The dust is still settling at NBC news following the debacle last month over its hiring and firing of former Republican National Committee chair Ronna McDaniel, but scrutiny of the Comcast-owned network’s leadership remains, particularly top boss Cesar Conde. Conde, who apologized to NBC staff over the hiring of McDaniel as an analyst after network … Continue reading NBC News chief being paid by Walmart, Pepsi 'clearly a problem' as network's ties to both companies go deep

Tag: Companies

California Gov. Newsom announces plan to sign climate bill requiring large companies to disclose gas emissions

California Gov. Gavin Newsom said Sunday that he plans to sign into law a pair of climate-focused bills intended to force major corporations to be more transparent about greenhouse gas emissions and the financial risks stemming from global warming.

Newsom’s announcement came during an out-of-state trip to New York’s Climate Week, where world leaders in business, politics and the arts are gathered to seek solutions for climate change.

California lawmakers last week passed legislation requiring large businesses from oil and gas companies to retail giants to disclose their direct greenhouse gas emissions as well as those that come from activities like employee business travel.

CA INTRODUCES CLIMATE BILL THAT WOULD MAKE COMPANIES DISCLOSE THEIR GREENHOUSE GAS EMISSIONS

Such disclosures are a “simple but intensely powerful driver of decarbonization,” said the bill’s author, state Sen. Scott Wiener, a Democrat.

“This legislation will support those companies doing their part to tackle the climate crisis and create accountability for those that aren’t,” Wiener said in a statement Sunday applauding Newsom’s decision.

Under the law, thousands of public and private businesses that operate in California and make more than $1 billion annually will have to make the emissions disclosures. The goal is to increase transparency and nudge companies to evaluate how they can cut their carbon emissions.

The second bill approved last week by the state Assembly requires companies making more than $500 million annually to disclose what financial risks climate change poses to their businesses and how they plan to address those risks.

CALIFORNIA’S GRID FACES COLLAPSE AS LEADERS PUSH RENEWABLES, ELECTRIC VEHICLES, EXPERTS SAY

State Sen. Henry Stern, a Democrat from Los Angeles who introduced the legislation, said the information would be useful for individuals and lawmakers when making public and private investment decisions. The bill was changed recently to require companies to begin reporting the information in 2026, instead of 2024, and mandate that they report every other year, instead of annually.

Newsom, a Democrat, said he wants California to lead the nation in addressing the climate crisis. “We need to exercise not just our formal authority, but we need to share our moral authority more abundantly,” he said.

Newsom’s office announced Saturday that California has filed a lawsuit against some of the world’s largest oil and gas companies, claiming they deceived the public about the risks of fossil fuels now faulted for climate change-related storms and wildfires that caused billions of dollars in damage.

The civil lawsuit filed in state Superior Court in San Francisco also seeks the creation of a fund — financed by the companies — to pay for recovery efforts following devastating storms and fires.

The post California Gov. Newsom announces plan to sign climate bill requiring large companies to disclose gas emissions appeared first on Buy It At A Bargain – Deals And Reviews.

7 Marketing Lessons Learned from Billion Dollar Companies You’ve Never Heard Of

You’ve heard of Apple, Facebook, Microsoft, Google, and even Amazon. It doesn’t matter where you live in the world, the chances are you have heard of those companies.

But have you ever heard of Danaher, Fortive, AmerisourceBergen, Centene, or Archer Daniels Midland?

I bet you haven’t heard of any of those companies.

These companies aren’t small either. Here’s how much revenue each of them generates a year:

- Danaher – $29.45 billion

- Fortive – $5.25 billion

- AmerisourceBergen – $213 billion

- Centene – $118 billion

- Archer Daniels Midland – $85.25 billion

Now that’s a lot of revenue. These companies didn’t get to where they are by accident either. And although they might not be as “sexy” as Nike or Apple, they still generate a lot of cash.

We don’t work with all the brands that I mentioned above at my ad agency, but we do work with some of them as well as dozens of other billion-dollar companies you have never heard of.

And although our primary objective is to help our clients (which we do, hence we were awarded agency of the year and the 21st fastest growing company by Inc Magazine), we also learn a lot by consulting with over a hundred publicly traded companies.

Here are some of the marketing insights that you aren’t thinking about that billion-dollar companies leverage on a regular basis.

Lesson #1: The riches are not in the niches

Marketers always talk about finding a niche and how it is easier to market in a niche.

That is totally wrong. It’s not easier to market in a niche.

Think of it this way… what’s easier to do… rank number 1 for the term “credit cards” or “heatmap analytics tool”.

It of course is easier to rank for terms like “heatmap analytics tool”, which funny enough is what one of my former companies does.

But what happens if very few people ever search for terms like heatmap analytics? Sure you’ll get high rankings so you could claim it is easier to do marketing for that product, but if you barely get any traffic and sales from that term does it really matter?

See, rankings don’t mean much. All that really matters is are your marketing efforts paying off.

To keep it simple, are your marketing efforts driving you revenue profitably?

And although niche industries aren’t as competitive, it is harder to generate sales or even traffic. But if you go broad and you go after industries that are applicable to everyone, such as health insurance, it’s much easier to get traffic.

Sure you probably won’t get anywhere near the amount of traffic as the competition, but even if you get 1/100th of the traffic you can still build a big business.

That’s why I don’t go after niches. I go after massive TAMs (Total Addressable Market).

And yes health insurance isn’t sexy but United Health Care, a company most people don’t think about, generates $287 billion dollars a year in revenue.

The bigger the market, the more customers, and the easier it is to make some money. Now, it will be harder for you to win and be the top dog within that industry but hey you don’t have to win in order to generate enough income to be happy.

A prime example of this is one of my friends used to have a best man speech website where he sold speeches to people. He ranked at the top of Google, was the most popular site within the space and he couldn’t figure out how to generate more than $200,000 a year.

Good income nonetheless, but when he put the same effort into the education space, he was nowhere near the most popular site, heck people took him for granted… but he was generating millions a year in profit with the same effort.

As Rich Barton (founder of Expedia and Zillow) once said, it takes the same effort to swing a home run as it does to hit a single or a double. So might as well swing for the fences every time.

Lesson #2: Easier to market multiple products

Similar to lesson number 1, your market size keeps expanding as you continually introduce more products.

The familiar big brands that you know of have many products.

Amazon has ecommerce, streaming, cloud computing, grocery stores, etc.

Google has search, android, self-driving cars, Nest, etc

Apple has phones, laptops, iPads, computers, headphones, etc.

But it isn’t just the well-known brands that have multiple products.

Look at how many business units Danaher has. Same with Fortive, they have tons of business units.

I can’t think of one multi-billion dollar company that I know that doesn’t have multiple products or services.

And if you can think of one, I bet they will have multiple product offers, it is just a question of when. It’s how successful companies continually grow. You have no choice but to expand.

So if you want to grow your traffic or sales, think about what other products you can start offering that your current customers would want.

You can then cross-sell, which should help on the revenue end. But you can also expand your marketing. Just think about all the new paid media or SEO campaigns you can kick off the moment you have more products to sell.

It’s one of the simplest ways to scale your growth.

Lesson #3: The best marketing is word-of-mouth marketing

I first started out in marketing learning SEO and become good at it (or at least I think I am decent at it).

I then got into social media marketing with Digg, which doesn’t really exist in its old form, but it used to drive 20,000 plus visitors to your site in a day if you got on the homepage.

Then I started to learn conversion optimization, email marketing, paid ads, and pretty much all forms of online marketing.

