The Best Project Management Software (In-Depth Review)

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

It’s every manager’s worst nightmare.

That ONE project that never seems to end. Nothing goes as planned and missed deadlines lurk around every corner. You can’t remember the last time you laughed. Your boss is mad and your employees stumble around trying to figure out what to do next.

You drive home wondering what went wrong and why the universe is working against you. If only there was a better way.

It doesn’t have to be this way.

By choosing the right project management software, projects won’t throw you into that panic-inducing nightmare.

I’ve managed countless projects, hundreds of teams, and bounced around to every project management software you can think of.

From Wrike to Trello. Trello to Asana. From Asana back to Wrike.

Rinse and repeat with every possible combination of tools on the market.

And you want to know a secret? It doesn’t matter which project management tool you use as long as you pick the right one and stick to it.

But to help make your decision easier, I reviewed six of my favorite options and put together a list of what to consider as you go through the process of choosing the right software.

The top 6 options for project management software

- Zoho Projects – Best for versatility

- Wrike – Best for marketing teams

- Teamwork – Best for remote teams

- Asana – Best for small teams

- Smartsheet – Best for large teams

- Trello – Best free project management software

How to choose the project management software for you

The best project management software for you depends on your projects’ complexity, the size of your team, and the features you need.

And choosing the right one can feel impossible because there are thousands of different tools.

So before we dive into my top recommendations, let’s talk about what to look for as you go through the process of finding the right software.

Number of users

Most project management software is charged on a per user per month basis. So, it’s crucial to understand how many seats you need and your budget.

If you have a large team with hundreds of users, you’re better off choosing an enterprise plan with custom pricing to get the most bang for your buck.

However, if you have less than 15 people, Asana is an excellent choice (free for up to 15 users).

And if you have fewer than three users, you can use Zoho Projects for free as well.

Project complexity

For simple and straightforward projects, basic project management software is all you need.

And you can probably get by using a free forever plan with Trello, Asana, or Zoho Projects.

However, as your projects get more complex, you need more robust features. So, you may need to upgrade to a paid plan if you go with a basic project management software.

On the other hand, tools like Wrike and Smartsheet offer more advanced and industry-specific capabilities. But they come with a higher price tag.

Task management

Task management is one of the most important features to pay attention to.

While most project management software includes basic task management, it’s important to consider the advanced capabilities you need.

Do you need to create task dependencies? Maybe you need to create recurring tasks on a daily, monthly, or yearly basis. Or perhaps you want to assign multiple people to the same task.

This also includes things like:

- Checklists and due dates

- File attachments

- Task archiving/deleting

- Task prioritization

- Automation

- Subtasks

So, carefully consider how you plan to manage projects and the task management features you need before making any decisions.

Discussion features

The best project management software includes internal discussion features like comments, forums, or instant messaging.

This is an essential feature that lets you keep discussions streamlined and intact with the different tasks or phases of your project. Rather than searching through thousands of emails, you can open the task and see everything related to it right away.

All of my top recommendations include this in some capacity. But make sure the software you choose includes robust discussion features as well.

Customization

Every project and team is different.

So it’s important that your project management software can adapt to meet your needs. Whether that’s a fully branded dashboard, the flexibility to scale, or improved functionality with the right integrations.

Furthermore, think about how you want to view and share project progress. Different software offers different project views, reporting, and analytics.

Start by creating a complete list of required features and integrations.

Lastly, consider everything you need your software to do and speak to a sales team to make sure their tool can handle your top priorities within your budget.

The different types of project management software

There are various different types of project management software. Some are much better than others while some are reserved specifically for developers or enterprises with a large budget.

Let’s walk through them together.

Cloud-based

All of my top recommendations are cloud-based software. This means that the software lives on a cloud server and you can access it from any web browser on any device.

This is the preferred type for most users because it’s easy to use, doesn’t require any infrastructure on your part, and you can access everything regardless of where you are.

You typically pay for this type of software on a per user per month basis.

Industry-specific

Different types of projects may require industry-specific solutions.

These make your life easier with pre-made templates, automated workflows, and more features specific to the types of projects you’re managing.

Most of the software on this list offer solutions for industries like:

- Digital marketing

- Manufacturing

- Education

- Real estate

- Construction

- Software development

- Remote teams

With that said, these companies also offer standard subscriptions at reasonable prices that don’t include industry-specific tools.

So you don’t have to use these higher-priced solutions unless you want to.

Most of these solutions come with custom pricing based on your specific needs. So they may be outside your budget, especially if you’re a small company or a brand new business.

