Tyrus shares lessons from new memoir: You will be 'attacked on both sides no matter what'

Fox News contributor Tyrus imparted wisdom from his new memoir Saturday on “One Nation.”

Fox News contributor Tyrus imparted wisdom from his new memoir Saturday on “One Nation.”

If you’ve spent any time learning about marketing analytics, you’ve probably come across the term “funnels.” What exactly are marketing funnels and why do they matter? Marketing funnels are a useful tool to help you visualize the path customers take from first finding out about your brand to converting. Understanding them provides useful insight into …

The post Marketing Funnel: What They Are, Why They Matter, and How to Create One first appeared on Online Web Store Site.

If you’ve spent any time learning about marketing analytics, you’ve probably come across the term “funnels.” What exactly are marketing funnels and why do they matter?

Marketing funnels are a useful tool to help you visualize the path customers take from first finding out about your brand to converting. Understanding them provides useful insight into why some customers convert — and some don’t.

A marketing funnel is a visual representation of the steps a visitor takes from first finding out about your brand until they convert. The most common type of marketing funnel is four steps:

The action can vary based on customer and industry — maybe you want them to make a purchase, sign up, or fill out a form. When someone does something you want them to do, it’s known as a conversion. The visitor converts from browsing to taking the action you want them to take.

Think about the Amazon purchase funnel. There are several steps a visitor has to go through before they can purchase a product. Here’s how it looks:

There are additional steps/actions that can be taken in between each of these steps, but they don’t matter in the marketing funnel unless they contribute to the final action. For example, a visitor may view Amazon’s Careers page, but we don’t need to count these in the funnel because they aren’t necessary steps.

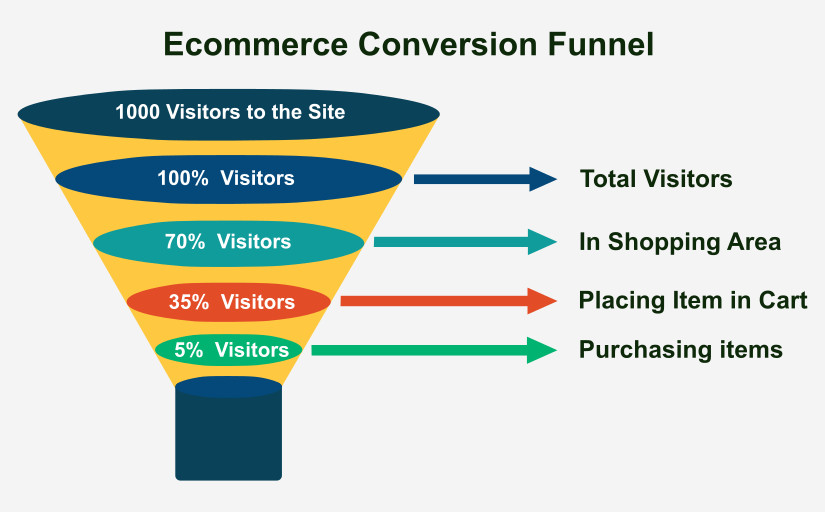

Why is the set of steps to conversion called a “funnel”? Because at the beginning of the process, there are a lot of people who take the first step.

As the people continue along and take the next steps, some of them drop out, and the size of the crowd thins or narrows. (Even further along in the process, your sales team gets involved to help close the deal.)

Losing customers might sound like a bad thing — but it’s not. The truth is, not everyone in your funnel will convert. The top of the funnel is where everyone goes in (visiting your site or viewing a marketing campaign). Only the most interested buyers will move further down your funnel.

So when you hear people say “widen the funnel,” you now know what they are referring to.

They want to cast a larger net by advertising to new audiences, increasing their brand awareness, or adding inbound marketing to drive more people to their site, thus widening their funnel. The more people there are in a funnel, the wider it is.

In this article, we’re focusing on marketing funnels, that is funnels that start with some sort of marketing campaign. That might be a PPC ad, content marketing campaign, white paper download, video ad, social media ad, or even an IRL ad. The point is the first step in the funnel is a marketing campaign of some sort.

Other types of funnels you might hear about include:

Despite the different names, these all track the same exact thing — the steps a prospective customer takes to conversion. (Sometimes they are even called conversion funnels!)

You aren’t limited to using a marketing funnel strictly for signing up and/or purchasing. You can put funnels all over your website to see how visitors move through a specific website flow.

You may want to track newsletter signup (Viewing newsletter signup form > Submitting form > Confirming email) or a simple page conversion (Viewing a signup page > Submitting signup).

Figure out what your goals are and what you want visitors to do on your site, and you can create a funnel for it.

Once you have the data, you’ll be able to see where roadblocks are and optimize your funnel. Let’s dig a little deeper into that.

Marketing funnels provide access to data, called a marketing funnel report, which lets you can see where you are losing customers. This is sometimes called a “leaky” funnel because it allows customers you want to keep to escape the funnel.

Let’s take your average SaaS business as an example. Here’s how a funnel may look for them:

Do people have to use the product before paying? They don’t, but it’s a good idea to track it so you can see if it’s a roadblock.

For example, if you are losing a lot of conversions after the trial stage, you might need to update your onboarding process so people understand how to use the tool or even adjust the top of your funnel so you aren’t attracting people outside of your target audience.

