If you still think Facebook and Twitter are the be-all and end-all of social media marketing tools, think again. Say “Hi” to your business’s new best friend: business Pinterest accounts. Eighty percent of Pinterest pins are repins, which means this is a platform that values sharable content. The average lifespan of a pin is three … Continue reading How to Use a Business Pinterest Account For Marketing and Brand Growth

Author: Steve Smallwood

Great Question (YC W21) Is Hiring a Founding Engineer (Rails) (Remote, PST-Ish)

Article URL: https://www.ycombinator.com/companies/great-question/jobs/rbDFLOP-founding-engineer-rails

Comments URL: https://news.ycombinator.com/item?id=26799244

Points: 1

# Comments: 0

How to Leverage Testimonial Examples in Paid Campaigns

No matter how creative and convincing your marketing can get, when you are trying to sell to someone, they sense they are being sold to. Maybe they are primed for that sale and ready to buy, or maybe not.

On the flip side, someone telling a story about their experience with a brand and recommending it is a lot more convincing, especially when they aren’t paid to do it.

Testimonial examples can boost the social proof in your paid ad campaigns, adding authenticity to your online marketing. Adding recommendations from your customers or clients into your digital ads can help them stand out from the competition, stop people from scrolling by, and encourage users to click through to learn more about your brand.

Why Are Testimonial Examples Important in Paid Ad Campaigns?

There are many considerations when you are building paid ad campaigns: images, text on the images and in the copy, calls to action (CTAs), URL, click-through landing page, and more.

With all these constraints and necessities, you may be tempted to lean into the direct sell as you build your paid ad campaign. You may want to get to the heart of things and tell people why you are amazing and why they should buy (and where).

There are also a lot of reasons to slow down and think about incorporating testimonial examples into your paid ads.

Below are four reasons to incorporate customer reviews in your paid campaigns.

1. Testimonial Examples Improve Credibility

Whether your product works better than anyone else’s, or your prices just can’t be beaten, a skeptical customer is always going to wonder if it’s too good to be true when they see your ad. If they haven’t heard of you, they may wonder what you’re all about.

They might click to read more and explore, but maybe they’ll just assume you aren’t legit and keep scrolling past your ad.

Testimonial examples can change all that by adding credibility to your ad and your brand. Suddenly, there’s some proof you’re worth it.

2. Testimonial Examples Set the Stage for Great Customer Relationships

Customer service is a critical element for many buyers. In fact, Microsoft reports that as many as 90 percent of consumers consider customer service when thinking about working with a company.

It’s not just about a good product at a reasonable price; customers want to know they will be supported if they have questions about your product or service.

Testimonial examples give you a chance to share happy customers’ best experiences. They can speak to the customer service they interacted with or the overall experience working with your brand. This can help make potential customers feel more confident in their decision to use your brand.

3. Testimonial Examples Show Authenticity

People feel sold to all day and are always on the lookout for real authenticity. An Edelman report shows that nearly three-quarters of consumers actively try to avoid ads.

Testimonial examples give you the chance to tell real stories about real experiences. People love hearing stories, and when they feel connected to them, they may be more emotionally inclined to work with you.

4. Testimonial Examples Increase Conversions

While all the above reasons are great psychological reasons for using testimonials in your paid campaigns, at the end of the day, your marketing is about making more sales for your brand. Your paid ads should be designed to convert.

When people feel more confident about your offerings and feel an authentic connection with your brand, they are more likely to click through your ad and get to your landing page or website. From there, they are more likely to learn more and eventually make that sale. In fact, a VWO study found that using testimonials increased sales by 34 percent.

When it comes down to it, one of the best reasons to add testimonial examples to your ads is to make more sales.

How to Use Testimonial Examples in Paid Ads

Is it time to start incorporating testimonial examples into your paid ads? There are different ways to do this, but let’s talk about the high-level considerations for getting those testimonials into your ads.

1. Incorporate High-Quality Images

A photo of your product or people interacting with your product (with a quote incorporated in it) is a great way to get started with testimonials in your ads.

Make sure you use a high-quality image with a testimonial quote that is short and easy to read and grabs a buyer’s attention quickly. You want people to “get it” immediately.

Another way to use images to showcase your testimonials is a screenshot of reviews or star ratings from your website. Again, make sure you have the highest quality image you can so buyers don’t strain to read or struggle to understand what you’re trying to convey. Keep it simple.

More about this below, but remember to make sure you have legal rights to the reviews you are sharing. You can’t just go and copy them from anywhere without the consent of the reviewer.

2. Experiment With Different Formats

Testimonials from your happy customers can come in a lot of different formats. They might be text quotes, full case studies, or video testimonials.

As you build your marketing campaign funnel, you can experiment with different formats and integrate different types of testimonial examples throughout the various touchpoints of your ads.

For instance, you can use a simple, short quote in the images or text of your digital ads. That introductory text should really deliver a punch such as “This product changed my life” or “I couldn’t do my work without this service.”

You may want it to be pithy and draw the readers’ attention so they are interested in reading more.

You could also use video interviews or testimonials from customers or clients who love what you do. Even as these are more interactive and engaging, they should still be short and sweet, grabbing the viewers’ attention quickly.

