Best Contact Management Software

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

When you’re trying to make the sale, you want to be as tactful as possible. You want to talk to your customer at the exact time they want what you’re selling.

This means going beyond storing their basic contact information and tracking points of contact, rebuttals, and previous sales deals.

That’s where contact management software can be one of your most valuable sales tools. It helps you streamline your sales process so that you can close sales faster, keep your most valuable customers, and grow your business.

But how do you find the right contact manager to integrate into your sales system?

In this extensive guide, I review five of the top contact management tools on the market and walk you through the best features as well as their price points.

Let’s get started.

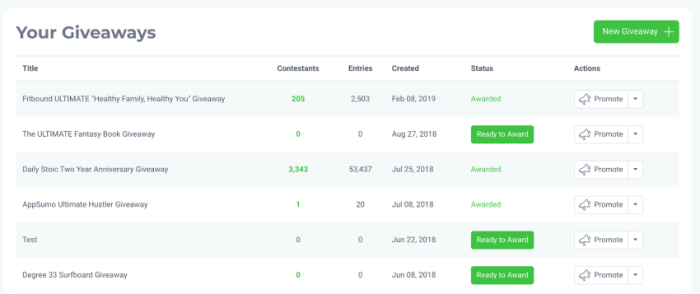

#1 – HubSpot Review — The Best Free Contact Management System

HubSpot stands alone as a powerful free contact management system with tons of accessible tools to enhance your sales cycle from beginning to end.

That’s because HubSpot gives away a free version of its award-winning CRM (customer relationship management) software. Contact management is one of the foundational services included with this suite, but you will find tools for sales, marketing, and customer service teams.

For a free product, it’s unbelievably rich.

Focusing in on just the list of contact management tasks you can do for free with HubSpot’s software still gives you a long list. You can keep track of contact website activity, deals, company insights, manage ticketing, manage ads, email tracking and notifications, and even messenger integrations.

HubSpot’s free contact management software is an excellent stepping stone toward more varied and growth-oriented contact management as your business grows since you can always upgrade to one of their paid CRM plans without having to migrate.

If you’re getting started with contact management and want to do more with your contacts in terms of sales strategy on a budget, I recommend you start onboarding HubSpot’s free tools for a strong beginning.

Start using HubSpot for free here.

#2 – Bigin Review — The Best For Simple Contact Management

A small or mid-sized business doesn’t always have use for tools built with enterprises in mind. Bigin takes the prize for a simple yet reliable contact manager you can easily start with.

A single dashboard unifies all your data points so you can make strategic decisions at a glance and manage everyone on your roster. It helps to think of it as your own personal yellow pages except for ten times more useful.

You can do things like adding your preferred tags to contacts to find what you’re looking for quickly, glance over at your expected revenue numbers, and see all your pending tasks.

Bigin makes it easier for you to close deals by scheduling follow-up activities and then closely monitoring results, all on an intuitive dashboard.

Bigin’s simplicity bleeds into its pricing structure, too. Here’s a quick overview:

Free

- Single user

- 500 contacts

- One pipeline

Express – $7/user per month

- 50,000 contacts

- 5 pipelines

- Add 10,000 additional contacts for $1/month

- Up to 20 custom fields per module and 10 custom dashboards

It’s that simple. One user with one pipeline can manage up to 500 contacts free, forever. And the paid tier isn’t tough to stomach, either.

Get started with Bigin here to go beyond managing a simple list of contacts.

