Personal Branding: How to Go from Zero to Hero in No Time

Do you remember when only celebrities and major companies had personal brands? Actors, musicians, Fortune 100 businesses, and athletes got all the attention and dominated the airwaves.

Now, nearly anyone willing to put in the time and effort can become a “thought leader” in a specific niche. It won’t happen overnight, of course.

You only need to do a quick Google search to see that ordinary people from all over the world are using new personal branding tools, particularly social media, to craft personal brands that attract countless people to their websites and social media accounts.

Personal branding is what separates you from the rest of the people trying to make it in your field. Building a personal brand allows you to become a standout figure that people know, like, and trust.

Follow these seven simple steps below to become the go-to expert in your space.

Step #1. Start By Finding Your Niche

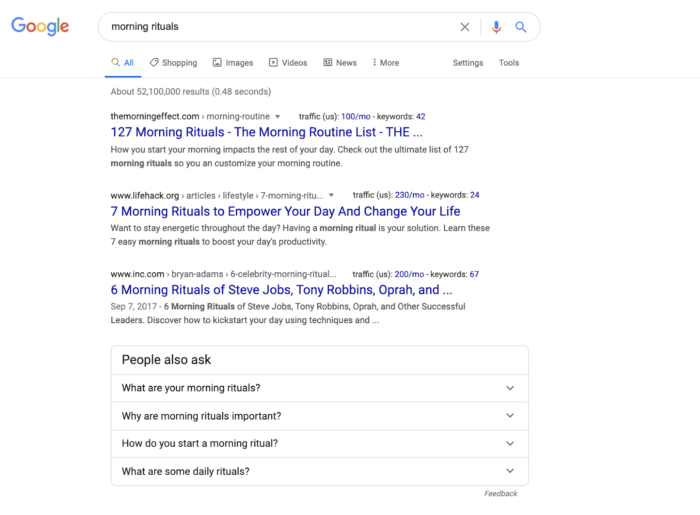

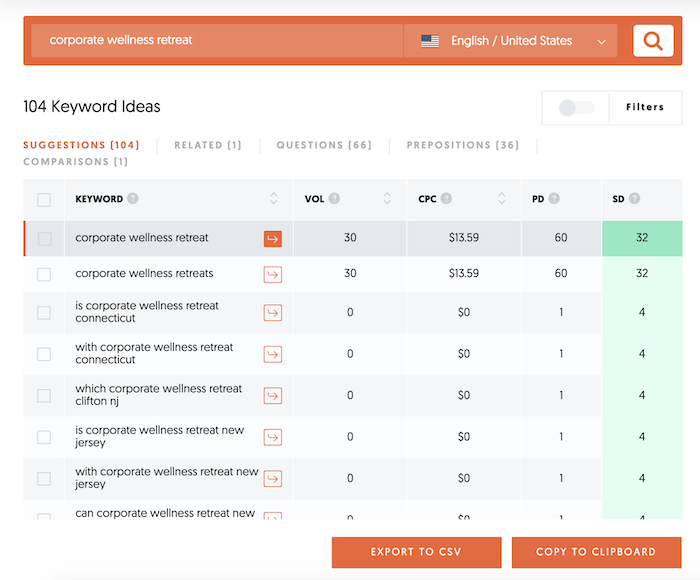

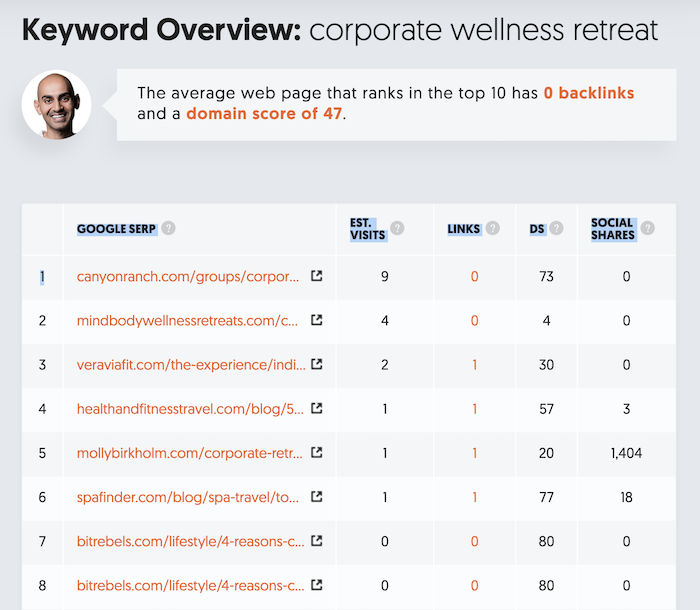

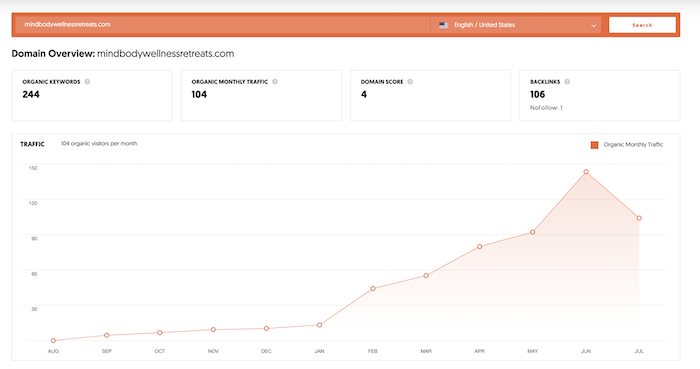

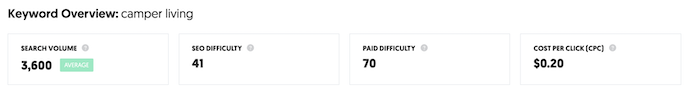

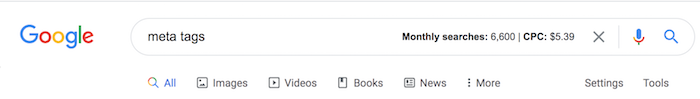

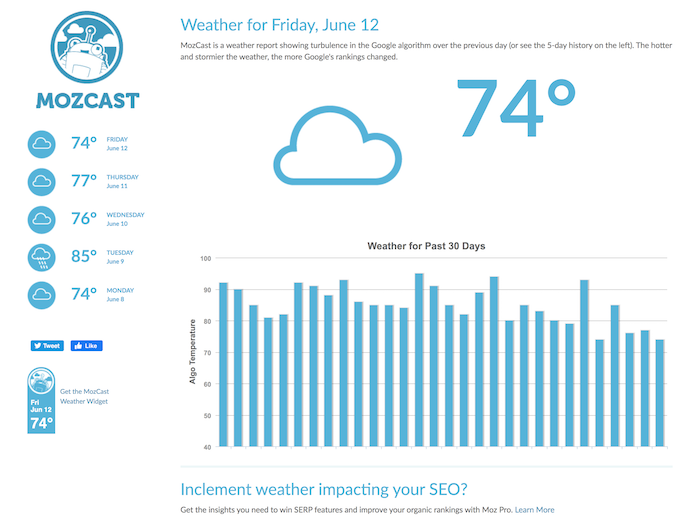

There’s a saying about SEO traffic that highlights something most people miss.

You can’t create search demand. You can only harvest it.

That means you can’t force people to search for a specific keyword. They either already do or they’re searching for something else.

See How My Agency Can Drive Massive Amounts of Traffic to Your Website

Your job in SEO is to recognize that and work on getting as much traffic you can from words that are already popular on their own.

Personal branding is similar, believe it or not.

For example, being the best CrossFit pug breeder in the world is worthless if there isn’t already a market or niche for that. (Seriously, is there?!)

The niche selection process is really important! You don’t want to spend all your time and energy linking your brand to a niche that’s not growing.

Where should you start when picking a niche?

That’s a good question because there’s no right answer necessarily, but here’s where I think you should start.

Pick something specific that you can do better than 90% of the world.

Why is that so specific? Because you can probably do a lot of things well, but that doesn’t mean you’re an expert in every single one of them.

The only way to create a personal brand is by becoming the go-to, recognized authority on a specific topic.

If you’re not an expert on it, someone else will be. Don’t be afraid to go small or narrow to dominate a topic.

The “online marketing” space, for example, is massive, and it’s taken the better part of a decade for me to become a recognized authority.

