Keir Starmer sees Putin clearly, unlike some on the American right. The post British Labour Leader Steps Up on Russia appeared first on #1 seo FOR SMALL BUSINESSES. The post British Labour Leader Steps Up on Russia appeared first on Buy It At A Bargain – Deals And Reviews.

Author: Malcom Martin

Mutual Funds Weekly: These money and investing tips can help you read the market’s signs and stay on your path

These money and investing stories were popular with MarketWatch readers over the past week.

The post Mutual Funds Weekly: These money and investing tips can help you read the market’s signs and stay on your path appeared first on WE TEACH MONEY LIFE SELF DEFENSE WITH FINANCIAL GOALS IN MIND.

The post Mutual Funds Weekly: These money and investing tips can help you read the market’s signs and stay on your path appeared first on Buy It At A Bargain – Deals And Reviews.

How to Use The Facebook Creative Hub

According to a study by HubSpot, over 30 percent of marketers say Facebook Ads provide the highest return on investment.

Struggling to see ROI with your ads? You’re not alone.

It’s tough making a Facebook ad that stands out, appeals to your audience, and converts. Then there are all the different ad formats to consider, making sure your images pass the text checker, writing the copy, getting final creative approval–and that’s all before you set up targeting inside the Ads Manager.

If you’re over throwing money at ads and not seeing your conversion rates improve, Facebook Creative Hub could be the answer to your woes.

The platform is incredibly powerful for finding strategies the top brands are using and implementing them into your creative before you hit publish.

By the time you finish reading this post, you’ll have a solid understanding of:

- What the Facebook Creative Hub is

- Why you need to use it as a marketer

- How to use the Creative Hub and what metrics to track

What Is Facebook Creative Hub?

The Facebook Creative Hub is an incredible feature designed to help you create better Facebook Ads. At its core, it’s an ad mock-up generator making it easy for you to create, test, review, and share ads before you hit “Publish.”

However, Facebook Creative Hub isn’t an average ad mock-up tool.

It’s a powerful way to find inspiration for your next campaign. Browse real-life examples from top brands, filter by ad type, and see their exact strategies for success.

What Value Does the Facebook Creative Hub Provide for Marketers?

As I mentioned earlier, Facebook Creative Hub is so much more than a full rendering of your creativity.

Here are some of the biggest benefits marketers can expect from the Facebook Creative Hub.

Find Inspiration

When Creative Hub first launched, a “Get Inspired” button helped you stumble across successful ad campaigns. Today, the button is long gone, but the inspiration page is still alive and well.

Filter by ad format and select from:

- photo

- video

- carousel

- instant experience

- stories

- Messenger

Filter by a platform such as:

- Messenger

- Audience Network

You can also browse the Featured and Leaderboard sections for even more ad inspiration.

Once you’ve found something you like, click the “Create Mockup” button and start creating!

Create Ad Mock-Ups Like a Pro

Are you a bit intimidated when it comes to creating mock-ups? Or do you feel as a busy marketer, it’s simply a waste of time?

Facebook Creative Hub is here to make the entire process quick and effortless while helping you see more ROI with your Facebook Ads.

Simply click the “Create Mockup” button, and you’ll enter a screen where you can see exactly what the final product of your ad will look like.

By combining your ad inspiration and the editor, you’re setting yourself up to create a powerful Facebook Ad.

Make Sure Your Images Won’t Sink Your Reach

If you’ve created Facebook Ads in the past, you’ll know the platform is strict on which images get approved.

Use something with too many words over your graphic, and your reach will plummet.

Creative Hub lets you run your images through the mock-up editor and its built-in text checker. It will instantly tell you if your image will negatively or positively impact your ad performance.

Share Ad Mock-Up With Your Team

Once you’ve added your images, ad copy, link, and call-to-action, you can generate a link to share with your team.

The link is active for 30 days, and you can use it to get feedback from anyone to see if they’ve got ideas for improvement.

Or, you can use it as a way to share the creative with your client before the ad goes live. The link will show the user exactly how the ad will look in all the different formats, giving clients a clear view of what to expect.

How to Use the Facebook Creative Hub

Ready to start creating your highest converting Facebook Ads yet? Here’s a step-by-step guide on how to create your mock-ups in Creative Hub.

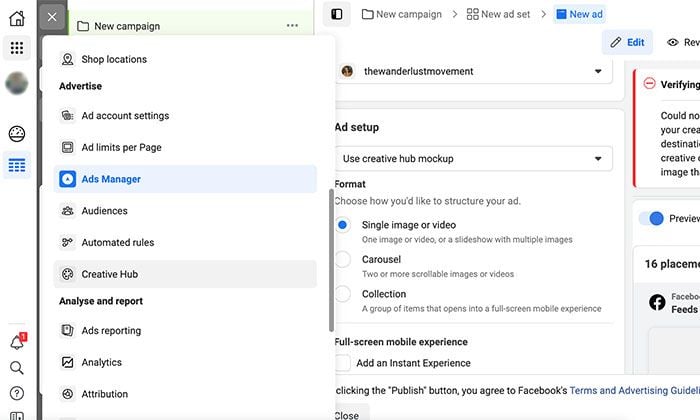

1. Where to Find Facebook Creative Hub

Go to Facebook Ads Manager and click on the grid of nine blocks. A menu will pop up. If Creative Hub isn’t in your shortcuts, scroll down to the “Advertise” section and click on it.

Next, Facebook will take you to the mock-up screen to start building your ad.

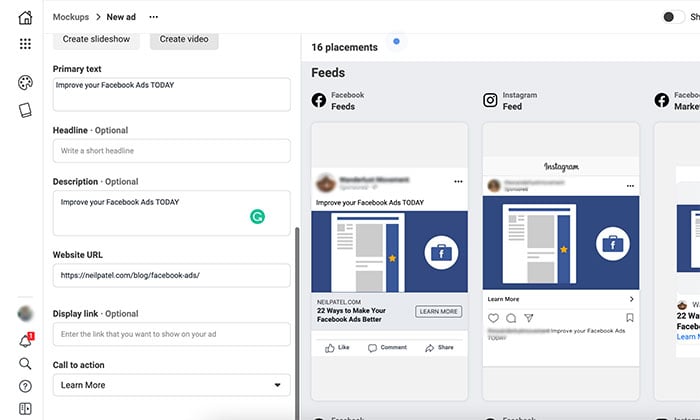

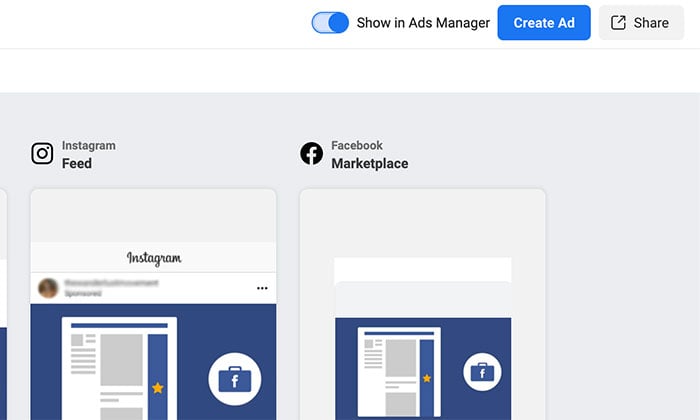

2. Pick a Feed Placement in Facebook Creative Hub

The first step in creating your ad mock-up is choosing a placement.

