Ubersuggest vs. Ahrefs: SEO Tool Comparison

There are so many SEO tools at your disposal today.

With digital marketing growing every day, the industry has to adapt quickly. So, the tools you use should help you work smarter and not harder.

Keyword research and SEO strategy are foundational pieces of your marketing plan. It’s all part of your workflow to draw in a larger audience—something that complements your marketing campaign overall.

To build a solid SEO strategy, you must start with a powerful research tool. So, which should you pick?

As two of the most popular names in the SEO space, my tool Ubersuggest is often compared to Ahrefs.

I know what you’re thinking: “Well, which one is better?”

When assessing SEO resources like Ubersuggest vs. Ahrefs, consider ease of use, features, functionality, and pricing. Let’s take a look at all three as we break down the differences between these two robust SEO tools.

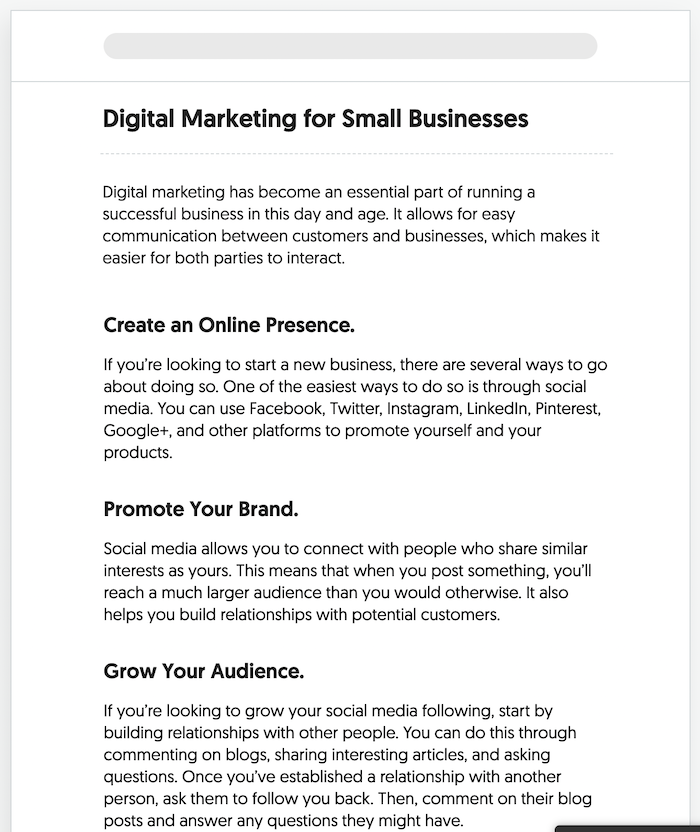

Using Ubersuggest for SEO

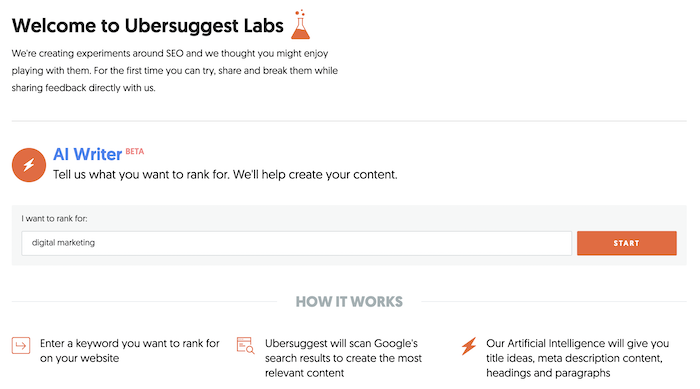

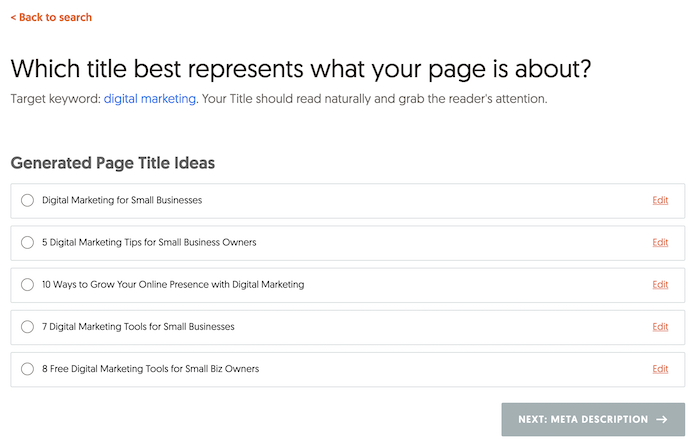

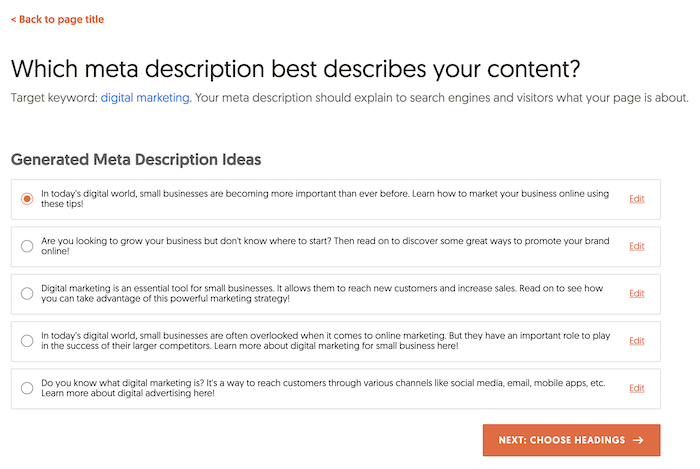

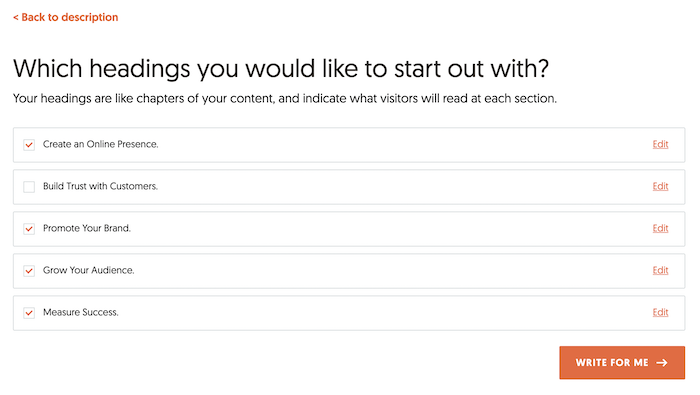

