Sen. Bernie Sanders, I-Vt., said Sunday “there is a real danger” congressional Democrats could fail to deliver on two major pieces of legislation furthering President Biden’s domestic agenda if moderates like Sen. Joe Manchin, D-W.Va., can’t agree on the price tag.

Tag: Real

10 Tips for Creating Real Estate Video Ads

Did you know that 73 percent of sellers prefer working with agencies that use real estate video marketing? Whether it’s a walkthrough of the property or a Q&A session, sellers expect their agents to use video marketing to reach the right buyers and sell their properties.

For real estate agents, this demand presents a few challenges. How do you make an engaging real estate video to impress both sellers and buyers alike, and how do you track a video’s performance for your marketing purposes?

Luckily it is not as hard as it might seem. Although real estate videos serve a unique purpose, they’re similar to regular marketing videos in many ways, so don’t be intimidated by them.

Let’s take a closer look at why real estate videos are worth the effort and how you fit them into your overall video marketing strategy.

Why Should You Create Real Estate Video Ads?

Real estate videos do two things: they attract buyers to your listing, and they encourage prospective sellers to choose your agency over your competitors.

Are they worth the effort, though, when you could create social media ads or optimize your listings? Maybe with the current market, you think it will be a waste of resources. Let’s look at what the numbers say.

- 46 percent of buyers think video tours are the most influential content on an agency’s website.

- Listings with embedded videos are 53 times more likely to rank highly on Google than listings without embedded video.

- Real estate videos attract up to 403 percent more traffic than other content.

- You’ll earn around 60 percent more qualified leads through real estate videos.

- A caring personality is one of the top reasons sellers choose a particular agent or agency, and that’s easier to share in a video than, say, a picture or article.

What’s more, 84 percent of video marketers feel they’ve generated more leads thanks to video marketing, and 94 percent of us use videos to learn more about the products we’re buying.

The takeaway? To draw traffic to your listings and impress your sellers, try out real estate video marketing.

Before we dig into strategies, let’s cover the basics.

What Equipment Do You Need to Create Real Estate Video Ads?

There’s no need to spend a fortune on top-of-the-range lighting, props, or cameras. However, you’ll still need some recording equipment before you shoot your first real estate video. How much you spend depends on your marketing budget, but let’s break down the basics.

First, you’ll need a camera capable of shooting in 4K or HD to make sure the videos are high quality and not blurry or pixelated. A smartphone works, too.

If you opt for a camera, make sure it’s capable of capturing both high-quality video and images. Practice shooting with the camera before filming day to ensure you get the most from the equipment.

Using a smartphone? Clip on a wide-angle camera lens. This allows you to shoot larger scenes while minimizing glare and improving image quality. Here’s what the lens looks like:

Lenses like this one shown above are cost-effective and widely available, so shop around.

Want to go all-out? You can always buy a drone for 360 aerial footage. However, you’ll probably need a permit to fly a drone in most areas, so keep that in mind.

Next, you’ll need lighting filters. Use a neutral density filter for shooting outside, and get a pocket-sized LED light you can attach to the camera (or smartphone) for filming in poorly-lit areas.

Got the lighting sorted? Now you’ll need a microphone. You can either buy a mic attachment for your smartphone, or a portable mic for attaching to any camera device.

You’ll also need editing software. Check out tools like Adobe Premiere Pro and Final Cut Pro X for professional editing support. You’ll likely pay for a subscription, but they’re easy enough to master, and you’ll produce the sharpest, most professional videos this way. Alternatively, you could outsource editing to a freelancer.

Finally, you’ll probably need a stabilizer like a selfie stick or a gimbal. These tools keep your camera steady and minimize shaking while you walk around a property.

10 Tips for Successful Real Estate Video Ads

A real estate video is all about setting a great first impression. You want to bring the property to life, connect with potential buyers, and ultimately set yourself apart from other realtors with your professional marketing skills.

To help ensure your content achieves these goals, here are ten tips to produce the highest-quality real estate video ads.

1. Know Your Real Estate Video Ad Budget

Be clear about what you can afford to spend on video marketing. Unsure how to allocate your budget? Let me give you a few pointers.

First, consider your target audience. It’s worth watching real estate videos in your listing’s price range to see how your efforts compare to your competitors’ video ads.

Next, think about how much you’ll spend on actually promoting your videos. From social media ads to targeted email marketing, the costs can eventually add up. To keep things more cost-effective, repurpose your real estate videos into digital ads so you can double your content output without spending more.

Also, take the time to research paid ad strategies, or hire a digital marketing consultant to take care of the budget, targeting, and testing.

2. Plan Your Angle in Advance

A great real estate video doesn’t just happen. It takes planning. Remember, you’re trying to tell a story, so you need to spend time thinking about what story you want to tell.

