Guests: Matt Finn, Miranda Devine, Candace Owens, Jason Rantz, Stephen Miller, Eva Vlaardingerbroek, Jonathan Pelson

Author: Robin Mitchell

New comment by petercrona in "Ask HN: Who is hiring? (December 2021)"

Small Improvements | Full-Stack, Backend, Frontend | Berlin, Germany | Hybrid or Remote (living in Germany) | Full-time (4 days possible after 6 months)

https://www.small-improvements.com/careers/senior-software-d…

We’re looking for a senior full-stack developer/engineer. We’re using mainly Java (with Spring) and TypeScript (with React). We’re a small and self-funded company. The engineering team puts a lot of weight on continous learning and always challenging the status quo – that’s the only way we can get better as individuals and as a team. All engineers get a lot of space and trust so they can always do their best.

As a company, we offer a performance management tool, which includes features like setting up and keeping track of objectives/goals, giving praise, 360 feedback and performance reviews.

Why do Lenders Prefer Using a Personal Credit Score to Approve a Business Loan?

Your Personal Credit Score Can Make a Difference When You Apply for a Business Loan

If you’re a small business owner, don’t assume your business credit is separate from your personal. If you apply for a loan, lenders will consider it on your personal credit, not your business credit. Your business credit score is considered on its own only if your company generates millions in annual income. Otherwise, assume that your personal credit score will matter.

Solid personal credit is a necessity. The need to build and maintain it never goes away for most small company owners.

Some lenders (like banks) place more importance on personal scores. This is for checking business loan applications.

To establish your business’ creditworthiness, most lenders first analyze your personal credit score. This happens with organizations in operation for only a few years. It also happens with businesses seeking their first business loan.

So, small business owners must focus on creating a solid business credit profile. This is along with building a good personal credit score.

What is the Difference Between Business Credit Score and Personal Credit Score?

Here are the main variations between company personal credit scores:

- Business credit reports use Employer Identification Numbers (EINs). Personal credit reports use Social Security numbers (SSNs).

- The ranges of personal and business credit scores are very different. Business scores tend to vary from 0 to 100. The range of personal credit scores is 300 to 850.

- Experian manages both business and personal credit. They use separate databases and departments if you have both kinds of credit.

- You can freeze or lock personal credit reports. But business credit reports cannot be locked or go under security freeze.

- Different rules apply to data used in business and personal credit reports.

- Anyone can examine your business scores (they must buy the report and scores). But only you and others who have your authorization can access your personal scores.

Demolish your funding problems with 27 killer ways to get cash for your business.

When do Lenders Consider a Personal Credit Score for Approving Business Loans?

When reviewing creditworthiness for a business loan, most lenders check personal credit history.

But some lenders will give your personal credit score less weight than others. Lenders may pay less attention to a poor personal credit score if you already have a track record of solid business credit.

Your personal credit will matter more for a business loan when any (or all) of the following are true:

a. If You’re Seeking a Loan from a Bank or Other Conventional Lender

You should assume banks have strict lending rules and often aren’t too flexible. But private lenders offer financial help. It’s in the form of business loans with low credit requirements. They provide funds considering a business owners’ personal score. This is even if the business score is low. Here, conventional lenders may check personal credit scores to offer you a business loan with flexible terms.

b. If Your Business is a Startup or Small in Nature

If your business score does not have enough info for lenders to check credibility, they will place a higher value on personal scores.

This can be the case with sole proprietorships or small businesses with few employees. Here, it may be hard for a conventional lender to distinguish between your business credit report and personal credit reports.

c. Your Personal Credit Score is Relatively Low

Even if you have a few old negative entries on your personal credit report, getting a business loan shouldn’t be tough. If your business’s credit history is excellent, then it shouldn’t be a problem.

But too many negative items on your personal credit history may damage your score. A low personal credit score is something a lender will notice and consider as a risk.

Your personal credit score reflects how you manage your personal credit liabilities. But some may argue that your personal credit score has nothing to do with how your business operates its business credit liabilities.

As a business owner, understand how your credit score is calculated, and how it’s used when you apply for a credit. And understand what you should do to improve it.

Demolish your funding problems with 27 killer ways to get cash for your business.

How is a Personal Credit Score Calculated?

The Federal Government improved credit reporting quality with the Fair Credit Reporting Act in 1970.

The consumer credit bureaus collect information from a consumer’s credit profiles to create FICO scores. Experian, Transunion, and Equifax are the three largest credit bureaus. These three major credit bureaus maintain the same basic formula to rate your credit. A personal credit score ranges from 300 to 850 and is rarely identical.

They calculate your FICO score using this basic, widely used formula:

Payment History (35%)

Late payments, judgments, and bankruptcies are problematic. So are debt settlements, repossessions, charge-offs, and liens in your credit report. They will lower your personal credit score.

Debt Owed (30%)

Your personal credit score also depends on your debt-to-credit limit ratio. And it depends on the number of credit accounts, the total amount of credit balances, and the amount paid off on installment loans.

