SEO vs PPC: Pros, Cons, & Everything In Between

“Which is better, SEO vs PPC?”

If there’s one question I get asked more than any other, this is it.

Everyone wants to know who wins in the battle and where they should spend their marketing dollars. And everyone hates when I tell them there isn’t an easy answer.

Like everything else, it depends.

Neither SEO nor PPC is fundamentally better than the other. As you’ll discover in this article, each tactic has its own set of advantages and disadvantages.

What is almost always true is that SEO and PPC work better together. Don’t believe me? I’ll prove it. In this article, I will:

- Guide you through the positives and negatives of both digital marketing strategies

- Show how each of them supports your business

- Show you how PPC and SEO work together

Ready? Then let’s look at my favorite digital marketing strategy first.

How SEO Supports Your Business

If you need a search engine optimization primer, read my guide to SEO before going any further. If you don’t, you should already have a pretty solid understanding of how ranking on a search engine’s result pages can generate awesome traffic that grows your business.

Almost any business can benefit from the free traffic that search engines like Google send their way, but that’s not to say SEO should definitely be the be-all-end-all when it comes to marketing strategies. As you’ll read below, while there are plenty of benefits of SEO, there are also a couple of drawbacks to be aware of.

Pros of SEO

It’s cost-effective. SEO can be one of the cheapest forms of marketing and an incredibly cost-effective way of growing your brand. You don’t have to pay to receive organic traffic, and you can do much of the work yourself. But even using an SEO agency is much more cost-effective than PPC.

It delivers long-term results. If you do SEO correctly, your efforts can pay dividends for years to come. Not only will you avoid Google penalties, but SEO also has a habit of compounding. The top pages get more backlinks by virtue of being the top-ranked pages on Google. In turn, that makes them even more likely to continue ranking high in the future.

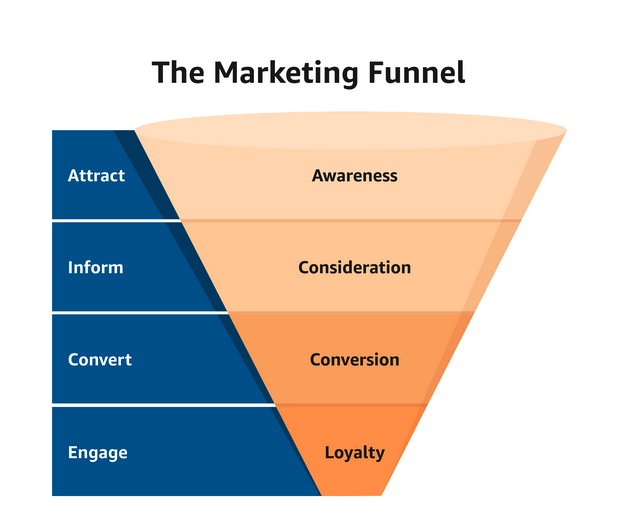

It targets every part of your funnel. Consumers are using Google at every stage of the buyer’s journey. That makes SEO one of the few digital marketing strategies to target every part of the sales funnel. Use SEO to engage customers early in their journey, and you should be able to significantly decrease acquisition costs.

Great brand awareness and trust. The more you appear on Google, the more consumers will trust your brand. And unlike PPC, you don’t have to spend a fortune to dominate the search results. With a focus on content marketing, you can become the go-to resource for your industry, appearing for every relevant keyword and positioning your brand as the trusted authority.

Cons of SEO

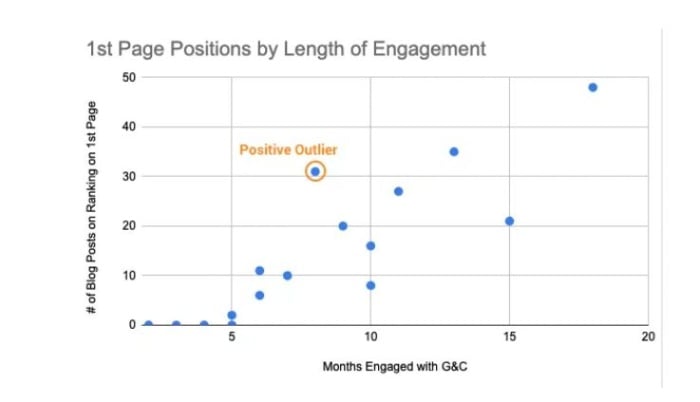

It takes time. Your SEO efforts aren’t going to drive instant results. It can take between six months and a year to see significant traction. As you can see from the graph below from content marketing agency Grow & Convert, there is a direct correlation between the length of engagement and the number of first-page rankings. Results can occur faster, but SEO may not be your best bet if you need to drive traffic now. That doesn’t mean you should avoid it, however. The sooner you start with SEO, the quicker you’ll see the kind of long-term results I described above.