Take someone like Brian Dean, who decided to go deep on a particular topic instead of biting off more than he could chew.

Notice how he perfectly positions his personal brand. It’s all about backlinks and rankings for SEO.

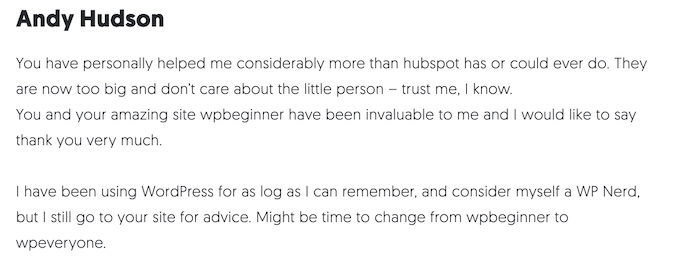

Then the site’s graphics, design, and testimonials all reinforce those points.

There’s another important ingredient for a successful personal brand, though. One that deals more with your own style and point of view on this topic.

Step #2. Inject Personality Into Your Personal Brand

The first step (finding your niche) is about your own skills and potential market value.

The second step is about what you personally bring to the table. It’s your point of view or your “tone” that will help differentiate you from everyone else who talks about the same topics as you.

For example, I want to be seen as personable and down-to-earth.

That’s why I often use slang when writing. We might be talking about a technical topic, but I want to help you understand it in an easy-to-digest format.

A similar example is Ramit Sethi from I Will Teach You To Be Rich.

He works in the personal finance space, which is full of questionable people that give suspicious recommendations.

Ramit takes the opposite approach, using casual language, inside jokes, and F-bombs to show you that he’s being honest and holding nothing back.

My favorite post of his is on avocado toast, in which he completely debunks terrible “advice” from another personal finance columnist.

Ash Ambirge at The Middle Finger Project also uses strong language and a no-B.S. attitude that gets people to sit up and take notice.

Being polarizing like this might turn some people off, but it can also help you create raving fans who might feel like being politically correct with the same material comes off as disingenuous.

Now, contrast that example with someone who talks about similar topics, but in a completely different style and tone: Marie Forleo.

They might both cover similar topics, but Marie’s personality (and therefore, content, design, and other branding elements) are polar opposites.

If Ash sometimes slips between PG-13 and rated R, Marie is firmly rated G.

What you’re saying is important, yes. But how you’re saying it can be equally so. Make sure you choose a tone that is authentic to you and port

Step #3. Create Your Brand Identity

Have you noticed a trend with the past few people mentioned?

From my own website to Ramit, Ash, and then Marie?

Go back and look at their websites. What do you notice?

The design is impeccable.

They each have custom sites, beautiful photography, and even their logos are easily identifiable.

Why the heavy investment in the look and feel of these sites?

Because according to one academic study, 94% of the time someone’s first impression is based on design, and it only takes 50 milliseconds for that split-second decision to get made.

