Article URL: https://raycast.com/jobs/software-engineer-macos/

Comments URL: https://news.ycombinator.com/item?id=29294685

Points: 1

# Comments: 0

Article URL: https://raycast.com/jobs/software-engineer-macos/

Comments URL: https://news.ycombinator.com/item?id=29294685

Points: 1

# Comments: 0

Rachel Campos-Duffy slammed Democrats for “purposely ignoring” the voices of the American people on “Fox News Primetime.”

Wondering how to find the best credit card for points? Well, it’s a question easier asked than answered. Everyone has different needs. Some businesses do a lot of travel, some entertain more, and others simply need to get cash back on purchases. Due to these differences, it can take some time to find just the right card for your business.

The thing is, there is a wide variety of credit cards out there. Some offer points at different rates for different types of spending. Of course, redemption options vary greatly as well. You need to find a card that offers the most points for the types of spending you do the most, as well as the best redemption offers that will save your specific business the most money.

Check out how our reliable process will help your business get the best business credit cards.

Also, if you’re asking yourself “Are credit card rewards taxable?” the answer is, they might be. It’s important to keep that in mind. There could be tax consequences associated with credit cards as well.

Here are some options we like when it comes to credit card rewards for points, but remember, details change frequently. We make every effort to update them regularly, but be sure to check with the card provider directly to ensure you have the most up to date information.

The Alpine Bank Visa Platinum Rewards card boasts a $0 annual fee. There is also a balance transfer APR of 10%. You earn one point per dollar spent, which is pretty standard. However, you also earn a 5,000 point bonus after you spend $3,000 in the first four billing cycles. When you do the math, that is less than $1,000 per month in the first four months to earn an extra 5,000 points. The annual percentage rate is 21% for cash advances and Prime + 8.74-14.74% for all other purchases.

The Bank of Hope Credit Card also has a $0 annual fee. Better yet, you can earn a 5,000 point bonus with this card as well. But, you only have to spend $1,000 in the first three months! You earn 3x points on gas, 2x on travel + dining, and one point per dollar on all other purchases. To top it off, there is a 0% introductory interest rate for nine months. After that, it’s variable at 12.49%, 16.49% or 20.49%, based on creditworthiness after the end of the introductory period.

Union Bank’s Business Preferred Rewards Card offers a very large points bonus of 10,000 points. To qualify, you have to spend $5,000 in the first 3 months. You earn 5X per dollar spent, up to $25,000 annually, on certain business expenses. Some of these include office supplies, utility bills, and telecom services. After that, you earn one point per dollar. You also earn 2X points up to $25,000 on gas and dining, and one point per dollar after that. All other spending is one point per dollar.

There is a 0% introductory interest rate for the first 6 months. Going forward, 11.99-20.99% variable. There is no annual fee.

Check out how our reliable process will help your business get the best business credit cards.

With the US Bank Business Leverage Visa Signature Card, there is no annual fee for the first year. After that it is $95 per year. If you spend $7,500 in the first four months, you earn 75,000 points. You also earn 2X points in your top two spending categories.

This PNC Visa Business Credit Card for points offers 5 points per dollar on net purchases. There is an introductory interest rate of 0% on the first 9 billing cycles on purchases. Also, earn a $200 bonus when you spend $3,000 during the first three billing cycles. There is no annual fee.

How do you choose the right card for your business? Consider your spending. Do you spend a lot on dining? Then, pick the card that offers the most points back on dining with the best bonus offer. For example, in the list above both the Bank of Hope and the Union Bank cards offer 2x points on dining. They also offer bonus points.

You may be thinking that the 10,000 points bonus offered by the Union Bank card is better, and you are right. That is, if your business will spend $5,000 in the first three months. If not, you will likely be better off with the Bank of Hope card, where the bonus is half that, but you only have to spend $1,000 in the first three months.

It’s also important to note that there are sometimes expiration dates on points, so be sure you will be able to use them before they expire. If not, they are worthless. Bonus points may expire faster than other points, so watch for that too.

Check out how our reliable process will help your business get the best business credit cards.

