Article URL: https://www.ycombinator.com/companies/heron-data/jobs/kN46lMk-software-engineer

Comments URL: https://news.ycombinator.com/item?id=28916344

Points: 1

# Comments: 0

Article URL: https://www.ycombinator.com/companies/heron-data/jobs/kN46lMk-software-engineer

Comments URL: https://news.ycombinator.com/item?id=28916344

Points: 1

# Comments: 0

Perfect Recall | Full Stack Engineer (first hire) | Full Time | Onsite Waterloo, Canada | https://www.perfectrecall.app

We let you share key highlights from your Zoom calls, replacing written notes. Our software records and transcribes Zoom calls. Users can then highlight transcript text to create short, consumable clips.

We’re making our first engineer hire.

You’ll have a major role in developing the core product and creating the culture of our engineering team. You’ll be working closely with the founders. You’ll have full ownership over major features – frontend and backend, from prototype to production.

Our frontend is written in React, with Typescript. Our backend is Django and Celery deployed with Terraform on AWS. We use Postgres and Redis. Experience with our stack is not necessary.

Engineering problems we’re solving: Recording Zoom calls at scale, producing dynamic media at near-real time performance.

Video calls today are an inferior substitute to in-person interactions; low-resolution, high-latency, and without additional capabilities. We believe that the potentials of video as a communications medium have just barely been explored, just as the first movies were essentially recorded stage-plays. We see a future where video calls are more productive than face-to-face, because of the value the intervening software delivers.

In terms of our company culture, we believe that raw hours make a difference. Working too many hours doesn’t guarantee success, but working too few leads to failure. We expect everyone to put in their best effort every day, but we generally don’t expect you to work late evenings or on weekends. We are careful to avoid burnout, but we also don’t want to sugarcoat the fact that raw hours can make a huge difference in a startup.

If what we’re doing sounds interesting, apply below or email david@perfectrecall.app

https://www.ycombinator.com/companies/perfect-recall/jobs/kc…

null

The post Follow live: Wisconsin, Penn State going down to the wire appeared first on Buy It At A Bargain – Deals And Reviews.

Machine learning is on the verge of transforming the marketing sector. In many ways, it’s already started. According to Gartner, 30% of companies will use machine learning in one part of their sales process by 2020.

What’s more, these companies are using machine learning to get ahead of competitors by tackling some of marketing’s toughest challenges, such as personalization, instant customer support, and big data.

In other words, machine learning isn’t just for computer scientists. Marketers should sit up and take notice. Below, I’ve covered five ways you can use machine learning to supercharge your digital marketing efforts.

Before we get into the marketing side of things, let’s take a second to establish what artificial intelligence and machine learning are.

Artificial intelligence is simply any form of intelligence demonstrated by a machine instead of the natural intelligence displayed in humans and animals. When most people think of artificial intelligence, they think specifically of computers that replicate some level of human intelligence, like a chess-playing computer I mentioned in the introduction.

Machine learning is a branch of artificial intelligence that enables systems to find new and better solutions automatically by learning from mistakes and experiences. The more data and experience a machine learning algorithm has access to, the better it becomes in the future.

Machine learning systems can largely be divided into two subsets: guided and unguided. Guided machine learning systems are supplied with data sets and solutions by humans in the first instance. They are taught which patterns to look for initially and will then get better at identifying those patterns going forward.

Unguided systems are given access to unsorted and disparate data sets and are left to decipher patterns independently without guidance from humans. Unguided systems will create an algorithm and then look for ways to improve it going forward.

We know that marketing teams don’t want for lack of data. Marketers struggle with making sense of all the data they have at their fingertips and then putting that data to use. This analysis is where machine learning comes in.

The primary reason to add machine learning to your marketing stack is that it can make sense of vast amounts of data much faster and much more effectively than humans.

Machine learning can use data to identify patterns and make predictions almost instantly. Marketers can then use these insights to optimize a huge portion of their workflow, from running more tests and improving their website’s UX to personalizing the customer experience and automating consumer engagement.

