New York Yankees outfielder Joey Gallo jumped on LinkedIn – just in case.

Tag: Profile

The 10 Elements of a Successful Social Media Profile

Having good social media profiles can get you more exposure online, help you connect with your fans or customers, and improve your online reputation.

Unless you have a major site associated with your name (like NeilPatel.com), your social media profiles are usually the first results Google shows when someone searches for you.

Start thinking of each social media profile you create as a landing page for your personal brand.

Your social media profiles are possibly the first encounter that someone is going to have with your brand, and you want that first impression to make the visitor interested in knowing more about you.

Here are 10 elements of successful social media profiles.

Element #1: Your Social Media Profile Display Name

Okay, this seems fairly basic. The name that displays on your social media profile should just be your own name, right?

Usually, that’s correct. However, sometimes that doesn’t make the most sense.

On platforms like Twitter, where you don’t have to use a real name, a pseudonym might make more sense.

Element #2: Your Social Media Username and URL

On most social networks, your username is included in your URL, and it’s often different from your display name. Usually, you can’t change your username, so choose it carefully.

If possible, it’s usually best to just go with your own name. Sometimes, if you’re the face of your company, the company name might work better.

On Twitter, Brian Dean isn’t @briandean but @Backlinko, since that’s the name of his company.

Finally, while it isn’t always possible, try to keep your username the same across platforms.

It can be confusing when this isn’t the case, like Instagram being @yourname and Twitter being @yourcompany or @yourmiddlename.

Element #3: Your Social Media Profile Picture

Should you go with a logo or a personal picture?

Of course, if it’s for a personal account, you should almost always go with a headshot.

What about for a company? It’s a tough call, but it really depends on your goals. If you run a smaller operation or are the face of your company, include a headshot of you.

That’s what Brian does on Twitter, even with his company usernames. This also applies to people that are brands themselves, like musicians, artists, or politicians.

If you have a more recognizable brand or don’t want your company to be associated with you specifically, go with the logo.

It’s also a good idea to stick with the same (or at least a similar) photo across different social networks. That way you’re easier to recognize on different platforms.

Element #4: Your Social Media Profile Link

This varies from one social media network to the next, but be sure to seek out any opportunity to get your link on the main page of your social profile.

For example, you can add a link on the “front page” of your profiles on Twitter and LinkedIn.

Make sure that your link is front and center so that people can find it quickly and click through to your website.

Another good idea for your links is to create a social network-specific landing page so you can track which profiles are bringing your site the most traffic.

You can use these pages to offer a special discount for people who have found you on Twitter or share information that is specific to a network, like recent blog posts you have written about Facebook.

Element #5: Your Social Media Profile Bio

Your main social profile bio should usually include a sentence or two about yourself or your business. Think of it as a perfect place to put your elevator pitch and include keywords.

In a few words, what would you say about your business? It’s also a good idea to use your bio to its fullest potential. Some sites, like Twitter, only let you write a short description.

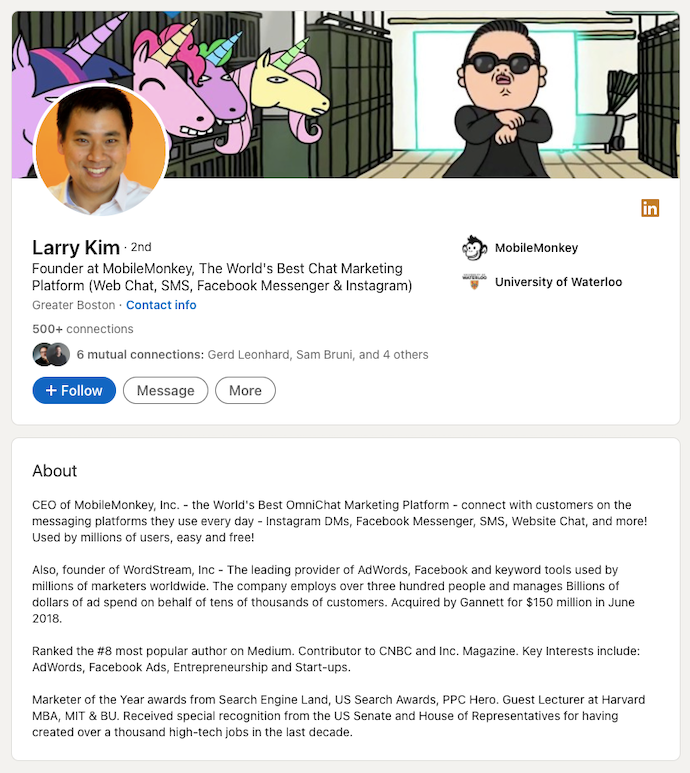

If you’re on a platform like LinkedIn, your “about” section can have up to 2,000 characters. This is a huge opportunity to explain what you’re all about and make a great first impression.