A massive part of creating a personal brand is looking the part. There’s a secondary benefit as well.

Consistent design helps them become recognizable no matter where they decide to post or interact online, from their websites to media sites like Entrepreneur.com or even Facebook and Twitter.

The first step to accomplish that is creating your brand’s mark or logo. Here are some of my favorite resources to make it happen.

99designs crowdsources design samples from people all over the world. So you can set a budget and explain what you’re looking for, then sit back and watch designers start submitting ideas.

Then you can decide which ones are on the right track, give them feedback to further revise the logo, and disqualify the rest.

Best of all, if you’re unsatisfied with the options, you’re not locked into paying.

If you don’t think the design examples you received are up to snuff, you can simply use the company’s 100% money-back guarantee to get your funds back.

Another less expensive alternative is LogoNerds, which is ideal if you’re on a budget. These logos start for as little as $27!

Many times, you can even have LogoNerds create a few samples to get ideas, and then take those off to a more seasoned designer to show them the direction you like or don’t like.

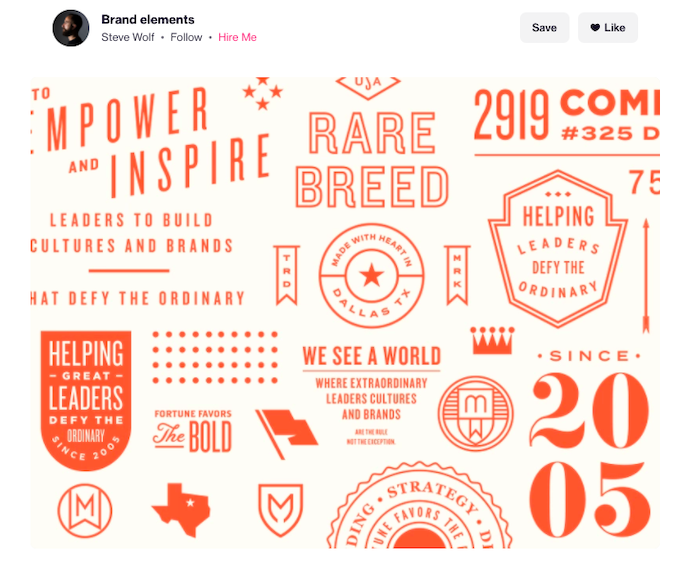

Once you’re ready for the big leagues (with a budget to match), you can find amazing designers to work with personally on Dribbble.

The best designers will use Dribbble as a way to showcase their work and latest projects so that you can get a sense of their style.

Many will also show off brand concepts or logo ideas, like these Brand Elements from Steve Wolf, so you can get a feel for what your own might look like.

Professional design is often what separates the ‘real’ experts from everyone else.

Start small with a logo to establish that working relationship with a designer you like, because they’re going to be worth their weight in gold when it comes time to redesign your website.

Step #4. Create and Redesign Your Own Personal Site

Look: there’s a TON of noise out there.

You’ve probably already heard all the statistics. Like the one that says there are five million blog posts published daily.

This means not only does your content need to be great, it means it also needs to be published frequently(like several times a week at least).

Continually putting out good stuff under your own name starts to create that connection between you and the topic target you’re aiming at.

Here’s what I mean.

