Article URL: https://www.notion.so/opvia/Opvia-Roles-151305ed30a140f29ec9eb7df00deadc Comments URL: https://news.ycombinator.com/item?id=31444213 Points: 1 # Comments: 0 The post Opvia (YC S20) Is Hiring in London, UK first appeared on Online Web Store Site.

Author: Kevin Sibley

New comment by tennguye95 in "Ask HN: Who wants to be hired? (April 2022)"

Location: Santa Ana, CA (willing to relocate)

Remote: Yes

Willing to relocate: Yes

Technologies: JavaScript, React, NodeJs, Express, MongoDB, GraphSQL, Docker, Python, AWS

Resume: https://drive.google.com/file/d/1bzyvYfAfSl1Fnd3EEJJohmL8Q_M…

Email: tennguye95@gmail.com

Linkedin: https://www.linkedin.com/in/tuan-nguyen-75774a146/

UM to wear jersey patch honoring Oxford victims

Michigan will wear a special patch in the Big Ten title game on Saturday to honor the four Oxford High School students who were killed in this week’s shooting. The post UM to wear jersey patch honoring Oxford victims appeared first on Buy It At A Bargain – Deals And Reviews.

The Great Resignation, Business Credit and Financing, and You

The Great Resignation: a Definition and an Explanation

Everywhere you look in the news, it seems to be there. It’s on TV and social media, and your friends may be talking about it. It’s the Great Resignation. It has caused people to start businesses and has disrupted our economy.

But…what is it?

The Great Resignation is the confluence of several different events, all happening at the same time. People are leaving their jobs in droves. As in, 20 million US workers between April and August of 2021.

Causes of the Great Resignation

The Pandemic

First is of course the pandemic. The sudden removal of over 700,000 Americans from our society was bound to create problems. A little under 190,000 of these deaths were among people aged 18 – 65. Even if not everyone could work, that leaves at least 150,000 people out of the workforce, due to dying from Covid-19.

This doesn’t account for those with ‘long Covid’. In the UK (US percentages should be similar), the percentage of people of working age to get long Covid runs about 1 – 2%. Over 48.5 million cases in the US translates to about half a million people of working age with long Covid in the US. Some of them may be considered disabled or have taken early retirement.

As a result, there are job openings.

But what about everyone and everything else pertaining to the Great Resignation?

Depressed Wages

Since the 1970s, wages have been depressed in the US, often not keeping up with inflation. This is particularly true in the service industry.

In contrast, during the worst of the lockdowns, the only employees who could not work from home were in the service industry.

There are some employers who have realized they can’t hire enough people back until they raise wages and improve perks (which is likely to be fueling inflation). Others don’t seem to have gotten the memo yet. Hence there are workers who would have taken those jobs not two years ago. But now? With an ever-present concern about Covid-19 and perhaps a feeling that wage hikes are only temporary, those jobs are going unfilled.

Politics, Ill Treatment, and Being Fed Up

As the disease, vaccines, and mask wearing all became more politicized, businesses were forced to police mask usage in their stores. This policing often fell to the lowest paid workers, in jobs like cashiers. With irate, sometimes violent customers, many workers felt they were being asked to put their own personal safety on the line. But with no added compensation.

In the medical field, there has been a nursing shortage for years, and it is projected to continue into 2030. With hospitals overloaded with Covid patients, anti-vax patients denying their symptoms, and again the threat of violence, many nurses have decided to throw in the towel. This has made the nursing shortage worse, and it has also affected Covid care.

Trillions of Dollars in Aid Programs

The prior and current presidents introduced programs like stimulus checks. This was with the best of intentions. They have led to many in the middle class beefing up their savings. Another big use for these checks has been paying down personal debt. This is from credit cards, car loans, and/or mortgages.

People with some discretionary money may end up being more choosy about employment. Not being desperate provides an opportunity to strive for longer term goals and more money.

Gen X and Younger Boomers Lead the Way in the Great Resignation

Surprised? It seems like quitting your job is a very millennial thing to do. Yet the Harvard Business Review said, “Employees between 30 and 45 years old have had the greatest increase in resignation rates, with an average increase of more than 20% between 2020 and 2021.” Employees with some work experience under their belts are more likely to be part of the Great Resignation.

But What Does The Great Resignation Have to do With Business Financing and Business Credit?

Quitting your job or being laid off can sustain you for just so long. For many Americans, time off and the ready availability of accessible technology led them to start a new business. A good 4.4 million new businesses were started in 2020, and half a million new businesses in January 2021 alone.

As these new businesses have aged, stimulus money has dried up, and the boost in savings is gone for their owners. These business owners—and you may be among them—have been looking for new ways to get money.

And if they (or you) have turned to banks, then there’s a good chance that they’ve gotten a denial.

New business owners are less likely to know about business credit, and how it can get them funding. And they may not be aware of the many alternatives to traditional lending that are out there. Because banks aren’t the only places to get business money.

Business Credit and the Great Resignation

Business credit is credit in the name of a business. It attaches to the business’s EIN (Employer Identification Number), not the owner’s Social Security Number. As a result, business credit relies on the ability of the business to pay its bills—period. A business owner can have poor personal credit yet have excellent business credit.