Credit History (15%)

Your credit history plays an integral part in building your credit score. The average age of the accounts and the length of your oldest credit account are the two most important criteria. The longer (or older) the file is, the better. This is because the score tries to forecast future creditworthiness based on past credit history.

Credit Types (10%)

Having different types of credit shows your ability to handle many credit accounts. These types include revolving, installment, and mortgage credit. It will definitely have a positive impact on your credit score.

New Credit Accounts (10%)

Each new “hard” inquiry on your credit report may have an adverse effect and may lower your score by 10%. Per Experian, these inquiries may stay on your report for a few years. But they will have no impact on your credit score after the initial year.

How Does This Information Build Your Credit Score?

Credit bureaus collect personal information like your name, date of birth, location, occupation, and more. They’ll also prepare a list of information that the creditors provide. Other information, like judgments or bankruptcy, will appear on your credit reports. It becomes part of your personal credit score. When you apply for new credit, your creditor will see all that info in your credit report and check your score.

If you find any inaccurate data reported, the credit bureaus have procedures in place to correct verifiable mistakes. Amendments to the Fair Credit Reporting Act in 1996 allow you to put a 100-word statement on any report that includes an item you dispute.

A range of factors can drive a bad credit score, including a divorce, severe illness, or loss of employment. This allows you to ensure that potential creditors are aware of the information.

Here’s what a potential creditor sees when they look at your score:

800-850 (Exceptional)

You should expect lenders to treat you like a king! With a credit score above 800, you can choose the best credit alternatives for your needs, and the best interest rates, from any lender you choose..

740-799 (Very Good)

If you have a credit score inside this range, lenders will treat you as a low-risk borrower. You can get a loan from almost any big lender with affordable rates. With this credit score, you can choose the best business loan that fits your business needs.

670-739 (Good)

This is a good score, and many people in the United States fall into this category. With this score, a borrower can hope to have more choices and approvals from various lenders.

580-669 (Fair)

This is a score that indicates a significant level of risk. A small business loan is feasible, but the interest rates will often be higher. If your score is in this range, you will have fewer possibilities than those with a higher level.

Most conventional lenders will not consider borrowers in this group for a small business loan. A personal credit score of 660 is the lowest that the SBA will typically consider.

300-579 (Very Poor)

Borrowers with this credit score can access some credit. But it’s considered a high-risk credit score. So there will likely be fewer possibilities and higher interest rates. If your score falls in this range and you want to get a business loan, consider offering some collateral.

Demolish your funding problems with 27 killer ways to get cash for your business.

How To Improve Your Personal Credit Score?

There is no simple solution to fix your personal credit score issues. But that doesn’t imply you can’t increase your score with time and effort. Here are six strategies to improve your personal credit score:

Analyze Your Score

You are entitled to get a free credit report once a year from annualcreditreport.com. You can get your credit report as many times as you want from all three major credit reporting agencies. These bureaus provide credit monitoring services for an affordable fee. Get your report from them and analyze it properly.

Make Good Use of Credit

This may sound oversimplified, but it’s critical. Resist the urge to use all your credit limits all the time. This is so even if you pay off the total outstanding debt balance every month through credit card debt consolidation. Using all the available credit further can damage your credit score.

Keep credit usage to roughly 15% of your available credit limit to increase your credit score.

Make Your Payments On Time

This is most likely the best and most successful strategy to improve your score. How fast you make payments and satisfy your liabilities makes up 35% of your score. A single late payment can significantly reduce your credit score.

Do Not Apply for Excess Credit

Applying for unnecessary credit reduces your credit score. So if you’re attempting to raise your score, it’s not a good idea.

Don’t Transfer Balances Too Often

Transferring balances from one credit card to another does not affect your credit score. But, it’s generally known as a wrong financial move that could harm your personal credit. Frequently transferring balances can put a bad impression on your future creditors.

Have Patience and Keep Trying

Improving your credit score requires strong determination and hard work. Your constant effort over six months or even a year can make a significant difference. But missing a payment or two will almost certainly lower your credit score fast.

About the Author:

Lyle Solomon has considerable litigation experience. He has substantial hands-on knowledge and expertise in legal analysis and writing. Since 2003, he has been a member of the State Bar of California. In 1998, he graduated from the University of the Pacific’s McGeorge School of Law in Sacramento, California. He now serves as a principal attorney for the Oak View Law Group in California.

Lyle Solomon has considerable litigation experience. He has substantial hands-on knowledge and expertise in legal analysis and writing. Since 2003, he has been a member of the State Bar of California. In 1998, he graduated from the University of the Pacific’s McGeorge School of Law in Sacramento, California. He now serves as a principal attorney for the Oak View Law Group in California.

The post Why do Lenders Prefer Using a Personal Credit Score to Approve a Business Loan? appeared first on Credit Suite.

Heron Data (YC S20) Is Hiring a Full-Stack Engineer (London)

Article URL: https://www.ycombinator.com/companies/heron-data/jobs/kN46lMk-software-engineer Comments URL: https://news.ycombinator.com/item?id=28916344 Points: 1 # Comments: 0

Personal Branding: How to Go from Zero to Hero in No Time

Do you remember when only celebrities and major companies had personal brands? Actors, musicians, Fortune 100 businesses, and athletes got all the attention and dominated the airwaves.

