Article URL: https://www.notion.so/pathfinance/Fullstack-Engineer-Path-YC-S19-ff0fd31fa5d4410dafce77f83403ce0d Comments URL: https://news.ycombinator.com/item?id=27932945 Points: 1 # Comments: 0

Author: Norma Anderson

Who lost out more in Baku – Hamilton or Verstappen?

Max Verstappen and Lewis Hamilton both missed a golden opportunity to claim a big victory in their championship fight at the Azerbaijan GP.

The post Who lost out more in Baku – Hamilton or Verstappen? appeared first on Buy It At A Bargain – Deals And Reviews.

Get a Recession Business Credit Line – Here’s How

It’s Probably True: You Need a Recession Business Credit Line

As a small business owner, you probably can’t put your hand on enough capital, at least not immediately. And if you are new, then it’s even harder. There will always be more ramp up costs than you think. So if you have ever wondered where to establish business credit, and how to actually get a credit line, it comes from really two areas. Those are business credit cards and loans. Your business needs a recession business credit line: here is how to get one (or more!)

For both types of credit line, it helps to have good business credit. And if you do not have what is considered a good business credit score, or if your company is new and has not yet established its own credit, then creditors will look at your personal credit score.

You want them looking at your business credit score.

But let’s start with recession-era funding.

Recession Period Financing

The number of US financial institutions as well as thrifts has been decreasing slowly for 25 years. This is coming from consolidation in the market in addition to deregulation in the 1990s, reducing barriers to interstate banking. See: https://www.fundera.com/blog/happened-americas-small-businesses-financial-crisis-six-years-start-crisis-look-back-10-charts

Assets concentrated in ever‐larger banks is problematic for local business owners. Big financial institutions are much less likely to make small loans. Economic downturns imply financial institutions end up being a lot more careful with lending. Luckily, business credit does not rely on financial institutions.

Let’s go over credit lines.

Your Business Needs a Recession Business Credit Line – But What Are Credit Lines?

A credit line, or line of credit (LOC), is an agreement between a borrower and a bank or private investor that establishes a maximum loan balance which a borrower can access.

A borrower can access funds from their line of credit anytime, so long as they don’t go over the maximum set in the arrangement, and as long as they meet any other conditions of the financial institution or investor like making prompt payments.

Advantages

Your business needs a credit line because credit lines deliver many distinct advantages to borrowers including versatility. Borrowers can apply their line of credit and only pay interest on what they use, in contrast to loans where they pay interest on the sum total borrowed. Credit lines can be reused, so as you acquire a balance and pay that balance off, you can use that accessible credit again, and again.

Details

Credit lines are revolving accounts similar to credit cards, and contrast other forms of funding like installment loans. In many cases, lines of credit are unsecured, much the same as credit cards are. There are some credit lines which are secured, and thus easier to get approval for

Credit lines are the most frequently sought after loan type in the business world even though they are popular, true credit lines are unusual, and hard to find. Many are also very difficult to qualify for requiring good credit, good time in business, and good financials. But there are various other credit cards and lines which few know about that are attainable for startup companies, poor credit, or even if you have absolutely no financials.

Your Business Needs a Recession Business Credit Line from The SBA

The majority of credit line varieties that most entrepreneurs imagine come from standard banks and conventional banks use SBA loans as their principal loan product for small business owners. This is because SBA guarantees as much as 90% of the loan in the event of a default. These credit lines are the hardest to get approval for because you must qualify with SBA and the bank.

SBA Loans

There are two fundamental sorts of SBA loans you can normally obtain. One type is CAPLines. There are in fact 4 types of CAPLines that can work for your small business.

You can also get a smaller loan amount more quickly using the SBA Express program. The majority of these programs offer BOTH loans and revolving lines of credit.

From the SBA … “CAPLines is the umbrella program under which SBA helps business owners meet short-term and cyclical working capital needs”. Loan amounts are offered up to $5 million. Loan qualification criteria are the same as with other SBA programs.

Seasonal Line

This one advances against foreseen inventory and accounts receivables. It was designed to assist seasonal businesses. Loan or revolving are on offer.

Contract Line

This one finances the direct labor and material costs of performing assignable contracts. Loan or revolving types are available.

Builders Line

This one was made for general contractors or builders constructing or renovating industrial or residential buildings. This line is for fund direct labor-and material costs, where the building project functions as the collateral. Loan or revolving types are on offer.

