Article URL: https://www.ycombinator.com/companies/codecrafters/jobs/M2ELjtC-influencer-partnerships-manager

Comments URL: https://news.ycombinator.com/item?id=39598170

Points: 0

# Comments: 0

Article URL: https://www.ycombinator.com/companies/codecrafters/jobs/M2ELjtC-influencer-partnerships-manager

Comments URL: https://news.ycombinator.com/item?id=39598170

Points: 0

# Comments: 0

Joran van der Sloot will be arraigned on Friday morning at 11 a.m. in a Birmingham, Alabama, federal courthouse on extortion charges related to the disappearance of Natalee Holloway.

Van der Sloot arrived in Birmingham on Thursday afternoon after being flown on a Department of Justice jet with agents from the Federal Bureau of Investigation, which left from Lima, Peru.

Van der Sloot is the prime suspect in the May 2005 disappearance of Natalee Holloway in Aruba during a Mountain Brook High School, Alabama, senior trip.

The Dutch national will now face charges of extortion and wire fraud in the U.S. after allegedly attempting to sell Beth Holloway, Natalee’s mother, information regarding the location of her daughter’s body.

NATALEE HOLLOWAY SUSPECT JORAN VAN DER SLOOT ARRIVES IN US TO FACE EXTORTION, WIRE FRAUD CHARGES

Federal prosecutors say van der Sloot asked for $250,000 — $25,000 upfront for the information, and the rest to be paid out when the body of Natalee Holloway was positively identified.

However, van der Sloot lied to Beth Holloway’s lawyer, John Q. Kelly, about where her daughter’s remains were located, according to American prosecutors.

The alleged extortion scheme took place between March 29, 2010, and May 17, 2010.

Van der Sloot then traveled to Peru and met Stephany Flores, 21, at a Lima casino owned by her father. Van der Sloot admitted to killing Flores, claiming he murdered her May 30, 2010, in a fit of anger after the 21-year-old found out he was connected to Natalee Holloway’s disappearance.

JORAN VAN DER SLOOT WILL LIKELY BE TRANSFERRED TO US DESPITE LAST-MINUTE EFFORTS: INTERPOL OFFICIAL

The charges were filed by federal prosecutors in 2010, but Peruvian officials didn’t agree to release van der Sloot into American custody until this May.

He was originally sentenced to 28 years in prison for the killing of Flores, but more time was added because of a drug smuggling scandal he was involved in while in jail.

Once van der Sloot’s federal case concludes, he will head back to Peru to finish his sentence for murdering Flores. After finishing his sentence in Peru, van der Sloot will then come to an American prison, if convicted.

Nearly three months after a bombshell draft Supreme Court opinion over abortion rights was leaked to the media, the question of who was responsible remains an ongoing Washington summer mystery.

Chief Justice John Roberts has ordered the Court’s marshal to conduct an internal investigation, but there has been no official update, and no indication whether the probe is ongoing, ended or suspended.

But multiple sources tell Fox News the investigation into the approximately 70 individuals in the court who may have had access to the draft opinion has been narrowed. Sources say much of the initial focus was on the three dozen or so law clerks, who work directly with the justices on their caseload. Fox News had previously reported those law clerks were asked to turn over their cell phones and sign affidavits. It is unclear whether those clerks have all cooperated.

Supreme Court law clerks work on a one-year contract for individual justices, and their term typically ends in mid-July. Most of the law clerks have now presumably moved on to other jobs, and any future cooperation with them into the leak investigation was seen as problematic.

SUPREME COURT’S ROE V. WADE DECISION: READ THE DOBBS V. JACKSON WOMEN’S HEALTH RULING

Fox News has been told court Marshal Gail Curley has also asked several permanent court staff who may have had access to the draft opinion to turn over their cell phones and electronic devices.

But the key question of the leaker’s identity remains unknown, at least publicly. Also unanswered is whether any punishment or discipline will be forthcoming; whether outside federal law enforcement or private law or security firm has been hired to help; and what steps if any will be taken to prevent future such leaks.

The court’s public information officer Patricia McCabe offered a formal “no comment” when asked Friday by Fox News.

