Article URL: https://deepnote.com/publish/jobs Comments URL: https://news.ycombinator.com/item?id=24737134 Points: 1 # Comments: 0

Author: Kevin Bernal

Producing a Survey Landing Page A study touchdown web page i…

Producing a Survey Landing Page A study touchdown web page is an easy touchdown web page that asks the site visitor a couple of concerns as well as after that offers them with the telephone call to activity. When I initially remained utilizing a study touchdown web page, it was for a deal called SeniorSoulmates. …

The post Producing a Survey Landing Page

A study touchdown web page i… first appeared on Online Web Store Site.

How to Use Email Images to Boost CTR

Email is one of the most effective marketing campaigns out there — in fact, the average ROI of an email campaign is 122%.

For those who aren’t afraid to take a few extra steps, email images will spice up your campaign and help your email campaign stand out.

I’m going to show you how to leverage images in email the right way.

Email Images: Yes or No?

You can use email images, but should you?

I want to start by asking a few questions, because these will help you determine if using email images helps or hurts you. Read these and answer yes or no:

- Do my images support my brand?

- Have I optimized the image size?

- Am I using the right number of images?

- Am I properly using image alt tags?

- Are my emails easily accessible?

Chances are you may not even know the answer to all these questions.

If that’s the case, then you’re not getting all you can from your email images, and this guide will help you.

But it’s not quite that simple. Having email images can boost your email’s aesthetics, but how do you increase email click-through rates with images?

What Is a Good Email Click-Through Rate?

Your click-through rate is the percentage of people who click on an image, link, or video in your email to continue through to your content. The average click-through rate is around 2.5% across all industries.

This number might sound a little low, but keep in mind, we’re talking about click-through and not open rates, which is the number of people who read your email.

Including images in your campaigns is a great way to increase engagement and improve your chances of driving traffic or even sales.

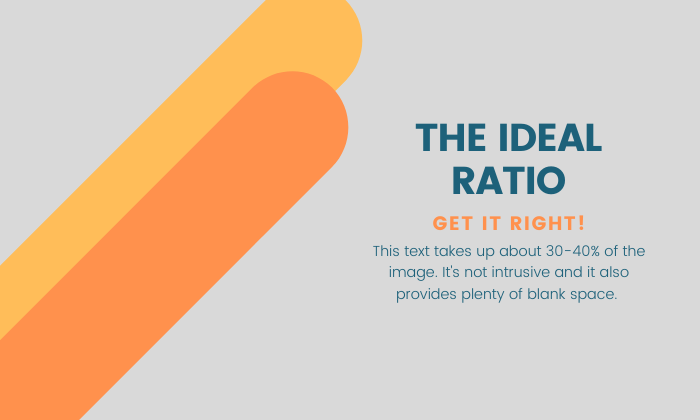

Images in Email Marketing: The Magic Ratio

Many marketers will tell you there’s a specific magic ratio of image to text, but it’s not always true. What is true is image-only emails will almost always cost you a trip to the spam folder.

Do that too much, and you’ll find your whole domain blacklisted.

That’s no good.

The ideal ratio is around 30-40% image to text. Any higher, you run the risk of triggering spam filters. Any less will make your email difficult to read.

The only way to find out what works for your audience is to test it! Use A/B testing to figure out what works and what doesn’t.

Keep Your Email Images Consistent

How many times have you searched for something on Google, found what you wanted, and clicked through to the website only to realize the link didn’t lead where you expected — at all?

It’s frustrating.

The truth is, you might be doing this to people right now without even realizing it.

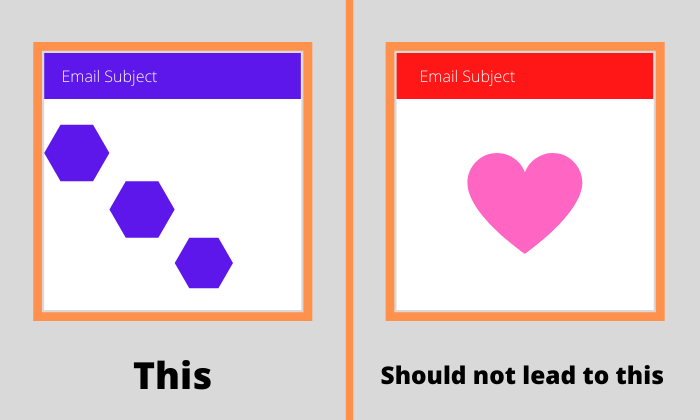

Your email image needs to align with your brand and remain consistent throughout your marketing campaign.

Make sure when someone decides to open your email, it remains true to your company message, and all the emails look relatively similar.

If you’re using blue headers with a specific font in your campaign, it should match the landing page your visitor ends on.

Personalization and Targeting Are Key

Email personalization is more important than ever.

Why?

Because there’s more impersonal spammy communication out there than ever before. Personalization changes the way your email appears based on the person you’re targeting.

Just think about it. How often have you received an email that seems like it was made for you?

Not often, right?

This is where you can get ahead of your competition by doing the things no one else is willing to do.

No product or service has “universal appeal,” so you need to narrow down your email images to a targeted audience.

According to Invesp, 59% of online shoppers find products more interesting when you personalize your marketing approach.

So, how do you personalize your email images?

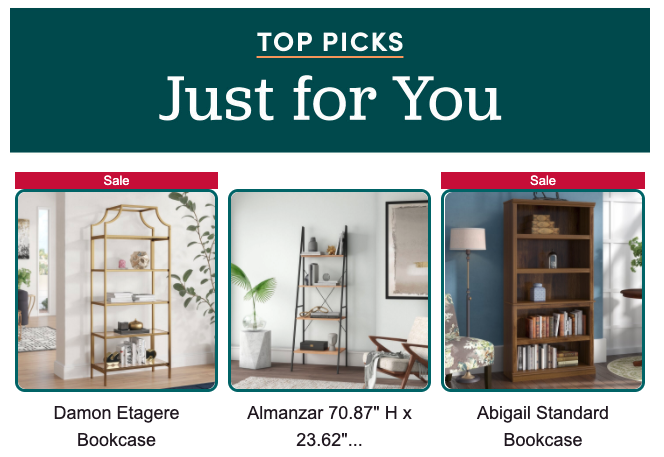

Cater to Repeat Buyers

Find products people need to purchase regularly and appeal to people who bought in the past. Amazon uses this strategy, resulting in 60% conversions from their on-site recommendations.