The long and short of it is machine learning can be used to improve just about every part of your digital marketing efforts. Below we discuss five of the most important ways.

However you use machine learning in your marketing efforts, the process will probably begin by analyzing data sets.

For instance, machine learning can be used to analyze and find user activity patterns on your website. Rather than sifting through data in your Google Analytics profile yourself, a machine learning algorithm could do the job in seconds, predicting future user behavior and identifying patterns that you can use to optimize your site.

Sure, humans are perfectly capable of analyzing data themselves, but you can’t do it half as fast or accurately as AI-powered solutions.

Marketers can also use machine learning to gain a better understanding of their customer base.

Take customer segmentation, for instance. Dividing up your audience into different groups can make your marketing efforts much more effective, but it’s time-consuming to do so yourself. On the other hand, a machine learning algorithm could automatically segment your customer base based on actions and behavioral patterns that you couldn’t hope to identify.

You don’t need me to reiterate the importance of content in your digital marketing efforts. However, you may need clarification on how machine learning can improve what you write and publish and why using machine learning in your content marketing strategy is essential.

For starters, machine learning can help your articles rank higher in search engine results. It’s one thing to be a great writer; it’s another to write in a way that pleases Google, so it rewards you in the SERPs. You need to make sure you use all relevant keywords, discuss every relevant topic, and cover all of your bases in general.

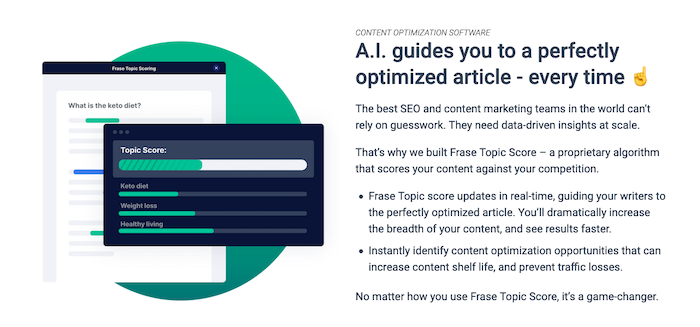

That’s pretty hard to do without smart content creation tools like Frase.io, which uses machine learning to compare your content against Google’s top results and make sure you hit all of the relevant points.

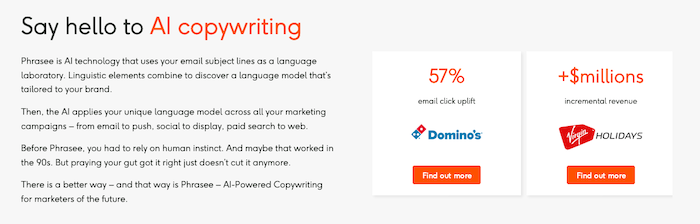

Second, you can have machine learning algorithms write content for you. Phrasee is an AI-powered copywriting tool that uses machine learning to create email subject lines and push notifications that its algorithm believes will drive the highest ROI.

You can even use AI to help you curate content for your customers. Curata offers a machine learning content curation software that helps marketers find and publish the most relevant and engaging content for their audiences.

Personalization matters for consumers. Research by Accenture shows 91% of consumers prefer brands that remember who they are and provide relevant offers and recommendations as a result. What’s more, if they don’t get a personalized experience, over half of consumers are only too happy to switch to a competitor.

Here’s the good news: machine learning lets you deliver the most personalized customer experience possible. You can employ a machine learning algorithm that tracks user behavior on a granular level, learns what products they like, and creates a personalized homepage and recommendation list as a result.

Amazon, for instance, uses AI algorithms that take into account the purchase history of users, the items in their cart, and their viewing habits to offer the product recommendations that are most likely to convert.

The same algorithm could also generate personalized offers for every customer and email them to consumers when they are most likely to purchase.

Better personalization is one way machine learning can transform how your brand engages customers, but it’s not the only way. AI and machine learning can also be used to better automate your marketing efforts and significantly improve customer engagement as a result.