A day after the early May leak, Roberts announced the internal probe, which was not given a deadline or any publicly-released mandate.

“To the extent this betrayal of the confidences of the Court was intended to undermine the integrity of our operations, it will not succeed,” the chief justice said in a rare public statement. “The work of the Court will not be affected in any way.”

It all comes amid ongoing, underlying tensions at the court. The building remains surrounded by high metal fencing, erected shortly after the May 3 leak of the draft obtained by Politico. That draft showed at least five conservative justices prepared at that time to strike down the nearly five-decade Roe v. Wade precedent, and end the nationwide constitutional right to abortion. The final opinion issued June 24 did just that, causing enormous political, legal, and social ripples, as states and Congress now grapple with revising and crafting legislation on access to the procedure.

The justices and their families are now under round-the-clock protection, and vocal protesters have shown up regularly at the homes of some justices. A California man has been charged with attempting to assassinate Justice Brett Kavanaugh, after being arrested near the justice’s Maryland home, armed with a handgun and after making threats.

Inside the court, the leak and ensuing final opinion in Dobbs v. Jackson Women’s Health Organization intensified the already strained dynamic among the nine justices, where a 6-3 conservative majority in the past two years has moved aggressively on hot-button issues like gun rights, immigration, religious liberty, and executive power.

“Look where we are, where now — that trust or that belief is gone forever,” Justice Clarence Thomas said shortly after the leak became public. “When you lose that trust, especially in the institution that I’m in, it changes the institution fundamentally. You begin to look over your shoulder. It’s like kind of an infidelity that you can explain… but you can’t undo it.”

SUPREME COURT JUSTICE CLARENCE THOMAS WILL NOT TEACH GEORGE WASHINGTON LAW SEMINAR AFTER UPROAR

Thomas is not exaggerating. But several people close to the justices say the nine members hope the ongoing summer recess serves as a “cooling off” period after tensions in the last weeks and months of the past term made the unique workplace very difficult.

And there is the expectation the newest Justice Ketanji Brown Jackson will bring a fresh perspective and a new dynamic to the court — someone who like her mentor and predecessor Justice Stephen Breyer may be able to reach across the ideological aisle on many issues.

Jackson officially joined the court July 1, and has spent the past few weeks quietly moving into her chambers and hiring her small staff — including the four law clerks who will serve a vital supporting role — a sounding board for the myriad of cases big and small that will come her way.

Her colleagues — and the public at large — will watch to see how quickly the 51-year-old Jackson adjusts to a fractured court, and whether she will be the strong progressive voice President Biden and her supporters have promised.

Like last term, the court’s docket for its next term that begins in October is already filled with its share of divisive cases — affirmative action in college admissions, religious liberty and LGBTQ+ rights, immigration policy, and election redistricting.

For now, the conservative majority seems poised to advance its winning streak.

“I expect that continuation of where they’re going, they’re going to be controlled by a conservative majority,” said Thomas Dupree a former top Justice Department official and now a leading appellate attorney.

“There’s not going to be a great ideological shift when you’re replacing one liberal vote with another liberal vote,” with the addition of Justice Jackson. “But at the same time, justices over history will tell you that any time you have a single member added to the court, given that it’s a nine person body, it’s a new court. The interpersonal dynamics are different than negotiations behind the scenes are different, and you can never quite anticipate how that might ultimately play out. But at least for the foreseeable future, I think we’re going to continue to see the conservative majority controlling the outcomes in most of the big ticket cases,” Dupree said.

Justice Elena Kagan has expressed concern for how the public will perceive the court moving forward.

“I’m not talking about any particular decision or even any particular series of decisions, but if over time the court loses all connection with the public and with public sentiment, that’s a dangerous thing for a democracy,” Kagan said at a judicial conference in Montana last week. “Overall, the way the court retains its legitimacy and fosters public confidence is by acting like a court, is by doing the kinds of things that do not seem to people political or partisan.”

Amid preparations for his Indianapolis 500 debut — the fulfillment of a childhood dream — Jimmie Johnson told The Associated Press on Tuesday that he’s “ecstatic and ready to go.”