For example, determine what equipment you’ll need, whether you’ll hire actors to play any roles, and what time of day or night you plan on filming. Do you want to sell your own real estate skills or help a buyer fall in love with an unusual property?

Depending on the seller, you might also need their approval before you start filming or sending the video out to prospects, so factor in time for adjusting your angle and making changes as required.

3. Keep Your Real Estate Video Ad Short and Sweet

The length of your real estate video depends on where you’re marketing it. For example, according to HubSpot, popular Twitter videos average around 43 seconds, while popular YouTube videos run a little longer at two minutes.

A real estate video can be as long as six minutes, but it’s not always wise to fill this time. Why? People have short attention spans. Don’t risk losing a potential buyer’s attention just because you’ve added 30 or 40 seconds of filler to your video.

For example, here’s a video for a property listed by Douglas Elliman. It’s just over 90 seconds long, but it’s visually engaging and covers every angle a potential buyer needs to see without extra fluff:

4. Script the Video

Great real estate videos typically follow a three-act story structure, according to research by Vimeo.

- Act one: Give a clear, frontal view of the property and a few clips of the neighborhood.

- Act two: This part focuses on showcasing each room. Start with the main feature rooms before moving on to the smaller rooms.

- Act three: End the video ad with an exterior view of the property. If you’re using drone footage, place it here.

Remember, you’re telling a story, so following a traditional story structure works!

5. Provide an Engaging House Tour

If you want to ensure a prospect watches your video the whole way through, keep it engaging. Be enthusiastic. Show people why you’re excited about the property, and inspire potential buyers to envision themselves living in the property.

Focus on the possibilities. What could make this property truly special for the right buyer? How might the property be flexible over time? For example, a first-floor bedroom can be an office now and a bedroom for an aging parent or partner later. A basement can be a game room, an in-law suite, or an at-home gym. Drive home how the property can meet their needs over time.

6. Focus on Special or Unique Features

No matter the price range, every property boasts a special, unique, or at least intriguing feature.

Maybe there’s cool history attached to the building, or there’s a custom marble countertop in the kitchen. Or, maybe it’s just the first house to come to market in the area for a long time.

To identify unique features, ask the buyer what changes they’ve made since they bought the house, and if it’s an older property, identify if they kept any key features like original wooden flooring.

Special features can be anything from dual sinks to fully-landscaped gardens, so look for those little quirks that make the property unique compared to similar properties.

For example, this property in Montecito has a wine rack:

Plus, it boasts a hot tub:

Capturing these features in the video highlights the unique aspects of this home.

7. Show Off the Neighborhood

It’s great to show off a property, but what’s going on around it? Include a few clips of the surrounding area, even if you just zoom out to capture the apartment block and a couple of nearby amenities. Make sure to include any famous landmarks, fun events, schools, and even sidewalks.

Is the neighborhood a little rundown or potentially off-putting? An aerial view might work best, so you don’t focus too much on the finer details.

8. Sell the Lifestyle

When you’re looking for a property, it’s not just about the unit. It’s about the life the buyer will lead when they live there. For example, if you’re near the beach or a park, talk up the family-friendly vibes. Are you close to the buzz of shops, restaurants, and cafes? Highlight the walkable, cosmopolitan lifestyle.

Use the property to sell the lifestyle, too. For example, going back to the Montecito property, the landscaping gives off seriously chilled, secluded vibes:

9. Interview Neighbors

People make neighborhoods. After all, who better to tell you what a neighborhood is really like than the residents? Try to get a testimonial or two to add some authenticity and personality to your real estate videos.

Unless it’s a new neighborhood, try to find residents who’ve lived there a few years. Otherwise, potential buyers might wonder why people don’t stay there very long!

10. Use Interactive Elements

From CTA buttons to clickable links, interactive elements help bring your videos to life. Use your editing software to add a CTA inviting people to book a showing, or include a link to a page where buyers can learn more about the listing and the services you offer.

Remember, real estate videos are a marketing tool. Use them effectively and treat them as you would, say, a YouTube video or digital ad.

Measuring the Success of Your Real Estate Video Ads

You’ve filmed your real estate video and launched some ads. How do you know if it’s working for you? The answer’s in your metrics. Here are five key metrics to track if you’re trying to measure your success rate.

- View count: Your view count tells you, well, how many people watched your video!

- Engagement: Video engagement levels tell whether people watch your video all the way through or stop watching.

- Click-through rate: Want to know if people interact with your video and click those links and buttons? Check the click-through rate.

- Conversions: Your conversions tell you if people are taking the desired actions, such as booking a showing or signing up for a newsletter.

- Social media shares: Are people sharing your videos across social media? It’s a good sign if they are, so track your social media shares.