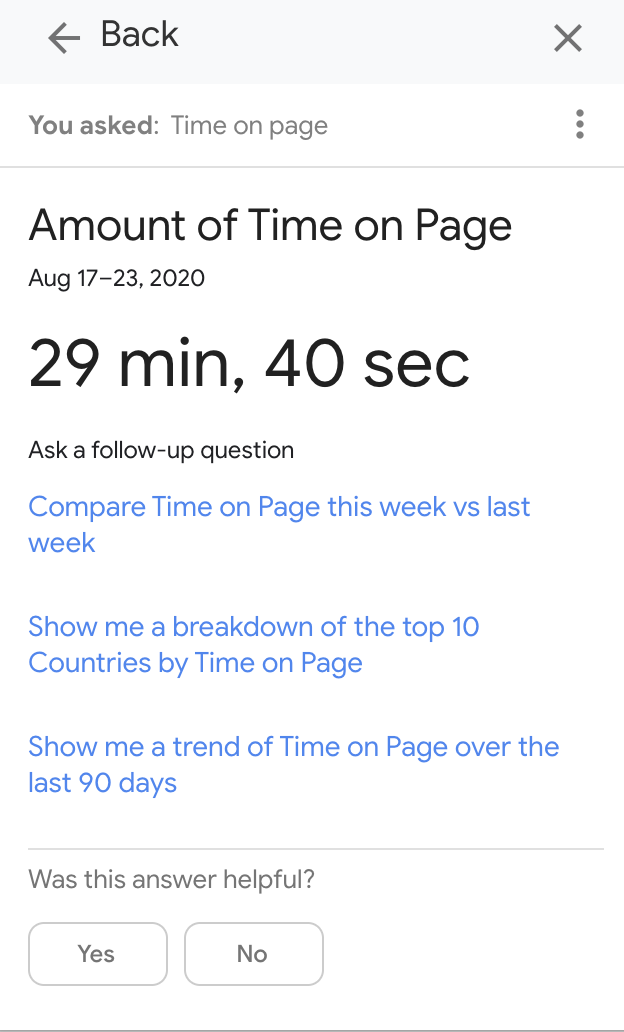

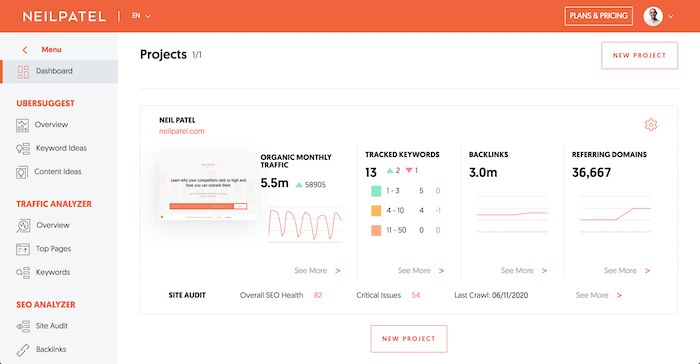

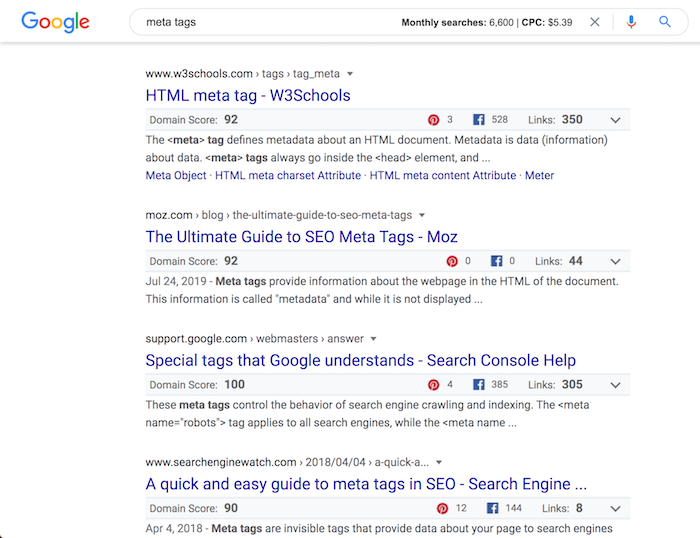

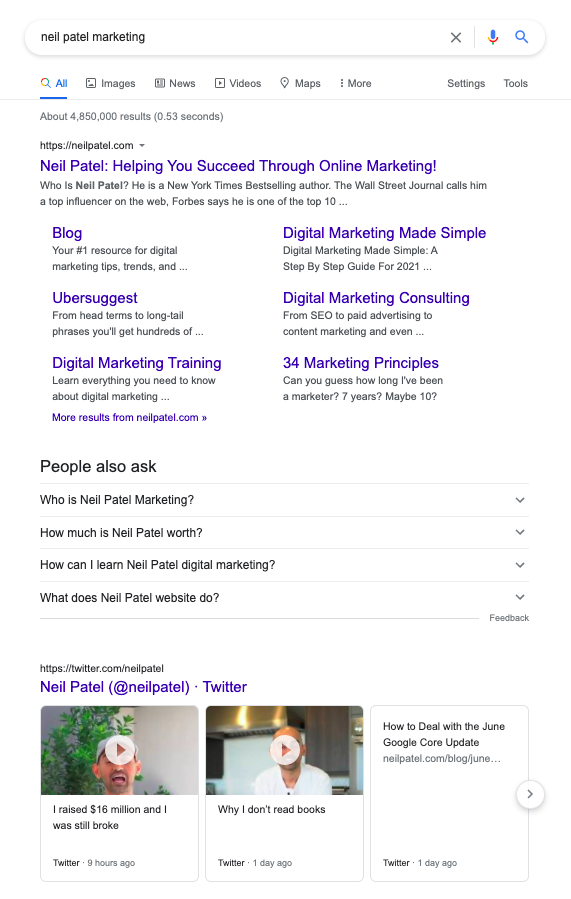

Google “Neil Patel marketing.”

My content shows up all over the place, from Entrepreneur.com to Inc. and beyond.

Those sites are so big that they’re often ranked at the top of the search engines. So imagine you work hard to become an expert on a topic, but then when people Google you, they end up going to a different website instead of your own.

Frustrating, right?!

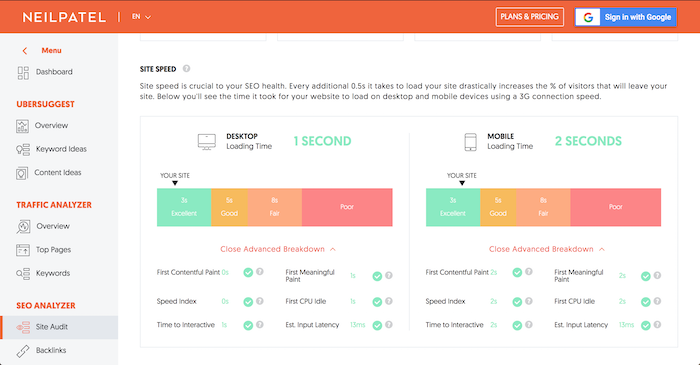

That’s why having your own site, and then working hard to raise its profile, can be an invaluable part of reinforcing your own personal brand.

See! I own and control almost every site on the first page of the SERPs for my name.

If anyone is looking for more information about me, they go to one of my websites instead of someone else’s.

That means I’m able to convert a much higher percentage of people into new, interested leads each month.

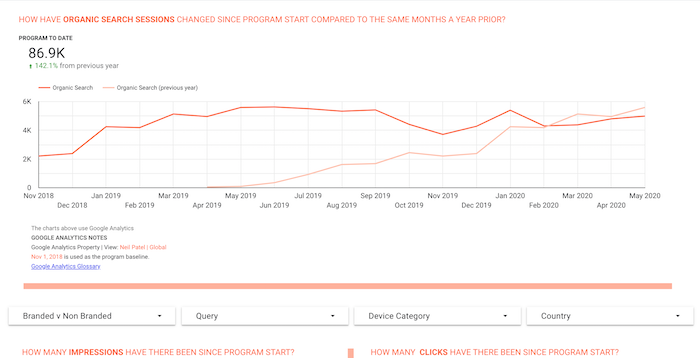

My content and social strategies are among the main reasons that my sites rank above those other mainstream media sites.

