Article URL: https://devcycle.com/company/careers

Comments URL: https://news.ycombinator.com/item?id=29394332

Points: 1

# Comments: 0

Article URL: https://devcycle.com/company/careers

Comments URL: https://news.ycombinator.com/item?id=29394332

Points: 1

# Comments: 0

Facebook engagement is easier and more valuable than you ever imagined.

I found this out the hard way.

At one point, I was spending hundreds of thousands of dollars a month on Facebook Ads.

Sure, I was getting some huge successes. But I was also wasting a ton of money.

For example, I once spent $400,000 on Facebook fan page likes.

I still feel dumb for that one.

The engagement just wasn’t there. I had a large number of fans, but very little actual engagement.

I had no idea that hidden tools within Facebook’s apps, extensions, and insights (and a few external tools) could have made my Facebook ad spend 80 times more effective.

Facebook marketing is like an iceberg. Most people see the top part — Facebook ads. They spend their entire time optimizing that little bit of potential.

The real power is underneath. It’s hidden.

That’s why I created this list.

I want you to know exactly what those hidden Facebook marketing tools are and how you can increase your engagement by 154 percent, as I did.

Before we get started, for the first few hidden tools you need Mobile Monkey to utilize all of the tactics (it’s free).

Some of the hidden tools I’ll share are within Facebook; you just don’t know about them.

This one is hiding in plain sight: Facebook Messenger marketing.

For some reason, not very many marketers are taking advantage of Messenger marketing, even though it’s the hottest opportunity in digital marketing today.

What does this mean for you? It means that you can gain first mover’s advantage.

Using Facebook Messenger for marketing is as simple as it sounds… you send messages to customers on Facebook Messenger.

What makes this channel different from other marketing methods like email marketing is the results.

Where else can you get engagement results like that?

I don’t know of any, and I’ve done quite a bit of online marketing.

The best way to get started with Facebook Messenger marketing is with MobileMonkey.

MobileMonkey is a powerful chatbot builder that I use personally. Chatbots are essential for scoring sky-high open rates, CTRs, and conversion rates.

And best of all, it’s free.

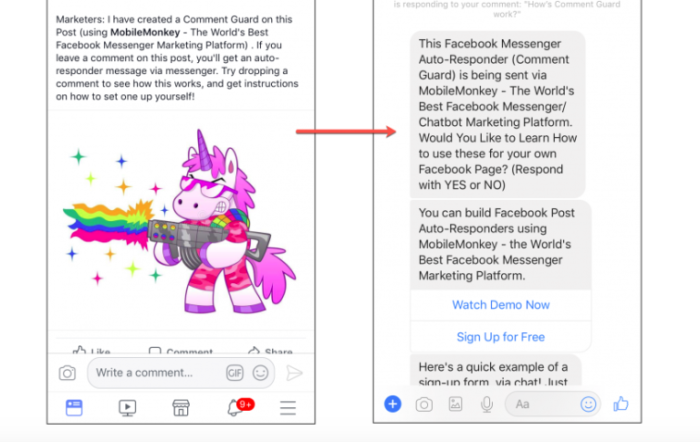

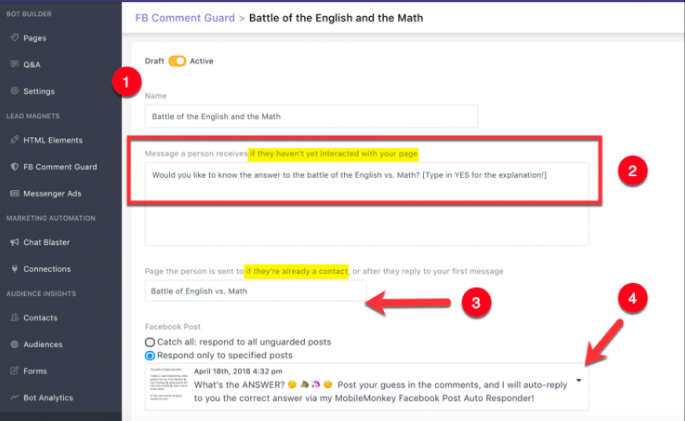

A comment guard is a Facebook Messenger marketing feature that allows you to add new contacts to your contact list when they comment on your Facebook post.

Here’s how it works:

The mobile screenshot below displays exactly what happens.

Say you post something on your Facebook page that has high engagement potential, such as a meme, a quiz, a contest, a question, whatever. All the comments aren’t just comments anymore; they’re warm leads.

You’ll need to use MobileMonkey in order to pull this off, but it’s really easy.

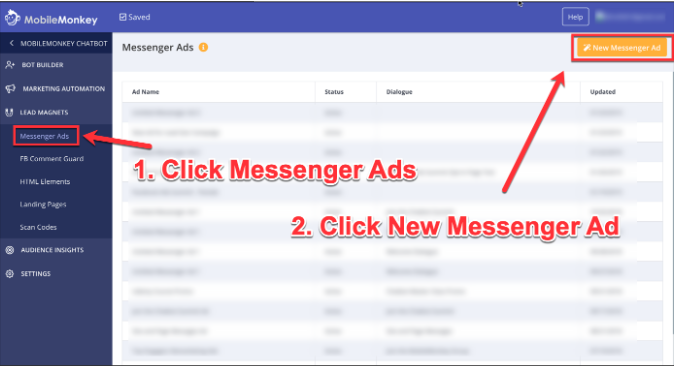

A Click-to-Messenger Ad is a normal Facebook ad with a twist. Instead of sending people to a landing page, you send them to a Facebook Messenger bot sequence.

It looks like this:

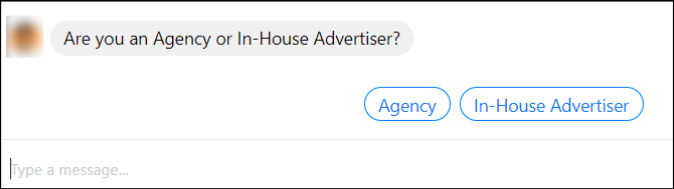

Once the person starts the Facebook Messenger sequence, they are a lead. Then, the chatbot takes over to bring them through the conversion funnel.

For example, you could have your chatbot ask users questions, and send them offers based on their responses.

It can be hard to manually respond to thousands of messages. Instead, you can direct those chat from your Messenger Ads directly to a MobileMonkey chatbot, which can ask qualifying questions and engage users at scale.

Check out this article, for step by step instructions on leveraging this strategy.

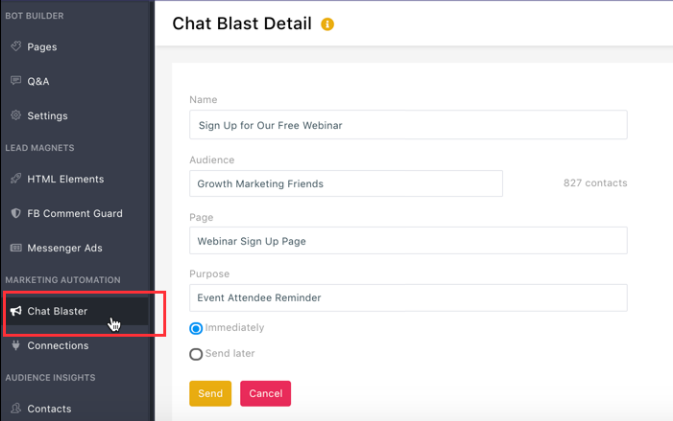

Chat blasting is a powerful method for getting your message in front of your entire Facebook Messenger list in minutes.

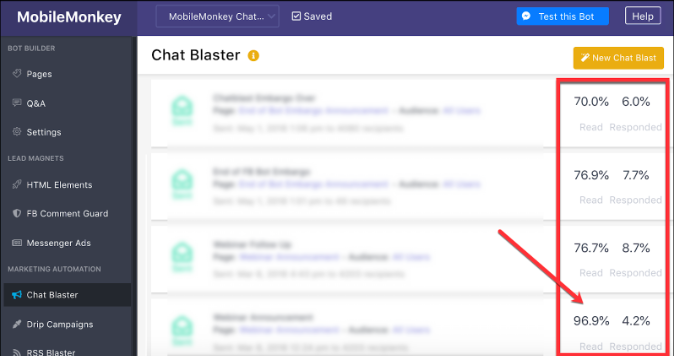

I’ve managed chat blasting campaigns that scored a 96.9 percent open rates in just sixty minutes.

With MobileMonkey, you can schedule chat blasts, bulk send, develop interactive Messenger sequences, create special offers, and anything else that helps your marketing.

To start, just click “Chat Blaster” in the app.

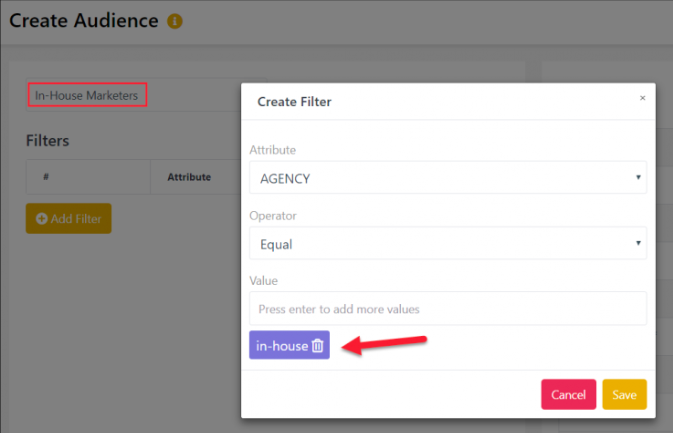

Chat Blaster also has the ability to segment audiences. Many of the campaigns I manage involve thousands of contacts, so I want to narrow down my contacts to just the right targets.

Creating segments is simple using MobileMonkey, which allows you to “Create Audience” with a click.

Your audience can perform self-segmentation when the chat blast sends.

