Laura Ingraham questions effectiveness of remote work for federal employees

The ‘Ingraham Angle’ host cast doubt on the effectiveness of federal remote work in her opening monologue Tuesday night

The ‘Ingraham Angle’ host cast doubt on the effectiveness of federal remote work in her opening monologue Tuesday night

Heidi Planck, 39, was last seen on Oct. 17 at her 10-year-old son’s football game before vanishing.

How often do you see ads asking a question?

Whether you notice or not, plenty of PPC ads utilize questions to get more engagement. The questions can be literal or rhetorical, but either way, they’re trying to get you to click so you can learn the answer.

Does this method work for PPC campaigns?

In this article, we’ll discuss why you should consider asking questions in your PPC ads and provide tips about best practices in doing so.

Questions are how people show interest in each other’s lives, and they’re a regular part of our everyday lives to boot. When ads use questions effectively, potential customers may feel like the brand cares about them and isn’t simply trying to sell them something.

That said, marketers can’t measure how customers feel. But, you can measure data to see if your questions in PPC ads are driving people to your page. Here are some reasons marketers have discovered questions in PPC ads work:

A question can easily pique people’s interest, especially if it’s about a relatable struggle.

Let’s say you’re a marketing agency.

Try starting your PPC ads with statements like, “Do you want to increase your conversion rate?” or “Do you want to boost marketing results?”

The answers to these questions may seem like no-brainers. Yet, they can easily attract the attention of business owners who are desperately looking for ways to improve their sales results, as they want you to answer these questions for them without having to dig further.

Engaging your audience is essential. If they feel like you’re talking at them, not with them, they have no reason to click, like, share, or comment.

So, if you ask a question they want an answer to or want to answer, you’re inviting them into the conversation, not giving them the hard sell.

Your ultimate goal is to convert people into paying customers, but engaging with them via questions could get them to want to purchase from you instead of the person who simply said: “buy our product.”

Not only can questions pique interest, but they can tap into a feeling of social obligation. When you ask someone a question in “real life,” they often feel obligated to answer. While your PPC ad isn’t staring at a user anticipating an answer, the reader could feel like they need to respond.

Or, they could have that question themselves—maybe they even typed in that exact question, and that’s why they see your ad. It could feel like they asked you the question and are now the ones waiting for your answer!

Asking a question you want them to answer, like “Are you ready to take the leap?” or a question they may have asked, like “Why should I travel to Iceland?” could make them click.

Note: Be sure your PPC ad’s link actually answers the question, provides relevant information before they provide contact information, or is directly related to the query in another way. Don’t just send them to your homepage unless the answer is there.

The questions you ask will give customers an idea about your brand identity or personality.

Let’s take a look at the difference between these two questions:

“What’s your next six-figure move?”

“If you could travel anywhere for free, where would it be?”

The first question will likely give the impression that a business-savvy financial advisor or entrepreneur wrote the ad. It may even attract like-minded individuals who want to learn about generating passive income or building their own business.

The second question could let viewers see you as a company with a genuine interest in their dreams and futures. The “if you could” portion may also trigger viewers to share the dream destinations they’ve been saving up for, which could increase visibility if your PPC ad is on social media and not a search engine.

You only have one chance to make a good first impression, so be sure your question does that for you.

How can you utilize questions when making your PPC ads? Here are five ways you can use them to yield the results you want.

There are brand messages which are easy to communicate, like “Buy now to get 70 percent off your first order,” or “Sign up to get free access to our course.” These statements answer a question that didn’t even need to be asked: “Do you want something for cheap or free?” So, questions aren’t needed.

However, when you’re making a tough sell, peppering your ad with a few questions can help readers ease into the idea of consuming your content or opting into your business.

Let’s say you’re a blogger in the finance industry who wants to talk about the perks of investing. Money can be a touchy subject—even an intimidating one—for many. Using questions focusing on the perks of investing or reflecting things readers may already be wondering could draw them in.

You could write something like, “Do you want to abandon the 9-to-5 grind and be your own boss?” or “Do you want to retire in your 50s?”

These inquiries can get people to notice your ads because they’re exciting and relatable.

Think about the last time you approached a stranger in a social situation.

To avoid being awkward, you probably introduced yourself with your name and a brief statement, then asked a question like, “How do you know [insert mutual friend’s name]?”

It’s the same way for PPC ads.

Questions are a good starting point to introducing your business and the services you offer without putting on too much pressure.

