Mastering TikTok Ads: Everything You Need to Know to Get More Revenue From TikTok

With over 1 billion users and counting, TikTok presents a great opportunity for businesses to advertise their services, grow their audience, and increase their ROI through targeted ad campaigns.

The challenge? Standing out on such a competitive platform and ensuring the right audience sees your ads at the right time. If you want to get the most from your TikTok advertising budget, you need to employ effective strategies, so here’s how to master TikTok ads and execute winning campaigns.

Who Should Use TikTok Ads?

Anyone can advertise on TikTok. However, TikTok ad campaigns work better if you’re targeting certain demographics.

Here’s what I mean. TikTok typically attracts teens and young adults. According to DataReportal’s research:

- 43.3 percent of users are aged between 18 and 24.

- 32.2 percent are between 25 and 34 years of age.

Just over 11 percent are 45 or over, so it’s not the best platform if you’re targeting this age demographic.

We can delve a little deeper into the demographics.

- Although men and women use TikTok, it’s more popular with women: females account for over 60 percent of TikTok’s user base.

- TikTok is most popular in the United States where there are over 136.4 million users.

Say you’re targeting young U.S. women. Do TikTok ads work better for certain businesses instead of others even within this demographic? Possibly. Fitness and sports-related content are among the most popular content with over 57 billion views, while beauty and skincare content has over 33 billion views.

To be clear, TikTok is available in 154 countries, so it does have global appeal among teens and young adults.

7 Steps to TikTok Advertising Success

While there isn’t a “right” way to run a TikTok advertising campaign, there are ways you can optimize your TikTok ads and boost your chances of success. To master TikTok advertising, follow these seven simple tips.

1. Get to Know TikTok Ads Manager

TikTok Ads Manager is a hub from which you can create, run, and manage your ads. With TikTok Ads Manager, you can:

- create engaging ads using different visual formats and templates;

- target specific audience groups per campaign; and

- track ad performance through customized reports.

How much does TikTok advertising cost? Well, TikTok uses a bidding model, so you can set your own daily and campaign limits depending on your marketing budget. As a guide, be prepared to spend at least $50 per day for campaigns, and $20 per day for specific ad groups.

Before you create TikTok ads, you need a TikTok Ads Manager account. TikTok offers a breakdown for getting going, but here’s a quick start guide.

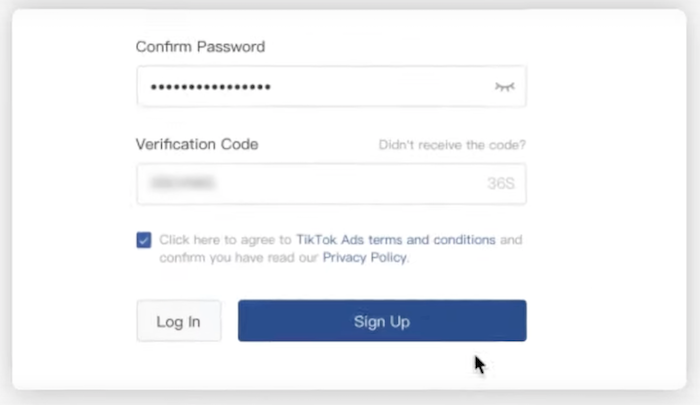

First, head to the TikTok for Business page and “Get Started.” From the next screen, click “Sign Up” then input your details before hitting “Sign Up” again:

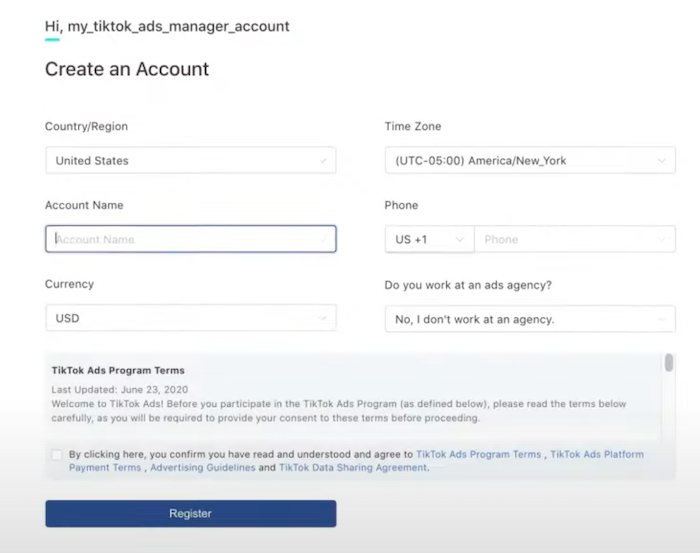

Next, input some basic business details to create your account:

Once you’ve registered, you’ll need to provide a few more business details, including payment information, and wait for account approval before creating your first ad.

Creating TikTok Ads

- From your TikTok Ads Manager account, click the “Campaign” button at the top of the page.

- Choose your campaign objective e.g., app installs, traffic, lead generation, or audience reach.

- Set a campaign name and a budget. If you choose “No Limit,” your spend is determined by the budget you set at the “ad group” level. Or, you can choose “Daily Budget” or “Lifetime Budget,” which means you’re limited by the daily or lifetime budget you set at the campaign level.

- Create your campaign.

Once there’s a campaign set up, you can set up an ad group and then create individual ads. The instructions are super easy to follow, and you can be up and running in minutes.

Here’s something crucial to note. Once you create a campaign, you can’t change the budget. Make sure you’re happy with your maximum spend limits before creating your TikTok Ads campaign.

2. Use Creative Elements to Stand Out

Although you can run ads for up to 60 seconds, TikTok suggests you keep most ads under 15 seconds. Given the short timeframe, you’ll want to use some fun creative elements to stand out, so here are some suggestions.

- Try “Branded Effects.” Branded Effects are elements like stickers and filters you can use to enrich your ads.

- Choose your ad format wisely. In-Feed ads, for example, look and feel just like native content which helps them feel more authentic, while TopView ads appear at the top of a user’s “For You” section and might help drive brand awareness.

- Add music or sound to add extra layers to your ads. Just make sure the music or sound effects match your brand’s voice.

Laneige, a popular Korean skincare brand wanted to increase engagement and encourage people to download a coupon for skincare products. They used Branded Effects to show what people may look like before moisturizing:

Then after moisturizing:

The result? 419,000 engagements, 12,000 new followers, and thousands of coupon downloads.

Unsure of what elements to use? View popular posts in your niche, consider why they resonate with your target audience, and apply these principles to your campaigns.

3. Test Spark Ads

Ever seen someone using (and loving) your product on TikTok? Do you wish you could run this user-generated content (UGC) as part of your own ad campaign?

Well, thanks to Spark Ads, you can take existing, organic posts from other TikTok accounts and turn them into original ad content. Why would you want to do this? Let me give you three reasons.

Using existing content means less work for you, for one thing.

What’s more, since the content comes from real TikTok accounts, any activity you generate (such as likes, follows, or shares) is linked to your post. If you’re looking to boost your engagement, Spark Ads can help.

Finally, UGC adds authenticity to your company and helps to boost your brand’s reputation. Since customers are over two times more likely to prefer UGC to branded content, Spark Ads are definitely worth your time.