To make this succeed, you’ll want to add more than just a simple description of what you’ve done and your current projects. Instead, create a story with a basic call to action.

For example, you can tell how you started with the industry you’re working in. What got you interested in it, and what makes you stick around and keep learning?

Finally, you can finish your bio with a simple call to action. This can be a link to a free report, an offer for someone to call you, or even a mission statement asking “will you join me?”

Element #6: Your Social Media Profile Interests

Some profiles allow you to have additional extended information about yourself in the form of favorite books, television shows, movies, and so on.

A lot of people skip over this, especially when it comes to business profiles, but that is a big mistake.

Look at these fields as an additional place to get some great value and connections

I doubt there is a niche out there that doesn’t have at least one or two published books.

Find books, documentaries, and profiles of influential people in your industry and add those in these additional fields (assuming you actually enjoy them, of course!)

This adds credibility and a new level of connection you can build with people who are learning about you for the first time.

Element #7: Your Social Media Profile Background or Cover Image

Different platforms have different requirements, but most social networks today have some way to add a larger image behind your main profile page.

Some users, especially on Twitter and LinkedIn, choose to use the default background image, but this is a mistake.

A customized background will allow you to share additional information and give personality to you or your brand.

Don’t make it distracting or more important than your profile picture, but a great cover image can go a long way to personalizing your social page.

On some platforms, like Facebook, this can even be a video. If you have the option (and decent video), this can be even an even more engaging way to connect with others.

Element #8: Your Social Media Profile Privacy Settings

After you have all of your profile filled out and pictures uploaded, the next thing that you will need to take a look at is your privacy settings.

These vary from network to network, but you will want to make sure that the information you would like to be public is viewable.

Chances are, if this is a business-related profile, you’ll want almost everything to be public. Of course, if your profile is more personal nature, you may want to hide some things.

Element #9: Your Social Media Activity

Once your profile setup is complete, your on-going mission will be to maintain a healthy level of activity on your main social networks.

It’s not enough to leave a profile blank. You need to contribute to the platform and build connections. After all, that’s what they’re there for in the first place.

No matter what social network you’re on, the basic guidelines still apply. You’ll want to connect with friends and followers by asking questions and responding to comments.

Provide value by posting interesting ideas, or at least sharing interesting and relevant things you find.

If you’re in any groups, become an active participant. Be helpful, connect with others in the group, and share things the group will find interesting.

Element #10: Your Social Media Promotion

Finally, there is nothing like a little healthy promotion of your social network profiles to help more people find and connect with you.

Be sure to add your social networking profile links to your website, email signature, and business card.

Also, don’t forget to interlink your profiles to each other. Many networks have places to include links to other networks, and you can and should use them whenever possible.

Stay connected, become an active member on the social network of your choice, and you’ll start acquiring a following.

Social Media Profile FAQs

This depends on what you do. If you have a personal profile or your brand centers around who you are, use a headshot. If you have a business where you aren’t the face, your logo will work well.

Using the same name is ideal but not always possible. If your username is taken on another platform, then use something very similar.

Your social media bio should have everything people need to know about your brand. Let them know what makes your brand stand out, what you do, and a call to action whenever possible.

You can brand your social media profile by using a custom cover image with your brand colors and logo. You can also put important information in your cover image. On some platforms, you can also add your interests. This is a great way to add a personal touch.

You can cross-promote your social media profile with each other, by adding all of your links to each profile. You can also all links to your website, and email campaigns.

Social Media Profiles Conclusion

If you’re getting started with social media marketing, the first step is to set up your accounts and profiles correctly.

