The Best Payroll Services (In-Depth Review)

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

What would you do with ten extra hours a month?

You’d probably work on growing your business, right? Maybe you’d spend it creating new marketing campaigns to generate more revenue. Perhaps you’d take half a day off to spend time with your family.

Regardless, the average small business owner spends five hours every pay period running payroll. That adds up to 21 full work-days a year.

But thankfully, that’s not what your payroll process has to look like.

The best payroll services help you automate paying your employees and simplify the entire process, so you can gain more control over how you spend your time.

Without sacrificing employee satisfaction.

But with so many options to choose from, it’s easy to waste time trying to pick the right one.

To help speed up the process, I reviewed six of the best systems on the market and put together a comprehensive list of what to look for as you make your final decision.

The 6 best payroll service options for 2020

- Gusto – Best payroll service for small businesses

- OnPay – Most flexible payroll service

- Paychex – Best for larger organizations

- ADP – Best payroll service with built-in HR

- QuickBooks Payroll – Best for QuickBooks integration

- Wave Payroll – Most affordable payroll service

How to choose the best payroll service for you

If you’ve spent some time searching for solutions from Google or asking for peers’ recommendations, you know there are hundreds of payroll companies to choose from.

With so many options, it can feel like a difficult decision.

To help you narrow things down, let’s walk through what to consider as you go through the process.

Number of employees

Most services charge a set monthly fee plus a small fee per employee. So, it’s essential to consider the number of employees you need to pay.

Some payroll services may limit the number of employees on certain plans while others may forego the per-employee fee altogether. Furthermore, some may also offer features that make it easier to pay many people at once.

You also need to consider whether you’re paying employees or contractors.

The process and fee structure may differ for different types of payments depending on which service you choose.

Basic payroll features

The best payroll services exist to simplify the process of paying your employees. So, every payroll service you consider should have a set of critical features, including:

- Automatic payroll options

- Self-service portal for full-time and part-time employees

- Mobile capability to manage payroll on the go

- Direct deposit so your employees get paid quickly

- Automatic tax calculations and withholdings

- W-2 and 1099 employee management

There are other advanced features you may want to consider as well, depending on what you need. This includes things like HR tools, benefits management, wage garnishments, and more.

So, carefully consider the essential features as well as the advanced features you need to simplify your payroll processes.

Tax features

Filing tax is a complicated and time-consuming process. It can also result in unfortunate and expensive penalties if you don’t do it right.

However, many payroll services offer tax features that simplify the process. From calculating payroll taxes to automatically withholding employee income taxes, there are countless things to consider.

So, it’s important to choose a payroll service that offers essential tax features to make your accountant’s life easier.

Or yours if you do your taxes yourself.

Built-in HR tools

If you offer benefits to your employees, you need a payroll service that helps you effectively manage things like time off, vacation requests, workers’ compensation, insurance, and more.

Furthermore, services with an employee self-service dashboard make this much more manageable. Employees can log in, update their accounts, request time off, and see an overview of their benefits package.

The cheaper options on this list tend to ditch HR features. So, carefully consider what you need against your budget before making any decisions.

Monthly payroll limits

If you have salaried employees or a set payroll schedule, most payroll services are adequate. However, if you pay freelancers or contractors on an irregular basis or run payroll more than twice a month, you need to be careful.

Some services offer unlimited payroll processing, while others limit the number of times you can issue payments every month.

So, carefully consider how often you need to send payments when making your final decision.

Integrations

To further simplify your business processes, it’s crucial to consider the business tools you’re already using to run your business.

It’s important to choose a payroll service provider that integrates seamlessly with those tools. Think about your accounting software, your employee scheduling software, and other essential tools related to payroll.

The different types of payroll services

There are several different services to consider, depending on your business’s size and your specific payroll needs.

So, before we dive into my top recommendations, I want to talk about the different types and how to decide between them.

1. Hiring someone to do it for you

If you can afford it, hiring someone (either in-house or as a contractor) to run payroll for you is an excellent option. This ensures you find someone who knows how to do it and that they have the time to do it well.

However, you still need payroll software. They may have their own preferences and expertise, which may help you decide which service is right for your business.

With that said, many small businesses don’t necessarily need to hire someone.

The best payroll services make running payroll easy, so anyone on your team can take care of it in a few clicks.

2. Software as a service (SaaS)

The software as a service (SaaS) model means you pay to use the software. Most service providers charge monthly or annually for this, and as long as you keep paying, you get to keep using it.

Most SaaS tools are cloud-based, meaning you can access it from a web browser anywhere.

However, some also offer desktop applications and mobile apps you install on a specific device.

This is the most common type of payroll service and the most convenient to use because you and your employees can access their accounts from any device, anywhere in the world with an internet connection.