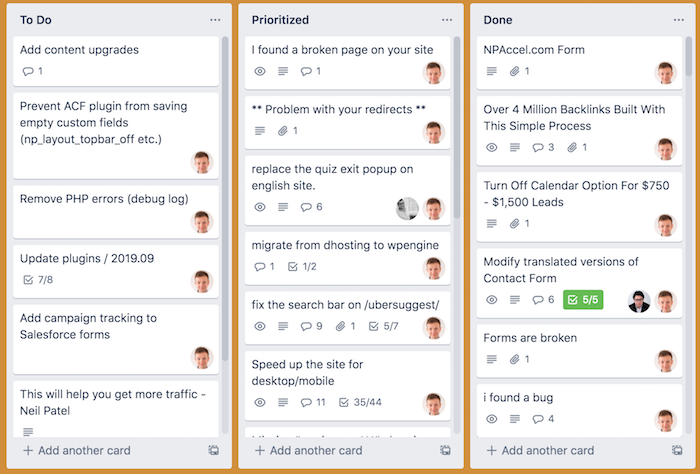

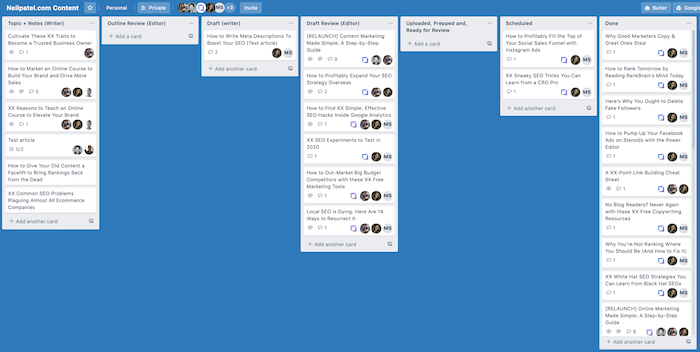

Step #5. Carve Out a Content and Social Strategy

Content marketing “costs 62% less than traditional marketing and generates about three times as many leads.”

That stat says about all there is to say!