If you’ve already been in the game for a while, it’s probably time to take a look at the profiles you set up.

Are there ways to improve what you already have online? Is the profile picture you uploaded last year still relevant? Does your bio or link need updating?

Since it’ll be the first impression many people see, it’s worth spending some time to improve your social media presence and make it compelling and interesting.

What strategies have you used to improve your social media profile?

Business Credit Profile: Best Way to Raise Credit Score?

Your business credit profile is the overall picture of the creditworthiness of your business. Lenders look at it to determine whether or not they want to lend to you. Your business credit score is likely the most important piece of this. As such, it’s important to know the best way to raise credit score. You have a personal credit profile alsol, and that is considered by most lenders as well.

Total Business Credit Profile Management: The Sure-Fire Best Way to Raise Credit Score

In fact, many lenders look at your personal credit profile first. However, if you have a strong business credit profile, it can only help you. Your business credit score is a huge part of that, so you need to know the best way to raise credit score for business.

Best Way to Raise Credit Score: What Is a Credit Profile?

Of course, you cannot let the rest of your business credit profile go unattended. Before you can work to execute the best way to raise credit score, you have to understand and learn how to manage your total business credit profile.

Your business credit profile is everything the business credit reporting agencies have on your business. For example, your open trade accounts, payment history, how you stand up in relation to other businesses, and more. The top three business credit reporting agencies are Dun & Bradstreent, Experian, and Equifax. FICO also offers a business credit report known as the FICO SBSS.

Keep your business protected with our professional business credit monitoring.

When a potential lender looks at your business credit profit, it can pull from any of these. The report will contain a business credit score, but it will contain a lot more as well.

Best Ways to Raise Credit Score: What is a Business Credit Score

So, what exactly is a business credit score? It is similar to your personal credit score, but it is for your business. Unlike your personal credit score, it is connected to your EIN, not your social security number. It is a numeric rating assigned to your business that helps a lender determine how likely your business is to repay debt. The number is calculated based on a number of things. The most influential factor is your payment history.

The more positive payment history you have, the better. That means two things. First, the longer you have been paying accounts on time the better your credit score will be. Also, the more accounts you are paying on time the better your score will be.

Best Way to Raise Credit Score?

So, what is the best way to raise your business credit score? The simple answer is to increase positive payment history and reduce negative payment history. Let’s break it down further.

Add More Trade Accounts

It sounds simple, but it’s not really. Unlike personal credit, not all business credit accounts report to the business credit reporting agencies. With personal credit, your payments on accounts are automatically reported to personal credit.

You have to be intentional about finding business credit accounts that will report. This can take some time and digging. A business credit expert can come in really handy here. Most vendors do not make it easy for the average Joe to find out if they report or not. A business credit expert will likely have relationships with vendors that allow them to know or find out this information more easily.

Aside from this, you can talk to vendors you already have a relationship with. You can ask them to report your payments if they already extend you credit or net terms on invoices. If they do not, you can ask if they will, and if they will then report. They don’t have to , but if they do, this can be the best way to raise credit score quickly.

You can also talk to providers that you pay monthly. Everyone pays utilities, phone, and internet bills. Ask those providers to report your payments to the business credit reporting agencies. They do not have to, but they might. If they do, this is another great way to improve your business credit score.

Handle Accounts Responsibly

Handling your business responsibly in every way affects your entire business credit profile. However, handling your trade accounts responsibly by making consistent, on-time payments is the number one best way to increase credit score. After all, the business credit score tells lenders how likely you are to pay, and nothing predicts future behavior like current habits.

Monitor and Correct Your Business Credit Report

Sometimes the best way to raise your credit score is as simple as correcting mistakes. However, without credit monitoring, you cannot know what those mistakes are, or if there are any at all. Personal credit monitoring is easy. You can access a full, complete report annually for free. Not only that, there are a plethora of free apps that offer a peek at your credit score and summary report throughout the year.

Keep your business protected with our professional business credit monitoring.

That is not the case with your business credit report however. You have to pay to get a glimpse of it at all. Each of the big three offer monitoring options, for a fee. Credit Suite can help you monitor your business credit for a fraction of the price.