Now, nearly anyone willing to put in the time and effort can become a “thought leader” in a specific niche. It won’t happen overnight, of course.

You only need to do a quick Google search to see that ordinary people from all over the world are using new personal branding tools, particularly social media, to craft personal brands that attract countless people to their websites and social media accounts.

Personal branding is what separates you from the rest of the people trying to make it in your field. Building a personal brand allows you to become a standout figure that people know, like, and trust.

Follow these seven simple steps below to become the go-to expert in your space.

Step #1. Start By Finding Your Niche

There’s a saying about SEO traffic that highlights something most people miss.

You can’t create search demand. You can only harvest it.

That means you can’t force people to search for a specific keyword. They either already do or they’re searching for something else.

See How My Agency Can Drive Massive Amounts of Traffic to Your Website

Your job in SEO is to recognize that and work on getting as much traffic you can from words that are already popular on their own.

Personal branding is similar, believe it or not.

For example, being the best CrossFit pug breeder in the world is worthless if there isn’t already a market or niche for that. (Seriously, is there?!)

The niche selection process is really important! You don’t want to spend all your time and energy linking your brand to a niche that’s not growing.

Where should you start when picking a niche?

That’s a good question because there’s no right answer necessarily, but here’s where I think you should start.

Pick something specific that you can do better than 90% of the world.

Why is that so specific? Because you can probably do a lot of things well, but that doesn’t mean you’re an expert in every single one of them.

The only way to create a personal brand is by becoming the go-to, recognized authority on a specific topic.

If you’re not an expert on it, someone else will be. Don’t be afraid to go small or narrow to dominate a topic.

The “online marketing” space, for example, is massive, and it’s taken the better part of a decade for me to become a recognized authority.

Take someone like Brian Dean, who decided to go deep on a particular topic instead of biting off more than he could chew.

Notice how he perfectly positions his personal brand. It’s all about backlinks and rankings for SEO.

Then the site’s graphics, design, and testimonials all reinforce those points.

There’s another important ingredient for a successful personal brand, though. One that deals more with your own style and point of view on this topic.

Step #2. Inject Personality Into Your Personal Brand

The first step (finding your niche) is about your own skills and potential market value.

The second step is about what you personally bring to the table. It’s your point of view or your “tone” that will help differentiate you from everyone else who talks about the same topics as you.

For example, I want to be seen as personable and down-to-earth.

That’s why I often use slang when writing. We might be talking about a technical topic, but I want to help you understand it in an easy-to-digest format.

A similar example is Ramit Sethi from I Will Teach You To Be Rich.

He works in the personal finance space, which is full of questionable people that give suspicious recommendations.

Ramit takes the opposite approach, using casual language, inside jokes, and F-bombs to show you that he’s being honest and holding nothing back.

My favorite post of his is on avocado toast, in which he completely debunks terrible “advice” from another personal finance columnist.

Ash Ambirge at The Middle Finger Project also uses strong language and a no-B.S. attitude that gets people to sit up and take notice.

Being polarizing like this might turn some people off, but it can also help you create raving fans who might feel like being politically correct with the same material comes off as disingenuous.

Now, contrast that example with someone who talks about similar topics, but in a completely different style and tone: Marie Forleo.

They might both cover similar topics, but Marie’s personality (and therefore, content, design, and other branding elements) are polar opposites.

If Ash sometimes slips between PG-13 and rated R, Marie is firmly rated G.

What you’re saying is important, yes. But how you’re saying it can be equally so. Make sure you choose a tone that is authentic to you and port

Step #3. Create Your Brand Identity

Have you noticed a trend with the past few people mentioned?

From my own website to Ramit, Ash, and then Marie?

Go back and look at their websites. What do you notice?

The design is impeccable.

They each have custom sites, beautiful photography, and even their logos are easily identifiable.

Why the heavy investment in the look and feel of these sites?

Because according to one academic study, 94% of the time someone’s first impression is based on design, and it only takes 50 milliseconds for that split-second decision to get made.

A massive part of creating a personal brand is looking the part. There’s a secondary benefit as well.

Consistent design helps them become recognizable no matter where they decide to post or interact online, from their websites to media sites like Entrepreneur.com or even Facebook and Twitter.

The first step to accomplish that is creating your brand’s mark or logo. Here are some of my favorite resources to make it happen.

99designs crowdsources design samples from people all over the world. So you can set a budget and explain what you’re looking for, then sit back and watch designers start submitting ideas.

Then you can decide which ones are on the right track, give them feedback to further revise the logo, and disqualify the rest.

Best of all, if you’re unsatisfied with the options, you’re not locked into paying.

If you don’t think the design examples you received are up to snuff, you can simply use the company’s 100% money-back guarantee to get your funds back.

Another less expensive alternative is LogoNerds, which is ideal if you’re on a budget. These logos start for as little as $27!

Many times, you can even have LogoNerds create a few samples to get ideas, and then take those off to a more seasoned designer to show them the direction you like or don’t like.

Once you’re ready for the big leagues (with a budget to match), you can find amazing designers to work with personally on Dribbble.