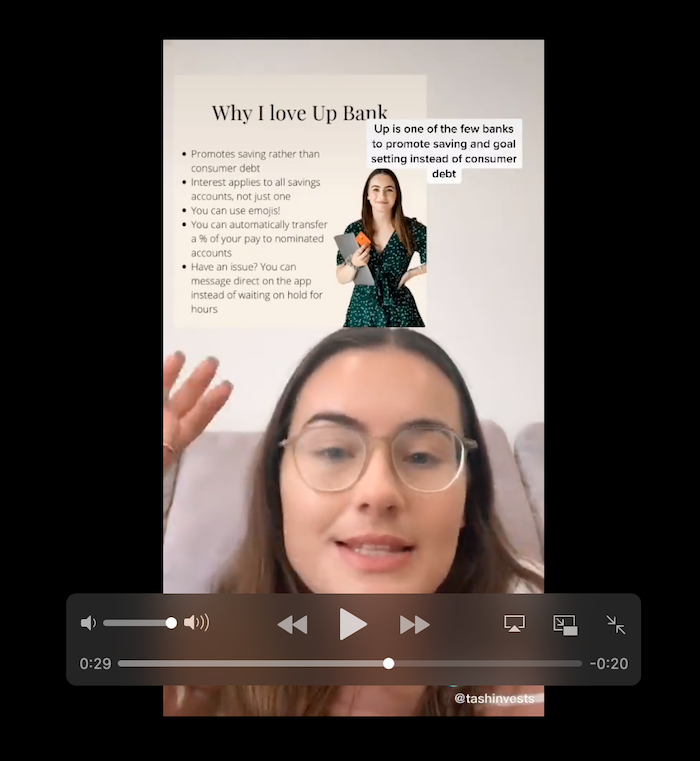

Here’s an example. Digital bank Up targets Australians aged between 18 and 34. They wanted a creator partnership to build brand awareness and grow their audience reach.

For their mission, Up chose an Australian finance influencer, @TashInvests. They produced Spark Ads which generated over 1.5 million impressions and 76 app downloads, which exceeded Up’s original expectations:

Here are some tips for getting the most from this form of TikTok advertising.

- Opt for content with happy, positive undertones to present your products in the best light.

- Use short text overlays to emphasize key points e.g. product features.

- Run A/B tests to identify which ads are performing best and revise your less successful ad content.

- Finally, always ensure you get someone’s permission before using their content in Spark Ads.

4. Test Different Targeting Options

The most successful ads target a specific audience. TikTok knows this, so the platform lets you tailor who sees your ads by excluding certain audiences and directly targeting others.

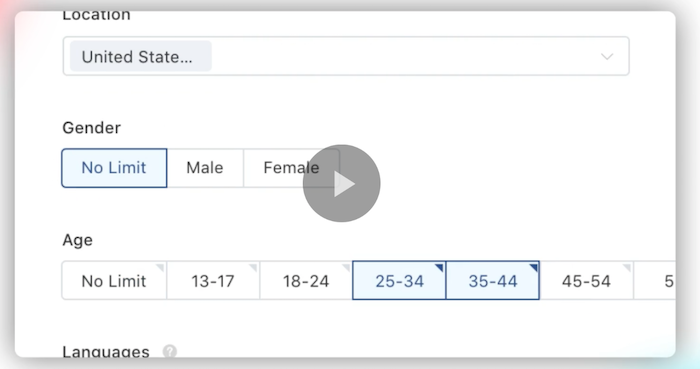

You can target audiences by dimensions such as their age, behaviors, device, interests, and physical location. For example, maybe you want to target under-25s using iPhones, people based in Canada, men interested in soccer, and so on.

Here’s how to do it.

From TikTok Ads Manager, go to “Ad Group,” then “Targeting.”

Then, choose which audience segment to target. For example, you might choose U.S. users aged between 25 and 44:

TikTok will then optimize who sees your ads so there’s a greater chance of running a successful campaign. Cool, right?

5. Use Data to Leverage Hashtags Effectively

Hashtags allow people to organize content into categories so others can find what they’re most interested in. For example, someone looking for Starbucks content might search for #starbucks.

While you can use as many hashtags as you want, you won’t reach your ideal audience unless you know which hashtags to target, so here’s how you might choose the right ones.

First, check out which hashtags your most successful competitors use. Chances are, it’s worth including at least one or two of these hashtags to boost your visibility.