3. Decide What Narrative You Want to Share

Carefully consider what kind of story you want your testimonial examples to share. Of course, they should be positive endorsements, but you will want to figure out the angle you want your testimonials to take.

They should be more nuanced than just “it’s a great product” or “you should buy it.”

Make sure your testimonial examples are framed around a compelling reason. Why is your product different from others? Why are your happy customers actually happy? Why would they want to tell others?

Imagine your customers talking to their best friends. What’s the reason they endorse your product? What brought it up in their conversation in the first place, and why are they excited to talk about it?

Especially if you decide to try some A/B testing or a variety of ad types to see what works best, building all your ads around a single narrative can help keep everything cohesive, improving the chances you connect with and convert your customers.

4. Make It Conversational

Testimonial examples in your ads can be a way to engage with your customers rather than just speaking at them. Keeping the tone of the ad approachable and conversational can add to the authentic nature of your message.

Maintaining a human touch is the key to this kind of message. Make sure it sounds like friends talking together, not a keynote presentation or a car salesperson.

One way to do this is to incorporate user-generated content, such as videos or photos. This kind of content brings honesty and a genuine feel to your ads.

Be careful to watch that narrative, as we discussed above, to ensure your message isn’t muddled. By setting those parameters for the message you are trying to convey, you can filter which user-generated content will be best for your paid ads.

5. Lead From the Ad to the Page

Keep the whole customer journey in mind as you put together your paid campaign using your testimonial examples. Remember that it’s not just about the ad; it’s about where they go next and what they will do once they get there.

You can use your ad to build intrigue and interest, then continue that story on the page you send them to.

Start with a short testimonial quote, an image of the customer sharing the testimonial, a quick video clip, or another snapshot that is going to get people interested.

Maybe it starts with a question such as, “How did this product change my life?” Perhaps it contains the first part of a testimonial and includes a CTA to tell the reader to click to hear the rest.

Your next step is to deliver. On the page, make sure you tell the next part in written text, graphics, a longer video, or a case study.

Don’t forget to make it easy to close the sale by including a buy link or another way to capture their information.

6. Don’t Overlook the Legalities

There are a lot of legal regulations surrounding how you use testimonials. This isn’t legal advice, and you should consult an attorney if you have specific questions. However, there are a few things to consider as you use testimonials in your ads.

- Make sure you have permission from the people whose testimonials you are using. Don’t just cut and paste a great review you find out there.

- Reach out and make sure the customer gives you written permission to use the review for marketing purposes. You can also include this information on your website or other places you are collecting reviews so customers aren’t surprised, but you should still get that permission.

- Ensure your testimonials are accurate and typical for most buyers. In other words, don’t exaggerate or oversell using testimonials. Let’s be honest: this isn’t just about the legalities. It’s also the right thing to do. Your testimonials should be about honesty and authenticity.

2 Great Testimonial Examples

Are you still wondering what testimonial examples look like in a paid campaign? Here are a couple of examples to get you started:

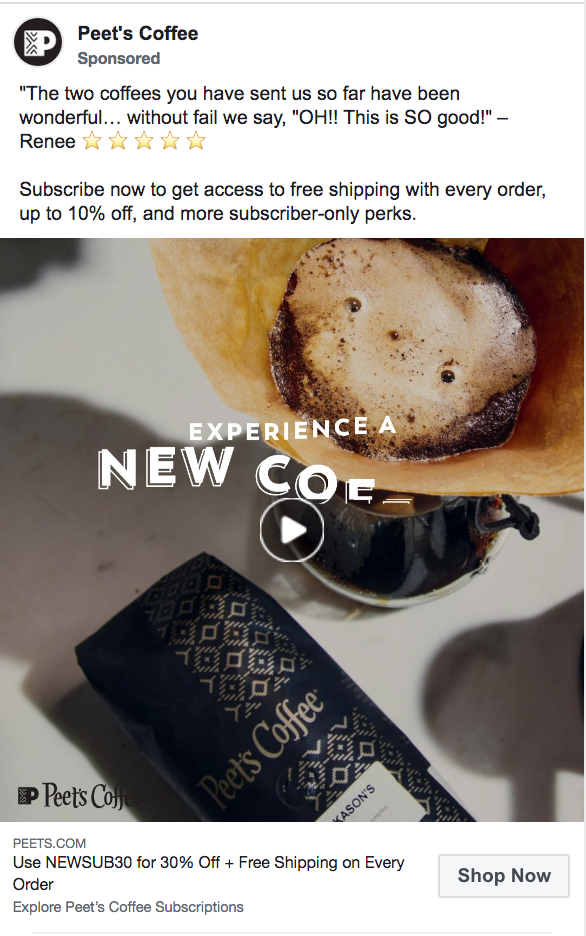

Peet’s Coffee

Using a real review from a user of their coffee subscription services, this Peet’s Coffee Facebook ad catches your eye with its simplicity and the star bar.

It puts a positive review of the subscription service right in front of you. The review retains a bit of authenticity as well with the exclamations and random capitalizations. It isn’t “cleaned up,” so to speak.

The rest of the ad continues with specifics about the services and a quick video overview. Starting with the review, it draws you in to learn more about what makes Renee so happy.

