Members of Iowa’s women’s swimming and diving team filed a Title IX suit to block the elimination of their program. The post Title IX suit filed vs. Iowa to save swimming appeared first on Buy It At A Bargain – Deals And Reviews.

Tag: Save

Sirum (YC W15 Nonprofit) is hiring developers to save medicine to save lives

Article URL: https://sirum.breezy.hr/

Comments URL: https://news.ycombinator.com/item?id=23992931

Points: 1

# Comments: 0

The SEO Tool Kit: 11 Tools That’ll Save You Time

When I first got into the world of SEO, you could literally optimize your site for any term and rank at the top of Google within a month or two.

But of course, that was ages ago.

Now with Google’s ever-evolving algorithm, it takes more time and effort to get results.

But what happens if you don’t have the luxury of time? Or you don’t have the financial resources to put in the effort that is truly needed.

What should you do?

Just forget about SEO?

Of course not. Today, I want to call out 11 tools that will help you get an edge over your competition. But unlike most lists, I am going to get very specific on the feature I want you to use within each tool to make your life easier and help you get results faster with less effort.

Let’s dive right in.

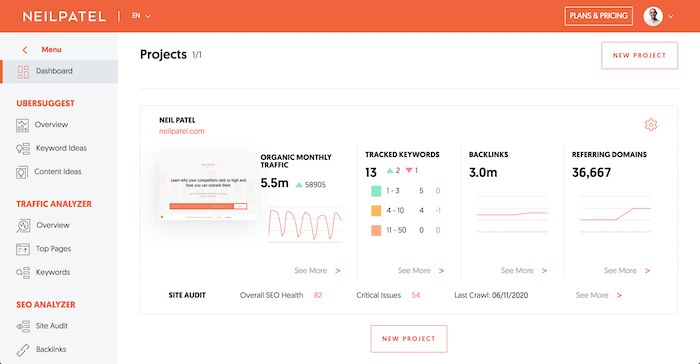

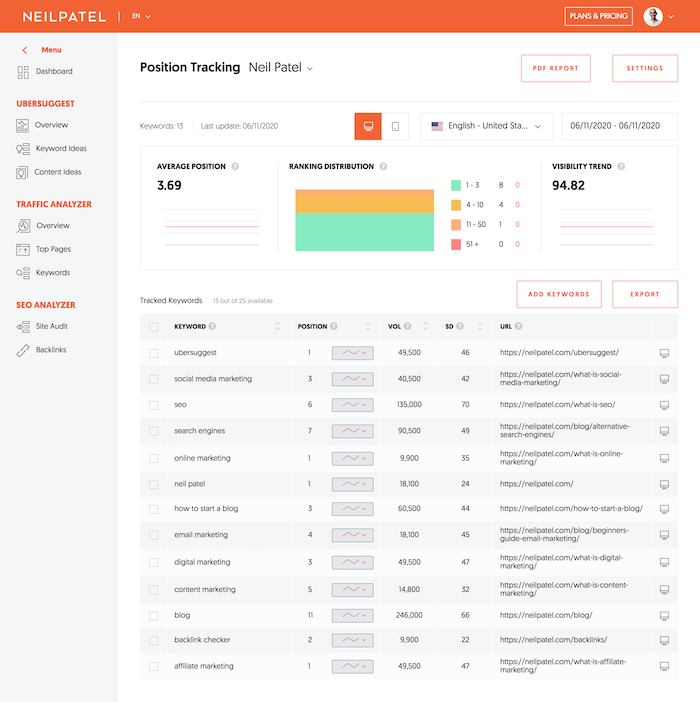

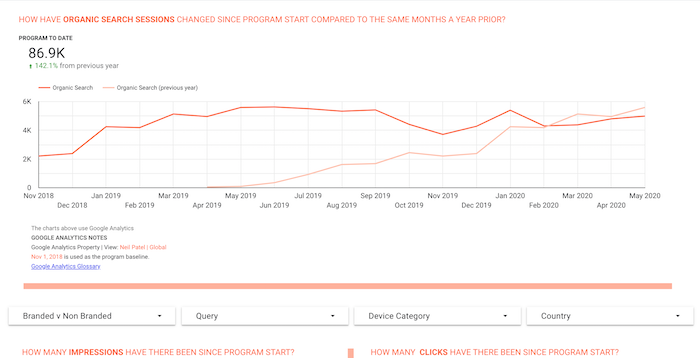

Tool #1: Ubersuggest Projects

You probably already know about Ubersuggest, but do you really have time to spend hours and hours each week to do your SEO?

Chances are you don’t.

So how do you improve your traffic with the least amount of effort?

You set up a project in Ubersuggest.

As you can see, it shows your SEO traffic over time. It will let you know if your rankings are going up or down, your link growth, and your SEO issues.

With so many things going on in marketing, you don’t have time to manually check your rankings or if things are going up or down or even what you need to fix.

Ubersuggest will do it for you all automatically and even notify you of what needs to happen through email. That way you don’t have to constantly check your SEO. Ubersuggest will do it all automatically.

More so, you’ll get notified of what you need to focus on each week to maximize your traffic.

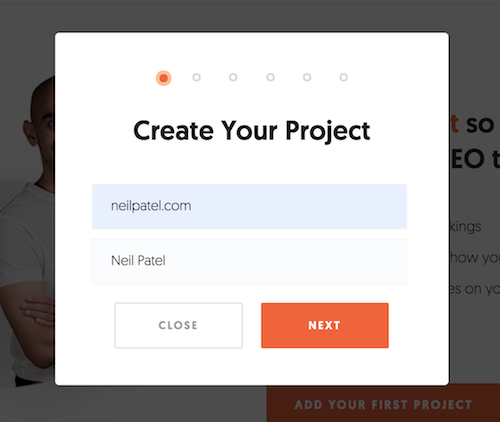

All you have do is head to the dashboard and click on “Add Your First Project.”

It’s as simple as adding in your URL.