To get this data, either integrate your videos with your usual marketing platform to track metrics, or use a dedicated video analytics platform like Vidyard.

Conclusion

Video ads bring a whole new dimension to real estate marketing. With the right editing tools, a sharp eye for detail, and some enthusiasm, you can bring your property to life or show possible clients why you are the best choice.

There’s one final point to remember. You can shoot a clear, engaging, and professional real estate video with little more than a smartphone.

Don’t feel like you need to splurge to create successful video ads unless it’s within your budget to do so!

Need any more help with marketing? Check out my consulting services.

Have you made a real estate video ad for a listing yet? How did it go?

A Complete Guide To Using Business Credit to Buy Real Estate

If you need to buy commercial real estate, it is probably best to do with business credit rather than a personal loan. Of course, if you can buy real estate with any loan at all, that’s even better. But how would you do that? How do you go about using business credit to buy real estate? What is business credit exactly? These are all questions that you need answered.

The Ins and Outs of Using Business Credit to Buy Real Estate

To put it simply, business credit is credit you get based on the creditworthiness, or fundability, of your business, no you the owner.

Find out why so many companies use our proven methods to get business loans.

So, what are the options for funding real estate? There are a few! If you are using business credit to buy real estate, you can do a commercial loan or hard money loan. If you want to try to reduce the amount of debt you have to take on, you can try crowdfunding a well. You may get all you need, but you may need to combine funding methods.

Real Estate Crowdfunding

Crowdfunding real estate is not all that different from crowdfunding anything else. You use a crowdfunding platform, and others on the platform can donate, or invest, in your cause as they see fit. It began the JOBS Act of 2012. Small businesses gained relief from a lot of requirements in place by the SEC. These requirements held many businesses back.

Though similar to crowdfunding for small businesses, crowdfunding real estate investing isn’t exactly the same. Most of those that list on real estate crowdfunding sites are commercial real estate businesses. They are seeking funding for their endeavors. Anyone can invest in commercial real estate. This is similar to investing in the stock market. Then they can enjoy the returns without actually buying an entire piece of commercial property.

As a result, commercial real estate investors can raise equity and avoid a loan. At the same time, individuals can enjoy the benefits of commercial real estate investing for as little as $500.

Benefits of Equity Crowdfunding for Real Estate Investors

First, you can raise funds without debt. This is the same reason crowdfunding is a popular way to fund a small business startup. It isn’t free money. There are fees and profit sharing involved. It is often substantially cheaper than borrowing the funds, however.

Real Estate Financing Using Hard Money

If you struggle with bad credit, hard money loans are an option. The loans are asset-based. They can fund any real estate investment. They are based on the property value. This means, there is no need for background checks or credit scores. Some lenders even offer hard money loans based on the after-repair value of a building.

Since it’s based on the real estate value , a borrower with poor credit can get these loans. Hard money loans are fast, sometimes even within 24 hours of application.

Interest rates can be very high, some even up to as much three times that of banks. Terms can be very short, like 6 – 18 months, versus a standard 30-year mortgage.

Plus, a hard money lender wants you to have some money in the project as well. Typically at least 10% of your own money is required. That way, the lender knows their interests are protected because you don’t want to lose your money. Hard money loans are usually not subject to consumer lending regulations.

Commercial Real Estate Loans

Commercial real estate is income-producing property that is solely for business purposes, not residential. Examples include retail malls, professional offices such as for medical professionals, office buildings and complexes, and auto dealerships. Financing, including the purchase, development, and construction of these properties, often comes from commercial real estate loans. These are mortgages secured by liens on the commercial property.

Commercial real estate loans are often made to business entities. These include developers, corporations, limited partnerships, and funds and trusts. These entities are sometimes formed for the specific purpose of owning commercial real estate.

Find out why so many companies use our proven methods to get business loans.

However, such a business entity may not have a financial track record or any credit rating. In that case the lender may require the principals or owners of the entity to guarantee the loan.

The owner then puts their property on the line. In case of loan default, the lender can recover from them.

If the lender does not require this type of guarantee, and the property is the only means of recovery in the event of loan default, this debt is a non-recourse loan. It means the lender has no recourse against anyone or anything other than the property.

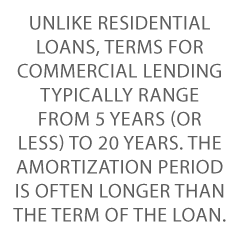

What are Typical Commercial Loan Terms for Real Estate?

Using business credit to buy real estate usually means shorter loan terms. Usually, they range from less than 5 years to 20 years rather than the typical 30 year residential mortgage. The amortization period is often longer than the term of the loan.

Amortization is an accounting technique. Its use is to periodically lower the book value of a loan or intangible asset over a set period of time.