You need to keep investing. While you can stop all SEO efforts and continue to see excellent results, I wouldn’t recommend it. In order to keep competing with the top brands, you’ll need to continue to publish new content, update existing articles and stay on top of the latest advice from Google.

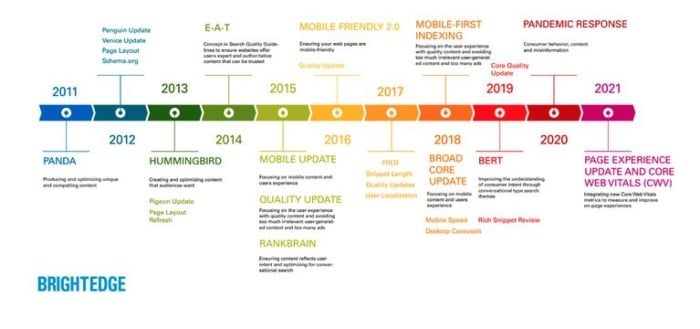

You must be precise. You can’t half-heartedly work on SEO. Because Google and other search engines are constantly updating their algorithms and penalizing sites that use black and gray hat optimization techniques, you need to do SEO the right way. Trying to cheat the system and get quick wins will only see you end up with a penalty. And once you get penalized by Google, it’s far from easy to recover.

It requires a high level of skill. While anyone can do the work of an SEO in theory, being successful is another thing entirely. Not only is there a lot to know because of the complex nature of Google’s algorithm, but the work can be incredibly time-consuming. So even if you follow my advice, you may not necessarily have the resources to create content, optimize your on-page elements and build links. That’s why most people will look to hire an SEO consultant or an SEO agency, instead of doing the work themselves.

How PPC Supports Your Businesses

PPC stands for Pay Per Click Marketing. It is the practice of using paid advertising on search engines like Google and Bing to drive targeted traffic to your website. If you need more information on the basics of PPC, check out my overview of PPC before reading on.

