It most certainly feels weird and somewhat ridiculous saying it, but…If you’ve ever been curious about my backstory, my personal life, what drives me, and how the E5 Method came about, the above 3-minute documentary will answer many of your questions. After you watch it, then go on to this week’s goodies… 😍 Enjoy the Memo? […]

Author: Brian Ellingsworth

New comment by lpnoel1 in "Ask HN: Who is hiring? (February 2024)"

Dialogue.co | Senior Software Engineer; Staff Software Engineer | ONSITE | Montreal

We’re in the business of caring. As Canada’s leading virtual care provider, we’re committed to helping millions of individuals improve their health and well-being.

Reporting to one of our Engineering Directors, the mission of the Senior Software Developer, Back-End is to empower Dialogue buyers to provide better health outcomes and achieve a stronger bottom line by creating best-in-class tools to supervise a delightful Integrated Health experience.

New comment by george87 in "Ask HN: Who wants to be hired? (January 2024)"

Location: Europe | USA

Remote: Yes

Willing to relocate: Possibly

Technologies: Java (SE, Spring, Swing/FX), JavaScript (Node, React, D3), various SQL & NoSQL datastores, ETL tools, UI/UX design tools, Git, Docker, AWS, Vercel, etc.

Résumé/CV: gtanev.github.io/cv/2023.pdf

Email: In résumé

Versatile software engineer with a master’s degree in computer science and research published through prestigious organizations such as IEEE, OEIS, and Springer. Author of the first linear algorithm for rolling binary trees. Experienced in devising advanced software solutions, from web and desktop applications to data pipelines and data visualizations. Able to build complex systems from design to deployment. Open to software engineer/consultant and tech co-founder/CTO roles.

Colorado GOP asking US Supreme Court to overturn ruling disqualifying Trump from 2024 ballot

The Colorado Republican Party said it’s asking the U.S. Supreme Court to overturn a ruling that barred former President Donald Trump from appearing on the state’s 2024 ballot.

Earlier this month, the Colorado Supreme Court, in a 4-3 vote, overturned a lower court ruling that allowed Trump to appear on the ballot as a presidential candidate. The initial ruling said a president is not among the officials subject to disqualification on a ballot.

“By excluding President Trump from the ballot, the Colorado Supreme Court engaged in an unprecedented disregard for the First Amendment right of political parties to select the candidates of their choice and a usurpation of the rights of the people to choose their elected officials,” attorneys for the state Republican party wrote in a petition of the Dec. 19 ruling.

POLL SHOWS BIDEN HITTING RECORD LOW APPROVALS, FALLING BEHIND AGAINST TRUMP IN 2024 MATCHUP

Fox News Digital has reached out to the Colorado GOP.

In their opinion, the justices on the state’s high court wrote that Trump “incited and encouraged” the use of violence to prevent the peaceful transfer of power on Jan. 6, 2021, when many of his followers stormed the U.S. Capitol as congressional lawmakers were certifying President Biden’s election win.

The case is being appealed based on three main arguments: whether the president is among those officials subject to disqualification by Section Three of the 14th Amendment, the so-called insurrection clause; whether Section Three is “self-executing,” meaning that it allows states to remove candidates from a ballot in absence of any congressional action.

The last point rests on whether denying a political party the ability to choose a candidate of its choice in a presidential primary and general election violates the First Amendment Right of Association. The attorneys said by excluding Trump, Colorado’s highest court has concluded that individuals, courts and election officials can possess legal authority to enforce Section Three.

“Rejecting a long history of precedent, a state Supreme Court has now concluded that individual litigants, state courts, and secretaries of state in all 50 states plus the District of Columbia have authority to enforce Section Three of the Fourteenth Amendment,” the state party wrote.

The party also said that other states may follow Colorado’s lead and exclude Trump from their ballots as well. Disqualification lawsuits relating to Trump’s appearance on the ballot are pending in 13 states, including Texas, Nevada and Wisconsin.

“With the number of challenges to President Trump’s candidacy now pending in other states, ranging from lawsuits to administrative proceedings, there is a real risk the Colorado Supreme Court majority’s flawed and unprecedented analysis will be borrowed, and the resulting grave legal error repeated,” the petition states.