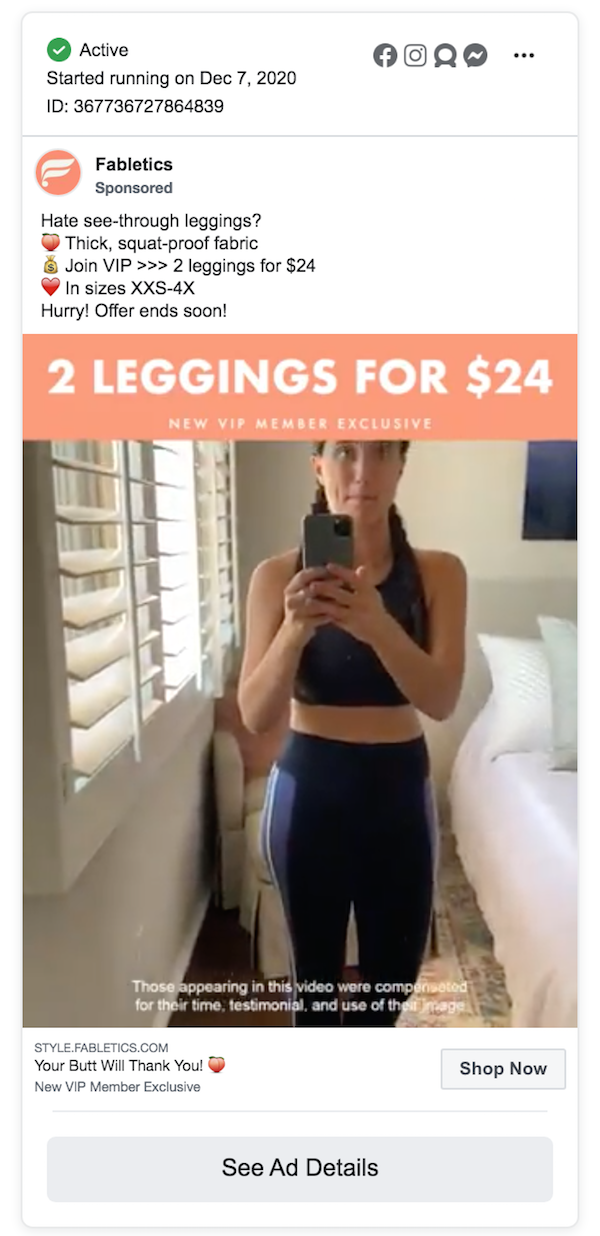

Fabletics

This Fabletics Facebook ad showcases a series of quick testimonial video snippets from happy wearers of their products. It’s instant proof these pants do what they’re advertised to do. They also show people actually wearing the pants, which is an added layer of authenticity.

You’ll notice the line on the bottom of the video that reminds people these people were compensated for the use of their reviews.

Conclusions

As you gather reviews from your customers, it may be time to start thinking about how you can incorporate them into your paid ad campaigns. Paid internet advertising can help you find your ideal audience and connect your brand with what your audience is looking for.

By setting up testimonial ads, you can bring social proof and realness to your brand, encouraging your audience to click to learn more and convert to customers.

Creating and maintaining your paid campaigns may be overwhelming to some. If that’s true for you, we can help. Our team of experts specializes in paid ads, as well as SEO and content marketing.

How will you be using testimonial examples in your next paid ad campaign?

Truebill is hiring an IT Engineer

You will be responsible for running all things IT at Truebill. That includes device management, access control (with and without SAML), and any IT requests that come up. You will be the primary IT provider for our nearly 100 employees and you will report directly to the CTO.

Email jobs+hn@truebill.com if you’d like to discuss!

Comments URL: https://news.ycombinator.com/item?id=26710782

Points: 1

# Comments: 0

New comment by heythisisom in "Ask HN: Who is hiring? (October 2020)"

Dive | Sr. Backend Engineer | India | Remote | Full Time |

https://www.letsdive.io/

Dive is a fun space for remote teams where team members can socialize. You can see who’s online, call a group, play games, watch movies together, or bond on common interest areas. You can talk, screen share, and do video chat with a click.

We are growing rapidly and are looking for Sr. Backend Engineers to join our early stage engineering team. We are seeking someone who has experience building robust backend applications and can solve complex engineering problems at scale. The role is fully Remote. You can be anywhere in the world to apply to this position

We’re a relatively small team of about 4 people – meaning your work will have a lot of impact. We truly encourage being yourself at work and it shows in the creative code we write 🙂

Our Customers love us. We have given access to the product to a very limited set of companies which includes Facebook, Google, Gitlab, Rippling etc. who absolutely love using Dive.

We use: AWS, Kubernetes, Docker, gRPC, Django, Go, Node.js, Cassandra, MariaDB, Redis, React, Redux, Javascript

If you are interested in joining our small and passionate team drop me an e-mail to om[at]letsdive[dot]io – come chat about what we’re doing, or if you have questions!

