Article URL: https://boards.greenhouse.io/truebill/jobs/4047851003

Comments URL: https://news.ycombinator.com/item?id=24408971

Points: 1

# Comments: 0

Article URL: https://boards.greenhouse.io/truebill/jobs/4047851003

Comments URL: https://news.ycombinator.com/item?id=24408971

Points: 1

# Comments: 0

Article URL: https://www.flexport.com/careers

Comments URL: https://news.ycombinator.com/item?id=23505381

Points: 1

# Comments: 0

Podcasting.

You’ve heard about it before and I bet you’ve even listened to a handful of podcasts. But you probably haven’t created one yet.

Just think of it this way…

There are over 1 billion blogs and roughly 7 billion people

in this world. That’s 1 blog for every 7 people…

On the other hand, there are roughly 700,000 podcasts. That means there is only 1 podcast for every 10,000 people or so.

Podcasting is 1,428 times less competitive than blogging.

So, should you waste your time on podcasting?

Well, let me ask you this… do you want a new way to get more organic traffic from Google?

I’m guessing you said yes. But before I teach you how to do that, let me first break down some podcasting stats for you, in case you aren’t convinced yet.

From a marketing and monetization standpoint, podcasting isn’t too bad.

I have a podcast called Marketing School that I do with my buddy Eric Siu. We haven’t done much to market it and over time it’s grown naturally.

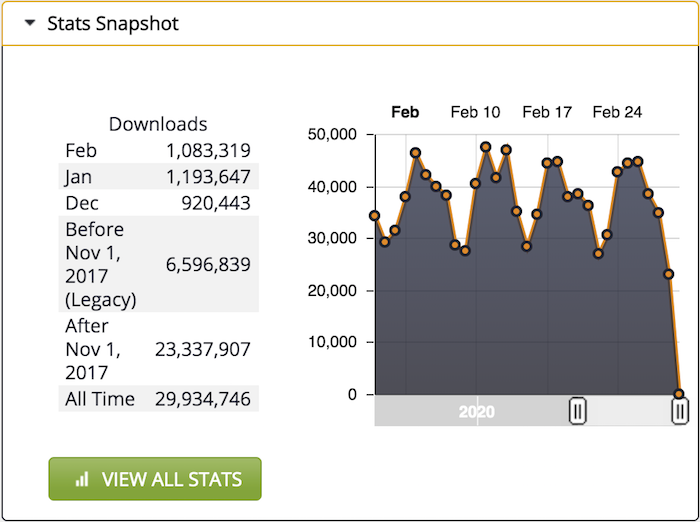

Here are the stats for the last month.

We got 1,083,219 downloads or “listens” last month. To give you an idea of what that is worth, Dream Host paid us $60,000 for an ad spot…

They’ve also been paying us for a while, technically we have a 1-year contract worth $720,000.

Now on top of the ad money, Eric and I both have gotten clients from our podcast. It’s tough to say how much revenue we’ve made from the podcast outside of advertising, but it is easy to say somewhere in the 7-figure range.

Keep in mind, when I make money through ads or generate revenue for my ad agency, there are costs so by no means does that revenue mean profit.

Sadly, my expenses are really high, but I’ll save that for a

different post.

But here is the cool thing: Eric and I only spend 3 hours a month to record podcast episodes for the entire month. So, the financial return for how much time we are spending is high.

And if that doesn’t convince you that you need to get into podcasting, here are some other stats that may:

If you haven’t created a podcast, this guide will

teach you how. And this

one will teach you how to get your first 10,000 downloads.