Business Credit Profile vs. Personal Credit Profile

To better understand the best way to raise credit score for your business, it can help to understand some of the differences between business credit profiles and personal profiles. There are many, but these specifically seem to cause a lot of misunderstanding and confusion among borrowers when they are denied funding.

Late Payments

Both business and personal credit reports are affected greatly by late payments. Yet, business credit scores are affected faster. Late payments are not reported to personal credit reports typically until they are 30 days past due. Late payments on business credit accounts are reported if only one day late.

Inquiries

Hard credit checks on your personal credit will lower your credit score. However, business credit reports are different. A credit check on your business credit profile does not affect your business credit score.

Data Reported

In addition to late payments being reported much more quickly, accounts on your business credit profile are listed by industry. In contrast, personal credit lists the name of the company that issues the credit.

Also, personal credit reports show the exact amounts of accounts, while business credit reports show rounded amounts. How long data stays on a personal credit report varies, but typically it’s the life of the file. Information stays on business credit reports an average of 3 years.

Keep your business protected with our professional business credit monitoring.

Also, with personal credit accounts, almost every account reports to the credit reporting agencies. In contrast, only about 7% of business credit accounts report to business credit reporting agencies. This is why you have to be intentional to get accounts reporting to business credit, and that is only one of many reasons working with a business credit expert is the way to go.

One last thing to note about business credit versus personal credit is this. While your business credit profile is totally separate from your personal credit profile and does not affect in any way, the reverse is not true. Your personal credit information can affect your business credit profile, and in some cases, even your business credit score.

What’s the Best Way to Raise Credit Score for Your Business?

There isn’t really one best way to raise credit score. In reality, the best way depends on what is pulling your score down to begin with. Is it a lack of sufficient history? Then you just have to give it time. Are there not enough accounts? You need to add more. Are you not paying on time? Start paying on time! Are there mistakes on your business credit report? Fix them. However, one thing is for sure. Whatever the problem is, paying your accounts consistently on-time will only raise your score. You cannot go wrong there.

The post Business Credit Profile: Best Way to Raise Credit Score? appeared first on Credit Suite.

5 Steps to Build your LinkedIn Profile and Grow your Followers

It doesn’t matter if you’re an established executive, a student or a small business owner, building your LinkedIn profile will help you achieve your goals. Being active on the platform will bring you value, and …

The post 5 Steps to Build your LinkedIn Profile and Grow your Followers appeared first on Paper.li blog.

5 Steps to Build your LinkedIn Profile and Grow your Followers

It doesn’t matter if you’re an established executive, a student or a small business owner, building your LinkedIn profile will help you achieve your goals. Being active on the platform will bring you value, and … The post 5 Steps to Build your LinkedIn Profile and Grow your Followers appeared first on Paper.li blog.

20 free background images to build your LinkedIn profile

Here are 20 free and inspirational background images to build your LinkedIn profile. A personal brand starts with using the right visual content. When it comes to building your personal brand, visual content is the …

The post 20 free background images to build your LinkedIn profile appeared first on Paper.li blog.

How Your Experian Financial Profile Can Affect Business Fundability

There are so many factors that affect the fundability of your business. Truthfully, your Experian profile is just one link in a very long fundability chain. However, that does not mean it isn’t important. As you know, it only takes one weak link to break a chain. As a business owner, it is important to understand your Experian financial profile.

Your Experian Financial Profile Can Affect the Fundability of Your Business

What does your Experian profile have to do with the fundability of your business? A lot actually. In fact, not only does your Experian business profile impact fundability, but your personal Experian profile does as well.

Experian Financial Profile and Fundability: What is Fundability?

Simply put, fundability is the ability to get funding for your business. If you are fundable, lenders see your business as one that can and will pay its debt. Since lenders are in it to make money, they see a fundable business as one that will offer a return on investment. That part is easy. The real question is, how does a business become fundable?

Keep your business protected with our professional business credit monitoring.

Sadly, the answer to that question is not quite as simple. Sure, a great business credit score is important. In addition, many of the things that are important for a strong business credit score are necessary for fundability as well.

The thing is, there is a lot more to fundability than credit score. You can find out more about that here. For now, let’s talk about the role the Experian plays in the fundability of your business.

Experian Financial Profile: What Does it Have to Do with Fundability?

