Article URL: https://www.ycombinator.com/companies/great-question/jobs/Jyl8JbP-senior-account-executive

Comments URL: https://news.ycombinator.com/item?id=38951087

Points: 0

# Comments: 0

Article URL: https://www.ycombinator.com/companies/great-question/jobs/Jyl8JbP-senior-account-executive

Comments URL: https://news.ycombinator.com/item?id=38951087

Points: 0

# Comments: 0

Bill Maher and his guests answer viewer questions after the show. (Originally aired 12/01/23)

Learn more about your ad choices. Visit megaphone.fm/adchoices

The post Overtime – Episode #642: David Mamet, Dave Rubin, James Carville appeared first on Buy It At A Bargain – Deals And Reviews.

Fullstack developer at UCLA, looking for a SWE internship (Summer or during the school year)

* Location: Los Angeles, CA

* Remote: Flexible

* Willing to relocate: Yes

* Languages: C++, C#, Python, JavaScript, TypeScript, HTML, CSS, Java Frameworks/Libraries: React, PyTorch, pandas, NumPy

* Developer Tools: Linux, Git, Firebase, Unity, VS Code, XCode, Jupyter Notebook

* Résumé/CV: https://www.linkedin.com/in/-michaeljiang/

* Email: mjiang225@gmail.com

Bill’s guests are Irshad Manji, Larry Charles, Kristen Soltis Anderson, Evelyn Farkas, Eric Swalwell. (Originally aired 3/22/19)

See omnystudio.com/listener for privacy information.

The post Ep. #489: Irshad Manji, Larry Charles appeared first on Buy It At A Bargain – Deals And Reviews.

Buildforce | Remote / Office in Austin, TX | Full-time https://buildforce.com/

Buildforce is helping electricians find jobs in Texas. You’ll have a huge impact on a business already growing at 10% every week since the beginning of 2021 and in the biggest industry vertical in the United States ($1.3 trillion a year in annual construction volume).

We’re a full-stack typescript/javascript shop building React and React Native apps on AWS that talk to a GraphQL API. We’re looking for great backend, mobile, and low code engineers.

Backend Engineer – We have a severlesss backend on AWS that uses SST framework. Our API is an Apollo GraphQL API. Some AWS services that we use are Lambas, RDS, Cognito, API Gateway, S3, Kinesis, and more.

https://joinbuildforce.recruitee.com/o/senior-backend-engine…

Mobile Engineer – We have a React Native app that talks to our backend through an Apollo GraphQL API.

https://joinbuildforce.recruitee.com/o/react-native-engineer

Low Code Engineer – We are building internal tools through Retool.

https://joinbuildforce.recruitee.com/o/low-code-engineer

Would love to chat with you at michael [at] buildforce.com

The age of the smartphone opened up a whole new window for businesses to connect with their customers in an interactive way using apps.

Because apps allow customers to interact with businesses from anywhere at any time, apps quickly became popular.

Unfortunately, apps are not as exciting to consumers as they were in their early days. This has resulted in app retention rates declining rapidly and, for some brands, their revenue has declined with them.

That’s why progressive web apps are becoming increasingly popular.

Progressive web apps (PWAs) are regular web applications/pages designed to look and function like native mobile applications. PWAs use features of web browsers and advanced enhancement strategies to give users a native app-like experience on any device.

In short, a progressive web app fuses the look, feel, and ease of use of an app but with the easy coding of a website.

What’s the difference between native, hybrid, and progressive web apps?

Despite being limited in tapping into a device’s native capabilities, are there any advantages of using progressive web apps?

There certainly are. Here are some of the most prominent:

Another significant advantage of PWAs is users can save them on their home screens without the hassle of downloading. This allows the PWA to load faster the next time it’s used.

One reason users love apps is they generally offer better experiences than web applications. However, developing and maintaining native apps is a lot of work, not to mention the expenses involved.

If your users use different platforms (Android, iOS, etc.), you have to code your app for each platform.

PWAs, however, don’t require you to code for each platform. They were designed with the philosophy of “code once, use everywhere.” Once you code your PWA, it can be used in-browser (as a website or web app), on desktops, and on mobile devices.