Alright, and now for the interesting part…

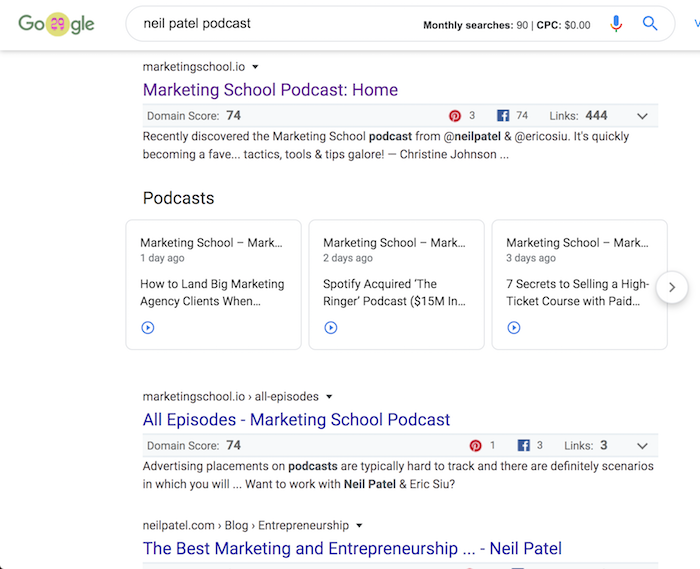

Back in 2019, Google saw how podcasts were growing at a rapid pace and they didn’t want to miss out.

They wanted people to continually use Google, even when it came to learning information that is given over audio format. So they decided to make a change to their search engine and algorithm and started to index podcasts and rank them.

And depending on what you search for and the more specific you get, you’ll even notice that Google is pulling out details from specific episodes. This clearly shows that they are able to transcribe the audio automatically.

This shouldn’t be too much of a shocker as they’ve already had this technology for years. They use it on YouTube to figure out what a video is really about.

But here is the thing, just recording a podcast and putting

it out there isn’t going to get you a ton of search traffic.

So how do you get more SEO traffic to your podcast?

Podcasting is a lot like blogging.

If you create a blog post on any random topic that no one

cares to read about, then you aren’t going to generate much traffic… whether it

is from social or search.

The same goes for podcasting. If you have an episode on a random topic that no one cares to listen to, then you won’t get many downloads (or listens) and very little SEO traffic as well.

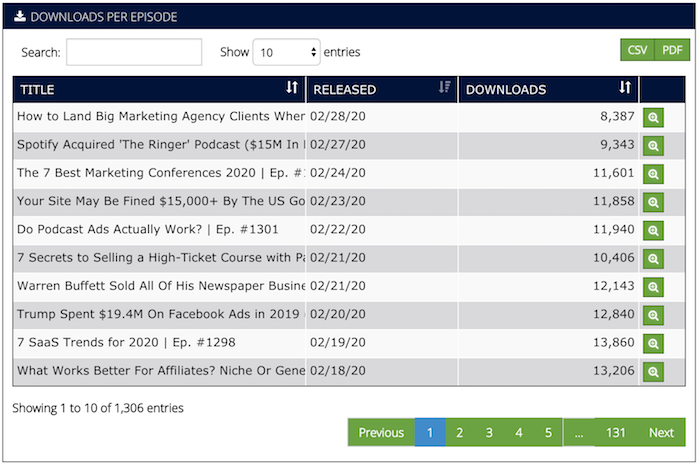

Just look at the stats for a few of our episodes.

Look at the screenshot above, you’ll see some do better than

others.

For example, the episode on “7 Secrets to Selling High Ticket Items” didn’t do as well as “The 7 Best Marketing Conferences 2020” or even “How to Drive More Paid Signups In Your Funnel.”

You won’t always be able to produce a hit for every podcast

you release, but there is a simple strategy you can use to increase your success

rate.