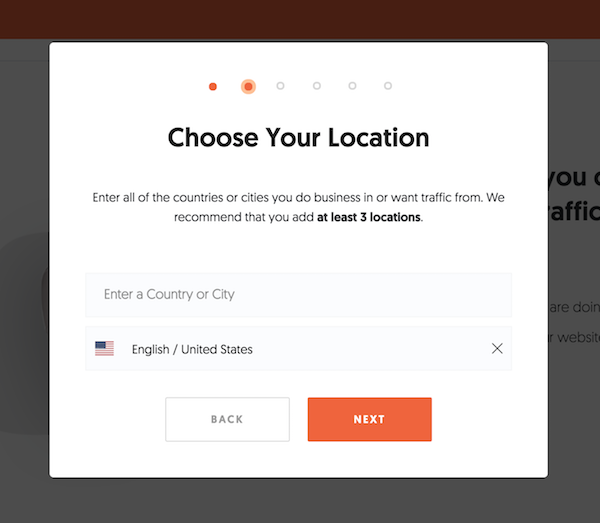

Then select the locations you do business in and want traffic from.

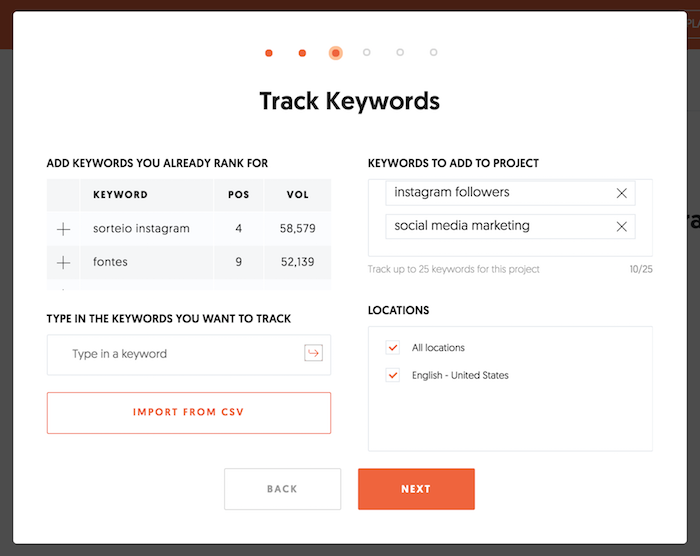

Then add in the keywords you currently rank for or want to go after.

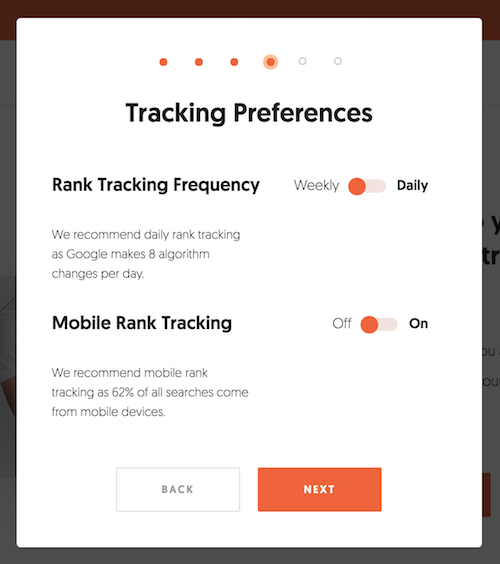

And of course, set up your traffic preferences.

And then you’ll be good to go.

Then when things go great, you’ll be notified. And when things are going wrong, you’ll also be notified. Ubersuggest will even tell you what to fix.

That way you get the maximum results in the least amount of time.

Tool #2: Google Analytics Alerts

You have Google Analytics set up on your site, but how often do you log in?

And when you do log in, do you know what to focus on or what to look at?

And if you do, do you know what to do with that data?

Google Analytics is a great tool, but you don’t want to waste hours and hours looking at reports. Instead, you want to spend your time doing and getting results.

But if you set up alerts in Google Analytics, you can save tons of time.

If you watch from the 6:33 mark, it will show you how to set up alerts. I added the whole video as it will teach you how to set up Google Analytics in general in case you don’t have goal tracking set in place.

Once you set up alerts, you’ll again get notified when anything good or bad happens. I usually have alerts set up for only when things go bad, so I know when I need to focus on fixing my marketing.

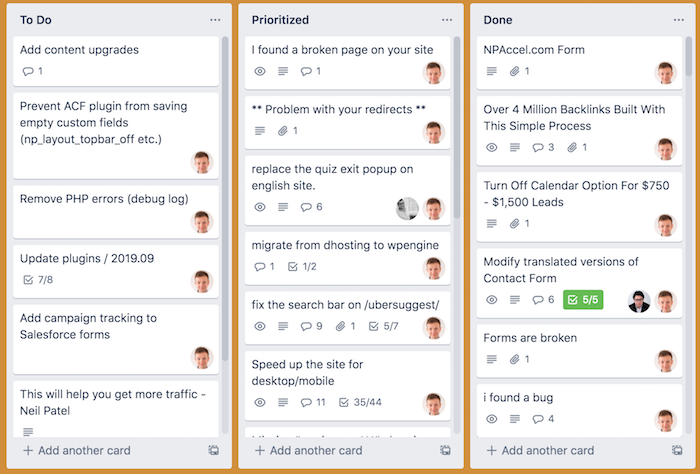

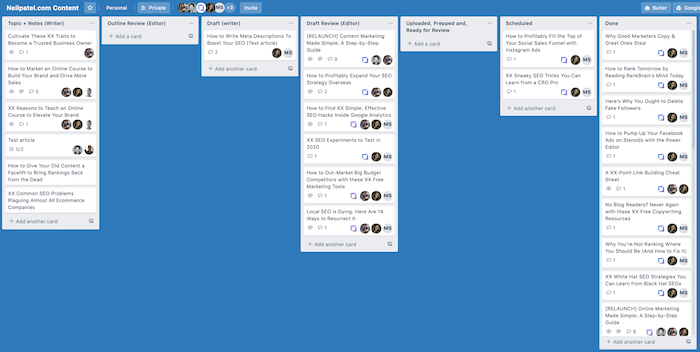

Tool #3: Trello

You’re probably thinking how the heck is Trello a marketing tool. It really isn’t, but it is a good project management tool.

And with your SEO, you may have a team helping you out and Trello will help streamline the process, make you more efficient, and get your results faster.