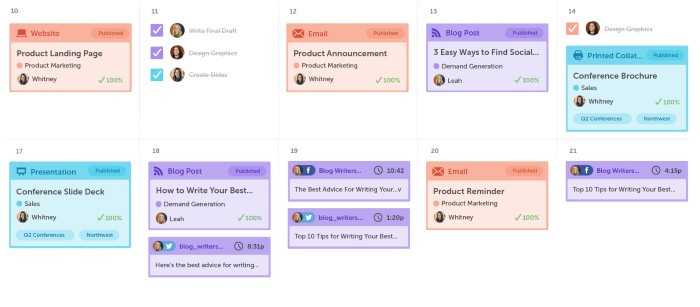

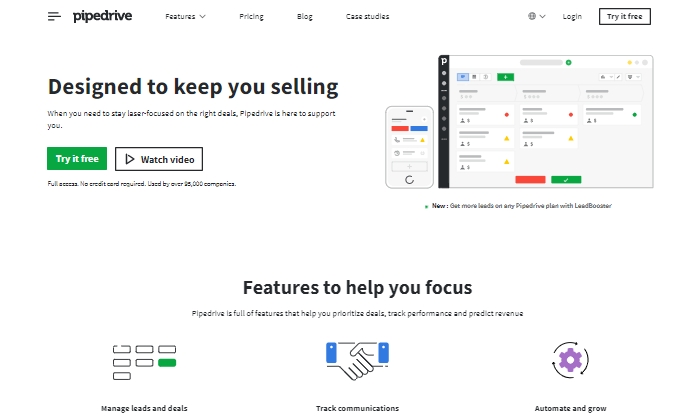

#3 – Pipedrive Review — The Best For Visual Contact Management

Pipedrive is loved not just for the wide array of CMS tools it offers but because it makes the whole contact management and sales process straightforward and visual. It’s been used by over 90,000 companies in more than 170 countries and business giants like Vimeo, Amazon, and Re/Max.

Pipedrive is a highly intuitive system that easily updates and automates contact tasks and sales calls. The easy drag-and-drop features and their clean and approachable interface make them an easily adaptable and usable system.

With a visual dashboard in mind, they don’t falter in the features department, as it offers plenty of tools for powerful contact management like task automation, lead pipelines, and smart lists that track the last time you contacted a prospect.

You can always try Pipedrive free for 14 days. It doesn’t hurt to spend a few days trying out the software’s ins and outs to see if they’re a good company match. Otherwise, the ricing plans break into four tiers:

- Essential – $12.50

- Advanced – $24.90

- Professional – $49.90

- Enterprise – $99

#4 – Zendesk Review — Best For Reporting and Analytics

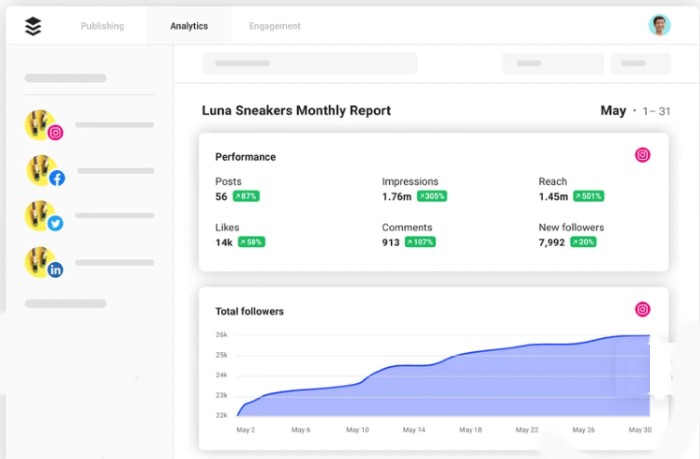

Zendesk is a dynamic CMS that emphasizes the analytical and reporting aspects of contact management.

The last thing you want is to grow a robust list of leads and then have no idea what to do with them due to lack of data. Zendesk’s analytics make it possible for you to engage in better conversations with your prospects with their pre-built analytics features.

With them, you can track rep activities, call response times, and live chat interactions. Their rich reporting features ensure you keep a finger on every touchpoint of your sales cycle. This makes it easy to increase the ROI of each sales rep on your team.

Zendesk’s price breakdowns can get specific depending on the solutions and features you’re looking for. The contact and relationship management tiers start at $19 per seat.

Here’s a quick overview of the pricing tiers:

- Team – $19 per seat per month

- Professional – $49 per seat per month

- Enterprise – $99 per seat per month

- Elite – $199 per seat per month

Get started with a free demo of Zendesk here.

#5 – Salesforce Review — The Best Scalable CMS

Contact management software that scales with you and offers powerful tools to take you beyond the basics? There’s a tool for that. It’s called Salesforce.

The point of a CMS is to increase the efficiency of your daily operations, so you’re never blindsided by lost sales or missed relationship-building opportunities.

Salesforce does that by offering the tools to build a good contact management base. This means contact history, survey answers, and email responses. But they take it a step further with their social data tool to keep track of what your customer is saying about products and services.

Not only that, but Salesforce makes it easy to collaborate with everyone in your business. You can share documents, comments, analytics and insights, sales history, and any other information relevant to your ROI.

On-the-go contact management is also possible with its mobile app. You can hop on a call armed with plenty of preemptive information about your customer from anywhere. This awesome array of tools makes Salesforce not only a contact management tool but a sales closing system, too, which is why it’s made it on my top five picks.

