A2 Hosting Review

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

For reliable hosting that focuses on speed, A2 Hosting provides plenty of options to get your site up and running.

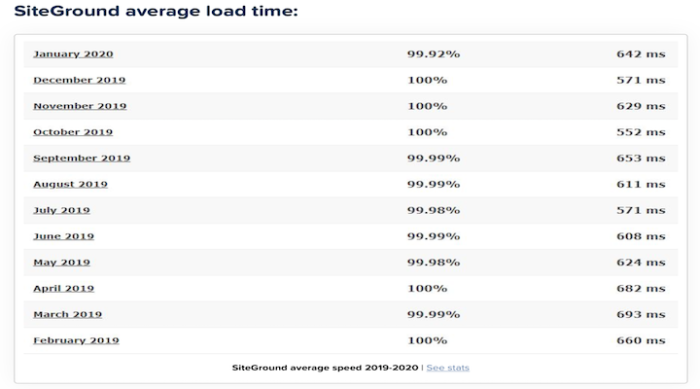

If you’re familiar with SEO and the ranking factors Google uses to decide where your site shows up in search results, you know speed is one major factor in securing higher rankings and increasing traffic and revenue.

This is one big way A2 differentiates itself from other standard web hosting options–it puts speed at the forefront of all its services.

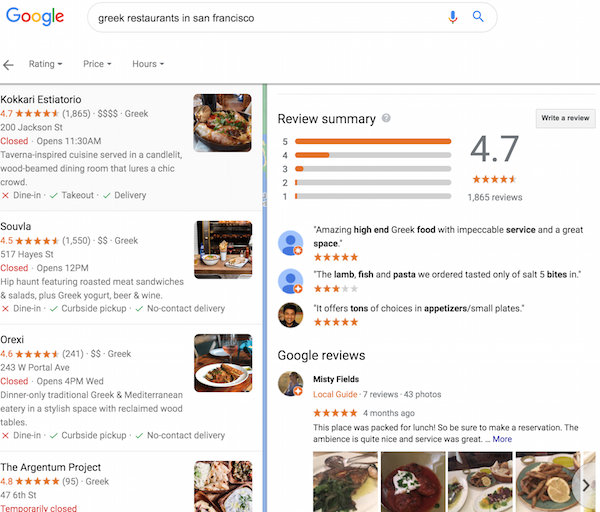

A2 Compared to The Best Shared Hosting Companies

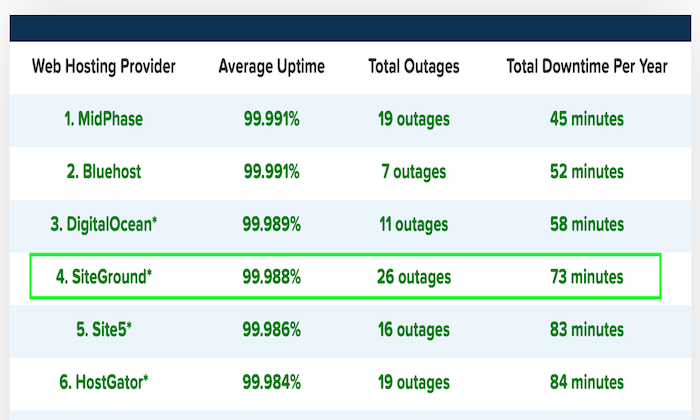

A 99.98% uptime guarantee, free automated backups, and free site migration are only some of the features that set A2 apart as far as reliable web hosting goes. As one of the oldest providers on the market, it’s a solid option for both new and veteran websites. WordPress users will especially love A2, as it has pricing packages specifically tailored for WordPress sites.

Before you make any solid decisions for a hosting provider, it’s always a good idea to know what your options are. I spent hours making sure the top list page contained only the best web hosting services according to a wide variety of needs and features. To see the full rundown, check out that post to see all the top picks.

Who is A2 Best For?

