13 Reasons Why Direct Mail Isn’t Dead

In an increasingly digital world, direct mail seems old and boring.

You wouldn’t drive a horse-drawn carriage to work or use a pager to contact your friends, would you?

Of course not.

Direct mail feels outdated.

But direct mail is still a great way to reach your audience, grab their attention, and connect with them on a personal level.

In 2016, The Data & Marketing Association reported that the direct mail customer response rate increased by 43%. Even better, the prospect response rate increased by 190% compared to 2015.

Many marketers are in shock.

But the data is undeniable.

Direct mail is still effective, and using it is a game-changer for any serious marketer.

Here are 13 reasons why direct mail still isn’t dead.

1. Direct Mail has a High ROI

Would it surprise you if I said that direct mail gives you more bang for your buck than paid search and online display ads?

Well, it does.

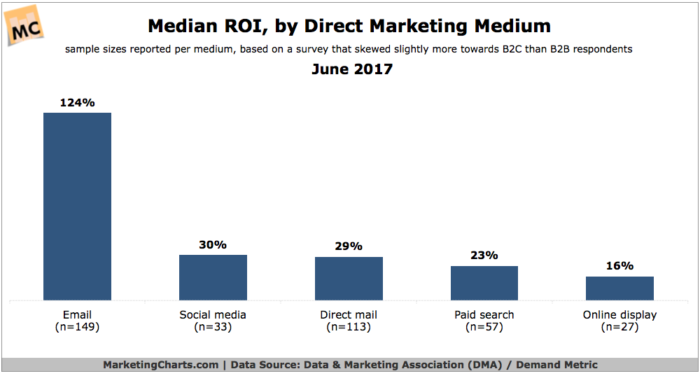

Direct mail has a median ROI of 29%, putting the ROI in third behind email and social media marketing in terms of ROI. Social media is ahead by only 1 percentage point.

That might not seem very high, but when you consider that paid search has an ROI of 23% and online display at 16%, that number looks a lot more attractive.

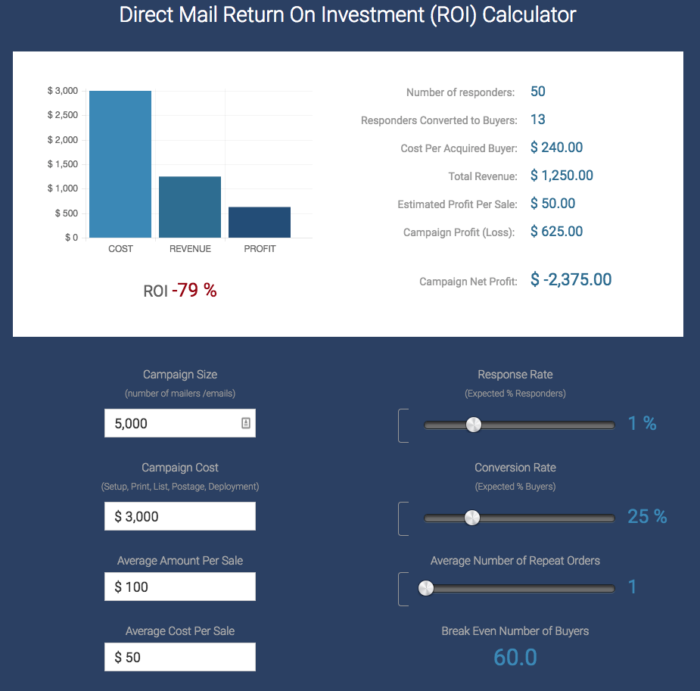

Are you curious about what your direct-mail ROI could become? You can go here to calculate it.