Building business credit is a great way to transition from bootstrapping to getting a company to fund itself.

Fundability

Fundability is the ability of a business to get funding. Building business credit starts with building what’s called a fundable foundation. Your business can look legit to credit providers and lenders—or not so legitimate. There are proactive steps you can take to improve fundability, even if you haven’t done these before.

Start to Build a Fundable Foundation (Your Business Name, NAICS and SIC Codes, and Your Business Entity)

Fundability starts with your business name. If your business name includes the name of a high-risk industry, this could tank any funding application from the start. Frank’s Gas Station can instead be called Frank’s.

NAICS and SIC codes exist to show lenders, credit providers, and the IRS how risky your business is. If your business can fit under more than one NAICS code, then pick the one which is less risky. There’s nothing unusual or underhanded about this.

Your business entity is sole proprietorship, partnership, corporation, and the like. To build business credit right, incorporate your business. This is because incorporating creates an entity separate from you, the owner. It adds a layer of protection over your personal assets when it comes to corporate debts and corporate wrongdoing. Plus, to build credit in the name of your business, it won’t separate from your own credit history if you and your business are still joined at the hip.

Enhance Fundability With an Excellent Online Presence (Your Website and Email Address)

Lenders and credit providers will look for information on your business online. With your own website, you can control a lot of the narrative. Without one, you’re at the mercy of whatever they can Google—which may not be too flattering.

Putting some of your earlier profits into a website is a smart business decision. It does more than improve fundability. It also makes your business more attractive to customers and prospects.

Purchasing your own domain name is the highest standard for fundability. Very often hosting providers will kick in a free email address on the same domain. Keep it professional with a name like info@yourbusinessname.com.

Grow Fundability With a Professional Offline Presence (Your Business Address and Phone Number)

Business lenders and credit providers also pay attention to your offline presence. Your business address needs to be a brick and mortar building where mail can be delivered—so a PO box or a UPS box is out. Technically, it can still be your home. But you may want to get a virtual address for job interviews or meetings. And if you are a retail business, you are going to need a separate address.

Your business phone number needs to be different from your personal phone number. This is because the listing for your personal phone number is you or your family. A separate, dedicated phone number is far more fundable. And it prevents your family from accidentally picking up on sales calls.

Protect Fundability By Following the Rules (Your Business Licenses and Getting a D-U-N-S Number)

Many industries require some form of licensing. Make sure you have all the licenses your business needs by checking with your Secretary of State. Being fully licensed can also be a way to assure customers and prospects.

Many industries require some form of licensing. Make sure you have all the licenses your business needs by checking with your Secretary of State. Being fully licensed can also be a way to assure customers and prospects.

D-U-N-S numbers are the way your business is identified in the system of the world’s largest business credit bureau, Dun & Bradstreet. D&B will give you a D-U-N-S number for free once you sign up for one on their website. You need a D-U-N-S to start to build business credit.

Go to the Next Level of Fundability (Get a Separate Business Bank Account and Get Set Up With the Business Credit Reporting Agencies)

A separate business bank account helps keep you from commingling funds. This increases the chances that your business is in compliance with all IRS requirements. You also need a separate business bank account to open a merchant account. A merchant account allows your business to take credit cards. Study upon study has shown that people spend more if they can pay by credit card.

You also need to get set up with the business credit reporting agencies. If you have your D-U-N-S already, then you’re set up with Dun & Bradstreet. Check the Experian and Equifax websites for a listing for your business.

Building Business Credit

Business credit building means buying on credit from vendors. Pay your bills on time and have the payments report to the business credit bureaus. Almost no vendors report positive payment experiences. So, it pays to work with a business credit specialist like Credit Suite.

If you are part of the Great Resignation and have a new business, business credit makes your business more attractive to funding sources.

Business Financing and the Great Resignation

Banks are not the only place to get business financing. When you are getting money for your business, you must leverage one or more of the following:

- Personal credit

- Collateral

- Cash flow

- Your time and attention

- Equity in your business

- Or business credit

Personal Credit

Your personal credit scores are dependent upon a few factors. One is credit utilization, which is the amount of credit in use divided by total available credit. Once this percentage gets high (above 30%), it starts to harm your personal credit score.

Business needs tend to be more expensive than personal needs. Business credit limits reflect that. Hence you can exceed that 30% fast by financing your business with personal credit. You might even max out your personal credit cards.

Collateral

Another way to get business financing is by leveraging collateral. For real estate transactions, that can be land. For equipment financing, it can be the equipment. And for other types of lending, it can even be your retirement funds.

Cash Flow

New businesses tend to have erratic cash flow, and so they aren’t likely to be able to leverage theirs. But once your cash flow becomes more predictable, you can use it as a way to get business money.

Your Time and Attention

With crowdfunding and grant proposals, you don’t have to give the money back. But you do have to spend time trying to get it—often with a low success rate.

Equity in Your Business

Business equity is a share in your business. You can sell yours to venture capitalists (if they’re interested), or to angel investors. This gets you business money in the short run. But in the long run, you’ll be sharing decisions and profits with anyone who owns equity.