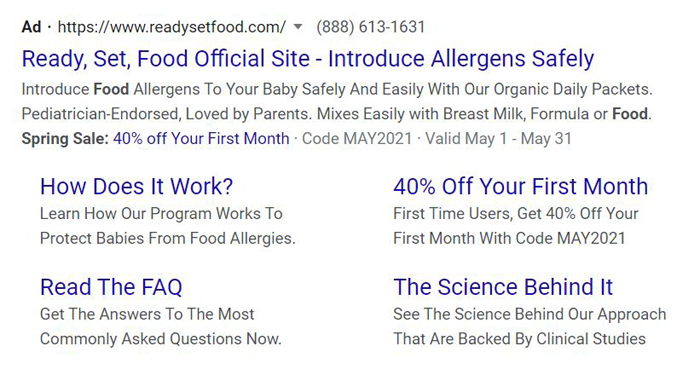

For example, Ready Set Food’s PPC ads introduce the company by name and give some basic information. First-time parents who are concerned about their baby’s diets may already be interested in the topic, but the CTA “How Does It Work?” truly gets the conversation started.

Asking a question reflecting the reader’s thoughts or addressing a pain point could lead them to click the call-to-action (CTA). The CTA could be the question itself, or the question could lead to the CTA.

A question that could be the CTA is reflected in the Ready, Set, Food ad above: How does it work?

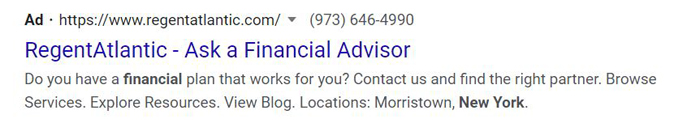

Regent Atlantic’s PPC ad uses a question to lead readers to the CTA by asking, “Do you have a financial plan that works for you?” They then encourage people to click their ad to get the financial help they need.

Including a question related to your businesses’ niche is a good starting point to establishing a relationship with your customers.

SEO agency Pushfire starts with the question, “Tired of SEO services that take shortcuts or attempt to game the latest algorithm?” Since SEO is a broad and complicated topic, the loaded question helps give a brief introduction of what their agency offers and how hard they’re willing to work for you.

PPC ads can have questions that introduce problems the audience may already have.

Your products or services should provide the solution, immediately answering the question in a way that lets the audience know this. People are looking for solutions, not problems.

For example, Bookakery Boxes’ PPC ad starts with, “Looking for a gift that will last beyond Christmas?” Their answer is their subscription box program, which lets people give books to their loved ones throughout the year.

It’s not just what you say; it’s how you say it. When it comes to questions in PPC ads, you need to know not just when to ask them but how and why you’re doing so.

What does your company stand for, and what does it offer? You need to answer these questions for yourself before you ask your audience anything.

The questions you ask readers should help them relate to your message.

For instance, if you run a travel agency focusing on affordability, you could ask, “Are you dreaming of a vacation but worried about the cost?”

Or, if you run a clothing store that donates a portion of all proceeds, you could ask, “Do you want to look great while helping others?”

In both of these, the audience knows what your company is all about from one simple question.

Chances are, we’ve all met someone who just constantly asks question after question, and eventually, they become background noise at best.

Questions are more effective when they are utilized infrequently.

Plus, asking too many questions could make your copy seem deceitful and spammy, like you’re trying to get answers out of them, not help them solve a problem. Not surprisingly, no one wants to see too many questions because we prefer to get answers or solutions.

Just include one question to maximize the impact of your ads.

Questions are natural parts of human conversation, and copy should reflect that—and no more than that.

These days, it’s not uncommon for keywords to be questions. Historically, it was best to have your long-tail keywords be verbatim in your copy; now, search engines are smart enough to understand context. Don’t wedge those questions in, especially repeatedly, just to fit your keywords.

There’s nothing wrong with adding questions every now and then. You want to make your PPC ad copy seem like you’re encouraging a friend to make it more engaging and enticing. Just don’t overdo it.

Picking the right question involves understanding your audience.

What are the most common dilemmas of your target audience? Why would they need your products or services? Formulating questions along these lines will help you create copy that resonates with your intended viewers.

Your questions should make people excited, not scared or unhappy. A question that only has a negative response could lead to a negative perception of your brand.

For example, the question “Do you want a house infested with rats?” could make readers uncomfortable and respond strongly with “no,” or even, “how dare you assume I would?” After all, it conjures an image of a house with a rat infestation and implies someone, somewhere, may say, “why yes, yes I do!”