What is a Facebook ad placement? It’s all the different places where your ad can show up on the platform. Choosing the right one comes down to your campaign objective and your audience.

For example, if you’re a fashion brand targeting Gen Z, you’ll want to focus on Instagram. It’s the generation’s prime channel for discovery and shopping, with 58 percent using the app to discover new brands and products.

You have 16 feed placements to choose from:

- Facebook Feeds

- Instagram Feeds

- Facebook Marketplace

- Facebook Video Feeds

- Facebook Right Column

- Instagram Explore

- Messenger Inbox

- Instagram Stories

- Facebook Stories

- Messenger Stories

- Facebook In-Steam Videos

- Facebook Search Results

- Facebook Instant Articles

- Audience Network Native

- Audience Network Rewarded Videos

- Audience Network In-Stream Videos

Click on the “Expand” button by the placement you want to focus on for your creative. It will open a pop-up, and you can see what your ad will look like on desktop, mobile, and other views.

3. Pick a Format

Next, you need to choose how you want to structure your ad. There are two formats to choose from:

- A single image, video, or slideshow with multiple images.

- A carousel ad with two or more scrollable images and videos.

Which one should you choose? Again, it boils down to your campaign objectives.

Carousel ads are excellent for:

- showcasing multiple products

- in-depth product showcases

- including multiple call-to-actions

Single image and video ads are perfect if you want to focus on a singular offer (for example, a flagship course) and increase brand awareness, lead generation, and traffic to your site.

4. Add Media to Facebook Creative Hub

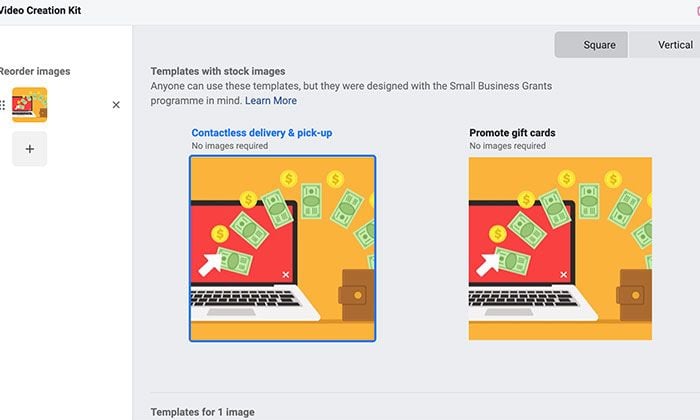

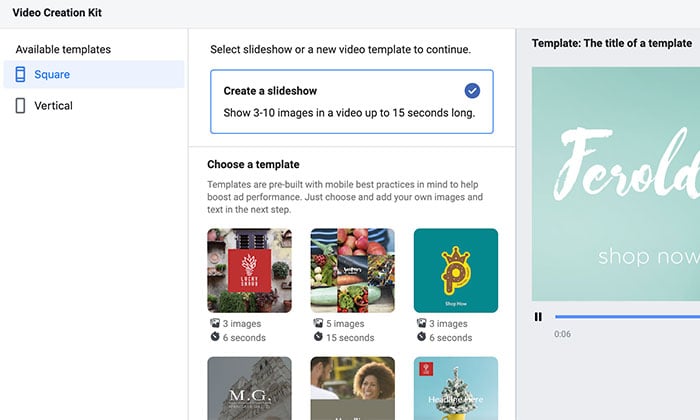

Next, scroll down to the “Default Mockup” section and start adding your media.

You can upload a premade video or an image straight from your desktop.

Creative Hub also gives you the option to create your content from scratch. Click on the “Create Video” button to launch the video creation kit, select a template, and turn still images into an engaging video.

Click on the “Slideshow” button, and Facebook will help you create a slideshow in under five minutes with one of the templates. You can add a background, stickers, and logos and choose from a variety of slideshow durations.

Both options are ideal for marketers who don’t have video editing skills or the budget to hire someone to create video content. With 74% of marketers saying video content has a better return on investment than static imagery, these two features help you get a slice of the action.

5. Add Other Basic Details

Next, you want to fill in the copy for your ad such as:

- Primary Text: This is the caption for your ad. It appears on most ad placements, and you want to keep it short and sweet. Facebook recommends under 125 characters.

- Headline: On average, eight out of 10 people will read a headline, but only two out of 10 will read the rest. If you’re struggling, I have an entire guide for writing powerful headlines that’ll increase your conversion rates.

- Description: This is optional additional text that will only appear in a few select placements.

- Website URL: Where you want to send traffic i.e., your landing page.

- Display Link: You have the option to display a shorter URL instead of the full website URL.

- Call-to-Action: Select a CTA from the drop-down list which is the best fit for your ad. For example, if you’re promoting an event, select “Get Tickets.”

6. Publish Your Ad

Once you’re happy with your mock-up, you’ll need to add it to the Ads Manager before it can go live.

To do this, turn on the slider in the top right-hand side corner. The “Create Ad” button will turn from gray to blue.

Click on it, and Facebook will take you to the Ads Manager. A pop-up will ask you to select your campaign objective from three columns: Awareness, Consideration, and Conversion.

When you’re done, scroll down and select the “Continue” button.

Here you can set your daily ad budget, the timeline for the campaign, and select your audience. Scroll down to the “Placements” header and select “Manual Placements” if you want control over where your ad is displayed.

When you’ve tweaked everything to your liking, click “Next.” You can preview the ad you created in Creative Hub one final time and change anything if necessary.

If you’re happy, click on “Publish.” Your ad will go into review, and Facebook will notify you once it’s live.

7.Track Your Ad’s Success

Here are some of the most important metrics to track for your Facebook Ads:

Conversion Rate

If your ad campaign involves someone clicking on a CTA, here’s what you need to measure:

- Lead Generation: How many people signed up for your offer from Facebook?

- Sales: How many sales did you end up making from your ad campaign?

- Traffic: How many link clicks to your website did you receive?

Frequency

If your ad budget is only a few dollars each day, you don’t need to worry about this metric. However, if you’re spending hundreds of dollars a month on Facebook Ads, you need to monitor frequency.

Frequency is the number of times your ad has been served to an average user.

If someone keeps seeing the same ad again and again, banner blindness creeps in, and your ad will lose its effectiveness.

Spend and Return on Ad Spend

Return on Ad Spend (ROAS) is how much revenue you make from each dollar you spend on advertising.

I recommend setting up the Facebook tracking pixel to get a clear ROI on your ad set spend.

If you don’t have the pixels set up, check out my guide on calculating ROI for your marketing campaigns.

Cost Per Click (CPC) and Click Through Rate (CTR)

CPC and CTR are metrics to measure the general appeal of your ad campaign.

CPC will tell you the average cost of a click from your ad to your website, and CTR is the percentage of people who click onto your website after seeing your ad.

If you notice you have a low CTR, it could mean your ad isn’t appealing to your audience, and it’s time to tweak your ad mock-ups.

Cost Per Action

Cost Per Action (CPA) refers to the behavior you want the person to take after seeing your ad.