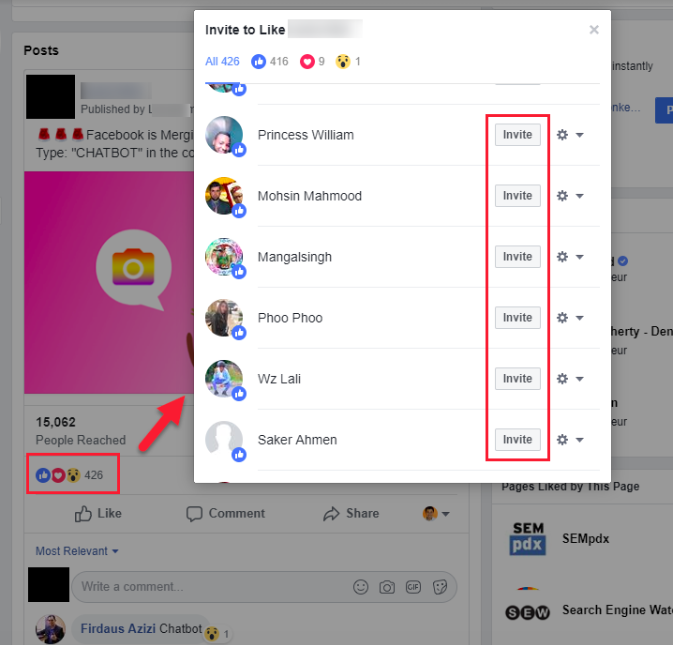

One tactic that I’ve used to build my Facebook audience is by personally inviting people who engage with my Facebook page to become a page fan.

From your business Facebook page (desktop), find a post that has engagement.

Using this tool, you view the people who engaged with your post and can invite people to like the page.

The reason why this is valuable is that you’re able to target engaged fans. If you have a lot of Facebook fans, but not a lot of engagement, Facebook’s algorithm will punish you.

Instead, identify those people who will be engaged and manually invite them.

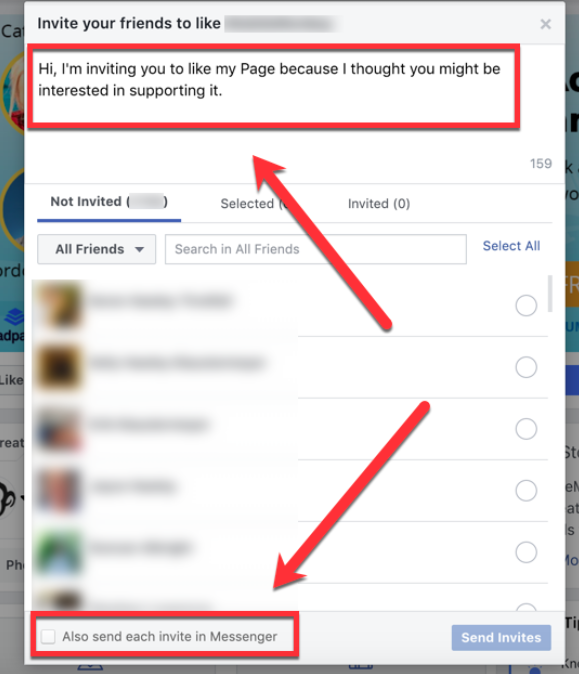

Another strategy is inviting your friends to like your business page, and also sending the invite in Messenger.

This allows you to personalize the message and give them two touches instead of just one.

Click on the “Community” button on your Facebook page, then click “Invite Friends to Like Your Page.”

Here, you can invite friends and create a personalized message. Be sure to check the box at the bottom to send the invite using Messenger.

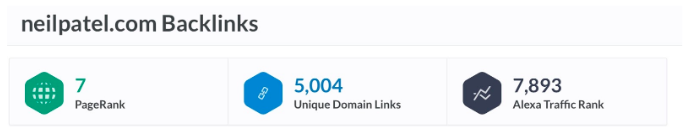

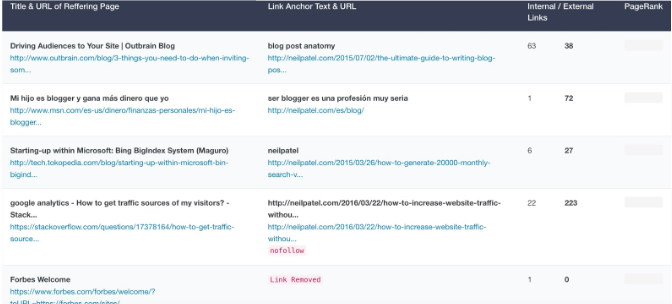

I’m a huge fan of ethical espionage.

In the world of SEO, it’s not that hard.

Just plug in a URL to something like RankSignals.

Boom, you have intel.

A lot of this data is really helpful.

With so many brands now spending millions of dollars on Facebook ads, how do you get a handle on that kind of information?

You will not be able to get your competitor’s targeting info and ad spend but you can find out where, how often, and what the competition is advertising.

Ever wish you could see exactly what ads your competitors are running? Actually, you can — right in Facebook.

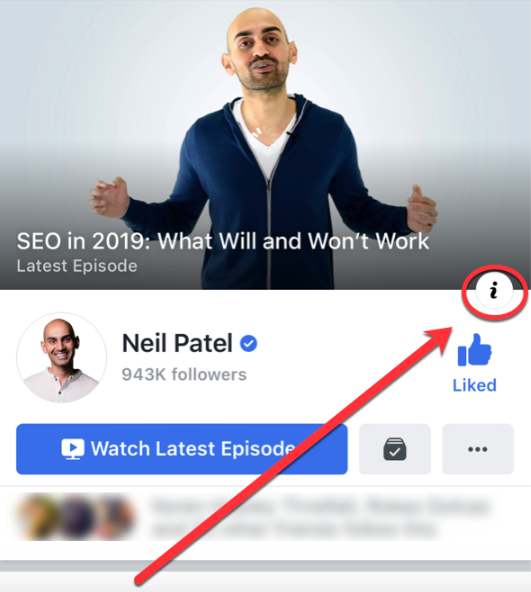

Let’s say I’m the competition and you want to spy on me. First, find my Facebook page and tap the “i” button. (It might be on the right or under the “Details” tab, depending on the device you’re using.)

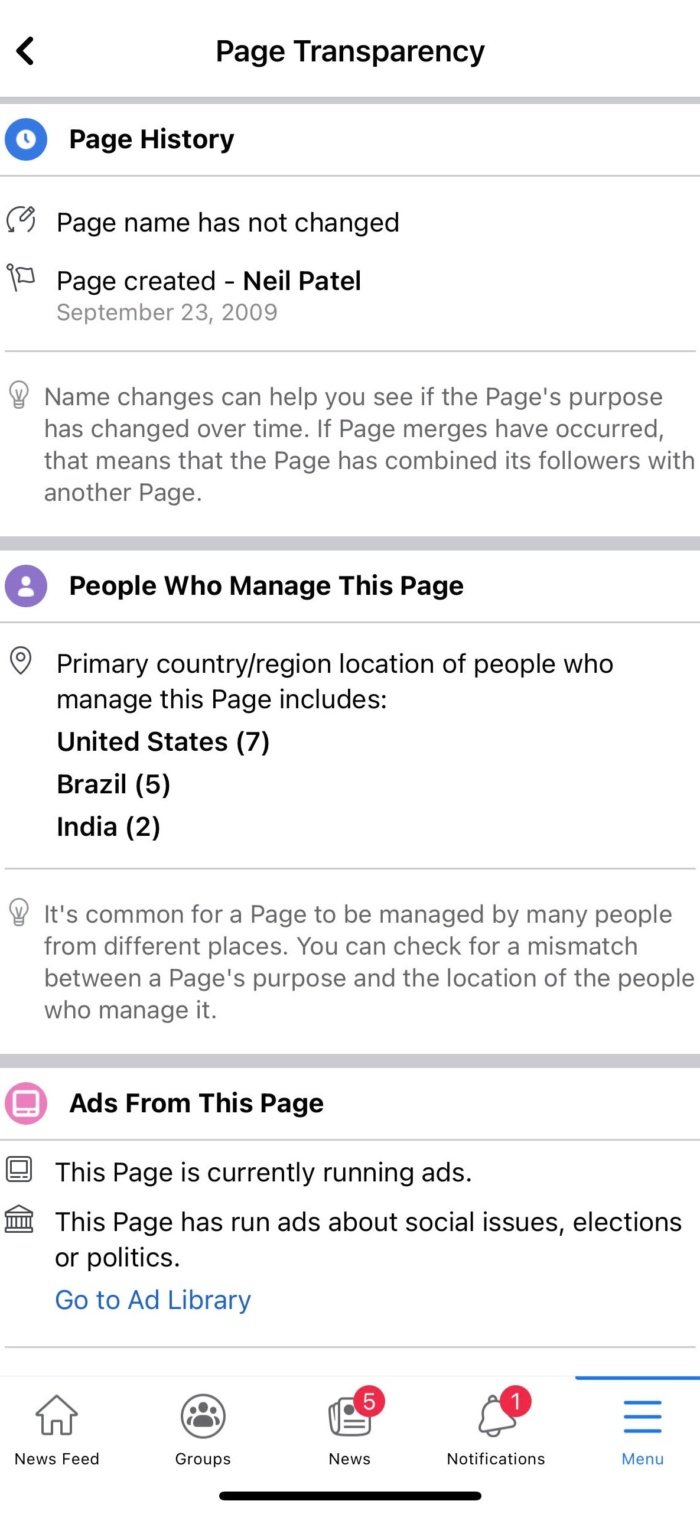

On this page, you can find out if the page has ever changed names, when it was created, and where the page managers are located. This can be handy intel.

Tap on “Go to Ad Library.”

If the page is (or has) run ads, you’ll be able to see them here. This means you can see the ads they are running now and see what they have run in the past.

Granted, you don’t have access to insights about how well ads performed, but you can see if they tend to use the same ad copy or types of images and use those strategies for your own page.

I like to have a solid understanding of who my competition is and what they’re up to.

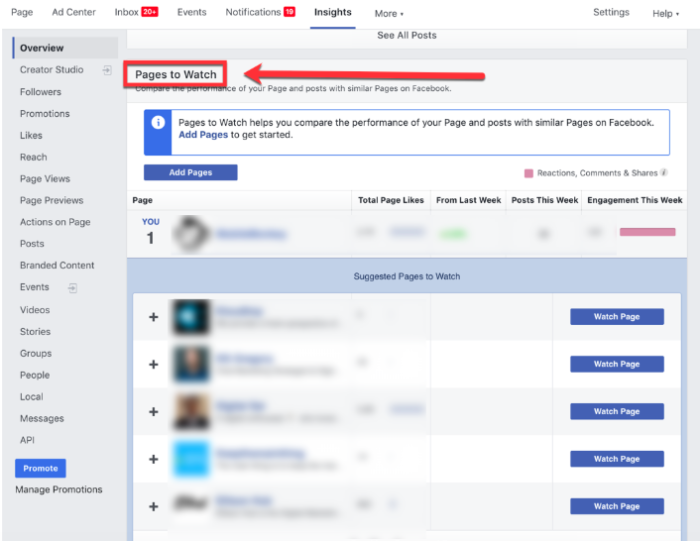

How do I know who my competition is? Thankfully, Facebook’s algorithm has figured it out for me.