I keep my Trello board simple by breaking it into 3 sections.

- To do – what needs to be done over time.

- Prioritized – what I need to be done now (tasks at the top are the most important)

- Done – tasks that need to be double-checked to ensure they were done right.

It’s that simple. That way you don’t have to micromanage your team.

Some people have more complex Trello boards, but something simple like I have works too.

If you want to create a Trello board for your content marketing, assuming you want to write lots of content (such as 10 posts a week), this process works well.

The columns I use for content writers are:

- Topics – this is where writers add topics they want to write about.

- Outline review – writers submit their outline before they write for approval.

- Draft – writers submit their rough draft.

- Draft review – editors review each draft.

- Uploaded, prepared, and ready to review – this is where the editor adds the post to your CMS (like WordPress).

- Scheduled – this is where you schedule the content to go live.

- Done – the content is now live.

We’ve found it effective if you are managing dozens of writers at once.

Tool #4: Content Decay Tool

Can you guess how many articles I write each week?

1.

Seriously, that’s it. 1 article a week which is roughly 4 to 5 per month (depending on how many weeks in the month).

And can you guess how many articles my team and I update each week?

21.

That’s roughly 90 a month.

Just think about it… why would I have a team of 3 people updating 90 articles per month when I only write 1 a week.

It’s because updating old content is an easier way to get more SEO traffic than it is to create new content.

But what content should you update?

The content decay tool will tell you that.

It breaks down in order which articles you should update first, second, third… based on what will generate you the most traffic.

If you are wondering what is involved with updating content, just think of it this way:

- Is there anything outdated within your post – if so, either update the outdated information and make it relevant again. If you can’t, then delete that part from your article.

- Can you use media to improve the experience – do you need to embed videos, add more pictures, maybe even add an infographic? Use media to better tell your story and message.

- Are you including the right keywords – a simple way to get more traffic is to integrate other popular related keywords within your article. Whatever your article is about, insert it into Ubersuggest and head to the “Keyword Ideas” report in the left-hand navigation.

- Is there anything missing – try to poke holes within your content. What could you have done to make it better? What do your competitors talk about that you forgot to mention? What questions didn’t you answer that the reader might have? By asking yourself these simple questions, you’ll be able to make it better.

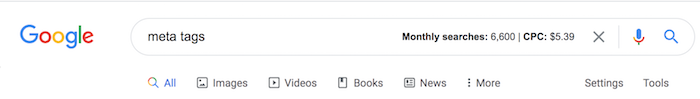

Tool #5: Ubersuggest Chrome Extension

If you haven’t installed the Ubersuggest Chrome extension, make sure you do so.

I’m not going to bore you with all of the features of the extension… instead, I am going to give you one thing that will save you time.

You know when you Google for information to learn more on any subject?

Chances are, sometimes you are Googling to learn something related to your space. And when you do, you’ll find that your site usually won’t be at the top of those search results.

And that’s ok.

But when you do a search, you’ll notice “monthly searches” in the Google search bar.

This shows you how often that keyword is searched.

So anytime you are looking up anything in your space, pay attention to that number. If you see a keyword with over 5,000 searches, it may be worth targeting.

And as you scroll down and start going through the sites that rank at the top, you’ll notice metrics under each site.

If you notice a web page with thousands of social shares and hundreds of links, it should reaffirm that you probably want to go after that term. And the listing that has thousands of social shares and hundreds of links is a good benchmark of a page that is high in quality and what people in your space prefer.

Ideally, you want to create something better than that one, as that is the main way you beat them over time.

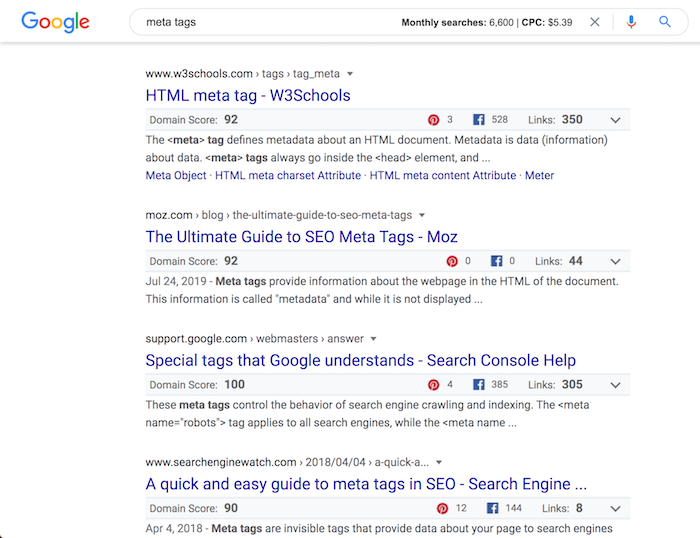

Tool #6: Hello Bar

SEO is very different than paid traffic.

With paid traffic, you can drive people to a landing page with very little content, which makes it easier to generate sales or leads.

With SEO, Google prefers to rank content-rich sites.

But when someone lands on a page full of educational-based content, they are less likely to convert into a customer.

There’s a simple fix… Hello Bar.

Hello Bar has a lot of features, but I just want you to use the top bar like I do on NeilPatel.com.

And as you scroll it moves along with you.

That one little thing allows me to improve my conversion rate from my SEO traffic.

You can easily adjust what you show with a few simple clicks within Hello Bar or you can even show people different messages based on where they are coming from.

Although SEO traffic doesn’t convert as well as paid traffic, it is much cheaper in the long run and does have a better overall ROI. And that one little Hello Bar will improve your numbers.

It’s responsible for 9.4% of revenue from NeilPatel.com.

Every little bit adds up.