Business Credit

Only business credit lets you keep all your equity. You don’t have to spend so much of your valuable time. And your cash flow doesn’t have to be stable yet. Plus, you won’t max out your personal credit cards and tank your utilization rate. And finally, it can help you avoid putting collateral on the line, or even enhance what you can get with the collateral you have.

The Great Resignation, Business Credit, and You: Takeaways

If yours is one of the over four million new small businesses that arose during the pandemic, you have options for business financing. Building business credit can help you succeed, and turn your part of the Great Resignation into a great new direction in life.

The post The Great Resignation, Business Credit and Financing, and You appeared first on Credit Suite.

Shopscribe (YC S21) Is Hiring a Full Stack Hacker

Article URL: https://www.ycombinator.com/companies/shopscribe/jobs/Ym3v6k1-full-stack-software-engineer

Comments URL: https://news.ycombinator.com/item?id=28783096

Points: 1

# Comments: 0

In Just a Few Minutes of Your Time, Learn All About Avoiding Risky NAICS Codes

What are NAICS Codes?

And how can they affect if you can get funding? We tell you all about NAICS Codes. They could be the difference between getting business money or not getting any money.

NAICS Codes: Some Background

Federal statistical agencies use the North American Industry Classification System (NAICS) . The idea is to classify business establishments. This is to collect, analyze, and publish statistical data, related to the U.S. business economy.

The NAICS was developed under the auspices of the Office of Management and Budget (OMB). Its adoption was in 1997. The intention is to replace the Standard Industrial Classification (SIC) system. The U.S. Economic Classification Policy Committee (ECPC) developed it with Statistics Canada and Mexico’s Instituto Nacional de Estadistica y Geografia. The intent was to make business stats easy to compare among North American countries.

What is the NAICS Structure and How Many Digits are in an NAICS Code?

NAICS is a 2- through 6-digit hierarchical classification system. It offers five levels of detail. Each digit in the code is part of a series of progressively narrower categories. The more digits in the code, the more classification detail.

Details on NAICS Code Structure

The first two digits are the economic sector. The third digit designates the subsector. And the fourth digit designates the industry group. The fifth digit designates the NAICS industry. The sixth digit designates the national industry.

A 5-digit NAICS code is comparable in code and definitions for most of the NAICS sectors. This is across the three countries participating in NAICS. They are the United States, Canada, and Mexico. The 6-digit level lets the U.S., Canada, and Mexico all have country-specific detail. A complete and valid NAICS code has six digits.

Codes and Industries

NAICS industry codes define businesses based on the primary activities they engage in. Recently, the NAICS changed many of its codes as it updated its philosophy. It no longer sets aside online businesses. Now the NAICS no longer distinguishes businesses by how they deliver goods or services.

High Risk NAICS Codes

There is an older NAICS list of high-risk and high-cash industries. Higher risk industries on the list include casinos, pawn shops, and liquor stores. But it also included automotive dealers and restaurants. But this list is from 2014 and does not appear to have ever gotten any updating.

Per the NAICS, various professionals in the banking industry compiled the list. The idea was to use it as a working guide. But it is not an officially sanctioned list. They do not guarantee the accuracy of this list.

Codes and Risk

When considering any aspects of a business, risk must be a major factor. There are inherent issues in every single industry. But some businesses are considered to be risky by their very nature. This is the case even if everything else goes off like a hitch and the business is prospering. Risk is inherent within these business types. Even if your business doesn’t feel risky, it could be anyway.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Why Risk Matters

The biggest reason why risk matters has to do with funding. There are several industries where lending institutions are hesitant to do business. In those particular cases, there are stricter underwriting guidelines. But at least a company can get funding.

In some industries, no funding is available at all. As a result, those businesses will need to find other solutions for financing. These solutions can include:

- Crowdfunding

- Angel investors

- Venture capital

- Business credit building and more

Still, a lot of businesses would rather work with lenders. But where are lenders’ ideas of the degree of risk coming from? One clue comes from the CDC.

Real Injury Risks According to the CDC

The Centers for Disease Control looks at risks in small businesses. Part of the calculation of risk comes from occupational injuries. But the other side of the risk coin is occupations which are high in cash transactions. After all, a pawn shop might not have much of a specific risk of injury at all. But the large amounts of cash normally associated with one mean it can be a tempting target for thieves.

A Look at Some Restricted Industries

These industries (among many others) can get an automatic decline:

- Ammunition or weapons manufacturing; wholesale and retail

- Energy, oil trading, or petroleum extraction or production

- Gaming or gambling activities

- Loans for the speculative purchases of securities or goods

- Political campaigns, candidates, or committees

- Public administration

- City, county, state, and federal governmental agencies

- X-rated products or entertainment

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

A Look at Some High-Risk Industries

These industries (among many others) can be subject to stricter underwriting guidelines:

- Auto, RV or boat sales

- Computer and software related services including programming

- Dry cleaners

- Gas stations or convenience stores

- Limousine services

- Long distance or “over-the-road” trucking

- Mobile or manufactured home sales

- Phone sales and direct selling establishments

- Real estate agents/brokers

- Real estate developers or land sub-dividers

- Restaurants or drinking establishments

- Taxi cabs

- This includes buying cab medallions

- Travel agencies

A Look at Some High-Risk NAICS Codes

According to the older list, the following codes are among those considered to be high risk:

- 445310 – Beer, Wine, and Liquor Stores

- 424940 – Tobacco and Tobacco Product Merchant Wholesalers

- 811113 – Automotive Transmission Repair

How do you choose a better code?

