Article URL: https://jobs.ashbyhq.com/motion/dfe19251-9d97-4e6b-b9ac-04422a697f57?utm_source=hn

Comments URL: https://news.ycombinator.com/item?id=33855362

Points: 1

# Comments: 0

Article URL: https://jobs.ashbyhq.com/motion/dfe19251-9d97-4e6b-b9ac-04422a697f57?utm_source=hn

Comments URL: https://news.ycombinator.com/item?id=33855362

Points: 1

# Comments: 0

Robert Wickens won for the first time since suffering a spinal cord injury in 2018 by teaming with Mark Wilkins to win the TCR class Saturday in the Michelin Pilot Challenge at Watkins Glen International in New York.

The post Wickens gets 1st win since '18 spinal cord injury appeared first on Buy It At A Bargain – Deals And Reviews.

Hawaii withdrew itself from the Hawaii Bowl game late Thursday evening, a day leading up to the game.

If your brand doesn’t have a solidified voice and tone, your customers are probably confused. How to standardize your brand guidelines and choose the right voice and tone for every occasion? How can you find …

The post How to Build Your Brand’s Voice appeared first on Paper.li blog.

– Location: Vancouver, Canada

– Remote:Yes

– Willing to relocate: Yes

– Technologies: Python (3yr), SQL(2yr), R(1yr), Stata(3yr), Tableau(2yr), Jupyter, LaTeX, CSS, JavaScript

– Résumé/CV: https://1drv.ms/b/s!Ar1eUasxvZfwgbQAZHOHzx92wPyzqw?e=2iMMHs

– Email: stezhu@gatech.edu

I am currently undertaking my master’s degree in analytics, and looking for a 4-8 month data science internship. I have previous experience in data analytics and machine learning, and am looking to help businesses make data driven decisions!

If you’ve got a franchise, then you probably need franchise financing.

Franchises are businesses that trade their name and operating methods to people in exchange for a royalty fee. They offer both the flexibility and independence of being a small business owner, plus the support and infrastructure of a large corporation. They can be the ideal opportunity for anyone interested in becoming an entrepreneur. But they do require a significant capital investment.

You may be tempted to pour your own money into your franchised location. Or you may want to use your own credit cards or take out a second mortgage on your house. You shouldn’t have to do any of these to finance a franchise.

If you need funding to purchase a franchise, your first conversation should be with your prospective franchisor. Many corporations with franchise business models offer tailored financing solutions exclusively designed for their franchisees. These can be either through partnerships with specific lenders or by providing capital directly from the corporation. This is one of the most common ways to finance a franchise and offers many benefits. For example, Gold’s Gym, UPS Store and Meineke all offer financing options to their franchise owners.

One benefit of using franchisor financing is that it can be a one-stop shop for everything you need. Many of these programs don’t just offer financing for the franchise fees. They can also offer financing to purchase equipment and other resources you need to start up the business. If you’re working with a franchisor who offers their own financing program, chances are you won’t need to look much further for funding.

Each franchisor financing agreement will differ. But some offer to take on as much as 75% of the debt burden from the new franchise owner. Agreements might involve deferred payments while the business is starting up. Or they may structure repayment on a sliding scale. Have your independent business attorney or accountant review the terms of your franchise agreement and the financing agreement. Have them help you understand the full terms before you sign. See entrepreneur.com/article/312476.

These are another option for franchise financing. Many business owners consider approaching their bank for funding. But a traditional term loan doesn’t have to come from a bank. Such loans can come from a credit union or an alternative lender. With these loans, the lender offers a lump sum of cash up front, which you then repay, plus interest, in monthly installments over a set period of time.

These kinds of loans are more likely to be available to business owners with good credit. Lenders will be looking at your financial history, as in how well you pay your bills. A better financial history means interest rates and terms will be better, and it can be the difference between being approved or not.

Demolish your funding problems with 27 killer ways to get cash for your business.

The Small Business Administration guarantees a portion of the loans made in its name. This gives lenders an incentive to offer more loans, and at better rates and terms. But keep in mind that qualification standards are strict. New business owners in particular are not likely to qualify.