The best designers will use Dribbble as a way to showcase their work and latest projects so that you can get a sense of their style.

Many will also show off brand concepts or logo ideas, like these Brand Elements from Steve Wolf, so you can get a feel for what your own might look like.

Professional design is often what separates the ‘real’ experts from everyone else.

Start small with a logo to establish that working relationship with a designer you like, because they’re going to be worth their weight in gold when it comes time to redesign your website.

Step #4. Create and Redesign Your Own Personal Site

Look: there’s a TON of noise out there.

You’ve probably already heard all the statistics. Like the one that says there are five million blog posts published daily.

This means not only does your content need to be great, it means it also needs to be published frequently(like several times a week at least).

Continually putting out good stuff under your own name starts to create that connection between you and the topic target you’re aiming at.

Here’s what I mean.

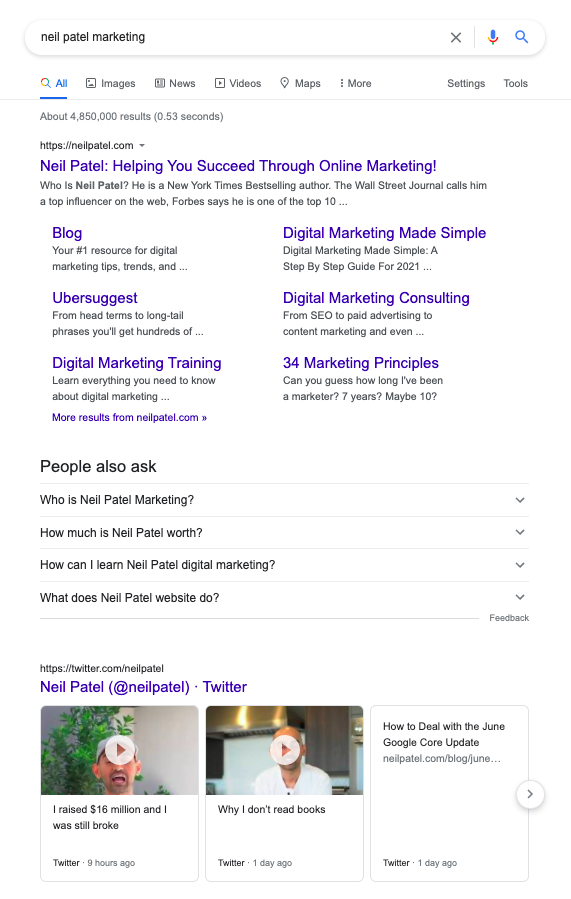

Google “Neil Patel marketing.”

My content shows up all over the place, from Entrepreneur.com to Inc. and beyond.

Those sites are so big that they’re often ranked at the top of the search engines. So imagine you work hard to become an expert on a topic, but then when people Google you, they end up going to a different website instead of your own.

Frustrating, right?!

That’s why having your own site, and then working hard to raise its profile, can be an invaluable part of reinforcing your own personal brand.

See! I own and control almost every site on the first page of the SERPs for my name.

If anyone is looking for more information about me, they go to one of my websites instead of someone else’s.

That means I’m able to convert a much higher percentage of people into new, interested leads each month.

My content and social strategies are among the main reasons that my sites rank above those other mainstream media sites.

Step #5. Carve Out a Content and Social Strategy

Content marketing “costs 62% less than traditional marketing and generates about three times as many leads.”

That stat says about all there is to say!

Look back at the SERP example in the last step.

The reason all my websites rank highly for my name is because of all the quality content I’ve published for over many years.

There’s no secret:just a lot of consistent hard work.

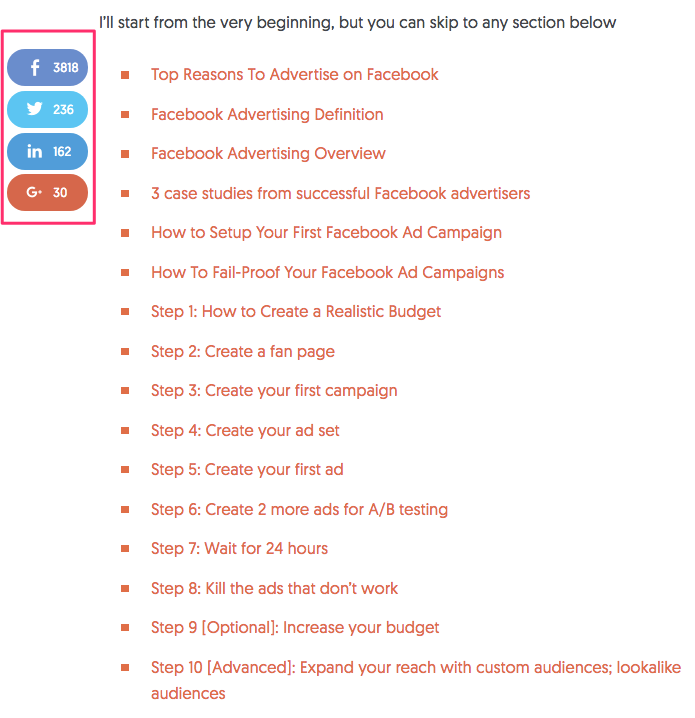

Personally, I find long, in-depth content works the best for generating leads and ranking well. For example, some of my posts are over 10,000 words and require a full table of contents!