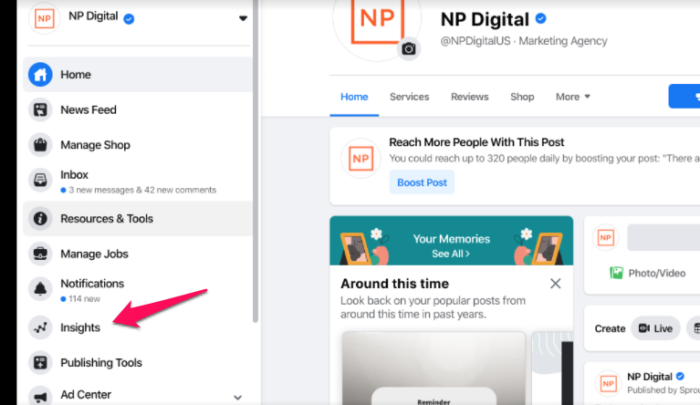

To use this feature, go to your Facebook Page Insights. From Insights, scroll down until you see “Pages to Watch.”

By default, Facebook shows you five potential competitors, but you can view more by clicking “See More Suggested Pages.”

When you add a competitor to your watched pages, you’ll be able to keep up with their activity, growth rates, total likes, and the frequency of their posts.

This information will help you understand how you’re doing and what you might need to change.

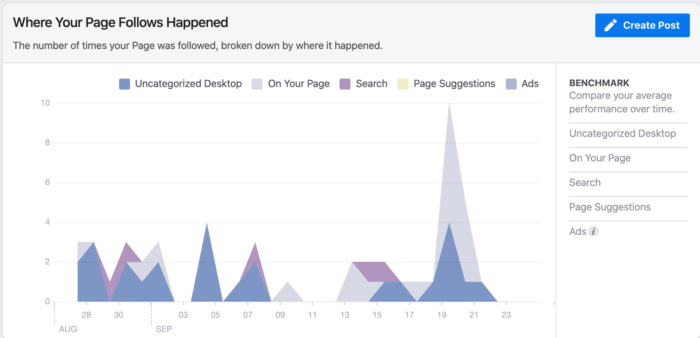

It is important to figure out where your followers are coming from so you can know how to get more.

One helpful way to get this information is again through Page Insights.

Facebook shows you follow quantities according to five locations:

If a particular source shows large follow rates, try to reverse engineer what happened, then do it again.

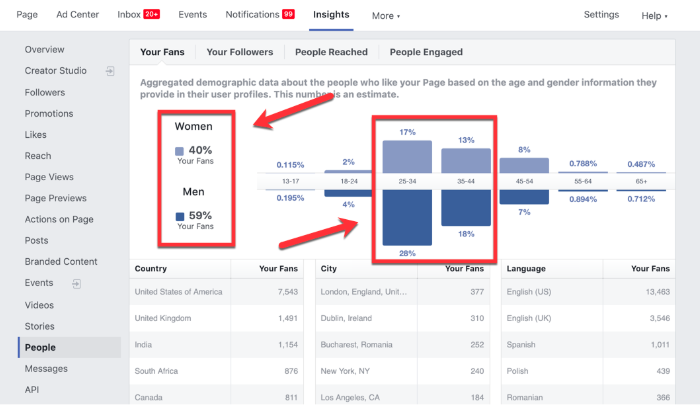

One way that I use metrics to improve my targeting is to view my Facebook page insights, particularly the demographic information.

When viewing this information, I’m looking for strong positives — indications that my audience favors a particular demographic.

For example, this page demonstrates a strong positive for men and women between the ages of 25-44.

If you’re 21, there’s only a small chance you’re going to be interested in my page. By contrast, if you’re a 30-year old male, there is a far stronger likelihood that you will have an interest in this page.

This information helps me know how, where, and upon whom to focus my marketing and advertising efforts.

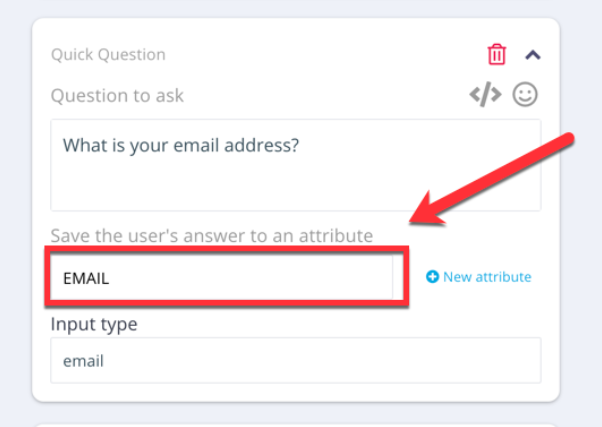

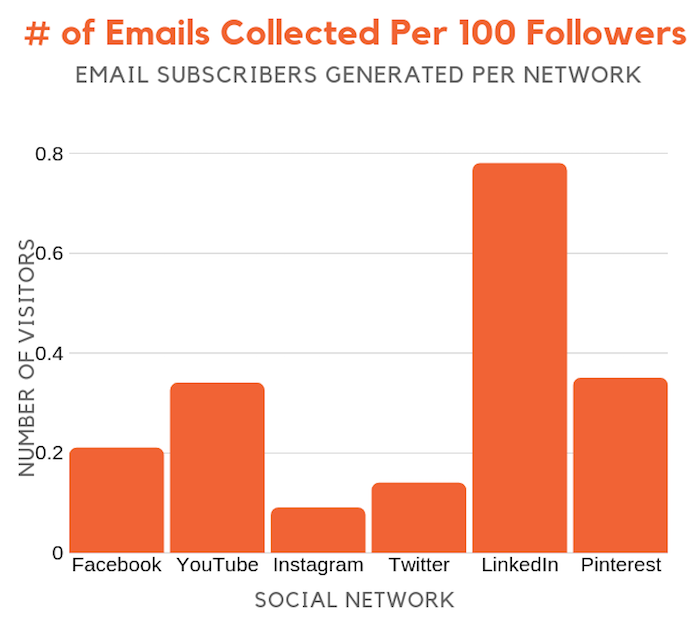

Building an email list is tough these days. No matter how appealing your content upgrade, asking for someone’s email address is tantamount to asking for their social security number.

With Facebook Messenger marketing, that’s no longer the case.

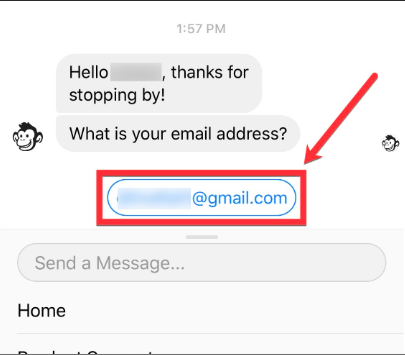

You can create a Facebook Messenger chatbot that asks for an individual’s email address. Then, all they do is click a button to pre-fill their address.

Facebook does all the work for you.

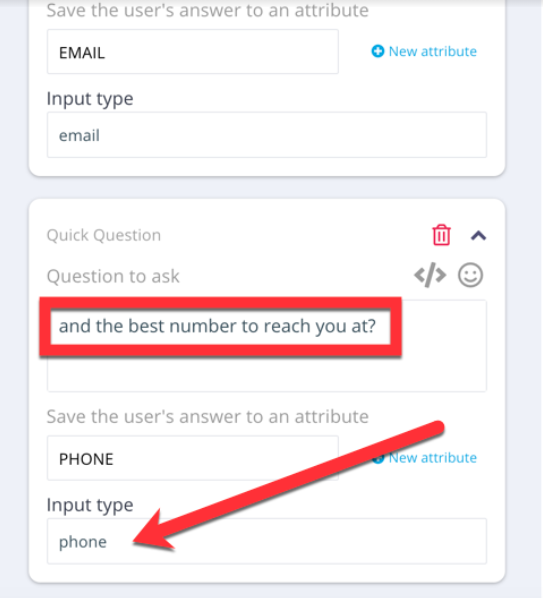

Here’s what the bot looks like in MobileMonkey.

As long as you set the input type as email, Facebook will know to pull the user’s email address as they’ve entered it when creating a Facebook account. No typos, nothing.

This is another case of using two different channels to get information and engage your users. When you use a chatbot, it makes the process automatic and easy.

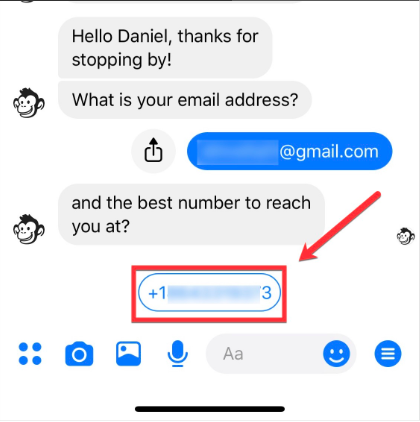

If there’s one thing harder to get from a customer than their email address, it’s their phone number.

Again, powered by chatbots, it’s a cinch. Using input type “phone” in MobileMonkey means that you’re guaranteed to get the user’s primary phone number as they provided when and if they stored their phone number in Facebook.

It’s understandable that people are hesitant to enter their phone number on an unfamiliar platform

Understandably, people are hesitant to enter their phone number on an unfamiliar platform — a contact form on your website, for instance.

It’s quite a different comfort level when they are asked for a phone number in a familiar messaging app, and Facebook automatically adds the number.

All that your contact has to do is tap their phone number.