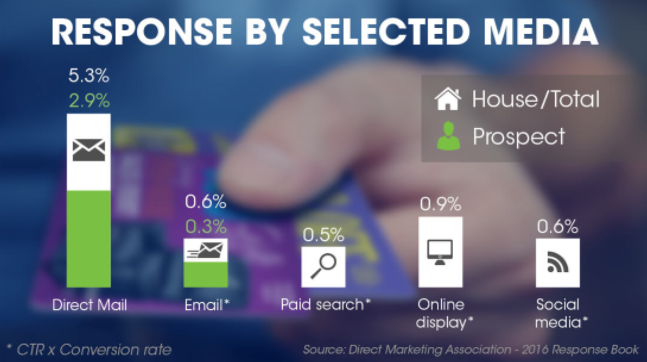

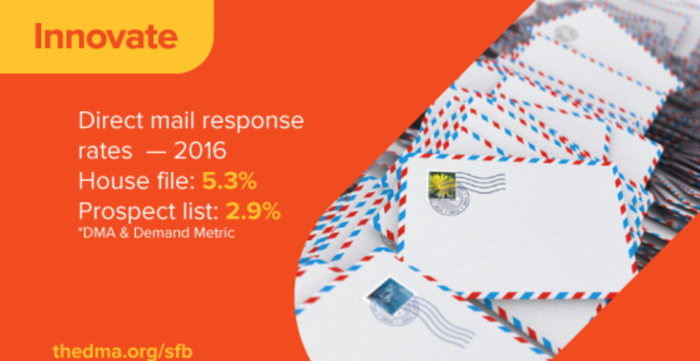

That baffling ROI says nothing of direct mail’s response rate, which is 5.3% for mail sent to houses and 2.9% for prospect lists.

Now compare that number to email, which has an average click-through rate of about 2% or 3%. And that’s the click-through rate, not the response rate, which is 0.6%.

Despite what the haters say, direct mail is still holding its own against other marketing channels.

2. Direct Mail Works Great with a Digital Marketing Strategy

Every great marketing strategy uses multiple channels.

Smart marketers wouldn’t run only Facebook Ads and call it a day.

They’d consider running Instagram ads, do paid search campaigns, and even use search engine optimization to increase traffic.

While you shouldn’t invest only in direct mail, you should consider it part of your marketing bag of tricks.

97th floor in Utah combined direct mail and digital marketing to increase loyalty with their clients.

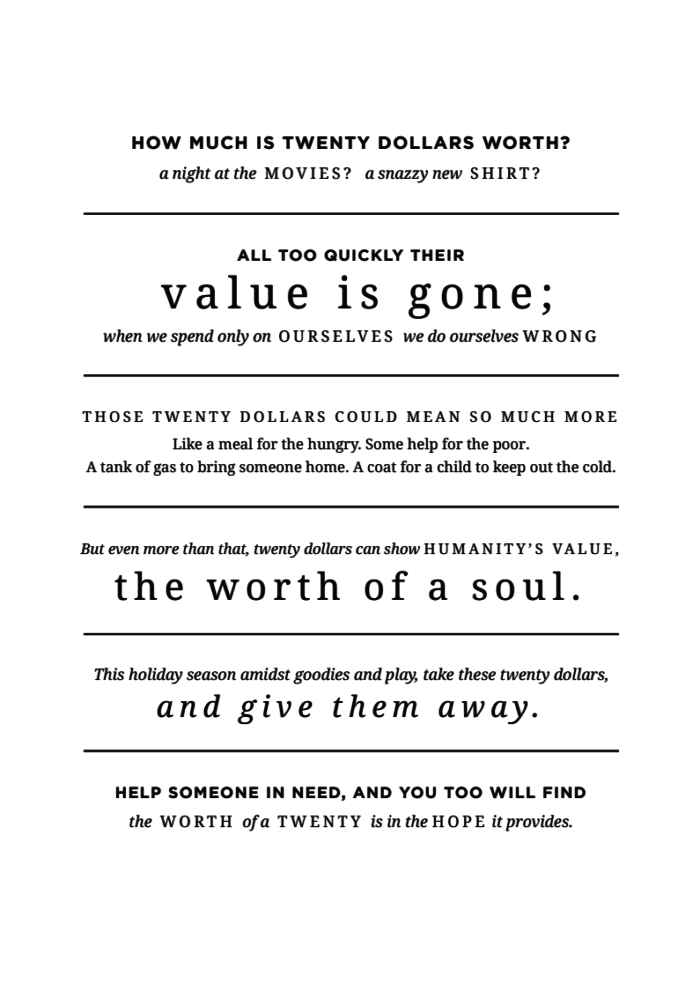

First, they sent out a direct mailer to all of their clients with a holiday poem and a $20 bill with a scannable code next to it.