It’s simple. Any website that is designed to drive sales and conversions can benefit from a hosting service like A2. I’ve mentioned it before, but I don’t get tired of saying speed is the name of the game if you want to capture new leads, retain existing customers, keep your Google rankings, and maintain a great brand reputation.

Now, there isn’t a web host on the planet that doesn’t come with a set of pros and cons. But one thing’s for sure: No website visitor wants to land on a website that takes forever to load. They’ll bounce right off your site faster than you can say web hosting.

While you can try to install cache plugins that slow down your site and claim to improve your website speed, a host like A2 that’s built with a focus on speed can be a better place to start.

A2: The Pros and Cons

Pros

Exclusive web servers: Global web servers that are exclusive to A2 give you a leg up in the speed game with speeds that can be up to 20 times faster than the competition.

24/7 live chat and support: A 24/7 live support feature is valuable if your site runs into any kind of technical issues or downtime. A2 has specialists standing by ready to walk you through any troubleshooting issues.

Free site migration: If you need to migrate your site to A2 from a previous web host they help you get the job done for free. Unlike other providers, there are no extra fees necessary.

Compatible with a variety of platforms: A2 Hosting works great with a number of CMS solutions like WordPress, Drupal, Joomla, Magento, and OpenCart. You can one-click install them once you sign up.

Free SSL certification: SSL certification is essential for site security and to ensure your visitors trust your site enough to keep coming back. Thankfully A2 offers this feature for free.

24/7 malware scanning and monitoring: You can sleep soundly at night knowing A2 is ready to alert you on any attempts at your site with their 24/7 monitoring feature, which other hosting services might not provide.

Free Cloudflare CDN: To keep adding to their speed features, A2 provides you with a free Cloudflare CDN for any hosting package you choose for added speed and loading times.

Carbon-neutral hosting: As the world evolves, A2 evolves with it through its carbon-neutral hosting option. A2 supports carbon-neutral hosting, meaning all of their servers are deemed ‘carbon-neutral’ by purchasing carbon offsets. With A2, you can be sure you’re hosting your site without adding to your carbon footprint.

Can handle websites of all sizes: If you’re planning on growing your website traffic, it doesn’t matter if you’re starting out with a website from scratch or you’re a big business reeling in plenty of traffic and sales, A2 can handle your site’s growth with a wide variety of hosting packages that are all geared for speed.

Cons

Doesn’t provide a free domain: While this isn’t a requirement for any hosting service to work properly, it’s nice to have the option to register a free domain like other hosting services do, especially if you’re working with a shoestring budget.

Increased renewal fees: For the most part, increased renewal rates can be expected from just about any hosting provider, but it’s still worth mentioning if you’re thinking and planning long term. Upon renewal, A2’s hosting packages do increase in price.

A2 Pricing

A2 doesn’t only differentiate itself as a speedy host. They also have a ton—and I mean a ton—of web hosting options from which you can take your pick.

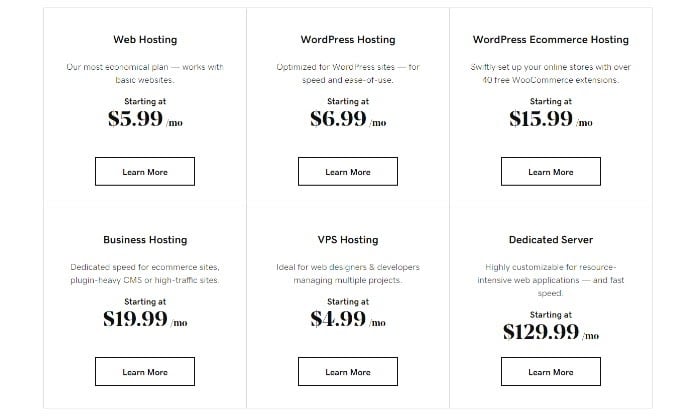

To start, their general hosting services fall into eight distinct categories and subcategories:

- Shared hosting – best for hosting personal sites and blogs

- Managed WordPress hosting – perfect for WordPress sites

- Managed VPS hosting – has more power than shared hosting

- Unmanaged VPS hosting – Unmanaged VPS for developers

- Reseller hosting – best for hosting your own customers

- Dedicated hosting (unmanaged servers) – best for developers

- Dedicated hosting (core servers) – managed server with root access

- Dedicated hosting (managed servers) – managed server with no root access

You can definitely start with one of their base options for each category according to your site needs. Especially if you’re a startup on a budget.