This often results in better performance, improved retention rates, and, ultimately, an affordable application offering your users a positive user experience (UX).

One reason brands develop native apps is to cater to users who return to their websites to perform specific actions frequently. Apps make it easier for these functions to be performed without going to the brand’s website. They also have characteristics that make them fun to use.

You can use progressive apps in the same situations native apps are used—for applications you expect your visitors to visit frequently.

Other times you should consider using a progressive web app are when:

If you meet any of the criteria above, chances are you need a progressive app.

Now that you know what a progressive web app is, let’s look at some examples.

Uber, the ride-hailing company, saw an opportunity to expand their customer base by creating a progressive web app to make it easier and faster to request rides. The PWA works well regardless of location, network speed, or device.

For people who love keeping abreast of news and trends across the globe, Flipboard is a must-have. To increase their reach and enable users to have access to their favorite online magazine, Flipboard developed a PWA.

Reduced data usage enables users to enjoy a fast, sleek experience even in places with poor network coverage.

In a bid to drive more online orders, Starbucks invested in a progressive web app. Even when offline, customers can browse the menu and add items to their carts. Once back online, they can then place their orders.

Any industry can use progressive web apps. If you can serve your customers via a website or an app, you can also serve them using a PWA.

Thanks to the many advantages that PWAs offer, there are myriad reasons why you should use one. Let’s look at nine of the most common ones.

Because progressive web apps are easy and cheaper to develop than typical apps, you could have yours running in no time. If you’re starting from scratch, you’re probably better off starting with a progressive web app as it will get to market faster.

Since it has most of your website’s core functionalities, you’ll still be able to offer your customers good service and a positive user experience.

One of the main reasons for high bounce rates is a sluggish website or app. Users don’t want to wait long for a page to load.

That’s another great reason to use progressive web apps.

Progressive web apps help reduce bounce rates as they offer users a fast and seamless experience. Take, for example, Superbalist. By implementing a progressive web app, they reduced their bounce rate by a whopping 21 percent.

If you want to increase the time users spend on your pages, a progressive web app is one way you can do that.

Users will often abandon your page if it loads slowly. Because a progressive web app is lightweight and doesn’t put a lot of demand on a device’s resources, it loads pages fast.

Transitioning to another page is also seamless.

This can result in users spending more time on your pages. For example, Pinterest invested in a progressive web app for mobile experiences, which resulted in time spent on page increasing by 40 percent.

Because of the lack of heavy coding and service workers’ use, progressive web apps can load information faster than traditional websites. Since fast loading times can be the difference between a conversion and a drop-off, offering users a quick way to interact with your brand is essential.

Apart from speed, PWAs are generally more reliable than both traditional websites and apps. By design, there are fewer things that could go wrong. Because they’re network-independent and platform agnostic, they should work every time on any platform.

One of the main drivers of conversions in today’s highly competitive landscape is UX. Progressive web apps rank highly among platforms that offer the best UX.

If increasing conversions is important to you, take a cue from AliExpress, who increased their conversion rate for first-time users by 104 percent.

Search engine optimization (SEO) is one of the main pillars of digital marketing. Every marketer is always looking for strategies to make their brand more visible on search engine results pages (SERPs) and drive organic traffic to their website.

This is one area in which progressive web apps outshine native apps.

Native apps, because they’re hosted on the users’ devices, aren’t discoverable online. However, because progressive apps are essentially websites, they’re seen by search engines.

But discoverability is not the only advantage PWAs have over native apps. Other advantages include that progressive web apps are:

If you want to boost your SEO while giving your users a native app-like experience, a progressive web app may be the solution.

Research shows that mobile devices drive 65 percent of all e-commerce traffic. If you’re in an industry that relies heavily on mobile traffic, you’ll undoubtedly want to leverage progressive web apps.

Because your users don’t have to download an app, you could enjoy better retention and engagement rates.

While progressive web apps work on any platform, they’re notably useful on mobile devices. Mobile devices have less ability to load large websites or heavy apps, which results in slow load speeds and poor UX.

Progressive web apps solve this problem by offering users the same experience without demanding their device’s resources.