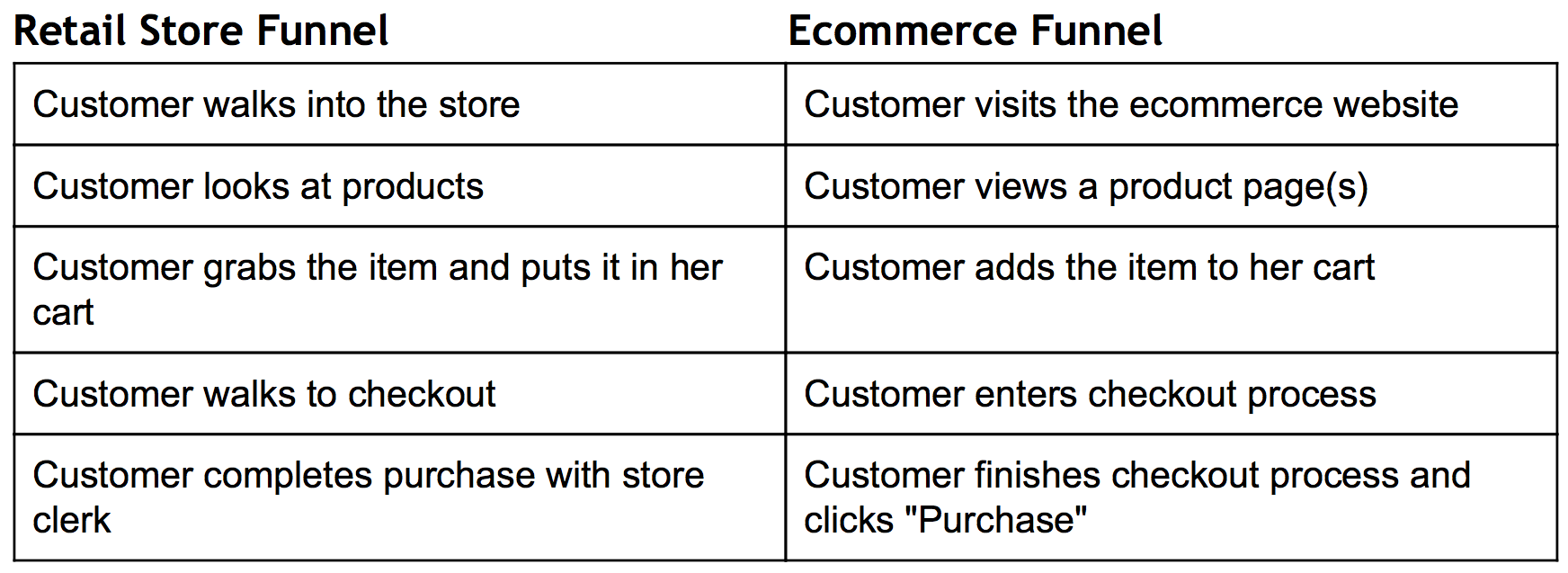

Let’s look at a funnel process for a retail store and see the corresponding steps in an e-commerce store. We’ll be tracking a purchase funnel.

The e-commerce store has the fortune of being able to see a funnel because they can track clicks, time on page, and other metrics. Their marketing would look something like this:

Okay, so now we have an understanding of what a funnel is and why it helps. Let’s take a look at a product that offers funnels – Google Analytics.

Google Analytics offers funnels, and I’ve written extensively about it in the past. This is an incredibly simple way to track the path prospects take before they convert. Sign in, then head to Admin > Goals > +New Goal > Choose a Goal to create a Google Analytics goal.

Here are a couple of things you’ll need to know when creating funnels in Google Analytics:

Overall, if you are just getting started with marketing funnels, Google Analytics is a solid place to start. Learn how to set up a conversion funnel in Google Analytics.

A marketing funnel is a visual representation of the steps a visitor takes from first finding out about your brand until they convert.

Sales funnels

Webinar funnels

Email funnels

Video marketing funnels

Lead magnet funnels

Home page funnels

Marketing funnels provide access to data, called a marketing funnel report, which lets you can see where you are losing customers.

Visited site > Signed up for a trial > Used product > Upgraded to paying customers

Sign in, then head to Admin > Goals > +New Goal > Choose a Goal to create a Google Analytics goal.

We’ve covered just about everything you need to know about marketing funnels. Here’s a quick recap:

Have you created a marketing funnel in Google Analytics? What did you learn?

People always ask me the same question about AdWords:

“What’s a ‘good’ cost per click?”

My response back to them is always the same:

“Why do you care?”

See, most people have AdWords wrong. They obsess over the costs.

They know that more and more competitors are advertising on the platform, which drives up prices.

So they’re zeroed-in on how much they’re going to have to spend.

That’s the wrong approach.

Instead, they should be concerned with what they’re going to get back in return.

I know this sounds counterintuitive. However, I almost never worry about the Cost Per Click for keywords.

In fact, I almost always ignore them.

I’m going to show you why CPC’s don’t matter in many cases. I’ll show you how worrying about keyword costs can mislead you time and time again.

Then, I’ll show what you should be analyzing to make sure you’re not leaving tons of money on the table.

Each year, companies analyze the most expensive keywords in the country.

These are typically competitive phrases in law or insurance and can cost as much $50 for just a single click.

The insane thing is almost none of those clicks will turn into customers immediately.

Instead, they’ll usually opt-into a form, first.

That means you might have to front the bill for 50 or 100 clicks before someone ever converts.

We’re talking thousands of dollars for a single customer.

It makes sense on the surface; CPC ultimately determines how much you need to spend.

WordStream, for example, always releases an annual update on Cost Per Click benchmarks across industries.

The businesses I own are all software-related. But we work with clients across different industries. So it’s always interesting to look at these cost breakdowns.

Average ecommerce CPC’s might only be around a dollar, while law might run up to around six dollars (these are higher than most Bing Shopping campaigns, which should be considered for e-commerce businesses as well).

To be honest, though, I don’t obsess over costs, alone.

The first reason comes down to what the study says at the top: Averages.

Average CPCs don’t really mean all that much.

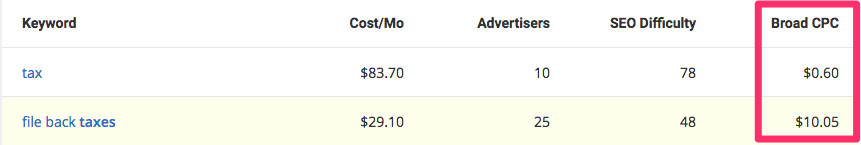

Popular, generic terms aren’t usually all that expensive.

Only a tiny percentage of the people who ever click on those will convert. Whereas, a more commercial long-tail keyword will be incredibly expensive.

Just compare the difference in costs between “tax” and “file back taxes”:

See? It’s not even close.

That makes it hard to use a standard, “industry average benchmark” for any in-depth analysis.

There’s another reason why I don’t like to just look at costs — because you’re often forgetting the other side of the equation.

Conversions ultimately have a much bigger impact than costs.

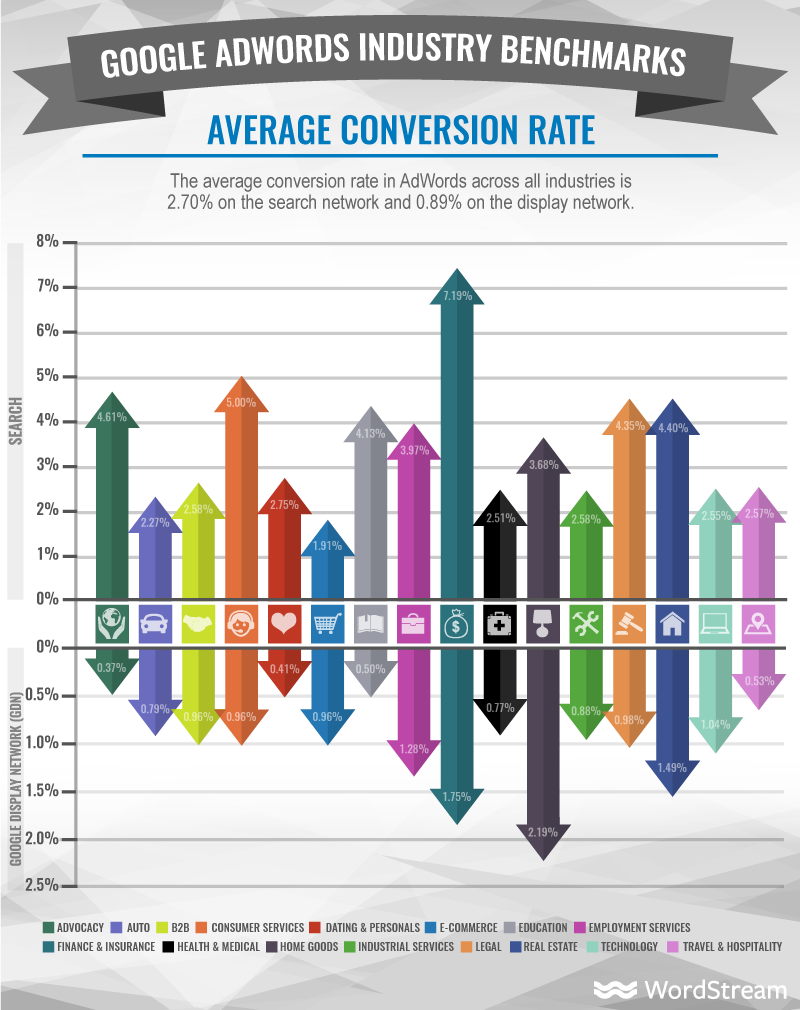

Now, let’s check out those industry average conversions from the same study:

Ok, now we’re getting a little closer.