Working Capital

Borrowers must use the loan proceeds for short term working capital/operating needs. If the proceeds are used to acquire fixed assets, lender must refinance the portion of the line used to acquire the fixed asset into an appropriate term facility no later than 90 days after lender discovers the line was used to finance a fixed asset.

Your Business Needs a Recession Business Credit Line from SBA Express

You can get approval for as much as $350,000. Interest rates vary, with SBA allowing banks to charge as much as 6.5% over their base rate. Loans in excess of $25,000 will need collateral.

Approval Details

To get approval you’ll need great personal and company credit. Plus the SBA says you should not have any blemishes on your report. An acceptable bank score demands you have at least $10,000 in your account over the most recent 90 days.

You’ll also need a resume showing you have business sector experience and a well put together business plan. You will need three years of company and personal tax returns, and your business returns should show a profit. And, you’ll need a recent balance sheet and income statement, thereby showing you have the cash to pay back the loan.

Collateral

To get approval you’ll need account receivables, but just if you have them. As for the collateral to offset the risk, often all company assets will function as collateral, and some personal assets which also include your home. It’s not unheard of to need collateral equivalent to 50% or more of the loan amount. You also need articles of incorporation, business licenses, and contracts with all third parties, and your lease.

Your Business Needs a Recession Business Credit Line from Private Investors and Alternative Lenders

Private investors and alternative lenders also offer credit lines. These are easier to qualify for than conventional SBA loans. They also necessitate much less documentation for approval. These alternative SBA credit lines ordinarily require good personal credit for approval.

Unlike with SBA, many of them don’t require good bank or business credit approval. Most of these sorts of programs call for two years’ of tax returns. Tax returns have to show a profit. Rates can vary from 7% or greater and loan amounts range from $25,000 into the millions.

Loan amounts are normally based on the revenues and/or profits on tax returns. In some cases lenders may ask for other financials such as a profit and loss statement, balance sheets, and income statements.

Your Business Needs a Recession Business Credit Line from Merchant Cash Advances

Merchant cash advances have rapidly become the most popular way to get financing, in large part because of the simple qualification process. Businesses with $10,000 in revenue can get approval, with the business owner having scores as low as 500.

Some sources have now even begun to offer credit lines that accompany their loans. You must have at least $10,000 in revenue for approval. You should be in business for at least one year, however three years is better. Lenders usually want to see a credit score of 650 or better for approval.

Details

Loan amounts are usually about $20,000. Lenders routinely do pull your business credit, so you ought to have some credit already and sometimes lenders will want to see tax returns.

Rates differ, due to the risk for this program, and there aren’t a lot of funding sources who offer it.

Your Business Needs a Recession Business Credit Line from Securities as Collateral for Financing

You can get financing despite personal credit if you have some form of stocks or bonds. You can also get approval if you have somebody intending to use their stocks or bonds as collateral for financing.

Personal credit quality doesn’t matter as there are no consumer credit criteria for approval. You can get approval for as much as 90% of the value of your stocks or bonds. Rates are commonly lower than 2%, making this one of the lowest rate credit lines you’ll ever see. You can still earn interest as you typically do on your stocks and bonds.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business. Get money even during the worst of a recession.

Credit Cards and Lines are Very Similar

Credit cards typically offer 0% intro rates for up to two years. This is also very useful for startups especially. And credit lines let you take out more cash at a more affordable rate than do cards. These are the main two differences that will have an effect on you between credit cards and credit line.

Investopedia even says that “lines of credit are potentially useful hybrids of credit cards.”

Both cards and lines are revolving credit. Credit lines are more difficult to qualify for as card approvals are typically very fast, many times automated, while at the same time line require an in-depth underwriting review. Lines usually offer lower rates, according to Bankrate card rates average 13% while lines average 4%.

Your Business Needs a Recession Business Credit Line from Unsecured Business Credit Cards

The majority of these cards report to the consumer credit reporting agencies. They all demand a personal guarantee from you. You can get approval typically for one card max as they stop approving you when you have two or more inquiries on your report.

Most credit card providers furnish business credit cards including Capital One, Chase, and American Express. These have rates similar to consumer rates and limits are also similar.

Some of them report to the consumer reporting agencies, some report to the business bureaus. Approval requirements resemble consumer credit card accounts.

Inquiries

Often, when you apply for a credit card you put an inquiry on your consumer report. When other lenders see these, they will not approve you for more credit since they have no idea how much other new credit you have lately obtained.

So they’ll only approve you if you have no more than two inquiries on your report within the most recent six months. Any more will get you refused.