Look at those social share numbers though!

My readers love long-form content (the stats back it up), so I keep delivering.

The same goes for my advanced guides, which in addition to being in-depth, are also beautifully designed.

The trick is to figure out what kind of content works best for you and your readers.

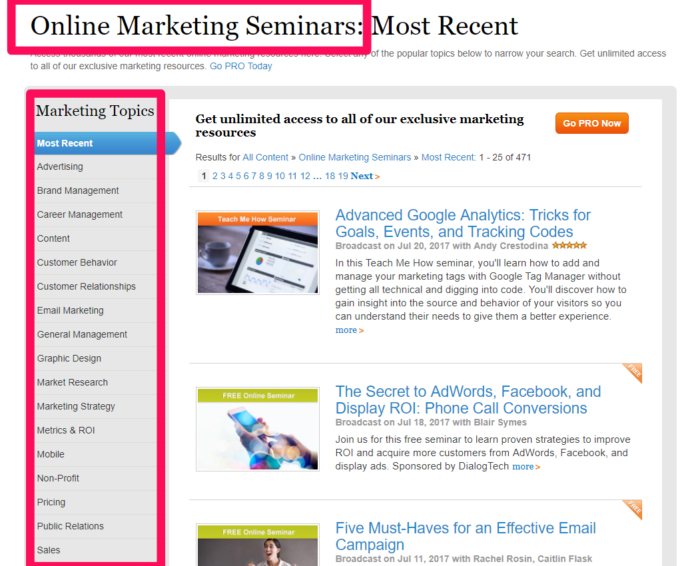

For example, MarketingProfs is another big website catering to marketing professionals. However, its content is totally different from mine.

MarketingProfs focuses on seminars, webinars, and other data as opposed to in-depth guides. So there’s no “right” answer, necessarily.

Your content strategy should also extend to your social media channels.

But keep in mind you shouldn’t necessarily be on every single social platform.

Spreading yourself too thin (and then not updating each frequently enough) is almost worse than not being on any social platforms at all.

So once again, go back to your own audience. Where are they?

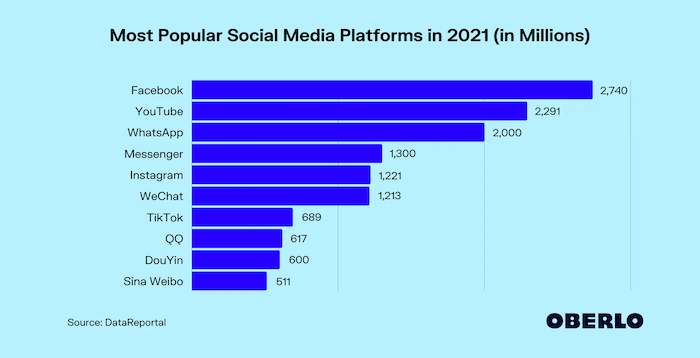

For example, here are the biggest social sites right now based on audience size.

Your own product or service plays a key role, too. For example, a wedding planner might not gain much traction on Twitter. However, if said wedding planner switches their focus to an image-focused social platform, like Pinterest or Instagram, they’re in business!

Step #6. Guest Blog to Promote Your Brand

In the early days, nobody will really know who you are.

That’s OK! It’s just critical that you realize this early before it’s too late.

If you spend all of your time initially only putting out good content on your own site, you’re unfortunately going to be wasting your time.

Instead, you should almost spend more time trying to get on other sites first.