It could be:

- visiting the landing page on your website

- playing the video

- signing up for your webinar

The lower your CPA, the higher your revenue and conversion rates for the same ad spend.

Conclusion

You’ve made it to the end of this post, which means you’re officially a Facebook Creative Hub master.

What’s next?

It’s time to start drawing inspiration from the biggest brands in the business and create amazing ads for your target audience.

However, before you do that, check out my deep dive on how to create, optimize, and test Facebook Ads. It includes everything you need in your marketer’s toolkit to run successful ads and the biggest lessons I’ve learned over the years.

What’s your biggest struggle with creating successful Facebook Ads? Do you think the Facebook Creative Hub will help?

New comment by frappuccino_o in "Ask HN: Who wants to be hired? (October 2020)"

Location: London, UK Remote: Yes Willing to relocate: Yes Technologies: Machine Learning, NLP, Speech synthesis (TTS) and recognition (STT). Résumé/CV: https://www.icloud.com/iclouddrive/0mZxCcN_tgnQ4MWY7yvNaCl4A#Resume Email: ilya@peacedata.uk

The post New comment by frappuccino_o in “Ask HN: Who wants to be hired? (October 2020)” first appeared on Online Web Store Site.

Contactless Payments Merchant Accounts

Contactless Payments Merchant Accounts

Contactless Payments Merchant Accounts

Due to the fact that of the threat of credit score card fraudulence, customers do not such as bring money yet are skeptical of handing over a debt card. What’s the option?

Contactless repayments.

The future generation of digital settlement, contactless repayments do not call for the consumer to turn over their card. The entire deal is finished online, and also their card never ever leaves their hand. It’s much faster, much easier as well as far more protected.

Should cash-heavy sellers hurry right into establishing up a contactless repayments vendor account? Contactless repayments vendor accounts supply also better advantages to vendors than it does to customers.

What is Contactless Payment?

Contactless settlements seller accounts are the 3rd generation of digital repayments. Sellers with contactless settlements seller accounts make it possible for clients to utilize their credit score cards for acquisitions without ever before handing their card over.

– Contactless viewers;

– Retailer cards/fobs;

– NFC (near area interaction) allowed mobile phone settlement software program; or

– Back finish processing/over the air repayment software program.

Consumers enjoy it!

They’re expanding extra comfy utilizing credit report, however they’re still rather anxious regarding protection concerns when handing over their card. 91% of most likely individuals would certainly really feel extra protected if they were permitted to hold their repayment card with their whole repayment procedure.

And afterwards there’s simplicity of benefit, rate as well as usage. Nationwide, virtually 75% of participants decline to wait in line much longer than 5 mins for an acquisition of much less than $25, and also greater than 25% refuse to wait longer than simply 2 mins.

Exactly how does contactless settlement contrast in terms of rate? Quite possibly, actually … It takes just 1/3 to 1/2 of the moment of the typical cash money or conventional charge card deal:

– CVS Pharmacy Average Cash Transaction = 33.7 secs

– Average Card Transaction (w/o Signature = 26.7 secs

– Average RF Transaction = 12.5 secs

Contactless settlements raise consumers’ feeling of safety as well as lower disliked wait-times. It’s not a surprise, after that, that clients enjoy it!

And also the development price of contactless repayments vendor accounts reveals it. According to Brian Triplett, elderly vice head of state for arising item development-Visa USA, “The fostering price is the fastest we’ve seen for any type of brand-new innovation. I do anticipate we will certainly remain to see considerable development; whether it’s three-way or dual we’ll need to see and also wait.”

What are the Benefits for Merchants?

One of the most apparent advantage for sellers in having contactless repayments seller accounts is that customers like it, so they’ll utilize it regularly and also invest even more.

The advantages do not finish there. Contactless repayments vendor accounts:

– Leverage ‘Top of Wallet’ ease – Like standard charge card (as well as unlike cash money), the client’s card is constantly in their pocketbook, which suggests they’re more probable to invest, just since they can.

– Deliver boosted seller distinction – Particularly in the very early days of fostering, sellers with contactless settlements vendor accounts will certainly ‘stand apart from the group.’ They’ll supply customers a interesting and also brand-new means to spend for solutions as well as products.

– Are less costly to run – Transactions clear as a card-present, magnetic stripe-read deal, yet card viewers are a portion of the expense of a brand-new POS terminal.

– Increase performance – Businesses with contactless settlements seller accounts appreciate a lot more quick check-out times throughout height hrs.

– Are simple to update and also set up – The equipment for contactless settlements seller accounts is all plug-n-play.

– Increase consumer commitment – Studies reveal that consumers go back to the getting involved vendor’s place on approximately 2 times a month.

– Leverage a basic customer activity far from cash money (20%) – Even consumers that do not particularly enjoy contactless settlement most likely DO especially do not like cash money. By using them an option, services boost the possibility of a sale.

In other words, organisations with contactless settlements vendor accounts appreciate raised purchase quantity (typical 45%) and also raised ticket dimension (typical 20%).

What Merchants Benefit Most from Contactless Payments Merchant Accounts?

Contactless repayments vendor accounts are excellent for cash-heavy vendors. Target sectors consist of:

– QSR

– Petroleum & C-store

– Book Stores

– Dry Cleaners

– Video Rental

– Pharmacy

– Grocery

– Parking

– Movie Theaters

– Stadiums & Arenas

– Theme Parks

– Events

– Cafeterias (Schools & Corporate).

– Taxis.

– Transit.

– Vending.

– News Stands.

– Parking Garages.

Verdict– The Future of Contactless Payments Merchant Accounts?

Contactless settlement uses considerable fundamental advantages to vendors. It’s the future generation repayment system that’s much faster, much easier, extra safe and also easier for customers, which implies it promotes even more sales (higher quantity deal) of higher worth (ticket lift) for vendors. It’s a great deal!

The following generation of digital repayment, contactless repayments do not need the client to hand over their card. Contactless settlements vendor accounts provide also higher advantages to sellers than it does to customers. Contactless settlements seller accounts are the 3rd generation of digital repayments. Vendors with contactless settlements seller accounts make it possible for consumers to utilize their credit history cards for acquisitions without ever before handing their card over. 91% of most likely individuals would certainly really feel a lot more safe and secure if they were enabled to hold their settlement card with their whole settlement procedure.

The post Contactless Payments Merchant Accounts appeared first on ROI Credit Builders.

Business Banking Account: Why You Need One and How to Get One

There may be some things you do not understand about business banking. For example, a lot of businesses start out thinking they can just run their personal and business transactions through the same accounts. It often works well and is easier for small businesses just beginning. However, they soon realize that they need a business banking account, for several reasons.

3 Reasons Why Having a Business Banking Account Is Non-Negotiable; And 4 Options to Kick Off Your Search for the Best One

What are these reasons? Why does it matter if your business has a separate account or not? Here are 3 reasons why you need a business banking account.

Get our business credit building checklist and build business credit the fast and easy way.

Reason 1 Why You Need a Business Banking Account: Separation

For many reasons, your business needs to be an entity all its own. The more it is separated from the personal finances of the owner, the better. The two main reasons this is necessary include:

Tax purposes

To file your business taxes, you are going to have to separate business and personal expenses. If you have a dedicated business banking account, this is immensely easier. Otherwise, you have to pull out the shoebox full of receipts, and that can get cumbersome. Sure, there are easier ways to do it than shoebox filing, but none of them are easier than simply keeping business expenses separated in their own account to begin with.