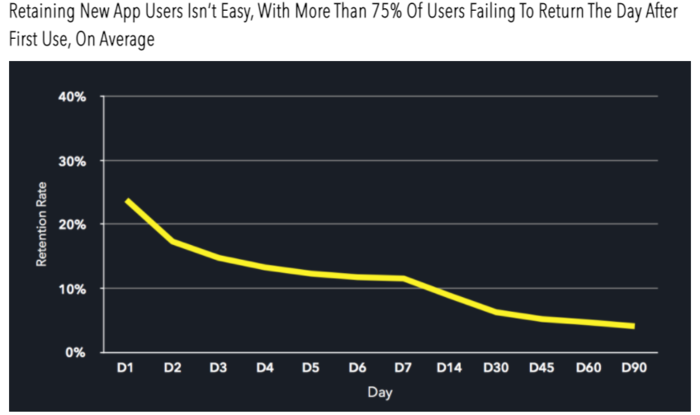

There are close to three million apps on Google’s Play store. Unfortunately, for most of the apps downloaded, only 25 percent of users use any given app after the day they downloaded it.

App abandonment results in a huge waste of time and resources for the developers and businesses sponsoring those apps’ development.

Again, this is where progressive web apps can save the day.

A few reasons why progressive web apps help retain users more are:

Progressive web apps are an excellent way of keeping your customers engaged with your brand.

One of the most significant limitations of native apps is that Google or Apple must process all in-app financial transactions. No third parties are allowed. For some businesses, this arrangement can be limiting.

With progressive web apps, on the other hand, you’re not bound by such regulations. You can choose any payment processor of your choice, just as you would on your website. You’re also able to monetize your PWA in any way you wish.

Progressive web apps are the future of web browsing. More than that, they could be the future of customer experience in the e-commerce world.

That’s why you must invest in developing one for your businesses.

With many advantages ranging from ease of development to improved SEO to creating exceptional user experiences, investing in a progressive web app may be worth the time.

Have you developed a progressive web app for your business?

The post When Should You Use Progressive Web Apps? appeared first on Neil Patel.

There are so many different types of business loans out there, it can be hard to figure out which type you actually need. Even harder is figuring out which type you actually qualify for. For example, if you need to buy new equipment, equipment loans would seem to be the way to go, right? Even then, do you go with SBA loans, traditional loans, private lenders?

The truth is, it’s not always so simple. Sometimes, traditional loans work best for equipment purchases. However, there are occasions when other options may fit your specific situation. But, when are those times? Furthermore, what are the other options?

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

Equipment loans, whether SBA loans or not, are loans that are secured by the equipment being financed. For example, if you bought a new industrial freezer and financed it with an equipment loan, then the freezer would serve as collateral for that loan.

The beauty of equipment loans is that you get the lower interest rates and better terms that typically come with secured financing. The problem is, that isn’t always enough to qualify.

Equipment is not attached to the property, but the assets are longer term generally speaking. This includes things like heavy duty copy machines, industrial freezers and ovens, and more. These things can be used as collateral to secure a loan to purchase them.

Using the equipment as security doesn’t get you out of needing to meet requirements like minimum credit score and income. However, if you do meet these requirements and therefore qualify for the loan, the collateral can help you snag better terms. Interest rates will almost definitely be lower, depending on other factors.

What if you don’t meet traditional requirements for equipment loans? There are other options.

The SBA has a few loans programs that work well for equipment financing.

This is the main program at the Small Business Administration. Through it, borrowers can get federally funded term loans up to $5 million. This money is available for expansion, working capital, and other things as well as, purchasing equipment. Banks, credit unions, and other specialized institutions in partnership with the SBA process these loans and disburse the cash.

The minimum credit score to qualify is 680. There is also a required down payment of at least 10% for the purchase of a business, commercial real estate, or equipment. The minimum time in business is 2 years. In the case of startups, business experience equivalent to two years will work.

This is the most popular SBA loan program. THis is due in part to the fact that funds are allowed to be used toward a broad range of projects, including buying equipment.

The 504 loan program offers loans up to $5 million. Money can buy equipment, as well as facilities or land. Generally, these loans are used for expansion. Private sector lenders or nonprofits process and disburse the funds. This program works well for commercial real estate purchases especially, but also for equipment.