Let’s say you automatically send an email to customers when they sign up for your newsletter or abandon their cart. While most brands will send a generic email, companies that adopt machine learning can tailor content and offers based on that consumer’s browsing history. If they looked at your brand’s range of dog toys before signing up for your newsletter, a relevant offer on chew toys would make them much more likely to re-engage with your brand.

For SaaS brands, AI-powered marketing automation tools can analyze much larger and disparate data sets to better segment leads. This allows sales reps to prioritize those leads that are much more likely to convert.

Marketing automation is incredibly powerful. According to Invesp, marketing automation leads to an over 14% increase in sales productivity and an over 12% reduction in marketing overhead.

It’s entirely possible to do this without machine learning, but AI makes your automation efforts much more personalized and much more powerful.

Chatbots are a powerful customer service tool. Eight out of ten consumers who have engaged with them report a positive experience. If you run an online business, they are all but essential.

With chatbots, you don’t have to have a human on-hand to respond to consumers. Instead, machine learning-powered chatbots can automatically answer consumer queries with a scarily-high rate of accuracy. That’s because your chatbot will learn from your website’s content and the conversations it has with consumers to constantly improve the answers it provides.

Because the chatbot is continuously learning and improving itself, it will deliver an even better customer experience with more conversations. You may want to have your chatbot pass an incredibly complicated query onto a human at first, but soon the bot will become so effective there’ll be no need for a human to interject. Eventually, you’ll have a smart enough chatbot to upsell the consumer, not just answer their questions.

Consumers probably won’t be able to tell they’re speaking to a robot, either. Some chatbots, like IntelliTicks, employ another branch of AI, Natural Language Processing (NLP), to have human-level conversations with customers.

What’s more, data gathered by AI-powered chatbots can be analyzed by another machine learning algorithm to generate insights that marketers can use to optimize their efforts going forward.

Things move fast in the world of machine learning. Expect advances in marketing AI to happen rapidly.

Improved unsupervised machine learning algorithms are in development right now, for instance. These algorithms don’t need input from humans at the start, making them much easier and faster for marketers to implement.

Personalization will become even more powerful, too. Machine learning algorithms will become better at discerning what consumers want for one, but the ways they can be integrated with online stores will improve, too. Soon, marketers will be able to customize every part of their sites for individual users, much like social media timelines are personalized for every user.

Finally, expect big advances in mobile machine learning. AI-powered digital assistants will become a more prominent part of our life, and marketers will have to develop strategies to contend with this. Mobile applications will also be able to integrate machine learning features in the same way websites can right now.

Don’t get overwhelmed, however. Before you start worrying about what the future holds, work your way through the suggestions I’ve made above first. You’ll then be ready for whatever occurs in the future.

It’s clear: machine learning can transform your digital marketing efforts.

Don’t rush into the world of machine learning, however. Adopting solutions without first understanding how the technology works and its role in your company will typically do more harm than good.

Machine learning is powerful, but it isn’t a silver bullet. Adopt one solution at a time, however, and you’ll be fine.

Continue your education by reading my articles on AI’s role in SEO and AI-powered digital assistants.

Which machine learning strategy are you going to implement first?

The post How to Use Machine Learning to Improve Your Digital Marketing appeared first on Neil Patel.

Get a business credit report in a recession and stay on top of your scores.

You got this: we show you exactly how to get your business credit report in a recession.

In a recession, inevitably banks and other credit issuers get more conservative. So it pays to get your business credit report in a recession so you can pounce on any mistakes immediately.

Your best bet as a company owner is to stay on top of every business credit report from PAYDEX, Equifax, and Experian.

There are three big credit reporting agencies for companies and you really should check all three of them frequently. This is because they use moderately different yardsticks. Hence moving the needle for one can move the needle for both of the others. Although maybe not as much.