Business Credit

You also need your business and personal finances separated for business credit purposes. The more connected your business transactions are to you personally, the more likely they are to show up on your personal credit report rather than your business credit report.

In addition to a business bank account, the following things are needed to ensure proper separation for business credit building.

Separate Contact Information

Make sure your business has its own phone number, fax number, and address. Of course, that doesn’t mean you have to get a separate phone line, or even a separate location. You can still run your business from your home or on your computer if you want. You don’t even have to have a fax machine.

In fact, you can get a business phone number and fax number pretty easily that will work over the internet instead of phone lines. In addition, the phone number will forward to any phone you want it too so you can simply use your personal cell phone or landline if you want. Whenever someone calls your business number it will ring straight to you.

More About Separate Contact Information

Faxes can be sent to an online fax service, if anyone ever happens to actually fax you. This part may seem outdated, but it does help your business appear legitimate to lenders.

You can use a virtual office for a business address. How do you get a virtual office? What is that? It’s not what you may think. This is a business that offers a physical address for a fee, and sometimes they even offer mail service and live receptionist services. In addition, there are some that offer meeting spaces for those times you may need to meet a client or customer in person.

EIN

You need to get an EIN for your business. This is an identifying number for your business that works in a way similar to how your SSN works for you personally. Some business owners use their SSN for their business. However, not only does it look unprofessional, but it allows your business and personal transactions to get all mixed up because they are all attached to the same identifying number. To get the separation you need, an EIN is necessary. You can get one for free from the IRS.

Incorporate

Incorporating your business as an LLC, S-corp, or corporation is necessary for establishing a business as a separate entity from the owner. It also lends credence to the legitimacy of your business. As an added bonus, it comes with some protection from liability.

Which option you choose does not matter as much for fundability as it does for your budget and needs for liability protection. The best thing to do is talk to your attorney or a tax professional. What is going to happen is that you are going to lose the time in business that you have. When you incorporate, you become a new entity. You basically have to start over. You’ll also lose any positive payment history you may have accumulated as well.

This is why you have to incorporate as soon as possible. Not only is it necessary for separation, but it affects your time in business. The longer you have been in business the more fundable you appear to be. That starts on the date of incorporation, regardless of when you actually started doing business.

Get our business credit building checklist and build business credit the fast and easy way.

Reason 2 Why You Need a Business Banking Account: Merchant Account

Okay, so having a business bank account aids in separating your business from yourself for business credit building, along with all the other factors mentioned above. While that is most definitely a big deal, it for sure isn’t the only reason you need one. Here’s another reason, and it’s a biggie.

If you do not have a business bank account, you can’t get a merchant account. Without a merchant account, you can’t accept credit card payments. Studies show that customers spend more when they can use a credit card. This makes sense when you think about it, because online sales are made mostly by credit cards. Accepting credit card payments captures impulse sales as well.

When you look at it this way, not having a business banking account, and thus being able to take credit card payments, can severely impact sales in a negative way.

Reason 3 Why You Need a Business Banking Account: More Funding Options

The third reason you need a business bank account is that is opens the door to more funding options. First, it increases fundability. This alone increases the funding options available to you, indirectly. However, there are some lenders and credit card companies that require a business banking account specifically in their requirements for approval.

For example, if you are working toward building business credit, you are going to need to work with starter vendors. These are vendors that will offer net 30 terms on accounts without checking your credit. Then they will report those payments to the business credit reporting agencies. This is basically the cornerstone of how to get started with business credit, because you can get credit without already having credit.

However, since they aren’t checking credit scores, they need to reduce risk in other ways. One of those ways for some is looking for a minimum average balance in a business bank account. If you do not have an account at all, it will be much harder to get this type of vendor credit.

Business Banking Account: A Word About Your Bank Score

You bank score is not the same thing as your credit score. It is basically a score assigned to you by your bank. It helps them determine if they should let you open an account. The sad fact is, if you are not able to open a personal account, the chances are high you will not be allowed to open a business bank account. One thing some banks do is check with agencies such as ChexSystems, Early Warning Systems, and Telecheck to see what your report from them says. As ChexSystems is the most common, let’s take a closer look at them. The others work in a similar way.

Per the ChexSystems website, they are, “a nationwide specialty consumer reporting agency under the federal Fair Credit Reporting Act (FCRA). ChexSystems’ clients regularly contribute information on closed checking and savings accounts.”

In addition, they say, “ChexSystems provides services to financial institutions and other types of companies that have a permissible purpose under the FCRA. ChexSystems’ services primarily assist its clients in assessing the risk of opening new accounts.”

Details About ChexSystems

Other things noted about ChexSystems on their site include,

- “ChexSystems is not a collection agency.

- Also, “ChexSystems will never contact a consumer as part of an effort to collect a debt, and does not make unsolicited calls to consumers.”

- And “ChexSystems will never require payment from a consumer in order to investigate the accuracy of consumer reporting information, nor will it ever require payment in order to remove inaccurate consumer reporting information.”

More About ChexSystems

That still leaves a lot of unanswered questions. As mentioned above, some banks will use reports from them to help determine if they should let you open an account. On occasion, lenders will use them to help determine fundability as well. They report on insufficient funds, closed accounts, and overdrafts. If these things are present in large numbers, it could affect your ability to get a bank account. This would affect your fundability.

Most people don’t even know that ChexSystems is a thing. That is of course, until they’re turned down for a loan or cannot open an account. Find out what to do if this happens to you and get out of ChexSystems jail.

Get our business credit building checklist and build business credit the fast and easy way.

Business Banking Account: Best to Start from the Beginning

It stands to reason that it would be easier to open a business banking account from the very beginning. Still, most business owners do not know how important it is. It seems easier at the time to just use an already existing personal account. Then, before they know it, the need a business bank account becomes obvious. At that point, they have a lot of work to do to sort things out.

The hassle of separating business from personal transactions grows as your business does. You have to change any auto drafts. You need to make sure all information is updated with all vendors and on all documents. There are any number of things that have to be done to change over to a new bank account. Furthermore, if it is the middle of the year, you will have to do some major quilt work when it is time to do the taxes. Long story short, the sooner you open your business bank account, the better.

Business Banking Accounts: Best Options to Get Started

Not all business banking accounts are created equal. Some work better for new businesses than others. Also, some have better rewards and incentives than others. Here are a few to look at to get your started, but be sure to take a look around at all the different accounts available.

Chase

The Chase free business checking account has one of the lowest minimum balance requirements available at $1,500. Up to 100 transactions are free each month. In addition, you get unlimited electronic deposits for free. The minimum amount required to open the account is $25, but if you open it with less than the $1,500 minimum balance requirement you will have to pay the $15 monthly fee until you reach the minimum balance.

Bank of America

The minimum balance for the Bank of America free business checking account is a little higher at $3,000. You get up to 200 free transactions per month.

Axos

There is no minimum balance requirement for this free business checking account. The minimum initial deposit requirement for Axos is $1,000. Also, you get up to 200 transactions free per month. As an added bonus, there is unlimited ATM fee reimbursement.

