Straight Talk: Is Divvy Really a Tool You Want In Your Business Toolbox?

We all have tools. I’m not just talking about hammers and nails. We have kitchen tools, lawn care tools, tools we use in the office, even tools we use to care for our pets and our children. Business owners have tools they use for many things, including managing finances. Is Divvy a tool that business owners need in their toolbox? Let’s find out.

Find Out If Divvy Is Right For Your Business

There are a number of money management tools on the market. We’re digging in with Divvy to find the good, the bad, and the ugly so you can make an informed decision for your business.

What Divvy Is, and What It Isn’t

What is Divvy? At its core, it is an expense management system. In fact, it was recently acquired by Bill.com, due to the fact that Bill.com had an increasing number of customers looking for help with money management.

Check out how our reliable process will help your business get the best business credit cards.

It is designed to help businesses manage their business finances by integrating with accounting systems and helping them control spending in a streamlined manner. That is what Divvy is.

It is not meant to be a business funding option on its own. It does offer a charge card option that allows for business funding, and even helps build business credit. However, it’s purpose is to be another spending management tool. If it were a hammer, this card would be the backside that pulls the nails out. You buy a hammer to hammer nails. The other side is useful, but generally you don’t use a hammer simply to pull nails. It works for that, but that is not it’s main purpose.

Money Management Tool

They offer a lot of great money management products for managing spending, expenses, and accounts payable. The system allows you to see transactions in real time, and send funds in seconds via mobile or desktop.

You can also issue cards to employees, either virtual or physical cards, and give them direct access to funds with a spending limit you set. This not only cuts down on expense reports, but also helps with budget management. That is the main purpose of the card.

The system currently integrates with Quickbooks Online and Oracle Netsuite. Integration with Xero and Quickbooks Desktop is coming soon.

On the accounts payable side, you can seamlessly receive invoices, get approvals, and send payment by either ACH, check, or virtual card. It’s truly an easy and innovative way to streamline processes and manage spend. However, there is currently a waitlist for accounts payable services.

Building Business Credit

So, what’s the deal with Divvy and business credit? They do offer a business card. They have more than one way of underwriting so that if you do not qualify with traditional underwriting, they can look at other factors for approval. There is really no elaboration on what these may be. But, often it is monthly income, time in business, and the like.

So, if you do not qualify for other cards, you may qualify for this one. The main point of the card however, is that it is attached to the Divvy system. That means, if you distribute cards or virtual cards to employees, you can see their spending in real time. It offers business owners more control.

Check out how our reliable process will help your business get the best business credit cards.

They report positive payment history to the Small Business Finance Exchange. That means this card does help you build your business credit score, because the SBFE reports information to Dun & Bradstreet. Since only 7% of companies that offer credit to businesses actually report positive history, this is big. One of the largest obstacles to building business credit is finding accounts that will report positive history. Most only report missed payments.

The thing about business credit building is, one account reporting is just not enough. Your business has to be set up properly to be fundable to begin with. Also, you need a lot more accounts that will report before you have a business credit score at all. That in itself is a challenge. This is where a program like the Credit Suite Business Credit Builder can be helpful, because it walks you through the process of setting up to be fundable, finding accounts that will report, and applying for them at the right time so that you actually qualify.

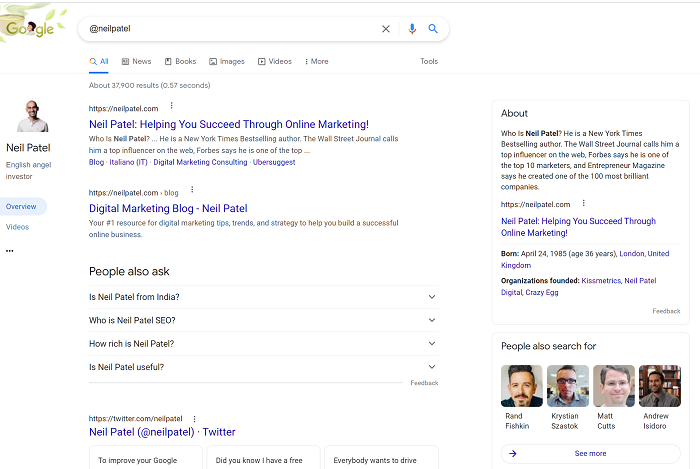

Divvy’s Online Reputation

If you look at online reviews, you are going to get a mixed bag. Most of the negative reviews and complaints come from those looking for a business credit card. They are not looking for money management services. Those looking for money management services seem to be pleased.

It does appear that maybe they are not clear on a lot of things, or at least they do not make the information easy to find, pertaining to how the card works and rewards. For example, one complaint was that this is a charge card, not a credit card. That means the balance must be paid in full each month. This would explain why there is no interest rate information, as there is no interest since the card carries no balance.

After a lot of digging around I did confirm that the Divvy card is a charge card used to pull against a line of credit. It is not a credit card, and therefore you cannot carry a balance. This information was definitely not easy to find on the website, and they refer to the card as a credit card multiple times.

Check out how our reliable process will help your business get the best business credit cards.

Another complaint noted that card rewards are not earned unless you use at least 30% of the credit line. I could not verify this. There is no mention of it that I could find. That doesn’t mean it isn’t there, but it certainly is not out front information.

There were many positive reviews from those who were using the service mainly for money management.

They have a D+ rating at BBB.org. However, the fact that the business is only 3 years old and there are only a handful of reviews and complaints, skews this grade. People are much more likely to report negative experiences to the Better Business Bureau. Any negative report is going to bring the grade down very quickly.

It’s important to note also that the company did respond to the complaints and worked to make them right if they were in the wrong.

What’s the Final Word on Divvy?

This is a new company, and it appears to be making its way well among the new-ish niche of money management options. They offer what appears to be smooth integration with common accounting systems. Their charge card allows for spend control and options for managing cash flow. It is an added bonus that they report on-time payments to your business credit profile.

In conclusion, this is a great tool for money management. One major reason for this is that they can help you build credit for your business. If you are looking for a money management option for your business tool box, it’s a solid choice. Apply for Divvy now. If you are mainly looking for a business credit card, you may be better off with something else.

The Credit Suite Business Credit Builder can help you position your business to qualify for all the funding you will ever need, and help you find the best vendors for your business at the same time. Sign up for a free business credit consultation today.

The post Straight Talk: Is Divvy Really a Tool You Want In Your Business Toolbox? appeared first on Credit Suite.