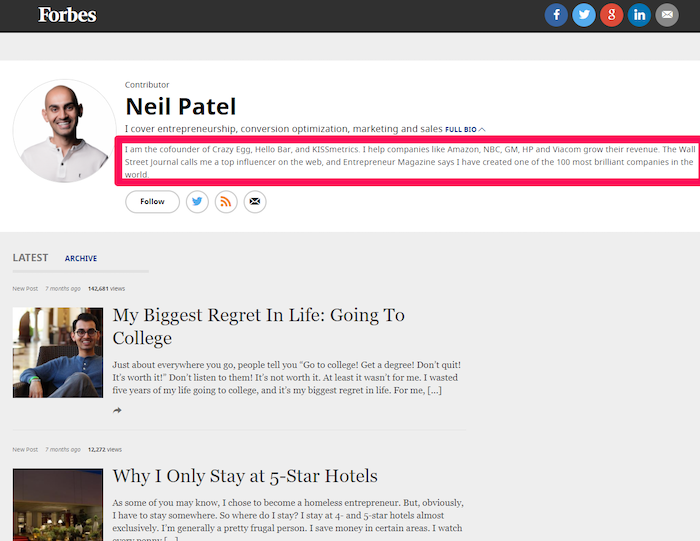

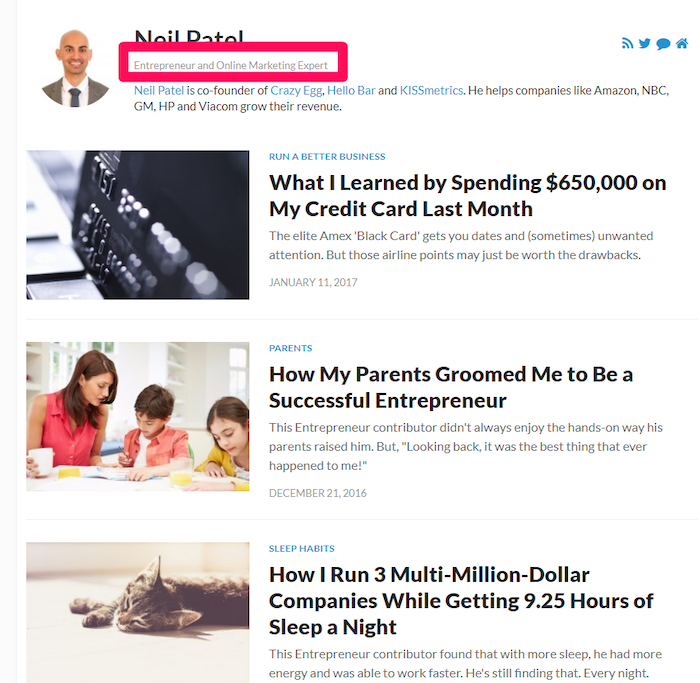

Focus on sites that already have the traffic and audience numbers you’re targeting. For example, becoming a regular on a huge site like Forbes suddenly gives you a presence in the industry.

Now you can leverage that traffic to drive people back to your own site when they start looking for more information about you.

Many times, these sites will allow you to add your own bio and title, too.

So instead of the generic “Founder of a Company That Nobody’s Ever Heard From,” you can use that valuable real estate to start planting the seed for your personal brand. Incorporate your niche and bring in elements of your personality.

Step #7. Seek Out Mentors

There’s no such thing as a “self-made” successful person.

They had to have help from someone, somewhere, at some time in their life.

Similarly, becoming a recognized expert in a field can be incredibly challenging at first.

You’ll eventually need other big-name players in the industry to recognize you as an expert, which will boost your brand to help you reach the top of your chosen niche.

Even Tiger Woods, arguably the most successful golfer of all time, worked with a swing coach for almost his entire career.

Think about that.

The guy arguably didn’t need to listen to anyone; and yet, he used mentors to help him sharpen his game.

80% of CEOs surveyed in one study said they had a mentor to help them early in their careers.

Almost all successful entrepreneurs I know have had mentors help them become the recognized experts they are today.

Personal Branding FAQs

Personal branding is reputation building by finding what makes you unique. This is how your brand communicates and how your brand presents itself visually.

Specifying your niche will allow you to find what makes you unique. This also means you’ll be able to tap into the audience that is looking for what you can do to help them.

Great design is easy on the eyes and captures attention. It’s also easy for people to identify common design elements so reinforcing your brand is easier. This makes you instantly recognizable online.

Creating and promoting content on other websites and blogs will help you connect with existing audiences and build awareness about you. Guest posts on blogs can help you build a digital presence.

Personal Branding Conclusion

Becoming the go-to, recognized expert in your industry isn’t an overnight proposition.

It’s going to take a lot of hard work and effort to reach the top, but it’s also one of the highest ROI activities you can pursue.

Not at first, of course. You have to invest the time, money, and work to slowly break through in your industry.

You’re going to have to look the part, put out content at an intense pace, and constantly meet new people. Finding a mentor can help you to avoid many of the same mistakes that have plagued the people before you.

Ultimately, becoming a recognized authority in your niche is definitely doable as long as you put in the work.

What’s your best personal branding tip to break through a crowded space?

Qventus (YC W15) Is Hiring Data Platform Engineers

Article URL: https://jobs.lever.co/qventus/c0d604cf-ec1c-48ea-847d-5ffc7a67698d Comments URL: https://news.ycombinator.com/item?id=27421523 Points: 1 # Comments: 0

Improve Your Chances of Getting a Loan with Small Business Lenders

Small Business Lenders Have the Money You Want

Can you improve your chances of getting a loan from small business lenders?

Small Business Lenders, Business Loans, and Funding

Of course you know your business needs money. But business lending doesn’t just come from banks. Still, working to make your business more attractive to lending institutions isn’t just an end unto itself. It will also help your company also become more attractive to nontraditional lenders. It may even help make your business more attractive to prospects. There are factors which are within your control and you can help your business right now.

Start Making it Easier to Get Money from Small Business Lenders

Once you understand what banks and lenders are looking for, you can address their concerns directly. Many of these are actions you only need to take one time, and many of them will also help you to convince prospects to buy from you, thereby helping you recoup any incurred costs.

Working to More Easily Get Money from Small Business Lenders: It All Starts with Fundability

Fundability is the ability of your business to get funding. When lenders consider funding your business, does it appear to them to be a good idea to make the loan? What do they look at to make that determination? Fundability means recognizing what’s important to lenders, and then giving them what they want.