Endearing, right? But the beauty is when you flip over the card and look at the left-hand side. There’s a scannable code and a hashtag to use below it.

So what’s up with the $20 bill?

When someone scanned the code with their phone, it sent them to a video that encouraged them to spend $20 on someone less fortunate during the holiday season.

The agency then asked for everyone to share what they did on Twitter using the hashtag #20helps.

Combining direct mail with savvy digital-marketing techniques increases the personability of the message you’re sending.

When you give people something to do with your direct mail, such as watching a video, taking a selfie, or spending $20, few people resist the urge to participate.

3. Direct Mail is Easier to Target Than You Might Think

On social media, targeting your audience is dead simple. Facebook, Instagram, and Twitter all offer tons of targeting tools based on interests, demographics, even behavior.

But what about sending the right message to your customers using direct mail?

Can you target your ideal client well enough to make it worth your time and money?

Yes, you can.

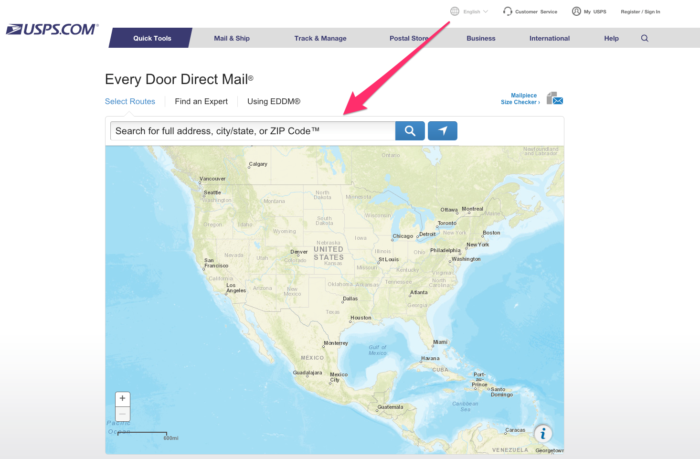

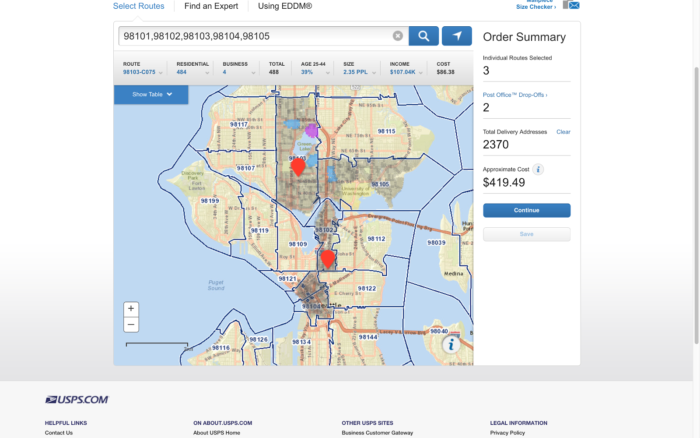

At USPS.com, you can use their Every Door Direct Mail tool to send mail to different customers in different areas.

Start by entering your city and state or zip code.