Do not permit your business credit scores slide, as you have to catch any mistakes as fast as you can. Plus, you need to identify anything which is dragging your scores down. And then take remedial measures. You can get a business credit report in a recession easily and stay on top of all three scores by following a few straightforward steps.

Dun & Bradstreet’s PAYDEX score of your company can end up being one of the primary reasons that your business receives credit in any manner.

A Dun & Bradstreet Report (also known as a D&B Report) is a database-generated report. The business services giant produces such a report in order to assist its clients in making decisions regarding new credit applications.

The primary reason for a client using this kind of a report is to engage in credit risk monitoring of vendors, suppliers, and business partners. This helps companies make informed business credit determinations and avoid bad debt.

Dun & Bradstreet takes several factors into account in generating such a report. These include a predictor of payment delinquency; how financially stressed a company is compared to comparable businesses; an evaluation of supplier risk; credit limit recommendation; D&B rating; and PAYDEX score. Let’s consider all these factors in turn.

Dun & Bradstreet uses predictive models to ascertain how likely a company is to be late with its payments. Predictive scoring is a means of using historical information to attempt to predict future outcomes. It entails identifying the risks inherent in a future decision. It does this by examining the relationship between historical information and the future event.

This represents an objective and statistically derived counterpart to subjective and intuitive assessments. Such scoring allows a business to rank and order accounts based upon the probability of an event occurring, such as delinquent payments. However, note that Predictive Scoring only represents a statistical probability, and not a guarantee.

A PAYDEX Score is Dun & Bradstreet’s proprietary dollar-weighted numerical indicator of how a firm has paid its bills over the past year. The score is based upon trade experiences reported to Dun & Bradstreet by various vendors. In addition, the D&B PAYDEX Score ranges from 1 to 100; higher scores indicate a better payment performance.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

D & B offers Credit Signal, which is a means to keep track of your credit score by having the business credit report come immediately to you, for a cost. You may discover the expense is well worth it in order to avoid the frustrations that can emerge from letting this score slip. And you will not need to produce and handle the organizing and reminders you might need to stay up to date with if you don’t use it.

Don’t wish to make use of Credit Signal? Not a problem, as you can obtain your PAYDEX report through D & B and, if need be, you can get in touch with their Customer Service department (this department exists as a section of Dun & Bradstreet itself).

In addition, in order to review your PAYDEX report, check out what D & B provides, which is a specimen report and even some higher level tips in the way to analyze it.

Any report is only as good as the data it comes from. Dun & Bradstreet’s database contains over 250 million firms spanning the globe, which includes around 120 million active companies and about 130 million businesses which are out of business but kept for historical purposes.

D&B constantly gathers data and works to improve its analyses to ensure the greatest degree of accuracy possible.

Equifax, one of the large credit reporting bureaus, furnishes a risk monitoring service which is more convenient as it allows for a business credit report to come directly to you.

If you don’t want to purchase continuing reports, you can instead order your company’s Equifax report.

Additionally, if you have to question your small business’s Equifax report, you can do so by following the information on their website.

You can learn how to go over your Equifax report by checking out a specimen of their reports.

Now that you know what enters into it, you can see that some of the more crucial pieces of information Equifax looks into are public records, credit usage, and how you take care of your financial and nonfinancial accounts.

Start getting rid of your debts as quickly as possible and not going delinquent. And keep your credit utilization within reason. Less than 30% of your overall available credit is best. And start staying away from overdue payments. Then you should have the ability to build up your Equifax score.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

Experian, one more big credit reporting firm, also offers a way having their business credit report sent to you for a fee. As a result you can keep an eye on your Experian small business credit score here and the setup is simple.

However, if you prefer to not get continuing reports (and pay for them), then you can order a single Experian report for your firm on their site.

Experian provides a handy list of ways to improve your own, specific report.

You can get your company’s real Experian report and can dispute any errors on your company’s Experian report by following the directions on their website.

Now that you know what goes into it, you can see what some of the more important pieces of data Experian looks into are. These include payment history and credit utilization. And they also include the amount of time in business. Or at least they show the amount of time your company has had an Experian listing.