First, you should know that Experian keeps files on both your personal and your business finances. Consequently, if you own a business, you have a business profile with them as well as a personal profile. In most cases, a personal and business credit profile is totally separate. However, with Experian, that isn’t always the case. While they do keep the two separates if you set things up that way, they also issue a combined report that incorporates your personal credit as a piece of business credit for lenders making decisions.

For you, that means that at least as far as your Experian profile is concerned, your personal credit history can actually affect the fundability of your business.

You can see your personal Experian financial profile here.

Experian Financial Profile: What about Business Credit?

Of course, it’s pretty obvious how Experian business credit can affect fundability. The big questions still remain however. What do you Experian reports tell lenders? Where do they get their information? How do they calculate their business credit score, and what does it mean?

Experian keeps business credit profiles on 99.9% of all United States companies. In addition, it claims to have the credit industry’s most broad data on small and mid-sized businesses. That’s why, if you own a business, it likely has a business Experian file.

According to Experian, all their information stems from third party sources. That means you cannot add anything to your profile. Still, you can check your profile and let them know about any inaccuracies. As a result, you have to know what that report is telling lenders about you and your business to stay ahead of the game. Also, you need to know where the information comes from, and what you can do about it.

Business Experian Financial Profile: What’s on there?

First, there isn’t just one score. On the contrary, your complete business Experian profile consists of a number of reports and scores. Lenders can choose to use any or all of them. Each one tells them something different. It takes all the scores put together to get a complete credit picture, but not all lenders look at all scores.

Intelliscore Plus

Quite simply, the Intelliscore Plus credit score shows credit risk based on statistics. It is a highly predictive score. As such, its main purpose is to assist users in making well informed credit decisions.

The Intelliscore scores range from 1 to 100. The higher your score, the lower your risk class. The opposite is true as well. Meaning, the lower your score, the higher your risk class.

Score Range Risk Class

76 — 100 Low

51 — 75 Low — Medium

26 — 50 Medium

11 — 25 High — Medium

1 — 10 High

How Do They Calculate the Intelliscore Plus Score?

One of the things Intelliscore is most known for is the identification of key factors that can indicate how likely a business is to pay their debt. There are over 800 commercial and owner variables used to calculate an Intelliscore Plus credit score. They can be broken down like this:

Payment History

This is just your current payment status. It’s how many times accounts have become delinquent. Additionally, it shows how many accounts are currently delinquent and overall trade balance.

Keep your business protected with our professional business credit monitoring.

Frequency

The frequency factor shows how many times your accounts have been sent to collections. It also notes the number of liens and judgments you may have. Any bankruptcies related to your business or personal accounts are in the part as well.

In addition, frequency includes data regarding your payment patterns. Were you regularly slow or late with payment? Did you decrease the number of late payments over time? As you can imagine, those things make a difference.

Monetary

This specific factor focuses on how you use your credit. For example, how much of your available credit are you using right now? Do you have a high ratio of late balances when compared with your credit limits?

Of course, if you are a new business owner, a lot of this information will not exist yet. Intelliscore Plus handles this by using a “blended model” to identify your score. That means that they take your personal consumer credit score into account when determining your business’s credit score.

The Experian Financial Stability Risk Score (FSR)

FSR predicts the potential of a business going bankrupt or not paying its debts. The score identifies the highest risk businesses by making use of payment and public records. These records include all of the following and more.

- high use of credit lines

- severely late payments

- tax liens

- judgments

- collection accounts

- risk industries

- length of time in business

Experian’s Blended Score

This is a one-page report that provides a summary of the business and its owner. A combined business-owner credit scoring model is more comprehensive than a business only or consumer only model. Blended scores have been found to outperform consumer or business alone by 10 – 20%.

Business Experian Financial Profile: How to Know What Yours Is Telling Lenders

Experian sells a number of products which can be used to monitor your business’s credit with them.

Business Credit Advantage Plan

This option is $149 per month and incorporates mobile-friendly alerts and score improvement recommendations.

Profile Plus Report

This report costs $49.95 and includes in-depth financial payment details. Also, it offers predictive information on payment behavior.

Credit Score Report

A cheaper option at $39.95, this report contains details on the company, credit information, and a summary of financial payment information.

