All You Need to Know About The 3 Credit Bureaus

What are the 3 Credit Bureaus for Business All About?

Are they really different? The 3 credit bureaus all have reports – are any of them more valuable than the others?

The 3 Credit Bureaus for Business

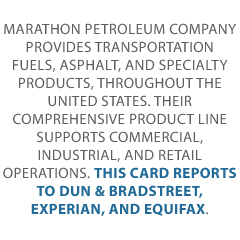

There are three credit reporting agencies for business in the US:

- Dun & Bradstreet

- Experian

- Equifax Commercial

These are the biggest and best-known bureaus reporting on your EIN credit. But they are not the only business credit bureaus.

The 3 Credit Bureaus and Their Data

The major credit bureaus get data from many different places. These may include:

- Utility companies

- Landlords

- Companies that help set up new businesses

- Insurance and benefit providers,

- The internet, etc.

Dun & Bradstreet

They are the oldest and largest of the 3 credit bureaus. You need a D-U-N-S number to start building business credit. No D-U-N-S number? Then get one; they’re free. This number gets a business into their system. Check with D&B to see if they have a record set up for you now.

Get Set Up with D&B

If your search with D&B doesn’t show you have a D-U-N-S number, you’ll need one. This is a nine-digit number issued by Dun & Bradstreet. It’s assigned to each business location in the D&B database. Each business has a unique, separate, and distinct operation for the purpose. Every business must first have a D-U-N-S number before D&B will assign a PAYDEX business credit score.

Get a D-U-N-S number on the D&B site. During the D-U-N-S set up process you’ll be asked for a lot of information. If you select that you’re a government contractor, you’ll get a D-U-N-S in about 1-2 weeks. But if you don’t pay D&B anything and aren’t a contractor, it can take up to 30 days to get a D-U-N-S.

Your Initial D&B Record

But what if you find a record? If you pull up a record for your business with D&B, then consider pulling your actual business credit report. To do so, you’ll need to enroll for credit monitoring. In doing so, you’ll see if you have any credit reporting. You’ll also see if you have scores. If you have negative items on your report, then dispute those through Duns Manager.

Build Business Credit with D&B

One way to start building your business credit is by using D&B’s Credit Builder program. With this option, you are only setting up credit with D&B, and not Experian and Equifax. This runs $149 monthly (as of July 2021).

Dun & Bradstreet Scores

The main score is PAYDEX. But a business will not get a PAYDEX score, unless it has at least 3 trade lines reporting, and a D-U-N-S number. A business must have BOTH to get a D&B score or report.

Get our business credit building checklist and build business credit the fast and easy way.

D&B Reports

In general when D&B does not have all the information that they need, they will say so in their reports. But missing information does not necessarily mean a company is a poor credit risk. Instead, the risk is unknown. They favor objective and statistically derived data, rather than subjective and intuitive judgments. D&B’s database contains millions of companies around the world.

PAYDEX Score

This is Dun & Bradstreet’s dollar-weighted numerical rating of how a company has paid the bills over the past year. D&B bases this score on trade experiences reported by various vendors. The Score ranges from 1 to 100; higher scores mean a better payment performance. PAYDEX scores reflect how well a company pays its bills.

PAYDEX Yearly Trend

Reports also contain a PAYDEX Yearly Trend graph. It includes detailed payment history. with payment habits and a payment summary. This helps show whether a business pays its bigger bills first or last.

D&B Rating

This rating helps companies quickly assess a business’s size and composite credit appraisal. D&B bases this rating on information in a company’s interim or fiscal balance sheet plus an overall evaluation of the firm’s creditworthiness.

The scale goes from 5A to HH. Rating Classifications show company size based on worth or equity. D&B assigns such a rating only if a company has supplied a current financial statement.

The rating contains a Financial Strength Indicator. It is calculated using the Net Worth or Issued Capital of a company. Preference is to use Net Worth. D&B will show if a business is new or if they never got this information.

This section also adds a Composition Credit Appraisal. This number runs 1 through 4, and it reflects D&B’s overall rating of a business’s creditworthiness. Lower numbers are better. A D&B rating might look like 3A4.

Financial Stress Class

Numbers range from 1 to 5. 1 is businesses least likely to fail. 5 is firms most likely to fail. The Financial Stress Class measures likelihood of failure.

Credit Score Class

The Credit Score Class measures how often a company is delinquent in paying its bills. Numbers range from 1 to 5. 1 is businesses least likely to be late. 5 is firms most likely to be late making payments. More granular scores run from 101 to 670. 670 is the highest risk.

Monitoring Your Business Credit with Dun & Bradstreet

D&B offers Credit Evaluator Plus . According to them, it’s “A credit report for simple credit decisions.” It can help you quickly determine a company’s risk of late payment. And it can help you identify how much credit to extend based on a company’s D&B PAYDEX® Score, D&B Maximum Credit Recommendation, and past payment behavior. As of the third quarter of 2021, it costs $61.99 to get a report for one company.