Your Business Needs a Recession Business Credit Line from Our Credit Line Hybrid

With this form of business financing, you work with a lender who concentrates on securing business credit cards. This is a very unusual, very little know of program that few lending sources offer. They can usually get you three to five times the approvals that you can get on your own.

This is because they are familiar with the sources to apply for, the order to apply, and can time their applications so the card issuers won’t reject you for the other card inquiries. Individual approvals oftentimes range from $2,000 – 50,000.

The end result of their services is that you oftentimes get up to five cards that mimic the credit limits of your highest limit accounts now. Multiple cards create competition, and this means they will raise your limits, frequently within 6 months or fewer of first approval.

Approvals

Approvals can go up to $150,000 per entity like a corporation. With a hybrid credit line they actually get you three to five business credit cards which report just to the business credit reporting agencies. This is significant, something most lenders don’t offer or advertise. Not only will you get funds, but you build your business credit as well so in three to four months, you can then use your new corporate credit to get even more money.

Rates

The lender can also get you low introductory rates, often 0% for 6-18 months. You’ll then pay normal rates after that, typically 5-21% APR with 20-25% APR for cash advances. And they’ll also get you the very best cards for points. So this means you get the very best rewards.

Just like with just about anything, there are HUGE benefits in dealing with a source who specializes in this area. The results will be much better than if you try to go at it alone.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business. Get money even during the worst of a recession.

Qualifications

You must have excellent personal credit right now, preferably 685 or better scores, the same as with all business credit cards. You shouldn’t have any negative credit on your report to get approval. And you must also have open revolving credit on your consumer reports now and you’ll need to have five inquiries or fewer in the most recent six months reported.

Fees

All lenders within this space charge a 9-15% success based fee and you only pay the cost off of what you secure. Bear in mind, you get a ton of extra advantages and about three to five times more cash in this program than you could get on your own, which is why there’s a fee, the same as all other lending programs.

You can get approval making use of a guarantor and you can even use a number of guarantors to get even more money. There are likewise other cards you can get utilizing this very same program but these cards only report to the consumer reporting agencies, not the business reporting agencies. They are consumer credit cards versus business credit cards.

Benefits

They furnish similar benefits which include 0% intro annual percentage rates and five times the amount of approval of a single card but they’re a lot easier to get approval for.

You can get approval with a 650 score and seven inquiries (or fewer) in the most recent six months and you can have a bankruptcy on your credit and other negative items. These are a lot easier to get approval for than unsecured corporate credit cards.

With all previous cards above, you have to have good consumer credit to get approval but what happens if your personal credit is not good, and you do not have a guarantor?

This is the time when building corporate credit makes a great deal of sense even when you have good personal credit, setting up your company credit helps you get even more money, and without having a personal guarantee.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business. Get money even during the worst of a recession.

Your Business Needs a Recession Business Credit Line But You Can’t Get One? Then Start Building Better Business Credit

As with personal credit, it seems as if the companies which don’t need credit are the ones which are more likely to get it. But that is banks and creditors doing better and more responsible business for themselves – if your company is at risk of defaulting, they either want to give you more expensive terms, or not extend any credit at all.

Here are a few tips on building and improving better business credit.

Separate Your Company Credit From Your Personal Credit

One way is to change your business entity. That is, to either incorporate or become a limited liability company (LLC). Get a separate identification number from the IRS, too, in order to really demonstrate there is a difference.

Get a D-U-N-S Number from Dun & Bradstreet

A D-U-N-S number is necessary in order for D&B to start tracking your business’s credit. Dun & Bradstreet requires that you register on their site before they will give you a D-U-N-S number. Registration is simple and, once you have said yes to the Terms and Conditions, then the next screen is a dashboard. This is where you either ask for a D-U-N-S number or you can look up to see if your business is already in the listings. If your company is already in the listings, then click on your business name to make any needed changes.

Business Credit with a Personal Guarantee

Another means of establishing business credit is by going to your bank and establishing business credit lines or cards with personal guarantees. This means you are personally responsible in case the business defaults or any loans or bills go into collections. Hence if your company is in a high risk business or a seasonal one, you might find your car on the line.

Make sure when you get these kinds of business credit cards, they have the personal guarantee removal feature built right in. Keep your credit utilization at one third of your credit ceiling or less (that is, don’t use more than about one third of your total available credit). Make certain to pay on time every time.