For example, a lender might make a commercial loan for a term of eight years, with an amortization period of 30 years. Then, the borrower would make payments for eight years, of an amount based on the loan being paid off over 30 years.

Then one final balloon payment of the entire remaining balance on the loan is due at the 8 year mark.

The length of the loan term and the amortization period affect the rate the lender charges. Depending on the credit strength of the borrower, these terms may be negotiable. However, general, the longer the loan repayment schedule, the higher the interest rate.

Credit Suite Options for Funding Real Estate Investments

These options are all viable, but some work better than others. It can be hard to determine what will work best for you.

Credit Suite has commercial real estate financing that you should check out. It ranges from $100,000 – $10,000,000. This financing can be used for refinancing a property, even if you are doing a cash-out refinance. The maximum LTV 70% and loan-to-values range from 55 – 65%, depending on the purpose of the loan. Renovations get loan-to-value of up to 60%. Credit Suite has funding programs available including:

- conventional property financing

- money for investment properties and hard money loans

- bridge loans and

- loans for the purchase of commercial real estate

Credit Suite offers financing for various, and even unique, property types. You can get funding for offices, industrial offices, industrial facilities, light manufacturing buildings, self-storage facilities, mixed use properties, commercial condos, auto dealerships, light auto services, day cares, assisted living facilities, entertainment venues, multi-family properties, retail warehouses, and more.

Find out why so many companies use our proven methods to get business loans.

How a Business Credit Expert Can Help

If you plan on using business credit to buy real estate, you can do so even if your personal credit score isn’t great. However, you may get better terms and interest rates if you have a strong business credit score also. A business credit expert can help you evaluate your fundability and guide you as you navigate the process of increasing fundability and building a strong business credit score.

The post A Complete Guide To Using Business Credit to Buy Real Estate appeared first on Credit Suite.

Commercial Loan for Real Estate Financing

What is a Commercial Loan for Real Estate Financing?

Commercial real estate (CRE) is income-producing property with just business (rather than residential) purposes. Examples include retail malls, professional offices such as for dentists, office buildings and complexes, and auto dealerships. Financing, including the acquisition, development, and construction of these properties, often comes from commercial real estate loans. These are mortgages secured by liens on the commercial property. So this is a commercial loan for real estate financing.

What is a Commercial Loan for Real Estate All About?

Commercial real estate loans are often made to business entities.

These include developers, corporations, limited partnerships, and funds and trusts. These entities are often formed for the specific purpose of owning commercial real estate.

But such a business entity may not have a financial track record or any credit rating. In that case the lender may require the principals or owners of the entity to guarantee the loan.

Hence a person (or group of people) puts their property on the line. In case of loan default, the lender can recover from them.

If the lender does not require this type of guarantee, and the property is the only means of recovery in the event of loan default, this debt is a non-recourse loan. It means the lender has no recourse against anyone or anything other than the property.

What are Typical Commercial Loan Terms for Real Estate?

Unlike residential loans, terms for commercial lending typically range from 5 years (or less) to 20 years. The amortization period is often longer than the term of the loan.

Amortization is an accounting technique. Its use is to periodically lower the book value of a loan or intangible asset over a set period of time.

A lender, for example, might make a commercial loan for a term of eight years, with an amortization period of 30 years. Here, the investor would make payments for eight years, of an amount based on the loan being paid off over 30 years.

Then one final balloon payment of the entire remaining balance on the loan follows.

The length of the loan term and the amortization period affect the rate the lender charges. Depending on the investor’s credit strength, these terms may be negotiable.

But in general, the longer the loan repayment schedule, the higher the interest rate.

Learn business loan secrets and get money for your business.

What are Loan-to-Value Ratios in a Commercial Loan for Real Estate?

LTV is a calculation measuring the value of a loan against the value of the property. A lender calculates LTV by dividing the amount of the loan by the lesser of the property’s appraised value, or its purchase price. For example, the LTV for a $80,000 loan on a $100,000 property would be 80% ($80,000 ÷ $100,000 = 0.8, or 80%).

Borrowers with lower LTVs will qualify for more favorable financing rates than those with higher LTVs. This because they have more equity (i.e., a stake) in the property. It works out to be less risk from the lender’s perspective.

Commercial loan LTVs tend to fall into the 65% to 80% range. While some loans may be made at higher LTVs, they are less common. The specific LTV will often depend upon the loan category

What is Debt-Service Coverage Ratio?

DSCR compares a property’s annual net operating income (NOI), to its annual mortgage debt service. This includes principal and interest. It measures the property’s ability to service its debt. You calculate it by dividing the NOI by the annual debt service.

For example, a property with $150,000 in NOI and $100,000 in annual mortgage debt service, would have a DSCR of 1.5 ($150,000 ÷ $100,000 = 1.5). The ratio helps lenders determine maximum loan size. That has a basis in the cash flow generated by the property.

