What is an Influencer: Types, Examples, & How Much They Make

If you don’t know what an influencer is, where have you been living for the past decade? Influencers have transformed the way customers and brands use social media.

For most brands, they are part of a core marketing strategy that drives awareness, traffic, and sales. Influencers wield a lot of power. If you can get an influencer to endorse your product or brand, you can tap into the audience at the influencer’s disposal, which may be far more vast than your own following.

In this article, I’ll explain what an influencer is and how influencer marketing works. I’ll let you know how much you can expect to spend and how to get started today. Ready to increase your reach? Then let’s begin.

What Is an Influencer and What Is Influencer Marketing?

To put it simply, an influencer is any person who influences the behavior of others. In a marketing context, influencers are individuals who collaborate with brands to promote products or services to their audience.

Now that word-of-mouth recommendations and criticisms spread through social media faster than fire in a dry field, influencers are more important than ever. They usually have huge followings on social media and are brand advocates as well as niche promoters.

True influence drives action, not just awareness.

Jay Baer

What Is Influencer Marketing?

Influencer marketing is a social media marketing strategy that sees brands leverage the audience of influencers to drive awareness and sales. Influencers are paid to endorse or promote a product to their audience, who, in turn, buy the product from the brand.

Influencer marketing has been growing in popularity for years and will once again be one of the leading marketing trends for 2022. Almost three-quarters (72.5 percent) of marketers are predicted to use influencer marketing in 2022.

Who Uses Influencer Marketing?

While it seems that some companies don’t want to let go of their outbound marketing practices, fashion ecommerce sites are targeting influencers like pros. Many are reaching out to reputable fashion bloggers and sending them clothing and accessory items to be reviewed. The blogger then posts photos and writes about the garments, often linking back to the site where their audience can buy the items being reviewed.

ModCloth, a vintage clothing site, does a great job of this. They are active in sharing (on social media platforms) the images their audience members provide showing them wearing ModCloth’s clothing. This makes their audience feel special, which encourages more posts about the clothing.

I’ve seen many fashion sites send their items to an influencer, and then the audience could enter a contest to receive them. Or sometimes, they will send a credit to an active fashion social media user, magazine writer, or blogger so they can go to the site, pick out some clothing, and then review the experience as a whole.

What Are the 4 Types of Influencers?

There are several different types of influencers. Influencers can be celebrities with millions of followers, or they can be a normal person with a few thousand followers. Typically, influencers are grouped into the following four categories depending on their audience size.

Nano-influencers

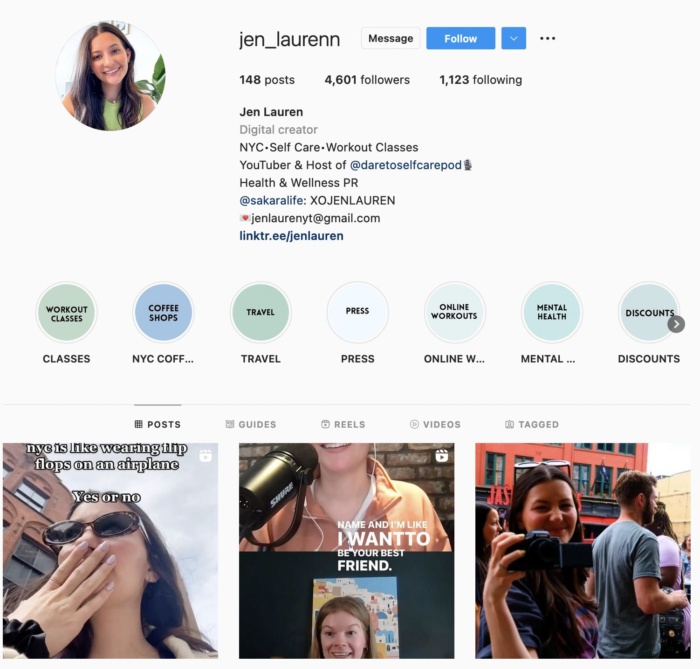

Nano-influencers have the smallest audience size with 10,000 followers or fewer. These people may be experts in very niche areas or people who are just starting their influencer journey. Their audiences may be small, but they are incredibly engaged.