Terms for 504 Loans range from 10 to 20 years, and funding can take from 30 to 90 days. They require a minimum credit score of 680, and collateral is the asset it is financing. There is also a down payment requirement of 10%, which can increase to 15% for a new business.

There is a requirement you be in business at least 2 years, or that management has equivalent experience if the business is a startup.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive

Microloans are just what they sound like. They are small loans, up to $50,000, that can be used to purchase equipment, start a business, buy inventory, or just as working capital. Community based non-profits administer microloan programs as intermediaries. The financing comes directly from the Small Business Administration. They can take upwards of 90 days to fund, and the minimum credit score is 640.

If SBA loans will not work for your equipment needs, a credit line hybrid might. It allows you to fund your business without putting up collateral. Furthermore,you only pay back what you use. It is unsecured, no-doc funding. That means you do not have to turn in any financials.

How hard is it to qualify? Not as hard as you may think. You need good personal credit, but that is relative. Your personal credit score should be at least 685, which is lower than what is required by most traditional lenders. In addition, you can’t have any liens, judgments, bankruptcies or late payments.

Also, in the past 6 months you should have fewer than 5 credit inquiries. You need to have less than a 45% balance on all business and personal credit cards as well. It’s preferred that you have established business credit, but not absolutely necessary.

Now, if you don’t meet all of the requirements, you can take on a credit partner that does. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding.

There are a ton of benefits to using a credit line hybrid. Most notably, it is unsecured, meaning you do not have to have any collateral to put up. Then, as mentioned, the funding is “no-doc.” This means you do not have to provide any bank statements or financials.

Not only that, but typically approval is up to 5x that of the highest credit limit on the personal credit report. Additionally, often you can get interest rates as low as 0% for the first few months, allowing you to put that savings back into your business.

The process is pretty fast. One other benefit is this. The approval for multiple credit cards creates competition. This makes it easier, and even likely if you handle the credit responsibly, that you can get interest rates lowered and limits raised every few months.

Another option if SBA loans will not work is an online lender. This is especially true if your personal credit score isn’t great.

Even if you have great business credit, most term loans and many lines of credit require a personal credit check. They may take your business credit into account, but if your personal credit stinks, it won’t help you much. Online lenders tend to have lower minimum personal credit score requirements than traditional lenders.

An added benefit is, an online lender will typically send you the funds faster. Sometimes you can have the money in as little as a few days, with approval coming in as little as 24 hours.

An Online Lender Could be the Answer to Your Funding Needs

If you can go with a traditional lender, great. They often have better rates and terms. However, if you, like many business owners, do not have that option, an online lender may be the perfect solution for equipment financing. Approval requirements allow many more borrowers to get their funds quickly and easily. Take into account the following factors:

It’s also important to note, there are a lot of predatory lenders online. You have to be careful. The list above is a great starting point, but don’t stop there. There are a lot of options, so be sure to research.

Founded in 2008 by college roommates, online lender Fora Financial now funds more than $1.3 million in working capital around the United States. There is no minimum credit score, and there is an early repayment discount if you qualify.

The minimum loan amount is $5,000 and the maximum is $500,000. The business must be at least 6 months in operation and the monthly revenue has to be $12,000 or more. There can be no open bankruptcies.

Obtaining financing from OnDeck is quick and easy. First, you apply online and receive your decision once application processing is complete. If you receive approval, your loan funds will go directly to your bank account. The minimum loan amount is $5,000 and the maximum is $500,000.

Just like any other online lender, they do have certain requirements to qualify for a loan. For example, a personal credit score of 600 or more. Also, you must be in business for at least one year. Annual revenue must be at or exceed $100,000. In addition, there can be no bankruptcy on file in the past 2 years and no unresolved liens or judgements.

Kabbage is an online lender. They offer a small business line of credit that can help businesses meet their goals quickly. The minimum loan amount is $500, and they do not exceed $250,000. You must be in business for at least one year and have $50,000 or more in annual revenue, or $4,200 or more in monthly revenue, over the last 3 months.

Kabbage is great if you need cash quickly. Also, their non-traditional approach puts less weight on your credit score, so they may work better for some borrowers than other lenders.