Beyond anything else, improving your payment history will increase your Experian credit scores.

Keep your credit utilization within reason. So this is because less than 30% of your total available credit is best. Clear your debts as quickly as you are able to. And don’t go delinquent. Also, avoid any late payments. Then, you should be able to improve your Experian score over time.

Likewise, if there are any problems or matters of contention, you can question any errors on your business’s Experian report if you follow the directions on their web site.

Find out about assessing your Experian report by assessing a sample Experian company credit report.

Know what is happening with your credit. Make sure it is being reported and deal with any errors ASAP. Get in the habit of taking a look at credit reports. Dig into the details, not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less than it would cost you at the CRAs.

At Equifax, you can monitor your account at: www.equifax.com/business/business-credit-monitor-small-business.

Update the details if there are inaccuracies or the data is incomplete. At D&B, you can do this at: https://iupdate.dnb.com/iUpdate/viewiUpdateHome.htm. For Experian, go here: www.experian.com/small-business/business-credit-information.jsp. So for Equifax, go here: www.equifax.com/business/small-business.

So, what’s all this monitoring for? It’s to challenge any problems in your records. Mistakes in your credit report(s) can be fixed. But the CRAs typically want you to dispute in a particular way.

Get your business’s PAYDEX report at: www.dnb.com/about-us/our-data.html. Get your company’s Experian report at: www.businesscreditfacts.com/pdp.aspx?pg=SearchForm. And get your Equifax business credit report at: www.equifax.com/business/credit-information.

Disputing credit report mistakes generally means you send a paper letter with duplicates of any evidence of payment with it. These are documents like receipts and cancelled checks. Never send the originals. Always send copies and keep the original copies.

Fixing credit report errors also means you specifically itemize any charges you dispute. Make your dispute letter as crystal clear as possible. Be specific about the issues with your report. Use certified mail so that you will have proof that you mailed in your dispute.

Dispute your or your small business’s Equifax report by following the instructions here: www.equifax.com/small-business-faqs/#Dispute-FAQs.

You can dispute errors on your or your business’s Experian report by following the instructions here: www.experian.com/small-business/business-credit-information.jsp.

And D&B’s PAYDEX Customer Service contact number is here: www.dandb.com/glossary/paydex.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN. Get money even in a recession!

At times, it pays to hand over a few dollars to ensure you get a business credit report in a recession consistently. It’s a lot less troublesome than to have to remember to do this.

And you’ll probably look at these reports more thoroughly, as they come at a price tag.

Continue track and make use of the tools that these credit reporting companies provide, and make your life simpler. After all; you’ve already got enough on your plate.

Because of recent data breaches, there are even more reasons to assess your business and personal credit reports and be vigilant about any errors you find. In a recession, you need the highest business credit scores you can get. When you get a business credit report in a recession, you’re doing just that.

The post Get a Business Credit Report in a Recession appeared first on Credit Suite.

Regulatory Authorities Step Up Crypto Fraud Enforcement 40 Wall St., 35thFloor, New York, NY 10005. The blog post Regulators Step Up Crypto Fraud Enforcement showed up initially on High Paying Affiliate Programs. Visit this site For Original Source Of The Article State as well as government protections regulatory authorities have actually been acutely concentrated upon … Continue reading Regulatory Authorities Step Up Crypto Fraud Enforcement

40 W…

Fundation Group LLC is one of many lending companies online. They provide term loans and lines of credit. Foundation confirmed the information we found about them online. We look at the specifics and drill down into the details. So check out our Fundation Group LLC recession funding review.

Fundation Group LLC is located online here: http://www.fundation.com/. Their physical address is located in Reston, VA. Plus you can call them at: (888) 390-0064. So their contact page is here: https://fundation.com/about/.

Their capital base has come from Goldman Sachs; Garrison Investment Group; and Midcap Financial, LLC.