Valuation Report

The valuation report costs $99. It shows the market value of your small business and features key performance indicators. It also displays your company’s fair market value.

Premium Corporate Profiles

Experian also sells premium corporate profiles. These are enhanced profiles that contain extra information. For example, sales figures, size, contact details, products and operations, credit summary, and any Uniform Commercial Code (UCC) filings will show up here. This report also includes fictitious business names, payment history, and collections history.

In addition, you can subscribe to business credit alerts through Experian’s Business Credit Advantage program. This is a self-monitoring service that offers limitless access to your company’s business credit report and score. It allows business owners to proactively manage small business credit. Alerts are sent when:

– Company address changes

– Business credit score changes

– Credit inquiries show up

– Newly-opened credit tradelines are added

– Any USS filings open

– Collection filings open

– Any public record filings pop up. This includes liens, bankruptcies, and judgments.

Despite all that business Experian credit monitoring offers, it is pricey. Monitor your business credit at Experian and Dun & Bradstreet here for much less.

Keep your business protected with our professional business credit monitoring.

Experian Financial Profile: How to Make a Positive Change

Since both your personal and your business Experian profiles affect the fundability of your business, it is important to understand how to make positive changes if you need to.

While you may not be able to do anything to make a big score increase happen all at once, you can definitely do some things that will make a positive difference over time.

Make On-time, Consistent Payments

This is number one. Over time, paying your bills on time will help establish your company as one that pays their debts. This will definitely help push your score up and show other firms that you are a low credit risk.

Handle Your Credit Responsibly

The more debt you have, the more monthly bills you have. As a result, you have less of your income available to spend. If your overall debt is close to or even over your income, it will look like you are a high credit risk.

Keep your debts in check and consistently pay them down or off to keep a good balance between what you make and what you owe.

You Have to Use Credit to Increase Your Credit Score

Keeping your debts low is good advice, but you have to use the business credit accounts you have. You make payments on accounts for your score to grow. Having a ton of credit and not using it at all doesn’t really help. Again, balance is key.

There is no need to buy things you do not need however. Even if you can pay cash, use credit for the things you would be buying regularly for your business regardless. Then, use the cash to pay the credit account.

Pay Attention to Both Business and Personal Credit

By now, you’re aware that personal credit is fair game when it comes to your Intelliscore Plus score. But don’t fall into the trap of thinking your personal credit doesn’t matter. If it is bad, there are options for working around it. However, it is much better to just keep it strong. Making certain you stay on top of your monthly bills is the number one way to keep your personal score healthy. Avoid unneeded credit inquiries, and refrain from compromising your personal credit for business needs.

This means setting things up in a way to actually have separate personal and business credit. Find more about how to do that here.

Make Use of Monitoring Options

No matter what your credit score is, it is crucial that you continue to be diligent and review your personal and business credit reports. This can help you spot possible errors and stay on top of your Experian financial profile.

For personal credit this is easy and free. Not only can you get a free copy of your personal credit reports annually, but there are a number of free services that offer you a peek at your personal credit score throughout the year.

As mentioned above, keeping track of your business credit will cost you. The good thing is, there are options to fit most budgets.

Experian Financial Profile: It Definitely Matters

Experian is well known in the personal credit world, but when it comes to business credit, Dun & Bradstreet often gets all the glory. Your business Experian financial profile can definitely affect fundability however. Throw in the fact that Intelliscore has a personal credit aspect, and you can see just how much your Experian reports can matter.

Keep monitoring all your credit reports and make changes when needed. Work hard to ensure only positive information is reported to all credit reporting agencies. Also, take the time to do a fundability analysis on your business. So take action where needed. If you do these things, you should be able to get funding for your business whenever you need it. Whether you want credit cards, loans, lines of credit, or some combination, you shouldn’t have a problem.

The post How Your Experian Financial Profile Can Affect Business Fundability appeared first on Credit Suite.

Does Your Business Credit Card Show on Your Personal Credit Profile? It Might!

How to Get Your Business Credit Card Off Your Personal Credit Profile

If you have a business credit card, you probably think it isn’t affecting your personal credit profile. While ideally this would absolutely be the case, the fact it, it could be. There are ways to keep your business debt off your personal credit report, but it isn’t something that happens automatically. There is a very specific process that actually takes some time.