Using a Different NAICS Code

Of course you want to be 100% honest when it comes to selecting your NAICS code. But if more than one can apply, you don’t have to choose the one that’s higher risk. So it pays to check and be careful when making your selection.

Also, if only high risk codes apply, there’s nothing wrong with changing your business. Then you may be able to match a related but lower risk code. There is nothing underhanded or dishonest about doing this.

An Example of How to Switch an NAICS Code

Let’s say your business is automotive transmission repair (NAICS Code 811113). We know this is a high risk code. But 811191 is not on the NAICS list. It covers Automotive Oil Change and Lubrication Shops. So why not offer oil changes and use the lower risk code? It could be the difference between getting funding, or not.

Which Agencies Use NAICS Codes?

The Internal Revenue Service will use the NAICS code you select. This is to see if your business tax returns are comparable to other businesses in your industry. If your deductions do not reasonably resemble other businesses in your industry, your business could be subject to an audit.

The IRS may label some companies as high-risk when they do not choose the right NAICS code. But if you know how the system works, then you can choose the correct code on your first try.

Learn more here and get started with building business credit with your company’s EIN and not your SSN.

Which Agencies Other Than the IRS Use These Codes?

Lenders, banks, insurance companies, and business CRAs all use codes. They tend to use both NAICS and SIC Codes. SIC Codes are the older business classification system. D&B uses both SIC and NAICS Codes.

OSHA uses NAICS Codes for industry identification in its data. These agencies use them to determine if your business is in a high-risk industry. So you could get a loan or business credit card denial based on your business classification. Some SIC codes in particular can trigger automatic turn-downs. You could end up paying higher premiums, and get reduced credit limits for your business.

There Are No Guarantees in Life

Will a better NAICS code guarantee funding for your business venture? Of course it won’t. But at least your business will not be automatically turned down before you can make a case for funding.

NAICS Codes: Takeaways

Industries are defined by codes from the North American Industry Classification System. Codes go up to six digits for the most granular information. Some codes are always associated with high risk. This makes it harder to get business funding. So if more than one NAICS code can apply to your business, pick the one that’s less risky.

The post In Just a Few Minutes of Your Time, Learn All About Avoiding Risky NAICS Codes appeared first on Credit Suite.

How to Use Wolfram Alpha for Marketing Research

Are you searching for new ways to make sense of the marketing data you’ve been aggregating?

With the continuous growth in artificial intelligence (AI) and the ever-collecting stores of data, there’s a better way to view and use existing marketing data.

While many online tools promise functionality to allow users to see data in a whole new way, search engine Wolfram Alpha actually delivers.

Through a combination of AI, algorithms, and an extensive knowledge base, this unique engine can provide marketers with valuable data points, as well as answers to complex computational queries.

Interested?

You should be.

In this post, we’ll explore Wolfram Alpha offerings and break down five ways the search engine can best benefit data-minded marketers.

What Is Wolfram Alpha?

Wolfram Alpha self identifies as an answers engine.

While the term engine may conjure images of Google’s search results, Wolfram Alpha wasn’t created to compete with Google—in fact, it has highly different functionality than the search giant.

Launched in 2009, the engine serves up lists and tables, providing users with specific, numeric-based answers to their questions. Given this emphasis on numbers and data, this engine isn’t necessarily for purchase-minded searchers; rather, it’s a data-driven engine that can provide insights.

Wolfram Alpha works through harnessing the extensive stores of collected expert-level data and algorithms to answer questions, conduct analyses, and build reports.

Versatile in its usability, this search engine can be used by students to solve equations just as easily as it can help you find nutritional information about M&Ms.

While you may not care about the caloric values associated with M&Ms, you should care about how these incredible data stores can benefit marketers.

While the free version of this engine is filled with useful actions, Wolfram Alpha Pro users can also upload data, get custom visuals for presentation, and access unique web apps.

Below, we break down the five top ways marketers can benefit from the unique tool that is Wolfram Alpha.

5 Ways to Use Wolfram Alpha for Marketing Research

While some marketers may love a deep data dive, some may detest it. Regardless of which camp you belong in, Wolfram Alpha can take the guesswork out of data analysis for you.

What’s more, the engine removes the guesswork from data points, providing more reliable figures than other sources.

Below are the five best ways Wolfram Alpha can help you optimize your marketing campaigns.

1. Upload Files for Automatic Analysis and Computation

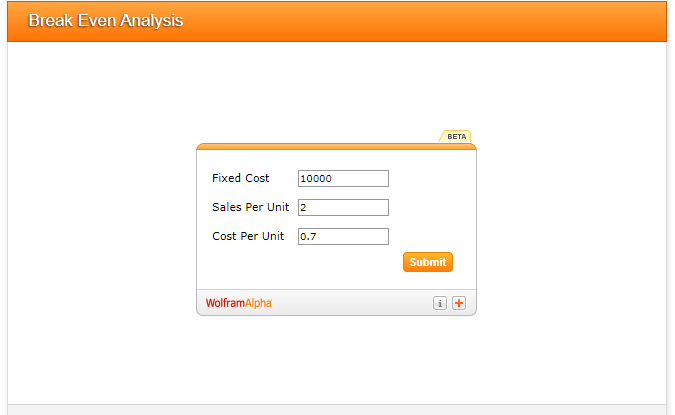

Whether you’re tracking the success of your content, the performance of your social channels, or break-even analysis, aggregating all of your marketing data can be difficult.