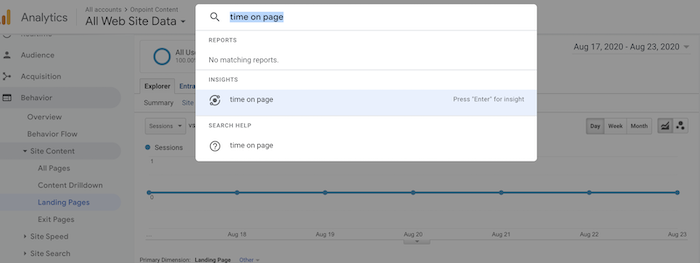

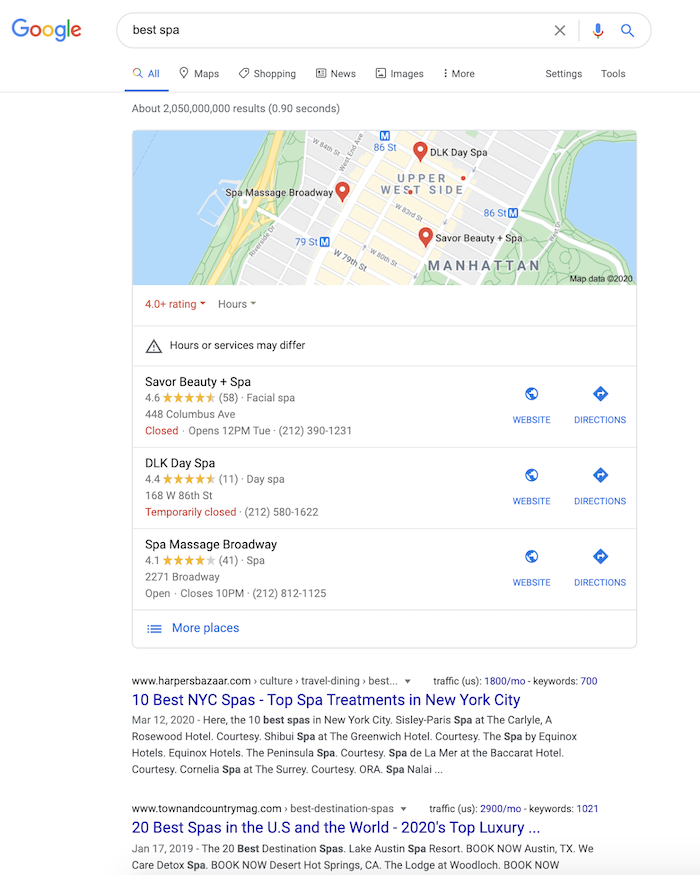

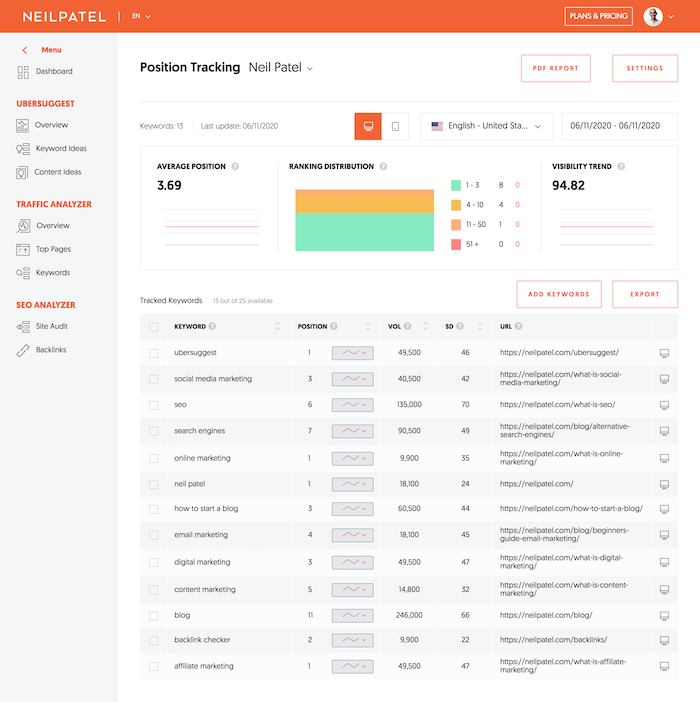

Look back at the SERP example in the last step.

The reason all my websites rank highly for my name is because of all the quality content I’ve published for over many years.

There’s no secret:just a lot of consistent hard work.

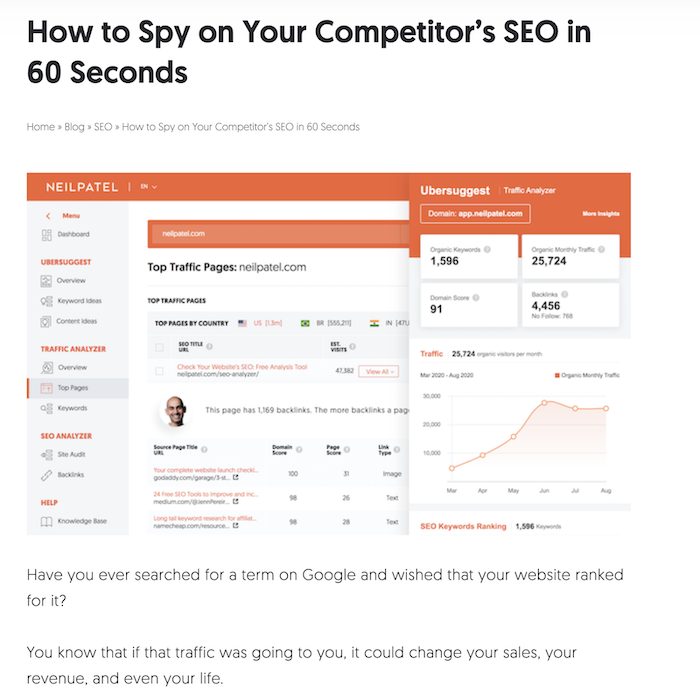

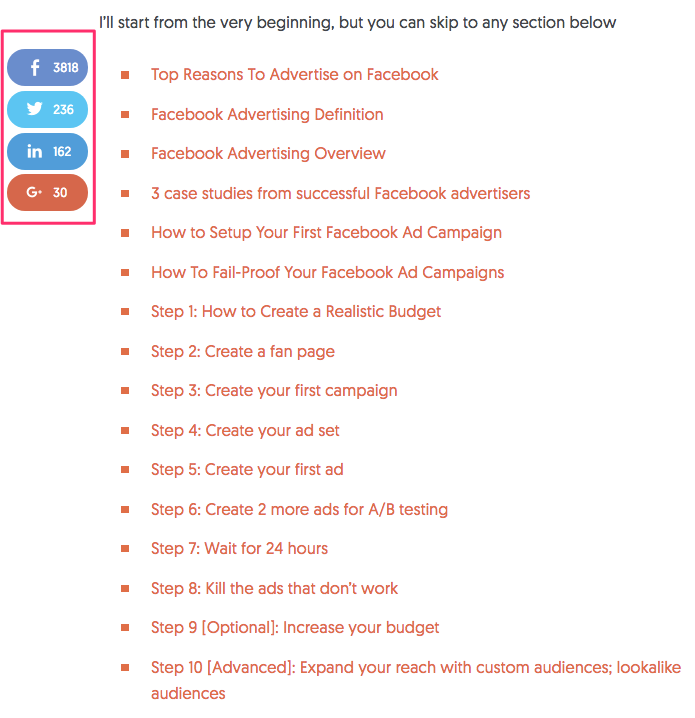

Personally, I find long, in-depth content works the best for generating leads and ranking well. For example, some of my posts are over 10,000 words and require a full table of contents!

Look at those social share numbers though!

My readers love long-form content (the stats back it up), so I keep delivering.

The same goes for my advanced guides, which in addition to being in-depth, are also beautifully designed.

The trick is to figure out what kind of content works best for you and your readers.

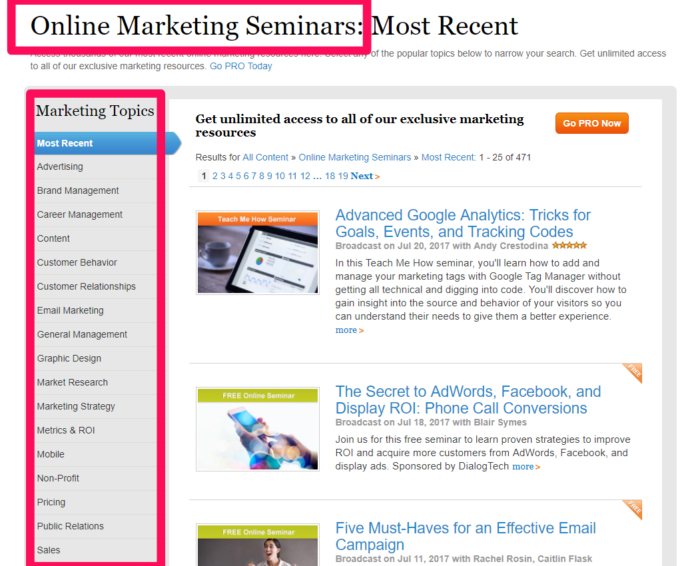

For example, MarketingProfs is another big website catering to marketing professionals. However, its content is totally different from mine.