It also has to be intentional. A business owner must be active about building business credit. It doesn’t happen passively. The idea is to set up your business in a way that it easily exists in the eyes of credit reporting agencies (CRAs) and lenders as an entity separate from yourself. How do you do that? After you do, how do you get accounts that will report to the CRAs before you have a business credit score?

We can answer all these questions and more. We can walk you through the process and show you not only how to establish business credit that will not show up on your personal credit profile, but how to build it so that it is strong enough to qualify for any financing you may need.

One Business Credit Misunderstanding

One major misunderstanding when it comes to business credit is that if you have a business credit card, it isn’t on your personal credit profile. While this can be true, if you haven’t actively built business credit and you did not apply for the credit card with your business information, it likely is not true. The fact is, that card is a personal credit card that has a few extra perks due to its business designation. It is not actually a credit card that is based on the merits of your business credit profile. If a business credit card is in the owner’s name, it is on the owner’s personal credit profile.

Share our foolproof business credit building checklist and tell your friends about how you’re building business credit the quick and easy way.

How to Establish Your Business as Separate from Yourself

The question then becomes how do you separate your business from yourself. Many new small business owners operate as a sole proprietorship because it is just easier. They simply use their own contact information as their business contact information, and business finances mingle with personal finances.

When it comes to establishing business credit however, this just will not work. Here is what you need to do.

Get Incorporated

The first step is to incorporate. There are three options for this.

- C Corp– This is the most definitive separation, but it is also the most complicated and expensive. Before choosing this option, be certain there are reasons other than establishing business credit that it needs to be done. If it isn’t necessary for some other reason, there are other, simpler, less expensive options.

- S Corp– This option basically offers the same separation as the C Corp, but taxes are paid at the personal level, rather than requiring the business to be taxed as well, resulting in double taxation. It is also cheaper than incorporating as a C Corp. If you aren’t required to file as a C corp, this is a good alternative.

- LLC– forming a Limited Liability Corporation results in less liability, thus the name, and offers enough separation to serve the purpose of establishing business credit. If you are not required to be a C Corp or S Corp, this is the easiest and most cost-effective way to create the separation of business and personal credit needed.

The option you choose will depend on your specific tax and liability needs, as they each offer different levels of protection and expenses.

Get an EIN to Keep Accounts off Your Personal Credit Profile

You need to apply for an EIN. Stop using your Social Security Number as the identifying number for your business. Your SSN is a direct link to you personally. It is virtually guaranteed that anything connected to it credit wise will end up on your personal credit reports.

In fact, even if you follow all the other steps for establishing business credit but skip this one, accounts could end up on both reports. You don’t want that.

The process of applying for and EIN is easy. The IRS has an online form, and as soon as they verify all the information, you receive your number. It typically happens almost immediately.

Don’t Forget to Get a D-U-N-S Number

Dun and Bradstreet (D&B) is the most widely used business credit reporting agency. They issue each business on file a 9-digit D-U-N-S number. Application is easy and free, and once you have that number, you will be even closer to establishing credit for your business separate from your own.

Get Shiny New Contact Information

Your business needs its own phone number and address. This way, when you apply for credit, you can enter contact information that is separate from your own. When information is reported to agencies, sometimes the phone number and address are used as identifying factors. If you and your business share a number and address, that just decreases the level of separation.

Be sure you get your contact information listed in the directory under your business name.

Get a Dedicated Business Bank Account

If you don’t have one already, you need a dedicated business bank account in the business name. Make sure all business expenses run through this account. Not only does this help separate you from your business, but it will keep business expenses separate from personal expenses for tax purposes as well.

Business Website and Email Address

A lot of business owners do not realize how important this is. Truly, these days if you do not have a website, you do not exist. However, your business website needs to be professionally built and hosted on a paid service such as GoDaddy. The email address needs to have the same URL as the website. Free web hosting and free email services such as Gmail and Yahoo do not work well.

These things make your business look fundable to lenders. This is the first step to building business credit.

Establish Credit Lines with Vendors

If you are a new business and just starting with vendors, look for those that will extend credit and report to the top credit agencies. We call this the vendor credit tier.

Share our foolproof business credit building checklist and tell your friends about how you’re building business credit the quick and easy way.