With Ubersuggest, my goal is to make sure you get the insights you need as easily as possible.

We kept the dashboard simple to navigate no matter what level you’re at in your SEO journey.

You want to be able to plan your next steps clearly, not be bombarded with numbers you don’t understand yet. In our navigation bar, you’ll find everything you need to keep your strategy on track.

Type in keywords or competitor sites you want to analyze. You can see general overviews of each category or generate content ideas and suggested keywords.

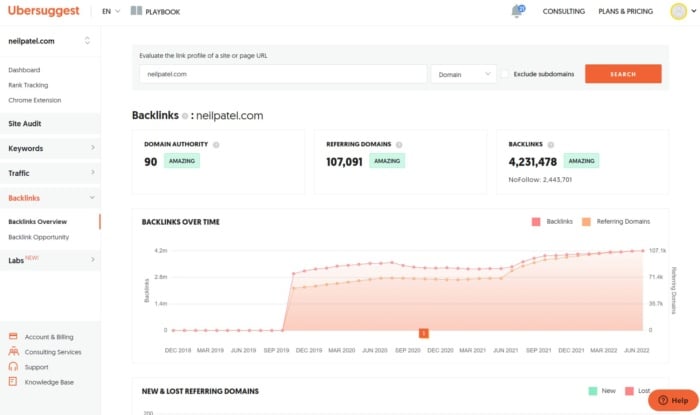

Hover over the sections and see what the numbers really mean. I like the button feature that explains what’s considered “good” or even “amazing” when it comes to metrics like domain authority or backlinks. It’s like a cheat sheet to quickly determine whether you’re on the right path.

You’ll quickly see why Ubersuggest is both a beginner-friendly tool and something experts want in their SEO toolkit.

Features

What originally set Ubersuggest apart from other SEO tools was the output of keyword ideas. We’ve added a ton of valuable features since then.