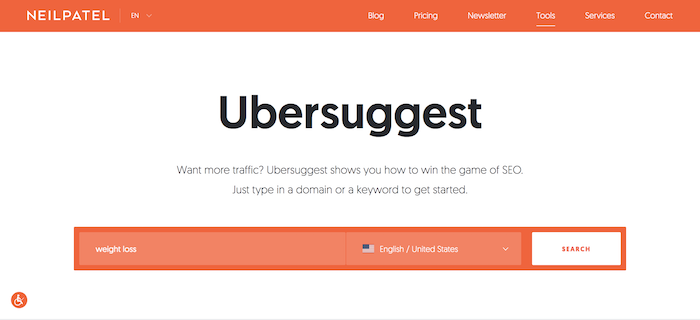

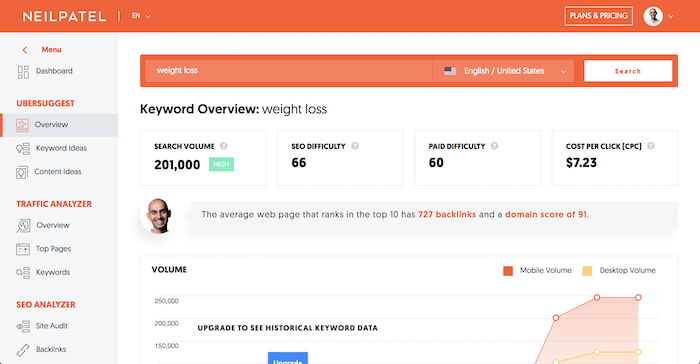

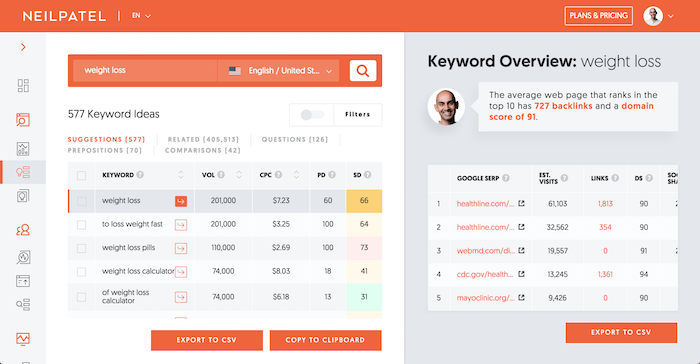

First, go to Ubersuggest

and type in a keyword or phrase related to what your podcast is about.

Once you type in your keyword or phrase, hit search.

You’ll land on a screen that looks something like this:

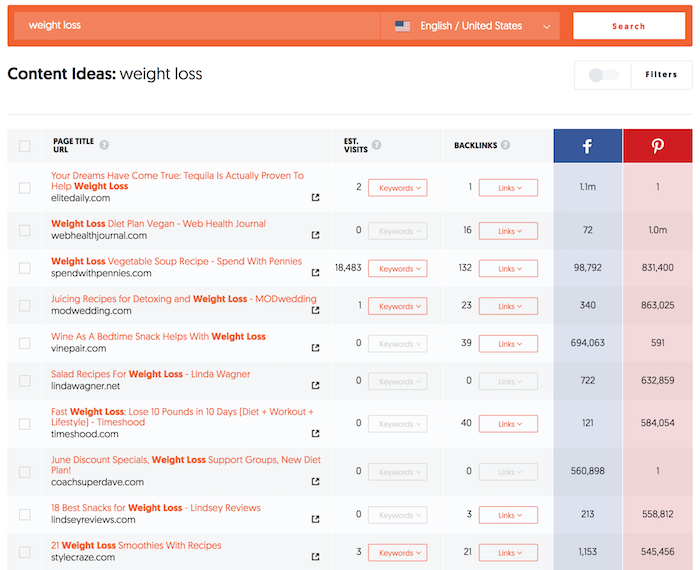

Then in the left-hand navigation, click on the “Content Ideas” option.

From there, you’ll see a list of popular topics on the subject you are researching.

This report breaks down popular blog posts based on social shares, SEO traffic, and backlinks.

Typically, if a blog post has all 3, that means people like the topic. Even if it has only 2 out of the 3, it shows that people are interested in the topic.

What we’ve found is that if a topic has done well as a blog post, it usually does well as a podcast episode.

See with the web, there are so many blogs, most topics have been beaten to death. But with podcasting, it is the opposite. Because there are very few podcasts, most topics haven’t been covered.

And if you take those beaten-to-death blog topics and turn them into podcast episodes, it is considered new, fresh content that people want to hear. And they tend to do really well.

Hopefully, you are still on the content ideas report and you’ve found some ideas to go after.