Here’s an example from Wayfair that was based on browsing history:

Recommend New Products

Recommend products to customers based on their previous buying history. Go the extra mile and even call it “Selections for [insert name].” That strategy helps create an “in-store experience” for your subscribers.

It’s as if you went to the clothing rack and specifically picked out items you thought would look great on them!

Ask Questions

If you’re selling a service or a digital subscription, you can ask your subscribers why they haven’t made a purchase yet. Give them a chance to sound off on what’s holding them back.

Doing this not only helps the email feel more personal and intimate, but it allows you to get feedback on what you could do better.

The ALT Tag Is More Important than You Think

We all know the importance of ALT tags for website images, but what about images in email marketing?

Are you currently using ALT tags properly in your email campaigns?

When the email client doesn’t download images correctly, your ALT tag becomes your lifeline for a few big reasons:

- When the email client doesn’t download the image, the ALT text displays to the email recipient.

- ALT text provides context if images aren’t loading.

- ALT tags make it easier for those who use screen readers and other accessible technology to understand the image.

When all else fails, the ALT tag might be the thing getting the email recipient to open.

How to Create ALT Tags for Emails?

On the back end, an ALT tag looks like this:

<img src=”youremailimage.jpg” border=”0″ alt=”How to Use Email Images in Email Marketing” width=”482px” height=”205″ />

Where it says “alt=” is where your ALT text goes. So, if an email image doesn’t load properly, that’s what will display across the email text area instead of the image.

The process of adding it might vary based on what email client you use. Here’s how to add ALT tags on MailChimp, for example.

Use the Best Format for Email Images

You have three primary formatting options for your email image. PNGs, JPEGs, and GIFs are the most common choices. Let’s look at the pros and cons of each.

PNG

Portable Network Graphics offer a large color palette, which means compressing the file size doesn’t impact the image’s resolution.

Another benefit is that you can add transparent layers, making it easy to embed the image on top of other content. This lets you blend the background image into an email with live text.

The only downside to PNGs is the file size is much larger compared to JPEGs and GIFs because of the image quality.

JPEG

JPEGs offer large image compression, but doing so impacts the quality of your image. When you reduce a JPEG image, it groups each section into larger blocks, which causes the image to become blurry — which isn’t a good look.

While these are the most common image types, I wouldn’t recommend using them for email images.

GIF

You get less color vibrance with GIFs because they use an 8-bit color palette compared to a 24-bit palette with PNGs and JPEGs.

The obvious difference is the animation effect. Using GIFs in your emails increases interactivity and can allow you to show more than one product with the same image.

How to Find the Best Email Images

Finding the right images to get your email message across is crucial. There’s a variety of different types of images you can use, and each has its own purpose. Let’s look at a few.

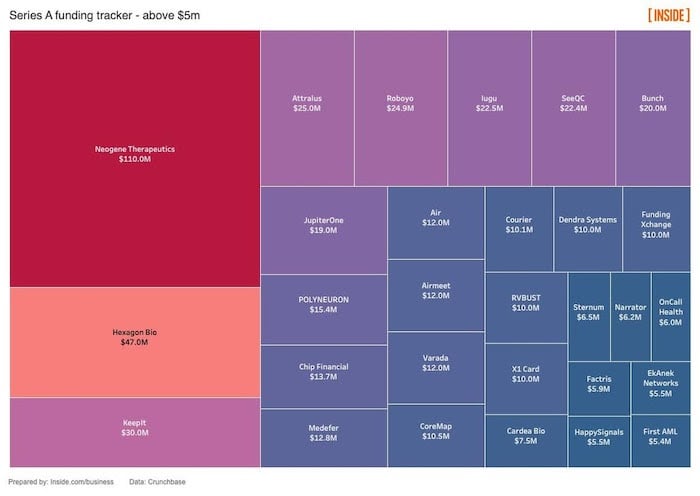

Charts and Graphs

Providing statistics and data is almost useless without a graphic to back it up. When you provide charts in your email to prove a point, it makes it much easier for the recipient to grasp your message.

Inside’s business newsletter has a Series A funding tracker where you can see what startups recently got funding above $5m:

This easily shows at a glance who got the largest amount of funding, by size and color.

Piktochart is an infographic tool that makes it easy to create free charts (with a watermark). Just enter the data and select the type of chart you want.

Stock Photos

Stock images are the easiest way to add images to your email marketing campaign. There’s a large assortment of sites to choose from like Shutterstock, Depositphotos, and Pixabay.

When sourcing the best image, choose something relatable to your audience. If you’re targeting middle-age moms of toddlers, find images that appeal to your demographic.

Don’t just add images to add images — make sure they have a purpose.

Screenshots

Instead of using a numbered list to explain how something works, turn the process into beautiful imagery with screenshots.

Awesome Screenshot is a browser extension on Chrome, Safari, and Firefox that makes it easy to capture screenshots directly from the browser. You can capture a whole page or a part and download it to your computer.

Personal Photos

Keeping it real and making things personal is never a bad choice. Email marketing is all about pulling back the curtain and showing people what you’re all about.

You don’t need professional photos to make sales, and the realistic and pure nature of personal photos can be what you need.

Illustrated Content

Illustrations are a nice way to expand your possibilities. While you might be able to do a certain amount of things with a product, an illustration can display limitless options while staying true to your brand.

Here’s an example from comedian Nate Bargatze announcing a drive-in tour. After this image, his email contained a text call-to-action with more information.

Consider hiring an illustrator on Fiverr or Upwork to get affordable illustrations.

User-Generated Content

User-generated content is huge. In fact, 76% of customers trust content coming from “average” people versus the brand itself.

UGC helps create trust, and it offers authority from a relatable audience. For example, imagine how an image of someone using your product in their home would outperform a stock photo or a cartoon using it.