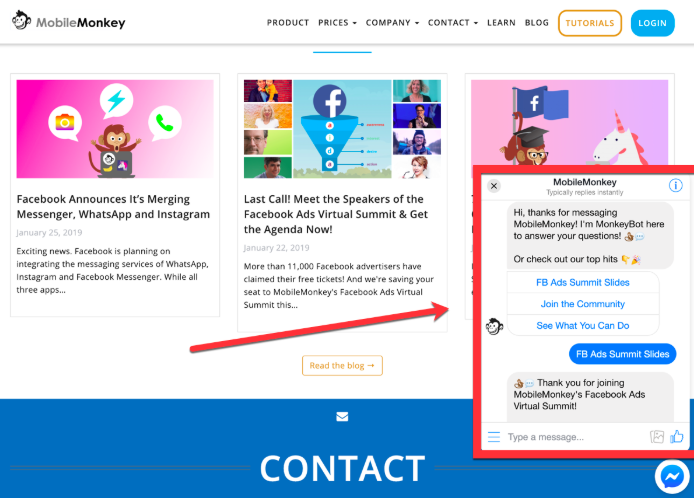

This one seems obvious, but again it’s surprising how few websites are putting the power of a website chat widget to work.

Check this out. If you go to MobileMonkey’s website, there is a chat widget on nearly every page.

If you’ve logged into Facebook Messenger on that browser, all you have to do is click and you’re introduced to a Messenger sequence with MobileMonkey.

This sequence powered by a chatbot brings you further down the funnel.

One of the unique and powerful features of this funnel is that it is self-guided. You feel as if you’re in control — making choices and selecting options.

Regardless of your choices, however, you are making deeper connections with the brand and the marketing funnel.

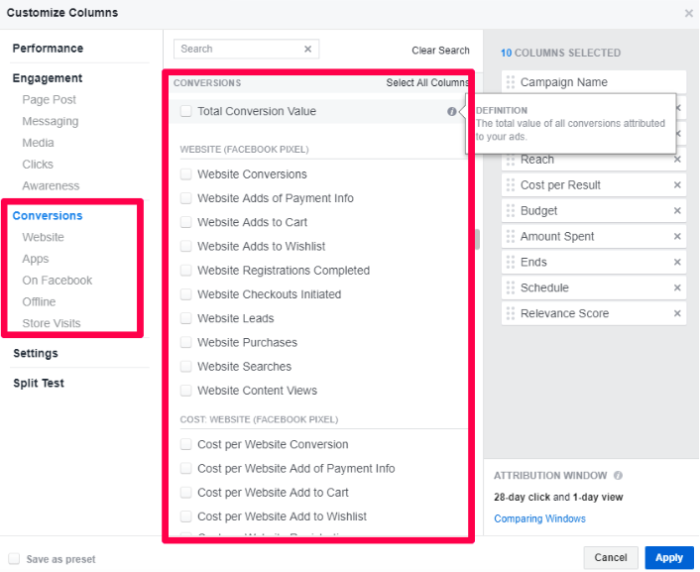

The good thing about Facebook Ads Manager is that you have access to a ton of information.

The bad thing about Facebook Ads Manager is that you also have access to a ton of information.

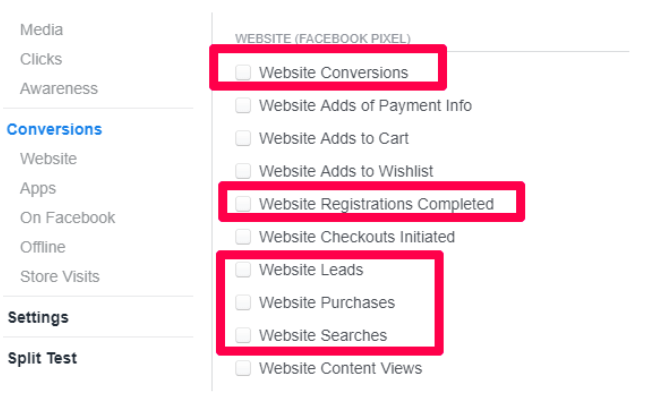

Take conversions, for example.

If you’re tracking them, good for you. But which conversions are you tracking? Here are the options:

I call this one “hidden” because true conversions are essentially in Ad Manager underneath a lot of other noise.

You have to narrow down your conversion tracking to just the conversions that you need to know about.

For one of my businesses, I only focus on five types of conversions.

Everything else is useless.

I’ve written about this before; when you get clarity on what to track, you’ll do a lot better at making real progress with your Facebook advertising.

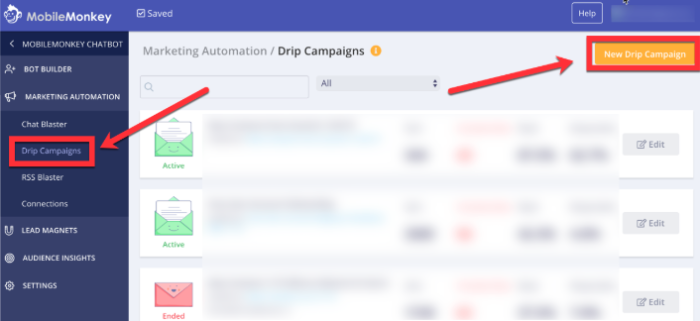

If you’ve been in internet marketing for any amount of time, you know how potent a good drip campaign can be.

Imagine increasing this potency by 10x.

That’s exactly what a Facebook Messenger drip campaign can do. Again, the power is in the chatbot builder.

MobileMonkey’s drip campaign feature just takes a click to get started.

Unlike an email drip campaign, which can take days or weeks to complete, a Facebook Messenger drip campaign can be completed in a matter of minutes or hours.

Plus, when you use a chatbot, the entire sequence can be interactive. You can create choices and engage the user on a far deeper level.

You can use Facebook to run ads, create and promote your own Facebook business page, join groups related to your industry and post your promotional content there.

As of 2021, there are about 2.85 billion Facebook users, meaning you have access to an unbelievably huge audience.

Facebook offers content curation, ad builders and campaign building, A/B testing, campaign measurement and reporting, hashtag targeting, and more.

If you want to market on Facebook, your first step should be to perform competitor research. Look into how your competition uses it to market their products or services, and figure out what they are doing well, and go from there.

There’s way more to Facebook than meets the eye.

There’s a reason why so many of the hidden marketing tools above focus on Facebook Messenger.

Facebook Messenger marketing has fundamentally changed the game, and it’s done so in two areas where marketing rises or falls:

It’s not going to last forever. Like the banner ads of decades past, Messenger marketing will lose its luster as people become accustomed to it.

By engaging Messenger marketing now, you’ll have a far stronger advantage.

What Messenger marketing tactics does your brand or business currently use?

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

Here’s some good news–you can get a website up and running without spending a dime.

Yes. Free web hosting exists, and I’ll show you how to get it.

You’ll be able to launch a website with a few clicks, but don’t expect anything fancy.

Some of the trade-offs with free web hosting include: ads on your site (that don’t make you money), a cap on how much traffic you can get, sudden downtimes, and little to no customer support.

There’s some really great cheap web hosting options that will help you build a site without tradeoffs for a few bucks a month.

But if you really need a 100% free web hosting solution, check out my recommendations below.

When it comes to building a simple blog or an online portfolio that highlights your work, Wix is the best intuitive website builder you can count on.

With the help of its simple drag-and-drop interface, you can create a simple website in minutes. Wix takes care of your website through free hosting so long as you don’t mind having Wix brand ads displayed on your pages.

And if you don’t want to build your own site, all you need to do is answer a few questions. The platform’s Artificial Design Intelligence (ADI) will then automatically generate a website with a design based on the answers you give.

You’ll get a great looking page in a few minutes, and from there you can fine-tune it the way you want. Editing within Wix is easy, and you’ll be surprised at how many options you have.

Although free accounts can only use the Wix subdomain, there are enough templates and apps you can choose from to add a little bit of personal touch to your website.

Should you decide to create a website with Wix, you will get a storage space of 500 MB and a bandwidth of 500 MB, enough for a low-traffic site like an online portfolio.

If you want more flexibility, you can upgrade to premium plans anytime to access custom domain, email, and ecommerce features.

Premium plans also eliminate ads so your website will look more professional and less cookie-cutter.

But even with ads, Wix has plenty to offer that will put the spotlight on your content. Whether you’re a writer, designer, or photographer, Wix remains the best website builder to help you establish an online presence without touching any code. Sign up now.

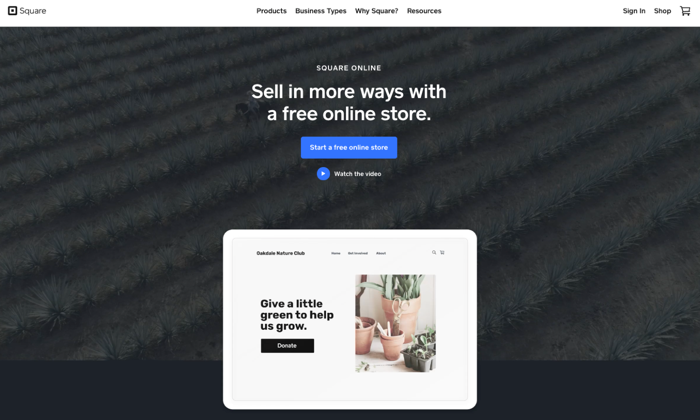

Square Online is a free ecommerce platform for aspiring entrepreneurs who are still getting their feet wet with online selling. Unlike big names in the industry, Square Online lets you sell unlimited products without paying recurring fees.

It’s free to set up your online store hosted by Square Online. You’ll pay a fee for transactions on the site, but it’s only a small percentage of your total sale.

Your still making money on your free Square Online site, which is pretty great considering you still pay transaction fees on paid hosting platforms as well.

The drag-and-drop editor only offers four customizable themes, but you get an assurance that every design follows your industry’s best practice. Without touching any code, you can create your online store with a responsive design that fits in any device.

Square Online also offers the following to help you get started with your business:

In exchange for hosting your online store for free, Square Online requires a small commission fee of 2.9% + 30¢ for each product sold. Should you decide to scale your business, you can leave the free plan and move to the premium plans starting at $12 per month.

Through a new feature called Square Online Checkout, sellers also have the option to sell their products and receive payment using only a link instead of a website.

Whether you’re an established brick-and-mortar store owner or just starting from scratch, Square Online has all the basics to help you navigate the unfamiliar world of ecommerce with ease. Start now.

DreamHost believes in every nonprofit organization’s advocacy so much that they’re giving them a shared hosting plan at no cost.

Aside from free web hosting, DreamHost also provides US-based charitable organizations with the following:

To create a free hosting account, DreamHost does not require any credit card details and needs just your billing address for verification purposes.