I always thought that you build big business through marketing. And to do well with that you have to take an omnichannel approach.

And although it helps it’s not how you grow into a billion-dollar business.

Luckily from working with some of these unknown multi-billion dollar companies, I’ve gotten to know many CMOs as well as CEOs of some of these companies.

When I ask them what’s their number one marketing channel, do you know what they all tell me?

It’s word-of-mouth marketing or variations of it. In essence, other people telling others about your company, your product, your service… it is how you win.

So then I went on to ask these people, how do you generate more word-of-mouth marketing? When I took all of their responses and aggregated the data, here is what people said were the top 3 ways of getting more word of mouth:

- Be in business for a long time – no matter what you are selling and no matter how great it is, word-of-mouth marketing doesn’t happen overnight. People need to be patient and give it 10 plus years for it to fully kick in.

- Have an amazing product or service – if your product is great you will have more word-of-mouth marketing. And if it is terrible you will either have little to no word-of-mouth marketing or even worse, you will have it but it will be people talking negatively about you.

- Build a big organization – having thousands of people work for you is marketing. Whether it is people listing your company on their LinkedIn or your employees telling other people about your company, having a big labor force working for you is a great way to spread your brand out to the masses.

Lesson #4: Ugly is sexy

Do you need a new pair of shoes? It would be nice to have the latest Jordan shoes, but do you really need them?

Do you need the new iPhone? Again it would be nice to have it, but I bet your old iPhone lets you order food, send text messages, make calls or even check your emails well enough.

Maybe the camera isn’t as good as the new phones, but I bet you don’t use your phone for high-end photography and more so just use it to take selfies… so the new camera isn’t really needed.

But what about industries like payroll? Do you think a business can just stop using its payroll provider?

Well if they do stop, their employees won’t be paid and they won’t have a business.

That’s why companies like Ceridian are so popular. Again, you probably haven’t heard of them but they generate $1.02 billion a year.

Why?

Because they provide payroll services. Businesses can’t just stop using them unless they want to have their employee go unpaid and be pissed at them.

And even if you choose not to use Ceridian for payroll, the chances are whoever you use, pays them for their tax infrastructure as they are one of two companies who help calculate tax information for payroll in the United States.

And building a system that helps calculate payroll tax payments in the United States is complicated. If you get it wrong there are penalties, which is a big liability for any company.

When building that system, you have to think about each state within the United States as well as each county and city as they all have their own tax rules which also constantly change.

In other words, there is a lot of money in building ugly businesses that people need.

You don’t see kids growing up talking about building software to help with payroll taxes. Instead, they talk about creating a new fashion brand or getting paid to be an influencer.

Lesson #5: the United States is not the center of the world

I live in the United States and love this country.

Yes, it has issues, but all countries have problems…

But the United States is by no means the center of the world. The majority of the 7.7 billion people in this world don’t live in the United States. They actually live in other countries.

At my ad agency NP Digital we have people who work with us all over the world. And we have offices in places like India, Brazil, Canada, Australia… and the list goes on and on.

We don’t have these offices for outsourcing as many people would assume. We have these offices to help people out with their marketing within those regions.

For example, why would companies like Cisco want to market to people in India? It’s a booming market.

Even my CEO, he was the president of a division within a publicly traded company. That division had over 4000 employees. And can you guess what percentage of their revenue came from the United States?

Roughly 26%. That means roughly 3/4 of their revenue was coming from regions outside of the United States.

Going global makes it easier for you to get more traffic because there is a bigger pool of people for you to target and in many cases, it is less competitive.

That was one of the instrumental strategies for our fast growth at NP Digital, in which we expanded globally (and we are still adding more regions).

We did this using this strategy. As it helped us get leads and traffic from countries all around the world.

Lesson #6: Your marketing is only as good as your team

Years ago I created a startup called KISSmetrics that failed.

It was a web analytics company that raised $16.4 million from investors.

I had an investor who sat on our board named Phil Black from True Ventures. Overall awesome guy and I loved him as a board member.

I remember him continually giving one piece of advice…

As an entrepreneur you don’t have to figure everything out or do everything on your own, instead you need to hire amazing people. People who have done what you are looking to accomplish and have done it before in your exact industry.

In other words, Phil kept pushing us to hire amazing people for every role.

For example, if you are an ad agency and you need to do better with sales, hire the head of sales from one of your competitors who you know is crushing it. It may cost you a lot of money, but there is a higher chance that they will know exactly what you need to do in order to succeed.

Versus just hiring a head of sales from a random industry because they won’t know your industry and what they need to do in order to succeed.

I wish I understood the power of what Phil was trying to teach to me when we founded the company in 2008. Because if I truly understood it, I would be much further along in my career.

With NP Digital we took that advice to the extreme. Our CEO was the President of iProspect, the largest performance marketing agency (aka a competitor).

Our head of client services came from there as well.

Our COO was in charge of all performance marketing fulfillment at Dentsu, which meant she was in charge of over $1 billion in revenue.

My co-founder and I continually look for the best people. As that is the way to really grow fast.

That’s what large corporations do.

You need to also do that with your marketing. From the person running your marketing division to each individual player such as your SEO or paid media manager.

Do they have industry experience? If not, they may not perform that well.

Did they continually get promotions at their previous jobs? If they didn’t then they may not be as great as they claim to be. It doesn’t matter how good people claim to be, if they didn’t continually get promotions at their previous jobs it means that others didn’t find them as valuable as they claim to be.

These are 2 things to consider when hiring marketers or any role for that matter of the fact. Yes, you want people who are a cultural fit, but you also want people who worked for competitors and continually got promotions and raises in the past because it usually means they did a good job.

Lesson #7: You have to build a brand to do well in the long run

What do you think the most popular search term is on Google within the United States?

Common, take a guess…

It’s actually the term “Facebook”.

Guess what the second most popular search term is?

It’s the term “YouTube”.

The 3rd most popular search term is Amazon. The 5th is Google, 6th is Walmart, and the 7th is Gmail.

Notice a trend here?

The most popular search terms, not just in the United States, but globally tended to be brands.

Just look at the brand Nike. In the United States, it is searched 6 million times a month. And the term shoes is only searched 1.2 million times a month. In other words, Nike gets more searches for the brand each month than the whole category of shoes.

Now, what do you think my most popular search term is that drives traffic to my business?

It’s actually not Neil Patel, it’s Ubersuggest.

Our second most popular term is another brand that we own… Answer the Public.

And the third most popular search term for us is my personal brand, Neil Patel.

To build a big business you need to build a brand.

SEO will only get you so far. Paid ads will only get you so far. To win people must love your product or service if you expect your brand to be big and do well.

If you are struggling to build a brand keep in mind that it just takes time. Don’t expect the world of results in the first 3 years. You’ll have to give it 5 plus years for your brand to start taking off.

Here is an article that I wrote that can help you build a brand and here is a video that can also help you out.

Conclusion

Learning from brands like Apple is great. They are an amazing company. Heck, I’m writing this blog post on a Macbook.

But it’s hard for people to replicate the magic Apple has with their business and even marketing.

On the flip side, it’s much easier for you to replicate the marketing strategies that these unknown multi-billion companies are leveraging because they work for all business types and they aren’t tough strategies to implement.

So, what other strategies have you learned from companies that many of us aren’t familiar with?

Public Companies Provide New Disclosures to Investors

Public Companies Provide New Disclosures to Investors

When firms provide their yearly records, financiers in the country’s openly traded business currently have accessibility to an unmatched degree of business details. For the very first time ever before, these records consist of information concerning a firm’s interior control over monetary coverage.