In the lower court ruling, Colorado District Judge Sarah B. Wallace allowed Trump to stay on the ballot, but found that he “engaged in insurrection” for his role in the Jan. 6 Capitol riot.

Biden won Colorado by 13.5 points in 2020.

On Wednesday, the Michigan Supreme Court rejected an attempt to remove Trump from the state’s 2024 Republican primary ballot.

“Significantly, Colorado’s election laws differ from Michigan’s laws in a material way that is directly relevant to why the appellants in this case are not entitled to the relief they seek concerning the presidential primary election in Michigan,” Justice Elizabeth Welch wrote Wednesday, explaining the court’s ruling.

Why Perez doesn't make ESPN's Top 10 for 2023

Sergio Perez was one of two drivers not called Max Verstappen to win a race but his disappointing season meant he did not feature in our top 10 – here’s why.

The post Why Perez doesn't make ESPN's Top 10 for 2023 appeared first on Buy It At A Bargain – Deals And Reviews.

New comment by ttezel in "Ask HN: Who is hiring? (September 2023)"

Canopy Connect | Product Engineer | Full-time | Remote | https://www.usecanopy.com/company/careers

Canopy Connect is single-click insurance data sharing (like “Plaid for insurance”). We serve large and small insurance agencies, lenders, insurtechs, fintechs, and insurance carriers to streamline acquiring verified insurance data from consumers and businesses.

We’re hiring Product Engineers. We’re a small, fully remote team based in the US and Canada. Apply here: https://boards.greenhouse.io/canopyconnect

New comment by dwrodri in "Ask HN: Who wants to be hired? (November 2022)"

Location: Boston, USA

Technologies:

– Python, C++, C, Go, CUDA, bash

– Docker, GitLab CI, FFmpeg

– Tableau, Pandas, NumPy, SpaCy

– PyTorch, TensorFlow, OpenVINO

– Redis, Kafka, MongoDB

– Git, Jira

Willing to relocate: No

Résumé/CV: https://dwrodri.gitlab.io/resume.pdf

Summary: Machine Learning Engineer with 5 YoE of experience in academia and 2

YoE of experience working as an ML Engineer seeking mid-career/senior roles in

the Computer Vision / ML Engineering space. Orgs with <100 employees preferred.

Reach out to me if the following experience seems applicable to a position:

– Shrunk bandwidth of a video ingress pipeline by 10X by writing high performance C++ code that linked against FFmpeg’s C API.

– Shipped an end-to-end topic classification system built using Kafka, Python, and SpaCy which classified 1M+/posts per second on a single node.

– Designed and launched a recommender system for the 2M+ scholarly articles in the arXiv database.

– Developed a cycle-approximate simulator of an open-source RISC-V CPU using Go.

Contact me at: derek [at] derekrodriguez [dot] dev

How to Use Customer Segmentation to Improve the Performance of Your Marketing Campaigns

Your audience wants personalized marketing from your business.

In fact, they expect it. According to research, 71 percent of customers expect businesses to send them personalized marketing messages, and 76 percent are disappointed when they receive generic communications instead.

The challenge? If you don’t know your audience, you can’t send them personalized content. You don’t know what matters to them, so you can’t reach them on the right level.

If this dilemma sounds familiar, don’t worry. I have a solution for you, and it’s called customer segmentation. Customer segmentation helps you understand your audience so you can target your marketing campaigns with greater precision. Let me show you how it works.

What Is Customer Segmentation?

Customer segmentation means dividing customers into groups, or “segments,” based on traits they have in common such as age, buying habits, gender, and needs.

Businesses use customer segmentation models to better understand their prospects so they can target them with relevant personalized marketing campaigns including ads, emails, and social media posts.

Customer segmentation isn’t just about reaching a new audience more effectively, though. It’s also a way to reconnect with lapsed customers and encourage new purchases by sending them carefully targeted messages.

Remember, every customer is unique. They each have own buying behaviors and reasons for choosing you over your competitors. While it’s impossible to personalize your marketing to every individual, a customer segmentation strategy is the next best thing.

Why Is Customer Segmentation Important?

For one thing, it helps you improve your customer service. By understanding your customers’ needs and wants, you’re better placed to help solve their problems.