You also need to attach a 501(c)(3) determination letter, a document from the United States IRS proving your tax-exempt non-profit status under the applicable sections of the tax code.

Since it’s a free account, you won’t have access to reliable 24/7 customer support. However, DreamHost’s dedicated help center and ticketing system offset this, which more than meets the need for straightforward troubleshooting solutions.

Should you want more control over your account, nonprofit organizations can also avail themselves of a 35% discount off DreamHost’s managed WordPress hosting plans. This means you can host your site under a paid plan for as low as $11 per month.

Often confused with the open-source software WordPress.org, WordPress.com is the free platform where non-technical users can create websites.

Since it is powered by the same robust and world-class infrastructure behind nearly half of the world’s websites, WordPress.com is the best place to learn how to manage a website while you’re still not ready or able to pay for a hosting service.

Setting up a website is easy. You can select a WordPress subdomain and choose from any of the available themes.

Just like Wix, WordPress.com also displays ads to sustain its free platform. While the ads may sometimes be annoying, this is a small price to pay for all the other features that WordPress.com has to offer:

While it has excellent performance for a free hosting platform, WordPress.com can’t beat the paid version in terms of flexibility. The WordPress CMS installed on websites in paid hosting plans gives you direct server access and freedom to install plugins and themes of your choice.

Still, WordPress.com is good for starters, especially if you only want a simple, stripped-down website to showcase your writing portfolio or personal diary.

Anyone with basic coding skills is already familiar with GitHub, an open-source platform where developers store their coding projects. GitHub Pages is where you can take these codes from the repository, have them go through a build process, and turn them into a simple static website.

A static website is ideal for those who prefer a small website that doesn’t need to be updated regularly. It’s also perfect for students who want a test site to play around with or present for their school projects.

GitHub Pages is completely free, yet it comes with a range of outstanding features:

To build your static website, all you need to do is sign in to your account and create a new repository. You can then use the Jekyll Theme Chooser to pick from one of the pre-made themes.

If you don’t like your theme or your static website’s content, no need to worry as changes are a simple edit and push away. You can make these changes either via the web or locally on your computer.

Whether you’re a developer or a non-techy looking for easy-to-follow instructions, GitHub Pages has all the tools you need to create a free static site.

Before we proceed, you have to remember that there’s no such thing as a free lunch.

In the case of a free web host, it has limitations that don’t appeal to everyone.

Free web hosting is designed to meet the needs of a niche market like a new hobby blogger who doesn’t intend to earn from his website or a student looking for a free platform where she can test her web development projects.

With that being said, you can’t use the same criteria in selecting a paid hosting plan when zeroing on the best free web hosting to suit your needs.

Remember, you get what you pay for. And in the case of a free web host, you shouldn’t expect to receive round-the-clock support, daily or on-demand backups, and 100% uptime guarantee, among others.

However, some free options are a cut above the rest. Use the following parameters to figure out whether a free web hosting service is worth a try.

Most companies are willing to host your website for free so long as you’re also willing to use a subdomain.

For instance, Wix is a popular website builder that requires its free users to use a subdomain (e.g., neilpatel.wix.com).

A subdomain doesn’t look professional nor is it good for branding. So, unless you only want a stripped down website you can play around with, it would be better to opt for a company that can host your custom domain for free.

A custom domain is one that you own (e.g., neilpatel.com). You can purchase it from a domain registrar or from any hosting provider that also offers domain registration on the side. Domains are inexpensive, and you’ll need to renew them annually.

If branding is your top priority, make sure to find a free web host that gives you the option to stand out in a sea of other freely hosted websites.

While advanced security features don’t exist in free web hosting platforms, they should at least offer a free SSL certificate.

SSL (secure sockets layer) is a technology that encrypts the information that passes through your website. It protects your site visitor’s sensitive data like passwords and credit card data from outside intruders.

If you’re launching a basic ecommerce site on a free hosting platform, a free SSL certificate is non-negotiable. However, some free web hosting services only offer a self-signed SSL, which misleads users into thinking that it’s the same as the industry-standard SSL certificate.

A self-signed SSL is issued by servers and not by trusted authorities like Comodo, Digicert, and Let’s Encrypt. Since it’s not a standard version, websites with self-signed SSL will still show security warnings to visitors.

Hence, a self-signed SSL defeats the purpose of an SSL certificate even though it offers the same level of encryption. Especially if you’re planning to sell a product through your website, having a self-signed SSL is no better than not having an SSL certificate at all.

As a rule of thumb, never go with free web hosting unless you’ll use it for a basic website with little to no traffic.

A free web host isn’t designed to handle huge traffic volume. This is why it’s important to read the fine print of the hosting provider’s terms and conditions before signing up.

Unfortunately, a lot of free hosting providers tend to mislead clueless users by including “unlimited storage” and “unlimited bandwidth” in their list of features.

Disk space or storage space is the amount of server space allocated to your website files, while bandwidth is the amount of data allowed to transfer from the server to your visitors in a given amount of time. If your website is hosted in a free platform, your disk space and bandwidth are best described as low and never “unlimited.”

“Unlimited bandwidth” is a promotional tactic by free hosting providers based on the assumption that sites on a shared server will not use up the available resources, which is rarely the case.

Instead of being swayed by these superficial features, pay more attention specifically to file size limit and CPU limit.

A file size limit is the maximum file size your website can upload, while the CPU limit refers to how much of the server’s central processing unit (CPU) your website is allowed to use.

Free web hosting providers can temporarily shut down your site without warning, so make sure you know exactly what and how much your limitations are.

The only reason why free web hosting continues to exist is because of the business behind it. And a business requires a source of revenue.

Some of the more popular free web hosts sustain their platform through ad space. This monetization method may be effective, but it comes at the expense of your visitors.

You have no control over what appears on the advertisements or where they’re placed. Not to mention ads, in general, tend to be obtrusive and take the joy out of consuming your content.

If you want free hosting but care about your site’s aesthetics and user-friendliness, you can opt for a company that supports their free platform through other means, such as the sales of premium hosting plans.

Support for websites hosted in a free web host is limited at best. Unless you already have both the budget and need to upgrade to premium plans, there’s nothing else you can do.

When looking for the best free web host to entrust your website, choose one with an active community forum.

Check the latest posts and see how fast the response time is. The more active users the service has, the quicker you’ll get a resolution to any problem you might face in the future.

In addition to a community forum, some free web hosts also have a self-service knowledge base where users can quickly get answers to their most basic questions.

Nothing beats a paid hosting plan for all the extra support, features, and functionality. Still, if you need free web hosting or if you want to try out different web hosts before committing to an investment, there are some good free options available.

These are my top choices if you are looking to get online without spending a dime:

The best free web hosting for you depends on what you’re looking for. Use the reviews and guide to help you narrow down your choices.

If you love to cook or you love to eat but know you can do better than the restaurants and cafés in your area, you might be dreaming about opening your own restaurant. But to grow a restaurant, you are going to need business capital. In a bad economy, that means a recession business loan for a restaurant.

Like all businesses, getting started with a restaurant is probably going to mean you will need to borrow capital. Often, that will be a business loan.

The number of US financial institutions and also thrifts has been decreasing slowly for 25 years. This is from consolidation in the marketplace as well as deregulation in the 1990s, reducing obstacles to interstate banking. See: https://www.fundera.com/blog/happened-americas-small-businesses-financial-crisis-six-years-start-crisis-look-back-10-charts

Assets focused in ever‐larger banks is troublesome for small business owners. Big banks are a lot less likely to make small loans. Economic downturns suggest financial institutions come to be much more mindful with financing. The good news is, business credit does not rely on banks.

Many credit line varieties that most business owners imagine come from conventional banks and conventional banks use SBA loans as their key loan product for small business owners. This is because SBA assures as much as 90% of the loan in the case of default. These credit lines are the most challenging to get approval for because you must qualify with SBA and the bank.

There are two fundamental sorts of SBA loans you can commonly get. One kind is CAPLines. There are in fact 4 types of CAPLines that can work for your business.

You can also secure a lesser loan amount more quickly using the SBA Express program. A lot of these programs offer BOTH loans and revolving lines of credit.

From the SBA … “CAPLines is the umbrella program under which SBA helps business owners meet short-term and cyclical working capital needs”. Loan amounts are offered right up to $5 million. Loan qualification prerequisites are the same as with other SBA programs.

This one advances against anticipated inventory and accounts receivables. It was created in order to help seasonal businesses. Loan or revolving are on offer.

This one finances the direct labor and material costs of performing assignable contracts. Loan or revolving kinds are available.

This one was made for general contractors or builders constructing or renovating industrial or residential buildings. This line is for fund direct labor-and material costs, where the building project acts as the collateral. Loan or revolving types are on offer.

Borrowers must use the loan proceeds for short term working capital/operating needs. If the proceeds are used to acquire fixed assets, lender must refinance the portion of the line used to acquire the fixed asset into an appropriate term facility no later than 90 days after lender discovers the line was used to finance a fixed asset.

You can get approval for right up to $350,000. Interest rates can be different, with SBA enabling banks to charge as much as 6.5% over their base rate. Loans above $25,000 will call for collateral.

To get approval you’ll need great personal and company credit. Plus the SBA states you must not have any blemishes on your report. An acceptable bank score demands you have at least $10,000 in your account over the very last 90 days.

You’ll likewise need a resume showing you have market practical experience and a well put together business plan. You will need three years of business and personal tax returns, and your business returns should show a profit. And, you’ll need a current balance sheet and income statement, therefore showing you have the funds to pay back the loan.

To get approval you’ll need account receivables, but just if you have them. As for the collateral to offset the risk, normally all business assets will serve as collateral, and some personal assets including your home. It’s not unheard of to need collateral equivalent to 50% or more of the loan amount. You also need articles of incorporation, business licenses, and contracts with all third parties, and your lease.

Let’s look at credit lines.

A credit line, or line of credit (LOC), is an agreement between a borrower and a bank or private investor that establishes a maximum loan balance that a borrower can access.

A borrower can access funds from their line of credit anytime, so long as they don’t go beyond the maximum set in the arrangement, and as long as they meet all other requirements of the bank or investor including making on time payments.

Credit lines deliver many unique benefits to borrowers including flexibility. Borrowers can use their line of credit and merely pay interest on what they use, in contrast to loans where they pay interest on the sum total borrowed. Credit lines can be reused, so as you acquire a balance and pay that balance off, you can use that accessible credit again, and again.

