members of the PLLC. And in Delaware, the term is LLC (they don’t use the term PLLC) although you can also create a Professional Corporation in Delaware. Both arrangements provide some protection. It will pay to compare the two types closing before deciding between them.

In general, creating a PLLC or LLC means the members must all be licensed to practice within the state of incorporation. Hence, unlike with other types of business incorporating, you wouldn’t be able to choose to incorporate in Delaware or Wyoming — unless of course your firm is in the applicable state and all of the members are admitted to practice there. Incorporation also must be done as soon as possible. A lot of lenders look for a minimum time in business, and generally they consider the start of business to be the incorporation date.

You have to open a separate, dedicated business bank account. There are a number of reasons for this. When it comes to fundability, the key is that there are several types of funding you cannot get without one. Many lenders and credit cards want to see a business account with a minimum average balance.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

If you do not have the necessary licenses to run your business, red flags are going to fly up all over the place. Lenders do not lend to borrowers that they feel are not doing what they should. In a legal LLC or PLLC, the members will all need to be admitted to practice in the applicable state.

Firms practicing in federally regulated fields (such as securities), will likely need federal licensure.

These days, you do not exist without a website. However, having a poorly put together website can be even worse. It’s the first impression you make on many, including lenders.

Spend the time and money necessary to have a website that is professionally designed and works well. Pay for hosting rather than usings a free hosting service. Also, make sure it has the same URL as your website. Don’t use a free service such as Yahoo or Gmail. In particular, free services may not have the kind of security you would need to maintain client confidentiality, anyway.

Another plus to having a professional website and email address(es) is they are an opportunity to establish a trusting relationship with your clientele.

A business credit report is a tool to help lenders determine how creditworthy a business is, even law firms. There are a few different sources, but the main ones are Dun & Bradstreet, Experian, Equifax, and FICO SBSS. Since you have no way of knowing which one your lender will choose, you need to make sure all of these reports are up to date and accurate.

In addition to the business credit reporting agencies that directly calculate and issue credit reports, there are other business data agencies that affect those reports indirectly. LexisNexis and The Small Business Finance Exchange are two examples of this.

These two agencies gather data from a variety of sources, including public records. They even have access to information relating to automobile accidents and liens. While you may not be able to access or change the data these agencies have on your business, you can ensure that any new information they receive is positive. Enough positive information can help counteract any negative information from the past.

In addition to the EIN, there are identifying numbers that go along with your business credit reports. The Experian BIN is simply assigned by Experian. But you do have to apply for a D-U-N-S number from Dun & Bradstreet.

Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. Apply for one through the D&B website. It’s free.

Your business credit history is what makes up your business credit score, which is a huge factor in the fundability of your business.

Your credit history consists of:

The more accounts you have reporting on-time payments, the stronger your credit score will be.

Business information needs to be consistent. Something as small as using an ampersand in your business name on one document and the word “and” on another can cause an application for funding to be denied.

A large number of loan applications are turned down each year due to fraud concerns simply because things do not match up. Maybe your business licenses have your personal address, but now you have a business address. Do some of your credit accounts have a slightly different name or a different phone number listed than what is on your loan application?

Inconsistency causes warning bells for lenders, and you may never know what the problem was.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

Your personal credit score from Experian, Equifax, and Transunion all make a difference. You have to have your personal credit in order because it will definitely affect the fundability of your business.

Some business credit reporting agencies use your personal score in your business score calculation. Of course, lenders may pull your personal score as well, regardless of what your business credit score looks like.

Both your personal and business tax returns need to be in order, and you need to be paying them. Tax returns aren’t the end of the story however.

It is best to have an accounting professional prepare regular financial statements for your business. Having an accountant’s name on financial statements lends credence to the legitimacy of your business.

Personal Financials

Often tax returns for the previous three years will suffice. Again, it is best to have a professional prepare them. Other information lenders may ask for include check stubs and bank statements, among other things.

There are several other agencies that hold information related to your personal finances that you need to know about. Everyone knows about FICO. Your personal FICO score needs to be as strong as possible. It really can affect business fundability and almost all traditional lenders will look at personal credit in addition to business credit.

ChexSystems is also in the mix. They track bad check activity, which makes a difference when it comes to your bank score. If you have too many bad checks, you will not be able to open a bank account. That will cause serious fundability issues.

Everything is fair game. Do you have a bankruptcy or short sale on your record? What about liens or UCC filings? Yes, even these personal things can affect the fundability of your business.

First, consider the timing of the application. Is your firm currently fundable? Next, ensure that your business name, business address, and ownership status are all verifiable. Lenders will check into it. Lastly, make sure you choose the right lending product for your business and your needs. Do you need a traditional loan or a line of credit? Would a working capital loan or expansion loan work best? Choosing the right product to apply for is important.

Everyone knows the easiest way to put together a puzzle is to start with the edges and corners. These are the easiest pieces to find because of their straight edges. Once in place, there is a framework within which to fit all the other pieces.

