How to Do Multiple Location SEO

Having multiple-location SEO enables businesses to attract website traffic from various states or countries across the globe.

It brings a lot of benefits to e-commerce businesses that offer worldwide or international shipping. If you have it in place, you can expand your customer base and quickly grow your business.

How to do multiple-location SEO? Here are some of the tips you need to know.

What Is Multiple-Location SEO?

To attract locals from various locations, you probably need to adopt a local SEO strategy.

Imagine your business has franchises or branches in various cities or countries. You can serve multiple areas or ship products internationally or worldwide.

How do you attract traffic from consumers based on a particular location? The solution is multiple-location SEO.

Multiple-location SEO helps you improve your search traffic from various locations. This way, locals who make searches related to your niche or services can see your website at the top of search results.

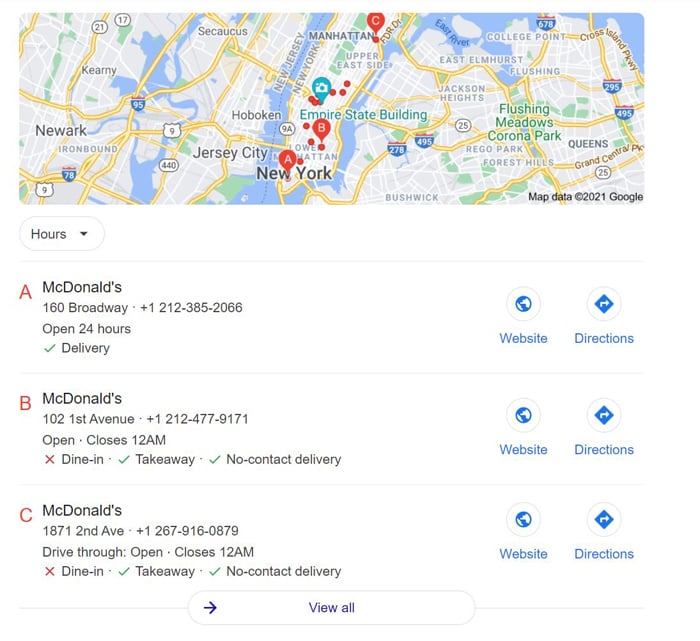

For instance, a search for McDonald’s in New York leads to Google search results with information on nearby branches in the city.

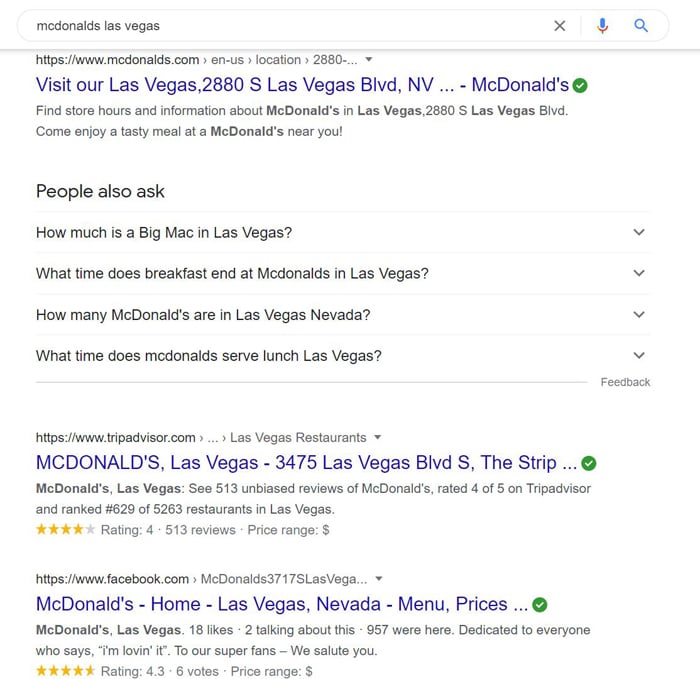

If you were traveling to Las Vegas, you’d also find branches and website results about McDonald’s that are related to your location.

In short, multiple-location SEO lets search engines differentiate between multiple locations. Hence, local customers can get relevant information on the products and offerings available in nearby outlets.

If you want more in-depth information about how this works, check out my definitive guide to SEO.

What’s the Benefit of Multiple-Location SEO?