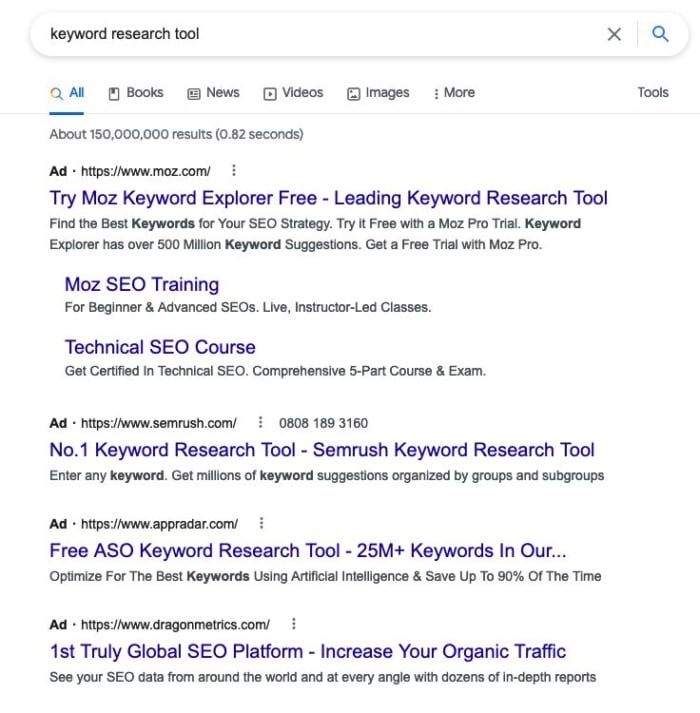

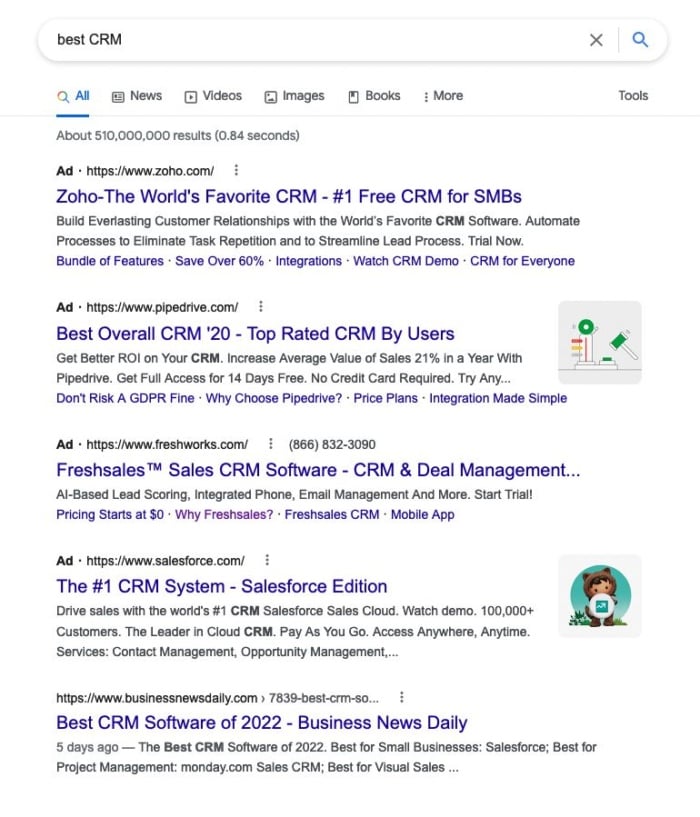

As you can see from the screenshot above, PPC gives you the opportunity to appear at the very top of search engines. I’ll show you below just how powerful that can be. But don’t think that kind of placement comes for free. Among the biggest cons of PPC is the price you have to pay.

Let’s dig into those pros and cons further.

Pros of PPC

It delivers instant results. PPC is possibly the only digital marketing strategy where you can see results the same day you launch a campaign. The same certainly can’t be said for SEO. Of course, you’ll need to pay a lot to achieve fast results, and you’ll still need to create a great landing page, but it’s certainly possible to see a return on your investment within a week. You can scale results quickly, too. If your ads and landing pages convert, then acquiring more visitors is usually just a case of spending more money on ads.

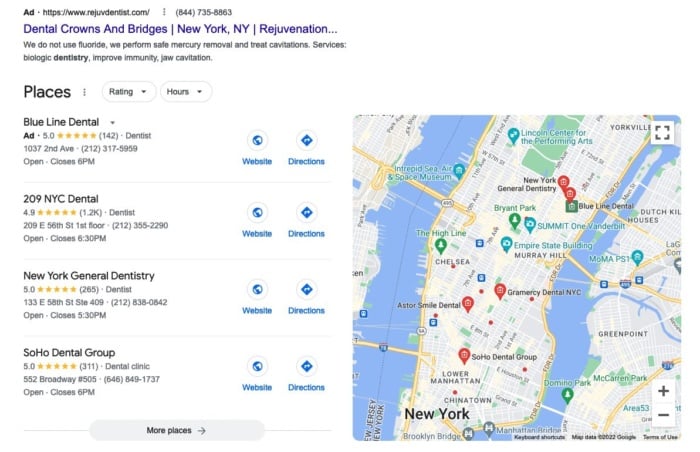

It offers exceptional visibility. PPC ads are the first thing users see on desktop and mobile searches. Better yet, Google now makes it far less obvious that the top results are paid ads. In some cases, there can be as many as four paid ad spots before the organic results, as well as shopping ads. PPC ads also let you highlight key business information like your phone number and site links in a way that SEO doesn’t.

You get high-intent clicks. Most of the users clicking on your PPC ads will be close to making a purchase. That’s because most PPC ads only target high-intent commercial keywords. As a result, conversation rates are much higher for PPC than SEO. It also means it’s much easier to track to what extent PPC ads drive revenue.

Great data. You will generate a serious amount of data when you run a PPC campaign. You’ll see which ads work, which keywords drive the most traffic, and which landing pages convert best. That makes it easy to optimize your campaigns to increase return on ad spend while decreasing costs. It will also give you data you can use to improve your SEO and other digital marketing campaigns.

Cons of PPC

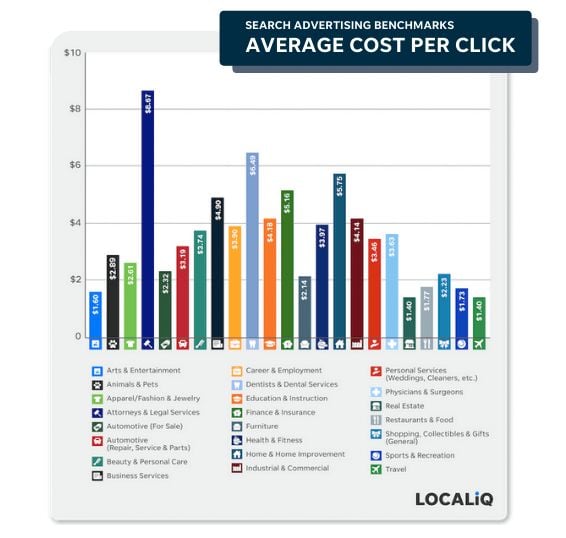

You have to pay to play. Unlike SEO, which can drive traffic for little to no money, you will need to have a pretty significant marketing budget to see results with PPC marketing. When we talk about industry-specific cost-per-click, it gets even higher, especially when talking about the legal and medical worlds. That’s fine as long as your ads are good, your landing pages convert, and you see a return on your ad spend. But that’s not always the case. Often, you can blow through hundreds or even thousands of dollars before achieving a positive ROI. As you can see, PPC cost per clicks can get pretty expensive.