As you can see, it’s important to carefully weigh the details to get the best deal. There are a lot of options, and some of the offerings are for a limited time. If you pay close attention though, you can find the best credit card for points to benefit your business.

The post What’s the Best Credit Card for Points? appeared first on Credit Suite.

The internet is a visual place. With the absence of body language, social cues, and audible tone, the best way to communicate with your users is through visual content.

Now and then, an online platform comes along that makes it easier than ever to showcase your visual content on the internet.

SlideShare is one such example.

The presentation-sharing platform has created a simple and seamless way to promote visual content while also encouraging user interaction.

In this post, we’ll teach you all about SlideShare, how to use it, why it matters to marketers, and how you can use it to create amazing content for your business.

Let’s get started.

SlideShare is a content-sharing platform that allows you to upload media presentations and share them on your website or social media profile. Content compatible with the platform includes presentations, infographics, videos, and documents.

While SlideShare is not a tool for building content, it does work with existing content formats such as Google Slides, Adobe PDF, OpenDocument, and Microsoft PowerPoint.

SlideShare is best known for being a comprehensive educational resource that makes it easy to display presentations and webinars online.

Here are some of the most popular ways to use SlideShare:

Acquired by LinkedIn in 2012, the company was later bought by the audiobook subscription platform Scribd.

SlideShare remains free to use and allows anyone to create a presentation to share privately or publicly.

For marketers, using SlideShare offers a unique and interactive way to display content online. By adding a presentation to your blog posts, web pages, and social media feeds, you create a completely new content type to engage your users.

SlideShare also allows you to display longer, more complex content in a simple way. Webinars or presentations can be easily uploaded and displayed for users to click through on their own time.

You can think of these presentations as an infographic with more interactivity.

It’s also important to note SlideShare boasts a user base of 80 million. Most of its user base are business professionals, and its most searched tags are:

SlideShare also receives 500 percent more traffic from business owners than Twitter, LinkedIn, Facebook, and YouTube. This offers a huge benefit to B2B marketers looking to connect with relevant audiences.

Now that you understand what SlideShare is and why it’s important for marketers, it’s time to learn how to create an effective and successful presentation.

Here are five steps to follow when using SlideShare for marketing.

Anyone who’s made a PowerPoint presentation knows they shouldn’t be text-heavy. When formatting your presentation for SlideShare, this is especially important, as online readers tend to lose focus on text-heavy content.

A general rule to follow when creating any type of presentation is the 5/5/5 rule:

Keep your readers interested and engaged in your SlideShare presentation by using mostly visual content and keeping your text short and succinct.

Visual metaphors can also be used to further cement the messaging of your presentation. You can see an example of a visual metaphor in the image below.

Your SlideShare presentation should work as part of your sales funnel, moving customers through the education, nurture, and convincing phases. In order to effectively move your customers through these phases, you’ll need to integrate calls to action (CTAs) throughout your content.

A CTA can be a request to contact your business or even a link to start a free trial. You could also ask your customer to sign up for your email list or visit your website.

Whatever you choose, place it strategically at a place where you know your customer will see it. As well, use a benefit-forward statement that shows your customer how they’ll see value from their click.

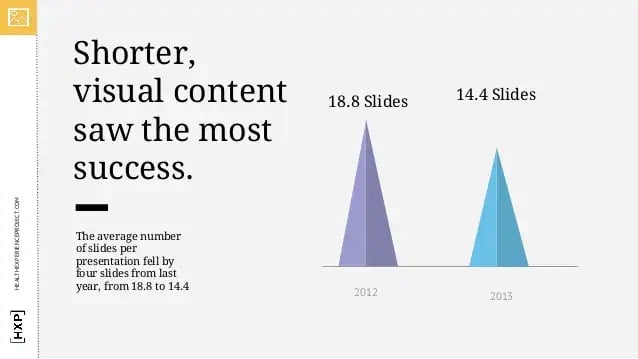

Keeping online reader attention spans in mind, it’s important to keep your presentation short to ensure your users stay engaged.