All of the recommendations on this list are SaaS payroll services.

3. Enterprise-grade solutions

Most payroll services offer enterprise-grade and industry-specific solutions for large businesses. They come with specialized, custom pricing to match the unique needs of enterprise-grade companies.

A software like this could be a SaaS tool or an on-premise deployment, depending on what you need and the company you choose.

Most businesses don’t need this. But if you manage payroll for a large company or find your current solution limited, it may be a good idea to consider an enterprise solution.

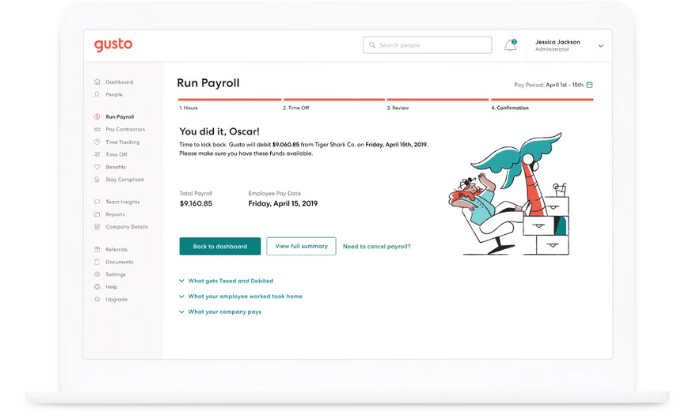

#1 – Gusto Review — The best for small businesses

If you’re a small business looking for a simple payroll service, Gusto is a smart choice. And you’ll be in good company with more than 100,000+ other small businesses around the world.

Gusto makes onboarding, paying, insuring, and supporting employees as easy as possible. And they don’t call themselves a “people platform” for no reason.

They offer the right set of tools and services to make your life (and your employees’ lives) easier.

Running payroll takes just a few clicks, and you can enjoy unlimited payroll runs every month. Need to pay seven different contractors at different times? No problem.

Need to pay the same employees the same wages every pay period? You can set it up to run automatically without you having to lift a finger.

Plus, you get access to a wide variety of features, including:

- Automatic tax calculations

- Built-in time tracking capabilities

- Health insurance, 401(k), PTO, workers’ comp, and more

- Compliance with I-9’s, W-2s, and 1099s

- Employee self-service onboarding and dashboards

- Next-day direct deposits (on specific plans)

And the best part? It’s affordable.

If you don’t have W-2 employees, Gusto starts at $6 per contractor per month. But if you do have full-time or part-time employees, expect to pay a bit more. Their other paid plans include:

- Basic — $19 per month + $6 per person per month

- Core — $39 per month + $6 per person per month

- Complete — $39 per month + $12 per person per month

- Concierge — $149 per month + $12 per person per month

Gusto is perfect for most startups and small businesses. But, large companies with complex benefits packages, and hundreds of employees may find it limiting.

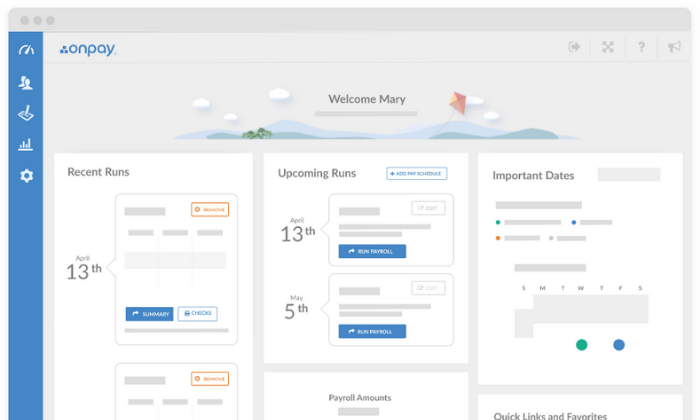

#2 – OnPay Review — The most flexible payroll service

If you’re looking for an all-in-one payroll system with transparent pricing and virtually unlimited flexibility, OnPay is an excellent choice.

Whether you’re a small company or a fast-growth startup, OnPay is versatile enough to suit your needs. Plus, you never have to guess how much you’re going to pay every month with their transparent pricing.

And you can rest easy knowing you have access to every feature OnPay offers regardless of the number of employees you have because they only provide one pricing plan.

Their software includes access to powerful features, including:

- Unlimited monthly payroll runs

- W-2 and 1099 capabilities

- Automatic tax calculations and filings

- Employee self-service onboarding and dashboards

- Intuitive mobile app for management on the go

- PTO, e-signing, org charts, and custom workflows

- Integrated workers’ comp, health insurance, and retirement

- Multi-state payroll

Plus, getting started is super easy. All you have to do is set up your account, add your employees, and start running payroll. Furthermore, OnPay automatically calculates and withholds taxes so you don’t have to worry about manual calculations or human error again.