Does customer service matter? Absolutely. Research says one in five customers will abandon a brand after just one poor customer experience, so the more effort you invest in great service, the better.

Similarly, segmenting your audience helps build customer loyalty. How? Because customers are typically more loyal to brands offering personalized messaging—for 79 percent of consumers, the more personalization a company uses, the more loyal they are.

What do loyal and happy customers have in common? They’re more likely to shop with you. By personalizing the shopping experience through segmentation, you create more dedicated customers, so you increase conversions over time.

Not convinced? Well, studies show that over 60 percent of customers are likely to be repeat buyers after a personalized shopping experience, so the stats speak for themselves.

Customer Segmentation Models

You can use various customer segmentation models, depending on your business needs and marketing goals. Here’s a look at seven of the most common models.

1. Demographic Segmentation Model

Demographic segmentation means dividing people into groups based on certain demographic factors, including age, income, marital status, and occupation.

Let’s say your audience is men and women aged between 30 and 65. You want to run a TikTok campaign to promote a new product.

- 61 percent of TikTok users are women.

- 11 percent of users are over 50.

If you only run a campaign on TikTok, you miss out on a huge chunk of your target audience. Perform some demographic segmentation, and you’ll know to target Facebook, too, since 73 percent of 50- to 64-year-olds use this platform.

Want to try it?

- Set your campaign goal.

- Choose your variables, whether it’s age, gender, and so on.

- Select your platforms to run personalized marketing campaigns, such as social media, email, etc.

- Measure success using tools like Google Analytics and revise your campaigns as needed.

Pros and Cons of Demographic Segmentation

On the plus side, it’s easy to use this model, and it helps you adjust your tone to target different genders and ages.

The main downsides? You risk making false assumptions about a particular segment. You could also lose your brand voice by targeting such varied demographics.

Always use this customer segmentation model alongside other techniques. For example, it might be helpful to know a customer’s buying habits and values, or where they live.

2. Geographic Segmentation Model

With geographic segmentation, you categorize your audience based on where they work, live, and shop.

This type of customer segmentation analysis is fairly straightforward. The main disadvantage? Ironically, it’s simplicity. On its own, geographic segmentation doesn’t reveal much about your audience, but you can use it alongside other models on this list to build the fullest possible picture of your audience.

How to Segment Customers Through Geographic Segmentation

Here’s how to get started with geographical segmentation:

- Determine your segments. You can divide people by, for example, climate, culture, language, or land area.

- Gather data, such as website location data and sales data, to identify the size of your community.

- Send targeted messages to customers based on these segments. As an example, you might run paid ad campaigns based on location, or if you’re launching an exclusive location-based product, email your target audience a promo code.

Case Study: McDonald’s

McDonald’s frequently uses geographic segmentation to target different audiences around the world. For example, here’s a burger found in McDonald’s India:

McDonald’s creates products to suit its diverse audience and tap into the flavors and products they may respond to based on geography.

This brings me to another advantage of geographic segmentation: exclusivity. Since the McDonald’s menu varies by location, each item feels exclusive, harder to acquire, and more valuable, which may increase conversions.

3. Psychographic Segmentation

We each have unique personalities, but we share traits or characteristics. Psychographic segmentation means forming groups based on common traits such as hobbies, lifestyle choices, personality traits, cultural beliefs, and values.

Psychographic segmentation helps you understand a customer’s psyche so you can devise highly focused, relevant campaigns. However, the main challenge is gathering (and organizing) the relevant data.

How to Use Psychographic Segmentation

Follow these steps to start using psychographic segmentation:

- Determine your ideal customer. Who are you selling to? What do they love about your products? This stage may involve some consumer research.

- Choose your segments, such as hobbies, values, or personality traits.

- Identify where your audience congregates. For example, over 1.5 billion people visit Reddit every month, and 38 percent of Americans listen to podcasts every month.

- Perform some (more) consumer research. Whether you run Instagram polls or send surveys, ask your audience what type of content they want from you.

- Evaluate the data to decide how to properly target your groups.

Case Study: Patagonia

Patagonia, an outdoor clothing brand, knows its customers care about sustainable living. They’ve made sustainability a core part of their brand messaging:

If you ran a store like Patagonia, you could segment customers based on whether they prefer hiking or cycling and then send targeted campaigns to meet their needs while retaining this core brand message.