. According to them, it’s “A credit report for simple credit decisions.” It can help you quickly determine a company’s risk of late payment. And it can help you identify how much credit to extend based on a company’s D&B PAYDEX® Score, D&B Maximum Credit Recommendation, and past payment behavior. As of the third quarter of 2021, it costs $61.99 to get a report for one company.

D&B also offers:

- Business Information Report

Snapshot ($139.99 per report)

Snapshot ($139.99 per report) - Business Information Report

On Demand ($189.99 per report)

On Demand ($189.99 per report) - Credit Reporter ($799 for 5 reports)

All three offer what Credit Evaluator Plus does, with some extras. All prices are current as of the third quarter of 2021.

does, with some extras. All prices are current as of the third quarter of 2021.

Monitoring Your Own Business at Dun & Bradstreet

Dun & Bradstreet also sells CreditSignal®. You can view four Dun & Bradstreet business credit scores and ratings for 14 days. Get unlimited access to inquiry, legal event, and trade payment summary data.

Receive email notifications when a change occurs in your business credit report. Free alerts to changes to these D&B® scores and ratings, including your D&B PAYDEX score. CreditSignal is free.

Experian

Experian focuses on providing data and analytics to help businesses better assess risk. They use both consumer and business credit information to gauge risk. They have found that blended data and reports work a lot better for them.

For troubled businesses, blended scores dropped an average of 30% over the four quarters leading up to a bad event. But the owner’s consumer scores showed no statistically significant decline during the same period.

Per Experian: “By combining personal and commercial credit information in one report, Experian provides a complete picture of the creditworthiness of small businesses.”

Get Set Up with Experian

Many credit issuers use Experian to see if you should get approval for a credit card, and how much you should get. Get started with Experian by using their BizVerify system. See if Experian has information about your company already. Verify the information they have.

If your initial search shows your business information, pull your Experian credit report. Do so even if you have no trade lines. This is because Experian will give you a low, failing credit score. And this is if they have even basic information about your business.

Experian says:

- “Experian® requires minimum information to generate a score. If a business doesn’t meet these requirements, a score is not generated. Minimum information is at least one tradeline and/or one demographic element.

- [these are] Demographics such as years on file, Standard Industrial Classification codes and business size.”

Working with Experian

It only takes one account reporting to change credit status from high risk to low risk. Even one reported trade line can change a score from 27-29 to 85-100. That is, once that account is on an Experian report. Get approval for an account from a vendor which reports. Buy something and pay the bill. It takes about 30-90 days after that for that account to report.

Per Experian, each business credit score report includes:

- Business credit scores and credit summary

- Summaries of collections and payments

- Uniform Commercial Code filing information

- Bankruptcy filings

- Judgment filings

- Tax lien filings

Experian Business Credit Score

Business Credit Scores range from 1 to 100. Higher scores show lower risk. This score predicts the likelihood of serious credit delinquencies in the next 12 months. It uses tradeline and collections information, public filings as well as other variables to predict future risk.

Experian Financial Stability Risk Rating

Scores range from 1 to 5. Lower ratings show lower risk. A Financial Stability Risk Rating of 1 shows a 0.55% potential risk of severe financial distress in the next 12 months. Experian categorizes all businesses to fit within one of the five risk segments.

This rating predicts the likelihood of payment default and/or bankruptcy within the next 12 months. It uses tradeline and collections data, public filings, and other variables to predict future risk.

Credit Summary

This section contains several counts of various data points

- Current Days Beyond Terms (DBT)

- Current total account balance

- Highest credit amount extended

- Number of payment tradelines

- The number of business inquiries

- Number of UCC Filings

- A percentage of businesses scoring worse than the company outlined in the report

- Number of bankruptcies and liens

Payment Trend Summary

This section has two graphs. They show the company in question versus its industry on:

- Monthly payment trends

- Quarterly payment trends

These are the percentages of on-time payments by month and quarter, respectively.

Score Improvement Tips

Experian offers suggestions on how to improve your reports, such as:

- Getting net-30 terms, if possible, from existing and future tradeline suppliers

- Paying accounts on time or working with the tradeline supplier to work out a payment plan so a business is not reported delinquent

- Lowering credit use

- Making sure all the information in the report is correct

Get our business credit building checklist and build business credit the fast and easy way.

Monitoring Your Business Credit with Experian

Available options provide varying levels of detail. One such report is the Experian CreditScore SM Report. Get an Experian Business Credit Score (Intelliscore). You also get the Experian Financial Stability Risk Rating. Get information on derogatories like judgments, tax liens, and bankruptcies. Learn about any fictitious business name information in the file. As of the third quarter of 2021, this report costs $39.95.