What makes multiple-location SEO good for business? Here are some of the benefits you need to know.

1. Boost Local Marketing Results

Taking advantage of Google’s multi-location SEO features can boost your marketing efforts.

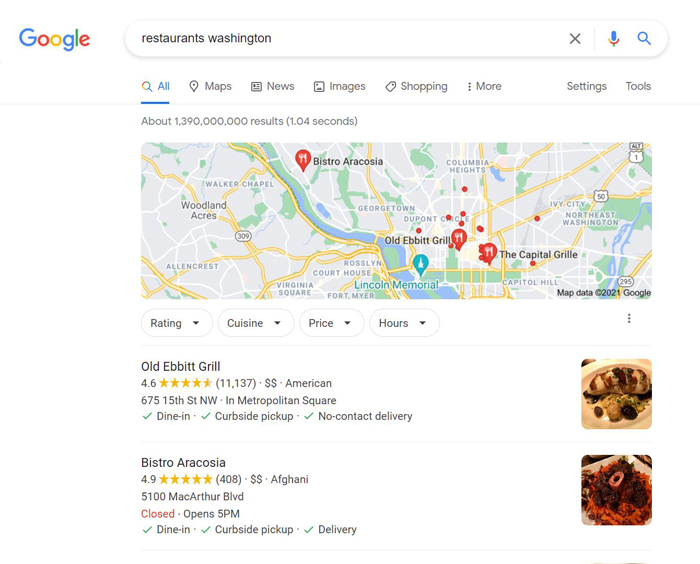

Google offers location-based data, such as drop pins on digital maps with information on your business’s exact address, opening hours, and other relevant information. First-time customers can also use the “Street View” function to find your outlet easily.

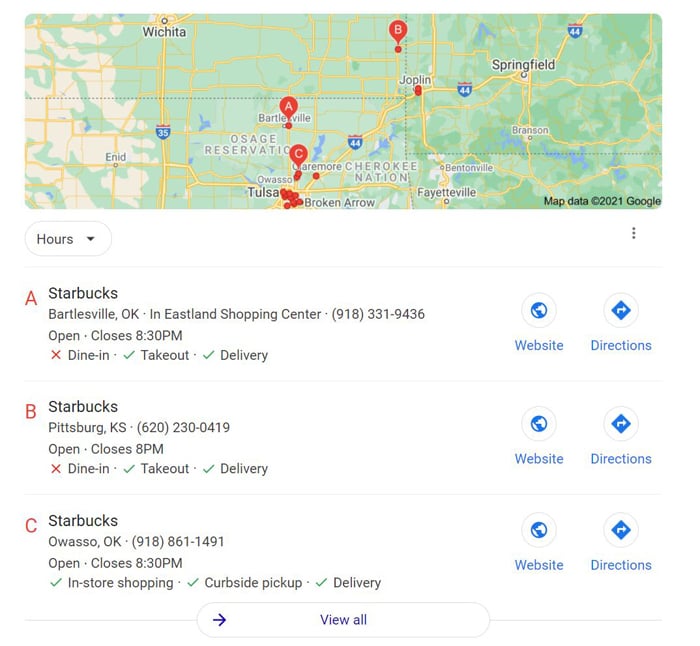

For example, when a tourist searches “Starbucks near me” on Google, you’ll get a map with information on nearby outlets, links to their website, and directions.

2. Attract Local Customers

Of course, multiple-location SEO can attract more local customers within the vicinity of your outlet.

According to website design company Go Gulf, 46 percent of all Google search results pertain to local information. Also, 72 percent of consumers that conducted a local search visited a store within five miles from their current location.

These numbers show incorporating a multiple-location SEO strategy is good for business.

When customers search for a local establishment offering a specific product or service, the search results will present the local businesses that specialize in it.

Food enthusiasts based in Washington, D.C. looking for a restaurant can conduct a search for “restaurants Washington.” Popular restaurants in the area will be displayed in the search results.

3. Boost Brand Awareness

Multiple-location SEO can raise awareness of your product or service by increasing traffic to product pages.

When customers use keywords related to your business’s offerings, your product pages could appear in the top search results.

Imagine a new resident browsing for items for his apartment in Washington, D.C. He conducts searches like “mattress Washington,” or “furniture Washington.” Businesses that are optimized for SEO within these locations will appear at the top of search results.