The post Johnson feels 'at home' in Indy 500 preparations appeared first on Buy It At A Bargain – Deals And Reviews.

When we talk about building business credit and fundability, we do so with an end in mind. If you start working the process from the beginning, by the time you have been in business for 3 years or more you will have access to all the business funding you’ll need. That includes $20k loans or even higher.

If you follow the steps in order and handle credit responsibly, by the time you have reached this point you will be eligible for the best rates and terms available.

What are these options available to companies that have been in business for 3 years or more?

Banks are often the first place we think of when we consider financing. Yet, big banks only sign off on about 25% of the small business loan applications that come their way. Term loans often have lower interest rates than many other funding options. They also tend to be for higher loan amounts.

Generally speaking, the companies banks end up funding have:

You are more likely to meet these qualifications if you have at least 3 years in business and have been working on fundability and building business credit during that time.

A bridge loan is a short-term loan that a business or individual can use until they secure more permanent financing or remove an existing obligation. It allows the user to meet current obligations by providing immediate cash flow. Bridge loans are short term, up to one year. They have relatively high interest rates. Collateral such as equipment or inventory is common as well.

Three years or more time in business will help make SBA loans a real possibility. It’ll be easier to get an SBA loan the longer you’re in business. This is because you can more easily show your business is established and making money consistently.

If you can show profitability and responsible credit and bank account management, your chances of getting an approval for an SBA loan will improve drastically.

SBA loans have great terms, so it’s worth it to work toward building eligibility.

The SBA 504 loan program is an economic development loan program that offers small businesses an avenue for business financing, while promoting business growth, and job creation.

This program provides approved small businesses with long-term, fixed-rate financing used to acquire fixed assets for expansion or modernization. Use it to buy currently existing buildings, construct new buildings, and more.

For corporations, anyone with a 20% ownership stake (or more) must fill out the application. This includes swearing they are not under indictment for any criminal offense. In general, the SBA provides 40% of the total project costs, a participating lender covers up to 50% of the total project costs and the borrower contributes 10% of the project costs.

Under certain circumstances, a borrower may have to contribute up to 20% of the total project costs.

This is the SBA’s most popular loan. The SBA guarantees 85% for loans up to $150,000 and 75% for loans greater than $150,000. The SBA makes the lending decision, but qualified lenders may be given authority to make credit decisions without SBA review.

Businesses must provide Articles of Organization, business licenses, documentation of lawsuits, judgments, bankruptcy, or other pertinent documentation. Also, lenders do not have to take collateral for loans up to $25,000.

For loans in excess of $350,000, the SBA requires that the lender collateralize the loan to the maximum extent possible up to the loan amount.

Online lending works well for those with less time in business, or in situations where traditional lenders will not work. Still, they will offer better terms and rates to those companies in business longer and with strong fundability. That means, it is best to not discount them even after you reach this point.

Some of our favorite online lenders are listed here.

If you are here looking for options for $20k loans for your business, and you have been in business for 3 years or more, you are probably going to be okay. This is especially true if you have been working to build strong fundability and business credit as part of that.

If you are struggling to find $20k loans, start now building fundability, including strong business credit, and you’ll get there in no time.

The post Top Options for $20k Loans If Your Company Has Been In Business for 3 Years or More appeared first on Credit Suite.

Asset managers reappraise decades-old technique to gauge downside risks amid fears of volatile 2022

The post Buy side turns to extreme value theory to spot tail risks appeared first on Buy It At A Bargain – Deals And Reviews.

The post Buy side turns to extreme value theory to spot tail risks appeared first on BUSINESS DEMO WEBSITES.

The post Buy side turns to extreme value theory to spot tail risks appeared first on Buy It At A Bargain – Deals And Reviews.

aware3.com | Kansas City, MO | REMOTE, Onsite | Full-time

We help non-profits (churches, schools, etc) engage and grow their communities.

Seeking JS Engineers & PHP Engineers

Remote | KC – Apply: https://aware3.com/careers

Read about our great Engineering team’s values here:

https://medium.com/@aware3/tapas-teamwork-850b0b06f43d

If you are thinking of starting a business, you are likely thinking about funding. Can you afford to start a business? If you have a good credit score you probably aren’t worried. If your credit score isn’t great, you may be wondering “What’s the best way to improve credit score in time to start a business?”