NYC-based self-care and exercise Instagrammer Jen Lauren is an excellent example of a nano influencer. She has a small but highly engaged community and creates niche content.

Micro-influencers

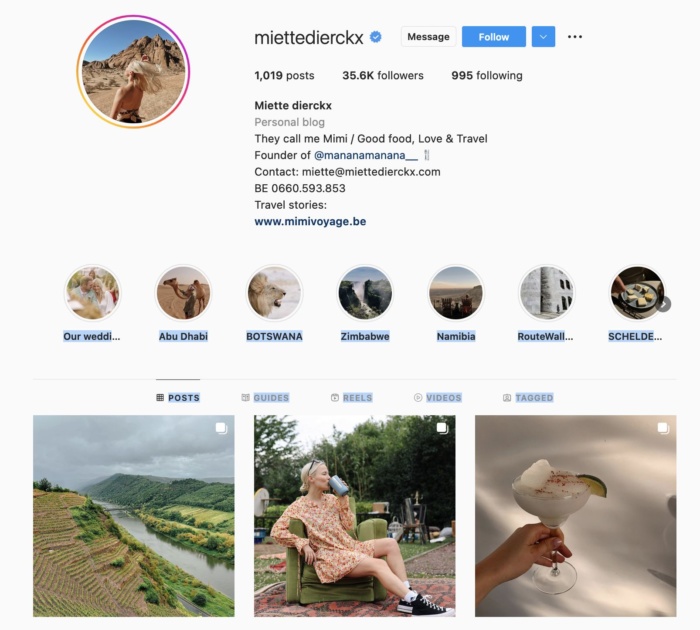

Micro-influencers have audiences that range from 10,000 followers to 100,000 followers. These people are typically niche experts with reasonably large and engaged audiences. They aren’t celebrities, and you’d walk past them in the street without knowing who they are.

Travel and lifestyle blogger Miette Dierckx is a micro-influencer with a carefully curated audience who follow her globe-trotting adventures. She works with a range of companies like sunscreen brand La Roche Posay and chocolate brand Cote D’or.

Macro-influencers

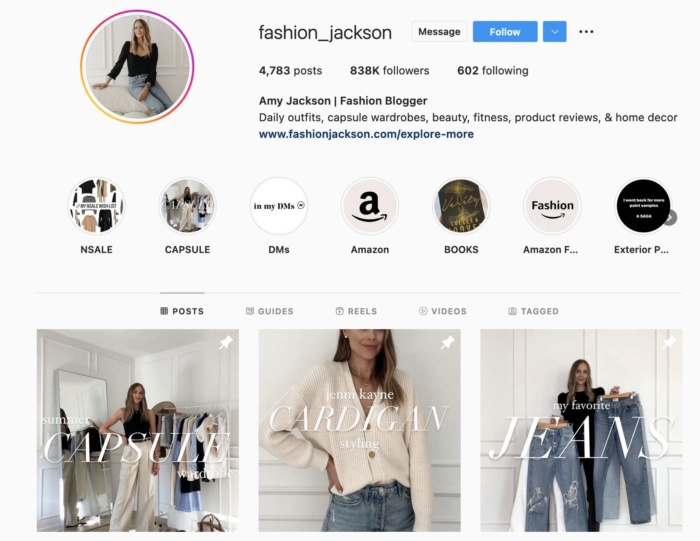

Macro-influencers have audiences sized between 100,000 and 1 million followers. These are some of the most accessible influencers with the biggest audiences. They tend to be B or C-list celebrities or online-native influencers who have worked hard to build up a big audience.

Fashion blogger Amy Jackson is a macro influencer who works with a huge range of brands like Celine and Cuyana.