Offer rewards to happy customers by having them upload images to social media using specific hashtags and use those images in your email marketing campaigns.

Never Send Image-Only Emails

While images are important – you should never send an image-only email.

Here’s why:

Image Blocking Is Real

If you work in the corporate world, you understand this point. Many companies block images by default, and in fact, 43% of email users have their images turned off.

So, if you don’t have your ALT text game up to par, your campaign won’t load properly.

Email Image File Size

Email image sizes can cause subscribers with slow connections to lag and become unresponsive. If your email takes too long to load, your subscribers are going to click out or even unsubscribe because they can’t get your emails to open correctly.

Email Accessibility Is Changing

More people are using voice assistants to read emails, and these do not recognize ALT text or HTML yet. So, if the user is trying to read your image-only email, you’re out of luck.

So, what’s the ideal email image format?

Background Images with Live Text

Remember earlier, when we talked about the pros of using PNG files for your email images? Here’s where this all comes together.

Background images applied as an element to the email allow you to put live text over it, providing the most accessibility. Even if the subscriber has images disabled, they’ll see the text, which ensures all your subscribers will get something from the email.

Bulletproof Buttons

Including your CTA in your image is a fatal error. If the image is blocked or doesn’t load properly, the button or CTA you have is hidden and completely missed by the recipient.

Using bulletproof buttons allows you to build the button with code, rather than images. So if everything fails and your image doesn’t load, the subscriber will still receive your text and CTA.

Conclusion

Email images are an effective strategy to increase your email campaigns’ success, but you can’t take shortcuts.

Using the right image size, format, and design is critical to ensuring your emails get delivered and get results.

Follow all of the best and worst practices outlined in this guide, and you’ll be well on your way to a higher click-through rate and a repeatable email process that will drive traffic for years to come.

Need some help perfecting your email image strategy? Drop a comment below.

The post How to Use Email Images to Boost CTR appeared first on Neil Patel.

Bad Credit in a Recession? You can get Business Cards and Build Credit

Do you have bad credit in a recession? You can get business cards and build credit – so don’t worry. Yes, even in a bad economy. And this is true no matter what happens with COVID-19.

Don’t Let Bad Credit in a Recession Get You Down

Per the SBA, small business credit card limits are a whopping 10 – 100 times that of personal credit cards!

This reveals you can get a lot more cash with business credit. And it also means you can have personal credit cards at stores. So you would now have an added card at the same retail stores for your company.

And you will not need collateral, cash flow, or financials in order to get small business credit.

Credit Card Benefits

Benefits can vary. So, make certain to pick the perk you like from this choice of options.

Bad Credit in a Recession? Get Trustworthy Credit Cards for Fair to Poor Credit, Not Calling for a Personal Guarantee

Brex Card for Startups

Check out the Brex Card for Startups. It has no yearly fee.

You will not need to provide your Social Security number to apply. And you will not need to supply a personal guarantee. They will take your EIN.

Nonetheless, they do not accept every industry.

Likewise, there are some industries they will not work with, as well as others where they want more documentation. For a list, go here: https://brex.com/legal/prohibited_activities/.

To determine creditworthiness, Brex checks a business’s cash balance, spending patterns, and investors.

You can get 7x points on rideshare. Get 4x on Brex Travel. Likewise, get triple points on restaurants. And get double points on recurring software payments. Get 1x points on everything else.

You can have bad credit scores (even a 300 FICO) to qualify.

Find it here: https://brex.com/lp/startups-higher-limits/

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines.

Bad Credit in a Recession? Get Corporate Credit Cards for Fair Credit Scores

Capital One® Spark® Classic for Business

Take a look at the Capital One® Spark® Classic for Business. It has no annual fee. There is no introductory APR offer. The regular APR is a variable 24.49%. You can get unlimited 1% cash back on every purchase for your company, with no minimum to redeem.

While this card is within reach if you have fair credit scores, beware of the APR. However if you can pay on time, and in full, then it is a bargain.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

Exceptional Business Credit Cards with Flexible Financing Credit Cards – Check Out Your Options!

The Plum Card® from American Express

Have a look at the Plum Card® from American Express. It has an introductory yearly fee of $0 for the first year. Afterwards, pay $250 per year.

Get a 1.5% early pay discount cash back bonus when you pay within 10 days. You can take up to 60 days to pay without interest when you pay the minimum due by the payment due date.

You will need good to superb credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/the-plum-card-business-charge-card/

Bad Credit in a Recession? Get Company Credit Cards with Jackpot Rewards That Never Expire

Capital One® Spark® Cash Select for Business

Have a look at the Capital One® Spark® Cash Select for Business. It has no annual fee. You can get 1.5% cash back on every purchase. There is no limit on the cash back you can earn. Also get a one-time $200 cash bonus when you spend $3,000 on purchases in the first three months. Rewards never expire.

Pay a 0% introductory APR for 9 months. Then pay 14.49% – 22.49% variable APR afterwards.

You will need great to outstanding credit scores to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash-select/

Bad Credit in a Recession? Get Business Credit Cards with a 0% Introductory APR – Pay Zero!

Blue Business® Plus Credit Card from American Express

Have a look at the Blue Business® Plus Credit Card from American Express. It has no annual fee. There is a 0% introductory APR for the first year. Afterwards, the APR is a variable 14.74 – 20.74%.

Get double Membership Rewards® points on day to day business purchases like office supplies or client dinners for the initial $50,000 spent annually. Get 1 point per dollar afterwards.

You will need good to outstanding credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/bluebusinessplus-credit-card/

American Express® Blue Business Cash Card

Also take a look at the American Express® Blue Business Cash Card. Note: the American Express® Blue Business Cash Card is identical to the Blue Business® Plus Credit Card from American Express. But its rewards are in cash rather than points.

Get 2% cash back on all eligible purchases on up to $50,000 per calendar year. Then get 1%.

It has no annual fee. There is a 0% introductory APR for the first year. After that, the APR is a variable 14.74 – 20.74%.

You will need good to superb credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/business-bluecash-credit-card/

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines.