This account operates online only. There are no branches to visit.

Azlo

Another online only free business checking account, Azlo has no minimum opening deposit or minimum balance. There is no ATM fee at BBV or Allpoint ATMs. In addition, there are no paper statement, incoming wire, or stop payment fees.

Having a Business Banking Account is More Important than You May Think

Most business owners do not realize just how important a business bank account is to their business. As you can see, however, it is very important indeed. By having this information upfront, you can be way ahead of the game. Whatever season your business is in, today is the day to open a business bank account. Whether you go with a bank you already have a relationship with, or one of the options above, it’s important to take this step now, rather than later.

The post Business Banking Account: Why You Need One and How to Get One appeared first on Credit Suite.

Are Money Market Funds For You?

Are Money Market Funds For You?

Cash market funds are among one of the most preferred money administration devices. These financial investments are likewise proclaimed as the most safe kind of shared fund. Prior to spending in them, you ought to initially understand what they are, their advantages, and also if they are appropriate financial investments for you.

What Money Market Funds Are

Cash market funds are shared funds that spend in cash or economic markets, which, in basic terms, suggests that you obtain or funding cash, specifically. A cash market fund is comparable to your down payment account at the financial institution in that it takes your cash as well as utilizes it for financial investment objectives.

Cash market funds generally spend in brief term financial investments that develop in much less than 13 months at the optimum. Because cash market funds are financial investment with much shorter time framework, the danger is considerably lowered. Typically, cash market funds spend in United States Treasury concerns, temporary company paper, and also certifications of down payment.

The Advantages of Money Market Funds

With this sort of financial investment, you are enabled to compose checks that attract from a cash market fund. This permits you to delight in the advantages of reward profits, plus you can quickly access your money. You require to validate with your organization initially concerning costs as well as constraints.

Cash market funds are most sensible for auto parking cash money you require in the short-term. These requirements might consist of deposit for a holiday, a residence or an auto. Given that cash market funds are totally fluid, you can market your shares in a cash fund anytime you desire to.

That Invests in Money Market Funds

Cash market funds are for capitalists that desire to gain good returns from secure financial investments. Cash market funds likewise permit you to take benefit of boosting passion prices.

Cash market funds are common funds that spend in cash or monetary markets, which, in straightforward terms, suggests that you obtain or funding cash, specifically. A cash market fund is comparable to your down payment account at the financial institution in that it takes your cash as well as utilizes it for financial investment objectives. Cash market funds normally spend in brief term financial investments that grow in much less than 13 months at the optimum. With this kind of financial investment, you are permitted to create checks that attract from a cash market fund. Because cash market funds are totally fluid, you can offer your shares in a cash fund anytime you desire to.

The post Are Money Market Funds For You? appeared first on ROI Credit Builders.

Get a Look at Instant Approval Business Credit Cards

Check Out Instant Approval Business Credit Cards

We looked at a lot of instant approval business credit cards, and did the research for you. So here are our picks.

Per the SBA, small business credit card limits are a whopping 10 – 100 times that of personal credit cards!

This reveals you can get a lot more funds with small business credit. And it also means you can have personal credit cards at stores. So you would now have an extra card at the same stores for your company.

And you will not need collateral, cash flow, or financial data in order to get business credit.

Instant Approval Business Credit Cards: Benefits

Perks can differ. So, make sure to pick the benefit you would prefer from this array of alternatives.

Instant Approval Business Credit Cards: Ironclad Secured Credit Cards

Wells Fargo Business Secured Credit Card

Take a look at the Wells Fargo Business Secured Credit Card. It charges a $25 yearly fee per card (up to 10 employee cards). It also requires a minimum security deposit of $500 (up to $25,000) and it is designed to help cardholders build or rebuild their credit.

Pick this card if you want to get 1.5% per dollar in purchases without any limits or earn one point for every dollar in purchases. You also get 1,000 bonus points for every month your company makes $1,000 in purchases on the card.

Details

Also, you get free FICO scores every month. There are no foreign transaction fees. It is possible to upgrade to unsecured credit. Your account is regularly reviewed. And you may become eligible for an upgrade to an unsecured card with responsible use over time. Approval is not guaranteed and depends on factors including how you manage this and your other accounts.

APR is the current prime rate plus 11.90%. There is no introductory APR period and no sign-up bonus. This is not a card for balance transfers.

Get it here: https://www.wellsfargo.com/biz/business-credit/credit-cards/secured-card/

Instant Approval Business Credit Cards for Average Credit

Capital One® Spark® Classic for Business

For average credit, we like the Capital One Spark Classic for Business. It has no yearly fee. There are cash-back rewards. The card gets an unlimited 1% cash back on all purchases. There is an annual fee of $0.

With this card, you will get benefits including an auto rental collision damage waiver, and purchase security. And you also get extended warranty coverage. And you get travel and emergency assistance services.

But BEAR IN MIND: the ongoing APR is 24.74% variable APR. And the penalty APR is even higher, 31.15%. Also, there is no sign-up bonus.

Get it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Instant Approval Business Credit Cards for Credit Building

Discover it® Student Cash Back

Make sure to check out the Discover it® Student Cash Back card. It has no annual fee. The credit card also has a six-month introductory period of 0% APR on purchases. And there is an APR of 14.99 – 23.99% variable on all purchases after that period.

One special feature is that it provides an incentive for scholars to maintain good grades with a $20 statement credit. If scholars earn a GPA of 3.0 or better each school year, the card will award the $20 statement credit annually for up to five years.

Details

Use this card to build personal credit. While this is a personal card versus a business credit card, for new credit users, their FICO scores will matter. And this credit card offers an excellent way to raise FICO while also getting rewards.

You can get 5% cash back at different places each quarter like grocery stores, gas stations, restaurants or Amazon.com up to the quarterly maximum. After that, this credit card offers unlimited 1% cash back on all purchases.

In the first year, all cash back rewards are matched 100%.

Downsides include a cash advance fee of either $10 or 5% of the amount of each cash advance, whichever is greater. And though they waive the first late payment fee, a fee of up to $37 applies on all other late payments. There is also a returned payment fee of up to $37.

Get it here: https://www.discover.com/credit-cards/cash-back/it-card.html

Instant Approval Business Credit Cards for Low APR/Balance Transfers

Discover it® Cash Back

Take a look at the Discover it® Cash Back card. There is a 10.99% introductory APR for six months from date of first transfer. So, this is for transfers under this offer which post to your account by January 10, 2019.

After the introductory APR expires, your APR will be 14.99% to 23.99%. So, this is based on your creditworthiness. Your APR will vary with the market, which is based on the Prime Rate.

Details

You can earn 5% cash back at different places every quarter. So, these are establishments like gas stations, grocery stores, restaurants, Amazon.com, or wholesale clubs. But this is up to the quarterly maximum each time you activate. Additionally, automatically earn unlimited 1% cash back on all other purchases.

You will earn an unlimited dollar-for-dollar match. This is for all the cash back you have gotten at the end of your first year, automatically.

Get it here: https://www.discover.com/credit-cards/cash-back/it-card.html

Instant Approval Business Credit Cards with 0% APR – Pay Absolutely Nothing!