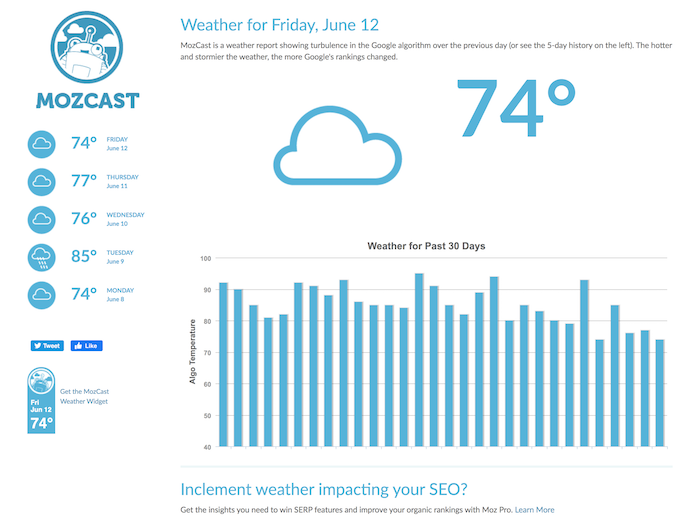

Tool #7: Mozcast

Google makes over 3,200 algorithm changes a year.

Are you really going to keep up to date with all of them?

If you followed the first tool and set up a project in Ubersuggest, you’ll get notified when your rankings go down.

And if you set up alerts in Google Analytics (tool number 2) you’ll also get notified when your traffic drops drastically.

What you’ll find is that it’s overwhelming to keep up with all of Google’s updates and it could be confusing to figure out what you need to fix to get your traffic back.

This report on Moz keeps track of all of the algorithm updates and gives you an overview of what has changed or what the update is about. On top of that, you’ll want to check out the Mozcast if you get a notification of ranking or traffic drops as this tool confirms if other people are also seeing changes from a Google update.

Keep in mind that Google doesn’t announce each update, hence you’ll want to cross-reference what you are seeing with the Mozcast.

That way you don’t have to spend hours researching each update.

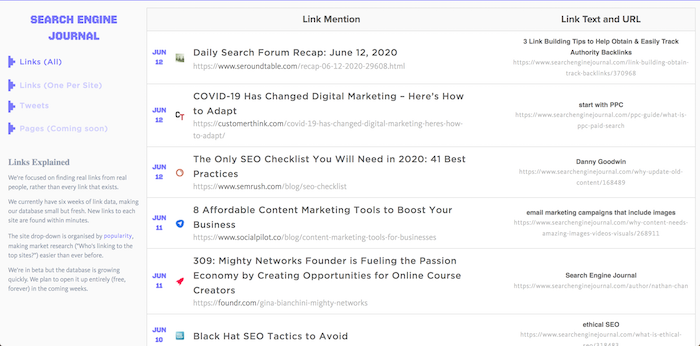

Tool #8: Detailed

Link building is a pain. There are so many link tools like this one… but let’s not kid ourselves… you just don’t have the time to spend 10 to 20 hours a week doing link building.

So, each minute you spend, you have to make sure it counts.

There’s a tool called Detailed that breaks down the best links for every industry.

All you have to do is select an industry and a site and it shows you all of the good links that are going to your competition.

You can then focus your efforts on reaching out to those sites to get links.

Sure, you will still need to have amazing content or a good product or service in order to convince those sites to link to you, but hey, if you don’t have any of that it’s going to be hard to do well in the first place.

So, don’t waste your time trying to search for links when Detailed will give you a list of hundreds of amazing sites to get links from within your space.

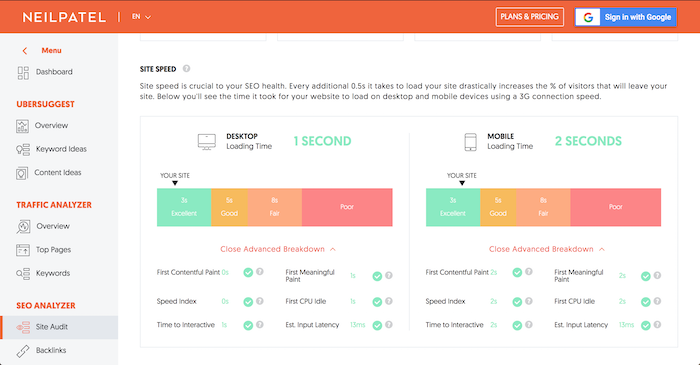

Tool #9: Site Speed Audit

Speed impacts rankings.

Google doesn’t want to rank slow websites anymore.

It doesn’t matter that technology has become better and you can now purchase satellite Internet. Not every location has blazing fast Internet.

For that reason, Google has an Accelerated Mobile Pages framework that helps with mobile load time.

But that’s not enough, you also need your website to load fast.

So, go here and put in your URL.

You’ll then be taken to a report that looks like this:

What you’ll want to focus on is site speed. That Ubersuggest report pulls from Google Lighthouse.

So, send that to your developer and tell them to get you in the green mark for both mobile and desktop load times.

As your speed goes up, so will your SEO rankings and traffic over time.

Tool #10: Supermetrics

Are you tired of having your data everywhere?

Why would you want to log into four of five different apps to get your SEO and marketing data when you could log into one.

And no, I am not talking about Google Analytics. I am talking about Google Data Studio.

If you haven’t used it yet, sign up for it… it’s free.

Google Data Studio is a business intelligence tool that will show you all of your data in one place.

So how do you get all of your SEO data into Google Data Studio? You use Supermetrics.

It passes all of your SEO data from different sources into Data Studio, so you no longer have to log into multiple tools, including Google Analytics.

My favorite feature in Supermetrics is you can automate your marketing reporting, so you no longer have to create your reports manually.

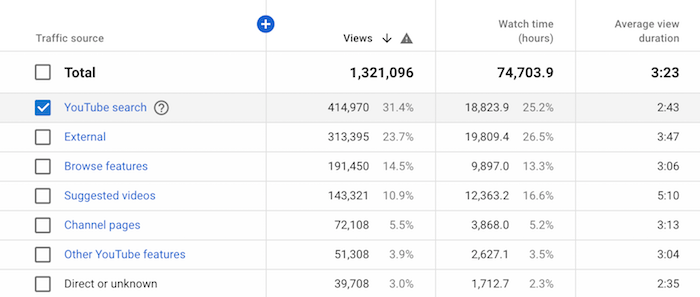

Tool #11: VidIQ

Google is the most popular search engine.

But do you know what the second most popular search engine is?

It’s not Bing… it’s actually YouTube, which Google actually owns.