Bad Credit in a Recession? Get Terrific Cards for Cash Back

Flat-Rate Rewards

Capital One ® Spark® Cash for Business

Take a look at the Capital One® Spark® Cash for Business. It has an introductory $0 annual fee for the initial year. Afterwards, this card costs $95 each year. There is no introductory APR offer. The regular APR is a variable 18.49%.

You can get a $500 one-time cash bonus after spending $4,000 in the initial three months from account opening. Get unlimited 2% cash back. Redeem any time with no minimums.

You will need good to excellent credit to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash/

Flat-Rate Rewards and No Yearly Cost

Discover it® Business Card

Have a look at the Discover it® Business Card. It has no annual fee. There is an introductory APR of 0% on purchases for year. After that the regular APR is a variable 14.49 – 22.49%.

Get unlimited 1.5% cash back on all purchases, with no category restrictions or bonuses. They double the 1.5% Cashback Match™ at the end of the first year. There is no minimal spend requirement.

You can download transactions| easily to Quicken, QuickBooks, and Excel. Note: you will need great to outstanding credit to get approval for this card.

https://www.discover.com/credit-cards/business/

Bonus Categories

Ink Business Cash℠ Credit Card

Take a look at the Ink Business Cash℠ Credit Card. It has no yearly fee. There is a 0% introductory APR for the initial year. Afterwards, the APR is a variable 14.74 – 20.74%. You can get a $500 one-time cash bonus after spending $3,000 in the first three months from account opening.

You can get 5% cash back on the initial $25,000 spent in combined purchases at office supply stores and on internet, cable and phone services each account anniversary year.

Get 2% cash back on the first $25,000 spent in combined purchases at filling stations and restaurants each account anniversary year. Get 1% cash back on all other purchases. There is no restriction to the amount you can get.

You will need superb credit scores to get approval for this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/cash?iCELL=61GF

Boosted Cash Back Categories

Bank of America® Business Advantage Cash Rewards MasterCard® credit card

Check out the Bank of America® Business Advantage Cash Rewards MasterCard® credit card. Get an 0% introductory APR for the first 9 billing cycles of the account. After that, the APR is 13.74% – 23.74% variable. There is no yearly fee. You can get a $300 statement credit offer.

Get 3% cash back in the category of your choice. So these are gas stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services. Get 2% cash back on dining. So this is for the initial $50,000 in combined choice category/dining purchases each calendar year. After that get 1% after, with no limits.

You will need outstanding credit scores to qualify.

Find it here: https://promo.bankofamerica.com/smallbusinesscards2/

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines.

Bad Credit in a Recession? Get Company Credit Cards for Luxurious Travel Points

Flat-rate Travel Rewards

Capital One® Spark® Miles for Business

Take a look at the Capital One® Spark® Miles for Business. It has an introductory annual fee of $0 for the first year, which after that rises to $95. The regular APR is 18.49%, variable due to the prime rate. There is no introductory annual percentage rate. Pay no transfer fees. Late fees go up to $39.

This card is wonderful for travel if your costs don’t fall into basic bonus categories. You can get unlimited double miles on all purchases, without any limits. Earn 5x miles on rental cars and hotels if you book with Capital One Travel.

Get an initial bonus of 50,000 miles. That’s the same as $500 in travel. But you just get it if you spend $4,500 in the initial 3 months from account opening. There is no foreign transaction fee. You will need a great to exceptional FICO rating to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-miles/

Bonus Travel Categories with a Sign-Up Offer

Ink Business Preferred℠ Credit Card

For a great sign-up offer and bonus categories, check out the Ink Business Preferred℠ Credit Card.

Pay an annual fee of $95. Regular APR is 17.49 – 22.49%, variable. There is no introductory APR offer.

Get 100,000 bonus points after spending $15,000 in the initial three months after account opening. This works out to $1,250 toward travel rewards if you redeem via Chase Ultimate Rewards.

Get three points per dollar of the first $150,000 you spend with this card. So this is for purchases on travel, shipping, internet, cable, and phone services. Plus it includes advertising purchases made with social media sites and search engines each account anniversary year.

You can get 25% more in travel redemption when you redeem for travel using Chase Ultimate Rewards. You will need a great to outstanding FICO score to qualify.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/business-preferred

No Yearly Fee

Bank of America® Business Advantage Travel Rewards World MasterCard® credit card

For no yearly fee while still getting travel rewards, have a look at this card from Bank of America. It has no annual fee and a 0% introductory APR for purchases during the first 9 billing cycles. After that, its regular APR is 13.74 – 23.74% variable.

You can get 30,000 bonus points when you make at least $3,000 in net purchases. So this is within 90 days of your account opening. You can redeem these points for a $300 statement credit towards travel purchases.

Get unlimited 1.5 points for every $1 you spend on all purchases, everywhere, every time. And this is despite how much you spend.

Likewise get 3 points per every dollar spent when you schedule your travel (car, hotel, airline) via the Bank of America® Travel Center. There is no limit to the number of points you can earn and points do not expire.

You will need superb credit scores to get this one (as in, 700s or better).

Find it here: https://www.bankofamerica.com/smallbusiness/credit-cards/products/travel-rewards-business-credit-card/

Hotel Credit Card

Marriott Bonvoy Business™ American Express® Card

Have a look at the Marriott Bonvoy Business™ Card from American Express. It has a yearly fee of $125. There is no introductory APR offer. The regular APR is a variable 17.24 – 26.24%. You will need great to superb credit scores to get this card.

Points

You can get 75,000 Marriott Bonvoy points after using your card to make purchases of $3,000 in the initial 3 months. Get 6x the points for qualified purchases at participating Marriott Bonvoy hotels. You can get 4x the points at United States restaurants and filling stations. And you can get 4x the points on wireless telephone services purchased directly from American service providers and on American purchases for shipping.

Get double points on all other qualified purchases.

Rewards

Plus, you get a free night every year after your card anniversary. And you can get one more free night after you spend $60,000 on your card in a calendar year.

You get Marriott Bonvoy Silver Elite status with your Card. Plus, spend $35,000 on eligible purchases in a calendar year and get an upgrade to Marriott Bonvoy Gold Elite status through the end of the next calendar year.