If you remember, the industry average CPC for ecommerce was only around a dollar. In fact, it was one of cheapest CPC’s on the entire list.

But if you now look at the average conversion rates, you’ll see why.

Their conversion rates are also among the lowest.

What does it matter if CPCs are ‘inexpensive’ if the conversions are equally low?

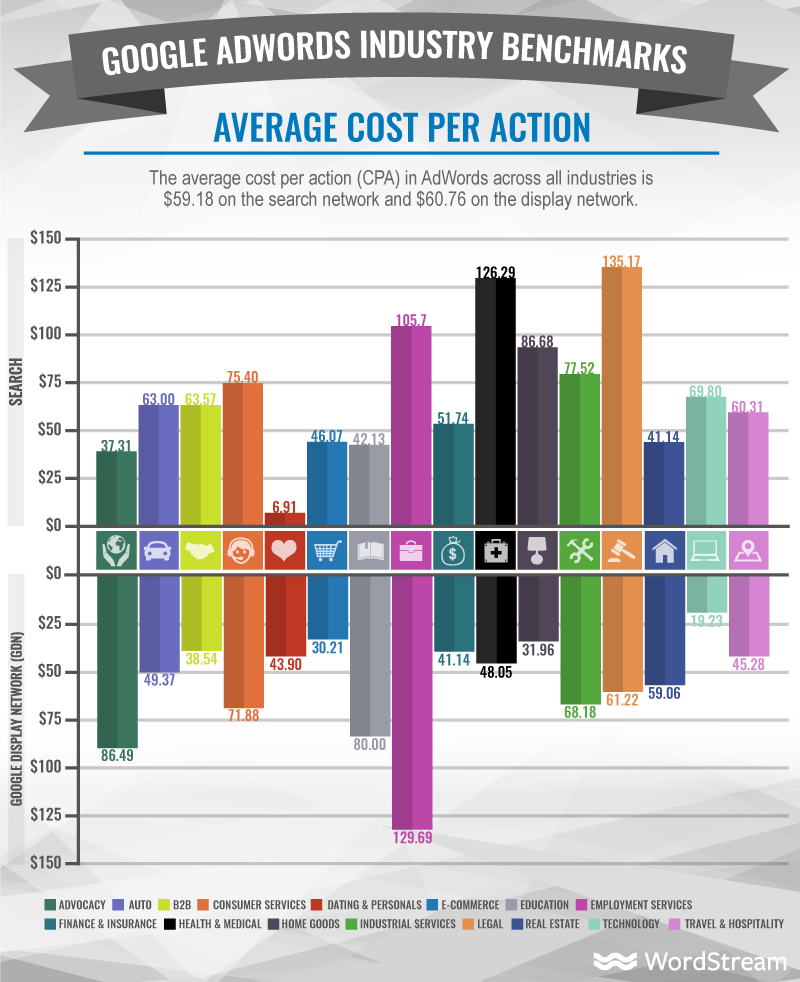

That’s why you often want to look at the Cost Per Action (or Acquisition) when putting together advertising estimates.

This is the effective price you pay to generate a lead, for instance.

It’s a performance ratio. It starts to take into account things like costs vs. conversions to help you determine a much better figure: ROI.

The industry average Cost Per Action for ecommerce lines up with education on the search network.

So from an ROI standpoint, there’s almost no difference.

This is why CPC is almost meaningless.

Yes, it’s important to a point because it drives things like your Cost Per Action.

However, what’s ultimately more important is the revenue you can generate.

It doesn’t matter whether we’re talking about Google AdWords, Facebook, or even Twitter ads. The message is still the same.

Digital Marketer once ran a Twitter Lead Gen campaign, testing the effective Cost Per Action (or Lead).

One campaign was able to see a $7.81 cost per lead.

They then ran the same study with the same ad and audience targeting. But this time, they optimized the campaigns to increase conversions.

It generated a $1.38 Cost Per Lead, which came out to a five time lead increase on the same ad budget.

They were able to 5X conversions simply by focusing on conversions and Cost Per Lead. They didn’t even have to touch the CPC.

You can see this time and time again.

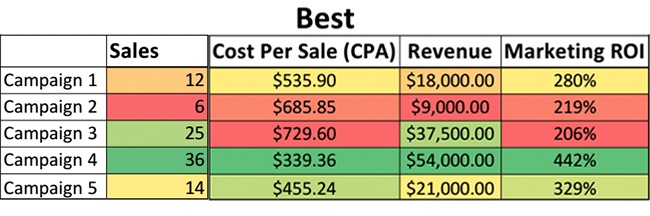

Jacob Baadsgaard of Disruptive Advertising confirms that the best PPC metrics are revenue-focused. They track lead data all the way through to closed sales.

Then, and only then, will they make a decision about which ad campaign is best.

It’s not that costs don’t matter. They do, of course. But they only matter in context to how much revenue you can generate from it.

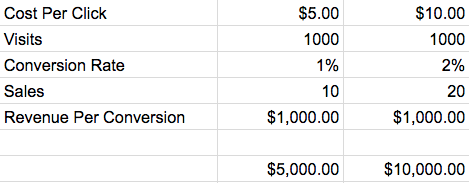

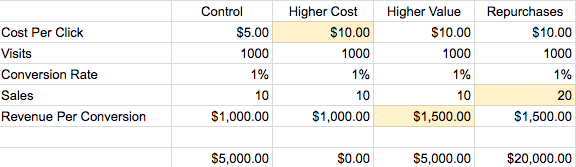

Here’s a very simple example to illustrate.

Let’s say you run two ad campaigns side-by-side.

The Cost Per Click for the second campaign is twice as much as the first. But because the conversion rate is 2% instead of 1%, you’re able to double revenue.

Would you pay twice as high a Cost Per Click to generate twice as much revenue? Of course you would!

This is after reducing revenue by your ad costs. So it’s already accounting for the higher ad budget.

At the end of the day, you’re still doubling revenue. It’s totally worth it!

Obsessing over CPC doesn’t just leave money on the table. It can also make you waste a ton of what you’re already spending.

Here are a few examples.

There are many things that separate big companies from small ones.