When a firm determines its interior control over economic coverage, it checks the essential procedures associated with videotaping deals and also preparing economic records. A business currently should reveal its analysis of the performance of its interior control over economic coverage, consisting of a specific declaration regarding whether that control works and also whether administration has actually determined any kind of “product weak point.”

These brand-new disclosures were established by the federal government complying with company failings and also company detractions that started with Enron in 2001. Due to the fact that efficient inner control over monetary coverage aids enhance the integrity of monetary records as well as can be a deterrent to company fraudulence, the disclosures are vital to financiers.

Product weak point in inner control over economic coverage does not indicate that a product economic misstatement has actually happened or will certainly happen, yet that it might happen. It is a caution flag.

It needs to be reviewed in the context of the business’s particular circumstance, consisting of factor to consider of the complying with locations.

* Fraud: Does the weak point entail company scams by elderly monitoring?

* Duration: Was the weak point the outcome of a short-lived malfunction or an extra systemic issue?

* Pervasiveness: Does the weak point associate with issues that may have a prevalent result on monetary coverage?

* Relevance: Is the weak point pertaining to a procedure that is crucial to the firm?

* Investigation: Is the weak point pertaining to a present governing examination or legal action?

* History: Does the firm have a background of restatements?

* Management response: How has administration responded to the product weak point?

* Tone on top: Does the weak point stand for a worry about the “tone on top”? – NU

The post Public Companies Provide New Disclosures to Investors appeared first on Get Funding For Your Business And Ventures.

The post Public Companies Provide New Disclosures to Investors appeared first on Buy It At A Bargain – Deals And Reviews.

Kable (YC W22) is hiring Founding Engineers to solve Billing for API companies

Article URL: https://www.ycombinator.com/companies/kable/jobs/7YUZkyG-founding-full-stack-software-engineer

Comments URL: https://news.ycombinator.com/item?id=31303271

Points: 1

# Comments: 0

Best Dropshipping Companies

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

Dropshipping makes it possible to sell products online–without having to purchase, store, or ship inventory. That’s right, you can operate an ecommerce site from your couch without ever touching the products you’re selling.

But in order to do this successfully, you’ll need to find a dropshipping company to handle the logistics of fulfilling orders.

Whether you have an existing ecommerce business or you’re new to selling online, this guide will help you find the best dropshipping company for your unique needs.

Continue below to learn more about my top recommendations and strategy for evaluating different options.

#1 – SaleHoo Review — The Best Wholesale Directory

SaleHoo is one of the most popular wholesaler directory platforms on the market today. A membership grants you access to 2.5+ million products from 8,000+ suppliers.

With SaleHoo, you can find products and start selling them online in a matter of minutes.

For 15+ years, more than 137,000 people have used SaleHoo to sell online with dropshipping services. Here are some other reasons why they come so highly recommended:

- All suppliers have been pre-vetted

- Unlimited dropshipping training

- Award-winning customer support

- Plans are backed by a 60-day money-back guarantee

- Market research tools for hot products and high profit margins

- Easy to navigate with a modern interface

- Ability to automate your online store

Annual pricing for the SaleHoo supplier directory costs $67. Alternatively, you can pay a one-time fee of $127 for lifetime access. Try it risk-free.

#2 – Oberlo Review — The Best for Shopify Stores

If you’re using Shopify to sell online, look no farther than Oberlo. The platform integrates seamlessly with your Shopify store, so you can start dropshipping with ease.

More than 100 million products have been sold online with Oberlo.

Oberlo is free for basic use, but you’ll definitely want to upgrade to a paid plan, or you’ll be limited with what you can accomplish. Some of the top features include:

- Unlimited monthly orders

- Free Oberlo Chrome extension

- Bulk orders

- Real-time order tracking

- Variant mapping

- CAPTCHA solver

- Ebooks, guides, and free learning tools

- 24/7 customer support

- Customizable listing information

- Powerful product data

Paid plans start at $29.90 per month. This entry-level plan supports up to 10,000 products. You can join Oberlo for free to get started.

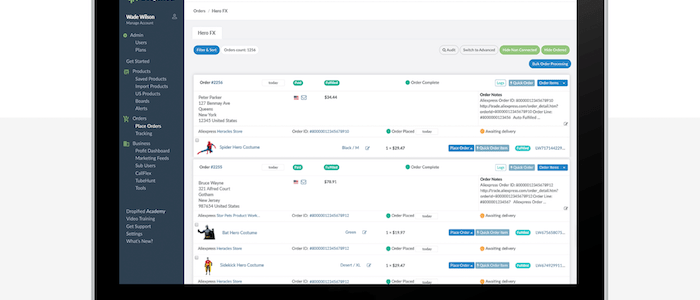

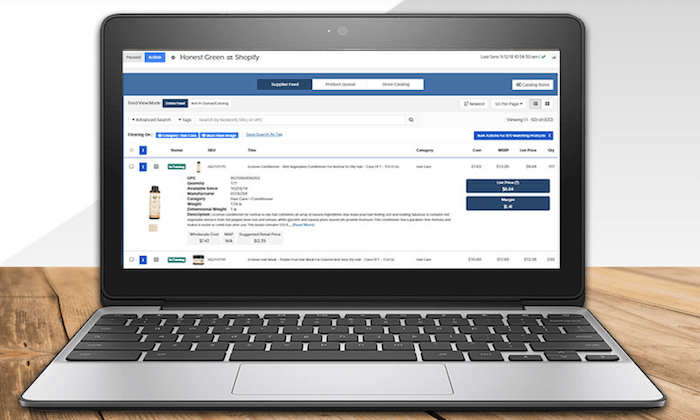

#3 – Dropified Review — The Best for eBay Sourcing

Dropified is another popular dropshipping solution. It seamlessly integrates with ecommerce platforms like Shopify, WooCommerce, BigCommerce, and more.

Unlike other dropshipping tools, Dropfied is also compatible with eBay and AliExpress.

If you’re using eBay or AliExpress for inventory, Dropfied eliminates the need to copy and paste customer order details. These orders can automatically be shipped to your customers directly from the supplier.

Other top features and perks of using Dropfied include:

- Automatic order fulfillment

- Automatic price change updates

- Dynamic Facebook feeds

- Automatic product availability updates

- Simple product variant setups

- Easy product filtering

- Product and inventory sync

- Add to your ecommerce store with a single click

- Product customization

- Automatically import product reviews from vendors

- Easy to change vendors for different products

This list of features and benefits goes on and on. It’s quite extensive, to say the least. Dropified plans start at $47 per month. The entry-level plan supports 15,000 products and unlimited monthly orders. Try it free for 14 days.

#4 – Inventory Source Review — The Best Dropshipping Automation Software

Inventory Source is a bit unique compared to other dropshipping companies on our list. They provide software to facilitate dropshipping automation.

To improve the logistics with your existing suppliers, Inventory Source will be a great option for you to consider.

Here’s why I like Inventory Source so much:

- Integrates with 25+ ecommerce platforms (Shopify, eBay, Amazon, Walmart, Magento, WooCommerce, etc.)

- Full product data integration

- Dropship order automation

- Automatic inventory sync

- Free directory of 230+ suppliers

- Ability to add your own suppliers outside of the Inventory Source directory

- Bulk feed management tools

Overall, the software is really easy to set up. It will benefit you and your suppliers alike. Plans start at $99 per month. You can create an account for free to browse supplier product feeds, automation tools, and integrations.