What Does it Mean to Have a DSCR of Less than One?

A DSCR of less than 1 means a negative cash flow. For example, a DSCR of .93, means there is only enough NOI to cover 93% of annual debt service. In general, commercial lenders look for DSCRs of at least 1.25. This is to ensure adequate cash flow.

A lower DSCR may be okay for loans with shorter amortization periods, and/or properties with stable cash flows. Higher ratios may be required for properties with volatile cash flows. These include, for example, hotels. This is because hotels do not have long-term (i.e., more predictable) tenant leases, which other types of commercial real estate have.

What Sorts of Interest Rates and Fees Do You Typical Pay with Commercial Real Estate Financing?

Interest rates on commercial loans tend to be higher than on residential loans. Commercial real estate loans also often involve fees adding to the overall cost of the loan. These include appraisal, legal, loan application, loan origination, and/or survey fees.

Some costs must be paid up front before loan approval or rejection. Others apply annually. A commercial real estate loan may have restrictions on prepayment. The intention is to preserve the lender’s anticipated yield on a loan.

If investors settle the debt before the loan’s maturity date, chances are good they will have to pay prepayment penalties. See investopedia.com/articles/personal-finance/100314/commercial-real-estate-loans.asp.

Learn business loan secrets and get money for your business.

What are Some Types of Commercial Real Estate Loans?

You can invest in real estate with an SBA 7(a) loan, or an SBA 504 loan. Conventional bank loans are another option, as are hard money loans. Joint venture loans allow parties to share the risk and returns from commercial property investment, without having to formally enter into a real estate partnership.

You can get a commercial mortgage from Freddie Mac, or Fannie Mae. You can try credit unions, or even life insurance companies. Another option is HUD. See stacksource.com/commercial-mortgage-rates.

You can try an online marketplace loan, AKA a soft money loan. Here, interest rates are still higher than conventional bank loans. But they are lower than loans from hard money lenders. For the most part, online marketplaces match borrowers with shorter-term loans. These run from six months to a few years. See fortunebuilders.com/commercial-real-estate-financing-basics.

What Do Most Lenders Look for When Checking if You Qualify for Commercial Loan for Real Estate Financing?

This depends on the lender and the type of financing. What they check can include available collateral, borrower creditworthiness, and certain financial ratios dependent on characteristics of the property.

Borrowers may have to provide several years of financial statements and income tax returns. Lenders may also want to see financial statements indicating cash flow for the property to be financed. See reonomy.com/blog/post/commercial-real-estate-financing.

Check Out a Commercial Loan for Real Estate Financing from Credit Suite

Did you know Credit Suite offers commercial real estate financing? It ranges from $100,000 – $20,000,000. You can use this financing for refinancing a property, even if you are doing a cash-out refinance. Maximum LTV is 70%.

Loan-to-values range from 55 – 65%, depending on the purpose of the loan. Plus your clients can also get SBA loans. Renovations get loan to value of up to 60%.

Credit Suite has funding programs available including conventional property financing, money for investment properties and hard money loans, bridge loans and loans for the purchase of commercial real estate.

Get Commercial Real Estate Financing for All Types of Buildings!

Credit Suite offers financing for many different, even unique property types. Get funding for offices, industrial offices (this includes general or medical/dental), industrial facilities, light manufacturing buildings, and self-storage facilities.

With our commercial real estate financing, you can also get funding for mixed use properties, commercial condos, auto dealerships, light auto services, and day cares.

And you can even get funding for assisted living facilities, entertainment venues, multi-family properties, retail warehouses, and more.

Learn business loan secrets and get money for your business.

Check Out Details on Credit Suite’s Commercial Loan for Real Estate Financing Program

Approval amounts go up to $20,000,000. Bad credit is okay. Use the real estate as collateral. You will need to provide bank statements. A commercial real estate loan is a big step, let’s take it together.

A Commercial Loan for Real Estate Financing: Takeaways

Commercial real estate financing is for buying properties used solely for commercial purposes. Loan terms tend to be shorter than with residential loans. Plus there are added fees such as an appraisal of the property. You can get a commercial real estate loan from the SBA, HUD, conventional lenders, etc. Credit Suite offers a commercial loan for real estate financing for up to $20,000,000. Check out our terms.

The post Commercial Loan for Real Estate Financing appeared first on Credit Suite.

Commercial Loan for Real Estate Financing

What is a Commercial Loan for Real Estate Financing? Commercial real estate (CRE) is income-producing property with just business (rather than residential) purposes. Examples include retail malls, professional offices such as for dentists, office buildings and complexes, and auto dealerships. Financing, including the acquisition, development, and construction of these properties, often comes from commercial real … Continue reading Commercial Loan for Real Estate Financing

How to Create PPC Campaigns for Real Estate Marketing

Even if you have a smaller real estate business, you don’t have to rely on third-party databases to get traffic to your listings through real estate marketing.