Mega-influencers

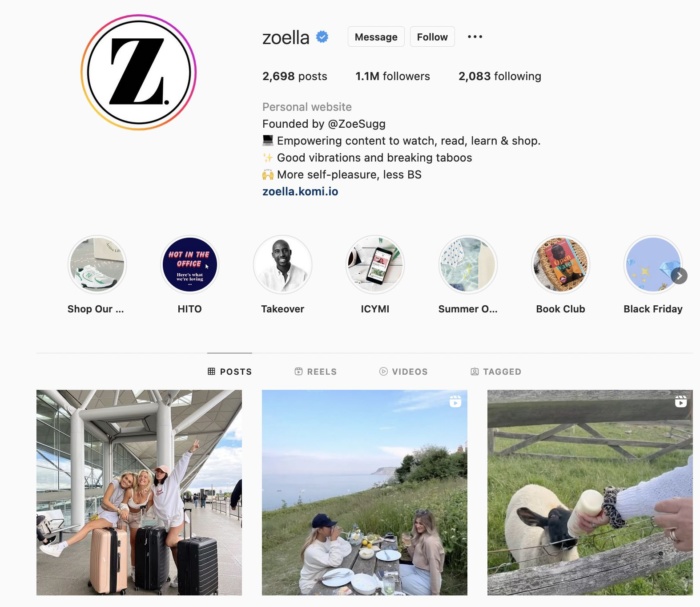

Mega influencers have the biggest audiences. Influencers have to have at least 1 million followers to be considered a mega influencer.

These are usually celebrities who have gained fame offline and translated that into online earnings — think Ryan Reynolds or the Jenners. Some, however, are native internet and social media users. People like Zoella or MrBeast are great examples of this.

How Much Do Influencers Cost?

Successful influencer marketing campaigns do not come cheap. In fact, brands will spend $15 billion on influencer marketing in 2022.

While you may be able to send free products to nano influencers, don’t expect a huge amount of traction. Influencers with larger audiences expect to be paid and campaigns can quickly reach five, six, and seven figures.

There are several ways you can pay influencers. Most will charge a flat fee for a post. Some may request an affiliate commission rate where they receive a percentage of every sale they make.

How much influencers cost depends on a number of factors, including:

- audience size

- platform

- engagement levels

- niche

Rates vary broadly. A report by Fox Business found that influencers with over one million followers can charge more than $100,000 per post. Micro-influencers, on the other hand, charge up to a few thousand dollars per post and can make upwards of $100,000 per year.

Why Do Influencers Matter For Your Brand?

Consumers trust recommendations from a third party more than from a brand itself, particularly if they are seen as knowledgeable and trustworthy. An influencer is a great example of this kind of third party. Working with influencers passes the trust they’ve built with their audience to your brand and makes you seem much more credible.

It makes sense if you think about it in a more personal context; you don’t usually trust a person at a cocktail party who comes up to you and brags about himself or herself and spouts fun facts about his or her personality to convince you to be a friend. Instead, you often believe your mutual friend who vouches for that person.

An influencer is the mutual friend connecting your brand with your target consumers.

An influencer also significantly expands your brand’s reach. When you align your brand with an influencer, not only do they bring their audience, but they also bring their audience’s network as well. Because of the loyalty of their audience, an influencer has the ability to drive traffic to your site, increase your social media exposure, and flat-out sell your product through their recommendation or story about their experience.

With the fall of traditional outbound marketing, influencer marketing is becoming one of the most effective ways to attract customers and clients. Modern-day consumers are self-sufficient and want to research a brand on their own and hear about it from someone they trust.

How do influencers assist with your inbound marketing? They generate content about your brand, they recommend your brand to their loyal following, and they insert themselves into conversations surrounding your brand. Getting them on your side before your competitor does can make a huge difference in the success (or lack thereof) of your company or product.

How to Get Started With Influencer Marketing

Working with influencers is a great way to grow your brand on social media.

Determine Your Goals

Do you want to increase brand awareness or make more sales? These are the two most common goals of influencer marketing campaigns, but achieving them requires significantly different strategies.

If you want to make more sales, for instance, you may choose to focus on micro-influencers who have small but engaged audiences. If you care about raising brand awareness, however, it will probably be better to work with a handful of macro and mega influencers.

Think About Your Audience

As a marketer, you already have a solid idea of the audience you should be targeting for your brand. To locate the ideal influencer, you need to take it one step further and think about the types of topics, blogs, and Twitter handles that your audience would follow.