With the Wolfram Alpha engine, the heavy lifting is done for you, letting you focus on other aspects of your marketing plan.

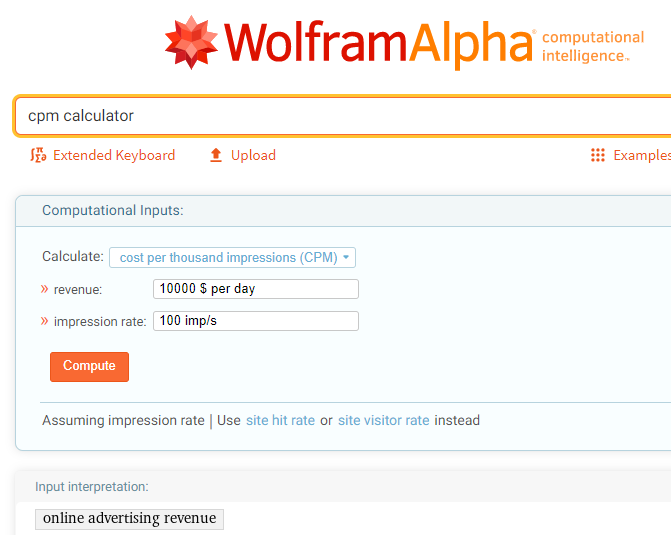

Check out this simple tool for calculating cost per thousand impressions (CPM):

A breeze, right?

In addition to the engine’s standard calculators, you can select from hundreds of existing widgets from the Widget Gallery that come with a simple embed code that you can easily copy and paste.

These widgets operate as shortcuts for your most-used formulas or can be built into your site.

Regardless of the computations you seek, Wolfram Alpha can complete simple to complex equations, making your job that much easier.

2. Research Keywords

As you most likely know, keyword research refers to the process of finding and analyzing terms individuals enter into search engines. This process lets marketers discover which terms to target to reach their ideal audience.

After you’ve identified the most important topics that relate to your audience and identified the related keywords, it’s time to dive deeper.

While you can certainly turn to Google’s “searches related to…” list that manifests at the bottom of your query page, you can also look to Wolfram Alpha to help you get creative about related terms that your audience may be searching.

Wolfram Alpha offers information about words that can be of particular interest to marketers. The two that top our list include word frequency and the thesaurus function:

- Word frequency: This tool enables searchers to learn the historical usage of a word, tracking its ebbs and flows in popularity over time. This can benefit your keyword research, as it speaks toward a word’s popularity (or lack thereof) and can be a strong indicator of search volume.

- Thesaurus: This feature not only allows users to search term synonyms but to either narrow or expand that search through hypernyms or hyponyms. Beneficial to marketers in its broadening and narrowing capacity, Wolfram Alpha helps you discover related terms you may have otherwise bypassed.

3. Visualize Data

While data for data’s sake is one thing, taking data and turning it into something consumable for your company or client takes data utility to the next level.

Wolfram Alpha doesn’t just compute metrics; it can chart them too.

Do you have some marketing results you want to see charted over time, with the ebbs and flows of success reflected in an easily consumable manner?

Plotting functions with Wolfram Alpha is super easy: Simply enter the particular function you want to graph and let the engine do the rest for you. The number and type of graphs that Wolfram Alpha can build are seemingly endless.

If you find yourself overwhelmed, here are three standard graph types Wolfram Alpha can help you build that are incredibly effective or digital marketers:

- Stacked charts: These can help demonstrate cumulative composition throughout a time span, such as leads from marketing channels.

- Pie charts: They are incredibly versatile and can help demonstrate everything from budget allotment to the percentage of users using respective social media channels.

- Distribution graphs: These allow marketers to show a single variable with a multitude of distribution points.

4. Use Localization

Perhaps you’re interested in doing some out-of-home advertising for your latest campaign. You want to be sure that the population in the area you’ve identified as a potential site aligns with your audience.

You could turn to Google, but you should turn to Wolfram Alpha.