With pay per click (PPC) advertising, you can bring people directly to your real estate website, where you own the medium and are in control of how you present yourself. This means rather than your listing appearing—and perhaps being lost—among a sea of competitors, you can showcase your entire portfolio without viewers being distracted by others’ listings.

PPC campaigns aren’t usually difficult to set up. With a few tweaks, you may reach your target audience more efficiently and bring motivated buyers to your website.

PPC Real Estate Marketing Trends

With six million homes sold in the U.S. in one year, it’s no wonder competition between real estate agents is tough.

As you would expect in such a competitive market, real estate marketing plays a huge role, and the tactics businesses use are always developing.

Today, we see many realtors using trends such as virtual staging, drone photography, inbound marketing, and automation of lead verification. New trends come and go, the need for a good website never changes—and neither does the need to bring traffic to your site.

This is where pay per click (PPC) comes in.

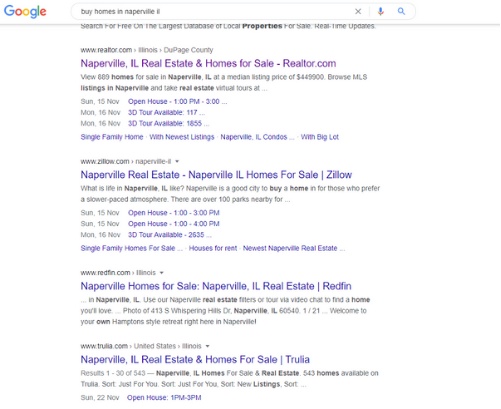

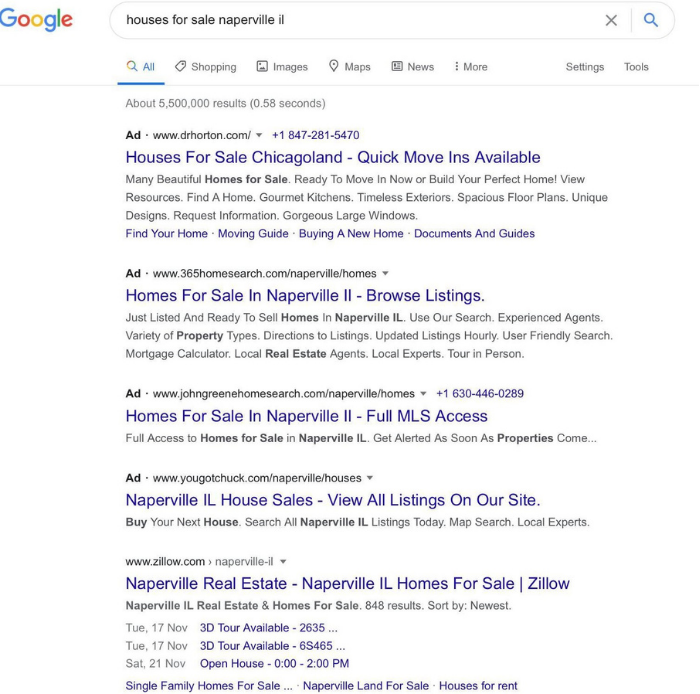

One of the difficulties with bringing traffic to your site is competition from huge online real estate databases like Zillow (236 million monthly users) and Realtor.com. Let’s take a look at a search query for “buy homes in Naperville IL.”

As you can see, those large sites are dominating the search engine results pages (SERPS).

However, ranking organically isn’t the only way to get to the top of the SERPs, and PPC may grant you a route to the top of the listings. Through a successful PPC campaign, your website could feature at the top of the page for your chosen keywords, potentially bringing in a large volume of traffic.

You pay a small fee for each click, but if you’re utilizing the latest real estate marketing trends well, then you could see a solid ROI. PPC allows you to bring traffic to a medium you control, which puts you in control of your marketing.

Selecting Keyword Phrases for Your Real Estate Marketing PPC

PPC could allow your website to appear at the top of the SERPs for virtually any keyword. Your real estate marketing isn’t going to benefit from featuring an irrelevant search term, though. This means you need to find the keywords that work for you and bring in people who convert into leads.

To do this, start by understanding your target audience.

- What does their customer profile look like?

- What information are your potential customers looking for?

- How do they search for that information?

Think about your audience and write out a list of all the ways they might search for your business.

For PPC to work for you, you also need to ensure your landing pages reflect the keywords you’re advertising for. When someone clicks on your ad, the page they land on needs to directly address why they clicked in the first place. Take a look at your current pages and list all the keywords reflecting the content you have on your site.