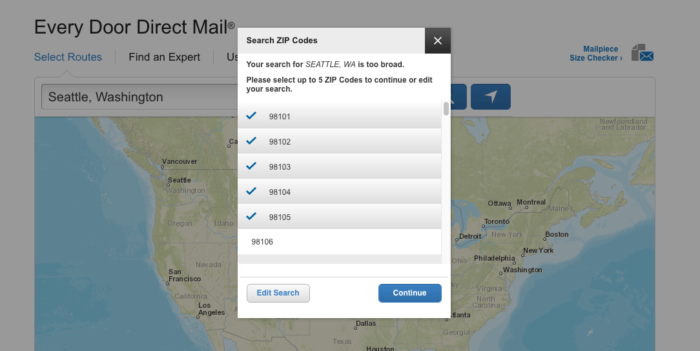

Hit enter. Select up to five zip codes near your location.

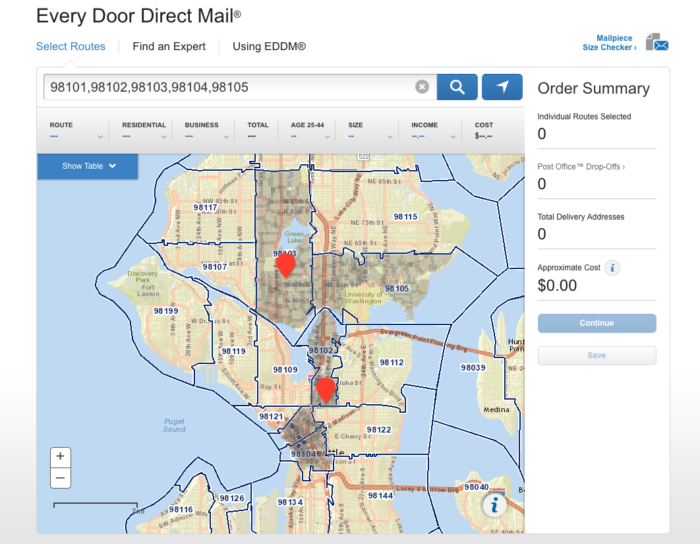

Then click continue. You’ll see a map that looks something like this.

When you hover your mouse over a route, the tool will show you the number of residents, number of businesses, age range, average household size, and average household income of that zone.

It even calculates the approximate cost of postage to send a mailer to that route.

As long as you already know who your target audience is, direct mail can be highly specific.

4. Direct Mail is Trackable (Yes, really)

Technically, there is no automatic way to track direct mail response rates, ROI, and general engagement. Unlike a Facebook ad, you can’t track that the user went from your ad to your product page.

Maybe a customer visits your website after seeing your direct-mail piece. While this person would count as a lead from your website, they should be a lead from your direct-mail campaign.

But wait, I just said direct mail is trackable.

It’s a little more complex, but tracking direct mail is totally doable.

Here are a few tricks you can use to find out how well your direct-mail campaign is working.

First, if your goal is to get someone to call you, choose a unique phone number for that direct-mail campaign.

Similar to this, if your goal is to get people to visit your website, you can create a unique landing page to track your results.

When people visit or click on the landing page, you’ll know that they came from that direct-mail campaign.

Whatever CTA you choose for your direct mail campaign, use a unique tracking device, whether that is a phone number or website URL.

Then, you can count it as a lead from your direct-mail campaign.

5. Direct Mail is Less Common

At first glance, that might not seem like a good thing.

Maybe fewer marketers are using direct mail because it doesn’t work.

As I’ve already shown you with the above statistics, that isn’t the case.

The answer is simple. Since everyone is familiar with digital marketing, it’s easier to start getting results than a direct-mail campaign. So fewer people do it.

In 2016, there was a 2% decrease in direct mail delivered from the previous year.

Why is that a good thing for your direct-mail campaign?

When fewer marketers are sending mail, your piece has a higher chance of standing out.

Think about how much harder it is today to rank in Google. If I type in “how to send awesome direct mail,” Google only shows me 10 results out of 6,470,000 possible answers.

In other words, the internet is full of marketing messages.

But mailboxes aren’t.

And that’s why direct mail still works so well in this digital age. Since it takes a bit more work than other digital marketing strategies, it’s less common and more effective.