If you haven’t done YouTube SEO yet, you should reconsider. Just look at how much search traffic I get from YouTube each month.

This article will break down how to do YouTube SEO if you want to learn how it works.

But to make things easier, install this Chrome extension.

Whenever you perform a search on YouTube it will show you what’s popular, what keywords are being searched that are related to each video, and which tags people are using to get more SEO traffic.

I wanted to end this post with VidIQ because it’s not competitive.

See, unlike traditional SEO, it doesn’t take months to see results. YouTube SEO is the opposite in which it isn’t as competitive (yet) and you can rank at the top within 24 to 48 hours of releasing a video (seriously!).

Conclusion

They say SEO is hard and time-consuming. And I am not going to lie, you won’t get results unless you put in some effort.

But who says it has to be as time-consuming?

By using some of the tools I mentioned above you’ll save time. It really is that simple.

I know there is a lot and it can be overwhelming. So if you don’t have time to use all of the tools it is fine… just start at the top and work your way down (I put them in order based on what will save you the most time).

What other ways do you save time on your SEO?

The post The SEO Tool Kit: 11 Tools That’ll Save You Time appeared first on Neil Patel.

Just How To Save Money On A Mobile Home Owner Insurance Quote

Just How To Save Money On A Mobile Home Owner Insurance Quote

A house is a residence, whether it is a practice block residence developed from scratch, or a produced mobile residence you have actually chosen and also had actually customized to your requirements. Simply due to the fact that your residence is a mobile residence does not imply you should not buy a residence proprietor’s insurance coverage plan for it.

Simply discover a Web website had by an insurance coverage firm that specializes in mobile house proprietor insurance policy, or a Web website that has accessibility to lots of various insurance coverage firms that specialize in mobile residence proprietor insurance policy. Occasionally there are elements that go right into mobile house proprietor insurance policy plans that do not go right into routine residence proprietor insurance policy plans, so make certain the business you pick does undoubtedly specialize in mobile residence proprietor insurance policy prior to concurring to anything.

You’ll after that start getting in the essential info. When you look for a mobile house proprietor insurance policy quote online, you are typically asked inquiries regarding your get in touch with details; the producer of the mobile residence as well as the year it was made; the dimension; the present lien owner if there is one; just how much the mobile house is from the shore; as well as just how close the mobile residence is to the local fire division.

Some Web websites that supply mobile residence proprietor insurance policy quotes will certainly use the quote promptly online; others will certainly pass your details to an insurance coverage representative that concentrates on mobile residence proprietor insurance coverage. No matter exactly how you obtain your mobile house proprietor insurance coverage quote and also from what insurer, make certain you chat straight to an online insurance policy representative and also get complete documents regarding your mobile house proprietor insurance policy quote– and also plan, need to you pick to buy one– prior to accepting anything.

The post Just How To Save Money On A Mobile Home Owner Insurance Quote appeared first on ROI Credit Builders.

Save money on Taxes Through Home Loan Lending

Minimize Taxes Through Home Loan Lending

Do you cluck with stress and anxiety as well as be sorry for each time you determine just how much of your income really goes to the tax obligation individuals? House funding borrowing makes having a home simple.

Mortgage Lending Lets You Save on Interest

You can also acquire added land with house finance loaning as well as declare the home passion as a reduction. The only problem is that this land be nearby to your residence. You can proclaim as a tax obligation reduction the passion on as much as $100,000 of your home-equity financial obligation.

Mortgage Lending Helps You Save on Taxes

When you buy a residence, you can proclaim all the genuine residential or commercial property tax obligations you pay as a tax obligation reduction. You can proclaim your share of the residential property tax obligations paid as a tax obligation reduction.

What makes this discount rate on tax obligations specifically intriguing is that there is no limitation to the variety of residential or commercial properties that top quality for this reduction. The home tax obligations you pay on all 15 residences can be stated as a reduction if you acquired 15 houses with house car loan financing.

Home Mortgage Lending Gives You Gain Exclusion

Intend you went for house financing borrowing 30 years earlier, as well as currently you have your residence. Is there any kind of method you can proceed taking pleasure in tax obligation benefit?

If you stayed in your residential or commercial property for a minimum of 2 of the previous 5 years prior to making a decision to offer it, you can leave out from your earnings statement $250,000 of the benefit from the sale. Also much better, if you marketed your home for much less than $250,000, you need not report the earnings to the IRS. You have no tax obligation on the sale.

Uncle Sam Is All for Home Loan Lending

A lot of decide for house car loan borrowing. Uncle Sam makes it much easier for you to have a residence by decreasing components of the expense you sustain in residence car loan borrowing.

Residence car loan financing simply may be the ideal point that can ever before take place to any person because the exploration of interior pipes. With residence car loan financing, you not just obtain to purchase a residence, you can utilize it to pay lower tax obligation!

When you buy a residence, you can proclaim all the genuine residential property tax obligations you pay as a tax obligation reduction. You can state your share of the building tax obligations paid as a tax obligation reduction.

Expect you went for residence funding borrowing 30 years earlier, and also currently you possess your home. Uncle Sam makes it less complicated for you to have a house by decreasing components of the price you sustain in house car loan financing.

With residence financing borrowing, you not just obtain to get a home, you can utilize it to pay minimal tax obligation!

The post Save money on Taxes Through Home Loan Lending appeared first on ROI Credit Builders.

Save money on Taxes Through Home Loan Lending

Minimize Taxes Through Home Loan Lending

Do you cluck with stress and anxiety as well as be sorry for each time you determine just how much of your income really goes to the tax obligation individuals? House funding borrowing makes having a home simple.

Mortgage Lending Lets You Save on Interest

You can also acquire added land with house finance loaning as well as declare the home passion as a reduction. The only problem is that this land be nearby to your residence. You can proclaim as a tax obligation reduction the passion on as much as $100,000 of your home-equity financial obligation.

Mortgage Lending Helps You Save on Taxes

When you buy a residence, you can proclaim all the genuine residential or commercial property tax obligations you pay as a tax obligation reduction. You can proclaim your share of the residential property tax obligations paid as a tax obligation reduction.