Also, each calendar year you can get credit for 15 nights towards the next level of Marriott Bonvoy Elite status.

Find it here: https://creditcard.americanexpress.com/d/bonvoy-business/

The Perfect Business Credit Cards for You (Even With Bad Credit in a Recession)

Your absolute best business credit cards hinge on your credit history and scores, even if you have bad credit in a recession.

Only you can select which features you want and need. So be sure to do your homework. What is excellent for you could be disastrous for another person.

And, as always, be sure to develop credit in the recommended order for the best, quickest benefits. The COVID-19 situation will not last forever.

The post Bad Credit in a Recession? You can get Business Cards and Build Credit appeared first on Credit Suite.

New comment by patrickt010 in "Ask HN: Who is hiring? (September 2020)"

Iteratively | Engineers & Designer | Full Time | Remote

Iteratively helps teams who rely on data to capture clean, consistent analytics they can trust.

You will be working in an early-stage but fast-growing VC backed startup with experienced founders.

Tech stack: TypeScript, React, Node.js, GraphQL, Postgres, Redis, AWS.

Senior Software Engineer: https://iterative.ly/careers/senior-software-engineer/

Senior Backend Engineer: https://iterative.ly/careers/senior-backend-engineer/

Senior Frontend Engineer: https://iterative.ly/careers/senior-frontend-engineer/

Product Design Lead: https://iterative.ly/careers/product-design-lead/

I’m one of the co-founders of Iteratively, feel free to reach out to me at patrick@iterative.ly with any questions.

Rapid Facts About Stocks Trading

According to the Securities and also Exchange Commission of the United States, capitalists need to deny or market the supposed ‘warm supplies’. These warm supplies often tend to climb in worth promptly yet when there are unforeseen hold-ups, the worth might additionally drop rapidly. You will definitely shed great deals of cash if you’re not that wise in spending in supplies trading.

Accounts can currently be accessed via the web however that is not an assurance that all your professions will certainly be rapid. If you intend to restrict the losses, take into consideration these points:

1. You need to recognize a great deal of details regarding the supplies you’re buying

2. You have to have the ability to comprehend the threats associated with supplies trading

3. You ought to know with the supplies trading procedure

If you desire to be effective in supplies trading, you need to recognize some of the troubles run into by capitalists. If you intend to get or market supplies, you need to position a limitation order instead than market orders. Do not try to acquire or market supplies at a really reduced or really high cost.

Intend you put a supply order for $10. You can likewise use the limitation order when you’re marketing supplies. You can not hold some of the supplies at longer durations also if you desire to wait up until the cost of the supply increases.

Immediate supplies trading can be influenced by troubles with web servers, modems, and also postponed equipment in between the broker and also dealership. You have to understand some efficient trading options simply in instance a trouble disrupts the deal.

When the order is postponed and also so they finish up making dual orders or dual marketing, there are times. There are times when the capitalist is able to acquire supplies that they do not such as or they offer supplies that are not also their own since of this. If you’re not really certain if the deal was finished, whether you’re offering or acquiring, you should promptly consult the broker.

You have to have a broker that can successfully manage supplies deals swiftly. You’re cost-free to make financial investments at any type of time as well as on any kind of kind of supply. That method, you will certainly get much more revenues with supplies trading.

If you’re not that wise in spending in supplies trading, you will definitely shed whole lots of cash.

If you desire to be effective in supplies trading, you need to recognize some of the issues come across by financiers. You can not hold some of the supplies at longer durations also if you desire to wait till the rate of the supply surges. Immediate supplies trading can be impacted by troubles with web servers, modems, as well as postponed equipment in between the broker and also dealership. Since of this, there are times when the capitalist is able to acquire supplies that they do not such as or they offer supplies that are not also their own.

The post Rapid Facts About Stocks Trading appeared first on ROI Credit Builders.

Corvus Robotics (YC S18) is hiring a robotics QA/DevOps engineer

Hi! We’re building autonomous aerial robots to help industrial clients track inventory. We’re looking for a DevOps/release/QA engineer to work closely with our amazing autonomy development team. This person would start PART-TIME, obviously remote, and after the virus ends, ideally join us full-time in Boston.

They would be an integral part of the team in bringing our autonomous vehicle to production, and would be involved in nearly every layer of the stack of an autonomous robot.

Key requirements:

– Attention to detail

– Enjoys automating things; dislikes inefficiencies in life

– Experienced with all of: C/C++, ros, Git, Jenkins/CI, unit tests, AWS, shell scripting / Ubuntu

Ideally, the candidate has also touched a screwdriver before, or a soldering iron (but not the hot side 🙂 )

If you’d like to be considered, please link your Github below, or email the link to qa-devops@corvus-robotics.com. Thank you!

Comments URL: https://news.ycombinator.com/item?id=22800418

Points: 1

# Comments: 0

InMapz App Publishes Detailed, Interactive, Mobile Maps For …

InMapz App Publishes Detailed, Interactive, Mobile Maps For Over 100 Top International Airports InMapz application fixes these troubles. InMapz maps are readily available for licensing as an API component to incorporate right into well-known mobile applications. InMapz system sustains mobile applications, branded white-label API components, and also equipment booths. InMapz reveals GPS-based, real-time you-are-here areas …

Supplies Online Are Quite Varied

Supplies Online Are Quite Varied

Still, lots of financiers locate trading supplies is one of the finest methods to develop as well as build up on riches. Also if it’s just a couple of bucks at hand to spend, supplies online can be a fantastic factor to consider.

Supplies on-line currently readily available for acquisition come in all kinds. For the a lot of component, financiers will certainly discover that supplies online are those that can additionally be acquired with a broker, paying greater charges.

The kinds of supplies online for acquisition often tend to consist of:

Cent supplies: These supplies are taken into consideration “scrap” by some, however the reality is some individuals have actually taken care of to make extremely large returns on more affordable buys. Beginning up firms as well as those brand-new to the supply market typically supply their supplies at extremely economical costs.