Funding as soon as one business day. Up to $500,000 is available; terms go up to 4 years. Payments are twice per month. No specific collateral is needed. They want a personal guarantee. Fundation will take out a UCC-1 blanket lien for most borrowers.

They do not seem to have a time in business requirement anymore. Fundation also does not seem to have an annual revenue or personal credit requirement anymore.

Rates are risk-based; the higher the risk, the higher the rate.

Interest rates are not listed; they will be determined based on several factors. There are no prepayment fees.

Several factors are considered when Fundation decides on the cost of a loan. These factors include time in business and seasonality. They also include financial metrics. So these metrics include profit margin and amount of debt.

Up to $150,000 is available. The new balance after each draw is amortized in equal installments over 18 months. Payments are monthly. No specific collateral is needed. They want a personal guarantee. Fundation will take out a UCC-1 blanket lien for most borrowers.

They do not seem to have a time in business requirement anymore. Fundation also does not seem to have an annual revenue or personal credit requirement anymore.

There are no prepayment fees. Just pay the outstanding balance plus accrued interest if you prepay

your loan or line of credit.

Keep your business protected with our professional business credit monitoring. It’s a worthwhile investment, saving you money even during a recession.

Advantages include no apparent time in business requirement. Their maximum loan amount is fairly high.

Disadvantages are they want personal guarantees for pretty much everything and will take out a UCC blanket lien.

Business credit is credit in a small business’s name. It doesn’t attach to an owner’s individual credit, not even when the owner is a sole proprietor and the solitary employee of the small business.

As such, a business owner’s business and individual credit scores can be very different.

Because business credit is distinct from personal, it helps to protect a small business owner’s personal assets, in case of a lawsuit or business bankruptcy.

Also, with two distinct credit scores, a small business owner can get two different cards from the same merchant. This effectively doubles buying power.

Another benefit is that even startup ventures can do this. Visiting a bank for a business loan can be a formula for disappointment. But building small business credit, when done right, is a plan for success.

Personal credit scores depend upon payments but also other factors like credit utilization percentages.

But for small business credit, the scores actually only depend on whether a business pays its invoices punctually.

Establishing company credit is a process, and it does not occur without effort. A company has to actively work to establish company credit.

However, it can be done readily and quickly, and it is much quicker than establishing consumer credit scores.

Vendors are a big aspect of this process.

Performing the steps out of sequence will cause repetitive denials. Nobody can start at the top with small business credit. For example, you can’t start with retail or cash credit from your bank. If you do, you’ll get a rejection 100% of the time.

A company must be fundable to credit issuers and vendors.

For that reason, a company will need a professional-looking web site and e-mail address. And it needs to have site hosting from a company like GoDaddy.

And, company phone and fax numbers must have a listing on ListYourself.net.

In addition, the company telephone number should be toll-free (800 exchange or the equivalent).

A small business will also need a bank account devoted strictly to it, and it needs to have all of the licenses essential for operation.

These licenses all must be in the perfect, appropriate name of the company. And they must have the same business address and phone numbers.

So keep in mind, that this means not just state licenses, but potentially also city licenses.

Keep your business protected with our professional business credit monitoring. It’s a worthwhile investment, saving you money even during a recession.

Visit the IRS web site and acquire an EIN for the small business. They’re totally free. Select a business entity such as corporation, LLC, etc.

A company can get started as a sole proprietor. But they will most likely wish to switch to a kind of corporation or an LLC.

This is in order to minimize risk. And it will make best use of tax benefits.

A business entity will matter when it pertains to tax obligations and liability in case of litigation. A sole proprietorship means the business owner is it when it comes to liability and taxes. No one else is responsible.

If you operate a company as a sole proprietor, then at least be sure to file for a DBA. This is ‘doing business as’ status.

If you do not, then your personal name is the same as the small business name. Therefore, you can end up being directly responsible for all small business debts.

Plus, according to the Internal Revenue Service, by having this arrangement there is a 1 in 7 probability of an IRS audit. There is a 1 in 50 probability for corporations! Prevent confusion and noticeably reduce the chances of an IRS audit at the same time.