Rates start at 6% and go up to 22%. APR works out to 8 to 25%, and there is a 3 to 5 % origination fee.

Advantages are the soft credit pull and the fact that they will look at factors other than your personal credit if your FICO score is low. Another benefit is that Bond Street can offer very large loans if you qualify. Disadvantages are the longer time in business requirement and high APR.

Credit Line Hybrid Financing: Get up to $150,000 in financing so your business can thrive.

Popular online lender Lending Club offers term loans. Business loans from $5,000 to $300,000. Loan terms are 1 to 5 years.

Get a quote in less than 5 minutes. Funds are available in as little as 48 hours if approved. There are no prepayment penalties.

Annual Revenue must be $75,000 or more. You must be in business for 2 years or more. Personal FICO score of 620 or better is required.

Rates of 5.99% to 29.99%. Total annualized rates starting at 8%.

Advantages are that the annual revenue requirement isn’t too high. Funds are available quickly. Disadvantages include high maximum rates.

Funding Circle is a way to apply for SBA funds online. To get started with Funding Circle, you must meet the following requirements.

Traditional equipment loans are the lowest cost way to finance equipment. They won’t work for everyone though. If they will not work for you, there are other options. The SBA offers loan programs that work well for equipment financing, and online lenders can be a possibility as well.

Perhaps the most unique and under-utilized option is the credit line hybrid. When you use this option, you do not have to use the equipment as collateral, and sometimes you can get 0% interest, at least initially.

It will likely take some time to figure out which option for equipment loans will work best for your business. The first step is finding out that there are, in fact, options.

The post SBA Loans for Equipment Loans? appeared first on Credit Suite.

Aid For Starting A New Small Business Beginning a brand-new little company comes with lots of threats included. It is not simple to begin a company little or big. You have to network Networking ways that you are broadening your network of services as well as close friends that might finish up assisting you in …

The post Aid For Starting A New Small Business first appeared on Online Web Store Site.

The post Aid For Starting A New Small Business appeared first on ROI Credit Builders.

The post Aid For Starting A New Small Business appeared first on Buy It At A Bargain – Deals And Reviews.

In an exclusive interview with ESPN, Mercedes team principal Toto Wolff rewinds the clock to the day he nearly killed himself attempting a new lap record at the Nurburgring’s legendary Nordschleife.

The post The story behind Toto Wolff's lap record and huge crash at the Nurburgring appeared first on Buy It At A Bargain – Deals And Reviews.

According to Unbounce, half of the people who click on your ads are more likely to make a purchase than those who came from an organic link.

That’s a bit surprising.

You’d think with 600 million devices running ad blockers —advertising would be less effective. Google Ads commands 73.1 percent of search advertising, roughly $40.3 billion. Advertisers couldn’t afford to continue spending that much money on ads if they didn’t work.

Google Ads are effective.

What’s tough for many companies is choosing the right AdWords Agency. Managing Google Ads takes a lot of time, effort, and energy. Most companies choose to outsource that hard work to a PPC agency. If you plan on doing the same, you’re going to need to know how to choose the right agency to manage your Google Ads.

Here’s how you do it.

Google Ads is a direct response platform where customers are searching directly for your product or service. To achieve profitable results with your Google Ads campaigns, you’ll need to have some concrete goals in mind. In general, companies focus their attention on a few specific goals, such as these listed on Google’s website:

The ultimate goal for each of these is revenue; each of the examples above would be considered a lead. Unlike SEO, where results require weeks or months of work, Google Ads is a direct response channel. A successful ad triggers immediate action from searchers.

The focus is on action.

Next, you’ll want to create specificity around your goals. This depends on a few factors like your budget, the keywords you choose, match types, etc. For example, if you’re running a service business, you know you’ll need a certain amount of leads. This means you’ll need to identify details like your:

There are more metrics you’ll need to track, but your agency can manage these for you and provide you with the reporting you need once you’re up and running. Providing your agency with these numbers makes it easier to set things up; you can use these to set your daily/monthly budget, identify profitable campaigns at-a-glance, or set goals to boost profitability.

It would be best if you had a rough idea of the numbers you need to be profitable — the number of leads, sales, and customers you need each month for the campaign to be self-sustaining.