The fundable foundation is like a puzzle framework. Even with a law firm, it’s easier to start building your fundability from the beginning, especially since many of the steps you need to take are what clients are looking for in a firm anyway. Similarly, the foundational pieces are easiest to find. As a result, filling in the details of all the other principles goes much more smoothly. Yet, many business owners do not even realize these pieces are part of the fundability puzzle at all.

Funding for law firms is out there. Making sure your firm is fundable assures you the best possible chance of getting the funding you need to grow and thrive.

The post How Fundability® Affects Funding for Law Firms appeared first on Credit Suite.

Whether you run a YouTube channel, blog, or social media empire, it pays to know how many subscribers you have on each platform. Not only do subscriber counts show you which channels are working and which aren’t, but you can also leverage them to build stronger and more profitable partnerships with brands.

Checking your subscriber count isn’t always easy, though. For every platform like YouTube that makes your following incredibly transparent, there’s a channel where it can be next to impossible to find your subscriber count.

Notice I said “next to impossible,” not “totally impossible.”

I’m here to explain how you can check your subscriber count on every major channel and social media platform.

It’s vital to know exactly how many subscribers you have on each platform for several reasons.

Let’s say you’re an up-and-coming marketing influencer. Part of your income will come from brands paying you for sponsorships and endorsements. Exactly how much they pay you hinges on how many subscribers and followers you have.

If you can show 50,000 people subscribe to your podcast, 100,000 people read your blog each month, and almost half a million people follow you on Instagram, you’ll be in a very strong position to command a big payday.

Your subscriber count can also help you make decisions on your way to becoming an influencer or growing your business’ following in general. Imagine you created accounts on Facebook, Twitter, LinkedIn, Instagram, and Pinterest when you started your business and posted to all of them equally.

At some point, you need to focus your efforts on the platform where you see the most success. Your subscriber count is a great way to quickly separate the good social media platforms from the ineffective ones. After all, what’s the point of wasting time on Pinterest, where you have half a dozen followers, over Twitter, where you have several thousand?

It’s not just social media subscribers you should think about, though. Perhaps you have a blog that gets upwards of 100,000 visitors every month, but you only have a couple of hundred people on your email list. This indicates your email marketing strategy isn’t working, and you should take steps to change that.

YouTube is one of the more transparent subscription-based platforms out there. Log in to your account, click on your profile photo, and head to your channel. You’ll see your subscriber count underneath your channel’s username.

You can also see your subscriber count by navigating to YouTube Studio. In addition to the overall numbers, you can find a list of your 100 most recent subscribers.

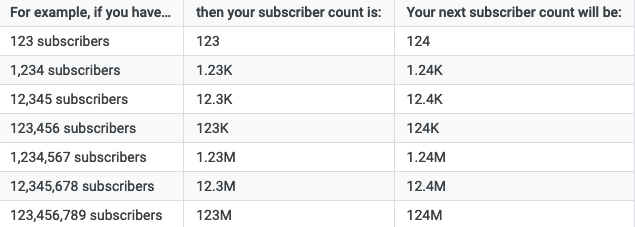

Visitors to your channel see a shortened version of your subscriber count rounded down to the nearest 10, 100, or 1000 subscribers. YouTube Studio provides a handy table showing how your subscriber count will be displayed to viewers.

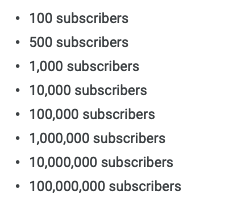

YouTube also notifies you within YouTube Studio and via email when you hit certain subscriber milestones.

Podcast success goes way beyond subscriber count, but the metric many podcasters want most is how many people subscribe to their podcast. This is often the hardest number to find.

Part of the problem is consumers can use dozens of different podcast apps to subscribe to shows rather than a single platform like YouTube. That means your podcast subscriber count will only ever be an estimate.

Most podcasting platforms, from the free to the pricey ones, provide some way to check your subscriber count. The method (and accuracy) varies by platform. The platform, however, should make it clear how to find this number. It’s usually to the side of where you post your podcast to begin with.

Some podcasting apps release subscriber numbers, though. You can end up with a bit more accuracy this way, but it takes more legwork on your part.

A couple of these are Podcast Addict and Castbox, though both account for about two percent of the market. Multiplying either subscriber count by 50 could give you a vague idea of how many subscribers you have in total, but it won’t give you the full picture.

A final suggestion from The Podcast Host is to publish a new episode and hold back from promoting it on social media, email, or anywhere else. In theory, any downloads occurring within about 24 hours of your show being posted are automatic downloads from subscribers; so if you have 50 downloads within a day of posting your episode, you likely have around 50 subscribers.

Most social media platforms make your number of subscribers readily available, so finding them is simply a matter of knowing where to look.

Here’s how you can find your subscribers on all of the major social media platforms.

How you check your follower count on Facebook will depend on whether you have a private user account or a business page.

Private users can allow people to follow them by turning on public posts and allowing people who aren’t their friends to follow them. This is an excellent option for bloggers and public figures who don’t want to have a private and a business Facebook account.

If this is you, head to the “Friends” tab on your profile page and click the “Followers” sub-tab. This will show you a full list of followers. You can see the total figure even faster by reading the “Intro” section on your profile page.