Blue chips: Some of America’s greatest firm names fall under heaven chip classification. These supplies on the internet often tend to be a lot more pricey than others, yet they are commonly kept in mind for their capacity to raise or keep cost. The concept behind heaven chip supplies is that if they drop, they will usually recoup their worth and also raise it.

Bonds, futures: It is occasionally feasible to purchase right into futures and also bonds online. Bonds can consist of community offerings and also those provided by firms.

In truth, those that look for supplies online will certainly discover nearly every little thing readily available on the residential front can be hand online. The schedule of some markets will certainly depend upon the website being made use of. Some investors will just use details markets they have accessibility to.

One more choice for on-line investors drops right into the world of international markets. Foreign exchange trading has actually come to be an extremely huge bargain with the Internet making it much easier as well as much easier for individuals to spend in international supply markets.

Regardless of just how supplies online are dealt, it’s a great concept to go into the handle treatment. Do some research on the websites being made use of to market and also acquire, examine the possible supply acquires as well as do take notice of significant fads up or down. When they play the video game well, also financiers with a really little bit of cash can make some genuine returns.

For the a lot of component, capitalists will certainly locate that supplies online are those that can likewise be acquired via a broker, paying greater charges. Cent supplies: These supplies are thought about “scrap” by some, however the reality is some individuals have actually handled to make extremely large returns on less expensive buys. Begin up business and also those brand-new to the supply market frequently supply their supplies at really inexpensive rates. In truth, those that look for supplies online will certainly discover virtually whatever offered on the residential front can be hand online. No issue exactly how supplies online are gotten as well as marketed, it’s a great concept to go into the offers with treatment.

The post Supplies Online Are Quite Varied appeared first on ROI Credit Builders.

Get Gas Cards for Small Business Now

The Very Best Gas Cards for Small Business

We took a look at a number of gas cards for small business, and did the research for you. So here are our preferences.

Per the SBA, business credit card limits are a whopping 10 – 100 times that of personal credit cards!

This demonstrates you can get a lot more money with small business credit. And it also means you can have personal credit cards at retail stores. So you would now have an extra card at the same stores for your company.

And you will not need collateral, cash flow, or financials in order to get business credit.

Gas Cards for Small Business: the Benefits

Benefits can vary. So, make sure to select the benefit you like from this choice of options.

Gas Cards for Small Business: Cards to Purchase Gasoline

Costco Anywhere Visa® Business Card by Citi

Check out the Costco Anywhere Visa® Business Card by Citi.

This card earns cash back with every purchase. Earn 4% cash back on the first $7,000 spent on eligible gas purchases annually (1% after that). Get 3% cash back at restaurants and on eligible travel purchases. Also, get 2% cash back at Costco and Costco.com. And earn 1% cash back on all other purchases.

Note: the $0 annual fee is only for Costco members. And an active Costco membership is required. Cardholders will get access to damage and theft purchase protection, extended warranty coverage and travel accident insurance.

Also, there is no sign-up bonus available with this card.

Get it here: https://www.citi.com/credit-cards/credit-card-details/citi.action?ID=Citi-costco-anywhere-visa-business-credit-card

Discover it® Cash Back

Check out the Discover it® Cash Back card. There is a 10.99% introductory APR for six months from date of first transfer. So, this is for transfers under this offer which post to your account by January 10, 2019.

After the introductory APR expires, your APR will be 14.99% to 23.99%. So, this is based on your creditworthiness. Your APR will vary with the market, which is based on the Prime Rate.

Details

You can earn 5% cash back at different places every quarter. So, these are establishments like gas stations, grocery stores, restaurants, Amazon.com, or wholesale clubs. But this is up to the quarterly maximum each time you activate. In addition, automatically get unlimited 1% cash back on all other purchases.

You will get an unlimited dollar-for-dollar match of all the cash back you have earned at the end of your first year, automatically.

Get it here: https://www.discover.com/credit-cards/cash-back/it-card.html

Discover it® Student Cash Back

Be sure to have a look at the Discover it® Student Cash Back card. It has no annual fee. The card also offers a six-month introductory period of 0% APR on purchases. And there is an APR of 14.99 – 23.99% variable on all purchases after that period.

One one-of-a-kind feature is that it offers an incentive for scholars to maintain good grades with a $20 statement credit. If scholars earn a GPA of 3.0 or better each school year, the card will award the $20 statement credit annually for up to five years.

Details

Use this card to build personal credit. While this is a personal credit card versus a business card, for new credit users, their FICO scores will be vital. And this credit card offers an excellent way to raise FICO while also getting rewards.

You can get 5% cash back at different places each quarter like grocery stores, gas stations, restaurants or Amazon.com up to the quarterly maximum. After that, this credit card offers unlimited 1% cash back on all purchases.

In the initial year, all cash back rewards are matched 100%.

Downsides include a cash advance fee of either $10 or 5% of the amount of each cash advance, whichever is more. And even though they waive the first late payment fee, a fee of up to $37 applies on all other late payments. There is also a returned payment fee of up to $37.

Get it here: https://www.discover.com/credit-cards/cash-back/it-card.html

IHG ® Rewards Club Premier Credit Card

Take a look at the IHG ® Rewards Club Premier Credit Card. it gets hotel rewards worldwide. For every dollar spent at participating IHG hotels, earn 10 points. Get two points per dollar spent at gas stations, grocery stores and restaurants.

Plus all other purchases earn one point. New cardholders can earn an 80,000-point sign-up bonus when they spend $2,000 in the first three months of account opening.

Details

This card provides a free one-night hotel stay annually. Plus there is a wide array of benefits like travel and purchase coverage and an upgrade to Platinum Elite status with the IHG Rewards Club. The club offers complimentary room upgrades when available and guaranteed room availability.

The most significant issue is that the card does not offer a zero percent APR introductory rate. And the standard APR is 17.99 – 24.99% variable. Also, the yearly fee is $89.

Get it here: https://creditcards.chase.com/a1/ihg/premiernaep

SimplyCash Plus Business Credit Card from American Express

Look at the SimplyCash Plus Business Credit Card from American Express. There is a $0 yearly fee. And there is a 0% APR on purchases So this is for the initial 15 months an account is open.