Presentations that are too long or too bulky will lose reader interest and result in lost leads for your business. Shorter presentations are easier to digest and offer a better chance of a reader seeing your final CTA.

SlideShare itself has noted that shorter visual content is most effective on its platform.

The first step in determining the kind of content you should publish in your SlideShare is to understand your customer pain points:

Before you publish your content, conduct customer research to find out what your leads are looking for and why.

Once you know what they’re after, give it to them. It’s really that easy.

SlideShare comes equipped with presentation descriptions and tags. Be sure to make use of these features when uploading your content.

Adding keywords to your SlideShare descriptions and tags will help your SEO efforts and ensure your presentation is being seen by the right people. If you’re looking for a keyword research tool, try Ubersuggest.

SlideShare can be a marketer’s best friend when used correctly. Here are a few SlideShare best practices to guide your process:

You’re almost ready to start taking the SlideShare world by storm! Here are a few success stories to help you get started.

The Brand Gap by Neutron LLC is a beautifully designed SlideShare that explores the makings of some of the world’s most iconic brands.

This presentation is successful because it harnesses strong visual design with simple copy to deliver a clear, concise message. The conversational tone of the copy invites readers to continue moving through the presentation, ending with a clear CTA at the finish.

While this presentation is longer than we recommend, Neutron LLC gets away with it because of its masterful design work and messaging.

How Google Works by Google is a creative and effective presentation that explains how Google operates as an innovative company.

Google used completely original and unique illustrations to provide clear visual metaphors throughout the presentation. Google’s brand colors are present in every slide, cementing their brand in the minds of the readers.

You Suck At Powerpoint by Jesse Desjardins is a humor design presentation that tells you everything you’ve done wrong in your past presentations.

Leaning on visual metaphor, this example is funny, concise, and clear in its messaging.

Not only does Jesse tell you what you’ve been doing wrong, but he tells you how to fix it. If you can’t do it yourself, his information is on the last slide.

Ready to create your first presentation? Follow these steps!

The first step in creating and sharing your first SlideShare presentation is to sign up for an account. If you have a LinkedIn profile, you can use your LinkedIn account to sign in. If you don’t already have a LinkedIn profile, you’ll need to create one in order to use the platform.

When creating your presentation, be consistent in your use of fonts and colors.

It’s always a good idea to use your own branding assets when creating your presentation to ensure cohesion across your content.

Create an intro and outro slide at the start and end of your presentation, and remember to add a CTA so your customers stay active after the presentation.

Once you’ve finished creating your presentation, it’s time to upload it to the site. You can upload your presentation as a Google Slide, Microsoft PowerPoint, or PDF.

SlideShare allows you to schedule your presentation if you’d like it to go live at a specific time. Once it’s live, be sure to promote it widely and share it across your social channels to ensure a wide reach.

It is free to use for anyone.

Not directly, no. SlideShare does not pay users for ads, and there is no direct way to make money from its platform. That said, by strategically including CTAs and actionable points, you can get an ROI from the presentations you upload.

It does not offer any direct monetization processes for its users, and it also does not include a built-in way to measure analytics.

SlideShare is an online platform that allows you to share your presentations across the internet. PowerPoint is simply a tool for creating presentations.

SlideShare is a visual content tool that helps you share educational presentations across the internet.

Because online readers want fast and efficient information, it is a great way to engage your audience and move your customers through your sales funnel.

Have you found success using SlideShare?

A Better Consultancy | Software Engineer | Full Time / Part Time | Singapore

We are a small technology advisory and consultancy firm who are highly selective on our client projects. We work with clients who have interesting software projects – from either business perspective or tech perspective – and that try to make the world a better place.

We also have a backlog of our own projects that we’re looking to bring to market to ensure that our workload is interesting, varied as well as technically and commercially exciting.

We are very open to flexible working arrangements – and are able to work with you to accommodate your own projects or hobbies – though we do need you to be based in Singapore already.

We work in small and close-knit teams of product manager, UX designer and developers. In terms of development, we use programming languages that are suitable for the project and the client’s needs. As long as you can code and are willing to learn new language or technologies, you are welcome – and we enjoy a learning focused, highly positive work environment.