Begin at the D&B web site and obtain a totally free D-U-N-S number. A D-U-N-S number is how D&B gets a business into their system, to produce a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s websites for the company. You can do this at www.creditsuite.com/reports. If there is a record with them, check it for accuracy and completeness. If there are no records with them, go to the next step in the process.

By doing this, Experian and Equifax will have something to report on.

First you must build trade lines that report. This is also referred to as vendor credit. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can begin to get retail and cash credit.

These sorts of accounts have the tendency to be for the things bought all the time, like marketing materials, shipping boxes, outdoor work wear, ink and toner, and office furniture.

But first off, what is trade credit? These trade lines are credit issuers who will give you initial credit when you have none now. Terms are often Net 30, rather than revolving.

So, if you get approval for $1,000 in vendor credit and use all of it, you must pay that money back in a set term, such as within 30 days on a Net 30 account.

Keep your business protected with our professional business credit monitoring. It’s a worthwhile investment, saving you money even during a recession.

Once there are 3 or more vendor trade accounts reporting to at least one of the CRAs, then move onto retail credit. These are companies like Office Depot and Staples.

Just use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, use the business’s EIN on these credit applications.

Are there more accounts reporting? Then move to fleet credit. These are companies like BP and Conoco. Use this credit to buy fuel, and to fix and maintain vehicles. Just use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, make sure to apply using the company’s EIN.

Have you been sensibly handling the credit you’ve up to this point? Then progress to more universal cash credit. These are companies such as Visa and MasterCard. Just use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, use your EIN instead.

These are frequently MasterCard credit cards. If you have more trade accounts reporting, then these are doable.

Monitor Your Business Credit

Monitor Your Business CreditKnow what is happening with your credit. Make certain it is being reported and deal with any mistakes ASAP. Get in the practice of taking a look at credit reports. Dig into the particulars, not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less.

Update the details if there are inaccuracies or the details is incomplete.

So, what’s all this monitoring for? It’s to contest any mistakes in your records. Mistakes in your credit report(s) can be corrected. But the CRAs normally want you to dispute in a particular way.

Disputing credit report errors typically means you send a paper letter with duplicates of any proofs of payment with it. These are documents like receipts and cancelled checks. Never send the originals. Always send copies and retain the original copies.

Fixing credit report inaccuracies also means you precisely itemize any charges you contest. Make your dispute letter as understandable as possible. Be specific about the issues with your report. Use certified mail so that you will have proof that you sent in your dispute.

Always use credit responsibly! Don’t borrow beyond what you can pay off. Track balances and deadlines for repayments. Paying punctually and fully will do more to boost business credit scores than pretty much anything else.

Building business credit pays. Great business credit scores help a business get loans. Your credit issuer knows the business can pay its financial obligations. They know the company is bona fide.

The business’s EIN attaches to high scores and loan providers won’t feel the need to demand a personal guarantee.

Business credit is an asset which can help your business for years to come. Learn more here and get started toward growing company credit.

A company needing higher amounts will likely do better with Fundation. But there are negatives.

Entrepreneurs will find they have to give up a personal guarantee and, on top of that, have a UCC blanket lien held by Fundation. A company that fails and ends up going out of business could be particularly harsh for an entrepreneur – so companies which are unsure of the chances of their success would do well to seek out other types of funding, where they either hand over a personal guarantee or a UCC blanket lien but not both.

And finally, as with every other lending program, whether online or offline, always remember to read the fine print and do the math. Go over the details with a fine-toothed comb, and decide whether this option will be good for you and your company. In addition, consider alternative financing options that go beyond lending, including building business credit, in order to best decide how to get the money you need to help your business grow.

The post Check Out Our Fundation Group LLC Recession Funding Review and Make Your Best Business Financing Decision Today appeared first on Credit Suite.