Capital One® Quicksilver® Card

Take a look at the Capital One® Quicksilver® Card. It features flat-rate rewards of 1.5% on all purchases. There are no limits how much in cash back rewards that cardholders can attain. Also, the card has a $0 yearly fee.

Details

New cardholders have a 0% APR on purchases and balance transfers for the first 15 months after opening the account. And then they have a 14.74 – 24.74% (variable) APR after that. A cash bonus of $150 goes to those who make a minimum of $500 on purchases. So this is in 3 months of account opening.

Also, cash back rewards do not expire for the life of the account. And there is no limit to how much you can earn.

Moreover, there is a cash bonus of $150 is available to cardholders. This is if you make a minimum of $500 on purchases within 3 months of account opening.

The card also offers travel accident insurance. And you can get an auto rental collision damage waiver. There are no foreign transaction fees. And there is extended warranty coverage.

Downsides are the flat reward rate, not allowing for any more than that. And then there’s the higher APR after the initial 15 months.

Get it here: https://www.capitalone.com/credit-cards/quicksilver/

Bank of America® Business Advantage Travel Rewards World Mastercard® Credit Card

The Bank of America® Business Advantage Travel Rewards World Mastercard® credit card has no yearly fee and comes with a 0% introductory APR on purchases for the initial nine months. After that, the card has a 13.24 – 23.24% variable APR

Earn 3 points/dollar spent when you book travel with the Bank of America Travel Center and 1.5 points/dollar on all other purchases. You can earn unlimited points and points will never expire.

Details

There is a 25,000-point sign-up bonus when you spend $1,000 in the initial 60 days of opening up the account. Cardholders get travel accident insurance, and lost luggage reimbursement.

They additionally get trip cancellation coverage, trip delay reimbursement and other benefits.

There is no introductory rate for balance transfers. Also, bonus categories are limited.

Get it here: https://www.bankofamerica.com/smallbusiness/credit-cards/products/travel-rewards-business-credit-card/

JetBlue Plus Card

Have a look at the JetBlue Plus Card for an additional offer of a 0% introductory APR

Earn six points/dollar on JetBlue purchases, two points/dollar at eating establishments and grocery stores. And get one point/dollar on all other purchases.

Details

Spend $1,000 in the first 90 days and pay the yearly fee, and earn 40,000 bonus points. New cardholders receive a 12 month, 0% initial APR on balance transfers made within 45 days of account opening.

Thereafter, the variable APR on purchases and balance transfers is 17.99%, 21.99% or 26.99%, based on creditworthiness. Benefits include a free first checked bag and 50% savings on in-flight purchases.

There is a $99 yearly fee for this card.

Get it here: https://cards.barclaycardus.com/cards/jetblue-card/

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Instant Approval Business Credit Cards with No Annual Fee

Uber Visa Card

Check out the Uber Visa Card. Uber is the very first ride-sharing service to offer a credit card, in a partnership with Visa and Barclays.

The card offers 4% back per dollar spent at restaurants, takeout and bars, including UberEATS. Also, earn 3% back on hotel, airfare and vacation home rentals. And get 2% back on online purchases.

So, this includes retailers and subscription services like Uber and Netflix. And get 1% back on all other purchases. Each percent/point has a value of 1 cent. Redeem points for cash back, gift cards or Uber credits directly in the app.

By spending at least $500 in the initial 90 days, users can earn a $100 sign-up bonus. Cardholders spending at least $5,000 per year are eligible to receive a $50 credit toward online subscription services.

Details

Pay your cell phone bill with this card, and get insurance up to $600 for cellphone damage or theft.

Cardholders are eligible for exclusive access to specific events and offers. Uber expects most of these offers to be available in major cities. These are places like New York, San Francisco, Los Angeles, Chicago and DC. There is no foreign transaction fee.

But there is no introductory rate. The APR is a variable 16.99%, 22.74% or 25.74%, based on your creditworthiness. Cardholders with less than stellar credit will be on the higher end of the range.

Also, there are restrictions on Uber credits. To redeem points as credits within the Uber app, accumulate at least 500 points, or $5. Cardholders can convert a maximum of 50,000 points, or $500, in a given day.

Get it here: https://www.uber.com/c/uber-credit-card/

Costco Anywhere Visa® Business Card by Citi

Not taking Uber? Then you’ll want to fill your gas tank somehow. Why not do so with the Costco Anywhere Visa® Business Card by Citi?

This credit card earns cash back with every purchase. Get 4% cash back on the first $7,000 spent on eligible gas purchases annually (1% after that). Get 3% cash back at restaurants and on eligible travel purchases. Also, earn 2% cash back at Costco and Costco.com. And earn 1% cash back on all other purchases.

Keep in mind: the $0 annual fee is only for Costco members. And an active Costco membership is required. Cardholders will get access to damage and theft purchase protection, extended warranty coverage and travel accident insurance.

Also, there is no sign-up bonus available with this card.

Get it here: https://www.citi.com/credit-cards/credit-card-details/citi.action?ID=Citi-costco-anywhere-visa-business-credit-card

Ink Business Cash℠ Credit Card

Look at the Ink Business Cash ℠ Credit Card. Companies can get cash back with each purchase. Spend $3,000 in the initial three months from account opening. And you’ll get a $500 bonus cash back.

There is a $0 annual fee with a 0% introductory APR for 12 months on purchases and balance transfers. After that, the APR is a 15.24 – 21.24% variable.

The card comes with travel and purchase coverage benefits. So, this includes an auto rental collision damage waiver and extended warranty protection.

Details

Earn additional cash back on business categories. So, these include office supply stores, telecommunications, gas stations and restaurants.

Note: this card has a balance transfer fee. Pay 5% of the amount transferred or $5, whichever is greater. Also, there is a foreign transaction fee of 3%.

Get it here: https://creditcards.chase.com/small-business-credit-cards/ink-cash

United MileagePlus Explorer Business Card

Get a good look at the United MileagePlus Explorer Business Card.

Get 2 miles/dollar with United and at restaurants, filling stations and office supply stores. All other purchases earn 1 mile/dollar. Earn a 50,000-mile sign-up bonus after spending $3,000 in the initial three months from account opening.

Benefits include priority boarding, a free first checked bag for you and a companion on the same reservation.

Details

Also, get two United Club passes annually. And get hotel and resort perks including upgrades. Additionally, get early check-in and late checkout. And get an auto rental collision damage waiver.

Also, get baggage delay insurance, lost luggage reimbursement, trip cancellation and interruption insurance. Finally, get trip delay reimbursement, purchase protection, price protection and concierge service.

After the first year, the card has an annual fee of $95. APR of 17.99% – 24.99%, based on creditworthiness.

Get it here: https://creditcards.chase.com/small-business-credit-cards/united-mileageplus-explorer-business

Starwood Preferred Guest® Business Credit Card from American Express

Another option is the Starwood Preferred Guest Business Credit Card from American Express.

This card is for those who stay at Starwood Preferred Guest and Marriott hotels often. Earn six points per dollar of eligible purchases at participating SPG and Marriott Rewards hotels.

And get four points per dollar at US restaurants, American gas stations, and on American purchases for shipping.

Also, earn four points to the dollar on wireless telephone services purchased directly from US service providers. For all other eligible purchases, get two points per dollar.