Here are some things you’ll want to look for when vetting an AdWords agency. These characteristics are important must-haves. Use them to determine if the agencies you’re considering are a good fit.

The agencies you’re considering should have Google Partners status. Google explains this more, sharing why this is so important for your agency:

“Achieving Partner status means that your company has demonstrated Google Ads skill and expertise, met Google ad spend requirements, delivered company agency and client revenue growth, and sustained and grown its client base. Partner status gives your company access to a number of benefits, including the Google Partner badge that can be shown on your website and marketing materials.”

If you’re looking for an agency to manage Google Ads on your behalf, this is important for a few reasons. It shows prospective clients that:

If you’re looking for a clear indication that your AdWords agency is legit, this is it. You’ll also want to verify that each of the paid search strategists on your account are individually certified. You can verify your agency’s partner status with Google at this URL. Verification will provide you with a list of Google products your agency has received certification for, their partnership type, and the number of offices certified by Google. If they have a banner/badge on their website, you should be able to click to verify your agency’s status with Google.

If you’ve requested a proposal, you should receive links to the certification URLs for each of the strategists assigned to your account. The URL should be displayed in the following format:

https://academy.exceedlms.com/student/award/20xxxxx

Their certification should provide you with a completion identification number and the completion and expiration dates for their certification. Here’s what an individual’s certification looks like:

Some PPC agencies rely on a pay-per-lead model. Using this model, they drive traffic to a general landing page or advertorial that generates leads for their clients. The downside to this model is the fact that clients don’t receive the landing pages, creative, or assets that went into producing the landing page.

This arrangement is great for agencies but bad for clients.

It’s great for agencies because they’re able to use one landing page or ad with multiple clients in the same industry. Sure, clients receive the leads that they need, but they’re always dependent on the agency that produced them. They never really figure out how to make things work for themselves.

This approach can work.

If you’re only interested in the leads and you’re not interested in creating your own content, landing pages, or marketing in the future, there’s nothing to worry about. If you’re also interested in sticking with the same agency indefinitely, there’s no problem.

Change any of those things, and you may not be able to continue to receive the same amazing results you’ve come to expect in the long term. Insist that your agency provides you with the assets and creative they’ve produced for your business.

Google requires agencies to be transparent with their clients. This has been a requirement for some time, and it’s another reason why Google Partner and individual certifications are so important.

“If you work with another company to manage your AdWords campaigns, you should be able to find out how much of your advertising budget (cost) was spent on AdWords, how many times your ads appeared (impressions) and how many times users clicked on your ads (clicks). We’ll include these requirements in our legal terms and agreements.”

Google also mentions that almost all of its certified partners are already offering this transparency to its clients. Transparency isn’t common with non-certified agencies; most agencies won’t provide this if clients don’t know any better.

If you’re working with your agency, you should have access to all reports. You should also have access to metrics including impressions, clickthrough rates, keywords, account and ad group structure, and more. If you have questions about where or how your money is being spent, you should receive straightforward answers. Ask your agency about the information they provide to clients if you’re unsure.

Some agencies prefer to lock you into a long-term contract (e.g., 12 or 24 months); this makes sense when you realize it takes a lot of time and resources to set up and launch a new client account. Most AdWords agencies don’t make money on the account until they’re a few months into the campaign.

This arrangement isn’t always what’s best for clients, especially if the agency fails to perform. Clients should be able to come and go as they please. When agencies focus on performing well for clients, the relationship is more stable.

Some agencies can offer month-to-month arrangements profitably. A compromise could be an initial three-month contract that switches to a month-to-month agreement afterward. Whatever you negotiate with your agency, it needs to be beneficial for both. If you’re unhappy with your agency, you should be free to leave.

Your agency should be able to provide you with references and case studies to validate their expertise. There shouldn’t be any doubt about your agency’s ability to perform. You should have the data you need to vet their experience and track record accordingly.

It’s not enough to prove that you’ve achieved amazing results for your clients. You need to demonstrate that you’ve been able to do it consistently over time.

Ask your agency for all of the data you need to validate their performance —references, case studies, anonymized campaign data, and before and after campaign data.