But here’s one of the biggest: Big companies spend more on advertising than small ones do.

Duh, right? Of course big companies have bigger budgets.

We’re not just talking about dollars spent, but percentage of revenue

Salesforce, the world’s biggest CRM company, spends up to 46 percent of their budget on marketing and advertising!

Crazy, right?

The question is why?

Why don’t small companies spend more on advertising?

In my experience, I find that they’re often too risk averse.

They don’t have the same access to capital. So they tend to obsess over costs, as opposed to revenues.

The classic scenario is when a business owner spends a few hundred bucks on new Facebook ads, only to conclude that they “Don’t work” five days later.

So they pull the plug too early.

In almost all cases, they just need to let the campaigns run longer.

Jennifer Shaheen found that campaigns should run at least 45 days before stopping. And that makes sense when you think about it.

Look at it this way.

How many sales do you need to break even? Let’s hypothetically say two or three.

So what are the chances that those two or three sales land in the first few days?

Pretty slim!

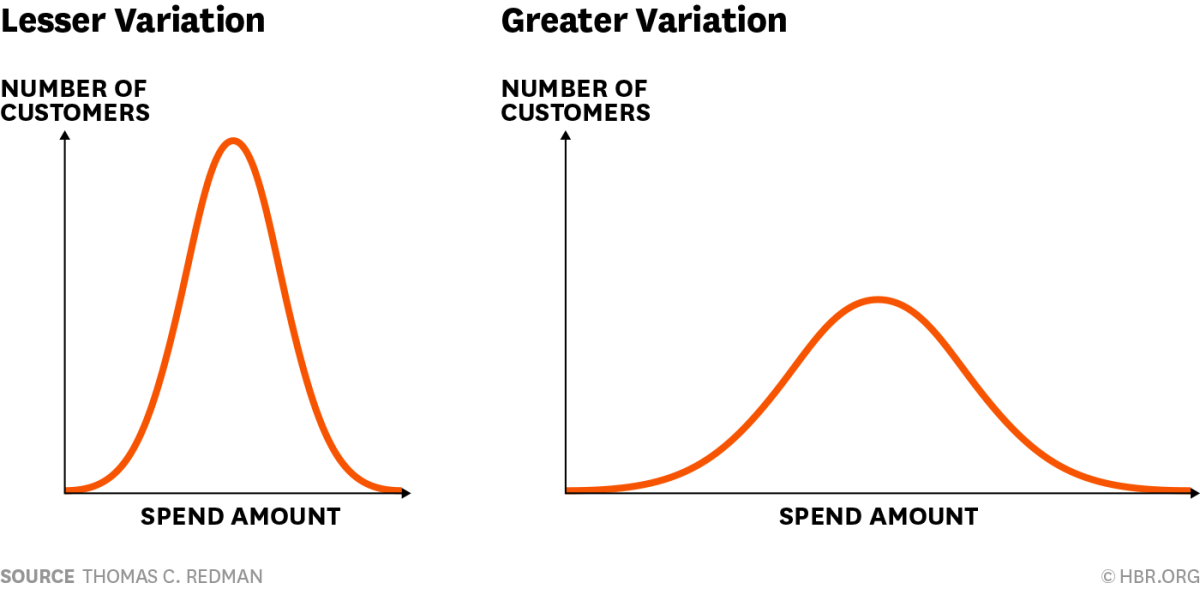

It’s the law of averages at work. You need a big sample size before numbers start to meet projections.

It’s going to take a few weeks, at least, to get statistically significant numbers. Otherwise, you’re just guessing.

All of this assumes that you know the ‘right’ ad campaign variables ahead of time. Which, in all likelihood, you don’t.

Not because you’re not smart. But because it takes awhile to figure these things out!

Here’s the other thing:

Many times, you actually need to increase ad spend.

Yes, you heard me right.

Listen, the reason you spend money on advertising is to make money — not save it.

That means you need to get to statistical significance as quickly as possible.

For example, go check out a few CPC ranges for keywords you’re about to bid on.

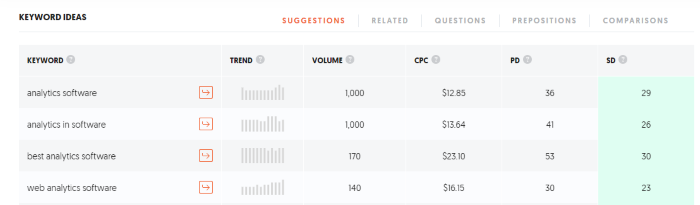

I like to use Ubersuggest to get a this data:

The average CPC for “analytics software” is estimated to be around $12.85 Ok, not bad I guess.

Let’s use that as the upper limit. We can create automated rules in the Facebook Business Manager.

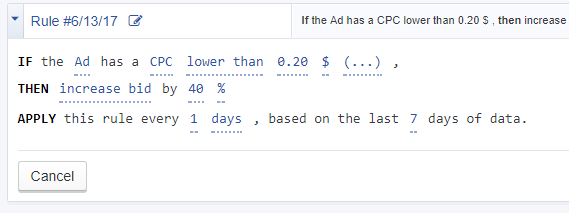

If you’re having a hard time hitting those numbers, you can set a rule to actually increase CPCs.

That will make sure I get better placement over the competition and as many conversions as possible.

Here’s how that might look inside AdEspresso:

Of course, this approach isn’t ideal.

Because you still might leave a lot of money on the table.

If your CPCs start edging up, the campaigns will back off or stop.

Then your lead flow will stop, too.

That’s why I like using CPAs as targets if possible, instead of CPCs.

Cost Per Action is a better performance than Cost Per Click.

It’s not as good as Revenue, though–and there’s the problem.

CPAs can still be subjective.

Is a ‘high’ CPA bad? Maybe, maybe not.

If your CPA is over $100 in ecommerce, that might be bad.

Almost every single campaign CPA will be over $100 in law, for example. So it’s not bad at all.

Its still a much better metric to control ad campaign performance, though.

You can still figure out an upper range that starts to make ad campaigns unprofitable. You’ll base this on your average sale per customer. (More on this later.)

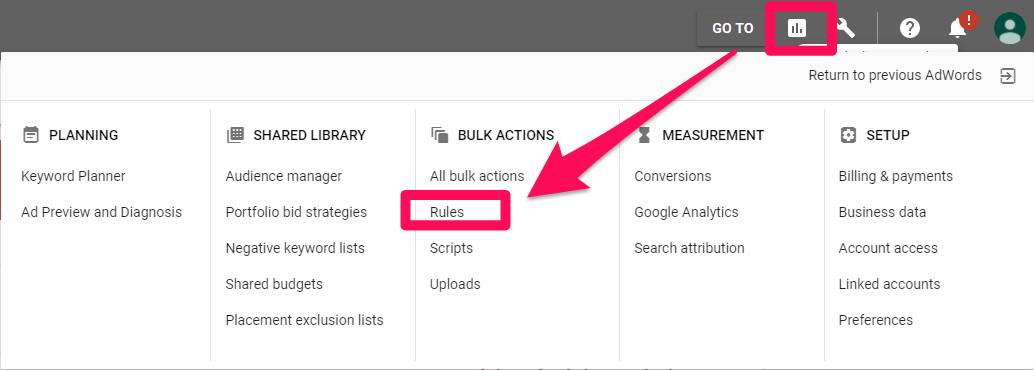

For starters, you can set automated rules to increase or decrease the total budget based on your CPA.