The bottom line is adopting a local SEO strategy can increase sales. Businesses who want to improve their visibility in a local area can improve their local presence.

Should E-Commerce Businesses Optimize for Multiple Locations?

More consumers have shifted to e-commerce because it is fast and convenient.

The unique advantage of e-commerce is its ability to cater to consumers from various locations, states, or countries.

Even if your e-commerce business is based in the U.S., your online shop will be viewable to consumers in countries like France, Italy, or Germany. All you need to do is enable international shipping, and you’re all set.

Sadly, international customers won’t be able to find your business if they can’t find you on the search engine. Hence, adopting a multiple-location SEO strategy is crucial for your business’s profits.

Multiple-location SEO is not merely about attracting traffic to your website. You can also use it to attract customers to your regional website and create unique pages and content for a particular location.

Let’s say you’re a clothing retailer catering to international customers.

Online stores in Singapore may offer different products compared with your e-commerce store based in the U.S. As a result, you can build a multiregional site to accommodate consumers within these locations.

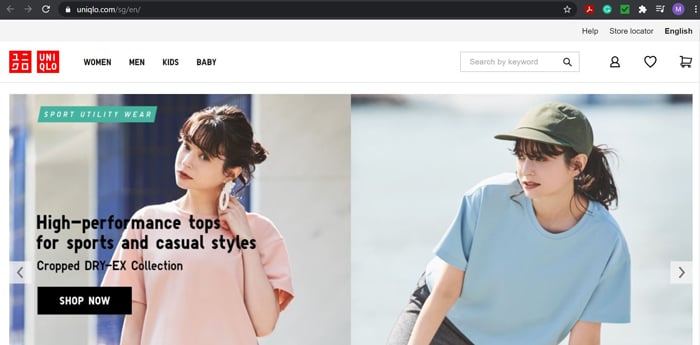

An example is clothing retailer Uniqlo, which has an online website for Singapore.

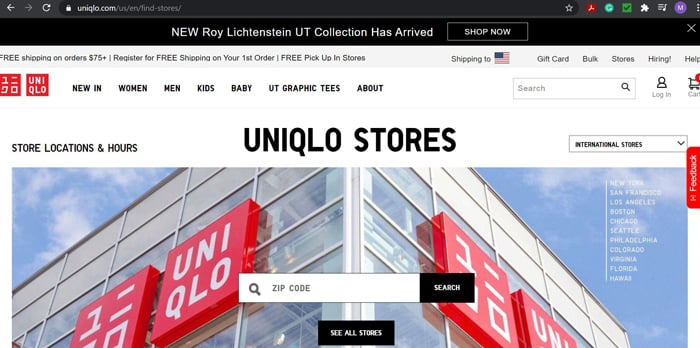

It has a separate online store for US consumers.

With multiple-location SEO, Singaporean consumers will be redirected to your Singapore website. They’ll be able to view products which they can purchase and ship to their homes. Likewise, consumers based in the U.S. will also enjoy these same benefits.

Furthermore, you can adjust to local trends and create exclusive product lines that interest local consumers. When consumers search for these products, they’ll view them on your local website.

Steps to Optimize for Multiple Locations

How can you optimize your store for multiple locations? Here are some tips you need to know.

1. Create a Page for Each Location on Your Website

The first step is to create pages based on your business’s or consumers’ location.

You can get this done by building a logical site structure to make it easy for search engines to find landing pages dedicated to a particular area.

For example, if your e-commerce store had various locations, then you can adopt the following URLs:

yourecommercestore.com/locations/newyork (for a specific state)

yourecommercestore.com/locations/newyork/manhattan (for a specific district)

Let’s say you have a store at East River Plaza in Manhattan. Then, you can use the following URL:

yourecommercestore.com/locations/manhattan/east-river-plaza

2. Optimize Each Page for the Location

Google won’t know your page is for a specific location unless you make an effort to optimize it.

This involves including the location in your title tag and meta description. Consider this search result for restaurants in New York City. The title, URL, and description have the keywords “restaurant New York City,” which helped it earn a top spot in the search results.

3. Create Localized Content for Each Location

Next, you’ll have to create localized content based on the products and services available in a particular location.