Facebook Business Page owners will need to navigate to their page, click on the “More” tab and then “Community” in the dropdown menu. Here you can find your total follower count, what your followers have posted on your page, and any posts where your business page was tagged.

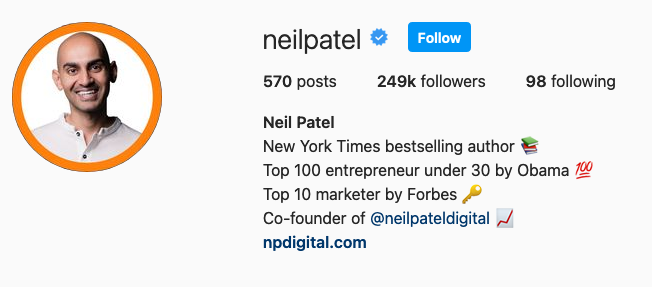

Instagram puts your number of followers front and center. At the top of your profile, you can see how many people you’re following and how many people follow you. Once you get over 10,000 followers, the number will be rounded down to the nearest 100 or 1000 followers.

If you want to get an exact subscriber count, use Instagram’s Insights tool. Navigate to that section on the app and click on “Audience” to see an exact follower count and a growth comparison with the previous week.

If you have fewer than 10,000 followers on Twitter, you can see exactly how many people follow you by looking at your profile page. If your follower count is higher than that, Twitter rounds the nearest one hundred followers.

To find the exact subscriber count on Twitter, head to the Analytics section and hover your mouse over the subscriber number in the top right-hand corner. An exact count will appear.

The only way to see your subscriber count on Snapchat is to have a Public Profile. Not only will you be able to see your subscriber count on the back-end of the platform, but you’ll also have the option to display your follower count publicly.

You need a Pro account to check your subscriber count on TikTok. With this kind of account set up, head to the “Settings” menu and click on “Analytics.” This shows a graph with how many video views you received over the last 28 days and how many followers you have.

Note: You need to wait seven days after creating a TikTok Pro account before analytics data becomes available.

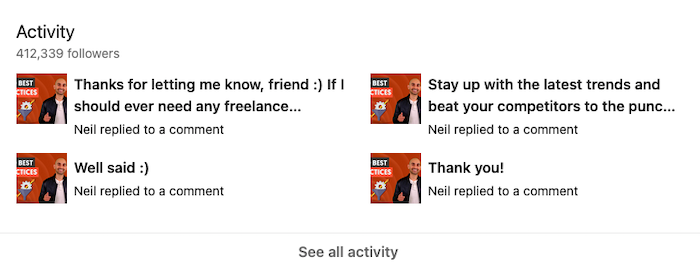

When I talk about subscribers on LinkedIn, I don’t mean the number of connections you have. I’m talking about the number of followers you have.

To see how many followers you have, sign into your account and scroll down to find the “Activity” section. There you can see your exact number of followers.

Track your Pinterest subscriber count on your Analytics dashboard. In addition to your follower count, you can see engagement metrics, popular pins by your fans, referral traffic, other top influencers, and competitor data.

People don’t subscribe to blogs in the same way they subscribe to YouTube channels or podcasts. That makes coming up with a subscriber number a little trickier. Here’s what you can do to estimate your subscribers.

Having an email newsletter is probably the best way to gauge how many people “subscribe” to your blog. However, you need to ask people to enter their email addresses without giving them anything other than your updates in return, as Ahrefs does, for example.

If you offer them something like a discount on a product you sell, you can’t prove they actually read your blog every week—they may immediately stop reading after they get their discount.

Checking your blog subscriber count can be as simple as opening up your email marketing platform and seeing how many people you have on your email marketing list.

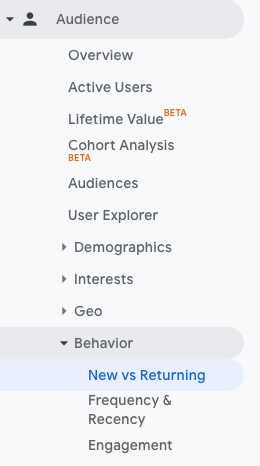

If you don’t think your email list accurately depicts your subscriber numbers, you can use a Google Analytics report to estimate the subscribers you have. Navigate to the “Audience” tab, click on the “Behavior” dropdown menu, and choose “New vs Returning.”

This will give you a chart that separates new users from returning visitors. I’d recommend taking the data over the last 30 days to get an accurate idea of your subscriber count.

Your subscriber count is certainly worth knowing, but it isn’t the end-all, be-all. Measuring the engagement on your website, YouTube, and social channels is also an effective way to show brands and other potential partners how valuable your following is.

It’s also a great way for you to determine which social media accounts are worth your time.

If you’re still feeling a bit stuck, whether with subscribers or engagement, that’s okay—there are a lot of metrics to take into consideration. For some extra help, check out my guide on how to make social media marketing work for you.

On which platform do you have the most subscribers?

Article URL: https://jobs.lever.co/substackinc/c98439dd-6560-4b58-b827-42eb92c61dbd

Comments URL: https://news.ycombinator.com/item?id=27239912

Points: 1

# Comments: 0