Often, alternative lenders have less stringent requirements and shorter turnaround times than traditional financing options. They offer a variety of loan options like equipment financing, business lines of credit and term loans.

But this access and convenience may cost you. Alternative loan products tend to be more expensive, offer shorter repayment terms and lower loan amounts, than their more traditional counterparts.

But it may be worth it if you need to supplement your existing financing or you can’t qualify for a bank or SBA loan or need cash quickly to jump on a life-changing opportunity. So don’t dismiss alternative lending out of hand. Here are some alternative lenders to consider.

This lender works exclusively with franchise businesses to help them find the solution that’s right for their needs. Get financing for new units, refinancing, recapitalization, remodels, and acquisitions, etc. You can also access equipment financing loans. Apple Pie works with a variety of different lenders, hence the interest rates and terms you receive on your franchise loan will vary, but it will be largely based on the type of product and your qualifications.

Apple Pie Capital is specifically dedicated to franchise financing. Get 5-10 year payment terms. They have flexible collateral options. There are no prepayment penalty options. See applepiecapital.com/franchise-financing.

This lender works with businesses in a variety of industries, including franchise businesses. With CAN Capital, you can access short-term loans and medium-term loans. Terms for the short-term loans range from 3 to 24 months, and 2 to 4 years for the medium-term loans. CAN Capital charges interest as a factor rate.

To qualify for a franchise loan from CAN Capital, you’ll need at least $4,500 revenue per month, a minimum credit score of 600, and 12 months preferred (although they will consider 3+ months with consistent revenue) in business, for their short-term loan.

Qualifying for a medium-term loan is stricter. For a CAN Capital medium-term loan, you’ll need a 680 personal credit score, 7 years in business, and a preferred $350,000 in annual revenue. See cancapital.com/business-loans.

Demolish your funding problems with 27 killer ways to get cash for your business.

This is one of the easiest and quickest ways to get a short-term loan up to $250,000 or a line of credit up to $100,000. Though OnDeck isn’t specifically geared toward franchise owners, it’s a viable online loan option for any type of small business owner who doesn’t qualify for a bank loan or doesn’t want to wait months to receive loan funds. See ondeck.com.

This lender has numerous franchise partners across the US, including Papa John’s, Pinkberry, Quiznos, etc. Funding Circle offers various loan products through partnered lenders for franchises in different stages of growth. For Funding Circle’s standard term loans and lines of credit, you’ll need to be a franchisee with a business that’s at least two years old and have a credit score of at least 660.

But they also offer merchant cash advances, short-term working capital loans, and invoice financing. These choices have higher rates, but more lenient requirements. For example, for an MCA, you’ll only need six months in business, and a credit score of 500.

Get online SBA loans up to $5 million for commercial real estate purchases, loans up to $350,000 for debt refinancing and business capital, and bank term loans up to $500,000. This lender is only an option for established franchises. You’ll need at least two years in business, positive cash flow, and good personal credit. See smartbizloans.com.

If you have a decent social media presence and a fairly large number of friends or followers, crowdfunding may be feasible. Acquaintances aren’t likely to send you thousands of dollars. But a few bucks here and there can add up. Crowdfunding is also a way to get funding without having to give up a portion of control and ownership.

Demolish your funding problems with 27 killer ways to get cash for your business.

The main difference between the two is angel is investing is actually a sale of some of your ownership and control, whereas loans from friends and family are much like more formal loans from a provider. Your family and friends are under no obligation to charge the kind of interest rates prescribed by the Federal Reserve, so they could potentially charge more. On the other hand, they aren’t obligated to charge interest at all.

Your family and friends are under no obligation to put anything in writing, but you should do so anyway, for the sake of your sanity if nothing else. Having your family and friends loan you money or buy a part of your business will change the dynamic. Can your relationship stand the strain?

Franchises, just like every other form of business, can build and improve their business credit. As long as they are an LLC or corporation it is fine. Note: you need each company you want to build business credit on to have its own EIN number.