6. Direct Mail Gives a Feeling of Romanticism

Like hot baths and candlelit dinners, direct mail has become romanticized in our culture.

Think about it. When you receive a handwritten letter from someone, what do you do?

You get excited. Someone cares enough to write you a letter. It’s not very often that you receive something like this.

What do you do next?

I’ll bet you sit down and read every word of that letter. But it’s not just you who loves getting letters.

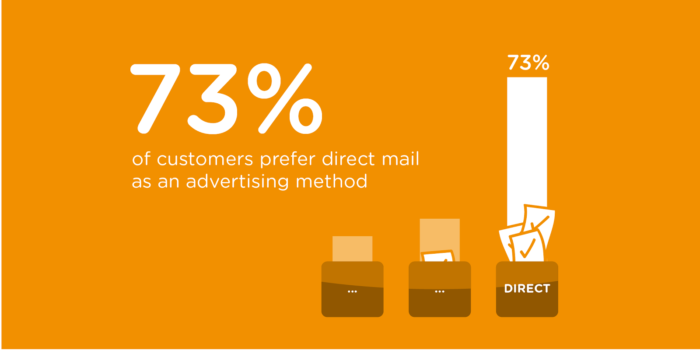

73% of people said that they prefer direct mail as an advertising method.

And, 59% of US consumers say they actually enjoy getting mail from brands.

Since people are receiving less direct mail, each piece of mail is more exciting.

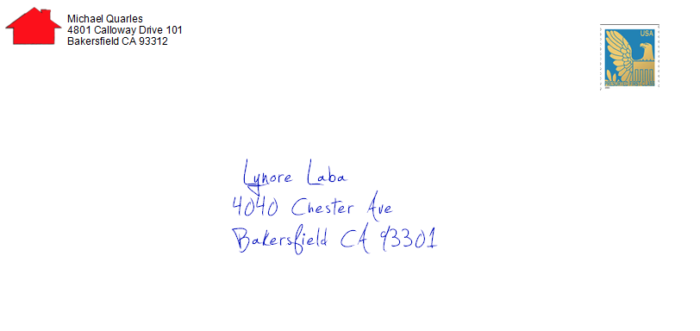

Especially if your direct mail is handwritten. Even if you add your signature.

In a world where everything gets written by a machine, handwriting on a direct-mail piece is a touch that receivers won’t be able to ignore.

Just check out this example from BiggerPockets.

It’s more like getting a personal letter from a friend than a marketing message from a business.

7. Direct Mail is Tangible

Imagine this. You receive a coupon in the mail for $10 off your next meal at your favorite local pub.

If you’re like me, you set the coupon on your refrigerator for future use.

Then, you pretty much forget about it. For the next few weeks, the coupon sits in your kitchen with other unused direct-mail offers.

But one night, your buddy calls and wants to watch the big game at a restaurant. As you’re trying to decide where to go, you remember, “Oh! I have a coupon for our favorite pub.”

And at that moment, the coupon decides for you.

Even though the coupon is for just $10.

You could do the same thing with a haircut business.

Or an ecommerce store. No brick-and-mortar location needed.

Since direct mail is tangible, it sticks around. It clutters physical space.

Email is easy to forget about because it’s just a number on a screen.

As a general rule of thumb, about two percent of online advertisements garner our attention each day. In other words, only about 100 out of every 5,000 ad exposures have any meaningful impact on consumers.

But direct mail is unavoidable.

About 66% of people have purchased a product because of direct mail.

If your direct mail piece has a special offer, most people will save it for future use, and then they won’t be able to forget about it.

8. Direct Mail Gets Undivided Attention

A certain fear accompanies direct mail.

What do I mean?

When you open the mailbox and pull out a small stack of letters, you won’t throw away any of the mail without glancing at it first.

You don’t immediately know which piece of mail requires your attention and which one you’re uninterested in. There is a fear that you might miss out on something important.