More Info: https://www.notion.so/letsdive/Careers-Dive-c75d4d1ee8c9486f…

Volley (YC W18) is hiring engineers and designers to build Alexa games

Article URL: https://jobs.lever.co/volleythat

Comments URL: https://news.ycombinator.com/item?id=24066223

Points: 1

# Comments: 0

Young Person Need To Seek Wealth Literacy, Not Financial Literacy

Young Person Need To Seek Wealth Literacy, Not Financial Literacy

Today there is much talk concerning just how young grownups are monetarily uneducated as if economic proficiency were appropriate to develop wide range. Millions of individuals have actually reviewed one of the ideal economic proficiency publications out there “Rich Dad, Poor Dad” yet there is a loss of translation someplace in between the audio concepts of economic proficiency and also their energy in structure riches.

( 1 )How to Leverage Money

( 2 )The Four Pillars of Wealth

( 3 )How to Invest Money

( 4 )Gold as well as Precious Metals

( 5 )How to Leverage Time

( 6 )Debunking Widespread Investment Myths; as well as

( 7 )Networking.

There would certainly be a number of much more lessons that I would certainly supply hereafter standard educational program was finished, consisting of:.

( 1 )The Connection Between Politics as well as Investing; as well as.

( 2 )Leveraging Technology to Build Wealth.

With an ample structure of expertise in all these programs, a young grownup would certainly be prepared to develop wide range without so much test as well as mistake, battle, or straight-out failing. If you assume regarding it, also at the Master degree, none of these typical company or monetary proficiency programs will actually show any type of pupil exactly how to construct wide range.

Numerous studies that I have actually come across that evaluate the monetary proficiency of young people are improperly structured due to the fact that they concentrate excessive on typical ideas such as supplies, choices, realty, and so forth versus approving an evaluation on whether young people are experienced concerning any type of principles essential to construct wide range. Being “economically” literate versus being “riches” literate are 2 totally various principles. I think that can be economically literate while not being wide range literate.

The distinction in between economic proficiency training courses as well as riches proficiency programs is this. Financial proficiency programs educate young grownups what they require to do to construct wide range however gives them none of the devices they will really require to effectively develop riches.

If one was a basketball gamer, the equivalent degree of a monetary proficiency training course would certainly be to inform a power onward that he requires a great selection of post-up actions close to the basket, a pleasant outdoors shot to make challengers appreciate his variety, a fast initial action to produce off the dribble as well as a strong protective video game so that challengers can not manipulate him for being a one-dimensional gamer. After informing the power ahead that, there would certainly be no additional description however a dream of “excellent luck” as well as a rub on the back. A riches proficiency training course would in fact educate the professional athlete particularly what he would certainly require to do to attain success in each location of his video game that would certainly make him a premier professional athlete.

Informing young people what they require to do will certainly have little effect on enhancing their lifestyle or making an effective change from young people right into economically independent grownups. Supplying a toolkit for just how to do so is much more vital. To this end, looking for training courses that show wide range proficiency as opposed to monetary proficiency to young people is far more crucial.

Millions of individuals have actually reviewed one of the finest monetary proficiency publications out there “Rich Dad, Poor Dad” yet there is a loss of translation someplace in between the audio concepts of monetary proficiency as well as their energy in structure wide range. Numerous studies that I have actually stumbled throughout that evaluate the economic proficiency of young grownups are improperly structured due to the fact that they concentrate as well much on standard principles such as supplies, choices, actual estate, and also so on versus approving an evaluation on whether young grownups are educated concerning any kind of ideas required to develop wide range. The distinction in between economic proficiency training courses and also riches proficiency programs is this. Financial proficiency programs instruct young grownups what they require to do to construct riches yet gives them none of the devices they will really require to efficiently construct riches. To this end, looking for programs that educate riches proficiency rather of monetary proficiency to young grownups is a lot a lot more vital.

The post Young Person Need To Seek Wealth Literacy, Not Financial Literacy appeared first on ROI Credit Builders.

Does Your Business Credit Card Show on Your Personal Credit Profile? It Might!

How to Get Your Business Credit Card Off Your Personal Credit Profile

If you have a business credit card, you probably think it isn’t affecting your personal credit profile. While ideally this would absolutely be the case, the fact it, it could be. There are ways to keep your business debt off your personal credit report, but it isn’t something that happens automatically. There is a very specific process that actually takes some time.

It also has to be intentional. A business owner must be active about building business credit. It doesn’t happen passively. The idea is to set up your business in a way that it easily exists in the eyes of credit reporting agencies (CRAs) and lenders as an entity separate from yourself. How do you do that? After you do, how do you get accounts that will report to the CRAs before you have a business credit score?

We can answer all these questions and more. We can walk you through the process and show you not only how to establish business credit that will not show up on your personal credit profile, but how to build it so that it is strong enough to qualify for any financing you may need.

One Business Credit Misunderstanding

One major misunderstanding when it comes to business credit is that if you have a business credit card, it isn’t on your personal credit profile. While this can be true, if you haven’t actively built business credit and you did not apply for the credit card with your business information, it likely is not true. The fact is, that card is a personal credit card that has a few extra perks due to its business designation. It is not actually a credit card that is based on the merits of your business credit profile. If a business credit card is in the owner’s name, it is on the owner’s personal credit profile.

Share our foolproof business credit building checklist and tell your friends about how you’re building business credit the quick and easy way.