But keep in mind, many franchises may require purchases directly from headquarters or suppliers specifically designated by them. This can be anything from uniforms to beef, to architectural plans for erecting a new building or renovating an existing one. It will always pay to check.

Franchises need funding, like every type of business. Check with the franchise itself to see if they have funding. Check the SBA and your bank, and alternative lenders. Consider crowdfunding, angel investing, or loans from your friends and family if other sources are not forthcoming. And be sure to build business credit for your franchise!

The post Franchise Financing appeared first on Credit Suite.

Evergreen content engages and educates readers for longer without a huge amount of effort. Once you master the art of writing “timeless” content, you can ensure your articles, e-books, and tutorials stay relevant for years to come. Below, I’m going to show you exactly why evergreen content should be part of every marketer’s content strategy, …

The post How to Create Evergreen Content Right From the Start first appeared on Online Web Store Site.

The post How to Create Evergreen Content Right From the Start appeared first on ROI Credit Builders.

Evergreen content engages and educates readers for longer without a huge amount of effort. Once you master the art of writing “timeless” content, you can ensure your articles, e-books, and tutorials stay relevant for years to come.

Below, I’m going to show you exactly why evergreen content should be part of every marketer’s content strategy, and I’ll explain how to craft your own timeless pieces.

Evergreen content is content that is optimized to stay relevant and drive traffic for months or even years at a time.

It doesn’t have an expiration date. It’s centered around a topic that people will be interested in for years to come.

Examples of topics that might be considered evergreen include:

It doesn’t matter what season we’re in, or what year it is: There’s always a healthy number of people searching for content on these topics.

Marketers tend to write about evergreen topics because it’s a relatively easy way to bring organic traffic to their website. There’s always going to be some interest in the topic, so you won’t struggle to find an audience base.

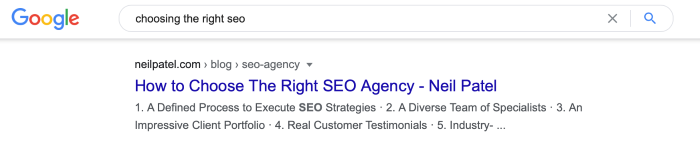

For example, if you Google “choosing the right SEO,” you’ll find one of my articles on the first page:

It’s evergreen because SEO isn’t fading out of style anytime soon. Businesses will be searching for SEO advice for years to come.

A little later, I’ll show you ways to improve your chances of holding a first-page ranking for a long time, but for now, just remember one thing: If it’s evergreen content, it persistently matters to people, and you should be writing about it.

Here are some examples of time-sensitive content that aren’t evergreen:

If it’s a niche topic you expect people to lose interest in overtime then it’s not evergreen, because people naturally stop thinking about it (and searching for it online).

Here’s an easy way to remember it:

Evergreen content is ever-relevant.

OK, so that’s what evergreen content is, but why does it matter? Well, a few reasons, but here are the three most important.

Did you know that 75 percent of people never scroll beyond the first page of search results? If you’re not on the first page, it’s unlikely people will ever find your content.

Evergreen content helps boost your Expertise, Authoritativeness, and Trustworthiness (“E-A-T”) score on Google. The higher your E-A-T score, the more likely it is you’ll secure a first-page ranking on Google.

How can long-lasting boost your E-A-T score? By helping position you as an authority in your industry.

To be clear, the level of “expertise” you’ll need to secure a good score varies depending on the subject matter.

For example, you’re more likely to rank on the first page if you’re a highly qualified doctor writing an evergreen post about weight loss than if you’re a general member of the public talking about weight loss tips.

Why? Because Google recognizes how important it is for someone to be qualified before they offer medical advice.

If you have expertise in your industry, you can increase your chances of a first-page ranking by producing quality evergreen content in your field.

Organic traffic is simply how many people visit your website after finding you on a search results page, rather than clicking through a paid ad.

How does evergreen content help you draw traffic? Here are a few ways:

The result is more organic traffic landing on your website.

It’s not just about generating traffic. It’s about ensuring you create valuable, relevant content for readers—and evergreen content helps you do just that.