The thing is, that’s the wrong question. You need to be asking yourself “What’s the best way to improve credit score for myself and my business?” Whether your business is brand new or fully established, it needs a strong business credit score to thrive.

Many business owners do not even know that their business can have a credit score. They assume everything rests on their personal credit. Others know their business can have credit all it’s own, but do not truly understand how a business gets its own credit score. That knowledge is key to learning the best way to raise your credit score and how to build a strong business credit score.

Keep your business protected with our professional business credit monitoring.

Your business credit profile is the overall picture of the creditworthiness of your business. Lenders look at it to determine whether or not they want to lend to you.

To better understand the best way to raise credit score for your business and how it is different from your personal credit score, you need to understand some of the differences between business credit profiles and personal credit profiles. There are many, but these specifically seem to cause a lot of misunderstanding and confusion among borrowers when they get a funding denial.

The biggest and probably most misunderstood difference is in how you establish the two profiles with their accompanying scores. Pretty much everyone knows that with your first debt, usually a credit card, you begin building your personal credit score. If you handle your credit responsibly, you will have a good score. If you do not, your score will be bad.

You do not have to do anything to open a credit profile for yourself. As you pay your debt, the creditor reports your payments, or lack thereof, and your score builds from there. Such is not the case with your business credit profile.

You have to intentionally set up your business in a way to establish your business credit profile. This means fully separating it from yourself as the owner by having separate contact information, an EIN, and D-U-N-S number, incorporating, and opening a separate bank account. In fact, this is the first best way to improve your business credit score. Before these things are done your business will have no credit profile or credit score of its own.

Both business and personal credit reports are affected greatly by late payments. Yet, business credit scores are affected faster and more profoundly. Late payments are not reported to personal credit reports typically until they are 30 days past due. Late payments on business credit accounts are reported if only one day late.

Hard credit checks on your personal credit will lower your credit score. However, business credit reports are different. A credit check on your business credit profile does not affect your business credit score.

In addition to late payments being reported much more quickly, accounts on your business credit profile are listed by industry. In contrast, personal credit lists the name of the company that issues the credit.

Also, personal credit reports show the exact amounts of accounts, while business credit reports show rounded amounts. How long data stays on a personal credit report varies, but typically it’s the life of the file. Information stays on business credit reports an average of 3 years.

Keep your business protected with our professional business credit monitoring.

Also, with personal credit accounts, almost every account reports to the credit reporting agencies. In contrast, only about 7% of business credit accounts report to business credit reporting agencies. This is why you have to intentionally seek accounts that will report to business credit reporting agencies (CRAs), and that is only one of many reasons working with a business credit expert is the way to go.

One last thing to note about business credit versus personal credit is this. While your business credit profile is totally separate from your personal credit profile and does not affect in any way, the reverse is not true. Your personal credit information can affect your business credit profile, and in some cases, even your business credit score.

Most people know many ways to do this, but what is the best way to improve credit score on your personal credit profile? Frankly, it’s to pay your bills consistently on-time. That said, sometimes that isn’t the problem. Furthermore, sometimes you need to make other improvements while you work on paying on time.

This is easy and free. You can get a free copy of your credit report annually. The first thing you need to do is look over it for mistakes. If you find any, contact the CRA in writing. Send with your letter copies any documents you have to support your case. This may be receipts, bank statements, anything that proves that what you are saying is a mistake is indeed a mistake.

After that, look closely for what else could be causing issues. Is too much available credit being used? Are there too many late payments? The best way to fix this is take a long, hard look at your budget. Cut wherever you can to start making more than the minimum payments.

A good strategy is to put all available extra cash on the highest interest debt. Then, when that is paid off, put that entire amount, extra plus the minimum, on the next highest interest debt, and so on. This is called the snowball method, and it can help you raise your credit score significantly if you stick with it.