How Does a Business Become Fundable?

You probably already know that a great business credit score is important. But many of the aspects necessary for a strong business credit score work for fundability as well. A potential creditor or lender needs to see your business is legitimate and profitable. Many loan applications get denials due to fraud concerns. Others, simply because something didn’t match up and threw up a red flag.

Your Business Setup

A business must be set up to appear to be a fundable entity separate from you, the owner. The first step is to ensure your business has its own phone number and address. That doesn’t mean you must get a separate phone line, or even a separate location. You can still run your business from your house or on your computer.

Business Phone Numbers

You can get a business phone number that will work over the internet instead of phone lines. This is called a VoIP (voice over internet protocol). The phone number will forward to any phone you want it too so you can use your personal cell phone or landline if you want. Whenever someone calls your business number it will ring straight to you.

Virtual Offices

Use a virtual office for a business address. A virtual office is a business that offers a physical address for a fee. They sometimes they even offer mail service and live receptionist services. There are some that offer meeting spaces for those times you may need to meet a client or customer in person.

But not every vendor will accept a virtual address.

Business Website and Email

A business website can affect your ability to get funding. But a poorly put together website that appears unprofessional will not help you with customers or potential lenders. Spend the time and money necessary to ensure your website is professionally designed and works well.

Along these same lines, your business needs a dedicated business email address. Make sure it has the same URL as your website. Don’t use a free service like Yahoo or Gmail.

Demolish your funding problems with 27 killer ways to get cash for your business.

Improve Your Chances of Getting Money from Small Business Lenders with Business Information and Consistency

All your business information should be the same everywhere you use it. But when you start changing things up like adding a business phone number and address or incorporating, you may find that some things slip through the cracks. This is a problem because many loan applications fail each year due to fraud concerns simply because things do not match up.

Consider all the places where this information could be.

Credit providers won’t stop to consider all the ways you could list your business. If you write Incorporated in one place, and Inc. in another, it can be enough to trigger a denial. Consistent and congruent information makes it fast and easy for credit providers and lenders to find your business and its payment history.

Fix Inconsistent Information by Getting Organized

Consider all the places where your business has a listing. It’s your website, credit applications, even places like Yelp and Google Reviews. Take the time to keep records of all of these places, so Google your business often. Claim your profile on review sites to better control how your business name, address, and other particulars are presented. Copy and paste your information. Don’t chance an error with typing it out. This also means updating info whenever it changes.

Get an EIN

An EIN is an identifying number for your business that works like how your SSN works for you personally. Many sole proprietorships and partnership use their SSN for their business. But it can cause your personal and business credit to get mixed up. When you are looking to increase fundability, you need to apply for and use an EIN. Get one for free from the IRS.

Demolish your funding problems with 27 killer ways to get cash for your business.

Incorporate Your Business

A lot of businesses start off as sole proprietorships. But there’s no separation between the owner and the business with this setup. Partnerships are another entity where the ownership and the business are more intimately connected. With either entity, any other efforts at separating business and personal credit could be all for naught.

Why Incorporate?

A corporate structure truly separates business and personal credit and finances. This is because a corporation is considered to be its own entity. Should you choose a C-corporation, an S-corporation, or a limited liability corporation? That’s up to you to decide. We highly recommend working with a corporate lawyer or an accountant to determine what’s best for your particular situation.

Why Should You Incorporate Quickly?

When you incorporate, you become a new entity. Hence if you haven’t incorporated ASAP, you lose the time in business that you have and must start over. You also lose any positive payment history you may have accumulated.

Hence you must incorporate as soon as possible. It’s not just necessary for fundability and for building business credit. Time in business is also vital. The longer you have been in business the more fundable you appear. That starts on the date of incorporation. This is regardless of when you actually started doing business.

Improve Your Chances of Getting Funding from Small Business Lenders with a Separate Business Bank Account

There are business owners who pay for business expenses with personal credit cards and checks. But a business’s credit file is only supposed to reflect the financial performance of the company itself. Using personal payment methods can muddy the waters. Resist the temptation to pay for any business expenses with personal credit or checks.

Separate Your Business and Personal Finances

Your business must stand or fall on its own financially. Once you get credit from starter vendors or any other business or lender, use it on your business, and stop floating what are essentially interest-free loans to your business.

Get a Merchant Account

Another way to assure your finances get and stay separate is separate bank accounts. Often, a starter vendor will want for your business to have its own bank account anyway. While you’re at it, open a merchant account so you can take credit cards from your customers. Customers will spend more if they can pay with plastic.

Improve Your Chances with Small Business Lenders and Get all Required Licenses

Fundability means being a legitimate business. For a business to be legitimate it must have all of the necessary licenses it needs to run. If it doesn’t, red flags will fly up all over the place. Do research to ensure you have all the licenses necessary to legitimately run your business at the federal, state, and local levels. Being properly licensed can help assure skittish prospects that you and your business are legit.

Get a D-U-N-S Number

In addition to the EIN, there are identifying numbers that go along with your business credit reports. Some are assigned by the agency, like the Experian BIN. Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. To get a D-U-N-S number, you must apply for one through the D&B website.