Techniques For Small Business Success

For numerous people, the need for looking for a little business opportunity has really revived. What are a few of one of the most reliable techniques to see to it that your regional company possibility decorations? When beginning with your really own little company possibility, right below are a number of criteria to remember.

Make the effort to notify on your very own pertaining to running a firm itself, to ensure that when you do begin to seek your small company opportunity, you are furnished with understanding that will definitely help preserve you from shedding essential time as well as additionally power.

When searching for success with your little company possibility, another critical point to keep in mind is that education and learning as well as understanding calls for to be constant. As your business increases along with the world around you continues, there will definitely frequently be new adjustments as well as likewise problems in the world of your small business opportunity.

Keep in mind, totally pleased customers are the technique to success in your little solution opportunity. After you have really done this, take therapy to produce a method for your little firm opportunity that permits others recognize particularly why your product or service is totally fit to their needs.

Another fantastic thing of suggestions for those beginning a neighborhood service possibility is to work purposefully, seeing to it to build a framework that will definitely last. When you situate customers for your little solution opportunity, spend time paying interest to them as well as situating out what it truly is that they need as well as wish.

Acknowledge that if you can develop a high quality link with your customers, this will definitely bring wonderful benefits to your neighborhood service possibility for a number of years in the future.

While trying to be likewise pleasurable as well as not ludicrous, still frequently get on the look for a feasible client or customer that could be curious about what your little solution opportunity needs to provide. Lug specialist firm cards with you in any way times, as well as likewise ensure your chums in addition to member of the family have actually included cards promoting your little company opportunity.

When creating your little solution opportunity, be specific to operate on one aspect at once. In time, framework upon that will definitely create outstanding end results for your little business opportunity.

Pursuing as well as additionally producing your really own neighborhood company possibility does take an affordable amount of prep work as well as likewise work. Reaching the purposes you have in fact developed for your actually very own little solution opportunity can be among one of the most meeting experiences of a life time.

Put in the time to inform by yourself pertaining to running a solution itself, to make sure that when you do begin to seek your little solution opportunity, you are furnished with understanding that will definitely aid keep you from wasting helpful time along with power. As your company increases along with the world around you advancements, there will definitely regularly be new alterations along with problems in the world of your little organisation opportunity.

Spend time paying interest to them as well as finding out what it truly is that they need as well as wish when you uncover customers for your little organisation opportunity. Lug professional solution cards with you in any way times, as well as additionally make sure your buddies as well as additionally relative have actually included cards marketing your little solution possibility.

When building your local business possibility, be particular to work on one component at once.

The post Approaches For Small Business Success appeared first on ROI Credit Builders.

Loan provider account! In Real estate

Whether you are acquiring or you are marketing a home in both the problems you constantly undergo an escrow duration. This component of the procedure entails the facility of a loan provider account, as they do not trust you.

Escrow is utilized to make a central, unbiased business or representative that can gather papers as defined in purchase papers in the actual estate. This is just recognized as escrow, and also is not a loan provider account.

A loan provider account is a financial institution account. A loan provider does not truly trust you also if he is providing you a house finance for hundreds of thousands of bucks. The lending institution utilizes the financial institution account to make certain for the settlements specific costs are paid, financial obligations that may or else trigger the loan provider troubles if they are not paid.

The loan provider takes the stated cash as well as pays the pertinent obligations and also financial obligations associated to the genuine estate. Depending on the loan provider as well as the financing, the customer might be called for to maintain a padding in account.

A loan provider account is great from the point of view of the lending institution. Purchasers require to see to it they comprehend the repayments needed as a big padding need might seriously affect a customer’s capital.

A lending institution account is a financial institution account. The lending institution utilizes the financial institution account to make certain for the repayments specific costs are paid, financial debts that could or else create the loan provider issues if they are not paid. The loan provider takes the claimed cash as well as pays the appropriate responsibilities and also financial debts connected to the actual estate. Depending on the loan provider and also the car loan, the debtor might be needed to maintain a padding in account.

The post Lending institution account! In Real estate appeared first on ROI Credit Builders.