After that, there are many free apps to help you track your personal credit score throughout the year. This is the best way to get credit score information on a regular basis. Typically, you can get a snapshot of what your credit looks like once a month with these, and if you pay a fee you can see it in real time. This can let you see if your efforts are working, and show you if something is amiss.

Understanding how your business credit score is different from your personal credit score helps a lot. For example, now that you know that a business credit account can report a late payment even one day late, you can plan accordingly.

Furthermore, knowing that not all business accounts report lets you know that you need to intentionally look for those that will report to raise your score.

There are a few ways to do this. First, talk to any vendors you already have a relationship with. Ask them to report your payments to the business CRAs. They don’t have to, but they may. It can only help you.

Next, talk to utility, phone, and internet providers. You pay them monthly already. Ask them to report those payments. Again, they do not have to. Still, if they agree, it can only help you.

After that, actively seek out accounts that report. The problem is, most vendors do not make it publicly known whether or not they report. This is just one of the many ways a business credit expert can be helpful. They have inside information and relationships with vendors to help you get this information and more.

Keep your business protected with our professional business credit monitoring.

This is a whole other ballgame. First, business credit score monitoring is never free. You may be able to get a peek as a one time free trial promotion, but for the most part you have to pay to see what is on your business credit profile. One exception is, if you get a loan denial because of what a lender sees on your business credit report. They have to disclose that, and you can get a free copy of your business credit report as a result.

While all the major business CRAs offer credit monitoring services, they are pricey. Credit Suite offers business credit monitoring for a fraction of the price.

Follow the same steps as you would with your personal credit profile. If you see a mistake, contest it. Each of the bureaus has directions on how to do so on their website.

All the best ways to get your credit score up involve one thing, knowledge. First, you have to know how to see what is one your credit report. Then, you have to know what to look for so you can know what the problems are. After that, you can fix them. One thing remains true however. The hands down best way to improve credit score, whether personal or business, is to pay your debt on time. If you need help on the business side, Credit Suite has you covered. Talk with one of our qualified business credit experts today!

The post What’s the Best Way to Improve Credit Score for You and Your Business? appeared first on Credit Suite.

Accounts receivables are a necessary part of many businesses. A lot of potential customers can be lost if you do not allow businesses to pay invoices with net terms, whether 30, 60, or 90 days. However, you can lose a lot of money if you don’t collect on those receivables. How do you offer the benefit, without suffering the consequences?

Accounts receivables really can lead a double life of sorts. On the one hand, they lure in customers with their appeal. On the other hand, they can cause major cash gaps simply by their nature. Those gaps can fill with unpaid obligations quickly if there is no bridge over them.

So, the question becomes, how do you enjoy the benefits without the gaps. The answer is accounts receivable financing. In fact, this answers more than one question. Not only is it a way to bridge cash gaps, but it is also a way to fast access to cash for other needs.

For example, you may not have an unmanageable cash gap, but rather you need to take advantage of special pricing on a bulk purchase. Maybe you do not want to exhaust your cash on hand, or you do not have the cash on hand. Either way, you can leverage your accounts receivable to finance more than just cash flow issues due to slow collections.

Credit Suite can help you get up to $10 million in account receivable financing. Up to 80% of receivables can be advanced within 24 hours. Interest rates range from 8% to 12% currently. The minimum credit score requirement is 500, and the receivables must be from another business or government agency, not an individual. You also have to be in business for at least one year.. In addition to an application, you’ll need to provide a breakdown of existing receivables and a sample invoice.

Find out why so many companies use our proven methods to get business loans.

This is an ideal way to access fast cash for your business for a number of reasons, especially if your credit isn’t the best. Not only that, but the interest rates are much more reasonable than that of most credit

cards.

If you accept credit cards as payment, you have another, similar option to accounts receivables financing.

It’s called a merchant cash advance. Our merchant financing program is a good fit for businesses that accept credit cards and need fast, easy financing. You can get up to $500,000 without collateral and a minimum credit score as low as 500.

You only have to turn over bank statements to prove cash flow. The lenders we work with do not ask for other documents such as financials, business plans, resumes, or any of the other documents traditional lenders typically ask for.

Just 4-6 months of your bank and merchant account statements is all it takes. They just want to see consistent deposits and annual revenue of $50,000 or higher. Also, you do have to have been in business for 6 months or more.