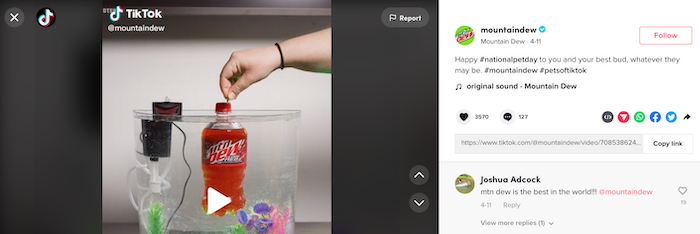

Next, use trending hashtags. Mountain Dew, for example, targeted #nationalpetday to advertise its “Code Red” beverage in a fun, engaging way:

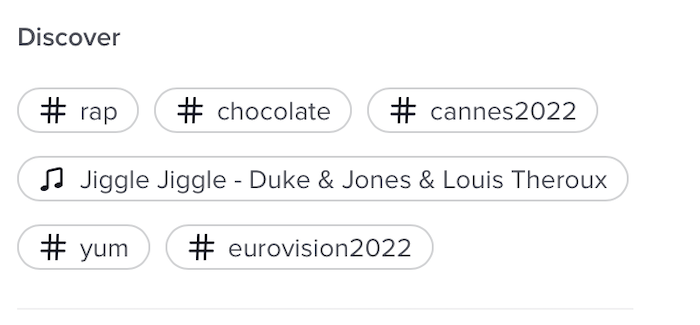

To find these hashtags, scroll to the “Discover” tab and check out the day’s top tags. Choose any that resonates with you:

You can also find related keywords by searching for a word and leaving the hashtag out. Tap “Hashtags” under the search bar, and you’ll see similar hashtags to include in your campaigns.

6. Create High-Quality Graphics

TikTok is a highly visual platform, so your ads need graphics and videos to stand out. If you don’t have expensive recording equipment, don’t worry; you don’t need it. Here’s how TikTok creator @lucajpeterson quickly creates high-quality visual content.

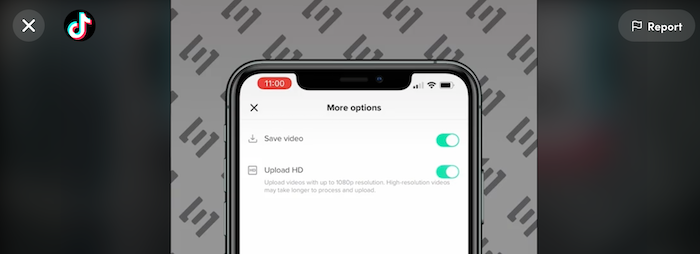

First, film and upload your video content as usual. Before clicking “Post,” hit “More Options” and drag the “Upload HD” bar right so it turns green:

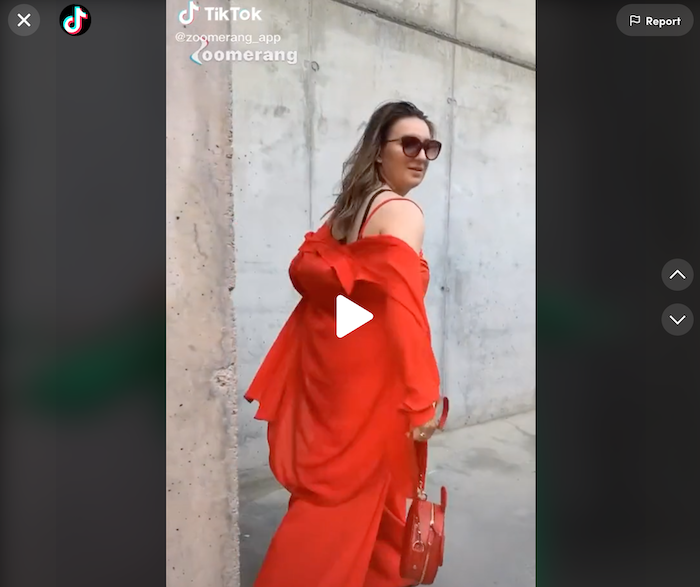

Sharp videos bring your content to life. In this Zoomerang TikTok video, for example, we get a real sense of the fabrics, textures, and colors since the brand uses high-quality graphics:

To get the most from your TikTok advertising, upload the clearest, sharpest graphics and videos you can.

Let me leave you a final tip here. According to TikTok’s own research, more than 63 percent of videos with the highest click-through rate (CTR) highlight the main focus product within the opening three seconds. Whatever your marketing goal, get to the point quickly.

7. Keep Your CTAs Simple

When it comes to TikTok ads, you might only have someone’s attention for a few seconds. This means that you need a clear, concise, and actionable call to action (CTA).