Details

Get 75,000 bonus points when you spend $3,000 in the initial three months of account opening. Benefits include free in-room premium internet access, Sheraton Club lounge access, and purchase protection.

Plus you get car rental loss and damage insurance. And you get baggage insurance. There is also a global assistance hotline. And there is a roadside assistance hotline. And get travel accident insurance and extended warranty coverage.

The most significant issue is the annual fee. There is a $0 introductory annual fee for the first year, then it’s $95 afterwards. Plus there is no 0% introductory APR. Instead, there is a 17.74 – 26.74% variable APR

Get it here: https://www.americanexpress.com/us/credit-cards/business/business-credit-cards/spg-amex-starwood-credit-card

Instant Approval Business Credit Cards for Cash Back

SimplyCash Plus Business Credit Card from American Express

Look at the SimplyCash Plus Business Credit Card from American Express. There is a $0 yearly fee. And there is a 0% APR on purchases So this is for the first 15 months an account is open.

But when the introductory period ends, the APR for purchases is 14.24 to 21.24%. So, this is variable and based on creditworthiness.

Details

This credit card has various benefits. These include purchase protection, car rental loss and damage insurance. And they also include a baggage insurance plan, extended warranty coverage and a global assist hotline.

Also, earn 5% cash back at US office supply stores and on wireless phone services. So, these must be purchased from American service providers. But this pertains to the initial $50,000 of annual spending. Then, you get 1% cash back.

You also earn 3% cash back on spending category of your choice. So, this is from eight distinct categories. They include airfare, gas, advertising and computer purchases. But it applies to the first $50,000 of annual spending. Then, you earn 1% cash back.

Cash-back bonuses are automatically credited to the customer’s billing statement.

Note: you cannot use this card for balance transfers. There is a foreign transaction fee of 2.7%. The card charges up to $38 in late fees. And the returned check fee is also $38. The penalty APR is 29.99%.

And, it kicks in if you have two or more late payments within 12 months. It can also apply if you fail to make the minimum payment on time or have a returned payment.

Get it here: https://www.americanexpress.com/us/small-business/credit-cards/simply-cash-plus-business-credit-card/44279

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

The Perfect Instant Approval Business Credit Cards for You

Your absolute best instant approval business credit cards hinge on your credit history and scores.

Only you can choose which features you want and need. So be sure to do your homework. What is outstanding for you could be catastrophic for other people.

And, as always, make certain to establish credit in the recommended order for the best, fastest benefits.

The post Get a Look at Instant Approval Business Credit Cards appeared first on Credit Suite.

The post Get a Look at Instant Approval Business Credit Cards appeared first on Buy It At A Bargain – Deals And Reviews.

Achieve Perfect Productivity and More! –10 Brilliant Business Tips of the Week

The Hottest and Most Brilliant Business Tips for YOU – Perfect Productivity Can Be Yours – and More

Our research ninjas at Credit Suite smuggled out ten amazing business tips for you! Be fierce and score in business with the best tips around the web. You can use them today and see fast results. You can take that to the bank – these are foolproof! Perfect productivity is within your reach!

Stop making stupid decisions and start powering up your business. Demolish your business nightmares and start celebrating as your business fulfills its promise.

And these brilliant business tips are all here for free! So settle in and scoop up these tantalizing goodies before your competition does!

#10. Love the ‘Gram

Our first jaw-dropping tip is all about marketing your business on Instagram. Noobpreneur tells us it’s better to talk to your customers than just blast them with sales messages. And we agree with that! Consider, if you will, why you follow a company on Instagram or any other social media platform.

It’s probably for something like – coupons, contests, information/training, or job openings. Most of us aren’t following, say, Coca-Cola, because we feel like watching or reading or listening to an ad. We see enough of those, day in, day out.

So stand out by showcasing something different.

#9. Multiply the Value of Every Customer

The next awesome tip is about selling more to existing customers. G2 has the details. Some of these should be fairly familiar. For example, the idea of upselling or offering cross-selling is nothing new. Upselling can be if you offer an extra something or other when the customer is ready to check out. This is something you base on what they have in their shopping cart.

Cross-selling is bundling – we’re used to seeing it with cable TV. Your customer is buying shoes, so they might also need socks. You get the idea.

But our favorite tip was seemingly counterintuitive.

Downselling.

Say what?

Offer Less to Keep the Prospect Interested

What an interesting concept. When customers abandon their shopping carts, over half the time it’s due to price. So why not offer them lower-priced items in your cart abandonment emails? Or coupon codes or discounts or the like – any of these can work.

Once you’ve proven yourself and your company to your customers, they might be inclined to buy that more expensive item anyway.

If you are as passionate about succeeding in business as we are, please help us spread the word about how to take the plunge and save time and money – and your sanity! Perfect productivity can be yours.

#8. An Awesome Business Plan is But a Week Away

Our following life-changing tip concerns writing a killer business plan in just about no time. Succeed As Your Own Boss says you’re looking for quality, and not quantity.

We really loved the first two tips. One was to look at problems as business opportunities. And the other was an old chestnut – know your customers.

A Fer-Instance

Let’s say the problem you’ve identified in the world is how easy it is for umbrellas to turn inside out in high winds. We all know what happens – people toss out the old brolly and buy a replacement. No biggie, yes?

Well, what happens if we suggest a different outcome? Our reinforced umbrella is probably going to cost more, at least to start. And it may be heavier than your garden variety umbrella. So who are our customers? People with some money and some upper arm strength. Hence our customers might not be the elderly or people with disabilities. At least, not yet.

Once you understand both these things, you start to have a clue about the framework of your business plan.

Of course, this example is simplistic. But there’s no reason you can’t do something similar when figuring out your own business plan.

Oh, and business plans can be changed. So don’t sweat it if oh my goodness your business is expanding and the plan no longer fits.

Just change the plan.

#7. Deals – Faster Than the Speed Of Business

For our next sensational tip, we looked at streamlining your deal flow. Mail Shake lays it all out for us. We were so pleased that the first task is research! After all, how can you understand your prospect if you don’t take even the minimal amount of time to get to know what motivates them? What do they want? And what will turn them right off?

True Story

So this probably doesn’t apply to most people, but what the hey. Your intrepid blog writer does not have children – and none planned. Hence, this is a minority position.

As a result, when talking to a sales person, being told something or other is good for my utterly mythological children is quite the turn off. Now, I don’t expect most sales people to have any idea about this nugget of information about me. Rather, what I expect is for sales to take into consideration that it’s possible they would encounter a member of my type of minority.

Or consider vegans buying a barbecue grill to cook fruit and vegetables (try corn on the cob and pineapple – they’re particularly awesome). And then the sales person goes through a whole spiel all about, you guessed it, cooking steaks on the grill.

You can imagine how well something like that is going to go over, eh?

Outreach, Engagement, and Closing

So these are the three other parts of a streamlined deal flow. The article has wonderful suggestions on how to stand out in these three areas. We recommend reading the article for the details.

#6. Tick Tock

#6. Tick Tock

This tip is so neat, and it works! Proof Hub notes that you don’t have to make time management mistakes.

So quit procrastinating!

It’s not so simple. Totally understood.

The article gives some ideas as to why we may be procrastinating. And their #9 is a doozy – you didn’t do the hardest thing first.