But if you want to take it a step further or want additional features, you can choose a more specific plan within the category of your choice.

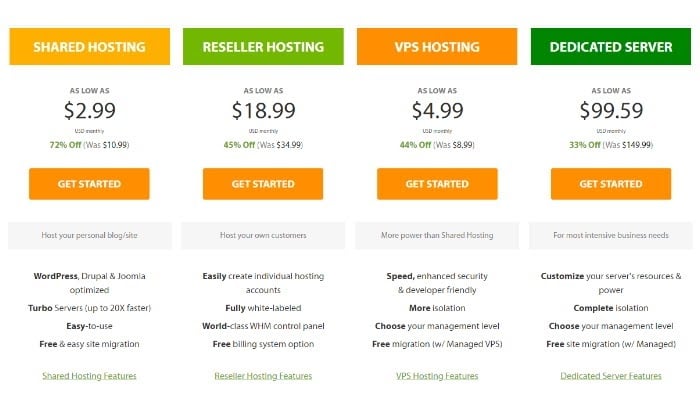

Here’s how their most affordable plans stack up:

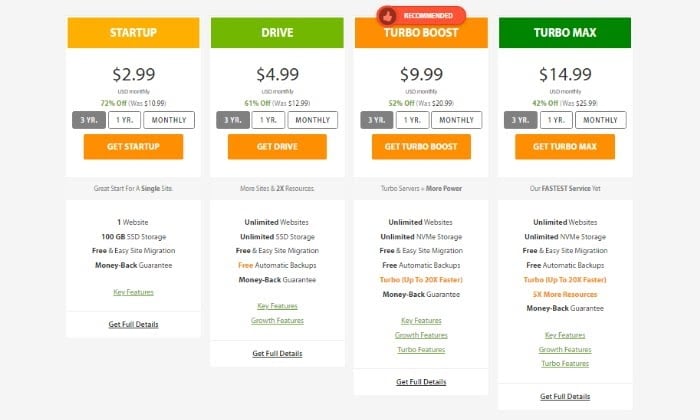

Shared Hosting

- Startup – $2.99 monthly paid upfront for a three-year plan

- Drive – $4.99 monthly paid upfront for a three-year plan

- Turbo Boost – $9.99 monthly paid upfront for a three-year plan

- Turbo Max – $14.99 monthly paid upfront for a three-year plan

Shared hosting works best for small websites that are just getting their start and beginning to see traffic. As you can see, their cheapest plan adds up to only $107 plus some change for a reliable three-year hosting plan.

Beginner deals like this compete with offers from the likes of Bluehost who offer similar prices but without the speed guarantee, which is a big plus on a shared hosting plan.

As you go up the price ladder, you can host an unlimited number of sites, get unlimited storage, and within the last two tiers, you’ll get a 20X turbo boost for faster site speeds.

Note that these pricing tiers are the exact same for a Shared WordPress Hosting plan.