Once you’ve built up a list of keywords, it’s time to narrow it down so the keywords you bid on are relevant to both your audience and the pages they land on.

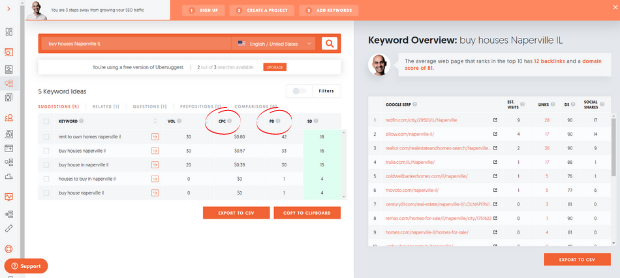

Part of succeeding at this is understanding where someone is in the buying cycle. For example, someone searching the keyword “best Chicago suburbs” might be at the beginning of the cycle, where the buyer intent is much lower than later on. Later in the cycle, they may search for “buy houses Naperville IL,” meaning they could quickly become a lead. This distinction should help you understand each keyword’s value and focus your real estate marketing PPC on boosting ROI.

After you’ve narrowed down your list, go to Ubersuggest to find out the cost per click and level of competition for each keyword.

Optimize Your Site for PPC Campaigns that Use Local Keyword Phrases

With all our examples so far, we’ve used what’s known as a “location modifier.” For instance, in “buy houses Naperville IL,” the terms “Naperville” and “IL” allow us to target a specific area. Nothing is stopping you from advertising for “buy houses,” and you’d probably get plenty of traffic—but there’s no point if you’re selling houses in Naperville and the user wants to buy one in Ft. Lauderdale.

Local keyword phrases are vital to real estate agents because they’re selling a product with a fixed location. As location is one of the driving forces behind real estate purchases, many people use these modifiers in their searches.

When you use local keyword phrases, your landing pages must match the search intent. If your advertisement says “houses for sale in Naperville,” then it has to deliver on its promise. Many people will click back to Google if it’s showing houses for rent or homes outside of Naperville.

Setting Max CPC Budgets for Your PPC Campaign

When you set up your real estate marketing campaign, you’re going to be asked to set a budget and decide the maximum you’re willing to pay per click for a specific keyword (max CPC). Remember, you’re not tied into anything—it’s something you can adjust as you go and optimize to get the best results.

To get an idea of your budget, set out the goals you want to achieve with your PPC campaign. For a simplified example, to make $5,000 a month from your advertising and the average value of your houses is $100,000 with a 1% commission, you need to sell five houses a month through your PPC.

The average cost per click for keywords related to real estate is $2.37 with a conversion rate of 2.47%—so, to sell your five houses, you might need just over 200 clicks at the cost of $494. While your numbers might vary from the industry average, you can always adjust your budget based on your average conversion rate and cost per click.

It’s also worth remembering that it’s not all about the price you pay per click, as your advertisement’s quality also plays a part. Google wants to send people to high-quality results, and if your ad achieves this, it’s more likely to be favored by the search engine’s algorithm.

Another way to maximize your budget is by boosting your click-through rate (CTR.) The average CTR for real estate ads is about 3.71%— but if you’re writing excellent ad copy, then you may find even better results. But remember, these are just industry averages, and your experience may vary. An ad budget of hundreds (or even thousands) doesn’t guarantee a sale, but PPC is worth a try for most markets.

Deciding Which Ad Platform is Right for Your Real Estate Marketing

When we think of search engines, our minds are naturally drawn to Google because it’s the biggest, with 3.5 billion searches per day. However, there are lots of different search engines and lots of other ad platforms.

Which ad platform you use should be decided by your business goals and your target audience. For example, if you’re selling sleek condos to millennials, your advertising will look very different than if you’re targeting seniors looking for a second home.

This differentiator is where you could help your real estate marketing campaigns by selecting the right platform.

Social media platforms such as YouTube, Facebook, Instagram, LinkedIn, and Pinterest are vital sources for real estate marketing, and they offer great PPC options. 99% of Millenials and 90% of Baby Boomers begin their real estate searches online, and with billions of people on social media, this could be a perfect way to reach them.

The great thing about PPC on social media is that they are highly visual media. Whereas with Google Ads you might be limited to text, social media allows you to incorporate video, images, and other effects. These tools can help your advertising stand out from the crowd, but you must choose the platform and message that resonates with your audience.

57% of Americans aged 25-30 are on Instagram, compared to 23% of 50- to 64-year-olds. However, the numbers look very different on Facebook, as 68% of 50- to 64-year-olds have accounts. This data shows people search for information differently, and your advertising needs to reflect this. You might find Google is the best way to reach your audience, or you may discover an alternative such as Instagram that offers you the most useful real estate marketing campaign.