On-premise

On-premise project management software lives on your servers, rather than on the cloud. And while it’s more secure, you can only access the software from devices on your network.

You also may need to install new infrastructure or hire an in-house maintenance team to update and maintain the software for you.

This is why none of the recommendations on this list are on-premise solutions.

Open API

Open API software is perfect for developers or if you’re interested in hiring a developer to create a custom project management solution for your business.

This type of software is highly customizable but difficult to manage if you’re not a developer.

And this level of customization isn’t necessary for most users. So, I didn’t include any open API software on this list.

#1 – Zoho Projects Review — The best for versatility

For most users, Zoho Projects is my top recommendation.

They offer a free forever plan, and paid plans start at just $3 per user per month. So, it’s incredibly affordable for small businesses and can scale as your business grows.

Whether you’re managing simple or complex projects, Zoho has everything you need, including powerful features like:

- Hosted file storage

- Task dependencies

- Recurring tasks

- Visual workflow builder

- Time tracking

- Task assignments and prioritization

- Chats, forums, and feeds

- Reporting and analytics

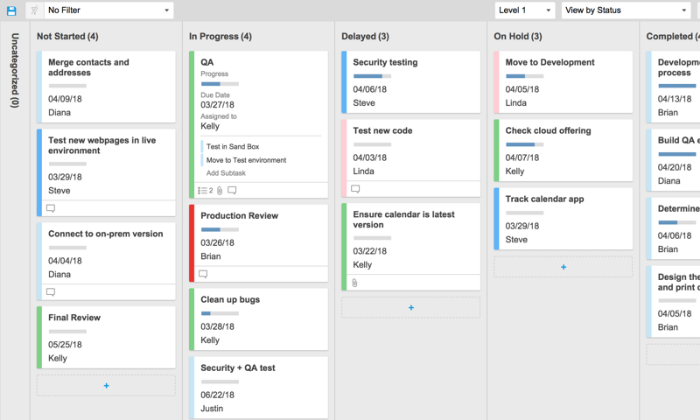

The drag-and-drop interface makes it easy to create workflows and track project progress quickly. Plus, you can view projects using Kanban, Gantt, or calendar views.

Furthermore, their internal communication tools (chat, forum, and feed) streamline team collaboration where it matters most.

You can also take advantage of more than 100+ built-in integrations with business tools you’re already using to run and manage your business.

These integrations include Slack, Zapier, DropBox, and more.

Zoho’s plans include:

- Free — up to 3 users, two projects, and 10 MB of storage

- Standard — $3/user per month and up to 10 projects (between 6 and 10 users)

- Express — $4/user per month + unlimited projects (between 12 and 50 users)

- Premium — $5/user per month + unlimited projects (between 15 and 100 users)

- Enterprise — $6/user per month + unlimited projects (for 20+ users)

Start your 10-day free trial to take Zoho for a test drive today.

#2 – Wrike Review — The best for marketing teams

Over 20,000+ businesses, including Google, Airbnb, and Dell, use Wrike to manage marketing and sales projects worldwide.

With Wrike, your project management software adapts to meet your needs, rather than the other way around. And features like custom workflows and dashboards, automation, and real-time communication make this an excellent choice for dynamic marketing teams of all sizes.

You also get end-to-end visualization so you can hone in on problem areas while maintaining constant forward movement with each project as a whole.

Furthermore, Wrike includes powerful marketing-specific templates including

- Campaign management

- Product launching

- Marketing operations

- Content creation

- Event management

And you can combine those with standard project management features like task management, proofing and approvals, communication tools, and real-time progress visibility.

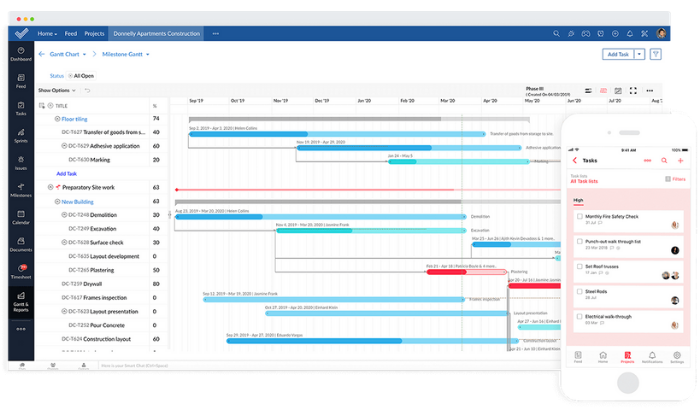

Project views include board, spreadsheet, Gantt, calendar, and custom views.