In contrast, the question “Do you have rats and want them gone?” makes your intended message more concise and clear. Readers know you’re offering products and services designed to take care of a rat infestation without assuming they do have a house full of rats.

Plus, people want solutions to their problems, and positively phrased questions and responses offer those.

When you ask someone to become engaged to be married, you’re likely already pretty sure they’ll say “yes.” The same goes when asking a reader to engage with your content—you need to be pretty sure the answer will be “yes.”

In other words, the “yes” should be so expected that the question is rhetorical.

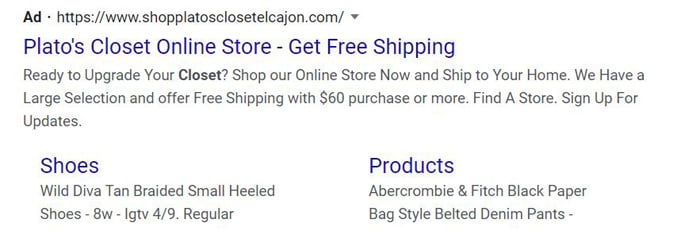

For example, Plato’s Closet has a PPC ad with the words, “Ready to upgrade your closet?”

In this situation, people who read the copy are more likely to stop and stare because of the free shipping option. The question just drove the message home.

Getting readers to respond “yes” to this early on, to the point where they click on the CTA, may make them more likely to answer “yes” once they’ve reached your product page. They’re already pretty excited about the questions they’ve already responded affirmatively to.

Questions in PPC ads could help you engage with your readers in various ways.

They can introduce your business, engage your audience at a human level, or make them excited to learn more. It can also be used to bring up a solution to a problem, which may encourage your audience to respond to your CTA.

Ask questions aligned with your main message. Make sure they seem natural and show you understand your target audience.

As long as you keep these tips in mind, you could create PPC ads that produce excellent results.

How will you use questions to get more engagement with your PPC ads?

I was reading an article from my buddy the other day and he had an interesting trend. 14.1% of all searches on Google are in the form of a question. Here’s the breakdown within the United States: How – 8.07% What – 3.4% Where – .88% Why – .82% Who – .6% Which – .33% …

The post SEO is Turning into a Questions and Answers Game first appeared on Online Web Store Site.

The post SEO is Turning into a Questions and Answers Game appeared first on ROI Credit Builders.

I was reading an article from my buddy the other day and he had an interesting trend. 14.1% of all searches on Google are in the form of a question. Here’s the breakdown within the United States: How – 8.07% What – 3.4% Where – .88% Why – .82% Who – .6% Which – .33% …

The post SEO is Turning into a Questions and Answers Game first appeared on Online Web Store Site.

The post SEO is Turning into a Questions and Answers Game appeared first on ROI Credit Builders.

I was reading an article from my buddy the other day and he had an interesting trend. 14.1% of all searches on Google are in the form of a question. Here’s the breakdown within the United States: How – 8.07% What – 3.4% Where – .88% Why – .82% Who – .6% Which – .33% …

The post SEO is Turning into a Questions and Answers Game first appeared on Online Web Store Site.

Running a blog is a lot of work. You have to continually feed it new content, keep up with WordPress updates, maintain your hosting account, moderate comments, respond to readers…dozens, maybe even hundreds, of little tasks. On top of all that, there’s promoting and monetizing your blog, which is even more work. It’s hard for …

The post Should I Outsource My Blog? 5 Questions to Help You Decide first appeared on Online Web Store Site.

Running a blog is a lot of work.

You have to continually feed it new content, keep up with WordPress updates, maintain your hosting account, moderate comments, respond to readers…dozens, maybe even hundreds, of little tasks. On top of all that, there’s promoting and monetizing your blog, which is even more work.

It’s hard for anyone to manage, and the larger your blog grows, the worse the situation becomes. That’s why it’s good to prepare in advance for blogging eventualities you might face.

If you’re feeling overwhelmed, one of the questions you should ask yourself is “should I outsource my blog?”

If so, there’s a few ways to do this.

You could split up the work with guest posts, staff bloggers, or outsource your blog completely. The method you select will depend on a couple of things.

When you blog, you need to build trust, bonds, and relationships with your readers. They grow to know you and like you, and they can’t wait to read your next post.

There’s a downfall to this though: your readership may want content only from you. They may be turned off if you step back and start outsourcing your blog posts.

What will happen to your blog if you outsource your blogging? It depends.