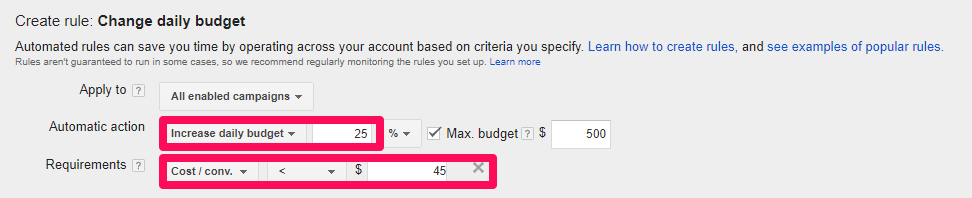

Inside AdWords, you can go to “Bulk Actions” and create new “Rules” for these ranges:

Under “Change budgets,” you can set an automated rule to either increase or decrease budgets based on cost per conversion numbers.

This tells AdWords to automatically increase your daily budget 25 percent if the CPA is within a certain dollar range.

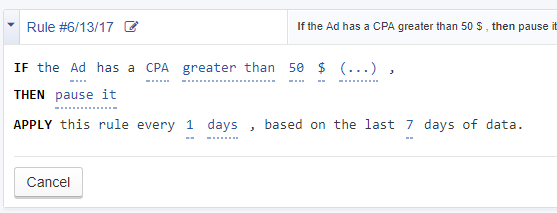

You can do this same exact strategy inside Facebook, too.

You’ll set a rule to increase, decrease, or stop a campaign if the CPA hits a certain threshold.

Managing ad campaigns by CPA can net you more customers and revenue.

There’s still one big section we’re forgetting.

Keyword pricing or competitive pressure aren’t the only factors to worry about.

Many times, your customer base could be going through their own issues, and that’s not something you can change.

That’s why focusing on revenue is always the best approach.

Spearmint Love is one my favorite success stories.

They went from a baby blog to growing revenue over 991% year over year, and they did it almost exclusively through Facebook and Instagram ads.

The craziest part is that it almost didn’t happen.

They were growing like a weed, until…everything just stopped.

Results were declining across the board and they couldn’t figure out why.

Until, one day while on a walk, it dawned on one of the co-founders.

Parents will buy baby clothes until that baby grows up. In other words, their customers were kind of ‘moving on’ from the company.

The ad campaign decline had nothing to do with costs or his ad campaigns per se.

It had everything to do with their customer base.

How on Earth do you solve this problem?

By focusing on increasing revenue — not touching costs.

If the CPA is ‘too high’ to make your numbers work, start by increasing average order values.

Upsells are easy, for example, when you bundle similar products.

Think about the last time you flew somewhere. Chances are, you bought a travel-sized product at a store before going through TSA.

But that product probably only cost a few bucks, right?

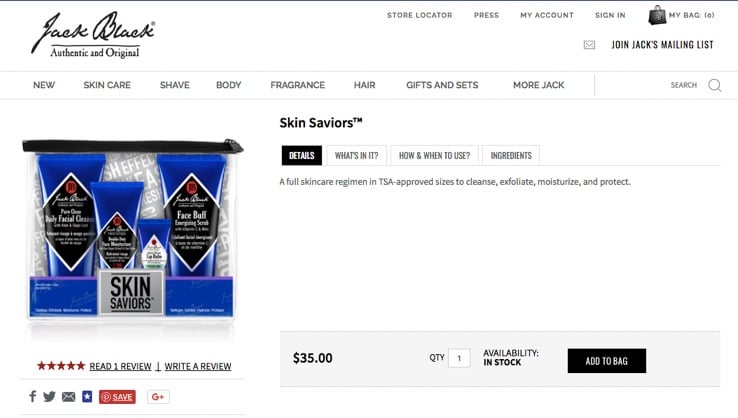

Check out what Jack Black does here, bundling several travel products together.

You arguably need all of these products if you’re flying somewhere.

Instead of only charging you a few bucks each, they’re charging you $35 for the whole pack!

Simply bundling similar products allows them to charge 10x more. Which means you can afford a much higher initial advertising cost now, too.

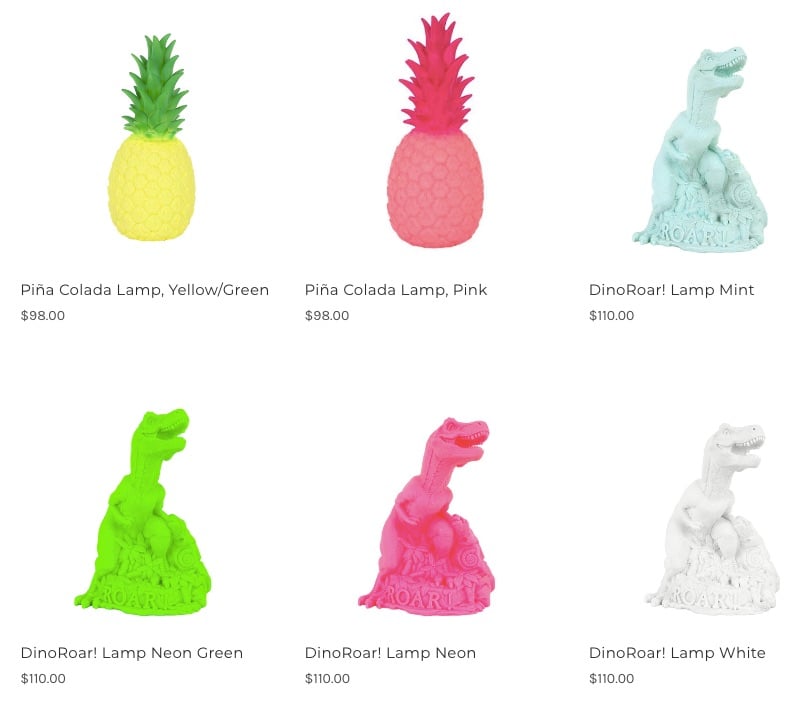

You can also cross-sell products to try and raise the average order value.

For example, right underneath this travel bundle, Jack Black offers a few related products to take with you:

One interesting thing to note is the price of all three items. They’re all slightly less than the initial $35 purchase.

Why?

They’re using price anchoring effect to make these additional products seem less expensive.

The Economist included a middle pricing tier for a print-only subscription. It was the same exact price as the ‘big’ plan for both the print and web editions.

Most people chose the combined third option because it seemed like the best deal.

Removing the middle plan on a subsequent test, however, led people to overwhelmingly pick the cheap option, instead.

Price anchoring changes someone’s perception of cost vs. value.

That’s why you should lead with the more expensive option. Then, showcase a few related products to cross-sell that are slightly less expensive.

Spearmint Love also expanded their product line to increase average order values.