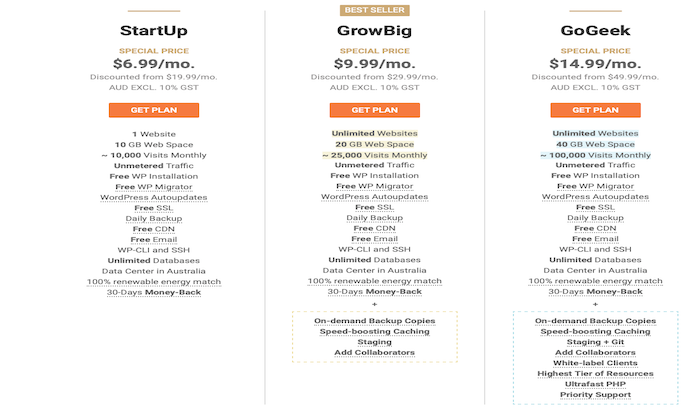

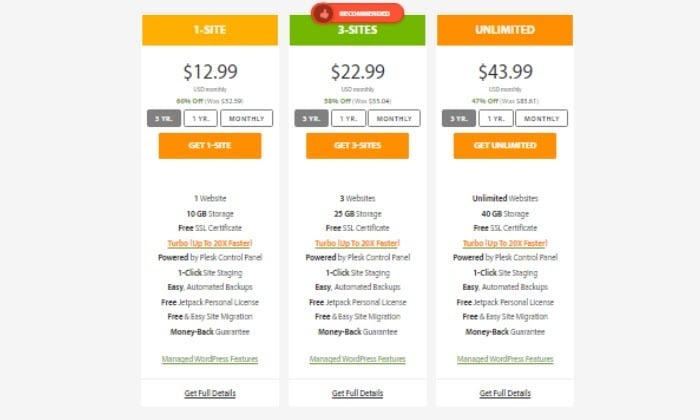

Managed WordPress Hosting

- 1 site – $12.99 a month paid upfront for three years

- 3 site – $22.99 a month paid upfront for three years

- Unlimited – $43.99 a month paid upfront for three years

Managed WordPress hosting is a step up from shared hosting with enhanced WordPress features that ensure security and speed. The biggest difference between the three different options you get within this category is the number of sites you need to manage and the amount of storage you need. It’s as simple as choosing the tier that fits your hosting needs. Thankfully, they all come with the 20X faster turbo speed feature.

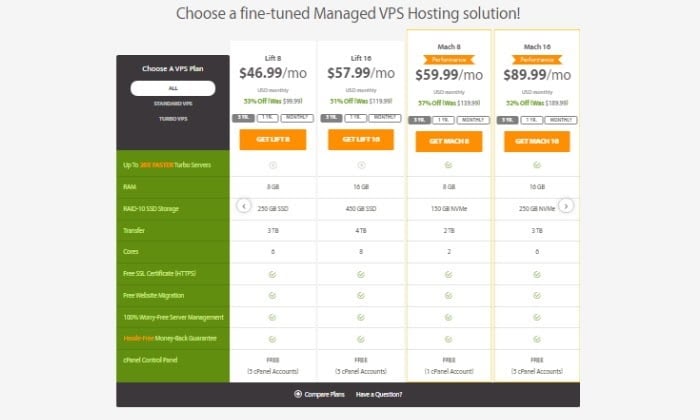

Managed VPS Hosting

- Lift 8 – $46.99 a month paid upfront for a three-year plan

- Lift 16 – $57.99 a month paid upfront for a three-year plan

- Mach 8 – $59.99 a month paid upfront for a three-year plan

- Mach 16 – $89.99 a month paid upfront for a three-year plan

- Mach 32 – $99.99 a month paid upfront for a three-year plan

When you start getting into managed VPS hosting territory, you start looking at increased RAM capabilities and storage capacity. It’s a great option right before you’re ready to step into a dedicated server plan. I recommend you see their pricing page for a full look at what each plan offers.