4. Technographic Segmentation

Technographic segmentation means categorizing people depending on the devices, hardware, and software they use. Why does this data matter? Well, according to statistics:

- 79 percent of U.S. smartphone users purchased something online through their mobile phone in the last six months.

- 40 percent of consumers switch to a competitor after one (yes, one) bad mobile phone experience.

- Purchases made on tablets are set to rise to over $64 billion in 2022.

As a marketer, you should care about how people are accessing your content so you can optimize their user experience (UX) and target them effectively. Technographic segmentation can help.

How to Perform Technographic Segmentation

There are a few ways to segment your audience using this method, but here’s how I suggest you start.

- Know your audience: Identify your customers, as they will determine which categories you choose.

- Pick your segments: For technographic segmentation, you might group people based on the devices they use, the software they’re working with, the apps they prefer, or how they use technology.

- Gather data: Collect the data you need to segment customers. You might do this by scraping websites, sending surveys, or even purchasing data from service providers.

Armed with this data, you can create your campaigns.

Example of a Technographic Segmentation Campaign

Let’s say you run a tech store. Some customers use Norton 360 for PCs. Others use Avast Security for Mac.

You split your marketing campaign by software. You send one email to Norton subscribers offering a discount on their annual subscription. You send another email to Avast customers offering the same discount for Avast.

The result? Emails that speak to your audience’s specific tech needs, which increase your chance of making conversions.

You could take it further, too. Say, through analytics, you notice your Norton PC customers are looking at mobile antivirus solutions. You could send them a discount code like this one from PCWorld:

By anticipating what matters to your audience based on their tech preferences, you’re meeting their needs…and hopefully nurturing them through to checkout.

Is this a perfect customer segmentation model? No. One significant drawback is its limitations: Knowing a customer’s tech preferences is only one part of what shapes their buyer’s journey. However, it’s a marketing technique worth adding to your toolbox.

5. Behavioral Segmentation

Want to know how your audience interacts with your business? Try behavioral segmentation.

Behavioral segmentation means grouping people together based on behavior patterns. These patterns reveal how consumers feel about your business so you can determine how to successfully reach them at every stage of the buyer’s journey.

As with other models, behavioral segmentation can be used at any point in your marketing strategy, whether it’s to revamp a landing page or send promotional emails.

How to Use Behavioral Segmentation

First, identify the behavior patterns to track. There are many ways to approach this, but you might segment customers based on their:

- buying stage

- engagement

- historical purchase history

- purchase frequency

- response to previous marketing campaigns

For example, say you group customers based on engagement. What counts as an “active” and “lapsed” customer varies depending on your business, but here are three groups you might have:

- Active customers shop with you every month.

- Infrequent customers only buy products every few months.

- Lapsed customers haven’t purchased from you in a year.

Next, you can devise three separate marketing campaigns. You might send active customers a loyalty discount, and infrequent customers a separate discount to tempt them back.

Once your campaigns are up and running, track your analytics. If you’re not getting the results you want, adjust your campaigns and try again.

Netflix and Behavioral Segmentation

With over 221 million subscribers, Netflix knows how to use behavioral segmentation to satisfy customer demand.

- Netflix uses machine learning to track what customers watch.

- The algorithms generated help Netflix customize everything for each customer, from the homepage to the show recommendations.

- Netflix can use A/B testing to track the impact of different recommendations and personalization features.

Behavioral segmentation has a significant downside, though: There’s always the chance you get the algorithms wrong. That said, if you track results diligently and respond to your findings, you can offset this drawback.

6. Needs-Based Segmentation

Successful marketing often comes down to showing prospects how your goods or services meet their needs. That’s where needs-based segmentation comes in.

With needs-based segmentation, you’re grouping people based on what they need from your product. The benefits they’re looking for when they buy something. What pain points they have, and the problems they need solving.

The biggest challenge? Identifying what these needs are.

For example, say you’re a food brand. Two prospects follow you on social media. One cares about fresh chicken, and the other wants vegan food. You might sell meat and non-meat products, but the same ad campaign won’t appeal to both.

Driving down into groups’ needs and motivations helps you maximize your campaigns.