Here’s why: Valuable content means lower bounce rates, since people stay on your page for longer.

Since evergreen content stays relevant, you can use it to show search engine’s that readers find your articles useful, which in turn helps boost your overall search rankings.

The best part? The more valuable content you create, the more you impress readers—and keep your brand relevant in an increasingly competitive digital space.

To be clear, not all your content needs to be evergreen. Your audience wants to know you’ve got your finger on the pulse of your industry and understands current trends that impact them. Also, sometimes, people just want their fill of short, relevant, and entertaining news articles.

However, it’s definitely worth crafting a solid hub of timeless, enduring content to impress your audience and set yourself apart from the competition.

With all this in mind, here are seven relatively simple ways to write your own evergreen pieces.

First, choose topics with persistent traffic potential.

An analytics tool like Google Analytics can help here. Briefly, here’s how to distinguish between trending and evergreen topics.

To get started, take a look at your own site and see what topics retain a high level of traffic over time. Are there related topics you can cover?

Then, check out leading blogs in your niche. Identify potentially evergreen topics, run them through a competitive analysis tool to see which ones get long-term traffic, and decide how you can put your own spin on the topic to add value for your own readers.

Now you’ve chosen a few topics you’d like to write about, you need to use the right keywords to ensure your posts appear in the search results.

Let’s check out an example.

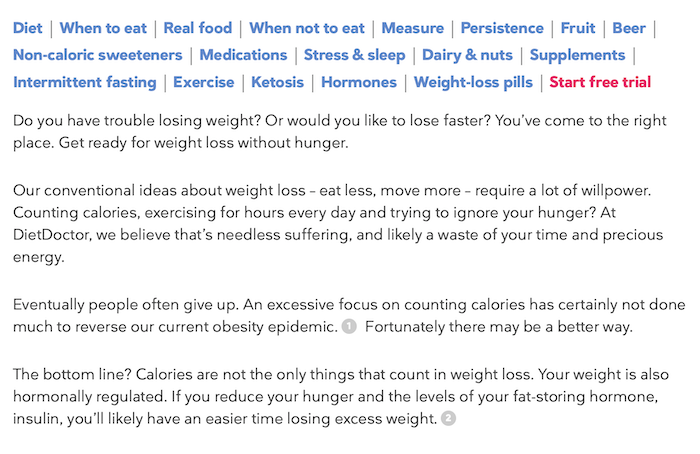

Say you want to write about weight loss. When you Google “how to lose weight,” one of the top search results is a post from Diet Doctor.

Here are the two main things we can take from this sample.

Return to the search results and you’ll find people also ask:

This is a quick and easy process, so give it a go!

One of the quickest ways to “date” your content, and shorten its lifespan, is by using current dates and events. Here’s why:

If you must use dates, be smart about it. For example, you could turn a “2021 Guide to Digital Marketing” into the “2022 Guide to Digital Marketing”, and so on. Or, make a plan to update content with a date annually.

In general, you’ll want to avoid using dates or referring to current news events, where possible.

Case studies won’t work for everyone. It all depends on your audience and the type of business you’re running.

However, if your audience values in-depth, analytical content, consider writing evergreen case studies. Here are a few benefits of case studies:

Finally, by sharing real case studies with your audience, you can boost your company’s authenticity. Since 90 percent of customers value authenticity when choosing which companies to support, I’m thinking this is a win!

When people want advice, they very often turn to guides and tutorials. Why? Because they’re comprehensive enough to answer all the questions they have about a specific topic. (Or, at least they should be!)

In other words, guides and tutorials make for excellent evergreen content ideas.

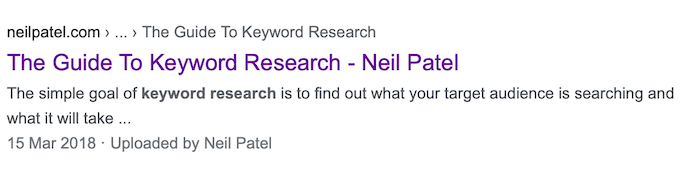

For example, if you type “keyword research” into Google, one of the top results is my own guide to keyword research:

It’s a guide, and it’s part of a comprehensive, three-part series on effective keyword research. I cover a huge amount of ground, and the goal is to ensure the guide is a “one-stop-shop” for your keyword research needs.