If not, just scroll down to the bottom of the Content Ideas report and keep clicking next… even if only a few numbers show, don’t worry, there are millions of results and as you go to the next page, more pages will show up.

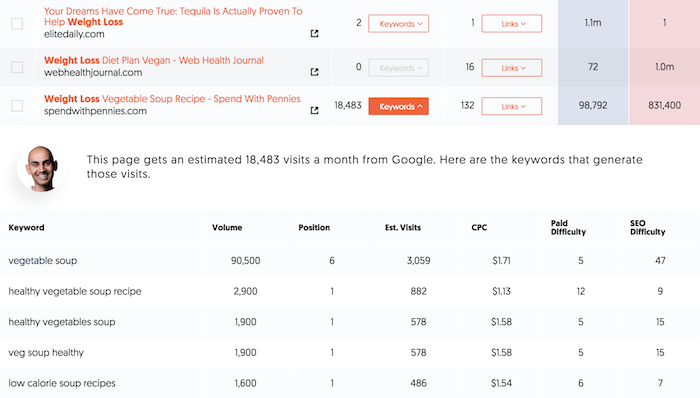

Once you find a topic, I want you to click the “Keywords” button under the “Estimated Visits” column.

This will give you more specific keywords to mention and so you can go even more in-depth during your podcast episode.

Remember that Google is able to decipher your audio and knows what topics and keywords you are covering.

So, when you mention a keyword within your podcast, your podcast episode is more likely to rank for that keyword or phrase.

But there are a few things I’ve learned through this whole process:

So how do you find the right keywords and questions to

incorporate into your podcasts?

Head back to Ubersuggest and type in a keyword or phrase related to a podcast episode you want to create. This should be a bit easier now because you’ve already leveraged the Content Ideas report to come up with popular topics that people want to hear about. 😉

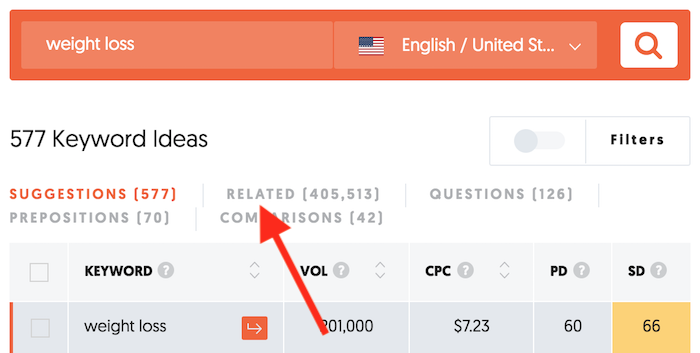

This time, I want you to click on the “Keyword Ideas” report in the left-hand navigation.

You’ll then see a list of suggestions that look something like this.

As you scroll down, you’ll continually see more and more keywords.

Don’t worry about the CPC data, but you will want to look at the SEO difficulty score as the easier the score the better chances you will have of ranking your podcast episode on Google. Also, look at search volume… the higher the number the better as that means more potential listens.

My recommendation for you is to target keywords and phrases that have an SEO difficulty of 40 or less.

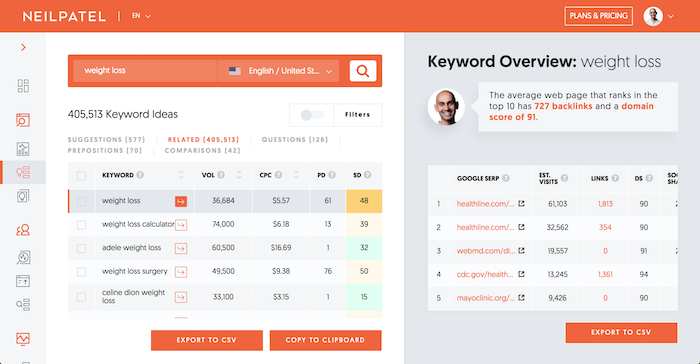

Once you have a list of keywords, I want you to click on the “Related” navigational link on that report.

Now, you’ll see a much bigger keyword list.