This makes a great deal of sense to us. But … we have a caveat to this.

Way Back When…

You know the old saying, “you have to kiss a lot of frogs before you find your prince?” That was your intrepid blog writer and jobs, at times. So I’ve been on a ton of job interviews. One question which came up more than once was, what do you do when you’ve got 3 hours’ worth of work but only 2 hours in which to do it in?

Tackling the hardest thing first is admirable, and it may even be rewarding. But it’s not necessarily the best way to get started – at least not in that particular scenario. In that instance, the first thing to do is anything which can make it easy or even possible for you to hand off some of that work to a fellow team member.

Because two people working for an hour and a half is about the same as one person working three hours. And then the work gets done. Pro tip – pointing out that this is a scenario which should be rare will never get you the job. Even though it’s true!

Back to Procrastinating

We also liked the fourth tip, which points out that not making an effort to get past procrastination is a problem. Well, yeah.

So do what it takes, if it means setting up a nanny-style app to keep you off the internet or setting an alarm or whatever. And remember: whenever you’re done with whatever it was you were procrastinating over; you’re going to feel an incredible sense of relief.

So get cracking! No, not after another game of solitaire.

#5. Perfect Productivity Isn’t Just Some Pipe Dream

Grab this mind-blowing tip while it’s hot!

Perfect productivity. It’s the Holy Grail, isn’t it? Resume.io tells us there are a few things we can stop doing the moment we get to work. One which we really liked – two actually – was to turn off your browser for the first half hour or so. And don’t open email then, either.

So, what should you be doing instead? The article also says to not go into a meeting first thing, either. And you shouldn’t be multitasking.

So, er, what are you supposed to be doing? Concentrating on … something.

Writers Unite for Perfect Productivity!

This works rather well for us writerly types. Turning off the world for a while so the work can get down is awesome. And being able to hear yourself think is key.

Of course if you need to check the internet to get your writing done, then you’re kind of out of luck. Like your intrepid blog writer. So we feel that’s a bit impractical. Still, it can help to at least restrict where you go or you can go. Hence you may need to get creative and block Facebook on a temporary basis, at least until you’ve done your first thing-type work.

Quelle horreur!

Heh, you’ll get over it.

Pro Tip for Perfect Productivity!

Sometimes utter silence can be as distracting as a beehive of an office. So here’s what your intrepid blog writer does – I listen to music. More specifically, 80s music. Now, this is where working from home comes in mighty handy. Coworkers aren’t subject to my need to sing along with Morrissey. The neighbors, however, are not so lucky.

Uh, sorry ‘bout that.

So it might work for you to sometimes turn on music. It’s usually best if it’s something you already know, so you’re not carefully listening to see if you like it. Some people report instrumentals are better, and classical can be great. You do you, whatever works best for your own personal perfect productivity.

If you are as passionate about succeeding in business as we are, please help us spread the word about how to take the plunge and save time and money – and your sanity! Perfect productivity can be yours.

#4. Promo and Then Promo Again

Check out this spectacular tip, all about unconventionally promoting your company blog. Freelancers Union says there are methods your competition probably hasn’t heard of.

Our favorite was Quora spaces. We had never heard of them – and we’ve been on Quora! So the concept behind the spaces is to allow people to categorize themselves. Want to just talk to company founders? You can.

Another tip we liked was creating teaser content. So rather than just promoting a post after it’s gone live, why not hype it beforehand?

But one thing we’ve observed wasn’t mentioned – if you tease too much, and you don’t really produce well enough to live up to the hype, people are going to stop falling prey to your teasing. So make sure you don’t overdo it.

#3. Harness the Power of the Google Snippet

It’s not your imagination: this winning tip can help you get more prospects from Google search snippets. Conversion XL has the lowdown. First off, before continuing – read the entire article! Yes, it’s that terrific.

But our favorite tip was something perhaps a bit unexpected. It’s using your meta description and other parts of your blog posts strategically. See, the meta description is the part you see in Google under the URL (note: you may see something else – this tip covers both). Now, you will most likely add your keyword phrase anyway. But why not add synonyms? Of course, you want to be writing this for a person. Don’t stuff keywords! Or even their synonyms.

Just … don’t.

But you can use strategic similar words without appearing obnoxious and overly salesy. Hence if your blog post is on over the road trucking, then you can maybe add related words like trucker, highway, or driving.

An Example

Looking for an over the road trucking company? Our truckers love driving down the open highway and they want to drive your cargo.

Okay, so it looks kind of lame. But it fits the criteria well. So, why do you want to do this?

Easy – when your prospects ask a question on Google, the matching words will show up in your Google snippet, in bold.

Where can I find an over the road trucking company? What’s a good company to get my cargo down the highway? Do I need professional truckers to handle my cargo?

These inquiries could all potentially bring your content to the top of search results. And even better, the matching words will pop.

#2. Spy on Your Competition’s Top Landing Pages

Our second to last unbeatable tip can give you a new perspective on gaining insights from your competition’s top landing pages. SEM Rush tells us that there are any number of insights you can glean from checking these pages. These pages, by definition, are what a prospect or customer gets to when they click from somewhere else.

Now keep in mind, this article is essentially a demonstration of how the SEM Rush product works. But the insights are still of some value. So try it yourself. But how?

Do a Little Detective Work

Have you ever shopped at your competition’s store? Whether online or in person, it’s a way to get an idea of the lay of the land. What do they offer? And what catches customers’ eyes?

You would probably disguise yourself if you were going in person – or you would hire someone to do the deed. You’re looking, although you might buy something to see how they do with checking people out. Heck, you could even try returning something and seeing how that goes.

There’s no reason whatsoever why you can’t do something similar online. You can also do this with search. If you are a residential real estate agent working in (for example) Philadelphia, then a search for Philadelphia real estate agent gets you where, exactly? What happens when you click through? And what happens if you use a variant of this search, like Philadelphia realtor or Main Line real estate agent?

Which page comes up? What are you served? And what does it seem is supposed to happen? Do you get information, or fill a shopping cart?

While doing this manually can’t get you metrics, and it’s slow, it can still get you some insights. Try it!

#1. You Can Imagine How Great it is to Understand How and When to Use Persuasive Words

We saved the best for last. For our favorite remarkable tip, we focused on the best persuasive words and phrases. Sales Hacker says there are words which spur sales, and others which close wallets.

And one of the most important things you can do is something so many of us do so little of – listen. We strongly encourage you to read the entire article, as it is that good. Oh, and check out how much we implemented in the title for this tip…

So which one of our brilliant business tips was your favorite? And which one will you be implementing now?

If you are as passionate about succeeding in business as we are, please help us spread the word about how to take the plunge and save time and money – and your sanity! Perfect productivity can be yours.

The post Achieve Perfect Productivity and More! –10 Brilliant Business Tips of the Week appeared first on Credit Suite.

Share Interesting Content to Your Facebook Groups

Facebook groups are a great way to network and connect with other like-minded peers in your industry or niche. As you know, at Paper.li we put a high focus in using targeted content to provide value and entice conversations and relationships with others in your community. Our technology saves you the hassle of manually… Read more »

The post Share Interesting Content to Your Facebook Groups appeared first on Paper.li blog.