Experian ProfilePlus SM Report

In addition to the Experian CreditScore Report, get:

- Trade payment detail

- Inquiry detail

- UCC detail

- Corporate financial information

As of the third quarter of 2021, this report costs $49.95.

Experian Business Credit Advantage SM Subscription Plan

You get (among other information):

- Trade payment detail

- Inquiry detail

- UCC detail

- Corporate financial information

As of the third quarter of 2021, this annual subscription costs $189.

Experian Business CreditScore Pro SM Subscription Plans

This is Experian’s most comprehensive plan. Along with everything above, you also get credit limit recommendations. Get reports on 30 businesses per month. As of the third quarter of 2021, this subscription costs $1,495 per year.

Experian BizVerify Report

This is Experian’s snapshot view of a business credit file. Use this report to verify that a new business is in their National Business Database. This brief summary report provides any available information on a business’s registration information. This is even for businesses that don’t yet have an Experian business credit score.

It isn’t much of a monitoring product; it’s more to make sure a business is in Experian’s records. As of the third quarter of 2021, this report costs less than $20.

Equifax

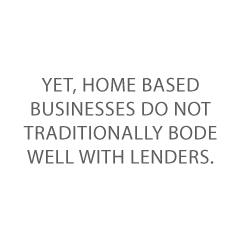

Most credit issuers and trade vendors report to D&B and Experian, not Equifax. So when you find trades that report to Equifax, apply, get approval, use your credit, and pay your bills on time. That way, you’ll build your reports and scores.

Many lenders pull your Equifax credit report for lending decisions. Your Equifax profile and score can also be a part of your FICO SBSS score. SBA lenders use this score for SBA loans. Build credit with Equifax when you can because it’s vital to getting the loans you need to grow your business.

Get Set Up with Equifax

If your search shows that Equifax has a record of your business, pull your Equifax reports and scores. See if you have trades reporting. Equifax can have an established report and score for you even if you have no trade lines reporting.

This is especially true if you have some type of public record out there, like a bankruptcy, lien, or lawsuit. In this case, access your Equifax company report and score even with 0 trades reporting.

Equifax Data

The company gets data from a data sharing agreement with the Small Business Exchange. They also use net 30 type industry trade credit information. They also get data from various suppliers of products and services to businesses on an invoice basis. Equifax combines financial data with industry trade credit data.

They add utility and telephone data and public record information. These are bankruptcies, judgments, and tax liens. Reports contain many calculated scores.

Get our business credit building checklist and build business credit the fast and easy way.

Equifax Reports

Equifax Business Credit Reports include:

- Credit Summary – synopsis of credit accounts with banks, suppliers, and service providers

- Public Records – Secretary of State business registration, judgments, liens, or bankruptcies

- Risk Scores – Equifax Business Credit Risk Score

and Equifax Business Failure Score

and Equifax Business Failure Score

- Payment Index – a 12-month payment comparison to the industry norm

- Additional Company Information – alternate business names, owner names, and guarantor names

It also includes business and credit grantor comments.

Credit Risk Score

This score runs from 101 to 992, and higher numbers are better. This section also shows key factors. These are positives and negatives about your business. Such as how old your oldest account is, and whether you have any charge-offs, and the size of your business.

Payment Index

A Payment Index score runs from 0 to 100, and higher numbers are better. It also shows Industry Median. Reports contain a table explaining the numbers:

- 90+: Paid as Agreed

- 80-89: 1-30 days overdue

- 60-79: 31-60 days overdue

- 40-59: 61-90 days overdue

- 20-39: 91-120 days overdue

- 1-19: 120+ days overdue

Monitoring and Disputing Issues with Your Equifax Report

Equifax will not change your scores without proof. They are starting to accept more and more online disputes. Include proofs of payment with it. These are documents like receipts and cancelled checks. Correct Equifax issues on their website. Be specific about the concerns with your report. As of the third quarter of 2021, you can order a single business credit report for $99.95. Or order a business credit report multi-pack (5 for the price of 4) for $399.95.

Monitor Business Credit at the 3 Credit Bureaus for Less

All these reports are expensive! But did you know that you can get business credit monitoring for all 3 credit bureaus, and all in one place – for less? Credit Suite offers monitoring through its Business Finance Suite (through Nav). See what credit issuers and lenders see. So you can improve your scores and get the business credit and funding you need.

Improving Your Reports

Whatever improves one report, is bound to improve your reports at the other two of the big 3 credit bureaus. Paying off accounts always pays dividends. So does avoiding bankruptcies, and correcting errors as you spot them.

The 3 Credit Bureaus: Takeaways

D&B is the largest of the 3 credit bureaus for business. Experian uses blended personal and business data. Lenders tend to use Equifax. Actions you take to improve one report tend to improve the other two. Let us help.

The post All You Need to Know About The 3 Credit Bureaus appeared first on Credit Suite.