If a blogger like Dooce or Naomi Dunford decided to outsource their blog, their readers would probably revolt. Their personalities are such a large part of the blog that it would be hard to get their readers to accept anyone else.

If your blog is already big and established, and you have thousands of loyal readers, it could be tough to outsource your blog. There’s a good chance you’ll lose some readers if you hire staff or start adding guest posters.

Fans will read their work politely, but it’s really you they want. It will take time, a good plan, and weathering rumbles from readers until they accept it.

No one likes change, but eventually, things will settle down. They’ll hang in there, especially if you’re still publishing quality content, are active with posting now and again, and if you hire a blogger whose style and tone match your brand personality. Make sure the blogger also provides similar-quality advice, info, or entertainment as you’ve been giving.

Of course, all of that only matters if you have an audience. What if you’re just getting started?

The truth is it’s a lot easier. You can build your blog around posting awesome content, rather than one particular personality. It won’t matter where the content comes from; as long as it’s awesome, your readers will be happy. That leaves the door open for you to hire other writers.

You can’t hire just anyone to write for your blog. You need to find a writer who fits with your business brand, its mission, and the level of knowledge your blog provides. Of course, this writer also has to be able to fit in with your goals and get results.

Here are some questions to think about before bringing someone on:

(Note that I didn’t mention, “How much do they cost?” We’ll get to that in a bit.)

First, though, recognize that outsourcing writing comes down to basically trusting someone with your business reputation. You’re not just shoving off a task; you’re giving someone permission to represent you and your business.

This means the person you hired needs to be able to maintain your credibility (or enhance it), please your readers and get them talking, and generally make your life better and easier by freeing up your time and becoming an asset to your blog.

Good writers don’t work for free, but they don’t always want just money, either.

Some ask for marketing exposure. Others want a link to their blog, republication rights, or a barter arrangement.

Before hiring someone, decide what you bring to the table. Can you send them traffic? Build their credibility? Improve their search engine rankings? Recommend their products and services to your readers?

You need to have something to offer in exchange for a writer’s work (and you’ll need more than $10 and a link), so figure out what you’re prepared to give in return for what the blogger brings to you.

In general, the more you give, the more you get.

Pay $10 for a blog post without offering anything else in exchange, and you’ll probably get a bad headline, sloppy grammar, and ordinary ideas, none of which would do much to build your blog.

At the other end of the spectrum, some bloggers will do everything for you, including editing, polishing, getting photos, and promoting your post to generate traffic. You’ll pay a lot more, anywhere from a few hundred to a few thousand dollars per post, but you’ll be getting a lot more for the money, too.

Ghostwriters write on your behalf and you present the work as your own. The President uses ghostwriters for his speeches; nothing wrong with that.

It’s controversial, however, especially when it comes to blogging. Some feel it’s dishonest.

Others feel that there’s nothing wrong with hiring someone to help write and share your knowledge with your audience. There’s no rule that says you must slave over writing posts if you absolutely can’t stand it, don’t have the time, or just don’t want to.

Here’s another argument: if your writing skills aren’t up to snuff, you might be potentially damaging your credibility and sales.

People with average writing skills often hire ghostwriters who turn their notes, audio files, thoughts, and outlines into great posts. You’re using the same knowledge; someone else is just doing the writing. Often, it’s the knowledge that your readers care about, not who puts it into words.

Ghostwriting may be a great option for you if you don’t like to spend time writing, can’t write well, aren’t seeing the results you want, or want time to develop other areas of your business.

Every time you make a change in your business, there’s always the risk it might not have been the best decision.

Let’s say you hire a writer, work with a few guest posters, or decide to hire a ghostwriter. After a couple of months, you realize that you’re not getting the results you wanted; maybe traffic is down or your audience has shifted or sales have dropped.

Don’t freak out. It happens. All you need to do is adjust. Unless you’ve completely trashed your business reputation, you can always change your content and blogging strategy.

You can go back to blogging yourself, hire a new writer with a different personality, get a ghostwriter to write more posts for you; whatever works.

As we’ve demonstrated in this article, if you’re wondering “should I outsource my blog,” the answer is: it depends.

No matter what you decide about outsourcing your blogging, you’re never stuck and committed forever. A blog is just a marketing tool that you can play with and test, adapt to your needs, and measure for effectiveness as you go along, just like any other form of marketing.

If you’re nervous to start or shift your blogging strategy, reach out to us for a consultation. We are here to help you find success with your blog and content marketing in general.

The post Should I Outsource My Blog? 5 Questions to Help You Decide appeared first on Neil Patel.