Because of that, you don’t want to throw mail away without taking a peek at it first.

Right?

When you receive an email, you probably have at least four (or forty) other tabs open on your computer. There are a bunch of notifications dinging on your phone and laptop.

The average American consumer is exposed to thousands of advertisements per day. In fact, it’s not unusual for the average consumer to see more than three hundred advertisements, of various sorts, within the first hour of waking up.

But when you receive a piece of direct mail, you’re at home, after work, with some extra time to view each letter.

Direct mail naturally gets more attention because there are fewer distractions when people see it.

9. Direct Mail Increases Brand Awareness

As I’ve shown you, direct mail is tangible, meaning it has the potential to stick around for a long time in someone’s house.

For this reason, consistent mailing increases awareness of your brand.

How?

Consider this piece of direct mail from Le Tote.

The front has the value proposition and offer, while the back demonstrates how easy it makes your life.

Since this postcard offers a coupon, there’s a good chance that the recipients will save it for a later date.

But what if they don’t use it later?

What if they see it, read it, and then throw it away?

Did you just lose money on a poor direct-mail campaign?

Not necessarily.

Sure, your recipients might not have interest in your offer right now. But they saw your logo, your brand name, and what you do.

If there comes a day when they want your product, they might just visit your website and buy something from you.

Before the direct mail piece, there was no chance of that because they didn’t know who you were — that’s the power of branding.

And that’s a win for any marketer.

10. Direct Mail is for All Age Groups.

I consider this one of the most compelling reasons that direct mail still isn’t dead.

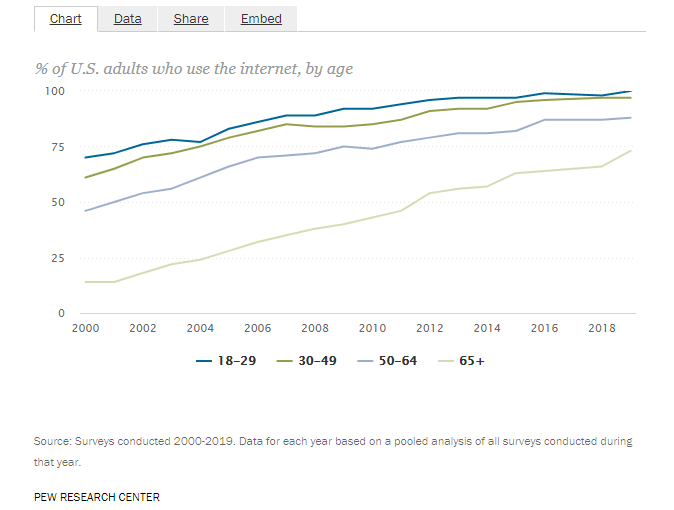

If you send an email, use Facebook Ads, or do any online marketing, your chance of reaching an older demographic isn’t very high.

Around 62% of people over the age of 70 use a smartphone. That percentage decreases all the way to 17% as the age increases.

Only 46% of American adults over the age of 65 use Facebook. And while that number is on the rise, that still means over half of older adults can’t be targeted on the larges social media platform in the world.

In fact, 33% of senior adults don’t even access the internet.

Conversely, direct mail reaches everyone, the young, and the old alike. Everyone checks the mail, and because of that, your postcards and coupons can turn just about anyone into a customer.

11. Direct Mail is Creative

When it comes to direct mail and creativity, the sky’s the limit.

Because direct mail is a physical product, sending stuff that stands out is just a matter of having fun with it.

This example from ADT is a bit controversial in its execution. But it’s a great example of creative direct-mail marketing in action.

Here’s how it works.

A letter-sized card slides under the door to the house of the receiver. But the letter is carefully engineered to pop-up into a box once it’s under the door.

On the box, it reads, “Breaking into your apartment is easier than you think.”

When someone sees it, they might immediately think, “What the… Did someone break into my house?!”

ADT highlighted a problem in action. What’s a good solution? Get an ADT security system.