Learn business loan secrets with our free, sure-fire guide. We can help you get money, even during a recession.

Credit lines are revolving accounts similar to credit cards, and compare to various other types of funding including installment loans. Oftentimes, lines of credit are unsecured, much the same as credit cards are. There are some credit lines which are secured, and for this reason easier to qualify for

Credit lines are the most commonly requested loan type in the business world although they are preferred, authentic credit lines are rare, and tricky to find. Many are also very hard to get approval for calling for good credit, good time in business, and good financials. But there are other credit cards and lines that few people know about that are attainable for startups, bad credit, and even if you have no financials.

Private investors and alternative lenders also offer credit lines. These are less complicated to qualify for than conventional SBA loans. They also demand much less documentation for approval. These alternative SBA credit lines frequently need good personal credit for approval.

Unlike with SBA, many of them don’t call for good bank or business credit approval. Most of these kinds of programs call for two years’ of tax returns. Tax returns need to demonstrate a profit. Rates can vary from 7% or greater and loan amounts range from $25,000 into the millions. Loan amounts are frequently based on the revenues and/or profits on tax returns. At times lenders may ask for other financials such as a profit and loss statement, balance sheets, and income statements.

Learn business loan secrets with our free, sure-fire guide. We can help you get money, even during a recession.

Merchant cash advances have quickly become the most popular way to get financing, in large part due to the effortless qualification process. Businesses with $10,000 in earnings can get approval, with the business owner having scores as low as 500.

Some sources have now even begun to offer credit lines that accompany their loans. You must have at least $10,000 in revenue for approval. You should be in business for at least one year, however three years is better. Lenders usually want to see a credit score of 650 or better for approval.

Loan amounts are usually around $20,000. Lenders normally will pull your business credit, so you ought to have some credit already and at times lenders will want to see tax returns.

Rates vary, due to the risk for this program, and there typically aren’t a lot of funding sources who offer it.

You can get financing despite personal credit if you have some sort of stocks or bonds. You can also get approval if you have somebody wishing to use their stocks or bonds as collateral for financing.

Personal credit quality doesn’t matter as there are no consumer credit requirements for approval. You can get approval for as much as 90% of the value of your stocks or bonds. Rates are often lower than 2%, making this one of the lowest rate credit lines you’ll ever see. You can still earn interest as you generally do on your stocks and bonds.

Credit cards ordinarily offer 0% intro rates for up to two years. This is also rather useful for startups in particular. And credit lines let you take out more cash at a more affordable rate than do cards. These are the main two differences which will have an effect on you between credit cards and credit line.

Investopedia even says that “lines of credit are potentially useful hybrids of credit cards.”

Both cards and lines are revolving credit. Credit lines are tougher to get approval for as card approvals are often very quick, many times automated, while line require an in-depth underwriting review. Lines usually offer lower rates, according to Bankrate card rates average 13% while lines average 4%.

The majority of these cards report to the consumer credit reporting agencies. They all require a personal guarantee from you. You can get approval in general for one card at the most as they discontinue approving you when you have two or more inquiries on your report.

The majority of these cards report to the consumer credit reporting agencies. They all require a personal guarantee from you. You can get approval in general for one card at the most as they discontinue approving you when you have two or more inquiries on your report.

Most credit card companies feature business credit cards including Capital One, Chase, and American Express. These have rates similar to consumer rates and limits are also similar.

Some of them report to the consumer reporting agencies, some report to the business bureaus. Approval requirements resemble consumer credit card accounts.

Frequently, when you apply for a credit card you put an inquiry on your consumer report. When other lenders see these, they won’t approve you for more credit for the reason that they do not know how much other new credit you have lately obtained.

So they’ll only approve you if you have less than two inquiries on your report within the most recent six months. Any more will get you refused.

With this form of business financing, you work with a lender who concentrates on securing business credit cards. This is a very rare, very few know about program which few lending sources offer. They can typically get you three to five times the approvals that you can get on your own.

This is because they are familiar with the sources to apply for, the order to apply, and can time their applications so the card issuers won’t reject you for the other card inquiries. Individual approvals frequently range from $2,000 – 50,000.

The end result of their services is that you generally get up to five cards that resemble the credit limits of your maximum limit accounts now. Multiple cards create competition, and this means they will raise your limits, often within 6 months or fewer of first approval.

Approvals can go up to $150,000 per entity such as a corporation. With our hybrid credit line you get three to five business credit cards that report only to the business credit reporting agencies. This is huge, something the majority of lenders don’t offer or advertise. Not only will you get cash, but you build your business credit also so within three to four months, you can then use your new company credit to get even more money.

The lender can also get you low introductory rates, typically 0% for 6-18 months. You’ll then pay normal rates after that, typically 5-21% APR with 20-25% APR for cash advances. And they’ll also get you the very best cards for points. So this means you get the very best rewards.

Like with just about anything, there are significant benefits in teaming up with a source who focuses on this area. The results will be far better than if you attempt to go at it by yourself.

Learn business loan secrets with our free, sure-fire guide. We can help you get money, even during a recession.

You must have excellent personal credit now, ideally 685 or higher scores, the same as with all business credit cards. You shouldn’t have any negative credit on your report to get approval. And you must also have open revolving credit on your consumer reports now and you’ll need to have five inquiries or less in the last six months reported.

All lenders in this space charge a 9-15% success based fee and you only pay the charge off of what you secure. Remember, you get a lot of extra advantages and about three to five times more cash in this program than you could get on your own, which is why there’s a fee, the same as all other lending programs.

You can get approval using a guarantor and you can even use various guarantors to get even more money. There are even other cards you can get making use of this very same program but these cards only report to the consumer reporting agencies, not the business reporting agencies. They are consumer credit cards versus business credit cards.

They offer similar benefits such as 0% intro annual percentage rates and five times the amount of approval of a solitary card but they are much easier to get approval for.

You can get approval with a 650 score and seven inquiries (or fewer) in the last six months and you can have a bankruptcy on your credit and other negative items. These are a lot easier to get approval for than unsecured business credit cards.

With all preceding cards above, you ought to have good consumer credit in order to get approval but what happens if your personal credit is not good, and you don’t have a guarantor?

This is when building company makes a great deal of sense even if you have good personal credit, developing your business credit helps you get even more money, and without having a personal guarantee.

Company credit is credit in a company name, in connection with the company’s EIN number, and not the owner’s Social Security Number. When accomplished correctly, you can acquire business credit without a personal credit check and without a personal guarantee. This is something all other cards above can’t deliver.

You can get three types of business credit cards. First is vendor credit, which offers net 30 terms to set up a business credit profile. Then is retail credit, where you will get credit cards with high limits at most stores.

Next is fleet credit. It’s credit to fuel, service, and maintain business vehicles. And then there’s cash credit, which includes Visa, MasterCard, and American Express cards that you can use anywhere. You can obtain these with no credit check or guarantee. Limits are oftentimes $5,000 – $10,000 to get started, and can exceed $50,000.

Your business can get credit cards and financing, if you know where to look. Learn more here and get started toward establishing business credit. Get a recession business loan for a restaurant. And grow a business you can be proud of!

The post Get a Recession Business Loan for a Restaurant appeared first on Credit Suite.

Delays will play havoc with federal Electoral College deadlines. Entire states could be disenfranchised. The post Mail-In Voting Could Deliver Chaos appeared first on ROI Credit Builders.

The post Mail-In Voting Could Deliver Chaos first appeared on Online Web Store Site.

The post Mail-In Voting Could Deliver Chaos appeared first on ROI Credit Builders.

Upsolve (YC and Eric Schmidt-backed) | Full-Stack Software Engineer | NYC (Remote for now) | upsolve.org

Upsolve is a nonprofit that helps low-income families in financial distress access their legal rights and re-enter the economy. We currently provide a web app that helps low-income families file bankruptcy for free. We’ve relieved $200M+ in debt. We’re looking for someone with 2+ years of production experience with React and Node. Our comp is on par with for-profit startups. Come help millions of Americans facing financial hardship due to COVID-19. Email rohanATupsolve.org!

There’s a lot going on right now. So let’s look at the CARES Act Fiscal Stimulus Plan. The details are still in flux. Some may change. This information is current as of right now.

Here’s an Overview of CARES. CARES stands for Coronavirus Aid, Relief, and Economic Security Act. This bill addresses economic impacts of, and otherwise responds to, the COVID-19 (coronavirus) outbreak. The bill authorizes emergency loans to distressed businesses, including air carriers and suspends certain aviation excise taxes.

With respect to small businesses, the bill establishes, and provides funding for, forgivable bridge loans; and provides additional funding for grants and technical assistance.

The bill also provides funding for $1,200 tax rebates to individuals, with additional $500 payments per qualifying child. The rebate begins phasing out when incomes exceed $75,000 (or $150,000 for joint filers). The bill establishes limits on requirements for employers to provide paid leave.

With respect to taxes, the bill establishes special rules for certain tax-favored withdrawals from retirement plans; delays due dates for employer payroll taxes and estimated tax payments for corporations; and revises other provisions, including those related to losses, charitable deductions, and business interest.

The bill also authorizes the Department of the Treasury to temporarily guarantee money-market funds.

See: congress.gov/bill/116th-congress/senate-bill/3548.

Lenders with delegated authority from SBA. This lets lenders determine eligibility and creditworthiness. They can do so without going through SBA channels.

The lender must consider if the borrower was in operation on February 15, 2020; and had employees for whom the borrower paid salaries and payroll taxes OR paid independent contractors, as reported on a Form 1099-MISC. The application period is February 15, 2020 to June 30, 2020.

So any small business, non-profit, veterans’ organization, sole proprietorship or independent contractor, eligible self-employed individuals, or tribal small business concern is eligible for a loan if they employ no more than the greater of 500 employees; or if applicable, the SBA size standard for employees in the industry where the borrower operates (NAICS code).

Employees include anyone employed on full-time, part-time or other basis. For businesses with more than 1 physical location (like food services), the 500 employees can be measured per physical location.

The maximum loan amount under the Paycheck Protection Program is the lesser of 2.5 times the average total monthly payments by applicant for payroll costs incurred during one year before the date of the making of the loan. And add in outstanding amounts of any Emergency Injury Disaster Loan (EIDL) gotten on or after January 31, 2020 to be refinanced under this loan. Or $10,000,000. There are special rules for seasonal employers and businesses not in existence from 2/15/2019 to 6/30/2019.