What’s more, tutorials and guides are a chance for you to showcase your authoritativeness and build trust in your brand. (Which, as we know, can improve your search rankings.)

No matter how hard you work to create evergreen content, you’ll still have to update it occasionally. Strategies change, new research and tools come out, and content becomes less fresh over time. If you want to keep your content ranking well, you’ll need to update it.

How does this work? By updating content, you’re creating a new publication date, which gives your post an instant boost: most first-page results are published within the last few years.

Here’s a few tips for updating content:

For a more detailed guide, check out this complete guide to giving your content a facelift.

Finally, once you’ve got a great piece of content it’s time to make it work for you. One of the best ways to make the most out of great content—and reach as wide of an audience as possible—is to repurpose content into different formats.

Here’s a few ideas:

These are just a few suggestions, don’t limit yourself!

You’ve compiled your evergreen content and you’re ranking well. Great!

Now comes the tricky part: how do you keep your first-page ranking for the months (and years) to come? Here are two suggestions.

I recommend using these techniques alongside other strategies like content repurposing and refreshing to maximize your chances of maintaining a first-page ranking.

Evergreen content is timeless. It never goes out of fashion. If you want to draw organic traffic, educate your audience, and position yourself as an industry authority, it needs to be part of your content marketing plan.

Don’t just dive in, though. Identify the topics that matter to your audience, do your own research, and put a fresh spin on them. Use the right keywords to improve your chances of ranking on Google, and don’t forget to update your content whenever you feel it’s a little stale.

What does evergreen content mean to you?

Article URL: https://deepsource.io/jobs/director-marketing-us/ Comments URL: https://news.ycombinator.com/item?id=25028979 Points: 1 # Comments: 0

Riskbook | Haskell Backend Developer | REMOTE (Worldwide) | Full-time

We’re looking for another Haskell developer to help us build the world’s best reinsurance trading platform.

# About Us

Riskbook is a funded startup based in London, but our team are distributed. We intend to keep it that way. We favour asynchronous communication, and try to hire “managers of one”. We don’t do daily stand-ups. We don’t count your hours. We don’t work weekends. We do code review, but it is not militant, and we do not tolerate sarcasm, aggression, rudeness, gatekeeping, or elitism. We support each other in working and learning, and we have a dedicated fortnightly “Research Day” where every programmer is free to not do chores for the product, and instead investigate/learn/play with whatever technology they choose. Want to learn more about type-level programming? Property-based testing? Expert systems? Go right ahead!

# About the Tech

We use Haskell with both the Yesod and Servant frameworks, and we use Elm for parts of the UI where we feel it makes sense. Otherwise, we try to keep most logic on the server in our fairly traditional monolithic application. Parts of our system are Event Sourced, and we’re mostly using PostgreSQL for persistence, with a bit of Redis thrown in for good measure. Our infrastructure is managed with Nix on AWS. We do not have any legacy system written in PHP or Ruby or whatever, as many companies do. We do not have a micro-services architecture, and we have no intention to build one.

You can read more about the tech here (although our Haskell code has grown considerably since this was published): https://serokell.io/blog/haskell-in-industry-riskbook

# About You

You must have demonstrable experience building things in idiomatic Haskell, and you should have a solid understanding of how web applications typically work. A degree is not required. You will need to be able to write SQL queries. In most cases we write ours with Persistent/Esqueleto.

You should be able to communicate clearly in English, but you do not need to speak excellent English. As most of our communication is written and asynchronous, it is important to us that we find someone who can describe their approach to problem solving in written form — we can’t have people working in complete isolation, and occasionally throwing completed tasks over the fence.

You have flexible working hours and you can work from anywhere, though this is a full-time position and the expectation is that of work based on a traditional 40 hour week.

Interested? Introduce yourself to me at jezen@riskbook.com and let me know your current situation and expectations.