On the less controversial side of things, a gym in Brazil struggled with members quitting because they didn’t see immediate results from their workouts.

As a reminder that getting results takes consistent time in the gym, they sent out calendars to their members that illustrated the gradual progress they’d see if they stuck with the program.

Coming up with flashy ideas is not easy. If you’re not naturally creative, then talk with someone who is.

If a security-system brand and a gym can come up with interesting direct-mail pieces, the chances are that you can too.

It might just take a little extra thought.

12. Direct Mail is Multi-Sensory

With digital marketing, it’s impossible to hit all of the senses and difficult to hit more than two.

The five senses are touch, hearing, sight, taste, and smell.

At most, a digital campaign can only focus on sight and hearing. By making a digital ad interactive, some smart marketers can appeal to someone’s sense of touch. But even that experience is not the same.

By making a digital ad interactive, some smart marketers can appeal to someone’s sense of touch. But even that experience is not the same.

Everyone experiences the world through their senses. Direct mail can take advantage of all 5 of them.

George Patterson Y&R Melbourne sent out a cardboard box with two knobs on it and a baggy of electronic components. It included everything necessary to build an FM radio.

Everything, except for one thing: instructions.

The mail piece went out to college engineering students.

When they put together the radio, an ad played, offering the student a fast track to an exciting military career.

Talk about multi-sensory. This cardboard radio took advantage of three senses, and some might argue 4 with the smell of cardboard.

Consider this KitKat mailer.

This direct mail piece acts as if you ordered a KitKat to your mailbox, implying that it was too “chunky” to arrive at your home.

Although there are technically only two senses involved, sight and touch, this piece does a good job of including taste by emphasizing the “chunky”-ness of a KitKat.

Not to mention, it’s fully interactive as you walk to the store.

Because humans experience the world through five senses, the more of these that your direct mail activates, the more likely recipients will engage with your message.

13. Direct Mail is Memorable

Advertisements now flash before our eyes at blazing speeds. Each time we search, stream, watch, read, scroll, click, or swipe, we are bombarded by advertisements.

But direct mail stands out.

Imagine putting together a radio delivered to your mailbox.

Maybe you receive a box near your door that reads, “Breaking into your house is easy.”

Or you get a funny mailer from KitKat that says your candy bar was too “chunky” to arrive at your home.

Or you get a tiny record player in the mail.

If you’re like most people, you’ll tell your friends about these memorable pieces of marketing genius.

Because direct mail is tangible and endlessly creative, it sticks with your audience.

As long as you take the time to put together an amazing piece of direct mail, your audience won’t quickly forget the message you sent.

Conclusion

The expansion of digital marketing has only enhanced the return on investment for direct mail campaigns.

If you’re wondering why direct mail should take a place in your marketing tool belt, the above 13 reasons are answer enough.

Direct mail campaigns give a high ROI and even a higher ROI than paid ads. They can work effectively in a campaign by themselves or alongside a digital-marketing campaign.

You can use direct mail to target the right customers at the right time. And it’s easy to track the results of each campaign you run.

With direct mail becoming less common, there is less noise. You can capture the undivided attention of your customers with its romantic appeal.

Because direct mail is more likely to get read, it increases your brand awareness, even if the first letter is unsuccessful.

Unlike digital campaigns, direct mail has a larger appeal to every age group.

Since direct mail is a physical product, it allows room for creativity. Thus it can appeal to more senses, leaving a lasting and memorable impact on your customer.

In the end, direct mail is powerful because it’s different from the digital way of doing things.

I get hundreds of emails every week. But I get a fraction of that number in the form of letters in my mailbox.

To stand out in a world where everything has gone electronic, consider complementing your digital marketing strategy with a direct-mail campaign.

It’s a missing personal touch in a hectic world.

And as every great marketer knows, being personal pays off.

What is the biggest reason you think that direct mail is still going strong?

The post 13 Reasons Why Direct Mail Isn’t Dead appeared first on Neil Patel.