In this case, you’ll see 405,513 related keywords that you can target. Again, ignore the CPC data but target keywords with an SEO difficulty of 40 or less and the more popular the keyword the better.

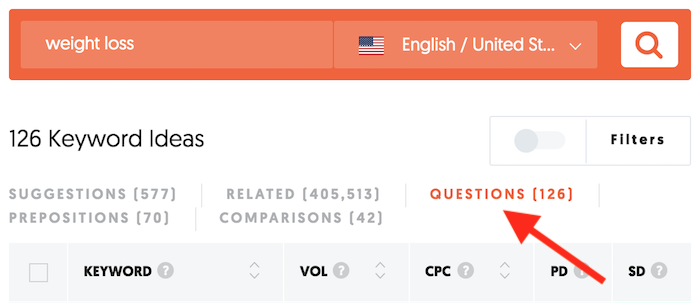

Lastly, I want you to click on the “Questions” navigational link…

Then scroll through the list and you’ll see a list of

questions that you can target.

According to Comscore, over 50% of the searches are voice searches. A large portion of those are questions, so covering them within your podcast or even labeling your titles based on questions is a great way to get more traffic.

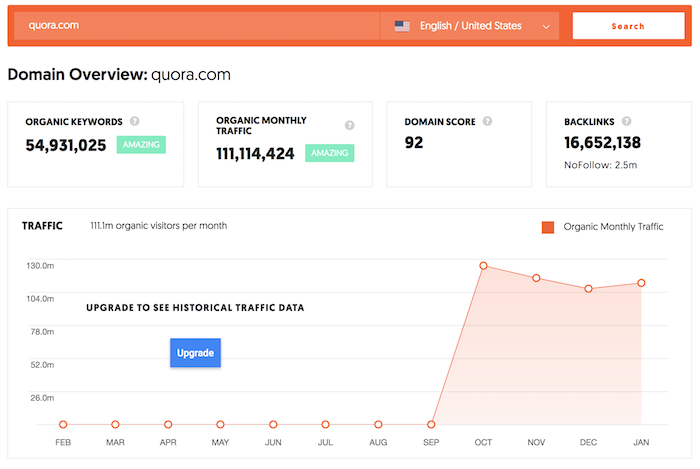

If you don’t think going after questions is a good strategy

to get more traffic, just look at Quora.

With roughly 111,114,424 estimated visits a month from Google, Quora is getting a lot of traffic by optimizing their site for question-related keywords.

Google

is the most popular site in the world. Whether you love SEO or hate it, you

have no choice but to leverage it.

One way to get more SEO traffic is to write tons of content and leverage content marketing. It’s a competitive approach and you should consider it.

But another solution that’s even easier is to create a podcast and rank it well on Google.

And ideally, you should be doing both.

Do you have a podcast? Have you tried ranking audio

content on Google?

The post 1,083,219 People Per Month and Counting: My New Favorite SEO Strategy appeared first on Neil Patel.

Article URL: https://jobs.lever.co/cambly/?department=Product&team=Engineering

Comments URL: https://news.ycombinator.com/item?id=22321740

Points: 1

# Comments: 0

Paper.li is on a mission to enable millions of passionate people with the personal marketing tools they need to build their brands. Isn’t it time you invested in yourself? Approaching our 10 year mark of …

The post Personal marketing tools for passionate people: Paper.li 2.0 appeared first on Paper.li blog.

Credit Scores Cards For People With Bad Credit- Facts

Debt cards for negative credit scores are absolutely not going to be the finest credit report offers, however credit report cards for individuals with negative credit rating may be your only choice readily available. If you are a young individual simply beginning to develop credit scores, or if you’ve had scenarios that has actually harmed your credit score background, you typically can certify for debt cards for negative credit report.

Bad Credit Deals

Poor credit history bargains are frequently split right into guaranteed credit score cards for negative credit rating that require a down payment as well as negative credit score unprotected credit scores cards, a poor debt card with a lot greater charges. These kinds of poor credit score supplies individuals with a bad debt rating or no previous credit scores background a simple as well as fast means to re-gain an excellent credit report background with poor debt cards.