How to Establish Your Business as Separate from Yourself

The question then becomes how do you separate your business from yourself. Many new small business owners operate as a sole proprietorship because it is just easier. They simply use their own contact information as their business contact information, and business finances mingle with personal finances.

When it comes to establishing business credit however, this just will not work. Here is what you need to do.

Get Incorporated

The first step is to incorporate. There are three options for this.

- C Corp– This is the most definitive separation, but it is also the most complicated and expensive. Before choosing this option, be certain there are reasons other than establishing business credit that it needs to be done. If it isn’t necessary for some other reason, there are other, simpler, less expensive options.

- S Corp– This option basically offers the same separation as the C Corp, but taxes are paid at the personal level, rather than requiring the business to be taxed as well, resulting in double taxation. It is also cheaper than incorporating as a C Corp. If you aren’t required to file as a C corp, this is a good alternative.

- LLC– forming a Limited Liability Corporation results in less liability, thus the name, and offers enough separation to serve the purpose of establishing business credit. If you are not required to be a C Corp or S Corp, this is the easiest and most cost-effective way to create the separation of business and personal credit needed.

The option you choose will depend on your specific tax and liability needs, as they each offer different levels of protection and expenses.

Get an EIN to Keep Accounts off Your Personal Credit Profile

You need to apply for an EIN. Stop using your Social Security Number as the identifying number for your business. Your SSN is a direct link to you personally. It is virtually guaranteed that anything connected to it credit wise will end up on your personal credit reports.

In fact, even if you follow all the other steps for establishing business credit but skip this one, accounts could end up on both reports. You don’t want that.

The process of applying for and EIN is easy. The IRS has an online form, and as soon as they verify all the information, you receive your number. It typically happens almost immediately.

Don’t Forget to Get a D-U-N-S Number

Dun and Bradstreet (D&B) is the most widely used business credit reporting agency. They issue each business on file a 9-digit D-U-N-S number. Application is easy and free, and once you have that number, you will be even closer to establishing credit for your business separate from your own.

Get Shiny New Contact Information

Your business needs its own phone number and address. This way, when you apply for credit, you can enter contact information that is separate from your own. When information is reported to agencies, sometimes the phone number and address are used as identifying factors. If you and your business share a number and address, that just decreases the level of separation.

Be sure you get your contact information listed in the directory under your business name.

Get a Dedicated Business Bank Account

If you don’t have one already, you need a dedicated business bank account in the business name. Make sure all business expenses run through this account. Not only does this help separate you from your business, but it will keep business expenses separate from personal expenses for tax purposes as well.

Business Website and Email Address

A lot of business owners do not realize how important this is. Truly, these days if you do not have a website, you do not exist. However, your business website needs to be professionally built and hosted on a paid service such as GoDaddy. The email address needs to have the same URL as the website. Free web hosting and free email services such as Gmail and Yahoo do not work well.

These things make your business look fundable to lenders. This is the first step to building business credit.

Establish Credit Lines with Vendors

If you are a new business and just starting with vendors, look for those that will extend credit and report to the top credit agencies. We call this the vendor credit tier.

Share our foolproof business credit building checklist and tell your friends about how you’re building business credit the quick and easy way.

If you have been around for a while and do not have credit with your existing vendors, ask for it. If they comply, ask if they currently report to the credit agencies, or if they will. Not all vendors do because it is not required. Not all are willing either. If your current vendors do not want to cooperate in this endeavor, consider switching to vendors that will.

Here are some of the starter vendors that are the easiest to get started with.

o Use Quill to order supplies you use every day, including pens, pencils, folders, printer ink, copy paper, and even cleaning supplies.

o Order shipping supplies, janitorial equipment, and more through Uline.

o Grainger offers industrial supplies as well as tools that you will need in the course of regular business.

It may be necessary to place a few initial orders with each of these before you can get net terms. There is no need to order anything you do not need however. They each sell things that business owners need in the everyday operations of a business. Once you make your on-time invoice payments and they begin reporting those payments to the credit agencies, your credit score will start to grow.

Talk to the Utility Companies

Sometimes utility companies are willing to report payments to credit agencies. However, you almost always have to ask. The worst they can do is refuse. If they do, no damage is done. If they agree, you will only establish your business credit faster.

Talk to them all, including telephone, electric, gas, and even internet. Before you do this, be certain that all of these utilities are in your business name with your business contact information.

Topsy Turvy: Your Personal Credit Profile Still Matters for Your Business

Taking these steps will help you establish separate credit for your business. That means your business credit cards and other business credit accounts will not show up on your personal credit profile. However, it is virtually impossible for the reverse of this to hold true all the time.

It’s true, your personal credit accounts will not show up on your business credit report. However, your personal credit can still affect your ability to get a loan even if you are using business credit. It doesn’t always, but it can. Here’s how.

First, some lenders insist on checking personal credit even if you have business credit. The thing is, if your personal credit isn’t up to par but you have strong business credit, you are more likely to get the loan anyway. That not so great personal credit score can affect your terms and rates however.

The other way that your personal credit profile can affect your business credit is this. Some CRAs actually use your personal credit in the calculation of your business credit score. While not all of them do this, there is really no way to know which of the CRAs your lender will choose to use.

The moral of this story is that you cannot ignore your personal credit profile while you are building business credit. You have to stay on top of your complete credit history.