Payroll costs include the sum of payments of any compensation for employees for salary, wage, commission, or similar compensation. They also include payment of cash tip or equivalent, and payment for vacation, parental, family, medical or sick leave. And they include allowance for dismissal or separation, and payment for the provision of group health care benefits, including insurance premiums. Plus they include payment of any retirement benefits, or payment of state or local tax assessed on the compensation of employees.

The sum of such payments cannot be more than $100,000 in 1 year, as prorated for February 15, 2020 to June 30, 2020.

Payroll costs do not include compensation of an individual employee’s in excess of an annual salary of $100,000 prorated from February 15, 2020 to June 30, 2020. And they do not include taxes imposed or withheld under FICA (Social Security and Medicare), Railroad Retirement Act, and IRC Chapter 24 (income tax at source).

Also, they don’t include any compensation of an employee whose principal place of residence is outside the US; and qualified sick leave or family leave wages where a credit is allowed under the Families First Coronavirus Response Act.

Want to review your options with one of our consultants? Give us a call at 877-600-2487.

Loans can be used for payroll costs and costs related to the continuation of group health care benefits during periods of paid sick, medical, or family leave, and insurance premiums. They can also be used for employee salaries, commission, or similar compensations.

You can use a loan for payments of interest on any mortgage obligation (excludes prepayment) or rent (including rent under a lease agreement). And you can use it on utilities and interest on any other debt obligation that was incurred before the period.

So here are the Good Faith Certification Requirements.

An eligible recipient applying for a covered loan must make a good faith certification that: the uncertainty of current economic conditions makes necessary the loan request to support ongoing operations. They acknowledge that funds will be used to retain workers and maintain payroll or make mortgage payments, lease payments, and utility payments

And they certify that the eligible recipient does not have an application pending for a loan under this subsection for the same purpose and duplicative of amounts applied for or received under a covered loan.

Plus they certify that, from February 15, 2020 to December 31, 2020, the eligible recipient has not received duplicate amounts for the same purpose received under a covered loan.

So here are the details on requirements and fees.

The SBA has no recourse against any individual shareholder, member, or partner of an eligible recipient of a covered loan for nonpayment of any covered loan unless it is used for a purpose not authorized.

From February 15, 2020 to June 30, 2020, no personal guarantee is required for the covered loan. And no collateral is required for the cover loan. Also, from February 15, 2020 to June 30, 2020, the SBA will not collect a fee.

So here are the Deferral of Payment details.

From February 15, 2020 to June 30, 2020, there is complete payment deferment relief for impacted borrowers with a loan with terms of 6 months to 1 year. This includes payment of principal, interest, and fees. An impacted borrower is one in operation on February 15, 2020 with an application for covered loan that is approved or pending after the enactment date.

So here is what is covered for the sum paid for eight weeks from the loan origination date.

Coverage includes payroll costs, and any payment of interest on any covered obligation. It also includes any indebtedness or debt instrument incurred in the ordinary course of business as a mortgage on real or personal property incurred before 2/15/2020.

And it includes any payment of rent made under a leasing agreement in force before 2/15/2020. Plus it includes any utility payment for electricity, gas, water, transportation, phone or internet access where service began before 2/15/2020.

Want to review your options with one of our consultants? Give us a call at 877-600-2487.

So here are the documents a borrower must provide. Provide verification of the number of full time equivalent employees on payroll and pay rates including payroll tax filings reported to the IRS and state income, payroll, and unemployment insurance filings.

Add cancelled checks, payment receipts, transcripts of accounts, and any other documents verifying payments on covered mortgages, leases, and utility payments.

And add certification from an authorized representative of the eligible recipient that the documentation presented is true and correct. Plus a certification that the amount for which forgiveness is requested was used to retain employees, make interest payments on a covered mortgage or rent obligation, or to make covered utility payments. Provide any other documentation the SBA determines is necessary. No eligible recipient shall receive forgiveness without submitting the documentation required.

So here are the loan forgiveness details. The lender will decide on the application no later than 60 days from receiving the application. Any amount which would be includible in gross income of the eligible recipient by reason of forgiveness is excluded from gross income.

There can be a reduction of loan forgiveness. A reduction can happen if there is a reduction in full time equivalent employees. So this is when comparing to the average number of FTEs per month employed by the recipient from February 15, 2019 to June 30, 2019 or January 1, 2020 to February 29, 2020.

Reductions also happen for over 25% in certain reductions in total salary or wages of any employees. These are employees who in 2019 did not receive a wage or salary at an annualized rate more than $100,000. There are special rules for tipped workers and rehires during a certain time period.

SBA’s Economic Injury Disaster Loans (or working capital loans) are available to small businesses; small agricultural cooperatives; small aquaculture businesses and most private non-profit organizations.

Available businesses include businesses directly affected by the disaster. And they include businesses that offer services directly related to the businesses in the declaration. They also include other businesses indirectly related to the industry that are likely to be harmed by losses in their community.

So here are the criteria for loan approval. Applicants must have a credit history acceptable to SBA. The SBA must determine that the applicant business can repay the SBA loan. And an applicant business must be physically located in a declared county. And it must be suffering working capital losses due to the declared disaster. So this cannot be due to a downturn in the economy or other reasons.

So check out how much you can borrow. Eligible entities may qualify for loans up to $2 million. The interest rates for this disaster are 3.75% for small businesses and 2.75% for nonprofit organizations. So terms go up to 30 years. Eligibility is based on business size, type of business and its financial resources.

The SBA defines what a small business is, at sba.gov/document/support–table-size-standards.

A business can pay fixed debts, payroll, accounts payable, and other bills that could have been paid had the disaster not occurred. But there is no intent for the loans to replace lost sales or profits or for expansion.

Want to review your options with one of our consultants? Give us a call at 877-600-2487.

So check out the Collateral requirements. Economic Injury Disaster Loans over $25,000 will need collateral. SBA takes real estate (commercial and residential) as collateral when available. The SBA will not decline a loan for lack of collateral. But they require borrowers to pledge what is available.

These are the ineligible entities under the act.

Agricultural Enterprises: if the primary activity of the business (including affiliates) is as defined in Section 18(b)(1) of the Small Business Act. Also ineligible are religious and charitable organizations. Plus gambling concerns if they derive more than one-third of their annual gross revenue from legal gambling activities. And casinos and racetracks, because these are businesses whose sole purpose for being is gambling. Plus real estate developers mainly subdividing real property into lots and developing it for resale on their own account.

So here are the details on the SBA’s Economic Injury Disaster Loan (EIDLs) Funds. Funds come straight from the United States Treasury. Applicants do not go through a bank to apply. They apply directly to the SBA’s Disaster Assistance Program. So you can visit disasterloan.sba.gov/ela.

There is no cost to apply. And there is no obligation to take the loan if offered. The maximum unsecured loan amount is $25,000. Applicants can have an existing SBA Disaster Loan and still qualify for an EIDL for this disaster. But you cannot consolidate the loans.

You can apply online. Applicants may apply online using the Electronic Loan Application (ELA). Visit disasterloan.sba.gov/ela. you can download paper loan applications at sba.gov/disaster.

Mail completed applications to:

US Small Business Administration

Processing and Disbursement Center

14925 Kingsport Road

Fort Worth, TX 76155

To get disaster loan information and application forms, call the SBA’s Customer Service Center at 800-659-2955 (800-877-8339 TTY). Or email disastercustomerservice@sba.gov.

Get assistance from SBA partners. So you can get free help with reconstructing financial records, preparing financial statements, and submitting the loan application as follows. Small Business Development Centers (SBDCs); SCORE; and Women’s Business Centers (WBC). For the nearest office: visit sba.gov/local-assistance.

Keep in mind, the CARES Act is still a bit in flux. But the details are probably not going to change much. The gist of it is to help small businesses during 2020. Most of the deadlines are in June, so apply NOW. Contact us today to learn more about the CARES Act and COVID-19: what you need to know.

The post The CARES Act and COVID-19: What You Need to Know NOW appeared first on Credit Suite.

FOREIGN EXCHANGE MARKET HOURS

At 7:00 pm Sunday, New York time, trading starts as markets open in Tokyo, Japan. By 4:00 am, the European markets are in complete swing, and also Asia has actually ended their trading day.

Perpetuity are priced quote in Eastern Standard Time (New York).

FX or Forex, money trading is the trading of one money versus one more. In terms of trading quantity, the money exchange market is the globe’s biggest market, with day-to-day trading quantities in extra of $1.5 trillion United States bucks.

Money are traded for hedging and also speculative functions. Numerous market individuals such as establishments, people, as well as companies trade foreign exchange for one or both factors.

Business treasurers, personal people and also financiers have money direct exposures throughout the normal program of company. The FXTrade Platform is a perfect system to hedge any kind of such direct exposure. A capitalist, that has actually purchased a European supply as well as anticipates the EUR currency exchange rate to decrease, can hedge his money direct exposure by offering the EUR versus the USD.

Money markets are preferably matched for speculative trading. Unlike equity trading, where limitations restrict an investor’s capability to make money from a market down turn, there are no such restrictions on money trading. Money investors can take benefit of both up as well as down patterns therefore boosting their earnings capacity.

One of the most generally traded money are: USD, EUR, JPY, GBP, CHF, CAD and also AUD.

One of the most frequently traded money set is EUR/USD.

Foreign Exchange Symbol Guide

Icon Currency Pair Trading Terminology

GBP/USD British Pound/ United States Dollar “Cable”.

EUR/USD Euro/ United States Dollar “Euro”.

USD/JPY United States Dollar/ Japanese Yen “Dollar Yen”.

USD/CHF United States Dollar/ Swiss Franc “Dollar Swiss”, or “Swissy”.

USD/CAD United States Dollar/ Canadian Dollar “Dollar Canada”.

AUD/USD Australian Dollar/ United States Dollar “Aussie Dollar”.

EUR/GBP Euro/ British Pound “Euro Sterling”.

EUR/JPY Euro/ Japanese Yen “Euro Yen”.

EUR/CHF Euro/ Swiss Franc “Euro Swiss”.

GBP/CHF British Pound/ Swiss Franc “Sterling Swiss”.

GBP/JPY British Pound/ Japanese Yen “Sterling Yen”.

CHF/JPY Swiss Franc/ Japanese Yen “Swiss Yen”.

NZD/USD New Zealand Dollar/ United States Dollar “New Zealand Dollar” or “Kiwi”.