Let’s do a simple comparison. Heck sells gluten-free vegan and non-vegan meat. They know some customers love the gym and care about high-protein snacks, so they launched a campaign to sell their meat at local gyms:

They know other customers care less about fitness and more about a vegan lifestyle, so they frequently create social media posts around meat-free products:

Heck clearly spent time learning about its wider customer base and what drives them so it can effectively reach every segment while retaining a consistent brand voice.

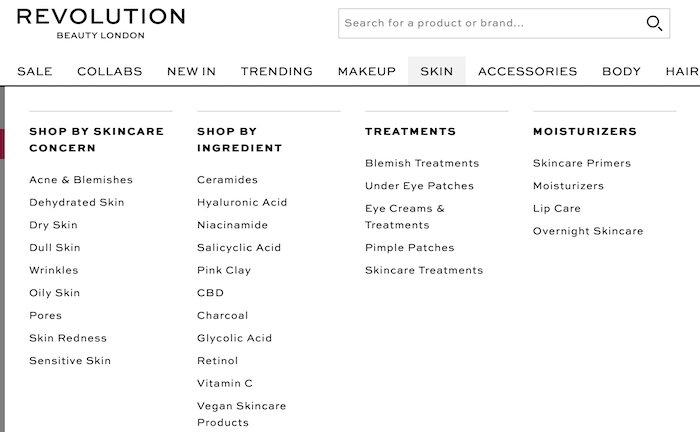

Here’s another example. Beauty store Revolution lets customers shop by skin concern and by ingredient to directly target consumers’ needs:

Needs-Based Segmentation Pros and Cons

Now that you understand how this customer segmentation model works, is it right for you?

Well, there are clear advantages. Needs-based segmentation helps you market with greater accuracy than, say, targeting groups by age or location. It’s comprehensive and effective, and it could help you build loyal customer relationships.

The main drawbacks? It’s challenging to identify the “right” needs to target, and if you don’t have accurate data, your campaigns may fail. What’s more, consumer needs evolve, so you’ll need to review your strategy regularly to maximize your campaign effectiveness.

How to Perform Needs-Based Segmentation

Here’s the simplest approach.

- Start with your products or services. Look at them from every angle and write down all their features and benefits.

- Build customer personas around these features. If you know how to segment customers based on behavior, age, location, etc., use the data you already have to help here.

- Finally, reach out to customers and learn what matters to them. You might, for example, look at product reviews, ask for customer testimonials, or send out questionnaires.

Once you have enough data, use your findings to create segmented marketing campaigns. Track your campaigns and tweak them as needed.

7. Value-Based Segmentation

The better you understand how much it costs to lose a certain client’s business, the better you can direct your marketing efforts. Value-based segmentation can help you by grouping customers together based on their value to your business.

Why group customers together this way? Well, there are two advantages.

Firstly, if you know which customers spend the most money on your products, then you know which customers you can’t afford to lose. You can direct resources into providing these customers with highly targeted campaigns and great customer service.

Secondly, you can identify your most loyal clients and how much it costs to retain their business. Once you know a customer’s relative value, you can decide if it’s worth retargeting these inactive customers with personalized messaging.

Is retention worth the effort, though? There’s evidence that it can be up to seven times more expensive to acquire rather than retain customers, so yes, retention matters.

Using Value-Based Segmentation

Here’s how to segment your customers on a value basis.

- Decide on your campaign goals. Maybe you want to identify your most lucrative audience and launch an ad campaign for your high-end products, or you want to nurture lapsed customers back to your store with enticing loyalty discounts.

- Identify your segmentation criteria. For value-based marketing, you might segment customers based on average spend or relationship duration as described above.

- Determine how you’ll target customers based on your findings; for example, on social media, by email, or through paid ads.

- Analyze your efforts such as by running regular A/B testing or asking customers for feedback.

On the plus side, value-based segmentation helps you quickly identify your most valuable customers in order to target them more effectively. However, if you’re a startup or young business, you may not have enough relevant data to use this customer model just yet.

Case Study: Global Cruise Company

Here’s an example of the basic value-based segmentation principles in action and how this method helps with retargeting and conversion.

Merkle, a marketing company, helped a global cruise company develop a value-based approach to their next marketing campaign.