If you have been around for a while and do not have credit with your existing vendors, ask for it. If they comply, ask if they currently report to the credit agencies, or if they will. Not all vendors do because it is not required. Not all are willing either. If your current vendors do not want to cooperate in this endeavor, consider switching to vendors that will.

Here are some of the starter vendors that are the easiest to get started with.

o Use Quill to order supplies you use every day, including pens, pencils, folders, printer ink, copy paper, and even cleaning supplies.

o Order shipping supplies, janitorial equipment, and more through Uline.

o Grainger offers industrial supplies as well as tools that you will need in the course of regular business.

It may be necessary to place a few initial orders with each of these before you can get net terms. There is no need to order anything you do not need however. They each sell things that business owners need in the everyday operations of a business. Once you make your on-time invoice payments and they begin reporting those payments to the credit agencies, your credit score will start to grow.

Talk to the Utility Companies

Sometimes utility companies are willing to report payments to credit agencies. However, you almost always have to ask. The worst they can do is refuse. If they do, no damage is done. If they agree, you will only establish your business credit faster.

Talk to them all, including telephone, electric, gas, and even internet. Before you do this, be certain that all of these utilities are in your business name with your business contact information.

Topsy Turvy: Your Personal Credit Profile Still Matters for Your Business

Taking these steps will help you establish separate credit for your business. That means your business credit cards and other business credit accounts will not show up on your personal credit profile. However, it is virtually impossible for the reverse of this to hold true all the time.

It’s true, your personal credit accounts will not show up on your business credit report. However, your personal credit can still affect your ability to get a loan even if you are using business credit. It doesn’t always, but it can. Here’s how.

First, some lenders insist on checking personal credit even if you have business credit. The thing is, if your personal credit isn’t up to par but you have strong business credit, you are more likely to get the loan anyway. That not so great personal credit score can affect your terms and rates however.

The other way that your personal credit profile can affect your business credit is this. Some CRAs actually use your personal credit in the calculation of your business credit score. While not all of them do this, there is really no way to know which of the CRAs your lender will choose to use.

The moral of this story is that you cannot ignore your personal credit profile while you are building business credit. You have to stay on top of your complete credit history.

Why Does it Matter if Business Credit Cards are on Your Personal Credit Profile?

You may be wondering why it matters. If your personal credit can affect things anyway, wouldn’t it be easier to just have everything in one place? The answer is a resounding no. In the long term, not having separate business credit is a bad idea.

The thing is, even if you make all your payments on time, your personal credit cannot handle the level of spending that running a business requires. Business credit cards that you get on your business credit have higher spending limits. These higher limits are designed to handle the larger spending amounts necessary to run a business.

Why does that matter? Well, when you carry balances at or near your credit limit, your debt-to-credit ratio goes up. A high debt-to-credit ratio has a negative impact on your personal credit score. With the level of monthly spending that most businesses require regularly, it is all but impossible to keep a low debt-to-credit ratio with business accounts on your personal credit profile, even with an immaculate credit history. This can impede your ability to get personal financing for things such as houses, home renovation, automobiles, and more.

Share our foolproof business credit building checklist and tell your friends about how you’re building business credit the quick and easy way.

Are Your Business Credit Cards Affecting Your Personal Credit Profile?

How can you know if your business cards are affecting your personal credit? Well, if you have not taken the steps necessary to separate your business credit from your personal credit, you can bet for sure this is happening. To know for certain, get a free copy of your personal credit report from each of the main personal credit CRAs. These include Experian, Equifax, and Transunion. You should be able to see them on there.

If you have strong business credit, call the credit card company and inquire about shutting down the card on your personal account and switching to a card on your business credit. If you do not yet have strong business credit, start building it now. When you have a high enough business credit score, take the steps necessary to remove the card that is on your personal credit and open new ones using your business credit.

You Don’t Know What You Don’t Know

If you aren’t sure if this is happening to you, or if you didn’t even know it was possible, find out now. Get copies of your personal credit profile and see what is on there. At the same time, start building business credit if you do not have it already. Then you can access all the funding you need to ensure your business is able to continue to grow and thrive.

The post Does Your Business Credit Card Show on Your Personal Credit Profile? It Might! appeared first on Credit Suite.