Rate of interest

There are numerous lures by having bank card and also while utilizing poor charge card to hold you over in limited circumstances, remember it is just short-lived alleviation as the rate of interest on bank card for negative credit report are incredibly high. Look around and also search for bank card for negative credit report with a rate of interest that you are definitely certain you will certainly have the ability to pay. Most likely the solitary crucial component of selecting bank card is the rates of interest, specifically for individuals that will certainly be surrendering equilibriums from month to month.

Tips

An individual has to constantly remember that bank card for negative credit scores are extremely simple to make use of so do not overdo it or you may locate on your own in a much even worse scenario. Look into the rates of interest as well as charges prior to you begin looking for charge card for poor credit scores. Do not obtain every poor bank card there is as this will certainly impact your credit rating, just select 2 of the most effective poor credit score bargains you can locate.

Credit score cards for poor credit scores are absolutely not going to be the finest credit history offers, yet credit history cards for individuals with negative credit score may be your only choice offered. Negative credit scores bargains are usually separated right into protected credit history cards for poor credit scores that require a down payment as well as poor credit report unsafe credit rating cards, a negative credit report card with a lot greater charges. These kinds of poor credit history uses individuals with an inadequate credit rating or no previous credit report background a very easy and also fast means to re-gain an excellent credit rating background with poor debt cards.

The post Credit Rating Cards For People With Bad Credit- Facts appeared first on ROI Credit Builders.

Those with disabilities run businesses every day. While there are not a lot of business funding resources available specifically for those with disabilities, some loans work better for them than others. Typically, you would have to wade through everything that’s out there to find the best business loans for disabled people. That could take forever. … Continue reading How to Find the Best Business Loans for Disabled People

Those with disabilities run businesses every day. While there are not a lot of business funding resources available specifically for those with disabilities, some loans work better for them than others. Typically, you would have to wade through everything that’s out there to find the best business loans for disabled people. That could take forever. We try to narrow it down a little.

Of course, there are some highly variable factors at play. Whether you are disabled or not, your credit score will make a difference when looking for business loans. Other factors will come into play as well, such as length of time in business and annual revenue. For traditional lenders, credit is still king. The best business loans for disable people with a high credit score (650 or over) include the following.

These are loans from the United States Department of Agriculture. They don’t provide loans directly. Rather, they guarantee loans from lenders and provide funds to agencies that act as intermediaries. Since a large share of disabled Americans are in rural communities, the USDA’s focus on these areas is a bonus.

The most popular of the USDA’s many business loan programs is the Business and Industry Guarantee Program. The USDA helps guarantee loans made to businesses in rural areas through this program. By USDA definition, a rural area has fewer than 50,000 residents. Therefore, if your business is located in an area that fits this definition, you could qualify. However, you will also need good credit, adequate business revenue, and potentially some collateral.

Learn business loan secrets and get money for your business.

Another option for disabled people with good credit is an SBA loan. Like the USDA, the SBA does not issue loans directly. They guarantee loans made through specific lenders. The 7(a) loan program is the SBA’s most popular. It offers up to $5 million in funding and repayment terms that go up to 25 years.

Entrepreneurs can use these funds to buy commercial real estate, expand a business that is already in operation, start a new business, buy equipment, and more. Not everyone will qualify however. In addition to a credit score of 650 or above, businesses operating for at least two years and already producing revenue are more likely to get approval. Collateral is also a likely requirement. The process takes several weeks.

The really cool thing about these loans is that you can qualify with credit that is between 550 and 650. They offer up to $50,000 in funding, so they are a great option for micro or home-based businesses. They can be used for hiring, launching a new location, and even remodeling your office. Accion, one of the partner lenders, will work with scores as low as 575. They focus more on the expected income during the loan term than current financial position.

The goal of these loans is to get funds to business owners in underserved groups. This, of course, includes disabled people. They go up to $250,000, so large investments work well with these funds. The application process works the same as with other small business loans in that you need to find an SBA partner lender. Use this tool to find a lender.