Apply for Third Party Guaranteed Lending

You can use an SBA loan for funding. Repaying this kind of a loan will help you build your business credit score. Or you can apply for a business credit card from a specific store. Often, these store credit cards do not need a personal guarantee. Make sure to choose a store where your business makes a lot of purchases. And don’t forget about those timely payments!

Business Credit Cards and Loans

If your business credit score is good (or if it has improved), then go to your local bank and ask for a credit line. And if you use a particular bank for payroll, you can try that one. If not (or maybe you’re a one-person shop and you don’t really have payroll at all), then you can also take your request to the bank where you do all your personal banking.

Because they already know you, and if they have seen you pay your credit cards on time and keep a good balance in your accounts, they may be more interested in giving your small business a line of credit even without guarantees or a serious credit check. No matter which kind of lending institution you try, go in with good credit as that will make your terms more favorable and it can generally mean the difference between any credit line and none.

Your Business Needs a Recession Business Credit Line – Takeaways

Your business can get credit cards and financing, if you know where to look. Learn more here and get started toward establishing business credit. Keep your small business afloat with a credit line.

The post Get a Recession Business Credit Line – Here’s How appeared first on Credit Suite.

Become a Google Partner and Join the Google Ads Inner Circle

Does your company manage Google Ads for third parties, and do you maintain some success with the pay-per-click (PPC) platform? If so, you may want to become a Google Partner, the search giant’s members-only club.

Joining the Google Partners program can provide you with immense benefits, such as specialized training, invitations to exciting events, and focused instruction to help you boost your Google Ads performance.

You already know Google Ads work. They convert 50% better than organic traffic, and most businesses earn double their ad spend, making advertising on Google highly effective and a no brainer.

Almost anyone can use Google’s PPC system to advertise on Google and grow their business (with the right budget and know-how).

Only a select few applicants become Google Partners and earn the world’s most popular search engine’s endorsement and other significant benefits.

Here’s what to know about becoming a Google partner.

Google Partner Members Get to Display a Google Badge

The definition of prestige on the search engine’s paid advertising platform is a Google Partner badge. Displaying the badge on your site shows that you’ve passed Google Ads product certification exams. It also tells customers you possess in-depth product knowledge, making you a Google PPC superstar.

Find the Google Partner Specialties That Interest You

As a Google Partner, you have the option of specializing in one or more Google Ads product areas. These include Search Advertising; Video Advertising, Display Advertising, and Shopping Advertising.

Let’s run through them one by one.

- Search: By passing this certification course, you highlight your ability to create and optimize ads that perform well on Google search. That means they’re prominently displayed and receive clicks with buyer intent. And if you need to, you’re able to advise others on keyword strategy and budget planning because you’re a search engine master.

- Video: This certification indicates your expertise in implementing and optimizing YouTube ad campaigns.

- Display: This certification area gives you the means to create compelling visual ads that snag the attention of customers on two million sites and 650,000 apps in Google’s combined networks.

- Shopping: As a Shopping Advertising Google Partner, you know how to place products on Google Search and set up your Merchant Center inventory. You also know how to create winning Google Shopping campaigns. Keep in mind: this certification is not available in all languages. See the Google Ads Help Center to learn more.

How Do You Join the Google Partners Program?

Applying to become a Google Partner is free, and anyone can try to join the program. Google gives you all the information you need to pass the exams and flourish in your chosen certification area. Whether or not you pass the certification exams is up to you.

What Are the Benefits of Becoming a Google Partner?

Google wants you to pass the exams and be successful in your Google Ads endeavors. To help you out, Google gives you access to a range of essential benefits, including education, support, expanded reach, and other rewards.

Education to Succeed

Google has pulled out all the stops to ensure you get the best Google Ad education possible. Skillshop learning courses help you develop and hone your skills, while certifications are provided to prove your knowledge. Google also makes available a host of valuable case studies, access to like-minded professionals, and much more on Think with Google and Google Trends.

Valuable Support

Google’s product support is available to help you by giving you access to relevant advice and a range of resources, including Google Ads Recommendations and Google Ads Help Center.

Expanded Reach

With Google Connect, you can display your thought leadership and host co-branded events. You can even onboard new clients or pitch potential ones with Google Ads promotional offers.

Business Acceleration

Google’s Acceleration program is a specialized online education system designed to help you boost your skills and business growth.

Bonus Rewards

By taking part in the Google Partners Rewards program, you get a chance to expand your knowledge by engaging in a series of quarterly challenges designed to help you gain new clients, optimize campaigns, or obtain certification. You even get access to seasonal insights, pitch decks, product advice, and a suite of other exciting rewards. You also have a chance to win prizes.