If you are interested, email hans[at]abetterconsultancy.co and let’s have a chat.

A derogatory account on credit report doesn’t have to sink your chances for getting business funding. But let’s start with fundability.

Fundability is the ability of a business to get funding. This is everything from getting credit to business loans. Because every business needs money, it quite literally pays to enhance your fundability whenever and wherever you can.

In addition to how well your business pays its bills, and your personal credit score, and whether your industry is a risky one, there’s the matter of public records.

Public records include bankruptcy (both personal and business), liens, judgments, and UCC Filings.

Errors in any of these kinds of public records will affect fundability, so correcting such mistakes will enhance your ability to get funding.

Bankruptcy is a process a business goes through in federal court. The idea to help a business eliminate or repay its debt under the guidance and protection of the bankruptcy court. Business bankruptcies are often described as liquidations or reorganizations. This depends on the type of bankruptcy an entrepreneur takes.

There are three main kinds of business bankruptcy:Chapter 7, Chapter 11, and Chapter 13. The type to use will depend on organizational structure. See thebalancesmb.com/what-is-business-bankruptcy-393017.

Corporations are legal business entities separate from their owners. They are more truly separate than partnerships. But in the event of a bankruptcy, either type of structure commonly will file of Chapter 7 (bankruptcy protection), or Chapter 11 (reorganization). The chapters refer to the US Bankruptcy Code.

This one may be the best choice when the business has no viable future. It is typically used when the debts of the business are so overwhelming that restructuring them is not feasible. Chapter 7 bankruptcy can be used for sole proprietorships, partnerships, or corporations. It is also appropriate when the business does not have any substantial assets. For Chapter 7, see: law.cornell.edu/uscode/text/11/chapter-7.

If a business is a sole proprietorship, and an extension of an owner’s skills, it often does not pay to reorganize it. Hence Chapter 7 would be appropriate.

Before a Chapter 7 bankruptcy gets approval,the applicant is subject to a “means” test. If their income is over a certain level, their application does not get approval. But if a Chapter 7 bankruptcy gets approval, the business is dissolved.

In a Chapter 7 bankruptcy, the bankruptcy court appoints a trustee. The trustee’s job is to take possession of the assets of the business and distribute them among all of the creditors. The order in which creditors get their payments can depend on the type of debt (secured vs. unsecured).

After the distribution of the assets, and the trustee is paid, a sole proprietor receives a “discharge” at the end of the case. It means that the owner of the business is released from any obligation for the debts. But partnerships and corporations do not receive a discharge.

Keep your business protected with our professional business credit monitoring.

Chapter 11 may be a better choice for businesses with a realistic chance to turn things around. It is usually a choice for partnerships and corporations. It can also be an option for sole proprietorships if their income level is too high to qualify for Chapter 13 bankruptcy. For Chapter 11, see: cornell.edu/uscode/text/11/chapter-11.

Chapter 11 is a plan where a company reorganizes and continues in business under a court-appointed trustee. The company files a detailed plan of reorganization explaining how it will deal with its creditors. The company can terminate contracts and leases, recover assets, and repay some of its debts, while discharging others to return to profitability.

The business presents the plan to its creditors who will vote on the plan. If the court finds the plan is fair and equitable, it will approve it. Reorganization plans provide for payments to creditors over some time. Chapter 11 bankruptcies are rather complex and not all of them succeed. It usually takes over a year to confirm a plan.

The Small Business Reorganization Act of 2019 enacted a new subchapter V of Chapter 11. This subchapter of Chapter 11 seems to favor the side of the applicant for business bankruptcy. But it only applies if the applicant wants it to apply. See cornell.edu/uscode/text/11/chapter-11/subchapter-V.

For example, subchapter V does not require the appointment of a committee of creditors, or that creditors have to approve a court plan. Per the U.S. Department of Justice, the act:act: “imposes shorter deadlines for completing the bankruptcy process, allows for greater flexibility in negotiating restructuring plans with creditors, and provides for a private trustee who will work with the small business debtor and its creditors to facilitate the development of a consensual plan of reorganizations. See justice.gov/opa/pr/us-trustee-program-ready-implement-small-business-reorganization-act-2019.