With comprehensive SEO page reports, you’ll see how you’re ranking in everything from URLs to keyword usage. You’ll also see where your site traffic is coming from and your backlinks. You can even run a site audit that tells you how to fix SEO issues and stay in good SEO health.

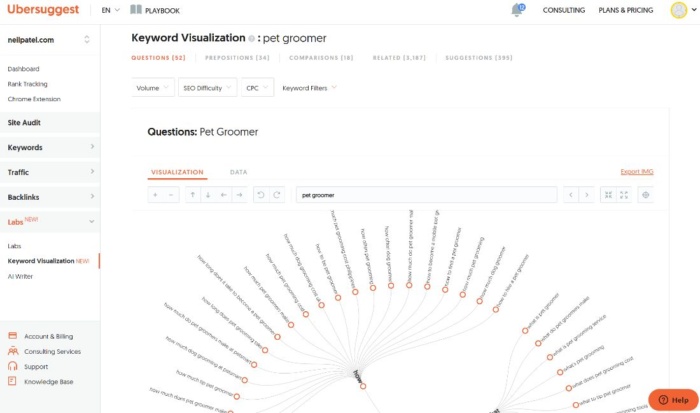

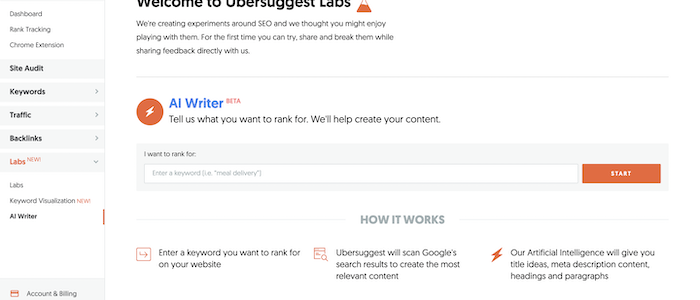

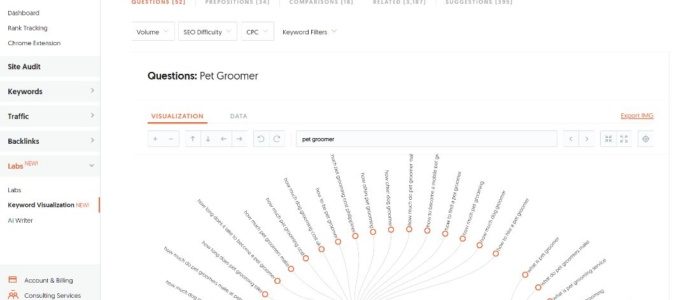

Labs, our newest feature, includes keyword visualization and keyword lists that work as a cluster of similar keywords. You can use keyword ideas to form topics and expand on content ideas.

These features give us an edge. Most importantly, we listen to you to form these offerings.

You told us what you wanted to see from this tool. Now we’re using the data to help you get ahead of your competition and hit your goals.

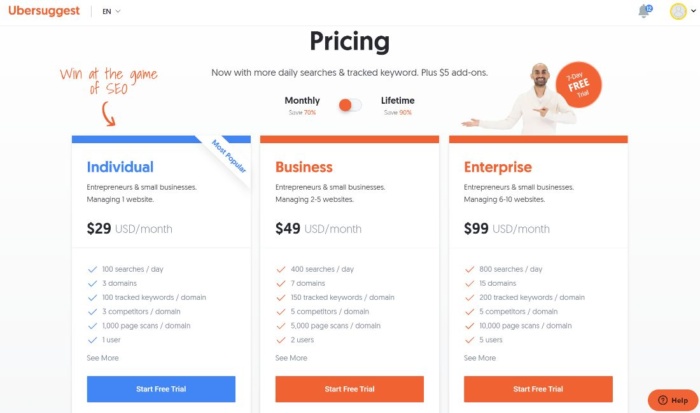

Pricing

I know your budget is top of mind as you grow your business.

This is why we have Ubersuggest features available for free. The way it works is you get a daily search allowance on free features. It’s a great way to try out Ubersuggest and get familiar with the platform.

If you like what you see, a paid account offers even more functionality and exclusive tools. We think you will.

The beautiful thing about Ubersuggest is the ability to crawl your site. You’ll know quickly when to make pivots because the data will let you know errors right away.

Pricing with Ubersuggest vs. Ahrefs is significantly lower.