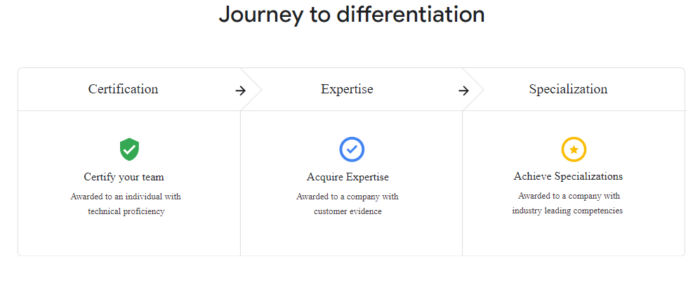

How Do You Qualify to Become a Google Partner?

The first thing you’ll need to do is pass the required Google Ads certification courses for your specialty areas. You must also meet the spend requirement across your managed accounts.

Finally, you must demonstrate performance by consistently delivering strong client and company growth. In other words, you must become an active and exemplary Google Ads user.

What Are the Partner Badge Requirements?

Once you’ve become a Google Partner and have demonstrated your expertise in Google Ads, you can be considered for a Partner Badge. You’ll need to meet a few additional requirements to apply.

Growth

You must consistently show advancing ad revenue and growth, as well as an expanding customer base.

Ad Spend

You must meet a 90-day ad spend requirement of $10,000 across your managed accounts. This sends a message to Partners that your company has a healthy level of activity. Google Partners will evaluate your account based on your manager account during an 18-month period.

Certification

Your company needs one user certified in Google Ads who has admin or standard access to the Google Ads manager account. It can also be any account linked to your manager account.

Google Badge Requirement Changes

Be prepared for a new set of rules to qualify for a Partner Badge. Many of the basic rules will still apply, but you won’t be required to adopt all the recommendations or achieve a 100% optimization score to earn a badge.

Going forward, you must achieve a 70% optimization score to qualify. Google introduced this optimization score to help users understand what was working and what wasn’t, and how to fix elements that weren’t performing.

Pay close attention to any suggestions Google gives you, as advertisers who increase their optimization scores by 10 points see a 10% conversion boost, on average.

New Ad Spend Requirements

To qualify for a Google Badge in 2020, your Google Ad spend must be at least $10,000 in 90 days. In 2021, this requirement will change to a $20,000 ad spend over 90 days, across your managed accounts, to prove your company maintains healthy advertising activity.

Certification

This year, In 2020, your company needs a user to certify in Google Ads or have standard access to the Google Ads manager account. In 2021, half of your eligible users will have to obtain certifications from Skillshop. As a partner, you’ll need to demonstrate your proficiency consistently.

Premier Badge Requirements

To meet the requirements for a Premier Partner Badge, you must deliver strong Google Ads revenue and growth, meet a higher ad spend across your managed accounts, and have two or more users in your company who are certified in Google Ads (or who have admin or standard status on your organization’s Google Ads manager account).

In 2021, once your company has succeeded in earning a Google Partners Badge, you have an opportunity to be chosen for Premier status. The program will grant Premier status to the top 3% of participating companies each calendar year. The companies are selected based on annual ad spend, client growth, client retention, and other information. The evaluation process is conducted annually and may exclude some markets.

Get Listed as a Google Partner on the Marketing Platform Directory

When you become certified as a Google Ads Partner, you’ll be listed in the Marketing Platform Directory. Your listing will include your business name, a short description of your organization, partner type, and the product certifications you possess.

There are two types of marketing platform partners: Certified Companies and Sales Partners.

Certified Company

This descriptor means you’re educated about Google Marketing Platform products. You’re able to use your expertise to offer quality services to your customers, whether you’re consulting, training, implementing Google products, or offering technical support.

Sales Partner

Certified Companies that help Google sell products are known as Sales Partners. Becoming one gives you access to special perks such as customer management tools, sales opportunities, and co-marketing opportunities.

How to Obtain Company Certification

Know the Rules

Familiarize yourself with Google’s Partners Terms and Conditions. It is essential to read the document when you get time. You have a lot invested in Google Ads. The better you know the rules of the game, the more successful you can be at it.

Initial Requirements

Google will ask for your company’s size and structure, the services you provide, and pricing practices. You’ll be judged on your track record of client satisfaction and your consistent Google Ad investments’ success.