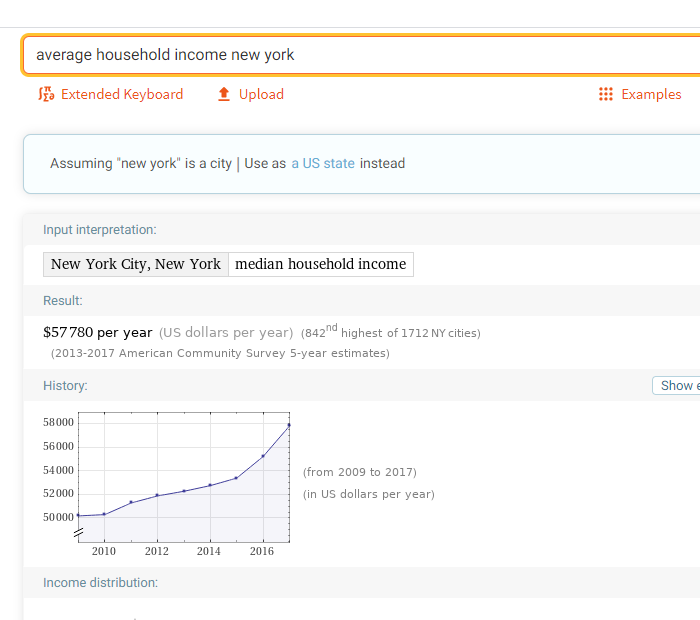

While Google can serve up different results to queries depending on where you’re physically standing, it can’t make every site it aggregates data from do the same. Wolfram Alpha, however, does not rely on other sites for its wealth of data, which makes the engine’s localization analysis more accurate to your query.

Let’s return to the out-of-home advertising example: Imagine you want to know the per capita income per a specific area to know if your product will work within the parameters of the population’s budget.

While Google will give you pretty decent results, Wolfram Alpha will provide you with more precise ones with accompanying information (like currency) reflecting your current location.

5. Compare Data

With the advertising revenue function of Wolfram Alpha, you can determine the projected outcomes of your advertising campaigns, as well as all the associated metrics.

Okay, maybe not that impressive. However, you can also compare campaigns to one another, identifying areas for improvement and relative and collective successes and failures.

The search engine’s comparison function doesn’t end here.

While on traditional search engines like Google and Bing, you’d be hard-pressed to find a sales tax comparison for three United States cities, but Wolfram Alpha serves up this data quickly and easily.

In addition, if you’re in need of a comparison between two data sets, Google has to have a relevant site indexed to provide that information, or you have to manually compare the sets. With Wolfram Alpha, you can compare multiple data sets for results. The engine also generates graphs, historical data comparisons, ratios, and tables.

If we continue with our ongoing out-of-home advertising example, you can compare regional information regarding population age, income, and various other helpful demographics that allow you to make informed decisions about areas for potential advertising.

How to Use Wolfram Alpha for Marketing Research

Regardless of what data points you’re searching for, the Wolfram Alpha answers engine has an algorithm for you. What’s more, savvy marketers can harness its incomparable data stores to dig deep into metrics, conducting better research for better results. Areas that can benefit marketers include:

- Uploading files for automatic analysis and computation:

With Wolfram Alpha’s insane computational ability, you can input almost any equation and gain instantaneous results.

- Researching keywords:

Tired of your go-to keyword research tools? This engine can help you dive deeper into your understanding of which words resonate with your audience.

- Visualizing data:

Pie chart? Scatter plot? Wolfram Alpha can help you see and present your marketing data in new, simple ways.

- Using localization:

Get better data about your consumers from Wolfram Alpha’s deep data stores. What’s more? The engine automatically translates that information into the most relevant representation of your location.

- Comparing data:

With Wolfram Alpha, you can compare almost anything through the engine’s deep data stores. Compare locations, audiences, and outcomes for improved marketing success for all your campaigns.

Wolfram Alpha for Marketing Research Conclusion

While Wolfram Alpha isn’t a traditional search engine that will send marketers scurrying to rank on its pages, the engine can still provide marketers and individuals alike with a plethora of knowledge that can help drive your next digital campaign.

As you explore the inner workings and functionalities of Wolfram Alpha, be sure to keep an eye on how the engine can help you dive deeper into data that will allow you to understand your audience, deliver effective presentations, or simply conduct better research.

As the platform continues to evolve, keep an eye on the blog to learn about the new advances and offerings the platform is creating that can help you harness the power of data to supercharge your next campaign.

What’s the most effective way you’ve used Wolfram Alpha for marketing research?

Podcast Discovery 101: How to Find Podcasts Easily

The growth in podcasts is significant for listeners looking for a show that appeals to their individual interests. Plus, it’s great for marketers and business owners looking for new platforms to advertise on and new audiences to reach.

While you won’t find any lack of podcasts, the sheer volume out there makes it time-consuming to slim down your choices and find appealing podcasts.

In this guide, we explore both how to find podcasts as well as how to get your own podcast discovered.

How to Find Podcasts That Interest You

If you’re overwhelmed by the number of podcasts out there, it’s not surprising. How many podcasts are there exactly? The latest research shows there are over 47 million episodes available, and the number is growing.

As an article on Pacific Content states, there are “Too many podcasts. Not enough time.”

Keeping up with new episodes and freshly-launched podcasts are tough enough, and that’s before finding time to read the backlog of podcasts we’ve got lined up.

Even if we don’t listen to a podcast, 75 percent of U.S. adults are at least aware of them, and with mobile devices, I think it’s safe to assume this number will keep growing.

With so many podcasts available, how do you find the ones you want to listen to?

1: How to Find Podcasts by Performing a Discovery Google Search

The quickest and easiest way to find podcasts is Google. Just choose your niche, and type in “business podcasts,” “health podcasts,” “relationship podcasts,” or whichever topic interests you the most. Google isn’t your only choice, though.