They came out with decor pieces, like hundred-dollar baby lamps.

The age of a child mattered less in this type of purchase. So it kept the company relevant longer in their eyes of their customers.

After increasing average order values, you should increase the lifetime value of each customer.

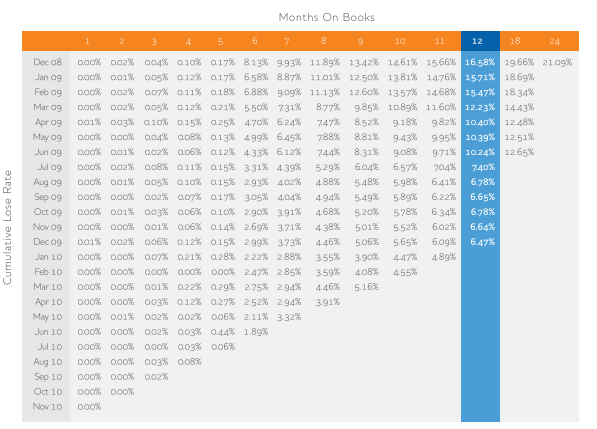

One technique is a vintage analysis, which shows you which customer cohorts are worth the most already.

This way, you can identify trends or patterns.

You can see what the most lucrative customers are doing and then apply those lessons across the board.

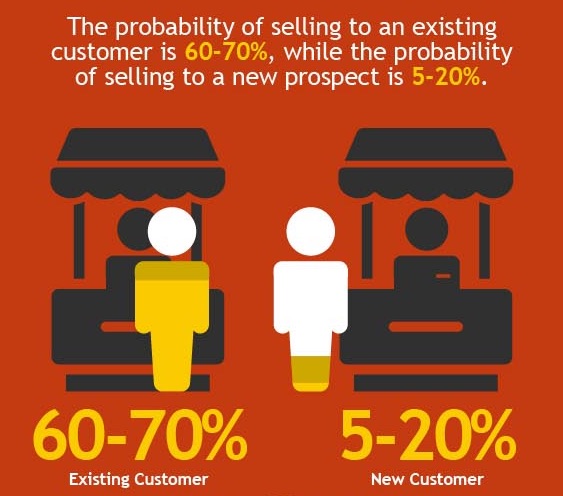

Constantly acquiring new customers is expensive. You have to spend a lot more to get them to buy.

Increasing repurchases from your existing customers has a massive impact on your bottom line.

Let’s revisit that initial ad model to see why.

Keep in mind this is a simplistic example. But I think it still does a decent job showing how this works.

The first campaign has a higher initial cost; you’re barely breaking even.

This is what most companies are scared of. They worry about spending more money on keywords.

As a result, they completely neglect optimizing conversions, average order values, or repurchases.

So yes, they might bring in a few sales. But the higher costs deplete their ad budget before long.

The end result is a wash.

The second campaign has a higher average order value.

In this case, you’re not even getting more conversions. All you’re doing is bundling a product, for example.

Already, you’re back in the black. Not bad.

However, the third campaign?

Not only are the average order values higher, but you’re getting more repeat purchases, too.

You’re basically generating more purchases from the same number of customers. Many times, you don’t even have to spend a single dollar to get them.

All you have to do is send out an email campaign. These loyal customers don’t take a lot of extra persuading.

More sales, without increasing ad costs, skyrockets revenue.

You make several times the other few campaigns.

Best of all, you didn’t sweat a single CPC. You willingly paid at the top-end of the budget range to maximize your opportunities.

Then, you doubled-down on the other side of the equation.

Increasing conversions and revenue spent can act as a lever to double or triple ad campaign ROI.

There’s only one reason to spend money on ads at the end of the day: to make money.

Chasing the keywords with the lowest CPC is a losing proposition.

If anything, you should be spending more money. You should actually search out the highest CPC’s in your industry.

Why?

Often, they offer the most potential. You want to maximize the most sales per dollar spent.

So you know all those “industry benchmark CPC” numbers? Don’t worry about them.

Instead, start focusing on CPA. That’s the number it costs for you to acquire each new customer.

It’s not perfect by any stretch. But it’s a better number to optimize around than CPC.

From there, try to dig into revenue numbers.

Can you bundle a few products to raise the average order value? Can you cross-sell recommended products and use price anchoring to lower their perceived cost?

Then, figure out how you can keep customers around longer.

That might mean introducing new, related product lines. Or it might mean introducing ‘consumable’ products that people need to repurchase again and again and again.

The point is to drive up the lifetime value of each customer as high as possible.

When you do that, CPC will matter even less.

There will be so much revenue generated per customer that you can afford to spend almost anything to get them in the first place.

How have you boosted ad campaign performance by focusing on conversions instead of costs?

The post The Great CPC Hoax: Why Cost Per Click Doesn’t Matter for High-ROI Ad Campaigns appeared first on Neil Patel.

What do you need to know about how to fund a startup business? First, there is more than one way to do it! It’s true. Regardless of what is happening around you, in most cases you can fund a startup business in some way. It may very well take longer depending on your exact situation, but it is almost always possible.

The thing is, virtually everyone assumes if they cannot get a business loan, they can’t fund a startup business. That really isn’t true. There are all kinds of options for funding. Loans are only one of them. Furthermore, there are probably many more types of loans than you think. We put together a list of some of the most common, and less common, ways to fund a startup business in any situation.

The thing is, virtually everyone assumes if they cannot get a business loan, they can’t fund a startup business. That really isn’t true. There are all kinds of options for funding. Loans are only one of them. Furthermore, there are probably many more types of loans than you think. We put together a list of some of the most common, and less common, ways to fund a startup business in any situation.

These are the loans that you go to the bank to get. With a traditional loan, you are almost always going to have to give a personal guarantee. This means they will check your personal credit. If it’s not great, you are probably out of luck. That is where a lot of people stop, thinking they have hit a brick wall.

There are ways over that wall however.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

SBA loans are traditional bank loans. However, they have a guarantee from the federal government. The Small Business Administration works with lenders to offer small businesses funding solutions that they may not be able to get based on their own credit history. Because of the government guarantee, lenders are able to be a little less strict on personal credit score requirements.

The trade-off is that the application progress is lengthy. There is a ton of paperwork connected with SBA loans.

Private business loans come from companies other than banks. These companies are sometimes called alternative lenders. Many have popped up in the past decade as entrepreneurship has become more common. The need for a financing option from somewhere other than traditional banks has spurred this growth.

There are a few benefits to using private business loans over traditional loans. The first is that they often have more flexible credit score minimums. They still rely on your personal credit. Yet, they will often accept a score much lower than what traditional lenders require. Another benefit is that they will sometimes report to the business credit reporting agencies. That helps build or improve business credit.

The tradeoff is that private business loans typically have higher interest rates and less favorable terms. Still, the ability to get funding and the potential increase in business credit score can make it well worth the cost.

The thing about private lenders is, you almost always have a time in business requirement. However, it can be as low as one year, even 6 months in some cases.