#5 – Wholesale2b Review — The Best Free and Simple Dropshipping Company

More than one million products are available on Wholesale2b. The platform makes it easy for anyone to integrate dropshippers to their online store.

Wholesale2b is compatible with multiple sales channels and online marketplaces like Amazon, WooCommerce, Shopify, BigCommerce, Ecwid, eBay, Magento, and more.

You don’t have to sign up with dozens of suppliers to get what you want–your single Wholesale2b account will give you access to more than 1 million products.

Here are some of the other top reasons why Wholesale2b ranks so high on my list:

- Free to sign up; no credit card required

- Easy to get started

- Extensive product catalog with options from multiple categories and industries

- 100+ dropshippers in the Wholesale2b network

- Automatic order imports and inventory tracking

- Ability to create a new turnkey ecommerce site from scratch

Whether you have an existing online store you’re planning to start a new ecommerce business, Wholesale2b has you covered. Sign up and try it today—it’s free.

#6 – Megagoods Review — The Best for Consumer Electronics

Megagoods is my top recommendation for online retailers in the consumer electronics space.

They provide fast shipping, efficient processing, and have a great selection of brand name electronics products.

Here are some of the most popular product categories offered through the Megagoods platform:

- Headphones

- Alarm clocks

- Car audio

- Televisions

- Speakers

- Home theaters

- DVD players

- DJ products

- Bluetooth products

- PA systems

- Portable electronics

- Gaming products

In addition to the extensive electronics options, Megagoods also supplies items like watches, kitchen appliances, cutlery, cookware sets, and more.

The interface is a little outdated, but a Megagoods subscription costs just $14.99 per month. This membership fee gives you access to exclusive pricing. Try it free for 30 days.

#7 – Doba Review — The Most Versatile Dropshipping Company

Doba is one of the most popular dropshipping services on the market today. Its popularity is largely due to the fact that it can accommodate such a wide range of ecommerce shops with varying needs.

With Doba, you’ll have access to millions of products from hundreds of suppliers in a single online catalog. Keep all your products for sale synced, even if you’re selling across eBay, Shopify, Amazon and other online marketplaces.

Other noteworthy highlights of Doba include:

- Compatible with 100+ ecommerce platforms including Shopify, Magento, BigCommerce, Volusion, eBay, Amazon, etc.

- Information on each supplier (average processing time, fulfillment rates, cost, etc.)

- Manage product lists and discover trending products

- Advanced search and filtering

- Data exports in a wide range of formats

- Inventory management tools

- Proactive inventory and price change alerts

Plans start at $29 per month. If you sign up for an annual subscription, you’ll get two months for free. Try it free for 30 days.

What I Looked at to Find the Best Dropshipping Company

There are hundreds, if not thousands of different dropshipping companies on the market today.

Without a buying guide to follow, narrowing down your options can seem like an insurmountable task. To make your life easier, follow the methodology that I’ve outlined below.

These are the factors that you should take into consideration as you’re researching and evaluating different dropshipping solutions.

Type of Dropshipping Company

There are a few different kinds of dropshipping companies. The first thing you need to do is determine what type of company will meet the requirements and goals of your business.

Do you need a manufacturer? Wholesale supplier? Supplier directory? In some instances, you might just be looking for dropshipping software to facilitate your existing supplier relationship.

Here are some of the major types of dropshipping options you are likely to encounter:

- Dropshipping Marketplaces are online platforms with a network of different dropshipping companies. You’ll be able to facilitate your entire operation and manage the relationships between different dropshippers from a single place.

- Manufacturers may let you buy straight from them, getting the lowest possible whole inventory prices. Not every manufacturer will let you dropship—you may have to use dropshipping software and set up the arrangement yourself.

- Supplier directories don’t actually handle dropshipping. Similar to an online marketplace, it’s a single location for you to find various suppliers. Typicall, you have to pay a membership fee to the directory.

- Dropshipping software is a great way for online stores to automate order fulfillment with their suppliers and manufacturers. These tools eliminate the need for ecommerce shops to manually enter order details after something is purchased through their online sales channels.

Ecommerce Platform

Next, you need to make sure that the company you’re considering supports your ecommerce platform. It’s worth noting that not all dropshipping solutions are compatible with every ecommerce website.

For example, online stores using Shopify won’t necessarily be using the same dropshipping company as a business selling via eBay or Amazon. A brick-and-mortar retailer that wants to add an online sales channel won’t have the same needs as new business selling via Wix or WooCommerce.

So verifying the compatibility between your online sales channel and the dropshipping company’s logistics will be a great way to narrow down your choices.

Wholesale Pricing

In addition to the logistical benefits of dropshipping, you’ll also have access to wholesale rates. But like any type of inventory, those prices will vary from supplier to supplier.

Some dropshipping companies force you to pay a monthly or annual membership for access to wholesale pricing. In many cases, these membership fees are well-worth the discounts you’ll get as a result. But usually, the manufacturers will offer the best rates if you buy directly through them.

You’ll have to walk the line between what makes sense for your convenience vs. profit margins.

Industry and Products

What products are you selling? What are you planning to sell online?

The answer to these questions will definitely impact the dropshipping company you choose. If you’re selling shirts and hats, you probably won’t have the same dropshipping needs as an online store that sells computers, headphones, and other electronics.

Are you selling brand name products? Or will you be putting your own logo on inventory?

These are other questions to consider as you’re evaluating prospective solutions.

Process Automation

The best dropshipping companies leverage automation, which allows you to be as hands-off as possible.

You need to understand the logistics between how orders get processed from company to company. What happens after a customer buys something online? How does that order ultimately end up at their doorstep? The answer varies depending on the solution you choose.

In some cases, you’ll have to manually enter those order details from your own website to the dropshipping platform. But with an automated process, you won’t have to do anything. An online order will automatically be sent to the supplier without any extra steps on your end.

For those of you who already have relationships with suppliers, you can leverage dropshipping software to automate your fulfillment process.

Quality and Speed

Even though you’re not touching the products with dropshipping, your company is still responsible for the product itself.

The customer doesn’t care where the product came from or who shipped it. They expect high-quality products delivered quickly. If the dropshipping company you’re using takes weeks to ship and delivers defective products, it’s going to be a poor reflection of your company—not theirs.

So choose a company with an established reputation in this space. You might have to pay a little extra for the inventory, but it’s worth it to keep your customers satisfied.

Conclusion

The concept of dropshipping is extremely appealing for anyone interested in selling online. But it only works well if you’re using the right dropshipping company.

Which dropshipping company is the best? It depends on your needs. Let’s review my entire list of recommendations:

- SaleHoo — Best Wholesale Directory

- Oberlo — Best for Shopify Stores

- Dropified— Best for eBay sourcing

- Inventory Source — Best dropshipping automation software

- Wholesale2b — Best free and simple dropshipping company

- Megagoods — Best for consumer electronics

- Doba — The most versatile dropshipping company

So Wholesale2b is my top overall pick. It’s going to work really well for most businesses. But as you can see, other options may work better depending on how your business is set up.

Just use the recommendations and buying guide explained in this post to find the best dropshipping services for your online store.