They also offer specialized solutions for different industries, including nonprofits, restaurants, and farming/agriculture.

OnPay is $36 per month plus $4 per person per month. So, you can add new employees to the software for just a few dollars, making it excellent for fast-growing companies and small businesses alike.

And while OnPay can handle large companies with hundreds of employees, there are better enterprise options available. It’s most suitable for small businesses and fast-growth companies that need simple pricing and flexibility.

Try OnPay free for 30 days to see if it’s right for you!

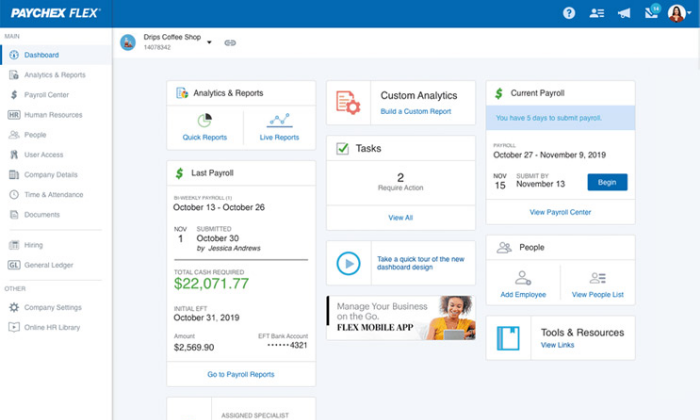

#3 – Paychex Review — The best for larger organizations

Paychex is an excellent choice for businesses with more than 50 employees. They also offer low-tier plans for small businesses, but they’re quite limited compared to the other small business options on this list.

However, their midsize to enterprise plans are perfect for large companies.

The larger your business is, the worse small discrepancies and human errors affect your tax calculations. And wrong tax filings equal harsh penalties from the IRS, even if it was an accident.

So as a large company, it’s imperative to have a payroll service that adapts to meet your needs. Paychex is more than a payroll service. It’s a human capital management (HCM) system designed to help you save time and reduce errors.

Their enterprise plans include features like:

- Recruiting and onboarding

- Performance and learning management

- Powerful real-time analytics

- 100% employee self-service

- Payroll automation features

- Direct deposit, paper checks, and paycards

- Salary, hourly, and contract workers

- Paycheck garnishments

- PTO and benefits management

- Job costing and labor distribution

All of which are scalable for enterprises with thousands of employees (or as little as 50). Plus, Paychex services more than 650,000+ companies and has more than 50 years of experience in the industry.

So, you can rest easy knowing you’re in good hands.

With that said, getting started isn’t as easy as it is with some of the other options on this list. Because each deployment is tailored to your business, you can’t get going on your own. However, they do offer a team of specialists to help you get the ball rolling.

Contact their sales team for a custom quote to get started!

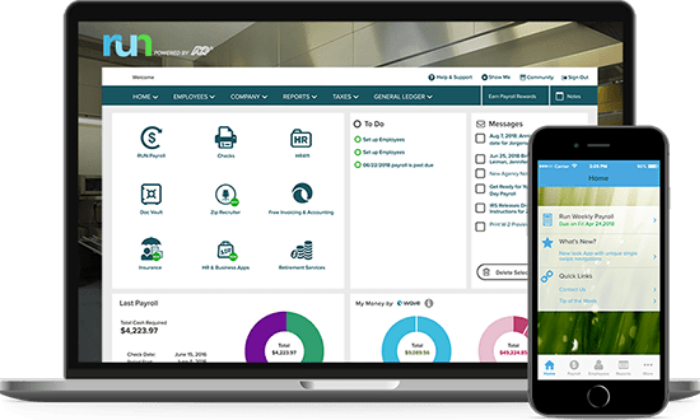

#4 – ADP Review — The best for built-in HR features

ADP is the way to go if you’re looking for a payroll service with the most built-in HR features. It’s perfect for smaller companies without an HR department and growing/large companies looking to streamline the process.

ADP works with more than 700,000 businesses in 140+ countries, making it one of the most popular payroll services for businesses of all shapes and sizes.

They offer tailored solutions for small, midsize, and enterprise businesses, so you’re sure to find the perfect solution whether you have five employees or 1000+.

Their lower-tiered plans include basic payroll features like automatic tax calculations, employee self-service tools, a mobile app, PTO management, and complete compliance support.

However, ADP offers more than just basic payroll and HR. They also include time tracking, talent recruitment, HR consulting services, advanced employee benefits, and the option to outsource your entire payroll/HR department.

You can also get unique benefits, like personalized training, legal assistance, background checks, and interview scheduling too.