What makes this discount rate on tax obligations specifically intriguing is that there is no limitation to the variety of residential or commercial properties that top quality for this reduction. The home tax obligations you pay on all 15 residences can be stated as a reduction if you acquired 15 houses with house car loan financing.

Home Mortgage Lending Gives You Gain Exclusion

Intend you went for house financing borrowing 30 years earlier, as well as currently you have your residence. Is there any kind of method you can proceed taking pleasure in tax obligation benefit?

If you stayed in your residential or commercial property for a minimum of 2 of the previous 5 years prior to making a decision to offer it, you can leave out from your earnings statement $250,000 of the benefit from the sale. Also much better, if you marketed your home for much less than $250,000, you need not report the earnings to the IRS. You have no tax obligation on the sale.

Uncle Sam Is All for Home Loan Lending

A lot of decide for house car loan borrowing. Uncle Sam makes it much easier for you to have a residence by decreasing components of the expense you sustain in residence car loan borrowing.

Residence car loan financing simply may be the ideal point that can ever before take place to any person because the exploration of interior pipes. With residence car loan financing, you not just obtain to purchase a residence, you can utilize it to pay lower tax obligation!

When you buy a residence, you can proclaim all the genuine residential property tax obligations you pay as a tax obligation reduction. You can state your share of the building tax obligations paid as a tax obligation reduction.

Expect you went for residence funding borrowing 30 years earlier, and also currently you possess your home. Uncle Sam makes it less complicated for you to have a house by decreasing components of the price you sustain in house car loan financing.

With residence financing borrowing, you not just obtain to get a home, you can utilize it to pay minimal tax obligation!

The post Save money on Taxes Through Home Loan Lending appeared first on ROI Credit Builders.

Save money on Taxes Through Home Loan Lending

Minimize Taxes Through Home Loan Lending

Do you cluck with stress and anxiety as well as be sorry for each time you determine just how much of your income really goes to the tax obligation individuals? House funding borrowing makes having a home simple.

Mortgage Lending Lets You Save on Interest

You can also acquire added land with house finance loaning as well as declare the home passion as a reduction. The only problem is that this land be nearby to your residence. You can proclaim as a tax obligation reduction the passion on as much as $100,000 of your home-equity financial obligation.

Mortgage Lending Helps You Save on Taxes

When you buy a residence, you can proclaim all the genuine residential or commercial property tax obligations you pay as a tax obligation reduction. You can proclaim your share of the residential property tax obligations paid as a tax obligation reduction.

What makes this discount rate on tax obligations specifically intriguing is that there is no limitation to the variety of residential or commercial properties that top quality for this reduction. The home tax obligations you pay on all 15 residences can be stated as a reduction if you acquired 15 houses with house car loan financing.

Home Mortgage Lending Gives You Gain Exclusion

Intend you went for house financing borrowing 30 years earlier, as well as currently you have your residence. Is there any kind of method you can proceed taking pleasure in tax obligation benefit?

If you stayed in your residential or commercial property for a minimum of 2 of the previous 5 years prior to making a decision to offer it, you can leave out from your earnings statement $250,000 of the benefit from the sale. Also much better, if you marketed your home for much less than $250,000, you need not report the earnings to the IRS. You have no tax obligation on the sale.

Uncle Sam Is All for Home Loan Lending

A lot of decide for house car loan borrowing. Uncle Sam makes it much easier for you to have a residence by decreasing components of the expense you sustain in residence car loan borrowing.

Residence car loan financing simply may be the ideal point that can ever before take place to any person because the exploration of interior pipes. With residence car loan financing, you not just obtain to purchase a residence, you can utilize it to pay lower tax obligation!

When you buy a residence, you can proclaim all the genuine residential property tax obligations you pay as a tax obligation reduction. You can state your share of the building tax obligations paid as a tax obligation reduction.

Expect you went for residence funding borrowing 30 years earlier, and also currently you possess your home. Uncle Sam makes it less complicated for you to have a house by decreasing components of the price you sustain in house car loan financing.

With residence financing borrowing, you not just obtain to get a home, you can utilize it to pay minimal tax obligation!

The post Save money on Taxes Through Home Loan Lending appeared first on ROI Credit Builders.

Save Your Bank Credit Score and Get Business Financing

Business financing is a challenge for many businesses. Don’t make it harder to get business financing with a bad bank credit score. We show you how to fix it.

Business Financing Can Be a Challenge If You Damage Your Bank Credit Score

Of course you want business financing. Every business owner does. But there’s a little-known number called a bank credit rating. And it may be making it harder for you to get money.

Your Bank Credit Rating – What’s it All About?

Did you know there are many ways you can ravage your bank credit rating? It is, regrettably, rather simple to run a power saw through your bank rating.

However prior to going any further, do you understand the distinction between bank credit ratings and company credit?

Company credit is the full and complete amount of money that your company can get from all types of creditors. That means the banking system, credit unions, credit card companies, and renting companies. And it also means providers, under what’s called trade credit or vendor credit or trade lines. That is, the vendor credit tier.

A bank credit score, on the other hand, is a measure of the sum total of borrowing capability which a company can get from the banking system only.

Bank Credit Ratings Explained

A company can get more company credit rapidly, so long as it has at the very least one financial institution reference and an average daily account balance of at the very least $10,000 for the most recent three month period. This setup will generate a bank credit score of a Low-5. So this means it is an Adjusted Debt Balance of from $5,000 to $30,000.

A lower score, like a High-4, or balance of $7,000 to $9,999 will not instantly turn down the small business’s loan application. Nonetheless, it will slow down the approval process.

What is a Bank Rating?

A bank rating is a measure of the average minimum balance as maintained in a business bank account over a three month long period. Thus a $10,000 balance| will rank as a Low-5, a $5,000 balance will rank as a Mid-4. So a $999 balance will rate as a High-3, and so on.

A company’s principal objective ought to always be to maintain a minimum Low-5 bank score (or, an average $10,000 balance) for at the very least three months. This is because, without at least a Low-5 rating, most banks will operate under the presumption that the business has little to no ability to repay a loan or a business line of credit.

However there is one thing to keep in mind: you will never really see this number. The financial institution will just keep this number in its back pocket.