But when the introductory period runs out, the APR for purchases is 14.24 to 21.24%. So, this is variable and based on creditworthiness.

Details

This card has numerous benefits. These include purchase protection, car rental loss and damage insurance. And they also include a baggage insurance plan, extended warranty coverage and a global assist hotline.

Also, get 5% cash back at US office supply stores and on wireless phone services. So, these must be bought from American service providers. But this applies to the initial $50,000 of yearly spending. Then, you earn 1% cash back.

You also earn 3% cash back on spending category of your choice. So, this is from eight distinct categories. They include airfare, gas, advertising and computer purchases. But it applies to the first $50,000 of yearly spending. Then, you earn 1% cash back.

Cash-back bonuses are automatically credited to the customer’s billing statement.

Note: you cannot use this card for balance transfers. There is a foreign transaction fee of 2.7%. The card charges up to $38 in late fees. And the returned check fee is also $38. The penalty APR is 29.99%.

And, it applies if you have two or more late payments within 12 months. It can also apply if you fail to make the minimum payment on time or have a returned payment.

Get it here: https://www.americanexpress.com/us/small-business/credit-cards/simply-cash-plus-business-credit-card/44279

Starwood Preferred Guest® Business Credit Card from American Express

Another alternative is the Starwood Preferred Guest Business Credit Card from American Express.

This card is for those who stay at Starwood Preferred Guest and Marriott hotels often. Get six points per dollar of eligible purchases at participating SPG and Marriott Rewards hotels.

And earn four points per dollar at US restaurants, US gas stations, and on US purchases for shipping.

Also, earn four points to the dollar on wireless telephone services purchased directly from US service providers. For all other eligible purchases, earn two points per dollar.

Details

Get 75,000 bonus points when you spend $3,000 in the initial three months of account opening. Benefits include free in-room premium internet access, Sheraton Club lounge access, and purchase protection.

Plus you get car rental loss and damage insurance. And you get baggage insurance. There is also a global assistance hotline. And there is a roadside assistance hotline. And get travel accident insurance and extended warranty coverage.

The most significant issue is the annual fee. There is a $0 introductory annual fee for the first year, then it’s $95 afterwards. Plus there is no 0% introductory APR. Instead, there is a 17.74 – 26.74% variable APR

Get it here: https://www.americanexpress.com/us/credit-cards/business/business-credit-cards/spg-amex-starwood-credit-card

We also found cards which offered auto rental waivers, because you might not be driving your own car when on business.

Gas Cards for Small Business: Also Check Out Cards Offering Auto Rental Waivers

Capital One® Quicksilver® Card

Take a look at the Capital One® Quicksilver® Card. It offers flat-rate rewards of 1.5% on all purchases. There are no limits to the amount of cash back rewards which cardholders can earn. Also, the card has a $0 annual fee.

New cardholders have a 0% APR on purchases and balance transfers for the first 15 months after opening the account. And then they have a 14.74 – 24.74% (variable) APR after that.

A cash bonus of $150 is available for those who make at the very least $500 in purchases within 3 months of account opening.

Details

Also, cash back rewards do not expire for the life of the account. And there is no limit to how much you can earn.

This card also offers travel accident insurance. And you get an auto rental collision damage waiver. There are no foreign transaction fees. And there is extended warranty coverage.

Downsides are the flat reward rate, not allowing for any more than that. And the higher APR after the first 15 months.

Get it here: https://www.capitalone.com/credit-cards/quicksilver/

Establish business credit fast with our research-backed guide to 12 business credit cards and lines. Get the best gas cards for small business and more!

Capital One® Spark® Classic for Business

For fair credit, we like the Capital One Spark Classic for Business. It has no annual fee. There are cash-back rewards. The card gets an unlimited 1% cash back on all purchases. There is an annual fee of $0.

With this card, you will get benefits including an auto rental collision damage waiver, and purchase security. And you also get extended warranty coverage. And you get travel and emergency assistance services.

But REMEMBER: the ongoing APR is 24.74% variable APR. And the penalty APR is even higher, 31.15%. Also, there is no sign-up bonus.

Get it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

Capital One® Spark® Miles for Business

Be sure to check out the Capital One® Spark® Miles for Business card. With this card, you can get 2 miles per dollar on all purchases. When you spend $4,500 within the first 3 months of opening an account, you can earn 50,000 miles. So, that is worth $500 in travel.

Benefits for cardholders include an auto rental collision damage waiver, and purchase security. And they also include extended warranty coverage. And you get travel and emergency assistance services.

Cardholders will pay $0 introductory for the first year. But they will pay $95 after that for the annual fee.

There is no 0% APR for purchases or balance transfers with this card. The APR is 18.74% (variable).

Get it here: https://www.capitalone.com/small-business/credit-cards/spark-miles/

Establish business credit fast with our research-backed guide to 12 business credit cards and lines. Get the best gas cards for small business and more!

Chase Sapphire Preferred® Card

Take a look at the Chase Sapphire Preferred® Card for travel points.

You can get two points per dollar spent on travel and dining at restaurants. And you can earn one point per dollar on all other purchases. Points can be traded in for cash back, gift cards, or travel.

The card’s benefits include trip cancellation insurance, travel and emergency assistance services. They also include an auto rental collision damage waiver, purchase protection and extended warranty protection.

When you spend $4,000 in the initial 3 months from account opening, you will get 50,000 bonus points. These points are worth $625 if you redeem them for travel through Chase Ultimate Rewards.

Details

You can get an unlimited two points per dollar for travel and dining at restaurants. And then earn one point per dollar for all other purchases. Points will transfer equally to 13 leading frequent travel programs with partners. So these include British Airways, Southwest Airlines, United, and Marriott.

There is no 0% introductory APR on purchases or balance transfers. The card’s standard APR is 17.74 – 24.74% variable. Also, the card has an annual fee of $0 introductory for the first year. And then it skyrockets to $95.

Get it here: https://creditcards.chase.com/rewards-credit-cards/chase-sapphire-preferred

Hilton Honors American Express Ascend Card

Have a look at the Hilton Honors American Express Ascend Card, which earns hotel rewards points. Earn up to 12 points per dollar of eligible purchases at participating Hilton hotels or resorts.