If you do need more features and more search capacity, we offer a package as low as $29/month. Other monthly options tier up to a Business plan at $49/month and the Enterprise plan at $99/month. These are great if you manage multiple websites, as they come with even more searches, support, and functionality.

Don’t want the hassle of a monthly bill? Get our lifetime version, pay a fixed price upfront, and you’re all set.

My goal is to keep Ubersuggest affordable and easy to use.

It’s all about helping you win at SEO and grow your traffic.

Customer Thoughts

It excites me to learn about customer opinions on Ubersuggest.

I take the feedback and learn where updates need to happen for a better user experience. Other than acknowledging Ubersuggest as a highly regarded platform, users see it as valuable.

When users mention why they switched from another platform to Ubersuggest, it is often due to the higher price and usability of the other platform.

Ubersuggest is all about low cost with high value.

It makes my day to see those who don’t consider themselves SEO experts feel their needs are covered with this tool.

Using Ahrefs for SEO

Ahrefs is categorized as a suite of SEO tools.

This advanced SEO resource gives you the inside scoop on content marketing. It helps users examine competitors’ success and high-ranking keywords. It also offers a unique backlink approach to help you make better decisions with content creation. What makes Ahrefs’ backlink tool unique is its ability to discover internal links for you to build on among other features.

If you’re a complete newbie to their software, they have a guide to walk you through it all.

Ahrefs knows getting ahead of your competition is important to you as a business owner. They emphasize how you can get more traffic and how to navigate hitting a plateau with site traffic.

Their keyword study offers the most critical data for users. This is just some of the data reports they offer. So, let’s look at all features to see how it’s shaping customer outcomes.