Since I market a blogger outreach tool for my company, the influencers that I target are PR and marketing blogs that focus on content and influencer marketing. Followers of these blogs usually are PR professionals and marketers who want to keep up with the latest technology and trends in their field.

Thus, hopefully, they find my company relevant when a blogger they follow recommends it. However, had I gone after bloggers who write about finance, even though a particular blogger might like my software, their audience most likely wouldn’t care.

Find the Right Influencer for Your Brand

With your goals and target audience established, you can start to find influencers who are a great fit for your brand. There are three factors I recommend bearing in mind when choosing influencers.

Context: Is your influencer a contextual fit? This is the most important characteristic when targeting the right influencers for your brand. For example, Justin Bieber is known as one of the most “influential” social media users with his 37+ million followers. Would his tweet about your software really bring in sales, though? Probably not, because the target audience for tech software and Justin’s target audience aren’t the same; his endorsement isn’t really relevant.

Reach: In addition to wanting an influencer from your field, you also want them to have reach. This is so they can share their awesome content or positive recommendation of your brand with as many of the right people as possible. If your online business sold clothes for “tweens,” then maybe a mention to 37 million girls from Justin Bieber wouldn’t be so bad after all.

Actionability: This is the influencer’s ability to cause their audience to take action. This characteristic comes naturally when you target individuals that are in contextual alignment with your brand and have a far enough reach.

Influencers don’t force themselves upon an audience. They are an “opt-in” network. Their audience chooses to follow their blog or Twitter handle. Thus, their audience is engaged and is there to hear about the topic being discussed. Hence, the need for a contextual fit.

I want to note that there is a lot of market research coming out about mid-level influencers. These are the influencers who have a decent reach but don’t have such a large audience that they can’t nurture relationships with their audience and harness loyalty. A loyal audience soaks up recommendations like a dry sponge. If in doubt, these are the influencers you should aim for.

Where to Look for Your Ideal Influencer

The final step in getting started with influencer marketing is to find those influencers who meet all of the criteria we’ve listed above. Here are my favorite ways of finding them.

Social Media Monitoring

Brand advocates are the loudest influencers your brand will have. Not only does their audience follow them because what they write aligns with your brand, but they also talk loudly and actively about how much they like your company. By tuning in to your social media mentions and blog posts about your brand, you will find influencers and advocates you didn’t realize you had.

Social media monitoring also allows you to find influencers who advocate for the genre or niche you outlined in step 1. For example, someone may post and tweet heavily about yoga gear but not mention your website as an awesome place to buy yoga apparel or equipment. Well, this is someone you want to engage with and expose your brand to.

Research Hashtags

Identify the hashtags that your target influencers are using. For my company, I follow #bloggeroutreach and #influencemktg. By tuning in to the conversations surrounding these hashtags, I have not only identified active talkers in these categories, but I’ve also identified blog topics that I wrote to appeal to these influencers as well.

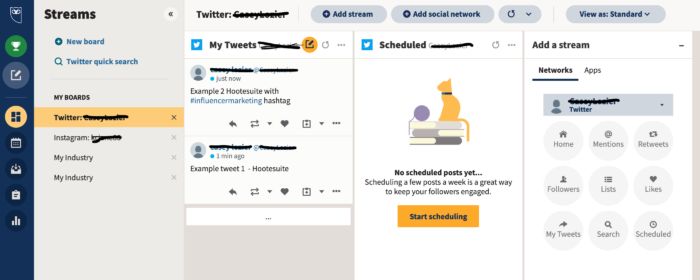

Once you start finding influencers that seem like a good fit for your brand, I recommend putting them in a Twitter list so that you can organize and follow them most effectively. I use HootSuite to organize my Twitter channel. Here is what my hashtags look like in their platform:

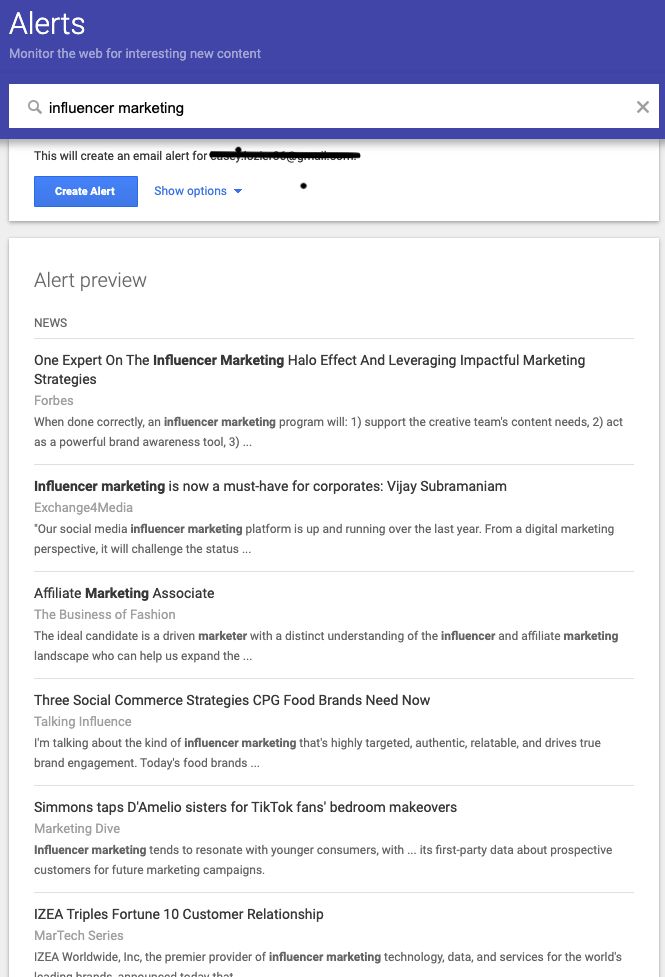

Google Alerts

Set alerts for keywords pertaining to your brand to identify people who actively write about topics in your realm. You also should create alternatives for the name of your brand so that you can find posts and articles containing your mentions and identify advocates who already are in place.

Mention

Mention allows you to type in your company’s name to discover mentions on different outlets such as YouTube, Twitter, and Facebook, just to name a few.

Blogger Outreach

Bloggers arguably are the strongest spoke in the wheel of influencers. One of the bonuses of targeting bloggers is they almost always are active across many social media platforms.

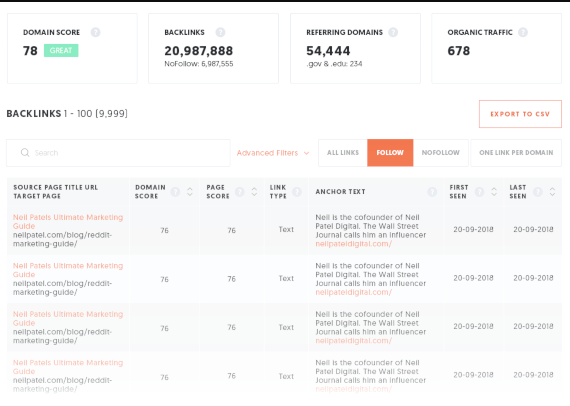

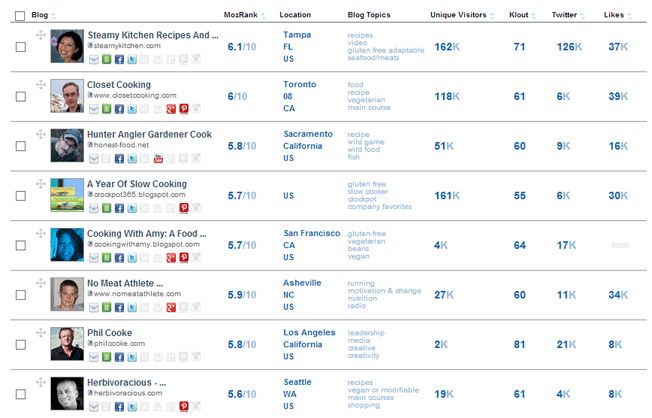

When locating influential bloggers for your brand, start by searching for blogs in your genre and find the niche(s) by reading through the posts to determine if they write about relevant post topics. After making a list of the contextually relevant bloggers, then it’s time to locate their SEO stats and social media information to pinpoint the ones that equal the best reach for your brand.