Why Does it Matter if Business Credit Cards are on Your Personal Credit Profile?

You may be wondering why it matters. If your personal credit can affect things anyway, wouldn’t it be easier to just have everything in one place? The answer is a resounding no. In the long term, not having separate business credit is a bad idea.

The thing is, even if you make all your payments on time, your personal credit cannot handle the level of spending that running a business requires. Business credit cards that you get on your business credit have higher spending limits. These higher limits are designed to handle the larger spending amounts necessary to run a business.

Why does that matter? Well, when you carry balances at or near your credit limit, your debt-to-credit ratio goes up. A high debt-to-credit ratio has a negative impact on your personal credit score. With the level of monthly spending that most businesses require regularly, it is all but impossible to keep a low debt-to-credit ratio with business accounts on your personal credit profile, even with an immaculate credit history. This can impede your ability to get personal financing for things such as houses, home renovation, automobiles, and more.

Share our foolproof business credit building checklist and tell your friends about how you’re building business credit the quick and easy way.

Are Your Business Credit Cards Affecting Your Personal Credit Profile?

How can you know if your business cards are affecting your personal credit? Well, if you have not taken the steps necessary to separate your business credit from your personal credit, you can bet for sure this is happening. To know for certain, get a free copy of your personal credit report from each of the main personal credit CRAs. These include Experian, Equifax, and Transunion. You should be able to see them on there.

If you have strong business credit, call the credit card company and inquire about shutting down the card on your personal account and switching to a card on your business credit. If you do not yet have strong business credit, start building it now. When you have a high enough business credit score, take the steps necessary to remove the card that is on your personal credit and open new ones using your business credit.

You Don’t Know What You Don’t Know

If you aren’t sure if this is happening to you, or if you didn’t even know it was possible, find out now. Get copies of your personal credit profile and see what is on there. At the same time, start building business credit if you do not have it already. Then you can access all the funding you need to ensure your business is able to continue to grow and thrive.

The post Does Your Business Credit Card Show on Your Personal Credit Profile? It Might! appeared first on Credit Suite.

Start Sparking Business Innovation –10 Brilliant Business Tips of the Week

The Hottest and Most Brilliant Business Tips for YOU – Start Sparking Business Innovation and More

Our research ninjas at Credit Suite smuggled out ten amazing business tips for you! Be fierce and score in business with the best tips around the web. You can use them today and see fast results. You can take that to the bank – these are foolproof! You can start sparking business innovation right now.

Stop making stupid decisions and start powering up your business. Demolish your business nightmares and start celebrating as your business fulfills its promise.

And these brilliant business tips are all here for free! So settle in and scoop up these tantalizing goodies before your competition does!

#10. Text Your Way to Marketing Success

Our first jaw-dropping tip is all about SMS Marketing. Opt In Monster says getting permission is vital, and so is providing clear instructions for how customers can opt out. This totally works for us. After all, if you can’t easily get rid of texts, they’re going to end up costing you in messaging and/or data.

Plus if you do any business at all in Europe, GDPR may very well require that you do both.

If nothing else, it’s good practice, particularly for avoiding annoying your customers and prospects.

Those are the last people you want to frustrate and annoy.

Do U Hate Slang? So Do I N U Shudnt Do It in SMS Mktg

Oh God, my writer/editor brain can’t take it.

Please don’t do this to your customers and prospects, not even if they’re teens and tweens. For the younger set, you’ll probably look truly inauthentic. For the older (ahem) among us, you’ll look unprofessional.

And so much slang and abbreviating can easily backfire as abbreviations and language evolve over time. You definitely don’t want to look and sound like yesterday’s news.

#9. New Brand, Who Dis?

The next awesome tip is about doing rebranding right. Word Stream notes you’ll even have to change and fix your online advertising campaigns. After all, let’s say Exxon changed its name from Esso this week, rather than in 1972.

They would need to update any ads. After all, it would be kind of embarrassing to have a great advertisement out there which touted the products sold by the old brand.

The article is great – so we suggest reading it in its entirety – and it gives detailed advice on how to fix things.

But then there’s another thing, not in the article.

Records Are Made to be Broken – and Updated

We talk about it all the time here. Congruency.

Your business name needs to be the same everywhere. Yelp, your business licenses, your phone listings, your IRS records – you name it.

Why?

Because lenders are going to hunt for your information online. And if they can’t find something, they’ll assume it doesn’t exist – and are far, far more likely to deny your loan application. And they’re not going to stop to consider the myriad ways your business could be listed online.

So change things in all of those places, too.

If you are as passionate about succeeding in business as we are, please help us spread the word about how to take the plunge and save time and money – and your sanity! From sparking business innovation to customer retention, this post has it all.

#8. Hello? Is There Anybody Out There? Just Nod If You Can Hear Me

Our following life-changing tip concerns increasing online survey response rates. G2 lays it all out for us. We all know that responses to online surveys could be better. Even if yours are bona fide amazing, it never hurts to try to improve things.

So, how do you do that?

Skip Logic is Not Some Guy’s Stage Name (Although Maybe It Should Be)

Our absolute fave tip was using what’s called ‘skip logic’ (no, that’s not some guy’s name).