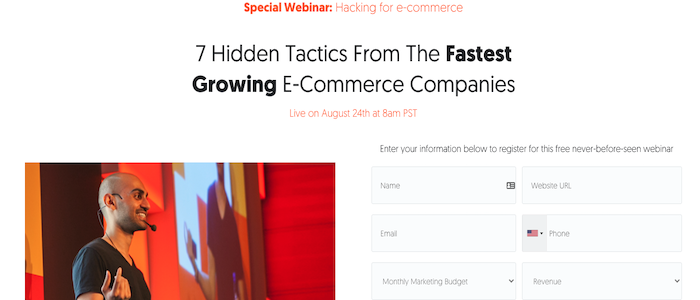

Upcoming Free Webinar: 7 Hidden Tactics From The Fastest Growing E-Commerce Companies

Are you struggling to grow your e-commerce business?

Sick of low conversion rates?

You’re not alone.

On average, only 3% of e-commerce website visitors converted into customers.

Yikes.

Yet, brands like the Dollar Shave Club and AppSumo are making millions even during a global pandemic.

You want to join their ranks, but you’re just not sure what you’re doing wrong. It feels like everyone else is in on some secret recipe to success.

On August 24 at 8 am PST, I’m exposing the hidden tactics the fastest growing e-commerce brands are using to dominate the online shopping industry with a free webinar.

Along with my co-host, Matthew Santos, VP of Products and Strategy at NP Accel, and Brooke Hess, Senior Director, Paid Media at NP Digital, we’ll break down how you can implement each one to boost your e-commerce sales.

It’s free. Register here.

What Will You Learn?

Since opening my agency, NP Digital, I’ve worked with companies of all sizes, including some of the world’s fastest-growing e-commerce brands.

I’ve seen first-hand the unique strategies these companies use to generate targeted traffic, attract quality leads, and convert shoppers into paying customers.

The best part? These e-commerce sales tactics work for brands of all sizes. Whether you’re just starting or you already have some skin in the game, these strategies can work for you.

Here are some of the specific things we will teach you:

- E-commerce SEO: Learn how to generate free, recurring, and high-converting traffic with SEO practices no one else is talking about.

- Paid advertising: Discover how to multiply your results and increase your conversion rate even with a small paid ads budget.

- E-commerce CRO: Uncover the powerful strategies fast-growing e-commerce brands use to improve conversion rate optimization (CRO).

These points are only scratching the surface of what you’ll learn.

Conclusion

One of the best ways to become successful in business is to look for clues. Brands leave breadcrumbs you can follow and reverse engineer to your benefit.

We’ll show you how to spot these clues and give you actionable advice on implementing these strategies to skyrocket your e-commerce brand’s growth.

Whether you’re just starting or you’re feeling stuck, these tactics will change the game for you.

Register for the webinar, and I’ll see you on August 24 at 8 am PST.

PS: If you want my team to implement these hacks and manage your e-commerce business, go here.

When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do …

The Perfect Business Credit Portfolio Includes Vehicle Financing

Does your business need vehicles to get the work done? This can be any number of kinds of vehicles, such as trucks for deliveries and hauling, sprinter vans, company cars, and even vans to facilitate commuting for your employees. Vehicle financing can be a smart way to afford all of them.

Vehicle Financing in a Nutshell

Much like you probably didn’t buy your personal vehicle outright, financing is a great way to go in order to get a vehicle now, without having to wait until you can just pay cash and drive it off the lot. With a car for personal use, your choices are usually buying or leasing. Providers include banks like Bank of America or the financing arm of the manufacturer, such as Chrysler Capital.

Commercial vehicle funding has certain parameters. Whether a vehicle is purchased new or used will affect the number of years you can finance the vehicle and the rates you will pay. If a vehicle is used, then the number of miles on it will also affect terms. Plus, business owners may be required to personally guarantee vehicle loans. If you are a co-borrower the loan will most likely report to your personal credit report. Some loans have a prepayment penalty and charge you for paying ahead.

In general, the following will eliminate the need to provide a personal guarantee for this type of financing: good business credit, a decent amount of time in business or good personal credit. And much like with any other kind of business borrowing, the more assurances you can give the lender, the better.

Basic Terms and Qualifying

You need to establish the amount of money you have for a down payment, and the vehicle you need. Plus, you must establish the costs associated with buying the vehicle.

You’ll need to provide documentation that proves you are the owner of a business. This includes business licenses, partnership agreements, LLC documents, and articles of incorporation (if applicable), listing you as having at least a 20% stake in the business.

You may also have to provide personal documentation like personal credit score and credit history. If you are a sole proprietor and the business is under your Social Security number, you are the borrower and guarantor. Hence you are personally liable for repaying the loan. It is also a good idea to have a loan proposal. A loan proposal should detail your business, loan needs, and financial statements.

Good Business Credit Can Help

If your company needs vehicles for operation build your business credit. This, way you will be able to qualify with no PG. Having this ability can give you the freedom to grow your fleet, and without your signature. More on this later. First, let’s look at those four keys to financing.

Demolish your funding problems with 27 killer ways to get cash for your business.

Vehicle Financing Key #1: Using Business Credit for Vehicle Financing

You can even finance a vehicle purchase or lease through our Business Credit Builder. These offers are in Tier 4, so these lenders will have certain requirements that business credit neophytes just won’t be able to meet. Lenders will want to see that you have the income to support the purchase.

As an example, consider Ford Commercial Vehicle Financing.

Ford Commercial Vehicle Financing Through Credit Suite

Ford offers several commercial funding options. These include loans, lines, and leases to actual business entities. This is not for sole proprietorships. You can get a loan or a lease.

Ford may ask for a Personal Guarantee (PG) if you don’t get an approval on the merit of your application. Apply at the dealership. Ford will report to D&B, Experian, and Equifax.

Ford Commercial Vehicle Financing: Terms and Qualifying

To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable) and a business bank account

You will need to have a strong business credit history. And you must have a good Experian business credit score.

Demolish your funding problems with 27 killer ways to get cash for your business.

Ally Car Financing Through Credit Suite

Ally provides personal financing. But Ally will also report to business credit bureaus. If your business qualifies for financing without the owner’s guarantee, you can get financing in the business name only. Ally will report to D&B, Experian, and Equifax

Ally Car Financing: Terms and Qualifying

For Ally Commercial Line of Credit, to qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

- Bank reference

- Fleet financing references

If you use a personal guarantee, Ally will not report to the personal credit bureaus unless the account defaults.

With Ally Commercial Vehicle Financing, you can get a lease or a loan. To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

There is no minimum time in business requirement. Apply in person only, dealer will advise if approval or Personal Guarantee (PG) needed.

Demolish your funding problems with 27 killer ways to get cash for your business.

Vehicle Financing Key #2: Credit Line Hybrid

Yet another potential form of vehicle financing is through the Credit Suite Credit Line Hybrid. A credit line hybrid is a form of unsecured funding. Our credit line hybrid has an even better interest rate than a secured loan. Get some of the highest loan amounts and credit lines for businesses. Get 0% business credit cards with stated income. These report to business CRAs. So you can build business credit at the same time. This will get you access to even more cash with no personal guarantee.

Credit Line Hybrid: Terms and Qualifying

You need a good credit score or a guarantor with good credit to get an approval (a FICO score of at least 680). No financials are necessary. You can often get a loan of five times the amount of current highest revolving credit limit account. This is up to $150,000.

Vehicle Financing Key #3: 401(k) Financing

Another option for vehicle financing is using your 401(k) as collateral. This is not a loan. You will not have to pay an early withdrawal fee or a tax penalty. You put the money back by contributing, just like with any 401(k) program. This means you won’t lose your retirement funds. This is a 401(k) Rollover for Working Capital program. The IRS calls it a Rollover for Business Startups (ROBS).