They will also look to see if there are a lot of Non-Sufficient-Funds showing on your bank statements, or low chargebacks on your merchant statements. More than 10 deposits in a month going into your bank account is a key positive factors

Lenders want to see that you manage your bank and merchant accounts responsibly and have a fair number of consistent credit card transaction deposits each month.

Maybe you don’t have accounts receivable. That may mean you do not have the cash gaps that can come with them, but you might still need cash access anyway. There are other options. One of the most flexible but least known types of business financing is the Credit Line Hybrid.

A credit line hybrid is unsecured business financing. It allows you to fund your business without putting up collateral, and you only pay back what you use.

Find out why so many companies use our proven methods to get business loans

Unlike accounts receivables financing, you do need good personal credit to qualify for the Credit Line Hybrid on your own. Your personal credit score should be at least 685. In addition, you can’t have any liens, judgments, bankruptcies or late payments. Furthermore, in the past 6 months you should have no more than 4 credit inquiries, and you should have less than a 45% balance on all business and personal credit cards. It’s also preferred that you have established business credit as well as personal credit.

However, there is a way around those requirements if you don’t meet them. You can take on a credit partner that meets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding.

The Credit Line Hybrid is an option if you do not have accounts receivable or do not accept credit card payments. However, if you qualify for more than one, you can combine them for even more powerful business funding.

Find out why so many companies use our proven methods to get business loans

That said, the Credit Line Hybrid does have one bonus that the accounts receivables funding and merchant cash advance does not. The Credit Line Hybrid reports to your business credit report, in turn helping you build a stronger business credit score.

If you made it here from a quick search about accounts receivables financing, you may be asking yourself what on earth a business credit report has to do with anything. The quick and dirty is, a strong business credit score can increase fundability and allow you to access even more funding for your business.

Fundability is the overall ability of your business to get funding. Not sure where you stand or what kind of funding you can get? Try a free consultation.

Accounts receivables can truly be a blessing or a curse. They are a great tool to help you draw more business. The ability to pay later is a huge benefit, and it can make the difference between a potential customer lost and a new customer.

However, if collections become an issue, the curse can kick in. Accounts receivables financing is a great way to overcome the curse and keep the blessing. That’s not the only way to use this kind of financing though.

Your accounts receivables can be leveraged to get funding your business can use to not only survive, but to thrive. If you do not qualify, a merchant cash advance or the Credit Line Hybrid can help as well. If you qualify for all three, you can get triple the funding to grow even more!

The post Don’t Let Accounts Receivables Sink Your Business appeared first on Credit Suite.

The average American sees up to 10,000 ads and brand messages every single day. Sounds a little overwhelming, right? That’s because it is.

After seeing this many ads every day, viewers simply stop noticing them—meaning they aren’t engaging with them. As a result, you miss out on sales opportunities.

You need to go further to engage your target audience and convert them by personalizing the whole marketing experience through interactive marketing tools. Here’s what you need to know.

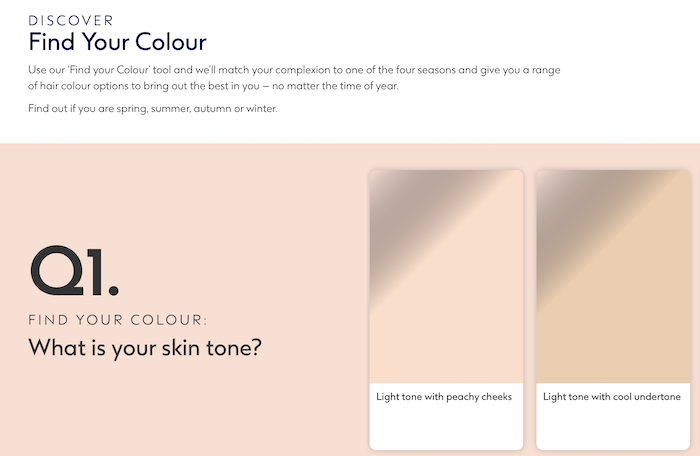

Pretend for a moment that you’re looking for new hair color. It’s tricky because you’re unsure which colors suit you, and you could use some personalized help.