Every entrepreneur asks themselves “How do I fund my business?” Some times it’s “What is the best way to fund my business?” The answers to each are many and varied, and they depend on a number of variables. Specifically, the question right now may be “How do I fund my business during a global pandemic?” We have the answers you seek.

When asking yourself how do I fund my business, you are likely only thinking of traditional loans and investors. First, it’s important to know that there are other options. That said, loans are the easiest and most reliable, despite the many pitfalls and barriers. This is true even if you have one of the best recession proof businesses around. The need for business funding never goes away. No doubt you are asking yourself what other options you have however, especially if loans are not currently an option.

Truthfully, taking on debt during the course of running a business is virtually unavoidable. However, there are debt free funding options that you can use to reduce the amount of debt you have to take on. Aside from investors, there are grants and crowdfunding options out there.

Learn bank rating secrets with our free, sure-fire guide.

Crowdfunding

With crowdfunding, you don’t have to find just one or two investors that have large sums of money. In fact, you can find a lot of investors to fund your business a few bucks at the time. Honestly, some may kick in as little as $5.

There are many crowdfunding platforms. Yet, they aren’t all the same. You have to check them each out and figure out which one will work best for your business. Here are a few to start with.

Of course, there are other platforms out there, but this is a good list to start with.

There are not a ton of grants out there compared to other funding options, and competition is stiff. Still, they are an option if you are wondering how to fund my business without debt.

Also, requirements vary from grant to grant. Furthermore, most are only awarded to a certain number of recipients. Despite this, they are still worth looking into if you fall into one of these basic categories.

There are also some corporations that offer grants in a contest format that do not require much other than that you meet the corporation’s definition of a small business and win the contest.

Companies like FedEx and LendingTree have grant contests each year.

Consequently, If traditional loans are not an option due to bad credit, you might look into private lender options. There are a lot of them, but they aren’t all created equal. You will have to do your research to avoid scams. Also, though all private lender rates are typically higher than their traditional counterparts, you will want to make sure you get the best rate you can. Here is some information to get you started.

Fundation provides both term business loans online and lines of credit. It is most known for its working capital financing options. These are funds meant to help cover the day-to-day costs of running a business rather than larger projects. Typically, these funds come in the form of a line-of-credit

StreetShares started as a service to veterans, but now offers term loans, lines of credit, and contract financing. They also offer small business loan investment options. The maximum loan amount is $250,000, and preapproval only takes a few minutes. They use a soft pull on your credit so it doesn’t affect your score. They require a minimum credit score of 620.

There are two options for small business financing with BlueVine. They include lines of credit and invoice factoring. Loans start at $5,000 and go up to $100,000. Your annual revenue must be $120,000 or more, and the borrower must be in business for at least 6 months. Also, with BlueVine, there is a personal credit score requirement of 600 or higher.

Fundbox offers an automated process that is super-fast. They have no specific credit score requirement. You simply have to be an established business with regular monthly revenue.

Founded in 2008 by college roommates, Fora Financial now funds more than $1.3 million in working capital around the United States. There is no minimum credit score, and there is an early repayment discount if you qualify.

OnDeck

Obtaining financing from OnDeck is quick and easy. First, you apply online and receive your decision once application processing is complete. If you receive approval, your loan funds will go directly to your bank account. The minimum loan amount is $5,000 and the maximum is $500,000. There is a personal credit score requirement of at least 500.

Learn bank rating secrets with our free, sure-fire guide.

The secret to Lendio’s success is excellent customer service and a short, easy application process. The loan-connections service it offers slashes the time it takes to find the right business loans online. This is due to its heavily vetted network of lenders. Your personal credit score must be 560 or above.

Credibly specializes in unsecured business loans. The minimum loan amount is $5,000 and the maximum is $250,000. They require a person credit score of at least 500 and at least 6 months in business. You also have to show at least $15,000 in average monthly deposits.

Kabbage offers a small business line of credit that can help accomplish your business goals quickly. The minimum loan amount is $500 and the maximum is $250,000. They require you to be in business at least one year and have $50,000 or more in annual revenue or $4,200 or more in monthly revenue over the last 3 months.

How Do I Fund My Business If I Don’t Know Where to Start?

Well, you don’t. You have to know where to start, so we are going to tell you. You start with the foundation. How your business is set up has everything to do with fundability. Fundability is the ability to get funding for your business. How do you set up your business to be fundable?

Your business must have its own:

An EIN is an identifying number for your business that works in a way similar to how your SSN works for you personally. You can get one for free from the IRS.