Per the IRS, a ROBS qualified plan is a separate entity with its own set of requirements. The plan, through its company stock investments, rather than the individual owns the trade or business. Therefore, some filing exceptions for individuals may not apply to such a plan. This type of financing isn’t a loan against, your 401(k), so there’s no interest to pay. It does not use the 401(k) or stocks as collateral. Instead, this is simply a movement or change of custodian.

401(k) Financing: Terms and Qualifying

Pay low rates, often less than 5%. Your 401(k) will need to have more than $35,000 in it. You can usually get up to 100% of what’s “rollable” within your 401(k) . The lender will want to see a copy of your two most recent 401(k) statements.

You can get 401(k) financing even with severely challenged personal credit. The 401(k) you use cannot be from a business where you are currently employed. So it will need to be from older employment. You cannot be currently contributing to it.

Vehicle Financing Key #4: SBA 504 Loans

The SBA 504 loan can be used to purchase “Long-term machinery and equipment”. As a result, it’s not a standard car loan. But you can purchase a truck with it. You can use an SBA 504 loan when the vehicles being purchased qualify as heavy equipment.

Some examples of trucks as ‘heavy equipment’ can include:

- Cement trucks

- Dump trucks

- Custom-build heavy trucks fit for specific purposes (loading/unloading septic tanks, for instance)

- Semis and tanker trailer trucks

If your vehicle needs run in this direction, then an SBA loan could be perfect for your needs.

SBA 504 Loans and Credit Suite

Did you know that you can get SBA loans through Credit Suite? Established businesses with tax returns that show good revenues and profitability can get very large sums of funding with Secured Small Business Loans. If you have positive business tax returns, you should apply for secured government-backed SBA program loans from $250,000 up to $12,000,000. Approval amounts will vary based on the collateral your business has, and the amount of net profit reflected on your tax returns.

The total time to close these loans is about 2-4 months. SBA loans offer some of the longest payback terms available for business financing. Get loan terms for 10, 15, or even 25 years with the SBA. Interest will total approximately 3% of the debt. The rate may be financed with the loan.

Get approved for up to $12 million. Your credit will have to be of good quality. Your collateral will need to equal 50% of the loan amount. Financials will be necessary.

SBA 504 Loans Through Credit Suite: Documentation

The SBA will require certain documentation to qualify including:

- Business and personal financials

- Resume and background information

- Personal and business credit reports

- Your business plan

- Bank statements

- Collateral and any other documentation relevant to the transaction

Vehicle Financing: Takeaways

Getting vehicle funding involves variables like whether the vehicle is new or used. Heavy vehicles like dump trucks can be paid for with SBA 504 loans. There is a possibility that you would have to provide a personal guarantee to get a loan or lease. Credit Suite offers financing that you can use to purchase vehicles, and we offer even more options through our Business Finance Suite. There are four keys to open the door to affording vehicles for your business. And there are a lot of options. Let’s explore them together.

The post When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do … appeared first on Credit Suite.

The post When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do … appeared first on Business Marketplace Product Reviews.

The post When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do … appeared first on Buy It At A Bargain – Deals And Reviews.

When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do …

The Perfect Business Credit Portfolio Includes Vehicle Financing

Does your business need vehicles to get the work done? This can be any number of kinds of vehicles, such as trucks for deliveries and hauling, sprinter vans, company cars, and even vans to facilitate commuting for your employees. Vehicle financing can be a smart way to afford all of them.

Vehicle Financing in a Nutshell

Much like you probably didn’t buy your personal vehicle outright, financing is a great way to go in order to get a vehicle now, without having to wait until you can just pay cash and drive it off the lot. With a car for personal use, your choices are usually buying or leasing. Providers include banks like Bank of America or the financing arm of the manufacturer, such as Chrysler Capital.

Commercial vehicle funding has certain parameters. Whether a vehicle is purchased new or used will affect the number of years you can finance the vehicle and the rates you will pay. If a vehicle is used, then the number of miles on it will also affect terms. Plus, business owners may be required to personally guarantee vehicle loans. If you are a co-borrower the loan will most likely report to your personal credit report. Some loans have a prepayment penalty and charge you for paying ahead.

In general, the following will eliminate the need to provide a personal guarantee for this type of financing: good business credit, a decent amount of time in business or good personal credit. And much like with any other kind of business borrowing, the more assurances you can give the lender, the better.

Basic Terms and Qualifying

You need to establish the amount of money you have for a down payment, and the vehicle you need. Plus, you must establish the costs associated with buying the vehicle.

You’ll need to provide documentation that proves you are the owner of a business. This includes business licenses, partnership agreements, LLC documents, and articles of incorporation (if applicable), listing you as having at least a 20% stake in the business.

You may also have to provide personal documentation like personal credit score and credit history. If you are a sole proprietor and the business is under your Social Security number, you are the borrower and guarantor. Hence you are personally liable for repaying the loan. It is also a good idea to have a loan proposal. A loan proposal should detail your business, loan needs, and financial statements.

Good Business Credit Can Help

If your company needs vehicles for operation build your business credit. This, way you will be able to qualify with no PG. Having this ability can give you the freedom to grow your fleet, and without your signature. More on this later. First, let’s look at those four keys to financing.

Demolish your funding problems with 27 killer ways to get cash for your business.

Vehicle Financing Key #1: Using Business Credit for Vehicle Financing

You can even finance a vehicle purchase or lease through our Business Credit Builder. These offers are in Tier 4, so these lenders will have certain requirements that business credit neophytes just won’t be able to meet. Lenders will want to see that you have the income to support the purchase.

As an example, consider Ford Commercial Vehicle Financing.

Ford Commercial Vehicle Financing Through Credit Suite

Ford offers several commercial funding options. These include loans, lines, and leases to actual business entities. This is not for sole proprietorships. You can get a loan or a lease.

Ford may ask for a Personal Guarantee (PG) if you don’t get an approval on the merit of your application. Apply at the dealership. Ford will report to D&B, Experian, and Equifax.

Ford Commercial Vehicle Financing: Terms and Qualifying

To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable) and a business bank account

You will need to have a strong business credit history. And you must have a good Experian business credit score.

Demolish your funding problems with 27 killer ways to get cash for your business.

Ally Car Financing Through Credit Suite

Ally provides personal financing. But Ally will also report to business credit bureaus. If your business qualifies for financing without the owner’s guarantee, you can get financing in the business name only. Ally will report to D&B, Experian, and Equifax

Ally Car Financing: Terms and Qualifying

For Ally Commercial Line of Credit, to qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

- Bank reference

- Fleet financing references

If you use a personal guarantee, Ally will not report to the personal credit bureaus unless the account defaults.

With Ally Commercial Vehicle Financing, you can get a lease or a loan. To qualify, you need:

- Entity in good standing with Secretary of State

- EIN number with IRS

- Business address- matching everywhere

- D-U-N-S number

- Business license (if applicable)

- And a business bank account

There is no minimum time in business requirement. Apply in person only, dealer will advise if approval or Personal Guarantee (PG) needed.

Demolish your funding problems with 27 killer ways to get cash for your business.

Vehicle Financing Key #2: Credit Line Hybrid

Yet another potential form of vehicle financing is through the Credit Suite Credit Line Hybrid. A credit line hybrid is a form of unsecured funding. Our credit line hybrid has an even better interest rate than a secured loan. Get some of the highest loan amounts and credit lines for businesses. Get 0% business credit cards with stated income. These report to business CRAs. So you can build business credit at the same time. This will get you access to even more cash with no personal guarantee.