Constant investment is required. Not only do you need to pay to play, but you also need to keep spending money to drive results. Your traffic and sales stop the moment you turn ads off. That makes it all too easy to become reliant on PPC. It is essential to balance your efforts with SEO and other digital marketing strategies.

There’s a learning curve. While it may seem easy to create an ad and put together a budget, optimizing your PPC campaign takes a lot of skill and knowledge. For one, Google and Bing’s platforms can be tricky for beginner marketers to get their heads around. But you also need to understand how optimizing your bids works, what negative keywords to add, and how to best optimize your landing page. None of these things are simple without the help of a PPC agency.

PPC ads can get stale. You need to constantly refresh your ads to keep them engaging. Any form of paid advertising, PPC or otherwise, can suffer when users become ad-blind. That’s when users notice they are reading an ad and scroll past it without engaging. That means PPC campaigns require more than just an ongoing budget. You need to commit to testing out new ads and landing pages if you want to continue driving sales.

SEO and PPC: How They Work Together

In reality, you shouldn’t be choosing between SEO and PPC. You should do both. PPC is great for achieving quick wins and driving high-intent traffic. SEO is a long-term game, but it should be a much more effective strategy after a year or two. You can rank for dozens of keywords with a single article, unlike PPC, where you can only target one.

What’s more, SEO and PPC are even more effective when you combine them together. Just check out the three strategies below for proof.

Crowd the SERPs on Branded Searches

You always want to appear at the top of the SERPs for your branded terms, right? Unfortunately, this isn’t always possible without combining SEO and PPC. Because companies will often create paid ads for their competitors’ branded keywords, you need to be creating PPC ads for your brand terms, too.

In doing so, you’ll own the first page for your terms and significantly boost brand awareness.

Don’t worry; you won’t have to spend a fortune on these ads. Because your landing page will be highly relevant to the search term, the cost of your ad appearing in the first paid ad position will be significantly less than what it will cost your competitors.

Move Expensive PPC Keywords to SEO

Run a PPC campaign for long enough, and you’ll soon find one or more expensive PPC ads that get a reasonable amount of clicks but almost no conversions. These keywords are a colossal waste of money.

This usually happens when these keywords lack commercial intent or target users at the start of the buyer’s journey.

That doesn’t mean it’s a bad keyword, though. Instead of giving up on it completely, use SEO to target it with an article instead. In doing so, you can introduce your brand to consumers earlier in the buyer’s journey and get the chance to grab their email address with a lead magnet. And because the data shows users click on your ad, you know they will probably click on an organic search result with the same angle, too.

Match Organic Results With PPC Ads

One final way to integrate SEO and PPC is to match your PPC ads to the SEO results. When you start doing both SEO and PPC, you’ll notice that a lot of the time, PPC ads don’t align with organic results.

This is particularly common on non-transactional comparison queries that occur in the middle of the buyer’s journey. Customers aren’t looking to buy at this point. They are looking for the best solution.

While the organic search results are filled with comparison posts, many PPC ads will only focus on one product. Search for “best CRM” and you’ll see a great example of this. The ads are all focused on single products, but the top organic result is a comparison post.

Here’s how you can win big in these cases. Rather than match your PPC ads to existing ads, match your ad to the searcher’s intent.

Instead of creating an ad solely focused on your product, create an ad and landing page that compares the best products in your industry. In doing so, users will be much more likely to click on your ad.

SEO vs PPC Frequently Asked Questions

PPC ads appear at the top of search engines ahead of SEO results. Paid ads are ranked depending on relevance, budget, and landing page quality. SEO results are ranked on over 200 factors.

You can use PPC ads to discover untapped and valuable keywords. PPC also supports your SEO efforts and helps you own the first page of results.

Neither PPC nor SEO is better than the other. They each have their own advantages and disadvantages. That being said, they always work best when used together.

The biggest difference between SEO and PPC is the cost. Traffic from SEO is free, while you need to pay to have a PPC ad appear in search engines.

SEO vs PPC Conclusion

You can use both SEO and PPC to grow your business. SEO will take time, but it is an incredibly cost-effective strategy in the long run. PPC will give you the customers you need now, even if you have to pay for the results.

That’s why I always recommend marketers don’t choose between them. Do both, and make sure you are using both strategies together to drive even more conversions.

Get started with SEO and PPC today by diving into keyword research before creating your first PPC campaign and an SEO strategy.

Which marketing strategy are you most excited about? Do you prioritize one over the other?