The SBA works with traditional lenders to help get loan funds in the hands of those that may not be able to qualify under traditional requirements. While the government guarantee helps, sometimes it still isn’t enough. If you find this is the case with your, business consider applying for loans from non-traditional lenders.

With OnDeck, applying for financing is quick and easy. Apply online, and you will receive your decision once application processing is complete. Loan funds will go straight to your bank account. The minimum loan amount is $5,000. The maximum is $500,000.

You must have a personal credit score of 600 or more. Also, the business has to be in operation for at least one year. There is an annual minimum revenue requirement of $100,000 as well. In addition, there can be no bankruptcy on file in the past 2 years and no unresolved liens or judgements.

StreetShares began as a service to veterans. These days, they offer term loans, lines of credit, and contract financing. They also offer small business loan investment options. The maximum loan amount is $250,000. Pre Approval only takes a few minutes. They use a soft pull on your credit so it doesn’t affect your score.

To be eligible, you have to be in business for at least 12 months with annual revenue of $25,000. Exceptions are possible however. For example, with loans to companies in business for at least 6 months that have higher earnings, they make decisions on a case by case basis. The borrower’s credit score must be at least 620. For more on StreetShares, see our in-depth review.

Kabbage is an online lender. They offer a small business line of credit that can help businesses meet their goals quickly. The minimum loan amount is $500, and they do not exceed $250,000. You must be in business for at least one year and have $50,000 or more in annual revenue, or $4,200 or more in monthly revenue, over the last 3 months.

Learn business loan secrets and get money for your business.

Kabbage is great if you need cash quickly. Also, their non-traditional approach puts less weight on your credit score, so they may work better for some borrowers than other lenders.

Business loans for disabled people are not easy to get. If your personal credit is totally shot and you are having trouble getting enough funding through business loans, business credit cards can help. Of course, you’re thinking if your credit isn’t good enough to get loans, how are you going to get credit cards?

First, credit cards are easier to get regardless. Those with poor credit scores can still get cards, they just have higher rates and lower limits. However, if you build credit for your business, known as business credit, you can get great business cards and fund your business quite successfully without bringing your personal credit into the picture at all.

Not just disabled business owners, but all business owners should build credit for their business that is separate from their own. Here’s why. If you have strong business credit you can get business credit cards with favorable terms and nice rewards regardless of what your personal credit looks like. Also, if your business runs into problems, your personal credit will be protected and you will still be able to do things like buy a car or a house.

The first thing you have to do is ensure accounts in your business name report to your business credit report and not your personal credit report. Do this by setting up your business as a fundable entity apart from yourself. Start by making sure your business has its own phone number and address that is not the same as yours. Be sure to get these listed in the business 411-directories.

Then, you need to get an EIN. You can do that at the IRS website for free. You’ll use it to apply for credit in place of your SSN. After that you have to incorporate. You can do so as a corporation, S-corp, or LLC. Do some research to determine which option will work best for your budget and liability protection needs, but you have to choose one.

There are just a few more things you need to do to make sure your business stands on its own credit wise:

You cannot just apply for business credit cards in your business name right away. First, you have to establish tradelines with starter vendors. These are vendors in the vendor credit tier that will issue invoices with Net 30 or longer terms. While you may need to make a few initial purchases with these vendors to establish yourself as a customer before they will extend these terms, there is no personal credit check. They do sometimes want to see a certain amount of time in business however.

As you pay the invoices consistently and on-time, these vendors will report your payments to the credit reporting agencies, thus establishing your business credit profile. Some of the most common and easiest to start with are Uline, Quill, and Grainger.

These are the easiest to start with simply because they sell products that most any business can use on a daily basis. Items such as paper, toner, pens, pencils, packing supplies, and even janitorial supplies. After you order from them a few times, apply for net 30 terms, pay on time, and watch your business credit score start to build like a snowball rolling downhill.

Once you have 8 to 10 tradelines reporting your on-time payments to the credit agencies, you can start to apply to creditors in the other credit tiers.