BlueVine

The minimum loan amount available from BlueVine is $5,000 and the maximum is $100,000. Annual revenue must be $120,000 or more and the borrower must be in business for at least 6 months. Personal credit score has to be at least 600. It is also important to know that BlueVine does not offer a line of credit in all states.

OnDeck

With OnDeck, applying for financing is quick and easy. Apply online, and you will receive your decision once application processing is complete. Loan funds will go directly to your bank account. The minimum loan amount is $5,000 and the maximum is $500,000.

There is a personal credit score requirement of 600 or more. Also, you must be in business for at least one year. There is an annual revenue requirement of at least $100,000 as well. In addition, there can be no bankruptcy on file in the past 2 years and no unresolved liens or judgements.

Crowdfunding sites allow you to pitch your business to thousands of micro investors. Anyone who wants a piece of the action can buy in.

Investors pledge amounts ranging from as low as $5 to as high as they want. They may give $5, $80, $150, or even over $500. As a general rule, they can give as much or as little as they want.

Though not always necessary, most business owners offer rewards for investment. Typically, this comes in the form of the product the business will be selling. Different levels of giving result in different rewards. For example, a $50 gift may get you product A, while a $100 gift will get you an upgraded version of product A.

The two most common crowdfunding platforms are Indiegogo and Kickstarter.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

These investors are usually only in for a one-time deal. Many choose to spread their risk out over many people and many businesses to be certain they get a safe return on their investment.

Angels tend to be a lot more informal than most types of funding. They can be people you know. Or they can be people you connect with through networking or other means.

Angels are not covered by the Securities Exchange Commission’s (SEC) standards for accredited investors. But a lot of them are accredited investors anyway.

To become an accredited investor, an person has to have a minimal net worth of $1 million, and an annual income of $200,000.

There are a number of angels who aren’t millionaires. They could be friends or colleagues with home equity, or local professionals who are looking to invest.

The best way to find these kinds of investors is to ask. You can also try an angel investors website or network. Try Gust, which used to be called Angel Soft. They keep a database of investors, companies, and programs. Startups can also search for business plan competitions and more.

Another option is to look at the biggest angel investor groups. Be aware, however, that these meetings are really only going to happen if you can get an introduction.

According to Entrepreneur, in order from smallest to largest the top 10 Angel Investor groups are:

Focus and requirements may vary from group to group. For example, some concentrate on local startups only. Do your research so you don’t waste yours and the angels’ time if it isn’t a good fit.

Here’s an option that most don’t want to hear, but it is totally legitimate and sometimes, it’s just the best way. If you do not have access to a ton of funds to launch a huge new business right away, consider keeping your day job and start your business small, as a side hustle.

Not every business can start this way, but a lot can. For example, a bakery or a cleaning business can easily start this way. If you set up from the beginning to be fundable and build business credit, you can go even further. More on that later.

This is similar to keeping your day job in that you start small. If you have retirement savings you could use that as loan security, or take a loan directly from retirement if your plan allows for that. You can build your business slowly, a little at the time. While you’re doing so, you can work to build business credit and overall fundability

So, how do you do that? How do you build fundability and business credit? The first thing you do is set up your business to be fundable. When you do this, you will also be setting it up to be a separate entity from you as the owner, which is the first step in building separate business credit. How do you build a fundable foundation? You need the following.

The first step in setting up a foundation of fundability is to ensure your business has its own phone number, fax number, and address. That doesn’t mean you have to get a separate phone line, or even a separate location. You can still run your business from your home or on your computer if that is what you want. You don’t even have to have a fax machine.

The next thing you need to do is get an EIN for your business. This is an identifying number for your business that works in a way similar to how your SSN works for you personally.

You have to incorporate as an LLC, S-corp, or corporation. It gives credit to your business as one that is legitimate, and it separates your business from you as the owner.

Which option you choose does not matter as much for fundability as it does for your specific budget and liability protection need. The best thing to do is discuss it with your attorney or a tax professional. You are going to lose the time in business that you have. When you incorporate, you become a new entity. Basically, you have to start over. You’ll also lose any positive payment history you may have.

This is why you have to incorporate as soon as possible. Not only is it vital to fundability and for building business credit, but time in business is also important. The longer you have been in business the more fundable you appear to be. That starts on the date of incorporation, regardless of when you actually started doing business.

You have to open a separate, dedicated business bank account. There are a few reasons for this. First, it will help you keep track of business finances. It will also help you keep them separate from personal finances for tax purposes.

In addition, you cannot get a merchant account without a business account at a bank. That means, you cannot take credit card payments. Studies show consumers tend to spend more when they can pay by credit card.

For a business to be legitimate it has to have all of the necessary licenses it needs to run. If it doesn’t, red flags are going to fly up all over the place. Do the research you need to do to ensure you have all of the licenses necessary to legitimately run your business at the federal, state, and local levels.

These days, you do not exist if you do not have a website. However, a poorly put together website can be even worse. It’s the first impression you make on most, and if it appears to be unprofessional it will not bode well for you with lenders or customers.

Okay so, you need to know how to fund a startup, not how to set it up, right? Here’s the thing. Once you have your business set up like this, you can start building business credit so that you have more options for funding your business.

The main key to this is to use starter vendors that will issue net terms on your invoices and report those payments to the business credit reporting agencies. Even if you are keeping your day job or starting small during retirement, you can use these vendors for the things you need in the everyday course of business.

Things like office supplies, packaging, and even cleaning supplies can be purchased from such vendors on account using your business information. As you get enough of these accounts reporting, you can apply for store credit, then fleet credit, and eventually, regular business credit cards that are not limited to specific types of purchases or specific stores. Then, your business credit should be strong enough that you can qualify for a loan and launch your business on a bigger scale.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

The truth is, there is more than one way to fund a startup business. Depending on your specific situation, you will have to decide which option or combination of options will work best for you and your business.

The post How to Fund a Startup Business No Matter What appeared first on Credit Suite.

What you don’t know about your business credit file can hurt you. You see, your business credit file is to your company as your personal credit file is to you as an individual. It details your credit history. In addition, it makes predictions about your ability to repay debts both now and into the future. These predictions are based upon not only your credit history, but also company finances and data received from other sources, such as public records. Lenders use it to help determine whether or not to lend to your business.

The thing is, your business credit file isn’t the only thing they use. It is simply a piece of a bigger puzzle known as fundability. When lenders look at your credit file, they are looking at it with fundability in mind. What is fundability? It is, overall, how your business looks to lenders in regards to return on investment.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

Lenders are in it for the profits. If you do not pay back the debt, they do not make money. Therefore, they only approve loans to those businesses that appear to be fundable. These are business that have all their ducks in a row. All licensees are in place. Contact and ownership information is complete, dedicated, and verifiable. There is a business bank account, and bills are being paid. All of this and more, including your business credit file, come together to create a complete fundability picture. Find out more about fundability and how to become fundable here.

Unlike your personal credit file, your business credit file is not something that occurs passively. For it to be complete and correct, you have to take action. This looks different depending on the business credit reporting agency (CRA.) Some of them do automatically open a file once a business starts opening accounts and those accounts start reporting. However, if that business is not set up properly to build business credit, the information will be all tangled up with personal information and will not accurately reflect the creditworthiness of the business itself.