Your agency should have an established process for managing and maintaining your account. They should be able to tell you when they add keywords and create new ads, how they set and maintain budgets across keywords and ad groups, and the adjustments or changes they’ll need to make for various markets.

They should also be able to tell you which tests will be run, how they’ll be run, and the metrics or KPIs they’ll be using to validate performance.

I’m not talking about the Ads setting in your account. I’m talking about your agency’s focus on boosting revenue. It’s common for many agencies to focus their attention on impressions or clicks. Your agency should focus on helping you convert those clicks to revenue.

This means your agency needs to focus its attention on:

Google Ads is a direct response platform, so optimizing for conversions and revenue should be your agency’s primary focus. If they’re focused on anything else, they’re not a good fit.

Here’s a list of the things your agency will need from you. These requirements aren’t hard, but they do require some effort on your part.

Give your agency the permission they need to make important decisions on your behalf. Establish a clear point-of-contact so your account strategists can reach out when they need your help. Spell out your expectations and communication standards ahead of time.

If you want weekly communication, let your agency know.

You can use Google Marketing Platform Partners, HubSpot Agency Directory, or Clutch.co to find an AdWords Agency. We’ve added a few of the best agencies to make things easier for you.

My agency, NP Digital, is focused on conversions and revenue. While many agencies are focused on clicks, we focus specifically on driving immediate revenue for our clients. Many agencies focus specifically on PPC ads via Google or Facebook. We offer A to Z paid search support covering: paid media, paid search/shopping, paid social, Amazon, and programmatic advertising.

Adventure Media Group got its start as an AdWords training company, then they pivoted to Agency services, focusing specifically on AdWords and landing page design. They’ve grown quickly, shifting their focus to Enterprise AdWords Management.

Ignite Visibility lists WeddingWire, Tony Robbins, and Mission Federal Credit Union as their clients. Their agency model is focused on returns. They’re a full-service agency, but they have the experience to manage paid search campaigns across several channels, including — social, display, and programmatic advertising.

Disruptive Advertising focuses on something they call results-based relationships. Their agency has 152 employees and a high concentration of paid search consultants, something uncommon in the industry. They’ve been listed as a top agency by Clutch.co, Upcity, and others. Their agency focuses on brands with larger PPC budgets.

Voy Media focuses on client growth via paid advertising. They describe themselves as the Swiss Army knife of advertising. They’re Facebook Ad specialists as well, so their agency is a good fit for clients who are looking to optimize their ad spend and who also rely on multichannel advertising to grow.

They’re listed as the #1 PPC Agency in Phoenix. They offer clients paid search management and conversion rate optimization services that are backed by their data-driven model. As an agency, they focus on 100 percent transparency with clients. They’re experienced pros when it comes to promoting tech companies, whether they’re in SaaS, Ecommerce, Tech, or Transportation.

KlientBoost has a unique business model that works well with low/entry budgets. PPC is typically an expensive thing for agencies to ramp up, but KlientBoost can make it work consistently for their clients. Their agency works well with small or local businesses.

WebMechanix is a performance-based digital marketing agency for mid to large companies. They’re an award winning firm that’s focused on paid search advertising. They offer other agency services as well, but they focus on measurable results and financial impact for their clients.

Directive is a paid search agency for software and SaaS companies. They describe themselves as next-gen performance marketing for software. They focus their attention on increasing qualified leads (MQLs) for their clients, helping their sales and marketing teams hit their performance numbers.

JumpFly specializes in digital advertising focusing on PPC account setup and management for Google Ads, Microsoft Ads, Facebook & Amazon. If you’re looking for a PPC specialist or you’d like PPC specialists to work with your in-house team, JumpFly may be a good fit.

Clicks on your PPC ads are more likely to lead to a sale. It sounds surprising, but paid advertising is still more effective than organic links, even with the growth of ad blockers.

Google Ads work.

But AdWords management is difficult, that’s why you need an agency. Use this post as a guide to choose the right agency to manage your Google Ads. Vet your agency carefully. Then, once you’ve found the agency that fits your needs, give them the tools and resources they need to boost your revenue.

The post How to Choose The Right Adwords Agency appeared first on Neil Patel.