The reason for this level of scrutiny is that Google wants to work with forward-driven companies that maintain a healthy ad budget and use it wisely.

Google vets you for Partner certification by scouring the web for clear documentation that proves client engagement, planning processes, frameworks, and templates. Google wants to know your clients can rely on you for complex solutions and receive pleasing results.

Lastly, your website should be populated with useful content that clearly describes your offerings.

Product Expertise Requirements

Certification rules stipulate you must have at least five local, full-time experts working with Google Marketing Platform products. Each must have passed an associated certification exam.

Google considers your team’s size, expertise, and rate of certification. The company notes that it does make exceptions for smaller companies who have difficulty meeting this particular requirement.

You’ll also need to submit a comprehensive review of each product you offer. The review is meant to represent advanced work that shows strategic planning and optimization toward your organization’s goals.

The review will also display your ability to go beyond basic or standard implementations and use and demonstrate your client’s goal through statistics and testimonials.

Google essentially wants a case study that proves you can walk the walk.

How Do You Check Your Partner Status?

You applied for the Partners Program, and you’ve been waiting, but haven’t received a response. Take action and check the status of your certification. If you don’t receive certification, keep trying and using the resources Google gives you. Do that, and you’re sure to become a Google Partner before long.

Conclusion

Being vouched for by Google and having a Google Badge to show for it are just two of the benefits of becoming a Google Partner.

Being a Google partner also gives you access to easily consumable courses. Google gives you everything you need to maintain a Google Ads campaign and keep it growing far into the future.

And when customers see your Google Badge, watch out. That may be all they need to choose you for the successful future of their Google Ad campaigns.

Have you tried joining the Google Partners Program? What was your experience?

The post Become a Google Partner and Join the Google Ads Inner Circle appeared first on Neil Patel.

New comment by pknerd in "Ask HN: Who wants to be hired? (March 2020)"

Technologies: Python, AWS, Web Scraping, ETL(Airflow, Luigi, Bonobo, Spark), Web Dev(Laravel, Django, Flask, Rails), BioPython.

I have a basic working knowledge of Apache Spark, Apache Beam, Apache Kafka, and ElasticSearch

I also maintain a blog where I write on a variety of different interesting topics; from ETL development to DNA Sequence Analysis.

A polyglot technologist who is curious and always up to learn new things. I am available for all kinds of remote engagements.

Check my profile at http://adnansiddiqi.me

And blog at http://blog.adnansiddiqi.me

Email: kadnan@gmail

Just Funded… $137,000 in Account Receivable Financing

The post Just Funded… $137,000 in Account Receivable Financing appeared first on Getting Your Business Started Off To The Right Start.

NuCypher (YC S16) is hiring a lead engineer to help build a new cryptosystem

NuCypher is a cryptography company that builds privacy-preserving infrastructure and protocols. A successful candidate does not need to have prior experience in cryptography as they will work very closely with a cryptographer to build out the system. However, they should be a quick learner and comfortable around math (e.g. linear algebra, probability, number theory). A … Continue reading NuCypher (YC S16) is hiring a lead engineer to help build a new cryptosystem

The Very First Internet Advertisements

When the net extremely initially began out, not lots of Americans might pay for a computer system allow alone, accessibility to the net. Not a great deal of Internet ads were seen since business had not yet come up with suggestions as to market their item. Currently they are all over the Internet, attempting to … Continue reading The Very First Internet Advertisements

Build or Improve Business Credit with Private Business Loans

How Private Business Loans Can Help Build or Improve Business Credit

The concepts of business credit and private business loans are new to many business owners. The terms are discussed more often now than they were 10 years ago. Still, many are unfamiliar with what they are and how they can play into the success of your business.

For many looking to start a business, they know no other way than to get started with personal loans on their personal credit. Others understand the concept of business credit, but are unsure how to get it. Then there are those that have found private loans, but aren’t sure how to best utilize them to build or improve business credit.

We hope to answer all these questions and more, specifically those relating to using private loans to build and improve business credit.

What Is Business Credit?

Business credit is credit that is in the name of your business. It isn’t connected to the business owner in any way. It is in the business name, the business contact information, and the business EIN rather than the owner’s SSN.

If you have business credit, you can use it to apply for funding for your business. The debt and the payments will not be on your personal credit report at all. The problem is, most traditional lenders rely on the personal credit score most heavily, even if a business does have business credit. This is where private business loans can be helpful.

What are Private Business Loans?