Wrike also includes seamless integrations with 400+ business tools, like Salesforce, G Mail, and Google Drive. So, you don’t have to worry about software incompatibility issues or anything like that.

You can start on their free forever plan for up to five users, but you may find it limiting. Paid plans include:

- Professional — $9.80/user per month (5 – 15 users)

- Business — $24.80/user per month (5 – 200 users)

- Enterprise — Custom (5 – unlimited users)

They also offer tailored plans for marketing teams, but you have to contact them for a custom quote. However, it includes specialty templates, Wrike Proof, and more.

Start your 14-day free trial or sign up for a free forever plan to get started today.

#3 – Teamwork Review — The best for remote teams

If you’re managing a remote team (or a soon-to-be remote team), Teamwork is an excellent choice. Their remote work module is specifically for distributed teams who need a flexible way to keep work moving forward.

20,000+ teams plus big names, including Disney, Netflix, and Spotify, rely on Teamwork for their remote project management needs — and for a good reason.

The software makes collaboration, task management, and project visibility a breeze regardless of where your team lives (and works). And as Teamwork says, “Just because you’re not in the same room doesn’t mean you can’t be on the same page.”

This remote project management software includes excellent features like:

- Internal chat software

- Centralized workspaces

- Board views

- Custom project templates

- Workload balancing

- Time tracking

- Gantt charts

Furthermore, you can pick and choose which software you need. Or, you can save 49% by bundling all of Teamwork’s software together.

At $35/mo per user (minimum of five users), it’s more suitable for businesses with a decent budget. But, their project management module alone is much more affordable, starting at $10/mo per user.

Alternatively, you can start with a free forever plan for up to five users and two projects. This is an excellent choice for small teams or fast-growth companies.

Sign up for a 30-day free trial to try Teamwork’s remote project management solution today.

#4 – Asana Review — The best for small teams

Asana is an excellent choice for teams of up to 15 people.

And with millions of users spanning 190+ countries worldwide, you can rest assured you’re in good hands.

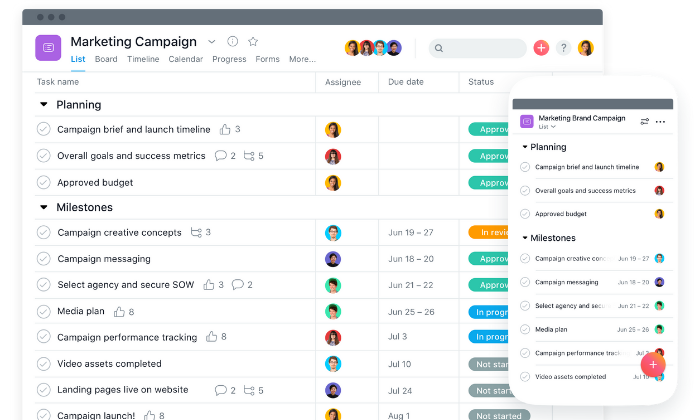

Their free forever plan includes 15 seats, unlimited tasks and projects, assignees, due dates, and everything you need (aside from a few advanced features) to manage projects of all sizes efficiently.

With Asana, you can map out even the smallest steps of every project to ensure forward movement and track your team’s progress along the way.

Furthermore, you can enjoy features like:

- Drag-and-drop board views

- Timeline views

- Automated workflows

- Work requests and forms

- Calendar view

- Portfolio overviews

- Workload balance

- Custom fields

- Reusable templates

Not only that, but the entire interface is beautiful and easy to navigate.

You can choose between pre-made industry templates or create your own to get your team on track in no time.

And with 100+ integrations including Adobe, Slack, Gmail, Chrome, Drive, and more, you can rest easy knowing Asana plays well with the tools you’re already using.

Plus, you can share files, communicate, and share feedback all in one place.

With a free price tag (for up to 15 users), Asana’s hard to beat. However, if you outgrow the free plan, you can upgrade to one of their paid plans, including:

- Premium — $10.99 per user per month

- Business — $24.99 per user per month

- Enterprise — custom pricing only

Sign up for a free forever plan to get started with Asana today!

#5 – Smartsheet Review — The best for large teams

Smartsheet is a dynamic project management software built for enterprises and large teams. However, the solution is flexible enough to suit businesses and projects of all sizes.

They specialize in rapid-movement projects with a ton of moving parts. So, you can trust Smartsheet for even the most complicated projects.