Furthermore, ADP offers industry-specific solutions for nine different industries, including:

- Restaurants

- Construction

- Healthcare

- Manufacturing

- Retail

- Nonprofits

Note: ADP pricing isn’t available online, so it may not be suitable for micro or small businesses interested in getting started quickly. If you need something fast and straightforward, my #1 recommendation is Gusto.

Request a free quote to see if ADP is right for you today.

#5 – Quickbooks Payroll — The best for QuickBooks integration

Quickbooks Online is one of the most well-known accounting tools on the market. And if you’re already a user, QuickBooks Payroll is an excellent addition to your tech stack.

The two tools integrate seamlessly, making account reconciliation and tax season a breeze.

Furthermore, QuickBooks’ payroll system works in all 50 states. So, whether you have a remote team or work with contractors across the country, you don’t have to worry about making errors or mishandling taxes.

You can also rest easy knowing your federal, state, and local taxes are automatically calculated plus paid for you every time you run payroll. Plus, the entire process is easily automated after your first round of payments.

With QuickBooks, you get a full-service payroll system regardless of the plan you choose.

And the user interface is aesthetically pleasing with direct deposit payments landing in your employees’ bank accounts within 24 – 48 hours.

The Core Plan starts at $45 per month, plus $4 per employee per month. It includes:

- Full-service payroll with unlimited runs

- Automatic payments after the first run

- Health benefits

- Wage garnishments

- Next-day direct deposit

- 24/7 live chat support

- All 50 states

So, even their most basic plan includes everything you need to simplify your HR and payroll processes.

But if that isn’t enough, their advanced plans include:

- Premium — $75 per month + $8/employee per month

- Elite — $125 per month + $10/employee per month

Get 70% off your first three months to take QuickBooks Payroll for a test drive today!

Note: 1099 contractors and freelancers aren’t included. It comes as an add-on with additional monthly fees. So, this isn’t the most affordable choice if you frequently handle contractors or freelancers.

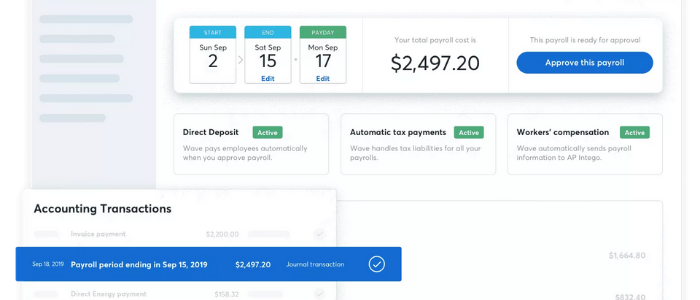

#6 – Wave Payroll Review — The most affordable payroll service

If you’re on a tight budget, Wave Payroll is an affordable payroll option. Wave also offers numerous other small business tools for free, including invoicing, accounting, and receipt management.

The different apps integrate seamlessly to create an affordable small business accounting and payroll solution.

With Wave, getting started takes just a few minutes, and running payroll goes even faster. Plus, they offer a 100% accuracy guarantee. You can also pay hourly, salary, and contractors and automatically generate the right tax forms.

In some states, Wave automatically files and pays your state/federal payroll taxes for you. However, in those states, Wave’s services are more expensive.

You also get access to features, like:

- Automatic journal entries (if you use Wave Accounting)

- Self-service pay stubs and tax forms for your employees

- Workers’ compensation management

- Basic payroll reporting

- Automatic year-end tax forms

- Timesheets for PTO and accruals

While Wave is one of the most affordable payroll services, it doesn’t sacrifice functionality and essential features. Despite being cheaper than the other options on this list, you still get all the essentials you need to run payroll for your small business.

In tax service states, Wave is $35 per month + $6 per contractor/employee per month. This service isn’t necessarily cheaper than the other options on this list.

But, it’s still a great option if you’re a small business owner looking for a simple payroll solution.

However, it’s $20 per month + $6 per contractor/employee per month in self-service states. At this price, it’s easily the cheapest option with the most features available.

And don’t forget that Wave Payroll seamlessly integrates with Wave’s free accounting and invoicing software as well.

So, if you don’t yet have accounting software, this is a smart choice.

Try Wave Payroll free for 30 days to see if it’s right for you and your business!

Summary

For most users, Gusto, OnPay, and Wave are my top recommendations.

They’re all excellent for small and fast-growth businesses with the ability to scale to match your needs. Plus, they’re affordable and easy to use.

However, different businesses require different solutions.

So, don’t forget to use the considerations we talked about as you go through the process of choosing the best payroll services for your business.

What payroll services do you prefer?

The post The Best Payroll Services (In-Depth Review) appeared first on Neil Patel.