Private business loans are loans from companies other than banks, also called alternative lenders. Many of these have popped up in the past decade as entrepreneurship has become more prevalent. The need for a financing option from institutions other than traditional banks has encouraged this increase.

There a few benefits to using private business loans over traditional loans. The first is that they often have more flexible credit score minimums. Even though they still rely on your personal credit, they will often accept a score much lower than what traditional lenders require. Another benefit it that they will often report to the business credit reporting agencies, which helps build or improve business credit.

The trade off is that private business loans often have higher interest rates and less favorable terms. In the end though, the ability to get funding and the potential increase in business credit score can make it well worth it.

Find out why so many companies are using our proven methods to improve their business credit scores.

How Can You Use Private Business Loans to Improve or Build Business Credit?

While not all private, or alternative, lenders report to the business credit reporting agencies, some do. These are the ones you want to work with. As they report your on-time payments, your credit will grow. They must report to Dun & Bradstreet, Experian Business, Equifax Business, or some other agency that reports business credit. Otherwise it won’t work. Not all private lenders will do this. You have to ask.

There are some lenders that are known to report to the business credit agencies however.

Which Private Lenders Report?

As a general rule, you simply have to research lenders to determine whether or not they report to the business credit reporting agencies. Sometimes this is as simple as asking them who they report payments to. Here are a few that we know oft to get you started.

Fundation

Fundation offers an automated process that is super-fast. Originally, they only had invoice financing. Then they added the line of credit service. Repayments are automatic, meaning they draft them electronically. This happens on a weekly basis. One thing to remember is that you could have a repayment as high as 5 to 7% of the amount you have drawn, as the repayment period is comparatively short.

You can get loans for as little as $100 and as high as up to $100,000, but the max initial draw is $50,000. They do have some products that go up to $500,000. Though there is no minimum credit score requirement, they do require at least 3 months in business, $50,000 or more in annual revenue, and a business checking account with a minimum balance of $500.

Fundation reports to Dun & Bradstreet, Equifax, SBFE, PayNet, and Experian, making them a great option if you are looking to build or improve business credit.

BlueVine

The minimum loan amount available from BlueVine is $5,000 and the maximum is $100,000. Annual revenue must be $120,000 or more and the borrower must be in business for at least 6 months. Personal credit score has to be at least 600. It is also important to know that BlueVine does not offer a line of credit in all states. You can find out more in our review here.

They report to Experian. They are one of the few invoice factoring companies that will report any business credit bureau.

OnDeck

With OnDeck, applying for financing is quick and easy. Apply online, and you will receive your decision once application processing is complete. Loan funds will go directly to your bank account. The minimum loan amount is $5,000 and the maximum is $500,000.

There is a personal credit score requirement of 600 or more. Also, you must be in business for at least one year. There is an annual revenue requirement of at least $100,000 as well. In addition, there can be no bankruptcy on file in the past 2 years and no unresolved liens or judgements.

OnDeck reports to the standard business credit bureaus.

The Business Backer

The Business Backer offers a product they call FlexFund Line of Credit. Funds range in amount from $5,000 to $240,000, and draws can be repaid on either a daily or weekly basis.

They report to Dun & Bradstreet and Equifax.

What Are Some Other Ways to Build Business Credit?

There are other ways to get accounts reporting on your business credit as well. One option is to look at the regular payments you make already. Do you pay rent? Do you pay telephone, internet, or utility bills? Ask your landlord and utility providers to report your payments to the business credit reporting agencies. Of course, they do not have too. However, some will if you ask. This is a way to get accounts reporting without taking on new debt.

Another option is to talk to merchants you already do business with. If you have been working with them for a while, there is a chance they will extend credit. Ask them if they will extend credit and report to the business credit agencies. Again, they may not do it, and they do not have to. It never hurts to ask though. You’ll never know until you do.

These two options are quick and easy ways to start to build business credit in addition to private business loans. There is another way however, and you can utilize it at the same time as you do the private business loan avenue. It’s called the vendor credit tier.

How to Use the Vendor Credit Tier and Private Business Loans Together to Build Credit Faster

The vendor credit tier is made up of starter vendors that will offer invoices with net terms, and then report payments on those invoices to the business credit reporting agencies. These vendors sell things most businesses use every day. This means all you have to do is buy the things you already need, pay the invoice, and watch you score grow.