Credit Line Hybrid: Terms and Qualifying

You need a good credit score or a guarantor with good credit to get an approval (a FICO score of at least 680). No financials are necessary. You can often get a loan of five times the amount of current highest revolving credit limit account. This is up to $150,000.

Vehicle Financing Key #3: 401(k) Financing

Another option for vehicle financing is using your 401(k) as collateral. This is not a loan. You will not have to pay an early withdrawal fee or a tax penalty. You put the money back by contributing, just like with any 401(k) program. This means you won’t lose your retirement funds. This is a 401(k) Rollover for Working Capital program. The IRS calls it a Rollover for Business Startups (ROBS).

Per the IRS, a ROBS qualified plan is a separate entity with its own set of requirements. The plan, through its company stock investments, rather than the individual owns the trade or business. Therefore, some filing exceptions for individuals may not apply to such a plan. This type of financing isn’t a loan against, your 401(k), so there’s no interest to pay. It does not use the 401(k) or stocks as collateral. Instead, this is simply a movement or change of custodian.

401(k) Financing: Terms and Qualifying

Pay low rates, often less than 5%. Your 401(k) will need to have more than $35,000 in it. You can usually get up to 100% of what’s “rollable” within your 401(k) . The lender will want to see a copy of your two most recent 401(k) statements.

You can get 401(k) financing even with severely challenged personal credit. The 401(k) you use cannot be from a business where you are currently employed. So it will need to be from older employment. You cannot be currently contributing to it.

Vehicle Financing Key #4: SBA 504 Loans

The SBA 504 loan can be used to purchase “Long-term machinery and equipment”. As a result, it’s not a standard car loan. But you can purchase a truck with it. You can use an SBA 504 loan when the vehicles being purchased qualify as heavy equipment.

Some examples of trucks as ‘heavy equipment’ can include:

- Cement trucks

- Dump trucks

- Custom-build heavy trucks fit for specific purposes (loading/unloading septic tanks, for instance)

- Semis and tanker trailer trucks

If your vehicle needs run in this direction, then an SBA loan could be perfect for your needs.

SBA 504 Loans and Credit Suite

Did you know that you can get SBA loans through Credit Suite? Established businesses with tax returns that show good revenues and profitability can get very large sums of funding with Secured Small Business Loans. If you have positive business tax returns, you should apply for secured government-backed SBA program loans from $250,000 up to $12,000,000. Approval amounts will vary based on the collateral your business has, and the amount of net profit reflected on your tax returns.

The total time to close these loans is about 2-4 months. SBA loans offer some of the longest payback terms available for business financing. Get loan terms for 10, 15, or even 25 years with the SBA. Interest will total approximately 3% of the debt. The rate may be financed with the loan.

Get approved for up to $12 million. Your credit will have to be of good quality. Your collateral will need to equal 50% of the loan amount. Financials will be necessary.

SBA 504 Loans Through Credit Suite: Documentation

The SBA will require certain documentation to qualify including:

- Business and personal financials

- Resume and background information

- Personal and business credit reports

- Your business plan

- Bank statements

- Collateral and any other documentation relevant to the transaction

Vehicle Financing: Takeaways

Getting vehicle funding involves variables like whether the vehicle is new or used. Heavy vehicles like dump trucks can be paid for with SBA 504 loans. There is a possibility that you would have to provide a personal guarantee to get a loan or lease. Credit Suite offers financing that you can use to purchase vehicles, and we offer even more options through our Business Finance Suite. There are four keys to open the door to affording vehicles for your business. And there are a lot of options. Let’s explore them together.

The post When The Most Successful Companies Look for Fleet and Vehicle Financing … Here’s What They Do … appeared first on Credit Suite.

5 Ways E-Commerce Companies Can Use BrickSeek to Increase Sales

If you’ve heard of BrickSeek, you likely know it’s a powerful tool for consumers, allowing them to track down inventory and find the best deals at big retailers.

However, once you scratch beneath the surface, you’ll find out there’s a lot more to BrickSeek. Far from just a customer-facing app, it has a lot to offer e-commerce companies.

In this guide, I’m going to explain how e-tailers can start using BrickSeek right now to boost their sales and revenue.

What Is BrickSeek?

I’ve written before about BrickSeek’s feature set and how consumers can use it to find hidden inventory sales, so for a more in-depth explanation of the app, check out my previous article.

However, to give a brief overview, BrickSeek started out in 2014 as a web application enabling LEGO collectors to track down popular sets online and in-store.

Then it branched out, leveraging the same technology to help users find inventory levels, sales, and clearance deals at some of the nation’s largest retailers, including:

- Amazon

- Best Buy

- Lowe’s

- Macy’s

- Office Depot

- Target

- Walmart

Why Should E-Commerce Companies Use BrickSeek?

The same things that make BrickSeek such a useful tool for consumers also make it a potentially invaluable resource for online retailers. Think about it. Wouldn’t you love to know:

- How much of a certain product your biggest rivals have in stock?

- How much other brands are charging for a specific item?

- Which products are being marked down, and in which locations?

- Which products are attracting the most interest from shoppers?

You can find all that information and much more on BrickSeek. In other words, it can be a vital source of competitive information if you know how to use it intelligently. It’s almost like having your own network of spies inside your rivals’ warehouses. Who wouldn’t want that?

Ways E-Commerce Companies Can Use BrickSeek to Increase Revenue and Sales

If you’re an e-commerce store owner, here are a few ways you can use BrickSeek in your business:

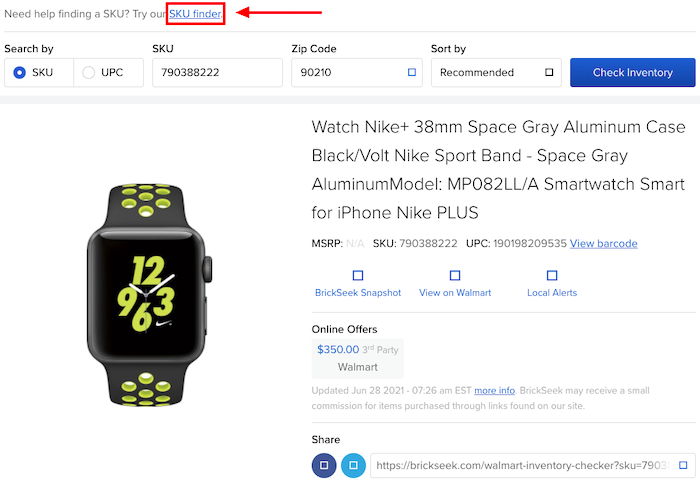

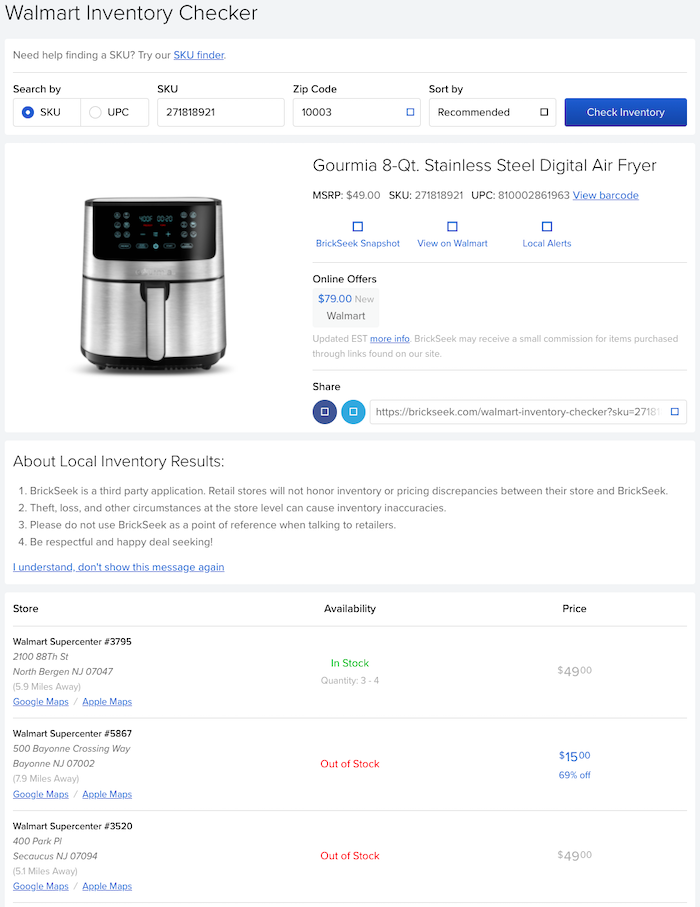

1. Use BrickSeek to Help You Set Your Prices

Do you sell the same products as your rivals? Then it’s vital you get your pricing right. After all, 91 percent of consumers say product price impacts their online purchase decisions, ahead of factors like free shipping (78 percent), brand preference (65 percent), and recommendations from friends and family (60 percent).

Set your prices too low and you won’t earn enough margin, which eats into your profits. Set them too high and you won’t drive enough sales. Get them just right and you’re well-placed to increase sales and revenue.

That’s where BrickSeek comes in.

First, search for a product’s stock-keeping unit (SKU) or universal product code (UPC). You can either find this through the website of the retailer in question or by using BrickSeek’s built-in SKU finder:

Then run a search on the SKU, using a zip code that aligns with an area you cover, to be presented with all the pricing information for your chosen product. Now you know how much you can afford to charge.

2. Use BrickSeek to Buy Materials for Cheap

Just because you sell products to consumers doesn’t mean you’re solely a B2C business. After all, your products need to come from somewhere. If you do some of your own manufacturing, you’ll need to source your own materials, too.

In those instances, you can simply access BrickSeek as if you’re a consumer, using the app to track down wholesale-standard prices on the products and materials you require.

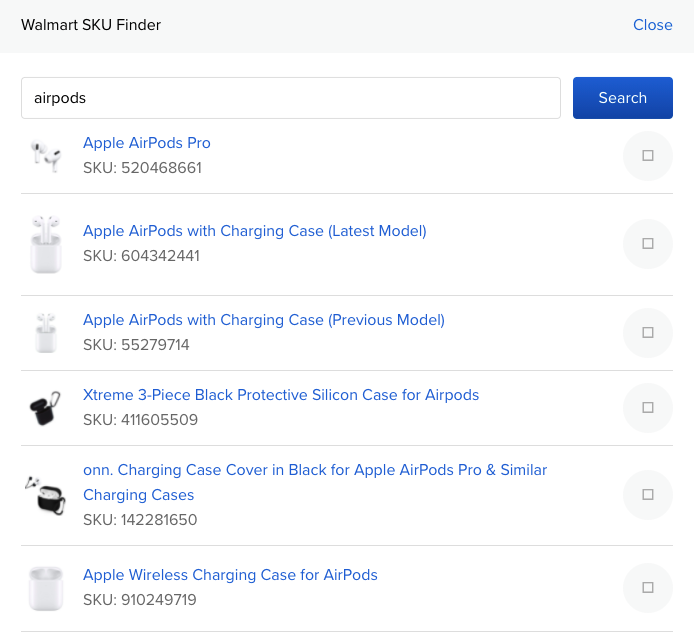

3. Save Time Checking Retailer Inventory

Looking for the best prices on products to sell is a time-consuming endeavor. BrickSeek helps you do it faster as you can quickly check the inventory from many different retailers.

Just enter the SKU or UPC using the same steps I described earlier, enter a relevant zip code, then hit “Check Inventory” to immediately see stock and pricing information from a given retailer on a specific product:

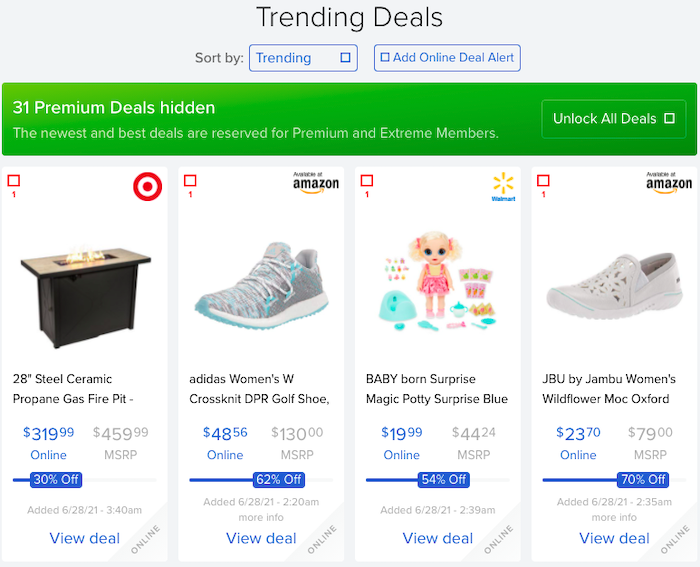

4. Discover Hot Sellers

Running a successful e-commerce business hinges mainly on knowing the right products to sell. This is something else BrickSeek can help you with. By checking the inventory of the retailers the platform supports, you can pick trends in products that move fast. That’s an indicator of which products you should consider selling.

5. Monitor Market Trends

The secret to success and longevity in the e-commerce industry is understanding market trends. That’s where BrickSeek’s top product searches feature comes in. By observing the products your customers frequently search for, you can anticipate trends in your niche. Monitoring market trends will help you make data-based decisions to help you stay ahead of the curve and your competitors.

FAQs About BrickSeek

Yes, BrickSeek is a legitimate tool for finding pricing information and inventory levels, as demonstrated by its A- rating from the Better Business Bureau.

While it’s definitely legitimate, BrickSeek isn’t always 100 percent accurate, as with any third-party tool. The site freely admits retailers will not honor inventory or pricing discrepancies between BrickSeek and “real life.”

All the inventory information provided through BrickSeek’s inventory checker is collected in real-time when you do a search.

At the time of writing, the BrickSeek app is in beta testing and is only available to Premium and Extreme members. In other words, you can’t currently access it without a paid BrickSeek account. If you’re a paying subscriber, you can request access to the Android or iOS apps here.

BrickSeek for E-Commerce Companies Conclusion

In less than a decade, BrickSeek has gone from being a simple, niche tool for finding obscure LEGO sets to a potentially mass-market app offering huge value to consumers and retailers alike. That’s some transformation!

Use BrickSeek intelligently, and you can gain unique insights on your biggest rivals, which in turn can help you:

- set competitive pricing

- pick up bargain prices on raw materials and products

- understand when other retailers are struggling to access stock on key product lines

- figure out whether a new product is worth selling based on levels of consumer interest

- keep track of trends in your market

Best of all, BrickSeek is still comparatively underutilized among e-commerce companies. By learning how to make it work for your brand, you can position yourself to beat your competition.

What do you think are the biggest reasons for retailers to start using BrickSee