E-commerce stores with distinct products and services based in each region could consider creating the following landing pages:

- Store location: Create dedicated landing pages with information about your physical outlets (if any). Ideally, this should include your opening hours, address, map with your location pinned, and directions.

- Images: Add photos of your physical outlets (if any).

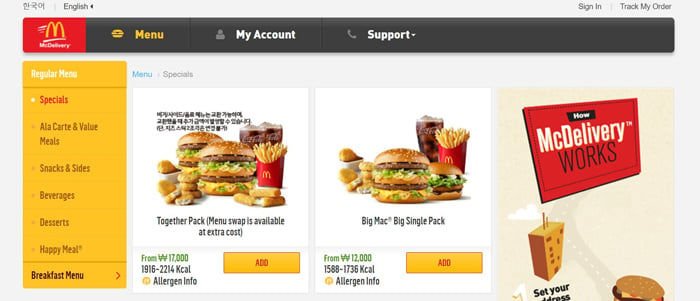

- Product pages: For products available in a particular location only, create product pages optimized based on location. For example, the McDonald’s Korea website has a menu page based on their current location.

- Service pages: Describe the services you offer in the particular location.

- Blog posts: Create blog posts designed to attract local customers based in a particular region.

These efforts ensure local customers will find information that is relevant to them when they check out your website and make a purchase.

4. Sign Up for Google My Business

Create a Google My Business account with listings for each location of your business.

You can check out my blog post on How to Optimize Google My Business to learn the basics about creating your listing.

A good listing should include basic business information, product photos, reviews, and social media pages. According to BrightLocal, 5 percent of Google My Business listing impressions lead to calls, clicks, or inquiries about the direction.

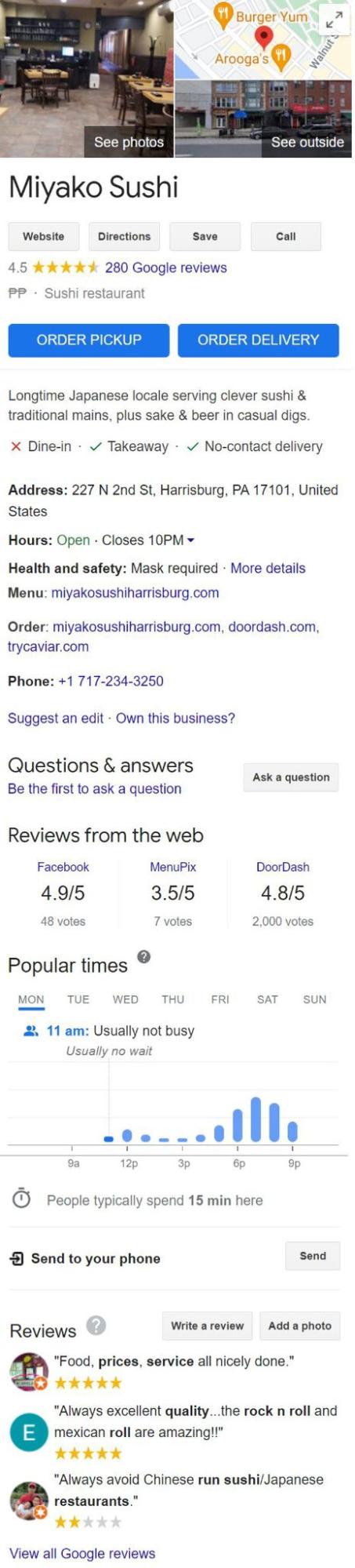

Take, for instance, this listing for Miyako Sushi based in Pennsylvania. The listing includes reviews from the web, popular times, website link, address, contact information, and any other pertinent facts to consumers.

This Google listing has all the information that consumers need to learn about the business. They can make an order, read reviews, and visit the website with the click of a button.

5. Showcase Reviews

Consumers regularly search for reviews before considering a purchase from an online store.

According to the State of Online Reviews by Podium Market Research, 93 percent of consumers said online reviews could influence their buying decision.

A Bright Local study found transitioning from a 3-star to a 5-star average rating on Google can lead to 25 percent more clicks. Businesses that achieved a 5-star rating also took around 69 percent of clicks in the local search, beating other competitors by a large margin.