Chapter 13 bankruptcy is a form of bankruptcy for individuals. Since a sole proprietorship is an extension of its one owner, the owner is responsible for all assets and liabilities of the firm. It is most common for a sole proprietorship to take bankruptcy by filing for Chapter 13. This is a reorganization bankruptcy. See Chapter 13: law.cornell.edu/uscode/text/11/chapter-13.

Chapter 13 is good for small businesses when a reorganization is the goal instead of liquidation. The entrepreneur files a repayment plan with the bankruptcy court. This details how they are going to repay their debts. Note: Chapter 13 and Chapter 7 bankruptcies are very different for businesses.

Chapter 13 is vital for individuals whose personal assets are tied up with their business assets, because they can avoid problems like losing a house if they file Chapter 13 versus Chapter 7. Chapter 13 lets a business stay in business and pay its debts. But Chapter 7 does not.

There are two other forms of individual bankruptcy. These are less common. Chapter 12 is bankruptcy protection for family farmers and family fisherman. See uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-12-bankruptcy-basics. Chapter 15 is bankruptcy protection when a bankruptcy matter involves people from another country. See uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-15-bankruptcy-basics.

In general, to correct bankruptcy issues, all you or your lawyer will need to do is file an amendment to your bankruptcy petition. These can be errors like forgetting to list an item of property, or disclosing an incorrect property value, or forgetting a creditor or income from a side business. See alllaw.com/articles/nolo/bankruptcy/bankruptcy-petition-mistake.html.

Keep your business protected with our professional business credit monitoring.

Per Investopedia, “A lien is a claim or legal right against assets that are typically used as collateral to satisfy a debt. A lien could be established by a creditor or a legal judgement. A lien serves to guarantee an underlying obligation, such as the repayment of a loan. If the underlying obligation is not satisfied, the creditor may be able to seize the asset that is the subject of the lien. There are many types of liens that are used to secure assets.”

Some of the worst errors when it comes to liens can involve real estate if land was used to secure a debt. Minor or typographical errors are called Scrivener’s errors. You can often fix them through either rerecording the deed of trust or by recording an instrument explaining and correcting the error. You cannot cure more substantial errors except by a Reformation lawsuit. This type of lawsuit asks a court to correct the deed of trust to reflect the parties’ intent.

Keep your business protected with our professional business credit monitoring.

The main ways you can lose in court are if you: default at the start and never answer a summons and complaint, lose a motion for summary judgment brought by the other side, lose a bench or jury trial, or exhaust all appeals and end up on the losing end.

If you or your business lose in court, then you may have a judgment entered against you. Judgments generally take the form of paying damages (money), or specific performance where you must do (or not do) something. Or the court enters an injunction and to prevent you from doing something. A civil judgment can’t send you to jail (that’s criminal, which is rather different).

Errors can take the form of a judgment entered against the wrong person and/or company. Or they can be a typo in the amount of money damages in the court’s records. Maybe there’s a judgment is entered but it’s already been satisfied (paid). Or there can be fraud or other misrepresentation on the part of one of the parties, or excusable neglect. For example, a city recovering from a major hurricane might not make the proper clerical entry of judgments a priority.

Correcting these errors can take several forms. Different states have differing rules. But every state wants their records to be right. They just have different ways you need to go about correcting the record.

For example, in Massachusetts, you or your lawyer will need to make a motion before the court under Rule 60(a). See mass.gov/rules-of-civil-procedure/civil-procedure-rule-60-relief-from-judgment-or-order. In Texas, you or your lawyer would need to file a motion for judgment nunc pro tunc (a motion to have the judgment corrected). See texaslawhelp.org/article/correcting-clerical-error-court-order-answers-common-questions#toc-9.

In Georgia, correcting a judgment comes under the general umbrella of relief from judgments. See law.justia.com/codes/georgia/2010/title-9/chapter-11/article-7/9-11-60. In Louisiana, it falls under an Amendment of Judgment, and you can correct calculation or language errors via motion. See law.justia.com/codes/louisiana/2015/code-codeofcivilprocedure/ccp-1951.