Features

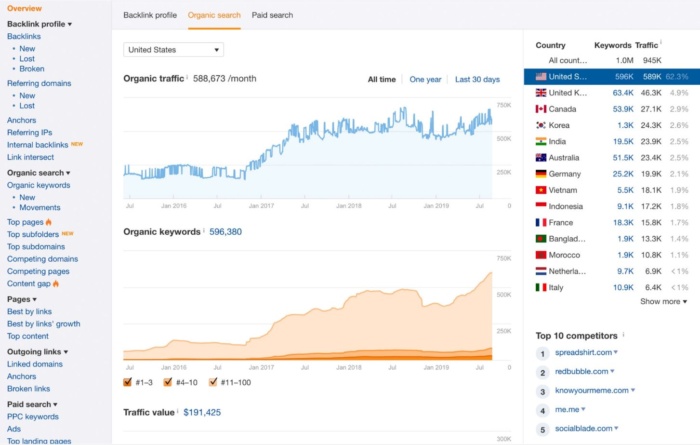

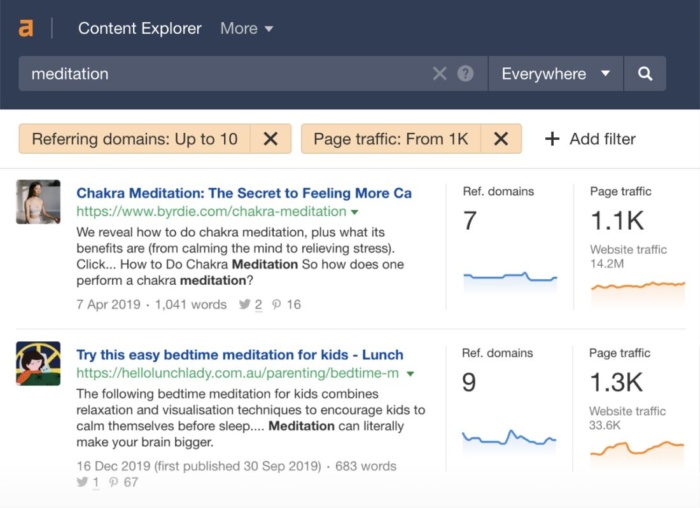

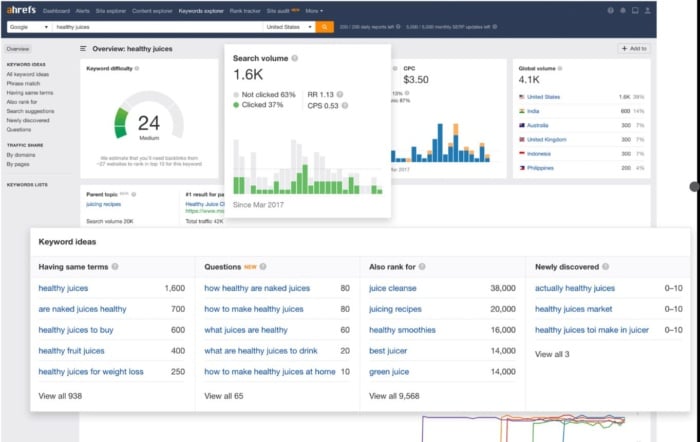

The main aids for users are broken into categories like Ubersuggest. There’s the Site Explorer, Content Explorer, Keyword Explorer, and the Site Audit.

The Site Explorer reports on the performance of different web pages, while the Content Explorer allows you to search for top-performing web pages. In Site Explorer, there are three SEO tools: organic traffic research, backlink checker, and paid traffic research. They each help you with measuring data through competitive research.

In Content Explorer, you can mix and match your search to discover high-performing content. With the filter options, you can analyze where to add new ideas when generating your own content.

This is consistent and connected with the Keyword Explorer, which generates the click-through rate (CTR) and monthly search volume for specific keywords. It returns stats on keywords, including data on search volume, keyword difficulty analysis, and a few other reports.

As with Ubersuggest, there is also a Site Audit feature. This shows you where your site needs cleanup at the page level and where you can make adjustments.

Pricing

Ahrefs has various plans ranging from Lite to Enterprise.

If you’re managing a single site, the Lite plan at $99/month is your best bet. Other options include the Standard plan for $199/month or $399/month for the Advanced plan. If you are an agency seeking their expertise, $999/month for the Enterprise plan is the going fee.

If you aren’t sure what level you should choose, sign up for Ahrefs Webmaster Tools to get free limited access to their Site Explorer & Site Audit. Then, if you decide you need more features, you can upgrade. You can see just how the tool will benefit you and your business without taking too much of a risk if it’s not a good fit.

Customer Thoughts

Users refer to Ahrefs as an all-in-one solution.

Many reviewers feel it meets their needs on a business level, making it their top preference for an SEO tool. Longtime users state that the updates usually trend in favor of sharpening their SEO strategy.

This attention to detail is what gets users to stick around.

Regularly updated features and fast solution development are other things users notice and appreciate. Users have expressed they’re taking SEO seriously, and the education Ahrefs provides makes it their must-have SEO tool.

Ubersuggest vs. Ahrefs: What’s the Better SEO Tool?

Both tools are big names in SEO.

When looking at features, pricing, and customer feedback, both have very positive standings.

Other than a few differences in features—which make each option unique—affordability is a big deal to businesses. If your choice boils down to overall price, Ubersuggest is the most budget-friendly option.

However, you could use them together for even better SEO results—if the price is right.

Can You Use Ubersuggest and Ahrefs Together?

It doesn’t have to be Ahrefs vs. Ubersuggest. You can use them together.

While the platforms are comparable, each one has features the other doesn’t that can be helpful to users.

For example, there’s Labs on Ubersuggest vs. Ahrefs, which offers internal backlink tracking.

You can then use both tools together to see where you can maximize keyword opportunities, especially long-tail options, and have internal links cycling within your content as much as possible.

So, having both is reasonable in many instances. Most importantly, both Ahrefs and Ubersuggest want to see you win at SEO.

Conclusion

There are several powerful SEO tools on the market. Make sure you test out all the features before diving in with a paid account. All the value offered will assist in molding your content creation, blog, and SEO ranking strategies.

When weighing Ahrefs vs. Ubersuggest, consider the overall value. Price point and resource functionality are what businesses like yours look for when expanding with workflow tools.

So, my recommendation is to try each tool’s lowest-level plan. After putting both tools to work, you will know which is best to upgrade your SEO strategy.

What have you been able to accomplish using Ubersuggest vs. Ahrefs? Do you use both solutions for your SEO needs?

The post Ubersuggest vs. Ahrefs: SEO Tool Comparison appeared first on #1 SEO FOR SMALL BUSINESSES.

The post Ubersuggest vs. Ahrefs: SEO Tool Comparison appeared first on Buy It At A Bargain – Deals And Reviews.