Finally, a website catches your eye because there’s an interactive tool designed to help you pick a hair color. All you need to do is input some simple details, such as your skin tone and eye color, and you’ll see a list of compatible hair dyes.

The outcome? You purchase a hair dye. In other words, you just went from a potential lead to a paying customer, and it’s all thanks to that interactive website tool.

Essentially, this is precisely how interactive tools for marketing are meant to work. And this particular example isn’t imaginary—you can check out Boots to see what I mean:

If you go through the sequence, you’ll find a list of compatible colors. Then, when you click on a color, a link pops up to take you straight to the right product:

How’s that for convenience?

With just a few minutes of interaction, users get helpful, meaningful results—and you may make a sale.

That’s just one example of interactive tools in a sales context. However, you can build many interactive tools and discover at least as many ways you can use them in your marketing strategy.

Here are five common types of interactive marketing tools we can use in different ways.

This one’s similar to what we just worked through, but it’s not quite identical—we’re taking it one step further.

Embedded “quizzes” like the one we just looked at rely on customers clicking on certain answers. The algorithm then presents people with solutions matching their answers.

Conversely, virtual try-ons use augmented reality or simple image captures to let people use selfies to “try on” everything from makeup to glasses.

The benefit? Customers know whether the product suits them or not, so they’re more likely to buy. Briefly, here’s how they work:

It’s not just limited to beauty products or accessories, either. For instance, platforms like Amazon allow their users to “place” furniture around the room to see if they look good in their home. The same technology applies.

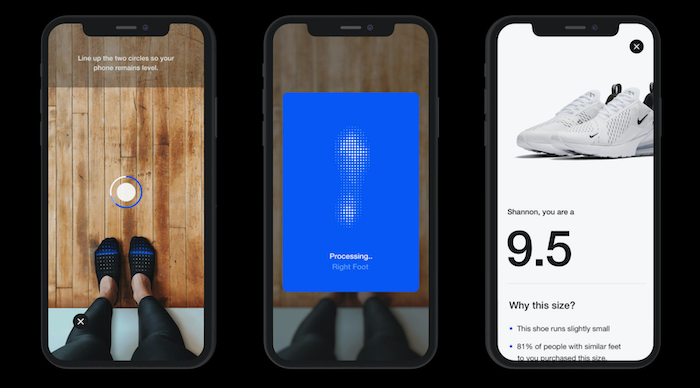

Customers sometimes find buying products like shoes online challenging because it’s hard to determine what size to get.

That’s where measurement tools come in. Let’s break down Nike’s Digital Foot Measurement Tool as an example.

It’s easy to see how this may lead to more sales and, happily, fewer returns.

Calculators are useful interactive tools for your website and can be used in more ways than one might think, including as:

Whichever sector you’re in, there’s a good chance you can use an interactive calculator to personalize the user experience.

For example, say you run a kitchen supplies website, and you want people to buy your recipe books. They’ve asked questions about how healthy the recipes are.

A nutritional calculator can help them out and, in turn, encourage people to spend more time on your website and potentially have more trust in your brand.

We’ve explored what interactive marketing tools are and how they work. There’s still a fundamental question remaining: Can these tools increase your sales?

The answer is: Yes! Here are my top seven reasons why interactive tools in your marketing strategy can increase sales:

Customer engagement is vital, but it’s hard to stand out from the crowd. Here are two reasons why:

Don’t worry, though. This time is where interactive tools have their chance to shine. 66% of marketers report an increase in engagement levels after introducing interactive content to their marketing plans.

Ultimately, increased customer engagement is a pretty effective way to generate more sales in the long-term, so it’s worth using interactive tools in your content.

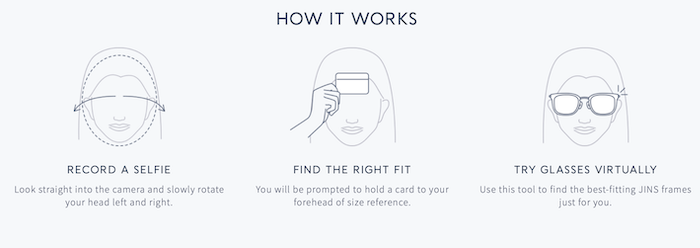

Conversion is what marketing is all about, and interactive tools could help you do just that. Let me show you how it’s working for JINS, a prescription eyewear provider.