As you can see, it all starts with building trade lines through the vendor credit tier. Then a whole credit world opens up to you!

Learn business loan secrets and get money for your business.

If you have a disability that makes it necessary for you to use assistive technology to run your business, you could benefit from one of these loans. An example of this would be if you need an automobile that is wheel-chair accessible to make deliveries. Another example would be braille-compatible software, or a hands-free device to make business calls.

Most often these types of loans come from local lenders, and requirements for eligibility vary. The National Disability Institute offers assistive technology loans in New Jersey and New York that range up to $30,000. It is important to note that your credit can affect your ability to get these loans, but if you can show you have sufficient income to pay it back that will help a lot.

Over the course of a lifetime, a disability can affect a person in a number of ways. You can feel like you are not able to do the same things others can. While this may be true in some cases, often having a disability doesn’t make a difference in what you can do. The difference that has to be made is how you do it. The vision impaired can read, just with their fingers instead of their eyes. The hearing impaired can talk, either with their hands or their mouths. Similarly, those with disabilities can fund a business, they just may have to go about it differently. There are resources for disabled business owners out there, but you have to know where to look.

While it can seem that your disabilities stop you from many things in life, they do not have to stop you from owning and running and successful business. There aren’t a ton of business loans for disabled people exclusively, but there are plenty of options that work well for all types of business owners. Take the time to do the research you need to and figure out what’s out there, what you qualify for, and what you actually need. In the meantime, start building your business credit so you can access business funding at any time. You’ll be glad you did.

The post How to Find the Best Business Loans for Disabled People appeared first on Credit Suite.

House Refinancing For People With Bad Credit – How To Avoid High Fees

When house refinancing with poor credit report is as crucial as discovering reduced prices, staying clear of high costs. With costs amounting to hundreds of bucks, make certain that you are obtaining the very best offer by contrasting lending institutions. Look at various other kinds of credit scores to protecting cash money out funding.

Inquire About Closing Costs And Fees

Demand car loan prices quote that consist of details on closing prices and also costs. The APR will certainly consist of the rate of interest price, shutting prices, and also any kind of yearly charges.

Know costs or shutting expenses that are consisted of as component of the concept. These are frequently identified as “no down” finances, yet in truth you are spending for those costs throughout the funding.

With finance quotes, understand that also the charges are flexible. You can request for them to be gotten rid of or removed. Some charges, such as the very early settlement charge, are just eliminated if you pay an added quantity at closing.

Select Low Fee Terms

While you are looking into funding business, additionally have a look at exactly how they structure their finances. Typically the most affordable prices, such as rate of interest just or balloon repayment lendings, have the highest possible charges.

Select terms that are much more desirable for reduced charges, such as dealt with or flexible prices. Flexible prices are normally the most affordable setting you back financings with some danger of boosting future prices.

Various Other Ways To Cash Out Your Equity

Take into consideration using for various kinds of credit score to conserve on costs if you are just re-financing to pay out component of your equity. Bank loans as well as credit lines have a lot reduced closing prices than re-financing your overall home loan. They can likewise be held for a much shorter duration, which additionally conserves you cash.

While reduced charges might be your objective, be open to far better funding choices. By contrasting the APR, you might discover that ordinary charges can generate much better prices that will certainly conserve you cash. The longer you maintain your car loan, the more vital reduced prices will certainly be.

Preventing high costs when house refinancing with poor credit history is as crucial as discovering reduced prices. Demand finance prices quote that consist of details on closing expenses and also costs. The APR will certainly consist of the rate of interest price, shutting expenses, as well as any kind of yearly costs. Some costs, such as the very early settlement charge, are just eliminated if you pay an extra quantity at closing.

If you are just re-financing to pay out component of your equity, think about using for various kinds of debt to conserve on charges.

The post Residence Refinancing For People With Bad Credit – How To Avoid High Fees appeared first on ROI Credit Builders.

Article URL: https://mux.com/jobs?a=1

Comments URL: https://news.ycombinator.com/item?id=20660005

Points: 1

# Comments: 0