The cruise company sent the same messages to every customer regardless of their lifetime value (LTV). To boost revenue, they wanted to segment customers based on their LTV to send tailored ads and emails.

The company broke down each customer’s total predicted economic value. Once they identified the highest-value and most loyal customers, they could better nurture them through the sales funnel with specific, smaller campaigns.

The results? Five percent of lapsed but loyal customers returned, and they shortened the purchase cycle by 24 percent. All it took was some focused, personalized messaging based on a customer’s relative value.

Customer Segmentation Frequently Asked Questions

What tools do I need to do customer segmentation?

You need data to segment customers effectively, so you’ll want analytics tools such as Google Analytics. You might also use dedicated customer segmentation software, depending on your budget and business goals.

Is customer segmentation worth it?

By segmenting your customers, you learn more about your target audience and what matters to them. The result is more effective marketing campaigns based on the unique needs of each segment within your broader audience base.

What type of campaigns does marketing segmentation work best with?

Segmentation works best on any channel when you’re using personalized ads aimed at certain people because you can run multiple smaller, highly targeted ad campaigns designed to deliver the right message to the right audiences.

How is customer segmentation used in customer retention?

Customer segmentation ensures your existing customers don’t feel overlooked. You can segment your loyal customers into smaller groups to deliver relevant, loyalty-based rewards that could help increase customer retention over time.

{

“@context”: “https://schema.org”,

“@type”: “FAQPage”,

“mainEntity”: [

{

“@type”: “Question”,

“name”: “What tools do I need to do customer segmentation?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

You need data to segment customers effectively, so you’ll want analytics tools such as Google Analytics. You might also use dedicated customer segmentation software, depending on your budget and business goals.

”

}

}

, {

“@type”: “Question”,

“name”: “Is customer segmentation worth it?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

By segmenting your customers, you learn more about your target audience and what matters to them. The result is more effective marketing campaigns based on the unique needs of each segment within your broader audience base.

”

}

}

, {

“@type”: “Question”,

“name”: “What type of campaigns does marketing segmentation work best with?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Segmentation works best on any channel when you’re using personalized ads aimed at certain people because you can run multiple smaller, highly targeted ad campaigns designed to deliver the right message to the right audiences.

”

}

}

, {

“@type”: “Question”,

“name”: “How is customer segmentation used in customer retention?”,

“acceptedAnswer”: {

“@type”: “Answer”,

“text”: ”

Customer segmentation ensures your existing customers don’t feel overlooked. You can segment your loyal customers into smaller groups to deliver relevant, loyalty-based rewards that could help increase customer retention over time.

”

}

}

]

}

Conclusion: Customer Segmentation

If you’re trying to upgrade your marketing, customer segmentation is your friend. By segmenting your audience, you can learn what matters to your customers, run targeted, more effective campaigns, and ultimately convert more leads into customers over time.

Start by evaluating the customer segmentation models I’ve described and consider which combination works best for your business goals. If you need any guidance for choosing between customer segmentation types, though, check out my consulting services to discover how my team can help.

Have you created your customer segmentation strategy yet? Which model do you find works best?

The post How to Use Customer Segmentation to Improve the Performance of Your Marketing Campaigns appeared first on #1 SEO FOR SMALL BUSINESSES.

The post How to Use Customer Segmentation to Improve the Performance of Your Marketing Campaigns appeared first on Buy It At A Bargain – Deals And Reviews.

Biden Can Boost Energy Production—and Protect National Parks

The post Biden Can Boost Energy Production—and Protect National Parks appeared first on Buy It At A Bargain – Deals And Reviews.

Getting ROI on Your Personal Guarantee

ROI, or return on investment, is a term that you may hear often. However, many have never considered it in terms of a personal guarantee (PG). Yet, if you think about it, giving a guarantee on a loan is an investment of sorts. According to Dictionary.com, the definition of investment is “the action or process of investing money for profit or material result.”

With a personal guarantee, you are putting your assets on the line as a way to get funding for your business in hopes of helping it survive and thrive. Since your guarantee is an investment in your business, and all investment involves risk, the question then becomes how do you minimize risk and increase ROI.

Why Take the Risk at All?