Not all vendors are starter vendors. True starter vendors will offer net terms without a credit check so that you can get started with them before you have any business credit to speak of. Instead, they look at things like time in business and annual revenue to determine eligibility. Some of the easiest vendors to get started with include:

● Grainger Industrial Supply

Grainger sells power tools, pumps, hardware and other things. In addition, they can handle maintenance of your auto fleet. You need a business license and EIN number to qualify, as well as a D-U-N-S number from Dun & Bradstreet.

You can apply by fax or over the phone. If you need less than $1,000 in credit, you only have to have a business license for approval. For over $1,000, you will need trade and bank references.

If you are just starting out and do not have references, the $1,000 is plenty to get you started building your business credit.

● Uline Shipping Supplies

Uline reports to Dun & Bradstreet and carries shipping boxes, trucks, dollies, janitorial supplies, and more. Since they report to D&B, you have to have a D-U-N-S number before you get started with them. They will also ask you for a bank reference and two other references. Initially, you may need to prepay. After that, they are likely to approve you for Net 30 terms.

Find out more about Uline here.

● Quill Office Supplies

Quill is the ultimate starter vendor and a mainstay in the vender credit tier. They sell office supplies as well as cleaning and packaging supplies. Products range from office supplies to office furniture, and even janitorial supplies.

They report to D&B. If you do not already have a D&B score, you will have to place an initial order first. Generally speaking, they establish a 90-day prepay schedule, and if you order each month for three months, they will most often approve you for a Net 30 account.

Find out why so many companies are using our proven methods to improve their business credit scores.

How to Keep Building Business Credit

Once you have a private business loan or two, as well as some starter vendors and other merchants reporting, you need to keep an eye on your credit report. Credit monitoring is vital to the process of building business credit. Mistakes on your report can slow progress significantly. By looking at your credit regularly, you can see which accounts are reporting and ensure that the information being reported is accurate.

There are a few options when it comes to monitoring your business credit. Unlike personal credit monitoring, it isn’t free. However, we can show you how to do it for cheaper than what the credit agencies themselves will offer.

Credit Monitoring with the Big Three

D & B provides Credit Signal, which is a means to track your credit score by having the reports come directly to you, for a price.

Equifax offers a risk monitoring service as well. It is convenient as it enables reports to come directly to you. If you don’t wish to pay for continual reports, you can submit an alternative request for a one-time Equifax report.

Experian provides similar services, with options for continual monitoring or one-time reports.

Prices for individual reports from each vary, with Experian and Equifax costing about $19.99 each. D&B ranges from $49.99 to $99.99.

Save money by monitoring your credit on a regular basis with Credit Suite. We can help you monitor business credit at Experian and D&B for only $24/month. See: www.creditsuite.com/monitoring.

What Do You Do with the Information?

Update the information if there are errors or the info is incomplete. At D&B, you can do this by going to: https://iupdate.dnb.com/iUpdate/viewiUpdateHome.htm.For Experian, to to:www.experian.com/small-business/business-credit-information.jsp. If you need to deal with Equifax, go here: www.equifax.com/business/small-business.

If there are inaccuracies in the credit information, you need to dispute them. Errors in your credit report(s) can be fixed. However, credit agencies normally want you to dispute in a particular way.

Disputing credit report mistakes generally means you send a paper letter with duplicates of any supporting documents like receipts or cancelled checks. Never mail the original copies.

Dispute errors on your small business’s Equifax report by following the directions here: www.equifax.com/small-business-faqs/#Dispute-FAQs.

You can dispute inaccuracies on your business’s Experian report by following the directions here: www.experian.com/small-business/business-credit-information.jsp.

For D&B’s PAYDEX Customer Service, use the phone number is here: www.dandb.com/glossary/paydex.

Find out why so many companies are using our proven methods to improve their business credit scores.

You Can Build and Improve Business Credit with Private Business Loans

Private business loans can definitely help you build business credit. However, you must choose lenders that will report your payments to at least one business credit agency. There are more that what we have listed. Be sure to do your own research to find the best options for your business.

Private business loans are just one tool to help you build business credit. There are many tools that you can stick in your tool box that will help you along the way. The vendor credit tier is one, but you can also ask those providers that you already make payments to if they will report. This can help you build business credit even faster.

The post Build or Improve Business Credit with Private Business Loans appeared first on Credit Suite.

Recently funded… $10,000.00 in Memphis TN

Recently funded… $10,000.00 in Memphis TN King’s Prince Xpress, LLC obtained $10,000.00 in unsecured business cards. In this way he had more working capital to succeed in increasing his business revenue. We were pleased to be able to assist in his success! Click Here to see how much funding you can get for your business. The …