Automatically get Hilton Honors Gold status. And this includes room upgrades when available, a 5th night free when you book a rewards stay of 5 nights or more.

And get free internet access and late checkout. It also includes a 25% bonus on base points earned with Hilton Honors.

This credit card has a variable purchase APR of 17.74 – 26.74%. There is an annual fee of $95.

Details

Cardholders can earn a 125,000-point welcome offer after making $2,000 in eligible purchases in 3 months from account opening. Earn a free weekend night award after making $15,000 in eligible purchases on your card in a calendar year.

Benefits include purchase protection. And there is extended warranty coverage. They also include car rental loss and damage insurance and travel accident insurance.

If you spend $40,000 on eligible purchases with the card in a calendar year, you can earn Hilton Honors Diamond status through the end of the next calendar year. This status includes all of the benefits of Gold status.

It also includes a 50% bonus on base points earned with Hilton Honors and exclusive floor lounge access at select properties. But that is terribly high spending required for elite status. Only you can decide if that’s worth it.

Get it here: https://www.americanexpress.com/us/credit-cards/card/hilton-honors-ascend/

Ink Business Preferred ℠ Credit Card

Get a look at the Ink Business Preferred Credit Card from Chase. Cardholders earn 3 points for every dollar spent on travel, shipping, internet, cable, phone and qualifying advertising with the card. So, this is up to $150,000 each year. And all other purchases earn an unlimited one point per dollar spent.

This is a Visa card.

Cardholders get benefits like purchase protection, trip cancellation or interruption insurance. They also get cellphone protection. And they get extended warranty coverage. And they get an auto rental collision damage waiver.

Details

Earn 80,000 bonus points when you spend $5,000 in the initial 3 months from account opening. There is an annual fee of $95. You can add employee cards at no additional cost.

This credit card only offers 3 points per dollar to a limit of $150,000 a year. So, this is for travel, shipping, internet, cable, phone and qualifying advertising. All other purchases get an unlimited flat rate of one point per dollar. And there is no introductory APR

Get it here: https://creditcards.chase.com/small-business-credit-cards/ink-business-preferred

Establish business credit fast with our research-backed guide to 12 business credit cards and lines. Get the best gas cards for small business and more!

United MileagePlus Explorer Business Card

Get a good look at the United MileagePlus Explorer Business Card.

Earn 2 miles/dollar with United and at restaurants, filling stations and office supply stores. All other purchases earn 1 mile/dollar. Earn a 50,000-mile sign-up bonus after spending $3,000 in the initial three months from account opening.

Benefits include priority boarding, a free first checked bag for you and a companion on the same reservation.

Details

Also, get two United Club passes annually. And get hotel and resort perks including upgrades. In addition, get early check-in and late checkout. And get an auto rental collision damage waiver.

Also, get baggage delay insurance, lost luggage reimbursement, trip cancellation and interruption insurance. Finally, get trip delay reimbursement, purchase protection, price protection and concierge service.

After the first year, the card has an annual fee of $95. APR of 17.99% – 24.99%, based on creditworthiness.

Get it here: https://creditcards.chase.com/small-business-credit-cards/united-mileageplus-explorer-business

Gas Cards for Small Businesses: Check Out This Card Offering Perks for Buying Gas and Car Rental Waivers

Ink Business Cash℠ Credit Card

Take a look at the Ink Business Cash ℠ Credit Card. Small businesses can earn cash back with every purchase. Spend $3,000 in the first three months from account opening. And you’ll earn a $500 bonus cash back.

There is a $0 annual fee with a 0% introductory APR for 12 months on purchases and balance transfers. Thereafter, the APR is a 15.24 – 21.24% variable.

The credit card features travel and purchase coverage benefits. So, this includes an auto rental collision damage waiver and extended warranty protection.

Details

Earn bonus cash back on business categories. So, these include office supply stores, telecommunications, gas stations and restaurants.

Note: this credit card has a balance transfer fee. Pay 5% of the amount transferred or $5, whichever is more. Also, there is a foreign transaction fee of 3%.

Get it here: https://creditcards.chase.com/small-business-credit-cards/ink-cash

We also found a great ride-sharing service card, for those times when someone will be doing the driving.

Gas Cards for Small Business: Also Check Out this Business Credit Card for Ride-Sharing

Uber Visa Card

Check out the Uber Visa Card. Uber is the first ride-sharing service to offer a credit card, in a partnership with Visa and Barclays.

The card provides 4% back per dollar spent at restaurants, takeout and bars, including UberEATS. Also, earn 3% back on hotel, airfare and vacation home rentals. And get 2% back on online purchases.

So, this includes retailers and subscription services such as Uber and Netflix. And earn 1% back on all other purchases. Each percent/point has a value of 1 cent. Redeem points for cash back, gift cards or Uber credits directly within the app.

By spending a minimum of $500 in the first 90 days, users can earn a $100 sign-up bonus. Cardholders spending a minimum of $5,000 yearly are eligible to receive a $50 credit toward online subscription services.

Details

If you pay your cellphone bill with this card, you are insured up to $600 for cellphone damage or theft.

Cardholders are eligible for exclusive access to certain events and offers. Uber anticipates most of these offers to be available in major cities like New York, San Francisco, Los Angeles, Chicago and DC. There is no foreign transaction fee.

But there is no introductory rate. The APR is a variable 16.99%, 22.74% or 25.74%, based on your creditworthiness. Cardholders with less than stellar credit will be on the higher end of the range.

Also, there are restrictions on Uber credits. To redeem points as credits in the Uber app, accumulate a minimum of 500 points, or $5. Cardholders can convert a maximum of 50,000 points, or $500, in a given day.

Get it here: https://www.uber.com/c/uber-credit-card/

The Best Gas Cards for Small Business for You

Your outright best gas cards for small business will hinge on your credit history and scores.

Only you can pick which features you want and need. So make sure to do your homework. What is outstanding for you could be catastrophic for another person.

And, as always, make certain to establish credit in the recommended order for the best, quickest benefits.

The post Get Gas Cards for Small Business Now appeared first on Credit Suite.