Honestly, not incorporating your business as an LLC, S-corp, or corporation is not an option. However, which form you choose, is. It does not matter as much for fundability, but it makes a difference for your budget and liability protection. Talk to your attorney or a tax professional about which option will work best for your needs..

Also, when you incorporate, you become a new entity. You basically have to start over. You’ll lose any time in business and a positive payment history you may have built up. For this reason, you need to incorporate as soon as possible.

In addition, you have to open a separate, dedicated business bank account. There are a few reasons for this. For these purposes, the main one is it will help create the separation from owner you need to build fundability.

For a business to be legitimate it has to have all of the necessary licenses it needs to run. Do the research you need to do to ensure you have all of the licenses necessary to legitimately run your business at the federal, state, and local levels.

Website

Spend the time and money necessary to ensure your website is professionally designed and works well. Pay for hosting too. Don’t use a free hosting service. Also, remember that email address you need? Make sure it has the same URL as your website. Don’t use a free service such as Yahoo or Gmail.

What happens after you have a fundable foundation? Are you automatically going to have all the answers to all of the how do I fund my business questions? No, you won’t. In fact, you won’t even be fundable yet. To fund your business into the future, you need to know everything that affects fundability so that you can make sure yours is strong. So, what exactly does affect the fundability of your business?

Where do business credit reports come from? There are a lot of different places, but the main ones are Dun & Bradstreet, Experian, Equifax, and FICO SBSS. Since you have no way of knowing which one your lender will choose, you need to make sure all of these reports are up to date and accurate.

In addition to the business credit reporting agencies that directly calculate and issue credit reports, there are other business data agencies that affect those reports indirectly. Two examples of this are LexisNexis and The Small Business Finance Exchange.

In addition to the EIN, there are identifying numbers that go along with your business credit reports. Some of them are simply assigned by the agency, like the Experian BIN. One, however, you have to apply to get. It is absolutely necessary that you do this.

Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. To get a D-U-N-S number, you have to apply for one through the D&B website.

Your credit history is a huge factor in the fundability of your business.

It consists of a number of things including:

The more accounts you have reporting on-time payments, the stronger your credit score will be.

This is a problem because a ton of loan applications are turned down each year for fraud concerns due to things not matching up. Maybe your business licenses have your personal address but now you have a business address. You have to change it. Perhaps some of your credit accounts have a slightly different name or a different phone number listed than what is on your loan application. Do your insurances all have the correct information?

Learn bank rating secrets with our free, sure-fire guide.

Both your personal and business tax returns need to be in order. Not only that, but you need to be paying your taxes, both business and personal.

It is best to have an accounting professional prepare regular financial statements for your business. Having an accountant’s name on financial statements lends credence to the legitimacy of your business.

If you cannot afford this monthly or quarterly, at least have professional statements prepared annually. Then, they are ready whenever you need to apply for a loan.

Often tax returns for the previous three years will suffice. Get a tax professional to prepare them. This is the bare minimum you will need. Other information lenders may ask for include check stubs and bank statements, among other things.

There are several other agencies that hold information related to your personal finances that you need to know about. Everyone knows about FICO. Your personal FICO score needs to be as strong as possible. It really can affect business fundability and almost all traditional lenders will look at personal credit in addition to business credit.

Also, there is ChexSystems. In the simplest terms, this keeps up with bad check activity and makes a difference when it comes to your bank score. If you have too many bad checks, you will not be able to open a bank account. Consequently, you will run into serious fundability issues.

Your personal credit score from Experian, Equifax, and Transunion all make a difference. You have to have your personal credit in order because it will definitely affect the fundability of your business. That means, if it isn’t great right now, get to work on it. The number one way to get a strong personal credit score or improve a weak one is to make payments consistently on time.

This is related to when you apply and what you apply for. Is it the right time to apply for financing? Are you applying for a product you can use or even get?

In the end, the key to funding any business at any time is to have strong fundability. As a result, you have to start from the foundation and continually work to build business credit and keep all information up-to-date and accurate. Do this, and you will be able to find the answers to all of your “How do I fund my business” questions.

The post How Do I Fund My Business? Your Top Questions Answered appeared first on Credit Suite.

The Packers drafted a QB, while the Patriots did not. What were the other most notable events from the NFL’s virtual draft?

The post 2020 NFL draft biggest takeaways: Surprises, lingering questions and lots of dogs appeared first on Buy It At A Bargain – Deals And Reviews.