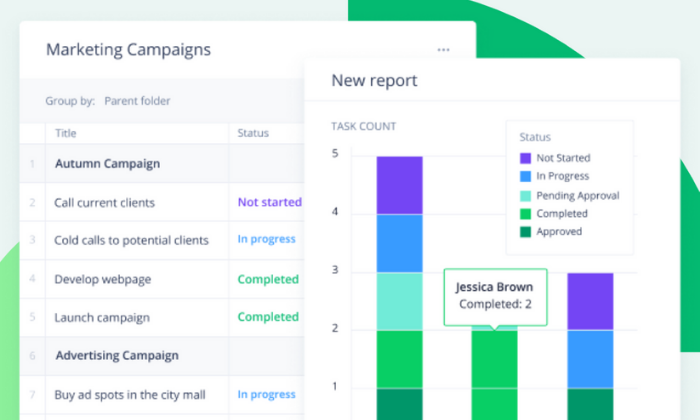

With Smartsheet, you can gain end-to-end project visibility with grid, card, Gantt, and calendar views. Furthermore, you can gather data from forms, automated workflows, and recurring tasks to see what you need to see, and when.

However, the software goes beyond essential project management. It’s an award-winning work execution platform that’s easy to implement, manage, and maintain.

Plus, 75% of fortune 500 companies use Smartsheet to get things done.

So, you’re in good company.

All plans also include on-demand customer support, continuous education materials, training + certification programs, and consulting services to help you make the most of your new project management software.

And you also get collaboration tools, all four project views, and extensive mobile apps/integrations with every plan.

While Smartsheet is overkill for most small businesses, it’s an excellent choice for large companies and enterprises looking to streamline their business processes.

Their paid plans include:

- Individual — $14 per month

- Business — $25 per user per month (minimum of three users)

- Enterprise — custom (enterprise-grade features and tools)

- Premier — custom (enterprise + premium features and tools)

Sign up for a 30-day free trial to try Smartsheets risk-free with no credit card required.

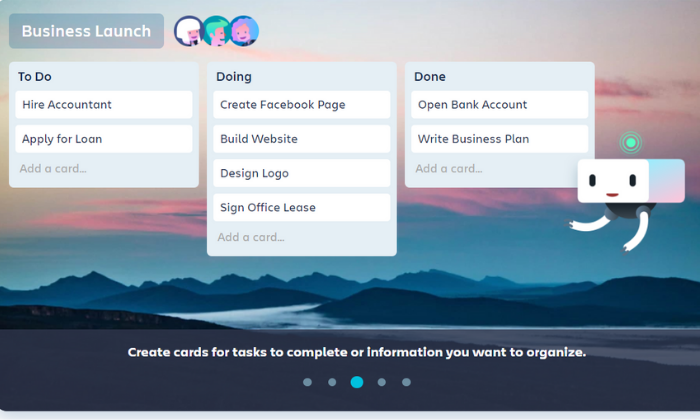

#6 – Trello Review — The best free project management software

If you’re on a tight budget, Trello is an excellent free project management software.

Plus, millions of users, including Pinterest, Peloton, Fender, and Costco, rely on it to map out and manage projects of all shapes and sizes.

It’s an excellent tool for basic visual project management for any type of project, from home improvement and side hustles to marketing campaigns and full-blown business operations as well.

Trello uses boards, cards, and lists to organize projects, making it a familiar and comfortable platform. You can drag and drop cards, move cards to new boards, and cross tasks off as you go along.

Furthermore, you can create automatic workflows with rule-based triggers, calendar commands, and more.

Plus, the free forever plan includes intuitive features like:

- Unlimited personal boards

- Unlimited cards and lists

- 10 MB file attachments

- Up to 10 team boards

- Basic automation

- And two-factor authentication

It’s an excellent solution for teams of all sizes since everyone can join for free. However, you need to upgrade to a paid plan if you need more than ten team boards.

And if you outgrow the free plan, you can upgrade to an affordable paid plan for more advanced features. Trello’s paid plans include:

- Business Class — $9.99/user per month

- Enterprise — $17.50/user per month

Sign up for a free forever plan to get started with Trello today.

Summary

Zoho Projects is my #1 recommendation for most users, starting at just $3 per user per month with an extensive free forever plan as well.

However, there isn’t a one-size-fits-all project management solution.

So, make sure you understand your needs and requirements before making any decisions. And don’t forget to use the criteria we talked about as you go through the process.

What’s your go-to project management software?

The post The Best Project Management Software (In-Depth Review) appeared first on Neil Patel.