Manually sorting through blogs to find all of the criteria that you outlined when you gave your influencer an image can take a long time. Luckily, there are a lot of really good blogger outreach tools out there to make this process easier. There is a tool to cover every part of the spectrum.

Influencer Marketplaces

Influencer marketplaces like AspireIQ and Famebit connect brands with influencers in their industry. They often help track the ROI of campaigns, manage payments, and track engagement metrics. They do, however, take a cut, so make sure it’s a good fit for your campaign before investing.

Examples of Influencer Marketing Matches

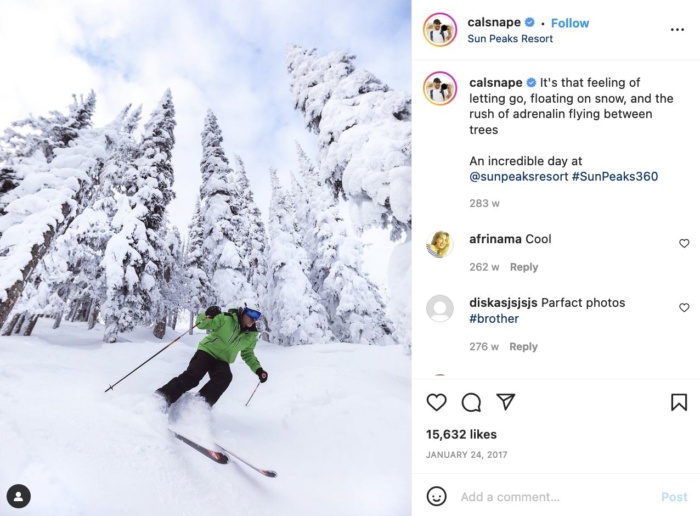

Callum Snape and Sun Peaks Resort

Macro influencer Callum Snape is one of Canada’s best-known wilderness and travel photographers. That made him a perfect partner for Sun Peaks Resort, an alpine ski resort in British Columbia. His incredible images and videos created hundreds of thousands of views and likes, driving massive awareness for the resort.

Chrissy Teigen and BECCA Cosmetics

Launching a new product alongside a mega influencer can result in a huge boost in awareness. That was the case for BECCA Cosmetics which launched its new Be a Light palette with Chrissy Teigen. Her promo video garnered 2.7 million views, which has helped launch an incredibly profitable product line.

Gymshark and Multiple Influencers

Gymshark has built a billion-dollar business on the back of influencers. The brand’s recent 66-day challenge is a great example of how you can raise brand awareness and engagement on a massive level by working with multiple influencers across several channels at once. By partnering with influencers like Melanie Walking and Laurie Elle, Gymshark garnered 241.3 million views on TikTok and 750,000 posts on Instagram.

FAQs

An influencer is an individual who wields influence over an audience of people. In a marketing context, they have a large social media following and work with brands to promote products and services.

There are 4 types of influencers: nano-influencers, micro-influencers, macro-influencers, and mega-influencers.

The cost can vary based on industry, the campaign, and the influencer’s reach. Smaller Instagram influencers make between $100 and $300 per post, large celebrities can make thousands or hundreds of thousands.

Consider using influencer engagement marketplaces or searching relevant hashtags and brands on your platform of choice.

Pairing influencer campaigns with affiliate marketing is the easiest way to track ROI. By providing influencers with a unique link makes it simple to track sales and engagement.

Like any marketing campaign, it depends on your strategy and goals. However, 80 percent of marketers find influencer marketing is effective, and 89 percent say it is as effective or more effective than other channels.

Conclusion

Influencer marketing has evolved since it first became a digital marketing strategy, but the technique continues to be successful for many brands.

It’s easy to make mistakes with your first influencer marketing campaign. If you want help creating an influencer campaign for your company, let our agency know and we can help guide you through the process.

Where do you look for influencers for your brand? Cheers to a good discussion in the comments below!