When small business owners are looking for a business loan, often banks will ask for personal guarantees. In particular, when a business does not have an extensive credit history, a lender’s risk is higher. As a result, the lender will require a guarantee to mitigate their own risk.

However, no company owner can give a guarantee for everything. It’s not practical. All of your personal credit would be tied up. Your personal credit score could plummet. You have to find the balance between when it is worth it to give a guarantee and when you should pursue another option. Understanding the potential return on investment (ROI) for your PG is vital to knowing if it is worth it, or not.

What Makes the Risk Worth It?

There are a few things that make the investment of a PG worth the risk. The first is, if you need immediate funding for your company and you cannot get it any other way. If it’s a choice between giving a guarantee or not getting the funds you need, it may be worth it to give a guarantee.

That is, assuming that the chances are high that the funds you get will have the desired effect of helping your business grow and thrive. Then it will be a good ROI on your personal guarantee.

It may also be worth it if the guarantee will significantly decrease the interest rate on the loan. Decreasing interest expense means you get the funds at a lower cost, which results in a higher ROI.

When are Personal Guarantees Not Worth It?

For business owners, it has to all be about value. Lenders will take a personal guarantee every chance they can get. Yet, it puts an owner’s personal assets on the line. In small business lending, this means lenders can legally claim whatever is pledged to secure the loan agreement. Consequently, you have to determine if the ROI on your guarantee is worth the potential cost.

If your business fails, then your personal assets will go to the lender. Unless your personal finances are infinite, you probably don’t have a lot of assets that are sufficient for a PG.

After real property, what other assets do you really have? Investments might work. But then, of course, you can lose them if your business defaults. If a small business owner is relying on a certain asset for something specific, like retirement financing, it could spell disaster. The risk, for a lot of owners, is too great. You could lose it all. That is not an acceptable ROI.

However, if you feel that the funds will help you to grow your business substantially and the risk to your personal assets is low, you may have an ROI that is acceptable to you.

What are the Risks of Defaulting on a Business Loan?

For newer businesses, the chance of failure is about 20% in the first year. It’s about a 50-50 chance a business will survive to see its fifth year.

This is why small business loans are a big risk for lenders. A lender asks for a personal guarantee to give the owners a greater stake in the company’s success. When a small business loan could cost an owner his or her future, then there’s more incentive to work toward company success.

That is where the ROI for the lender comes in. They get the loan funds back plus interest. But what about the owner? What owner isn’t going to work for business success regardless, whether their personal assets are on the line or not?

As an owner of a business, you have to know when it is necessary to give a guarantee. Then, you have to know when there is another choice and how to walk that path.

When do Small Business Owners Have to Provide a Personal Guarantee for a Business Loan?

There are a few times when a company owner has no option but to give a guarantee.

SBA Loans

SBA loans will always require a personal guarantee for loans over a certain amount. The Small Business Administration requires guarantees even from owners of well-established businesses. Furthermore, it will want them from all business partners.

This is in addition to all the other things the SBA wants to accompany a loan application. They require collateral, a business plan, a business proposal, possibly accounts receivable, and other financial statements.

That’s not to say an SBA loan is bad. There are other factors which make SBA loans worthwhile. Interest rates tend to be lower for one thing. That means the money you get costs less.

That is the definition of ROI on personal guarantees. If you get more money for less cost, and the benefits to your business are worth it, you have an acceptable ROI on your personal guarantee.

Term Loans from Traditional Lenders

Traditional lenders are likely to ask for personal guarantees regardless of whether you are applying for SBA loans or other traditional loans. They want a small business owner to repay any debt, and this is how they hedge that bet. So, for any small business loan you apply for with a traditional lender, you are likely to have to provide a guarantee.

Your goal, as the business owner, is to reduce the number of loans you need that require a guarantee overall. Then, of those that do require one, figure out how to reduce the amount of the guarantee required.

How to Reduce The Necessity for a Guarantee

SBA loans and traditional loans almost always require personal guarantees. So, the first way to reduce the number of guarantees you have to give is to use other types of business credit.

That means vendor credit and business credit cards. To do this in a way that reduces personal guarantees, you have to separate your business from yourself. That requires a Fundable Foundation.

Foundation.