As a forward-thinking company, JINS wanted a new, innovative way to increase conversion rates and improve customer experience. Their solution came via virtual try-ons for glasses.

All someone needs to do is turn on their camera and upload a selfie to the platform. Once that’s done, the user chooses which frames they’re interested in and puts them onto the selfie.

Here’s what it looks like in action. On the left, we have the selfie, and on the right, the actual frames after the customer made their purchase:

Potential customers now have a quick and accurate way to gauge which glasses to buy! According to JINS, conversion rates have drastically improved since they added this interactive tool.

Like I said earlier, this is not just about trying on hair colors or checking out fashion accessories. This technology is about making big purchases, too.

Take Target, for example. Users upload a picture of their room and place a true-to-life copy of a furniture piece in the space. They can also download the Target app and try out the augmented reality version instead, which is a little more engaging because you can move the product around the room. Amazon does this with many of their products in their app as well.

This feature allows users to check if the furniture or other large item fits their space before purchasing it, which means they’re more likely to click “buy” and less likely to make returns.

Do you see a pattern of personalization forming? Interactive tools allow us to personalize marketing like never before. Here’s why it matters from a sales perspective:

These stats tell us two things:

First, customers crave personalization. They want to feel valued by companies.

Second, they’re more likely to become loyal customers if there’s a personal touch to your marketing efforts.

This is a no-brainer way to build brand loyalty and increase your chance of future sales.

I’ve touched on this already, but it’s worth emphasizing just how effective a lead generation strategy using interactive tools can be from a sales perspective.

Firstly, there’s an SEO angle. If you can attract more social media shares and inbound links, you should generate more traffic. Additionally, if people spend more time on your website and there’s a lower bounce rate, your search engine ranking can improve. Social shares may boost your SEO ranking by over 20%, too. (You can check who’s linking back to you with my free backlink checker.)

The upshot of interactive tools catching people’s eyes is that there could be more organic traffic and better quality leads because the people you’re attracting are already looking for your product or service.

Let’s think about this from another angle, too. The data you’re capturing from prospects as they use your tools may help you figure out what your customers want so you can improve your products and services.

Consequently, you can generate more quality leads in the long-term, all without much extra effort from a marketing perspective.

Sounds great, right?

Yes, interactive tools can help you automate your marketing efforts, and the tools do much of the work for you. The algorithms detect what the customer wants and make recommendations or offer solutions based on this information.

This can help you increase sales and make alterations as needed because you can:

Without traffic coming to your website, there’s little chance you’ll make sales. Again, interactive tools can help you out here. Here’s why.

Firstly, 47% of people use ad blockers now, so there’s a chance some potential customers won’t even see your marketing if you’ve focused efforts on those. Interactive tools help you sidestep this problem.

Secondly, 79% of successful marketers say interactive tools and content encourage people to return to their websites. It’s not just about creating new content, either—you can use the same content time and time again when you have interactive tools.

Think about it. If a customer loves the eyeglasses they purchased from you the first time around, they’re more likely to return to your online shop. There, they’ll use the same virtual try on tool they used before to check out different pairs. You didn’t have to try to impress them with new interactive tools, promotional emails, or any other marketing strategy—they liked what they used the first time and engaged with it again.

How’s that for a cost-efficient way to solidify a lasting relationship with your customer base?

Why should you build interactive tools to increase your sales? Well, as we can see, they’re not just a reliable way to generate leads and improve conversion rates, but they’re cost-effective, too.

They’re not especially challenging to deploy, either. It’s easy enough to find interactive tools you can tweak to suit your needs and embed them on your website. If you want more help with introducing interactive tools into your marketing strategy, check out my consulting services.

Have you tried interactive marketing tools yet?

The post Why You Should Build Interactive Tools to Increase Sales appeared first on Neil Patel.