MarketingProfs focuses on seminars, webinars, and other data as opposed to in-depth guides. So there’s no “right” answer, necessarily.

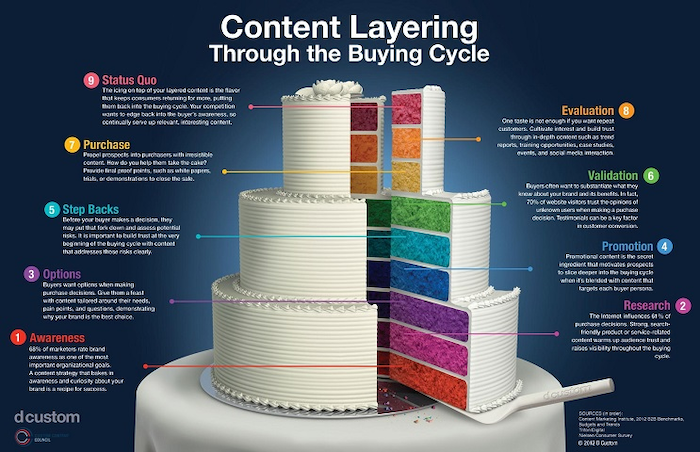

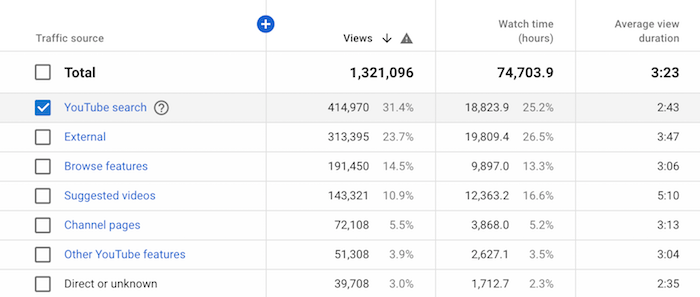

Your content strategy should also extend to your social media channels.

But keep in mind you shouldn’t necessarily be on every single social platform.

Spreading yourself too thin (and then not updating each frequently enough) is almost worse than not being on any social platforms at all.

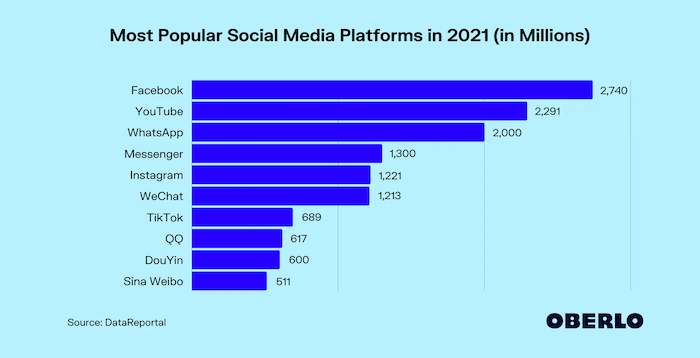

So once again, go back to your own audience. Where are they?

For example, here are the biggest social sites right now based on audience size.

Your own product or service plays a key role, too. For example, a wedding planner might not gain much traction on Twitter. However, if said wedding planner switches their focus to an image-focused social platform, like Pinterest or Instagram, they’re in business!

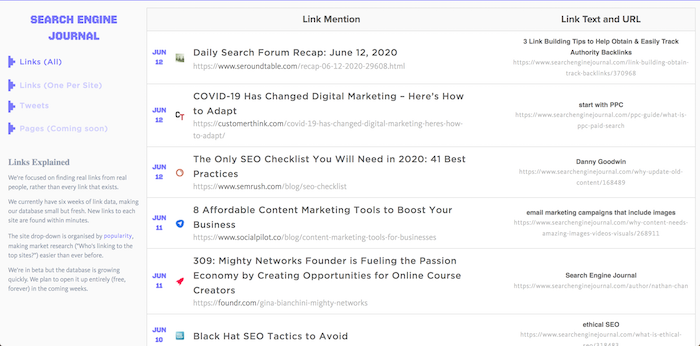

Step #6. Guest Blog to Promote Your Brand

In the early days, nobody will really know who you are.

That’s OK! It’s just critical that you realize this early before it’s too late.

If you spend all of your time initially only putting out good content on your own site, you’re unfortunately going to be wasting your time.

Instead, you should almost spend more time trying to get on other sites first.