Here’s a breakdown of each plan they offer:

- Essential – $25

- Professional – $75

- Enterprise – $150

- Unlimited – $300

Each plan comes with:

- Account, contact, lead, and opportunity management

- Email integration with Gmail and Outlook

- Access to the Salesforce mobile app and all it’s features

The higher the tier, the more access to customizable features and tools you’ll have. Thankfully, you don’t have to jump right into a plan without testing how they work first.

Salesforce also gives you the option of testing any pricing tier first before committing.

Try Salesforce for free first here and see what plan fits your contact management needs the best.

What I Looked at to Find the Best Contact Management Software

Choosing the best contact management software goes beyond making sure they provide the standard contact management software (CMS) tools like sales tracking, customer notes, emails, and sales history.

Your business is unique, which means your CMS needs are also unique. Because of this, it’s hard to pinpoint a one-size-fits-all CMS that you can use in any given sales scenario or industry.

You also have to consider the size of your team, your plans for scaling and revenue growth, and what functionalities are non-negotiable in your given industry.

Beyond that, there are a few specific key factors to think through when trying to make the best choice in a sea of software. Use these criteria to ensure you’re making the best contact management investment possible.

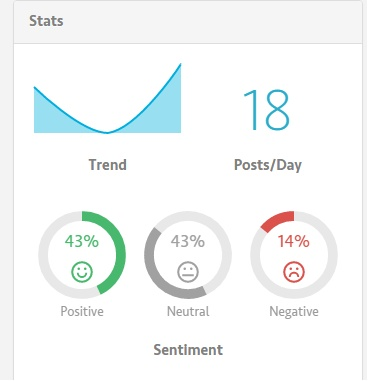

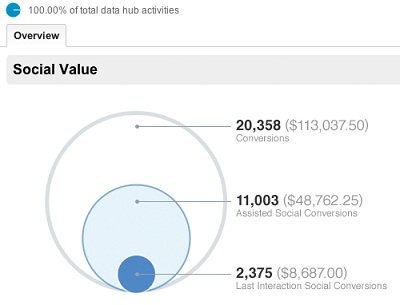

Reporting and Analytics Capabilities

Some contact management systems put more emphasis on sales reporting and analytics than others. This can prove to be a valuable asset or just an extra feature to your team, depending on how you handle your sales process.

These days, contact management software is increasingly robust in terms of the analytics it can gather to help you make the best sales decisions. Some of them can measure everything from live chat interactions to sales calls, email responses, and even what you’re prospective customers say on social media about you or your competitor’s product or service.

Deciding how deep you need your contact management analytics to go will ultimately depend on your sales goals and budget. Consulting with your sales team can be a sound idea in the process of making a final decision.

Sales Process and Software Fit

The sales process you use to sell printers isn’t necessarily the same one you’d use to sell premium car parts. This also means you’ll want to find a CMS that fits every unique point of sale your team goes through continuously.

If done right, this can mean higher ROI, shorter sales cycles, and more revenue. This is where it’s a good idea to take the time to test drive every prospective CMS that looks appealing to your sales team. Most of them have the option for a demo or a 14-day free trial.

These trials exist for a reason. I highly recommend you take advantage of them before you commit.

User Experience

The more scalable integrations and features a CMS has, the more likely it is to have a big learning curve. This is important to take into account when thinking about onboarding your sales team to the system successfully.

Besides that, the user experience for both your front-facing customer features like contact forms and chatbots and the backend features your sales team will have to interact with daily is also a crucial part of the process as far as ease of use goes.

An array of powerful features is pretty much useless if your sales team continually runs into trouble using them, or if integrations prove too clunky to operate properly.

This also raises questions about what support features your preferred CMS provides and whether they offer any accompanying training options like forums, live chats, or even training webinars.

Summary

Finding the right contact management system can make the difference between constant sales, shorter sales cycles, and more efficient business growth all around.

But it starts with figuring out what your sales needs are, how you go through your sales strategy, and what you need to optimize for higher ROI. Once you’ve figured out your key needs, you can start narrowing down your list of prospects.

My recommendations are all excellent products, but they each have their strong suit:

- HubSpot – Best free contact management software

- Bigin – Best for simple contact management

- Pipedrive – Best for visual contact management

- Zendesk – Best for reporting and analytics

- Salesforce – Best scalable contact management software

My top choices for effective contact management are HubSpot, because of their extensive list of free tools, and Salesforce, because of how versatile and adaptable they are. Make sure to use this review as a roadmap to make your final decision.