CTAs ask viewers to do something, whether it’s visiting your website, using a promo code, or downloading an app. Good CTAs can help boost sales by responding directly to users’ needs and driving specific actions.

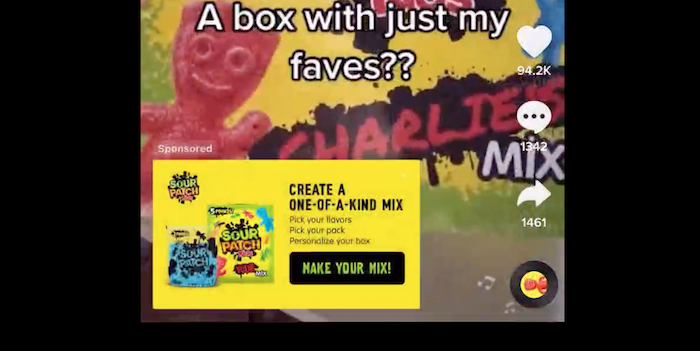

For example, Sour Patch Kids wanted to promote its “custom mix” which lets customers build own candy bag. The display card “Make Your Mix” is colorful, engaging, and fun, and specifies the desired action:

You can access pre-made CTA buttons through TikTok Ads Manager; however, creating your own visual inlay helps make your campaign stand out.

- Focus on your goals and use as few words as possible to communicate the message.

- Choose the right color palette: your button should complement the ad.

- Try to create a sense of urgency that entices viewers to click the button.

- Use different versions of the same ad and run A/B tests to see which CTA performs best.

Frequently Asked Questions About TikTok Advertising

How much does TikTok advertising cost?

Your TikTok advertising cost depends on several things. At the campaign level, there’s a daily and lifetime budget of $50. At the ad group level, you need a minimum budget of $20 per day, and your lifetime budget works out as your daily budget multiplied by the number of campaign days scheduled.

How do you create ads in TikTok?

First, create a TikTok Ads account and choose your campaign objective. Name your campaign, set your marketing budget, determine the ad placement, and choose your target audience. Set your campaign schedule and create your ads.

What kind of businesses should use TikTok advertising?

If you’re a business on TikTok, you could try TikTok ads. However, TikTok ads might work best for retailers selling to younger audiences.

What makes a good TikTok ad?

Good TikTok ads are visually appealing with clear CTAs and well-chosen hashtags to boost visibility. They use high-quality images and successfully capture a viewer’s attention within just a few seconds.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “How much does TikTok advertising cost?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Your TikTok advertising cost depends on several things. At the campaign level, there’s a daily and lifetime budget of $50. At the ad group level, you need a minimum budget of $20 per day, and your lifetime budget works out as your daily budget multiplied by the number of campaign days scheduled.

”

}

}

, {

“@type”: “Question”,

“name”: “How do you create ads in TikTok?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

First, create a TikTok Ads account and choose your campaign objective. Name your campaign, set your marketing budget, determine the ad placement, and choose your target audience. Set your campaign schedule and create your ads.

”

}

}

, {

“@type”: “Question”,

“name”: “What kind of businesses should use TikTok advertising?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

If you’re a business on TikTok, you could try TikTok ads. However, TikTok ads might work best for retailers selling to younger audiences.

”

}

}

, {

“@type”: “Question”,

“name”: “What makes a good TikTok ad? “,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Good TikTok ads are visually appealing with clear CTAs and well-chosen hashtags to boost visibility. They use high-quality images and successfully capture a viewer’s attention within just a few seconds.

”

}

}

]

}

Conclusion: TikTok Advertising

If you want to maximize visibility, increase your ROI, and boost your social media reach, then try TikTok ads. TikTok advertising is suitable for all businesses on the platform, it’s easy to get started, and since you don’t need a huge campaign budget, it’s accessible for startups and small companies.

To create a winning TikTok ad, use images and creative elements like videos where possible, keep your CTAs brief and impactful, and target the most relevant hashtags. Need help getting started? Take a look at my consulting services.

Have you tried TikTok advertising yet? What do you find most challenging about TikTok ads?