Like with most things, the faster you work to correct a legal judgment, the less it will cost you. In particular if the wrong person (you) is the defendant in a lawsuit, acting as fast as possible will save you in legal fees. Ignoring these problems will not make them go away.

When you secure a loan with property, creditors can tell other creditors about any of your assets in use as collateral for the secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the creditor of the creditor’s interest in the property. It’s in a creditor’s best interests to check for UCC filings, so they can make sure they’re the only creditor with a claim on that collateral.

Like anything else, there can be typographical errors in UCC filings. But the law says that, unless the errors “make the financing statement seriously misleading”, the UCC filing is still in effect. So if you’re depending on a typo to get out of a UCC filing, you might want to rethink that strategy. See law.cornell.edu/ucc/9/9-506.

For the most part, unless the errors are seriously misleading, the UCC says you don’t have to correct them. This is because the policy behind the law governing secured transactions under the UCC explains financing statements provide notice of a transaction. They give enough information to later potential creditors that the debtor’s property may be covered by an earlier creditor’s security interest. Essentially, a financing statement is the starting point in a later creditor’s due diligence process, not the conclusion. See jdsupra.com/legalnews/it-may-be-foul-but-there-is-no-harm-not-11403.

You can fix errors in public documents like judgments and UCC filings, but the mechanism for doing so will differ. This depends on the error, the type of record, and the jurisdiction. The faster you act, the better (and cheaper). Ignoring these mistakes will not make them go away. Correcting mistakes can make your business more fundable.

The post Credit is More Than a Score: How to Address a Derogatory Account on Credit Report When You’re Fighting a Public Record appeared first on Credit Suite.

Setting up a business means attending to what seems like a million little details. Your corporate email and website are two of those details. Don’t drop the ball on them!

But let’s start with business credit.

This is credit in a corporation’s name. It is not tied to the owner’s creditworthiness. Instead, biz credit scores depend on how well a company can pay its bills. Hence consumer and corporation credit scores can vary dramatically.

There are no demands for a personal guarantee. You can quickly get business credit regardless of personal credit quality. And there is no personal credit reporting of company accounts. Biz credit utilization won’t affect your consumer FICO score. Plus the owner isn’t personally liable for the debt the corporation incurs.

Getting corporate credit is not automatic. Building it requires some work. Some of the steps are intuitive, and some of them are not.

Fundability is the current ability of a firm to get funding. Some factors are within your control. Others (like your time in business) aren’t. Your online presence and data are one area which is at or close to 100% with your control.

The better your business credit and fundability are, the more likely you will get approval for financing. Today, let’s concentrate on your online presence, that is, your email address and your website.

They check information from a variety of sources, and they don’t tell you about any of them. Knowing what these secret sources measure can only help you. Understanding what matters the most makes getting a loan A LOT easier, because you know what to improve first. This information is the difference between getting an approval and getting a denial.

LexisNexis is one source where many of the lenders reviewing loan applications get their information from. They offer information regarding likelihood to pay, or not. Lenders compare LexisNexis information to what you put on your loan application. If the application and LexisNexis don’t match, then, the loan providers will deny you a loan. They will see the inconsistency as fraud.

LexisNexis connects all of the data that pertains to you, both positive and negative. They have access to

Keep your business protected with our professional business credit monitoring.

One place where lenders and vendors will be looking for your company is online. Even if they’re not specifically checking out your online presence, they may still need to know how to order your product or service, or where to send praise or complaints. Your online presence is where they will find that information, or not.

What happens if your family member or a friend built your website? Maybe that person is talented, but corporate websites differ from personal ones. A business website needs to be easy to navigate. It needs to answer customers’ questions.

Styles differ. Wedding photographers and construction companies differ. They have dissimilar sites and design sensibilities, but they both have Contact and About pages, and information about what they do.

Make sure you own your domain, and not just your domain at Wix or WordPress or the like. You can do this by buying hosting. This is through hosting companies like GoDaddy or HostGator.