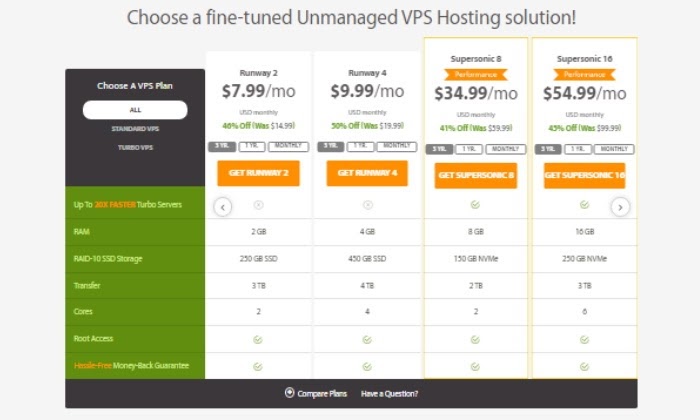

Unmanaged VPS Hosting

- Runway 2 – $7.99 a month paid upfront for a three-year plan

- Runway 4 – $9.99 a month paid upfront for a three-year plan

- Supersonic 8 – $34.99 a month paid upfront for a three-year plan

- Supersonic 16 – $54.99 a month paid upfront for a three-year plan

- Supersonic 32 – $74.99 a month paid upfront for a three-year plan

An unmanaged VPS plan ensures your site runs at fast speeds with additional RAM, storage, and root access. Needless to say, this VPS plan is definitely developer-friendly.

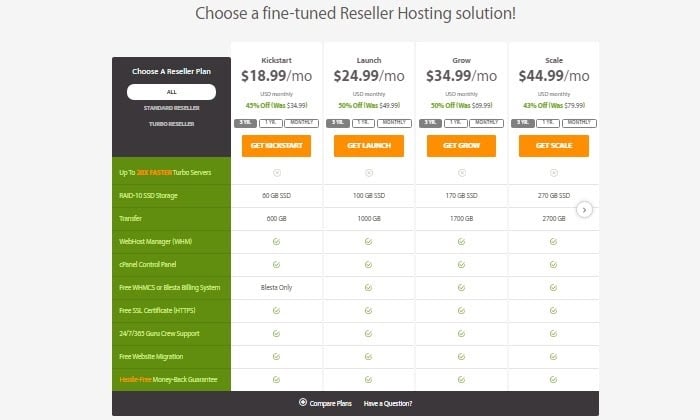

Reseller hosting

- Kickstart – $18.99 a month paid upfront for a three-year plan

- Launch – $24.99 a month paid upfront for a three-year plan

- Grow – $34.99 a month paid upfront for a three-year plan

- Scale – $44.99 a month paid upfront for a three-year plan

- Turbo Kickstart – $29.99 a month paid upfront for a three-year plan

With reseller hosting you get additional SSD storage, WebHost manager, cPanel, Free Blesta billing system, free SSL certificate, around the block guru support, and free website migration too. The more storage and transfer GB you need the more you’ll have to pay monthly.

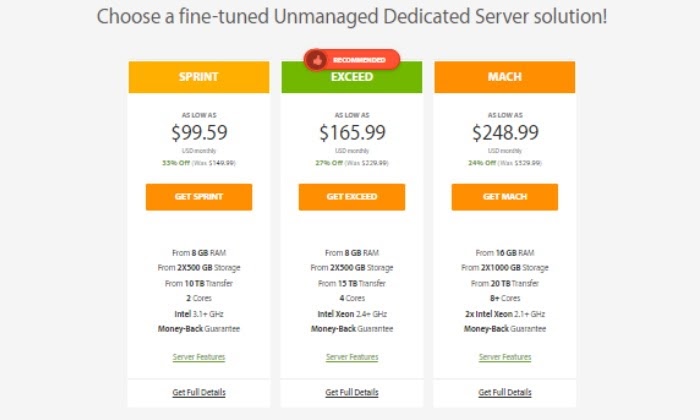

Dedicated Hosting (Unmanaged Servers)

- Sprint – $99.59 monthly

- Exceed – $165.99 monthly

- Mach – $248.99 monthly

As you can see, the more storage, RAM, or transfer TB you need the more you’ll have to pay monthly. Dedicated hosting with unmanaged servers is a great option for developers wanting more control. As with any other plan A2 Hosting offers, each tier also includes super fast site loading speeds.