2: How to Find Podcasts Using the Search Bar in the Main Podcast Host Sites

There’s no shortage of podcast hosting sites. With a quick search on Google, you’ll find:

- Buzzsprout

- Podbean

- Anchor

- Riverside

- Spreaker

There isn’t space to talk you through all of them, so I’ll use Spreaker as an example.

On Spreaker, go to the “listen” option at the top of the page and click. You’ll then get a list of subheads, including “staff picks,” ”crime,” and “featured,” where you’ll find plenty of podcasts to browse through.

3: How to Find Podcasts Using New and Emerging Podcast Discovery Tools

Regular podcast listeners may well be familiar with some of the newer discovery tools. These tools take the effort out of finding podcasts.

Below, I will outline some of the most prominent tools, explain how to use them, their advantages, and their main features, starting with Listen Notes.

Listen Notes

If you’re trying to find a podcast, Listen Notes calls itself “the best podcast search engine,” but it does a lot more than purely serve as a discovery tool.

To give you a better idea, you could:

- spot cross-promotion opportunities with other podcasters and use them for networking

- build podcast apps with Listen Notes API

- find information about topics for content ideas

The site is packed with features, too:

- “listen later,” where you create your playlists

- a “submit your podcast” option

- a discover tab for finding new podcasts

- the podcast academy, which provides tutorials and articles

- hot, best, curated, and “find similar podcasts” search functions

- classified ads, where you’ll find guest spots and cross-promotion opportunities

Listennotes.com takes you straight to the main search engine, so you can just type in “business growth” or “digital marketing,” or whatever interests you. Doing this will bring up a list of podcasts so you can dive in and see which ones appeal to you most.

It’s also worth typing in “trending” to see what’s happening and what’s capturing other users’ imaginations.

Another way to find podcasts is to go to the “discover” link at the top of the page. Here, you’ll find a drop-down list to select from.

Listen Notes is free, but you can sign up for a paid membership to access the “super” search engine and other features.

The site’s main advantages are its ease of use and navigation, and if you’re just looking for podcasts in your niche, you shouldn’t find any real disadvantages.

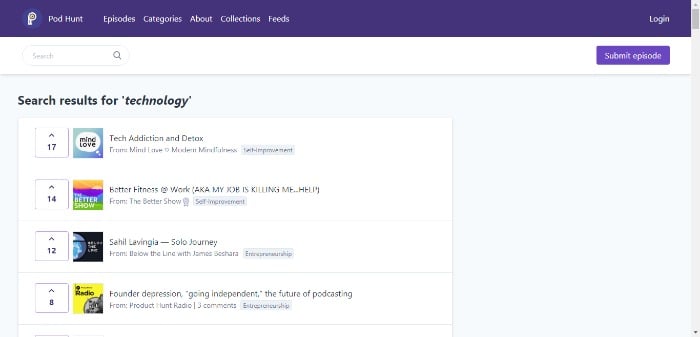

Pod Hunt

Pod Hunt promises “the best podcasts daily.” When you visit the site, you’ll go straight to the main search engine, where you can start your search.

In the example above, the search term is “technolog.” Once you’ve got a list of podcasts, you can click through to whichever one grabs your attention.

Along the top of the page, you’ll also find:

- episodes, for a list of recent episodes

- categories, which show an extensive range of A-Z topics

- collections, where you’ll discover curated podcasts

- feeds, where you can find the top podcast episodes

You can also sign up for the site’s newsletter or submit an episode from the main search engine page.

You might find Pod Hunt is not quite as sophisticated as Listen Notes, and there are fewer features. However, it’s a good site if you want to do a quick search.

Podchaser

Podchaser lets you find podcasts, curated lists, ratings, reviews, and guest appearances. The search page brings up a list of the latest episodes, or you can use the white search box at the top of the page to find podcasts in your preferred niche.

The right side of the page shows you the most popular categories, where you’ll find easy access to business, comedy, true crime, and news podcasts, among others. You’ll also find trending creators with well-known names like Barack Obama, Trevor Noah, and Joe Rogan.

It’s free, but if you want to “supercharge your broadcast planning and outreach,” you can request further details.

There are no apparent drawbacks. It’s a simply structured, easy-to-use search site.

Spreaker

Spreaker is podcast creation software and app. It organizes, curates, and delivers content through live audio feeds, simplifying everything and making it straightforward to find podcasts and import your podcast library.

Spreaker is also favorable to creators by using RSS feeds for direct distribution and monetization. It’s compatible with the iPhone and the iPad, and you just need to download the app to begin.

Its key features include:

- short-form audio highlights, enabling you to find podcasts of interest for you

- a personalized audio feed, which features recommendations

- a live playlist showing you the latest content

- nine categories, including “true crime” and “self-improvement”

The app’s biggest advantages are the time it saves looking for the content you want and how easy it is to find podcasts.

Castro

Castro is another podcast app you can download from the Apple App Store. It provides a single playlist known as the “Queue.”

Through Castro, you can manage large numbers of podcasts and choose whether you want to listen to the podcasts straight away or if you want them sent to your inbox for later.

Main features include:

- enhanced audio options

- push notifications for immediate listening

- customized playback speeds and reduced listening times

- podcast sharing

To use it, just download the app for free, or pay $18.99 a year to unlock advanced features.