The Bank Score Ranges

The numbers work out to the following ranges:

To get a High-5 score, your company will need to have an account balance of $70,000 to $99,999. For a Mid-5 rating, your company has to have an account balance of $40,000 to $69,999. And for a Low-5 score, your company has to keep an account balance of $10,000 to $39,000. So your business needs this level bank score or better so as to get a bank loan.

For a High-4 rating, your company needs to have an account balance of $7,000 to $9,999. And for a Mid-4 rating, your business must have an account balance of $4,000 to $6,999. So for a Low-4 rating, your business will need to have an account balance of $1,000 to $3,999.

Ruining Your Bank Score

And now, without further ado, below are 7 ways you can leave your bank score in tatters.

1st Way to Ruin Your Bank Credit and Miss Out on Business Financing

Banks are extremely motivated to lend to a company with regular deposits. And a business owner must also make regular deposits in order to maintain a positive bank score. The business owner must make several consistent deposits, more than the withdrawals they are making, in order to have and preserve a great bank rating. If they can do that, then they will have a great bank credit score.

Consistency is the hobgoblin of little minds, right? So be a free spirit!

2nd Way to Destroy Your Bank Credit

Do not let your company show a positive cash flow. The money coming in and leaving your firm’s bank account should reflect a positive free cash flow.

A positive free cash flow is the quantity of income left over after a firm has paid all of its expenses. According to Investopedia, it “represents the cash a company can generate after required investment to maintain or expand its asset base. It is a measurement of a company’s financial performance and health.”

When an account shows a positive cash flow it shows your small business is generating more income than is used to run the business. That means the bank will feel your company can pay its bills.

So if you truly want to damage your bank score, purchase whatever’s expensive for your small business so your expenditures outstrip your profits. Doesn’t every manufacturing facility deserve plush carpeting in the loading dock?

Check out our professional research on bank ratings, the little-known reason why you will – or won’t – get a get a bank loan for your business.

3rd Way to Damage Your Bank Credit Score and Miss Out on Business Financing

To add to #4, do not include overdraft protection to your bank account as soon as possible, to avoid NSFs. Why bother thinking ahead or planning for the future? Everything is going to be excellent forever, right?

Writing checks insufficient funds (NSFs) is a sure way to ruin your bank rating.

4th Way to Damage Your Bank Credit Score

Never handle your bank account responsibly. This means that your small business ought to not avoid writing non-sufficient funds (NSF) checks at all costs, because those annihilate bank scores. Non-sufficient-funds checks are something which no small business can afford to let happen.

Balancing checkbooks and accounts is so boring anyway. You’ve got adequate cash without even making sure, right?

5th Way to Ruin Your Bank Credit Score and Miss Out on Business Financing

To go along with #6, do not make certain that each and every credit bureau and trade credit vendor likewise lists the business name and address the precise same way. This is every keeper of financial records, revenue and sales taxes, web addresses and e-mail addresses, directory assistance, etc.

No lending institution is going to stop to consider the myriad manners in which a business may be listed, when they check out the business’s creditworthiness. Thus if they are not able to discover what they require easily, they will either deny an application or it won’t be reported to a business credit reporting agency such as Experian, Equifax or Dun & Bradstreet.

Therefore, if they are unable to discover what they need conveniently, they will just deny the application. So see to it your documents are a mess!

6th Way to Damage Your Bank Credit

Don’t bother to guarantee that your business bank accounts are reported precisely the same way as every one of your business documents are, and also with the precise same physical address (no post office box) and phone number. Sow confusion in this area by changing one and not another, or not remedying an error if there is one.

Check out our professional research on bank ratings, the little-known reason why you will – or won’t – get a get a bank loan for your business.

7th Way to Ruin Your Bank Credit Rating and Miss Out on Business Financing

Don’t maintain a minimum balance for a minimum of three months. Since every bank rating cycle is based on the previous three months, a consistently seesawing balance should damage your bank score.

Destroy Your Business’s Bank Score – Although You Will Never See It

You, the entrepreneur must never make consistent deposits. And these deposits must never be more than the withdrawals you are making, in order to destroy your bank credit rating.

If you can do these things, then your business will have a horrible bank credit score. And, consequently, a bad bank credit rating means your firm is far less likely to get business loans.

Just Kidding: Of Course We Don’t Truly Want You to Ruin Your Business’s Bank Credit Rating!

So, where do you go from here?

The 1st Great Way to Rescue Your Bank Credit Score and Get Business Financing

Maybe the simplest way to achieve and maintain a good bank credit score is to deposit at least $10,000 into your business bank account and maintain it there for as long as a half year. While you will still need to make consistent deposits, this one easy step will help in three ways. One, you will have kept a good minimum balance for at the very least three months. Two, you will more than likely not overdraw with such a good balance. And 3, you will be at the magic minimum for a Low-5 bank credit score. Therefore you will be dealing with our #4 and #7, above.

And you might even be able to get around our #3. Yet we still highly recommend overdraft protection.

The 2nd Wonderful Way to Rescue Your Bank Credit Rating and Get Business Financing

A 2nd requirement is to ensure your small business account information are consistent across the board, all over. While it might take some work order to make sure everything is right, you will be dealing with our #5 as well as #6, above.

The 3rd Great Way to Rescue Your Bank Credit Score and Get Business Financing

A third requirement is to make consistent deposits, as well as make certain they are greater than the quantities you are taking out every month. This will take care of our #1 as well as #2 smoothly.

Make it Easier to Get Business Financing With a Great Bank Credit Score: Takeaways

Your bank score is not to be trifled with. Although the financial institutions maintain a secret concerning them, failing to keep your bank credit rating high will make it a whole lot harder to do well in business.

Check out our professional research on bank ratings, the little-known reason why you will – or won’t – get a get a bank loan for your business.

The post Save Your Bank Credit Score and Get Business Financing appeared first on Credit Suite.

Contrast Business Credit Cards and also Save Money

Contrast Business Credit Cards and also Save Money

Today’s company owner have the ability to capitalize on the rewards provided to them by getting company bank card. Whether it is a little or huge organisation, having a credit line is essential and also company owner require to contrast organisation bank card to identify whether they fit their organisation demands. In retrospection, by figuring out which card remains in line with a proprietor’s organisation, she or he is in fact making one of one of the most important choices an entrepreneur can make.