Other CRAs requires you to manually take action to open an account specifically with them. For example, with Dun & Bradstreet you have to get a D-U-N-S number.

Other than that, the main thing to do is get accounts reporting to the business CRAs. There are several, but the most commonly used are Dun & Bradstreet, Experian, and Equifax. The key is to open business accounts that will report your payments to these agencies. With some, you can also self-report accounts to get your credit rolling, but that isn’t always the best idea.

Dun & Bradstreet and Equifax each allow you to self-report your payments on accounts. If you are already in business with vendors that will not report payments, and you cannot make a change, this may be an option.

Don’t forget you have to have a D-U-N-S number before you start reporting to D&B. If you don’t have that number already, accounts reported will not matter. Also, it costs money to self-report.

Additionally, they will try to sell you other products in the process. If these products will be useful to you, feel free to consider them. Just know that they are not necessary to open your business credit file. In fact, many of the products and services you will be offered are provided for free by other companies.

If you choose to self-report with Equifax, you will have to meet certain minimum requirements. For financial businesses, this means you must have a minimum of 500 vendors to report, and all other businesses must have a minimum of 2,000 vendors.

Experian does not allow self-reporting, but rather relies on verified information from third-parties. In fact, if you are currently running a business, you probably already have a business credit file with Experian.

While it is allowed, self-reporting can be costly. Not only that, but it doesn’t always result in a score increase. Accounts will report to your business credit file for free anyway if you handle things properly.

It is better to ensure your good credit practices are reported to all three credit agencies by verified third parties rather than self-reporting. How does this happen?

If you have any current vendor relationships, find out if they report your payments to the credit agencies. If they do not, ask them to do so. They don’t have too, but if they won’t, see about finding other vendors that will. While it isn’t always possible to switch vendors, it is worth it to try.

For future vendors, ask the question before you begin a business relationship. This will help establish a business credit file from the beginning.

The credit tiers are a new concept for many business owners. Here is how it works. You start by opening accounts with vendors, often called starter vendors, in the vendor credit tier. These are vendors that will extend net 30 terms without a credit check, and then report your payments to the business credit reporting agencies.

After you get enough of these reporting, you can apply for credit cards in the retail credit tier, the fleet credit tier, and the cash credit tier, in that order. Find out more about starter vendors and the process of working through the credit tiers here.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

Virtually all credit card companies report to the credit agencies. Use your business name and contact information and apply for a business credit card. You may have to make do with a lower credit limit and higher interest rate early on if you do not yet have a business credit score. However, once you build your credit file a bit, you can ask for an increase in limit or apply for a card with more favorable terms.

Remember to look for cards with other perks as well. A few examples of business credit cards and the perks they offer include:

Be aware that you probably will not qualify for these immediately if your business credit file is new or incomplete. Once you get the ball rolling and have a strong business credit score however, these should be accessible.

Most utilities do not report payments to credit agencies. Furthermore, they don’t have to. However, some of them will report if you ask. The worst they can say is no. Then, if they say yes and you pay on time, it can only help you.

Some private lenders will offer business loans with a low credit score and report payments to business credit reporting agencies. Here are a few to consider.

Many private lenders offer options more similar to invoice factoring and lines of credit. Why? These types of products present less risk than straight term loans.

The minimum loan amount available from BlueVine is $5,000 and the maximum is $100,000. Annual revenue must be $120,000 or more, and the borrower must be in business for at least 6 months. Personal credit score has to be 600 or above. Also, BlueVine does not offer a line of credit in all states. You can find out more in our review here.

They report to Experian. They are one of the few invoice factoring companies that will report to the business credit bureaus.

Fundation offers a fast automated process. Originally, they only offered invoice financing. Later, they included the line of credit service. Repayments are automatic. They draft them electronically on a weekly basis. One thing to remember is that repayment could be as high as 5 to 7% of the amount you have drawn currently. This is because the repayment period is relatively short.

You can get loans for as little as $100 and as high as up to $100,000, but the max initial draw is $50,000. They do have some products that go up to $500,000. Though there is no minimum credit score requirement, they do require at least 3 months in business, $50,000 or more in annual revenue, and a business checking account with a minimum balance of $500.

Fundation reports to Dun & Bradstreet, Equifax SBFE, PayNet, and Experian. As a result, they are a great option if you are looking to build a healthy credit file.

These guys offer a product they call FlexFund Line of Credit. Funds vary in amounts from $5,000 to $240,000. Draws can be repaid on either a weekly or daily basis.

They report to Dun & Bradstreet and Equifax.

With OnDeck, applying for financing is quick and easy. Apply online, and you will receive your decision once application processing is final. Loan funds will go straight to your bank account. The minimum loan amount is $5,000 and the maximum is $500,000.

There is a personal credit score requirement of 600 or more. Also, you must be in business for at least one year. There is an annual revenue requirement of at least $100,000 as well. In addition, there can’t be a bankruptcy on file in the past 2 years. No unresolved liens or judgements are allowed either.

OnDeck reports to the standard business credit bureaus.

Check out our best webinar with its trustworthy list of seven vendors to help you build business credit.

You know what your business credit file is and how to start it. You have a toolbox full of tips to help make it stronger. Still, you have no clue what yours actually says. How can you find out what is on your credit file? Furthermore, how can you correct any mistakes on your file? That is where credit monitoring comes into play.

Monitoring your business credit file can help you get an idea of how it is affecting the fundability of your business. Unfortunately, you cannot get a free copy of your business credit reports like you can with your personal credit reports. It costs money to monitor your business credit as a general rule.

For example, the big three charge close to $50 or more for each report:

However, you can monitor your credit with D&B and Experian at a fraction of these costs by going to https://www.creditsuite.com/monitoring/.

First, if you find any inaccuracies in contact information, simply update it. You will need to do so in writing. Next, look over reporting accounts. If you see any accounts that are not yours, you will also need to contact the company in writing. It is likely the mistake is due to another business having a similar name, so you may have to do some research and send in copies of your incorporation documents. You may also have to contact the company that is reporting the account.

If you find accounts reporting late or missed payments that you know are incorrect, notify the CRA of the mistake in writing. Send copies of supporting documentation showing that the payments were made and when they were made.

Monitoring your business credit file is vital to keeping it complete, accurate, and healthy.

Your business credit file is only one part of the much bigger fundability picture. However, it is a hugely important part. In fact, without it, the whole picture is pretty much ruined. For your business to be fundable, your business credit has to be in order.

This means ensuring your business is set up as an entity separate from yourself, and making sure all your information is consistent across all channels.

The post What is Your Business Credit File and Why Does it Matter appeared first on Credit Suite.

Do Outbound Links Matter For seo in 2020? I’ve had a number of comments questioning the usefulness of outbound links recently, so I wanted to create an official space for that discussion, and help people understand the uses and benefits of outbound links. So, do outbound links help SEO? If you’re looking for a quick … Continue reading Do Outbound Links Matter For SEO in 2020?