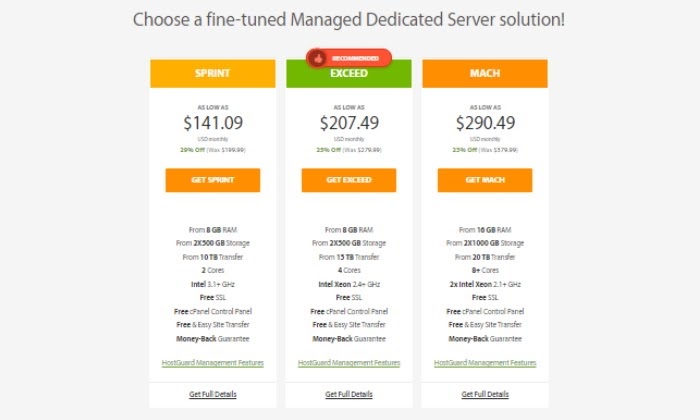

Dedicated Hosting (Core Servers)

- Sprint – $141.09 monthly

- Exceed – $207.49 monthly

- Mach – $290.49 monthly

Much like the previous tier category above, the more RAM, storage, and Transfer TB you need, the more you’ll need to pay monthly. With a dedicated hosting plan with core servers and root access, you also get all the HostGuard management features. This means:

- Daily automatic and rebootless updates

- Managed installs and upgrades of core software

- Smart system notifications

- 99.9% uptime commitment

- Security patches

Dedicated Hosting (Managed Servers)

- Sprint – $141.09 monthly

- Exceed – $207.49 monthly

- Mach – $290.49 monthly

Finally, if you’re running a site that simply can’t afford any downtime and that needs the best A2 Hosting offers, you’ll want to look at their managed dedicated server solutions. But you’ll have to be willing to pay the price tag to get access to perks like lightning-fast speeds, and a dedicated crew you’ll jump at the sight of any hosting issues no matter the time of day.

Their most affordable managed dedicated server solutions start at $141.09 a month. You can always try them for 30 days to experience their features first hand. If you’re not happy with A2 Hosting’s performance, there’s a 30-day money-back guarantee for all their hosting plans.

A2 Hosting Offerings

At this point, you’ve learned about A2 Hosting’s dedication to speed, uptime, customer support, and a variety of hosting options you can choose from.

However, they do offer additional tools and solutions. You can shop for your preferred domain directly through them and you can also explore their highly specific additional hosting solutions. Here’s what I mean:

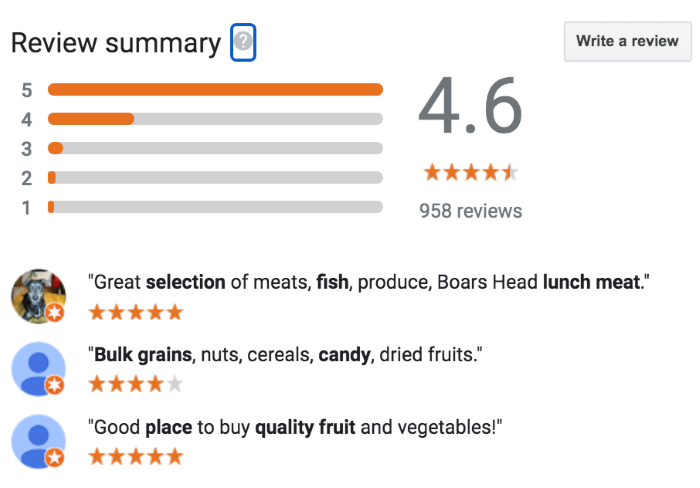

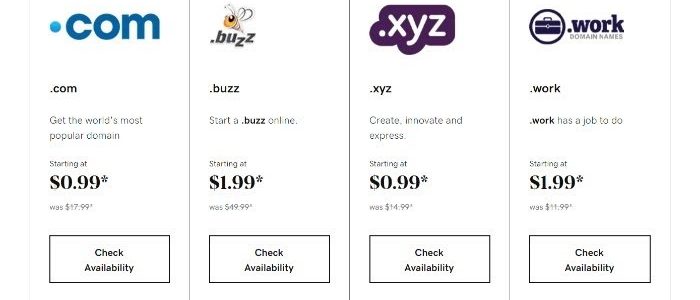

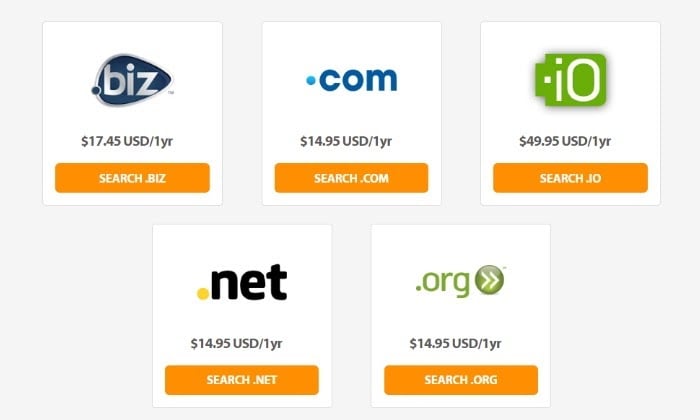

Domain

With A2 Hosting you’re definitely going to get the speed and the uptime but you can’t forget about your domain. You can either register a new domain or transfer an existing one to get your site up and running.

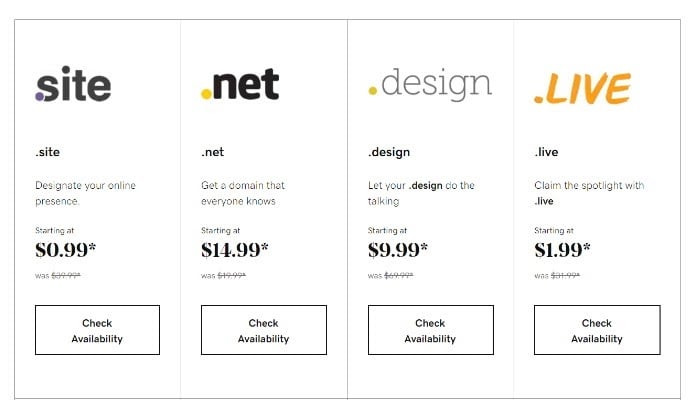

Their most popular extensions breakdown as follows:

- .biz – $17.45

- .com – $14.95

- .io – $49.95

- .net – $14.95

- .org – $14.95

While you might not get the cheapest deals on domains directly through A2 Hosting, it’s definitely an option that’s there for you if you don’t feel like going through the hassle of transferring one.

Additional hosting solutions

Yes, you’ve read that right. While we went over plenty of hosting plans and packages earlier, A2 Hosting lets you dig deeper into a seemingly endless rabbit hole of software and hosting solution combinations according to even more specific website needs.

Once you pick the appropriate solution for you, A2 Hosting lines up a combination of the best hosting options and software available to meet your specific needs.

For instance, if I’m going to be running a classified ad site through them, once I click on that option I’m greeted with a list of popular classified ad software that’s highly compatible with A2 hosting services. I’m also given a comprehensive list of the best web hosting plans perfect for classified ad sites.

This is an extremely useful feature if you’re running a site with more detailed needs and want to tackle them head-on. Features like these are yet another reason why A2 stands out as a powerful hosting solution for a wide variety of sites in a wide variety of niches.

The Best Shared Hosting Companies

Don’t forget to read through our in-depth review of the best shared hosting companies. See all of our top picks to make sure you’re making the best choice possible.