A Fundable Foundation requires:

Foundation requires:

- Separate contact information

- An EIN

- Incorporating

- A separate, dedicated business bank account

- A professional business website and email address with the same URL

Once you are set up this way, you can apply for vendor credit in the name of your business. Look for the vendors that do not require a guarantee or a credit check for initial credit, and that will report your payments to the business credit reporting agencies.

As payments are reported on more accounts, your business credit score will grow, helping you get approval on even more accounts without a PG.

How Does Business Credit Increase ROI on Your Personal Guarantee?

It’s almost like a domino effect. As you build a stronger business credit score without a PG, you are eligible for more and more accounts without personal guarantees. Eventually, you’ll be able to get a business credit card without a guarantee.

Here’s where things really start working in your favor. Use these accounts as much as possible. Be sure to responsibly repay credit issued to you. Rely on these accounts as much as you can, and you will reduce your need for a loan. In turn, you reduce your need to give a PG. There is an inverse relationship between personal guarantee and the amount of funds you get with it. The more money you can get with less personal guarantee, the higher the ROI.

An Oversimplified Example

Say you apply for a $10,000 business loan. The lender approves it, but you have to put up a guarantee for the entire amount. That means if your business defaults, you are responsible for the whole thing. You have the potential for an excellent ROI if the business doesn’t default, but if you have issues, you could lose $10,000 of your personal funds.

But, consider the same scenario except, due to your strong business credit score, the lender requires a 50% personal guarantee. Your potential ROI on that is much better, because at the most, you would only personally be responsible for $5,000.

As your business credit score goes, the need for a personal guarantee decreases, making your ROI on PG increase.

Is There More Than One Kind of PG?

Yes!

Usually, we think of an unlimited personal guarantee. However, there are also limited guarantees. A limited guarantee allows a lender to collect a certain amount of money or a certain percentage of the outstanding balance from a principal or business owner. These guarantees are common when there are several principals who can pay a certain fraction of the debt. For instance, if a small business defaults on its loan, the lender can go after each principal for 25% of the balance.

With a limited guarantee, the business owner has some protection. Not all their assets are on the line, which in itself increases borrower ROI. Since lenders can seek repayment from more than one of the owners, there is still value, even if the business fails and does not fully pay the debt. This is another way to increase the ROI on your personal guarantee.

When Can Business Owners Get More Value from Providing a Guarantee?

Sometimes, you need to make investments in equipment or inventory in a short time frame. Or you may want to buy quickly in order to hedge against rapidly rising inflation. In this case, after business owners evaluate risk and costs, they may determine that gambling on personal liability is worth it. That is when you weigh the potential ROI against the guaranteed ROI of nothing if you do not take advantage of the opportunity.

The initial investment may be scary, but it may also be worth it in the long term if it helps your business grow, thrive, and reach its full potential. In the end, business loans are risky on all sides. However, without risk there is no growth. No one starts a business and hopes it never grows. Growth is the first goal. Business growth equals profit growth, which is the ultimate ROI.

Loan agreements that require personal guarantees definitely have the potential to reduce ROI on the business overall. So, it is vital to carefully consider any loan agreement to discern whether it is worth it, or not.

As always, whether or not a PG is necessary is not the only thing to consider. There are also loan fees and legal fees that come into play. Pay attention to those. They can add up.

What Does it Take to Get Maximum ROI on Your Personal Guarantee?

As with other investments, the ROI on your personal guarantee depends on a number of factors. The key is to protect your own credit history while still giving your company it’s best shot. If an owner needs to personally guarantee funds, that isn’t a bad thing. Yet, it is important for small businesses to balance that with other credit that does not require that personal assets be sacrificed.

This means that the company has to have credit in the name of the business, separate from that of the owner. This business credit will not remove the need for a PG completely, but it can reduce it drastically. It can increase the amount of credit available without a guarantee, and reduce the amount of guarantee necessary for those accounts that still require one.

Another thing business credit can do is help you get lower interest rates on accounts. Since that means the funds cost less, it’s an automatic boost to ROI. Anytime you can get lower interest it’s a good thing.

Balance is key. Find out how to set your business up to get the most possible funding without a personal guarantee with a free Business Finance Assessment.

The post Getting ROI on Your Personal Guarantee appeared first on Credit Suite.