Here you can see just how different a promoted post on Instagram could look from the traditional ads you see on Google. These various formats could give you the ability to appeal to particular audience demographics and potentially maximize the effectiveness of your real estate marketing.

Whichever platform you use, you’ve got to make sure your message suits the medium, and you’re giving people the experience they’re looking for. Various advertising platforms allow you to diversify your marketing, but you’ve got to focus on the techniques that work best for each campaign.

Deciding Which Real Estate Marketing Ad Format is Best

When you come to set up your ads, you’ll find you have lots of format options. The options vary depending on which platform you’re using, but for Google, you’ll have the following choices:

- Search ads: These are the “traditional” ads at the top of a SERP. These are particularly useful for real estate marketing because they allow you to reach a targeted audience at the precise moment they are looking for your product.

- Shopping ads: Shopping ads are product-focused advertisements that also allow you to feature at the top of a SERP. However, shopping listings are more commonly used for very specific searches such as “buy Barbie dolls,” where many retailers sell the same products.

- Display ads: Display ads allow your listing to feature on other people’s websites. While this can be a cost-effective way to reach a broad audience, it’s more difficult to judge where these people are in the buyer cycle because they haven’t made a specific search.

- Video ads: Video ads play between videos on YouTube and are a great way to incorporate a more interactive aspect to your advertising. Many people use YouTube as a search engine, so it’s another good way to reach motivated buyers.

- Gmail ads: These advertisements appear at the top of someone’s Gmail inbox and allow you to reach a targeted audience. The difficulty with Gmail ads for real estate marketing is determining buyer-intent. You might be targeting someone because they are interested in real estate, but this does not guarantee they’re looking to buy a house.

The key to these different ad types is finding the ones that best suit your business goals. For many real estate businesses, this is likely to be search ads.

This is because this method may best allow you to understand the searcher’s intent. Someone has put a specific query into Google—“find houses in Naperville”— so you more clearly know what they’re looking for and can judge where they are in the buying cycle.

With options like display ads, you can reach a targeted audience—for example, people looking at a house improvement website—but you don’t have control over searcher intent. As you’re selling something very specific that focuses on location, search ads are a good place to start.

Conclusion

Pay per click advertising is an essential tool for your real estate marketing. If you’re to take back clicks from online real estate databases like Zillow, then you’ve got to find alternative ways of getting traffic to your website.

PPC is an excellent way to do this, and it could bring large numbers of targeted, highly engaged visitors with a strong buyer intent to your website. From there, you’re in control of the medium and not reliant on a third party who controls your interactions with customers.

If you’re investing in real estate marketing trends like virtual staging and drone photography and you want to maximize their effectiveness, a way you could do this is by getting them in front of a targeted, engaged audience. With good PPC, you could do just that because it may allow you to boost your lead generation significantly—and perhaps sell more houses.

If you do need help with your PPC campaigns, reach out to my team to see how we can help.

Has PPC benefited your real estate business?

The post How to Create PPC Campaigns for Real Estate Marketing appeared first on Neil Patel.

5 Real Estate Influencers With Exceptional Personal Brands

Real Estate is not only about selling and buying. It serves a higher purpose. When we think about fulfilling our goals and ambitions, we want only the best for ourselves and those who surround us. … The post 5 Real Estate Influencers With Exceptional Personal Brands appeared first on Paper.li blog. The post 5 Real …

The post 5 Real Estate Influencers With Exceptional Personal Brands first appeared on Online Web Store Site.

The post 5 Real Estate Influencers With Exceptional Personal Brands appeared first on ROI Credit Builders.

5 Real Estate Influencers With Exceptional Personal Brands

Real Estate is not only about selling and buying. It serves a higher purpose. When we think about fulfilling our goals and ambitions, we want only the best for ourselves and those who surround us. … The post 5 Real Estate Influencers With Exceptional Personal Brands appeared first on Paper.li blog.

The post 5 Real Estate Influencers With Exceptional Personal Brands first appeared on Online Web Store Site.

The post 5 Real Estate Influencers With Exceptional Personal Brands appeared first on ROI Credit Builders.

5 Real Estate Influencers With Exceptional Personal Brands

Real Estate is not only about selling and buying. It serves a higher purpose. When we think about fulfilling our goals and ambitions, we want only the best for ourselves and those who surround us. …

The post 5 Real Estate Influencers With Exceptional Personal Brands appeared first on Paper.li blog.

5 Real Estate Influencers With Exceptional Personal Brands

Real Estate is not only about selling and buying. It serves a higher purpose. When we think about fulfilling our goals and ambitions, we want only the best for ourselves and those who surround us. …

The post 5 Real Estate Influencers With Exceptional Personal Brands appeared first on Paper.li blog.

The post 5 Real Estate Influencers With Exceptional Personal Brands appeared first on ROI Credit Builders.