- Hostinger – The best cheap shared hosting plans

- Bluehost – The best shared hosting for WordPress

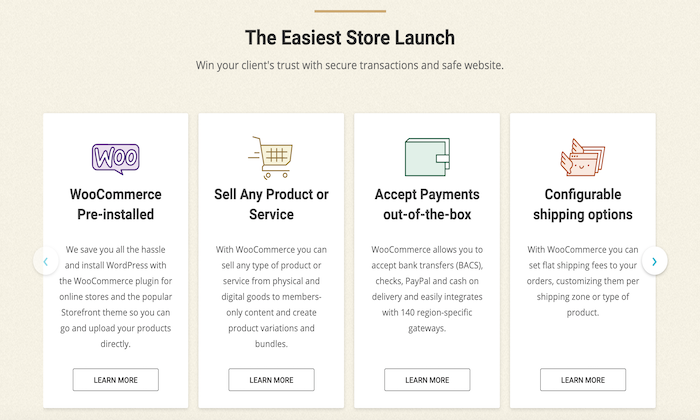

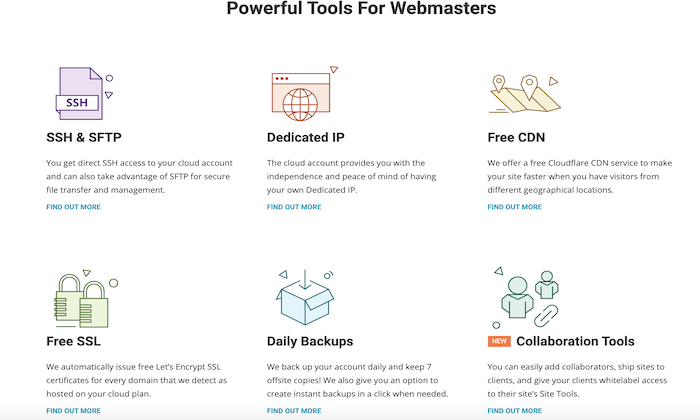

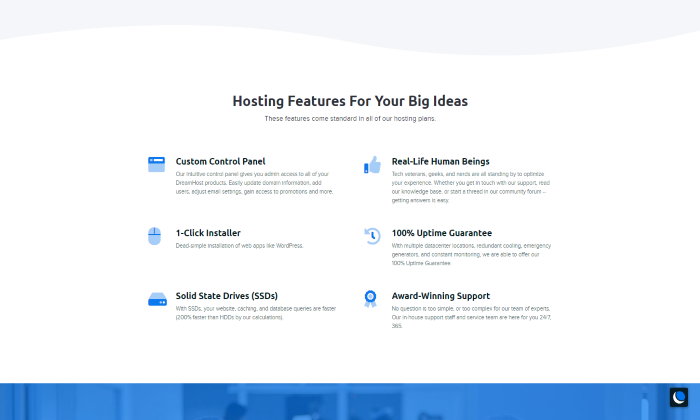

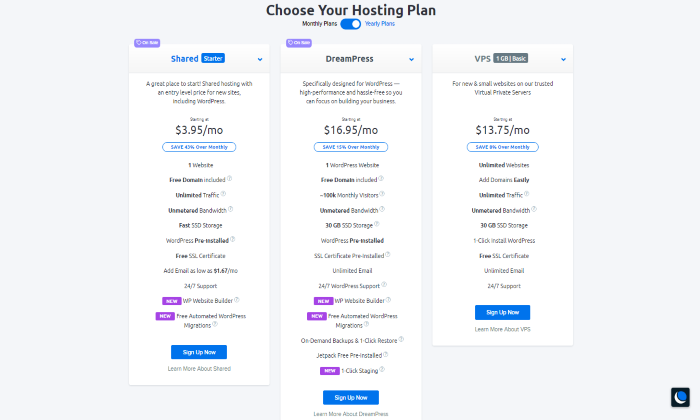

- A2 Hosting – The best hosting company for speed

- DreamHost – The best shared hosting features

- GreenGeeks – Best eco-friendly hosting

- TMDHosting – The best fully-managed plans

Without question, A2 Hosting is one of the fastest providers I have experience with. It provides around-the-clock support, exclusive global servers, and works great with a number of CMS solutions. What’s more, A2 Hosting even goes out of its way to lessen its carbon footprint. As a hosting provider that’s been around for as long as WordPress has, it stands solidly in our list of top picks as one of the best web host solutions out there.

The post A2 Hosting Review appeared first on Neil Patel.