Customers can easily write a review by clicking on your Google My Business listing.

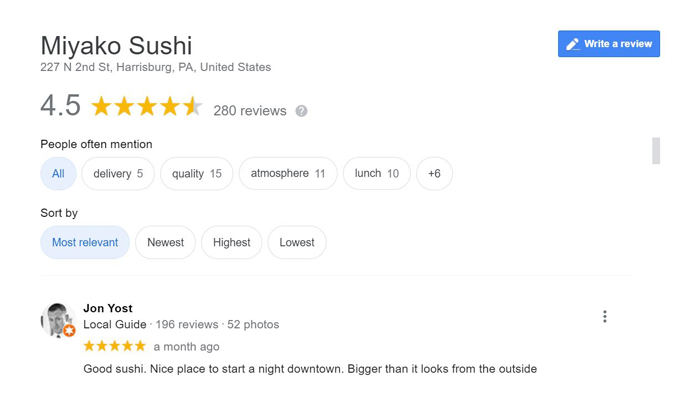

Let’s use the previous example on Miyako Sushi and look at the reviews.

Shortly after, you’ll be able to view a pop-up with an option to “Write a Review” in the upper-right corner.

To get more reviews, create an email asking customers to leave a review after making their purchase. You can also share reviews or testimonials to encourage customers to share their experiences with your business.

For better results, you could give customers a small incentive to leave a review, such as coupons or freebies.

6. Create Local Business Listings for Each Location

Besides Google, you can create local business listings on sites like Yelp and Bing to improve your local search results.

Similar to Google My Business listings, this should include relevant business information such as location, hours, and directions.

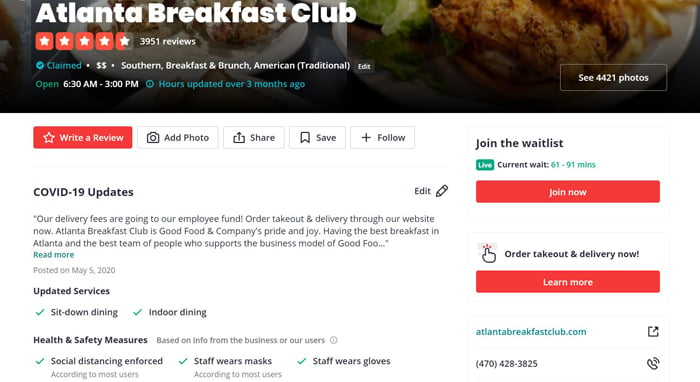

Here’s an example of a listing on Yelp for the Atlanta Breakfast Club:

As you can see, there’s crucial business information, such as links to reviews, health and safety measures, website links, and contact info. This information will help you attract local customers or tourists researching breakfast restaurants in the area.

As we’ve mentioned previously, consumers love businesses with reviews, so ask consumers to leave a review on these listing websites. In case there are any negative reviews, be sure to respond so you can satisfy frustrated customers and increase your average review rating.

You can also add links to these listings on location-specific pages on your website. This way, customers will be able to get the information they need with the click of a button.

7. Build Backlinks for Each Location

Backlinking is a crucial part of multiple SEO.

Businesses who want to improve their rank across multiple locations will need to build backlinks to individual pages for each location on their website.

You can get this done by reaching out to bloggers in your community.

If you own a restaurant, consider getting in touch with a food blogger so they can write a blog post or review about their experience. You can also get in touch with vloggers in your area to post video content about your restaurant online.

Host or participate in events within your community to get featured on local websites. Partner with organizations that can help you make an impact and build connections with locals. Network with journalists who can get you involved in newsworthy events and get you published in local publications.

The more backlinks you earn, the more likely you will boost your rankings in local search results.

Conclusion

Multi-location SEO can bring a lot of benefits to your business.

Not only does it provide you with an opportunity to increase brand awareness, but you’ll also attract local consumers. Since many people conduct local searches, you can even improve your customer acquisition results.

To reap the benefits of this SEO strategy, you’ll have to create a page for locations relevant to your business and optimize the page. Afterward, get reviews and create local business listings so customers will have a good evaluation of your business.

Follow the steps in this post, and you’ll be on your way to increasing local traffic to your website.

How will you do multiple-location SEO for your business?