Podible

Podible promises “more time listening and less time digging.” Download the free app from the iTunes store, and you’ll find podcasts and discover similar shows.

Other features include:

- listening to classics

- podcast recommendations

- playlist creation

Using the app needs little description: Just install it, and you’ll soon find your way around.

The most significant advantage is the ease of finding podcasts that match your niche, and it gets positive feedback for its user interface.

The recommendations feature needs some work on the downside, and it’s been some time since Podible has updated its social media content.

4: How to Find Podcasts Using Niche Podcast Discovery Apps

Another way to find podcasts is through niche apps. These further refine your search by narrowing it down to niche topics it’s true crime, business, comedy, or tech.

These apps are growing in popularity due to their time-saving abilities. To give you an idea of what’s offered, I’ve highlighted a few below.

Laughable

You’ve probably guessed the Laughable app is the place to go to find comedy shows, but it acts as a gateway to other genres as well. For example, you can discover Oprah’s and Barack Obama’s podcast through the app.

It’s regularly updated, so there’s always fresh podcast content available. Other features worth exploring are:

- curated episodes and download options for offline listening

- finding comedians when they’re hosting or appearing as a guest.

- different playback speeds and the “subscribe” button for listening to actors, musicians, and athletes

Laughable is extremely popular and often rated among the best. Its top feature is the easy search function, where you’ll find podcasts, episodes, and series.

As for negatives, some users would like to see a playlist, and a reviewer felt downloading podcasts was more complicated than necessary.

Pinna

On Pinna, you’ll find a host of resources to keep children entertained. Pinna doesn’t just limit its content to apps. It’s an ad-free service that offers audiobooks and music.

A yearly fee gives you yearlong access to the shows, and Pinna provides a month’s free trial to begin with.

Once you get on the Pinna website, choose the subheading that most interests you and get exploring.

You’ll find shows like:

- Hero Hotel

- The Totally Unauthorized Minecraft Fan Show

- Opal Watson: Private Eye

Click on whichever show grabs your attention or your child’s imagination, and sign up for the free trial to start listening.

They have various categories of content for different age groups, where you’ll find:

- bedtime stories

- car trip stories

- play along with content

- learning content

Leela Kids

Leela Kids searches the internet for audio content suitable for children. You can download the app from the App Store or Google Play, and there are three steps to accessing content:

- Choose the age group and area of interest.

- Check through the results to find suitable content.

- Then, click and listen.

You can also opt into emails to get recommendations a couple of times a month.

Like other niche-specific sites, Leela Kids takes the effort to find podcasts online, and its ease of use is by far its biggest advantage.

How to Get Your Podcast Discovered

Maybe you’re a podcaster trying to get your show discovered, or perhaps you’re just thinking about starting one up, and you want to make it easier for others to find your podcast.

It might seem intimidating if you’re not sure where to start, but don’t worry. These next steps will help you promote your show.

Use keywords: You use SEO to get your other content discovered, and there’s no reason you shouldn’t make your podcasts SEO-friendly as well. You can research keywords with free tools like Ubersuggest, the Ubersuggest Chrome Extension, or Google Keyword planner.

When you’ve got your list of keywords ready, include them in titles and descriptions and add them to podcast directories for organic traffic.

Get social: That doesn’t mean just using prominent platforms like Facebook and Twitter. Instead, take advantage of the networking opportunities you’ll find on podcast directories.

Some directories listed in the article have a networking section so you can build relationships with fellow podcasters and get the word out.

Use your mailing list: Existing marketers have a ready audience thanks to their mailing lists. Share snippets and links in your newsletters and other marketing materials to help them find your podcasts.

Start marketing: Don’t just use your existing customer base. Start marketing to a broader audience. Finding guest post opportunities, issuing press releases when you’re doing something newsworthy, and writing guest blogs for your niche are a few ways you can spread the word.

Repurpose your content: The more places you share your podcast content, the better chance people will find the content you’ve created. For example, you could:

- share part of a transcript in your newsletter with a link to the whole show

- create short YouTube videos or get your podcast listed on apps

- make an infographic or meme to share on social media

Conclusion

Podcasts are growing in popularity, and successful shows like the Marketing School give absorbable content for listeners on the move.

However, the sheer volume of podcasts can sometimes make it hard to find the podcasts you’re searching for, which is where podcast directories and niche apps come in; they simplify your search to make it easier to find podcasts that match your interests. You can use similar methods to get your own podcast discovered.

If you want to advertise on podcasts or make one of your own but aren’t sure how. to get started, reach out to our agency. We can help!

Do you listen to podcasts? How do you find podcasts that capture your attention? Tell us below.

Need Funding? Our Credibly Recession Financing Review Can Save Your Business

Get the Funding Your Business Craves with Our Credibly Recession Financing Review If you’ve been looking for a Credibly recession funding review, then look no further. Credibly is one of several online lending companies. They are actually an emerging Fintech platform. They also provide SBA PPP loans. Credibly can provide small business funding for working … Continue reading Need Funding? Our Credibly Recession Financing Review Can Save Your Business

BaseDash (YC S20) is hiring remote full stack engineers

Article URL: https://www.basedash.com/careers

Comments URL: https://news.ycombinator.com/item?id=24921183

Points: 1

# Comments: 0