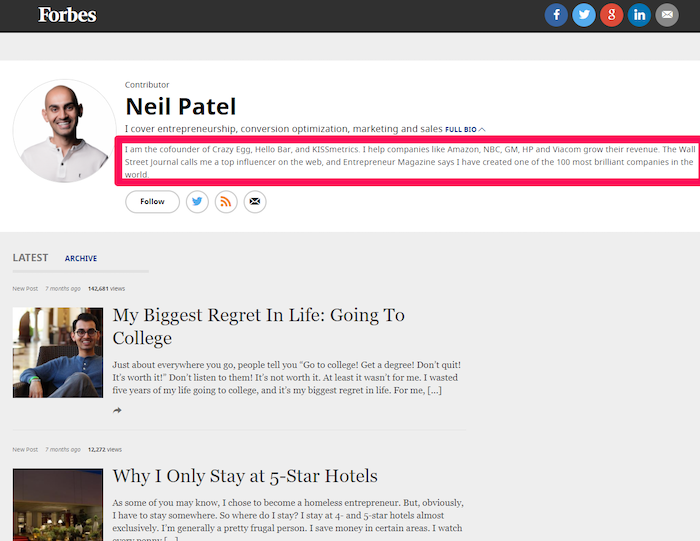

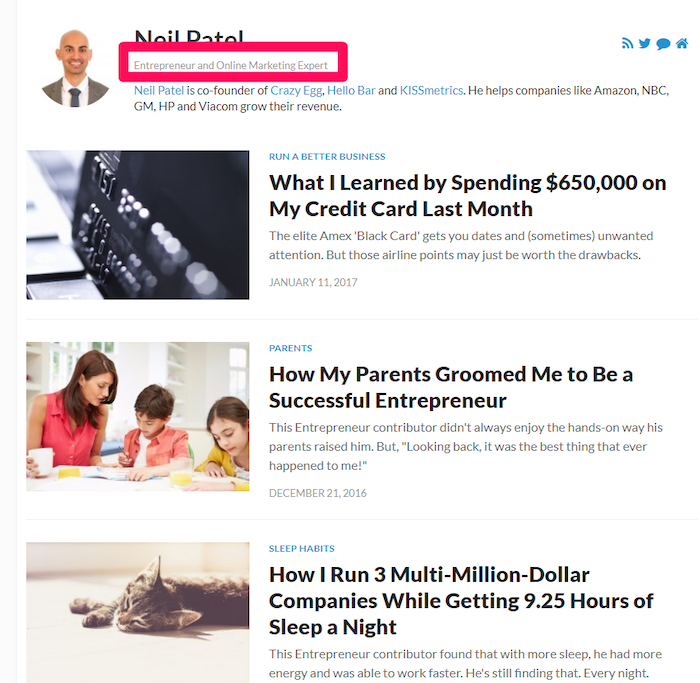

Focus on sites that already have the traffic and audience numbers you’re targeting. For example, becoming a regular on a huge site like Forbes suddenly gives you a presence in the industry.

Now you can leverage that traffic to drive people back to your own site when they start looking for more information about you.

Many times, these sites will allow you to add your own bio and title, too.

So instead of the generic “Founder of a Company That Nobody’s Ever Heard From,” you can use that valuable real estate to start planting the seed for your personal brand. Incorporate your niche and bring in elements of your personality.

Step #7. Seek Out Mentors

There’s no such thing as a “self-made” successful person.

They had to have help from someone, somewhere, at some time in their life.

Similarly, becoming a recognized expert in a field can be incredibly challenging at first.

You’ll eventually need other big-name players in the industry to recognize you as an expert, which will boost your brand to help you reach the top of your chosen niche.

Even Tiger Woods, arguably the most successful golfer of all time, worked with a swing coach for almost his entire career.

Think about that.

The guy arguably didn’t need to listen to anyone; and yet, he used mentors to help him sharpen his game.

80% of CEOs surveyed in one study said they had a mentor to help them early in their careers.

Almost all successful entrepreneurs I know have had mentors help them become the recognized experts they are today.

Personal Branding FAQs

Personal branding is reputation building by finding what makes you unique. This is how your brand communicates and how your brand presents itself visually.

Specifying your niche will allow you to find what makes you unique. This also means you’ll be able to tap into the audience that is looking for what you can do to help them.

Great design is easy on the eyes and captures attention. It’s also easy for people to identify common design elements so reinforcing your brand is easier. This makes you instantly recognizable online.

Creating and promoting content on other websites and blogs will help you connect with existing audiences and build awareness about you. Guest posts on blogs can help you build a digital presence.

Personal Branding Conclusion

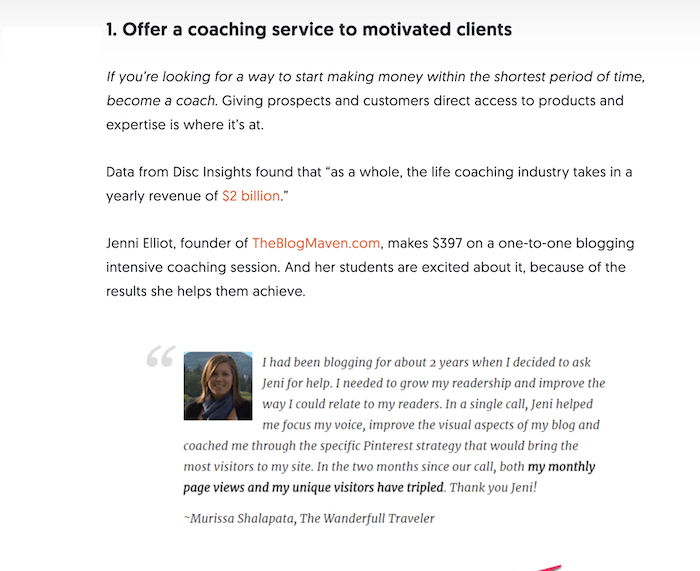

Becoming the go-to, recognized expert in your industry isn’t an overnight proposition.

It’s going to take a lot of hard work and effort to reach the top, but it’s also one of the highest ROI activities you can pursue.

Not at first, of course. You have to invest the time, money, and work to slowly break through in your industry.

You’re going to have to look the part, put out content at an intense pace, and constantly meet new people. Finding a mentor can help you to avoid many of the same mistakes that have plagued the people before you.

Ultimately, becoming a recognized authority in your niche is definitely doable as long as you put in the work.

What’s your best personal branding tip to break through a crowded space?

at the end of the first year. There is no minimal spend requirement.

at the end of the first year. There is no minimal spend requirement.