Skip logic is when an online survey can skip certain questions based upon previous answers.

For example, let’s say your survey is about people’s pets. Maybe you sell pet food or toys or the like. Probably one of your first questions, after demographics, will be which type of animal people have.

Hence, based on learning that a person has a goldfish, you wouldn’t ask them about leashes and walks, because you can’t take a goldfish for a walk. This is a truly terrific concept, because it reduces frustration immediately. How many times have you had to type ‘not applicable’ in the middle of a survey? And how many times have you just abandoned one because it didn’t appeal to you?

With skip logic, those frustrations should diminish if not downright go away entirely.

Branches Aren’t Just For Trees Anymore

A similar technique is branching, and it’s something many of us have seen in websites. That is, if you get a question with two or more answers and then if you click on one or the other, you get a different experience. There’s a similar vibe going on with branching for surveys.

The beauty of branching is you can lead your survey respondents down a progressive set of questions.

So let’s go back to our pets survey example for a moment. If the respondent says they have a dog, then the next logical question might be about the dog’s age or breed or level of training. If they say they have a cat, then questions could be about age or breed or whether this is an indoor or an outdoor cat.

For a big dog, the survey might go onto questions about how much of a chewer the dog is, or whether the dog is left outside for long time periods. For a smaller dog, the next set of questions might ask about how cold the dog gets at various temperatures (Italian greyhounds, for example, are really skinny and get cold a lot faster than Boston terriers generally do).

For an indoor cat, the next set of questions might be about how much scratching the cat does. Maybe for an outdoor cat, the next questions could be about if there are wild animals in the area that might steal cat food left out (raccoons do this a lot).

Either way, your survey respondent is bound to feel you’re asking about what matters the most to them.

#7. We’re Just Trying to Keep Our Customers Satisfied

For our next sensational tip, we looked at customer retention. Small Business Bonfire says that retaining customers is vital for a number of reasons, not the least of which that it costs a lot less than drumming up new business.

Consider this – your current customers already know and trust you. And you already know they love and need your product and service, and they see the need for it. So why wouldn’t you want to make and keep them happy?

Our favorite tip was about responsiveness. Seriously. When a customer has a question for you, do you respond as soon as possible? And if you don’t know the answer, do you at least say you’re working on it? Yes, even with difficult customers.

Neglected customers won’t be your customers for very long.

#6. Put Your Blog to Work

This tip is so cool, and it works! Freelancers Union tells us all about turning your blog into a lead generator. Now, keep in mind, the article is written from the perspective of a freelancer. But the same principles still apply.

There’s great information on both SEO and user experience. We suggest you read the whole thing to get the full experience, as it were.

But the point to highlight is all about the essential pages. They make sense – your home and about pages are vital! Plus your services page, otherwise no one has any idea of what you do and offer. Similar idea for any business, even if your ‘services page’ is several pages, and it’s for sales of goods rather than services.

Make it painfully clear what you do, what it costs, and what it includes. Don’t make prospects hunt for this information. They’ll just go to a competitor who doesn’t make them jump through those sorts of hoops.

Ouch.

#5. Today is the Day to Start Sparking Business Innovation

Grab this mind-blowing tip while it’s hot!

And by hot, we mean you’ve got the tinder and the match – it’s time to start sparking business innovation in your company.

Small Biz Trends says when it comes to sparking business innovation and getting your employees to start creating, it all depends on the stage the business is in.

For Startups, it’s All About the Benjamins

Not surprisingly, startups need cash. Yesterday. And so this tip focuses on getting the funds to light that creativity fire and start sparking business innovation.

Their two ideas where crowdfunding and government funding, like from the Small Business Innovation Research Program (SBIR). We particularly love the idea of crowdfunding. If Kickstarter, GoFundMe, and other similar campaigns reward anything, it’s usually creativity.

So toss some of your startup’s ideas against GoFundMe’s wall, and see if they stick.

During the Growth Stage, Structure Matters

For companies which are past the startup stage, money is less of an urgent need. Hence for them, the way to be creative is to bake it into the company’s culture and structure. This will help not only now, but for years to come.

Knock wood – your business is around for a super-long time – you’ll need some long-term plans. It can be harder to get unstuck if your company is entrenched and set in its ways. Better to make those set ways into something that pushes creativity.

How? One idea is to empower employees with decision-making capabilities. And another is to reward innovation, maybe through perks or recognition plaques or whatever strikes your fancy.

Engineers get patents. Music makers get gold records. Writers get published works. What do your employees get when they’re creative?

Established Businesses Open Up Labs and Undergo Digital Transformations

Uh, what?

One tip which made a lot of sense was to create what are essentially creativity incubators within a company. These are places (not necessarily physical) where employees are free to express their ideas.

The other bit is actually kind of basic – change your physical assets to digital ones.

True story. Long before joining Credit Suite, your intrepid blog writer audited law firms for a major insurance company. Now, a part of this was to check for billing discrepancies. But another angle was to suggest innovation. And one firm had – no lie – about an entire office floor dedicated to file storage space. This was the late 1990s. Scanners already existed as a thing.

And the head of this firm complained about all of the rent it was costing him to keep all of the documentation that we required. To which I countered – why not buy a scanner or two and have clerical staff scan most of the documents and then shred the physical? You could have a college student do this, or a summer intern.