Demolish your funding problems with 27 killer ways to get cash for your business.

Business Credit Monitoring

The key to keeping records consistent is to monitor your reports frequently. Monitoring your credit means you know what’s going on with it. You can pounce on errors quickly. Yes, the business CRAs make them, but they are all committed to accuracy and want to correct those mistakes ASAP.

When it comes to business credit reports, you can monitor through the reporting agencies directly. But that’s expensive! Or you can save 90% and monitor through Credit Suite.

Improve Your Chances with Small Business Lenders with a Good Business Credit History

Your credit history has a lot to do with your credit score. It is a huge factor in the fundability of your business. The more accounts you have reporting on-time payments, the stronger your credit score will be.

Your credit history consists of a number of things including:

- How many accounts are reporting payments?

- How long have you had each account?

- What type of accounts are they?

- How much credit are you using on each account versus how much is available?

- Are you making your payments on these accounts consistently on time?

Personal credit scores come from several metrics. But business credit mainly depends on one thing, how early or late you pay your credit bills. Paying late will damage your business credit scores at all three of the major CRAs.

Improving Your Business’s Payment History

Here are a few suggestions on how to improve your company’s payment history:

- Set up reminders to pay – your phone or your business calendar are both fine

- Set aside money for your credit bills as a part of your budget so you’re not caught short

- Shop around for better deals and spend less if you can

- Repurpose older equipment or the like to avoid spending in the first place

Improve Your Chances with Small Business Lenders by Building Business Credit

Business credit is credit in the name of the business, not its owner(s). It’s a measure of how well your business (not you) pays its bills. Properly created business credit separates personal and business credit completely. So if your business defaults on payments or goes bankrupt, it protects your personal assets.

Good business credit is the way to qualify for funding without good personal credit, collateral, cash, or a guarantor. Here are some tips on building business credit to improve your chances for financing from small business lenders.

Buy from Vendors and Other Credit Providers Which Report

While many vendors and credit providers don’t report all payment experiences, they have no problem reporting late and missing payments. So, seek out and mainly (if not 100%) work with vendors which report. These are called starter vendors. Their requirements change all the time. Fortunately, we know which vendors report, and we keep up with their ever-changing requirements.

Spread Out Your Credit Applications Over Time

Asking for too many lines of credit at once signals that you’re desperate and could be overextending yourself. Building a successful business takes time. In the same way, so does building a good business credit profile. As a result, spread your applications for additional lines of credit over time.

Applying for a lot of credit at once also means you’ll have a number of brand-new accounts, which will bring the average age down. Not using your credit can result in credit providers closing inactive accounts. This, too, brings the average age down.

Use Your Credit

Business credit isn’t going to be built if you get cards and then forget about them and never use them. The business credit reporting agencies are calculating your scores based on the credit you use. Using your credit, and paying on time, is positive fodder from business credit scores and reports. You can’t control the passage of time, but you can control card usage and not apply for every credit card you see all at once.

Finally, Apply for the Right Loan

Do you need a traditional loan or a line of credit? Would a working capital loan or expansion loan work best for your needs? Choosing the right product to apply for can make all the difference. Don’t waste yours and the lender’s time by not considering the best loan product to apply for.

Improve Your Chances for Approvals from Small Business Lenders: Some Takeaways

There are steps you can take to make it more likely your business will get a loan. These steps may also help your business become more appealing to prospects. They also help with building business credit. And applying for the right loan product will also help improve your chances of getting a business loan from small business lenders.

The post Improve Your Chances of Getting a Loan with Small Business Lenders appeared first on Credit Suite.

10 Powerful Instagram Marketing Tips (That Actually Work)

Since Instagram’s creation, it has grown into the ultimate platform for sharing photos. Over 1.16 billion monthly users are active on the site. Daily users spend about 8 minutes on the app and 500 million use Stories daily. There’s also a large number of influencers on the site with a massive amount of followers. And …

The post 10 Powerful Instagram Marketing Tips (That Actually Work) first appeared on Online Web Store Site.

PingLend (YC W21) is hiring a founding engineer

Article URL: https://www.ycombinator.com/companies/pinglend/jobs/8Lktq5A-building-a-whole-new-type-of-credit-card-ideally-bay-area-flexible-fintech-full-stack-pinglend-yc-w21 Comments URL: https://news.ycombinator.com/item?id=26845719 Points: 1 # Comments: 0

The post PingLend (YC W21) is hiring a founding engineer first appeared on Online Web Store Site.

New comment by zuzuleinen in "Ask HN: Freelancer? Seeking freelancer? (April 2021)"

SEEKING WORK Location: Romania Remote: Yes Willing to relocate: No Technologies: Go, Javascript, React.js, PHP, Laravel, Symfony, MySQL, Postgres, Git, Linux, HTML, CSS Résumé/CV: https://www.linkedin.com/in/andrei-boar-7aa32ab7 Email: andrey.boar at gmail com The post New comment by zuzuleinen in “Ask HN: Freelancer? Seeking freelancer? (April 2021)” appeared first on ROI Credit Builders.