For some entrepreneur, establishing what sort of service charge card fits the requirements of their service might be an overwhelming job. What’s essential to remember is that taking a seat as well as conceptualizing is much better than discovering later on that a poor choice was made and also it can promptly come to be an extremely pricey error.

Various company bank card supply entrepreneur different points. Business proprietor should realize that if an organisation charge card uses significant vacationer’s advantages, like traveling factors as well as tourist’s insurance policy, however that entrepreneur never ever is needed to take a trip, what good does that feature provide for his/her organisation? When business proprietor establishes what finest fits the requirements of his/her service, after that complies with the procedure of study, the most effective bank card selection can be made.

Credit scores card firms using service credit scores cards satisfaction themselves on showcasing what the business is providing. ‘Pay back’ standards might be either the following month or account repayments might be extended out to allow organisation proprietors have the deluxe of not fretting regarding paying the equilibrium on their service debt cards. Contrasting organisation cards can often be a challenging experience however for the a lot of component it is a required job due to the fact that making informed options is essential when self used in order to stay clear of service failing.

Contrasting service charge card can bring about establishing what fits the demands of your service. The sorts of calling card differ and also each deals motivations to local business owner in order to keep or produce long-term company partnerships and also respectability. There are, nevertheless, particular sorts of company charge card that all entrepreneur, tiny or big, ought to make the most of.

It is best to look for the kind of organisation credit history card that uses appealing reduced passion prices that are not just executed briefly, however that will certainly remain reduced for the life of the service credit history card. Make specific the reduced rate of interest price is not marketed for simply the initial month of the service debt card or for the initial year of the organisation credit score card.

Some service debt cards have extraordinary cash money back discounts programs, however have a limitation to the number of money back grants the service debt card gets. There are likewise some company credit score cards that offer organisation proprietors the choice to pay over time or pay equilibrium in complete. The lower line is to contrast organisation debt cards in order to pick the best one to fulfill all of the organisation’ requirements.

Whether it is a little or huge service, having a line of debt is critical as well as organisation proprietors require to contrast organisation credit score cards to figure out whether or not they fit their company demands. The company proprietor should be conscious that if a service credit history card provides significant tourist’s advantages, like traveling factors as well as vacationer’s insurance coverage, yet that organisation proprietor never ever is called for to take a trip, what good does that feature do for his or her company? The kinds of company cards differ as well as each deals rewards to service proprietors in order to preserve or produce lengthy long-term organisation partnerships as well as respectability. It is best to look for the kind of organisation debt card that supplies eye-catching reduced passion prices that are not just carried out momentarily, however that will certainly remain reduced for the life of the service credit scores card. Make specific the reduced passion price is not marketed for simply the initial month of the service credit rating card or for the very first year of the company credit rating card.

The post Contrast Business Credit Cards and also Save Money appeared first on ROI Credit Builders.

Contrast Business Credit Cards and also Save Money

Contrast Business Credit Cards and also Save Money

Today’s company owner have the ability to capitalize on the rewards provided to them by getting company bank card. Whether it is a little or huge organisation, having a credit line is essential and also company owner require to contrast organisation bank card to identify whether they fit their organisation demands. In retrospection, by figuring out which card remains in line with a proprietor’s organisation, she or he is in fact making one of one of the most important choices an entrepreneur can make.

For some entrepreneur, establishing what sort of service charge card fits the requirements of their service might be an overwhelming job. What’s essential to remember is that taking a seat as well as conceptualizing is much better than discovering later on that a poor choice was made and also it can promptly come to be an extremely pricey error.

Various company bank card supply entrepreneur different points. Business proprietor should realize that if an organisation charge card uses significant vacationer’s advantages, like traveling factors as well as tourist’s insurance policy, however that entrepreneur never ever is needed to take a trip, what good does that feature provide for his/her organisation? When business proprietor establishes what finest fits the requirements of his/her service, after that complies with the procedure of study, the most effective bank card selection can be made.

Credit scores card firms using service credit scores cards satisfaction themselves on showcasing what the business is providing. ‘Pay back’ standards might be either the following month or account repayments might be extended out to allow organisation proprietors have the deluxe of not fretting regarding paying the equilibrium on their service debt cards. Contrasting organisation cards can often be a challenging experience however for the a lot of component it is a required job due to the fact that making informed options is essential when self used in order to stay clear of service failing.

Contrasting service charge card can bring about establishing what fits the demands of your service. The sorts of calling card differ and also each deals motivations to local business owner in order to keep or produce long-term company partnerships and also respectability. There are, nevertheless, particular sorts of company charge card that all entrepreneur, tiny or big, ought to make the most of.

It is best to look for the kind of organisation credit history card that uses appealing reduced passion prices that are not just executed briefly, however that will certainly remain reduced for the life of the service credit history card. Make specific the reduced rate of interest price is not marketed for simply the initial month of the service debt card or for the initial year of the organisation credit score card.

Some service debt cards have extraordinary cash money back discounts programs, however have a limitation to the number of money back grants the service debt card gets. There are likewise some company credit score cards that offer organisation proprietors the choice to pay over time or pay equilibrium in complete. The lower line is to contrast organisation debt cards in order to pick the best one to fulfill all of the organisation’ requirements.

Whether it is a little or huge service, having a line of debt is critical as well as organisation proprietors require to contrast organisation credit score cards to figure out whether or not they fit their company demands. The company proprietor should be conscious that if a service credit history card provides significant tourist’s advantages, like traveling factors as well as vacationer’s insurance coverage, yet that organisation proprietor never ever is called for to take a trip, what good does that feature do for his or her company? The kinds of company cards differ as well as each deals rewards to service proprietors in order to preserve or produce lengthy long-term organisation partnerships as well as respectability. It is best to look for the kind of organisation debt card that supplies eye-catching reduced passion prices that are not just carried out momentarily, however that will certainly remain reduced for the life of the service credit scores card. Make specific the reduced passion price is not marketed for simply the initial month of the service credit rating card or for the very first year of the company credit rating card.

The post Contrast Business Credit Cards and also Save Money appeared first on ROI Credit Builders.