Oh no, we need to be able to make copies.

Well, but with digital, you can make infinite copies, and it doesn’t cost you a dime.

They had no idea.

But these days, we all know better. And one of the beauties of digital, beyond saving physical space, is it makes it far easier to change, manipulate, add to, and subtract from, your assets.

Talk about sparking business innovation.

If you are as passionate about succeeding in business as we are, please help us spread the word about how to take the plunge and save time and money – and your sanity! From sparking business innovation to customer retention, this post has it all.

#4. Keep an Eye on Your Cash and Manage it Right

Check out this spectacular tip, all about managing your business finances. Succeed As Your Own Boss notes that the first sensible thing to do is no great shocker – hire an accountant. But we loved some other grand ideas.

Consider the idea of opening a profit account. What’s a profit account? The idea is to skim off some of the payments to your business (say, 1 – 10%) for you. This isn’t an emergency account for the business (which is another excellent idea). It’s to make sure you, the big cheese, are actually getting paid.

And put it in an account that’s hard for you to tap into. Let it be a happy financial surprise, rather than a well you’re constantly dipping into.

#3. Productivity – To The Max!

#3. Productivity – To The Max!

It’s not your imagination: this winning tip can help you maximize employee productivity. Young Upstarts tells us there are great ways to up your employees’ productivity.

The first tip we really loved was about minimizing distractions. As a writer in particular, this speaks directly to me. Cutting cell phone use is helpful. But it’s also helpful to create what are almost office hours. Giving clear signals about when you’re available for meetings and impromptu discussions – and when you aren’t – can set reasonable expectations. And people will stop bugging you when you’re on a tight deadline.

And that just might start sparking business innovation, too!

Our other fave tip was to offer some incentives. These don’t have to be too costly, either. Consider what we did here at Credit Suite – we had a department video competition. The winners got movie tickets. And, ahem, Marketing won.

Then again, it’s easy (well, easier) when you’ve got so many talented folks who can create pretty graphics, smooth out any sound issues, and write a decent script. So we kinda had a few ringers in our department.

So far, we don’t know if Sales has vowed revenge….

#2. Keep Your Edge

Our second to last unbeatable tip can give you a new perspective on staying competitive. Under 30 CEO reveals all about maintaining your competitive edge.

Turns out it’s a group effort (who knew?).

The best tip (according to us) was the one about maintaining a network of people who will be honest with you and challenge you. That makes a great deal of sense.

Consider this. Let’s say you’re new to the business world. You have a great idea, people support it, and maybe you’re the recipient of enough crowdfunding cash or venture capital money infusions or angel investments.

But you have no idea how to do your books.

Would you wing it, or hire an expert?

Of course, you might not be able to afford an expert. But you’re flush with cash. So add it as a budget line item and hire one. Unless, of course, you think audits and possible lawsuits cost less.

Pro tip: they don’t.

So why should you hesitate in any other area where you aren’t quite sure of how to handle things?

Being the CEO doesn’t mean you also have to be the Lone Ranger.

#1. It’s All About the Search

We saved the best for last. For our favorite remarkable tip, we focused on upping your ecommerce SEO results. Fundera says you can improve your SEO in all aspects of ecommerce.

First off, for SEO in this area, as in every other, research is your first step! Consider every single way your product (or service, for that matter) can be described. Let’s say you’re a long haul trucker. The term ‘long distance trucker’ is the same thing, yes? So when you are putting together your website, you’re going to want to use both phrases throughout your content.

But do your research, and determine which is more popular. Of course, you want to concentrate on that one!

The idea of using keywords in the product pages and their URLs was terrific! Again, this is an article which is best appreciated in its entirety.

So which one of our brilliant business tips was your favorite? And which one will you be implementing now?

If you are as passionate about succeeding in business as we are, please help us spread the word about how to take the plunge and save time and money – and your sanity! From sparking business innovation to customer retention, this post has it all.

The post Start Sparking Business Innovation –10 Brilliant Business Tips of the Week appeared first on Credit Suite.

New comment by timanglade in "Ask HN: Who is hiring? (September 2019)"

Archipelago | Software Engineers, Product Managers | San Francisco or REMOTE (US only) | Fulltime

We’re an early stage startup, still in stealth, working to change how risk is insured. Our founders are tech & finance entrepreneurs with several IPOs and acquisitions under their belts. We are headquartered in San Francisco, have raised several million in seed money to date, and currently employ around thirty people. It’s still early days, so you get a chance to join something on the ground floor, and take it from 0 to 1. We’re a pretty supportive team, willing to give you as much independence or assistance as you need. You can work from our HQ in SF, or remotely (but unfortunately we can only consider applicants based in the US at this time).

– Product Manager with hands-on dev & UX experience -> https://archipelago.breezy.hr/p/6ea73c95d99401-platform-prod…

– React Front End Engineer: build our UI layer with ES6/ES5, TypeScript, HTML, CSS & ReactJS -> https://archipelago.breezy.hr/p/cf82a86231bd01

If you want to apply, it’s better to do it directly through the links above, but if you have any questions don’t hesitate to reach out to me directly tim@onarchipelago.com