Given that so much more of lending decisions is going on online these days, then your email address is an opportunity for your firm to puts its best foot forward. Don’t squander this easy and free opportunity! General email addresses like admin@yoursite.com tend to be best.

With a general email address, if someone leaves your employ, another employee can seamlessly take over that email address. A username like admin, webmaster, or even hello is far, far better than cutiepie or the like, even if you’re in a playful industry that caters to kids. After all, your bank and banker aren’t.

Keep your records consistent! This includes your online records. LexisNexis and the SBFE (Small Business Financial Exchange) are looking at everything, so it had better match.

Inconsistent records will lead to a denial due to fraud because that’s how lenders interpret inconsistencies. This is a cause of denials which is in the owner’s hands. You have the ability to change and correct this.

This means your corporate name, address, phone number – everything! – must look the same in these places and more:

Copy/paste this information; don’t chance it with retyping.

Keep your business protected with our professional business credit monitoring.

Keep your firm looking fundable (legit) with:

There are some aspects of fundability where you should pay particular attention to what’s going on online. They include:

Records consistency matters here, too. Your website should show who owns your company. And that information needs to be consistent. So if the owner is named Susan Johnson on your website’s About page, then she can’t be listed as Sue Johnson on your Contact page. If your ownership changes, you need to show that here.

Abbreviations can be your downfall here, as can punctuation like hyphens, commas, and colons. If your Contact page says your main office is on Main Street, then your About page can’t say it’s on Main St.

If you move, or you add subsidiaries and other locations, then you need to update that information everywhere. This even means whether you use your 5-digit ZIP code, or a ZIP plus 4 code (9 digits).

If your industry is over the road trucking, then it needs to be listed that way. Pro tip: when your industry can be called several different names, like long distance trucking, mention those other phrases on your website.

When your company domain matches your company name, it helps with fundability. Pro tip: try to match what people will be searching for online, so if (for example) the word ‘brothers’ is in your company name, then determine if ‘brothers’ or ‘bros’ will be used by people searching for your company and its goods and services online.

Keep your business protected with our professional business credit monitoring.

Good websites can help you get funding and convert prospects to customers. While websites differ, there are some things they all need. Such as:

Your website also needs:

One of the more vital items your website needs is content. This can mean blogging, and it certainly means creating pages which explain what you do and what sets your biz apart from its competition. It also means a page devoted to each product you sell or service you provide. Again, you’re making it easier for your prospects to find you.

More fundable companies can get more money, and they tend to get more prospects who decide to become customers. One area of fundability you have total or near total control over is your corporate online presence. Keep it professional, uniform. and appealing, and easy to use. We can help you with even more aspects of fundability.

The post Setting up a Business Email and Website to be More Fundable appeared first on Credit Suite.

Software Engineering- Mentor | Bangalore | ONSITE | Full-time employment | 75 paid vacations days | INR100K learning & travel allowance | Competitive compensation | Apply at https://careers.mountblue.io/mentor If you’ve ever thought of sharing your programming skills, we want you. MountBlue Technologies (https://www.mountblue.io) is looking for great software engineers to mentor the next generation of …

The post New comment by Bipasha in “Ask HN: Who is hiring? (November 2020)” first appeared on Online Web Store Site.

Article URL: https://boards.greenhouse.io/logdna/jobs/4884318002

Comments URL: https://news.ycombinator.com/item?id=24571973

Points: 1

# Comments: 0

The post LogDNA (YC W15) – Is Hiring a Senior Product Marketing Manager (Remote) appeared first on ROI Credit Builders.

Positrigo | Full Stack Software Developer | Zurich | Apply: https://positrigo-ag.breezy.hr/p/234b41567cba-full-stack-sof… Our vision at Positrigo is to image everyone by bringing nuclear medical imaging to the patients. That is why we work to develop the smallest and most affordable brain PET system – combining cutting-edge medical imaging technology with simplicity to enable the early and …

The post New comment by mahnen in “Ask HN: Who is hiring? (September 2020)” first appeared on Online Web Store Site.