USD/ZAR United States Dollar/ South African Rand “Dollar Zar” or “South African Rand”.

GLD/USD Spot Gold “Gold”.

SLV/USD Spot Silver “Silver”.

MONEY PAIRS.

All money are designated an International Standards Organization (ISO) code acronym. In money trading, these codes are usually utilized to share which particular money comprise a money set. USD/JPY refers to 2 money: the United States Dollar as well as the Japanese Yen.

AREA FOREX.

Area international exchange is constantly traded as one money in relationship to one more. That is, get and also market euros United States bucks.

What does it imply to be “lengthy” or “brief” a money?

Being long suggests getting a money. Being brief ways marketing a money.

He or she acquires United States Dollars and also offers Japanese Yen if an investor goes long USD/JPY. Acquiring a money is associated with taking a lengthy setting because money. If he or she thinks it will certainly value in worth, an investor takes a lengthy setting in a money.

He or she markets United States Dollars and also purchases Japanese Yen if an investor goes brief USD/JPY. Marketing a money is associated with shorting that money. If he or she thinks it will certainly diminish in worth, an investor would certainly short a money.

MONEY TRADING: BUYING AND SELLING CURRENCIES.

All Forex professions lead to the purchasing of one money as well as the marketing of one more (money trading), all at once.

Acquiring (” going long”) the money set suggests acquiring the initial, base money and also offering a comparable quantity of the 2nd, quote money (to spend for the base money). It is not essential to have the quote money before marketing, as it is marketed short. An investor acquires a money set if he/she thinks the base money will certainly rise about the quote money, or equivalently that the equivalent currency exchange rate will certainly increase.

Marketing (” going short”) the money set suggests marketing the very first, base money, and also getting the 2nd, quote money. An investor markets a money set if he/she thinks the base money will certainly decrease about the quote money, or equivalently, that the quote money will certainly rise about the base money.

An open profession or setting is one in which an investor has either marketed or got one money set as well as has actually not offered or redeemed an ample quantity of that money set to properly shut the profession. When an investor has an open profession or setting, he/she stands to shed or benefit from changes in the cost of that money set.

Foreign exchange is the foundation of all worldwide resources deals. Contrasted to the slim revenue margins made in various other locations of business financial, significant revenues are usually generated in an issue of mins develop small money market activities. Some financial institutions produce 60% of their benefit from trading money boldy.

Trading quantity has actually been expanding at a price of 25% annually considering that the mid-1980s as well as a result it is simple to approve the concept that the money market is just one of the globe fastest expanding markets. What accustomed to call for days to complete in Europe or Asia currently oly takes a couple of mins. It goes without saying, modern technology has actually altered whatever and also numerous Dollars are relocated from one money right into an additional every secondly of on a daily basis by significant financial institutions with computer systems as well as for the ordinary financier, with the touch of a computer system trick.

Forex is the foundation of all worldwide funding deals. Contrasted to the slim revenue margins provided in various other locations of industrial financial, significant earnings are normally created in an issue of mins from small money alternatives market activities. Some financial institutions create approximately 60% of their make money from trading money boldy.

When one nation’s money is acquired (traded) with an additional nation’s money, deals in international money take location. The rate set or worked out for the money acquired is described as the international exchange price. Significant industrial financial institutions in the cash market focuses throughout the globe are accountable for most of international money offered as well as got.

Trading quantity has actually been expanding at a price of 25% annually because the mid-1980s and also for that reason it is simple to approve the idea that the money choices is the globe ‘s fastest expanding sector. What accustomed to need days to achieve in Europe or Asia currently just takes a couple of mins. It goes without saying, innovation has actually altered every little thing and also countless Dollars are relocated from one money right into one more every secondly of everyday by significant financial institutions via computer systems as well as for the typical capitalist, with the touch of a phone.

FOREIGN EXCHANGE BASICS – What’s a PIP.

A “pip” is the tiniest increment in any type of money set. In EUR/USD, an activity from.8951 to.8952 is one pip, so a pip is.0001. In USD/JPY, an activity from 130.45 to 130.46 is one pip, so a pip is.01.

COMPUTING THE WORTH OF A PIP.

Exactly how much is one pip worth per 10,000 Dollars in USD/JPY? We will certainly refer to the dimension, in this instance 10,000 devices of the base money, as the “Notional Amount”.

( one pip, with correct decimal positioning/ money exchange price) x (Notional Amount).

Utilizing USD/JPY as an instance, this returns:.

(.01/ 130.46) x USD 10,000 = $0.77 or 77 cents per pip.

Utilizing EUR/USD as an instance, we have:.

(.0001/.8942) x EUR 10,000 = EUR 1.1183.

We desire the pip worth in USD, so we after that have to increase EUR 1.1183 x (EUR/USD exchange price): EUR 1.1183 x. 8942 = $1.00.

This remains in reality a sensation you will certainly see with any kind of money in which the money is priced estimate initially (such as EUR/USD or GBP/USD): the pip worth is constantly $1.00 per 10,000 money devices. This is why pip (or “tick”) worths in money futures, where the money is priced estimate initially, are constantly taken care of.

Approximate pip worths for the significant money are as complies with, per 10,000 systems of the base money:.

USD/JPY: 1 pip = $.77 (i.e. an adjustment from 130.45 to 130.46 deserves concerning $.77 per $10,000).

EUR/USD: 1 pip = $1.00 (.8941 to.8942 deserves $1.00 per 10,000 Euros).

GBP/USD: 1 pip = $1.00 (1.4765 to 1.4766 deserves $1.00 per 10,000 Pounds).

USD/CHF: 1 pip = $.59 (1.6855 to 1.6866 deserves $.59 per $10,000).

Spread.

The spread is the distinction in between the cost that you can market money at (Bid) and also the cost you can get money at (Ask). The spread on majors is generally 3 pips under typical market problems.

Market Hours.

The area Forex market is one-of-a-kind to any kind of various other market on the planet; trading 24-hours a day. Someplace worldwide an economic facility is open for company as well as financial institutions as well as various other establishments exchange money every hr of the night and day, just pausing on the weekend break. Fx markets comply with the sunlight worldwide, offering investors the versatility of establishing their trading day as well as the capacity to make the most of worldwide financial occasions.

FOREIGN EXCHANGE or The Foreign exchange price market is a global market where different money exchange purchases take area; this is in the form of at the same time purchasing one money as well as offering an additional. These 7 money are the United States Currency (Dollar, USD), Japanese Yen (JPY), Euro (EUR), British Pound (GBP), Swiss Franc (CHF), Canadian Dollar (CAD) as well as Australian Dollar (AUD).

Foreign exchange trading in most basic terms is the acquiring of one money as well as the marketing of one more. It is a 24-hour market allowing it to suit consistent transforming globe money exchange prices.

Unlike trading on the supply market, the foreign exchange market is not performed by a main exchange, yet on the “interbank” market, which is believed of as an OTC (over the counter) market. This globally circulation of trading centres suggests that the foreign exchange market is a 24-hour market.

In money trading, these codes are commonly utilized to share which certain money make up a money set. Getting a money is identified with taking a lengthy setting in that money. Acquiring (” going long”) the money set suggests acquiring the initial, base money and also offering a comparable quantity of the 2nd, quote money (to pay for the base money). An investor gets a money set if he/she thinks the base money will certainly go up loved one to the quote money, or equivalently that the matching exchange price will certainly go up.

Deals in international money take location when one nation’s money is bought (traded) with one more nation’s money.

The post Foreign Exchange Currency Trading Explained appeared first on ROI Credit Builders.

Rich Affiliate Will Change Your Life

Affluent Affiliate Will Change Your Life

Affluent Affiliate is by far one of the most full

If they desire find out to make, training course for the beginner to go

cash in associate advertising. With regularly

upgraded material and also lots of devices around to aid the

amateur, Wealthy Affiliate actually informs a novice to

ended up being experienced in associate advertising and marketing. Well-off Affiliate

is top-notch in whatever you need to come to be

efficient. I’m a participant of Wealthy Affiliate and also I have

found it to be the keystone of my success in

associate advertising and marketing. There are not a great deal of video clip and also

audio tutorials, and also for me, a selection of the 3 is

much better. Either technique, I needed to just self-control myself

as well as make the moment to go through whatever.

The very best component of the internet site is the 8 week activity

strategy and also the online forum. The activity strategy strolls you via

with each phases of internet marketing detailed with

effective straightforward relaxed to review words none of that

intricate internet marketing language. Whatever concerns

that could show up throughout the 8 week activity strategy

can be asked in the online forum or get in touch with the proprietors Carson

as well as Kyle for face to face mentoring. They’ll directly

address your concerns.

The Wealthy Affiliate subscription features a great deal of

additionals. And also when I state a great deal, I imply – a lot. Simply

to offer you a fine example of what you can anticipate – complimentary

drag as well as decline site building contractor, complimentary website organizing to host

your web site, discussion forum to ask whatever queries you

have.You have the ability to earn money your initial day you come to be

a participant from task uploading demands by participants.

Affluent Affiliate isn’t amongst those obtain abundant system

either. They’re even more of training program after that a straightforward

internet site, WA provides you the totally appropriate devices,

tutorials as well as guidance to aid you with the abilities to

generate income online however it will not gain for you. As soon as you obtain

a Wealthy Affiliate subscription you along with obtain

exclusive training from Kyle as well as Carson both young

millionaires as well as makers of Wealthy Affiliate.

At the time of signing up with, I had not been specific that I would certainly

discover one to one assistance. I though that with the thousands

of participant in the area, exactly how might I have one to one

assistance. When I send out off a Private Message( PM) to

Carson, I in fact obtained the reply inside 24 hrs. I was

waiting for at the least 2-3 days to obtain a reaction. For

3 days constantly I send PM to Carson and also I.

got the remedy each of them. Participants at.

Well-off Affiliate really obtain one to one assistance from.

Kyle as well as Carson.

I’ve belonged to Wealthy Affiliate considering that Oct. 07.

As well as, I’m beginning to generate income online with the complimentary as well as.

inexpensive advertising and marketing techniques that they show. I do not make use of.

Google to market my programs although I could. I.

will certainly some day with the lessons I will certainly have finished as a.

participant of WA. For day-after-day the advantages of being a.

Wealthy Affiliate out consider the cash I’ve thrown away with.

the remainder of the rubbish that’s being pitched available.

As well as when I claim a great deal, I suggest – a fantastic offer. Simply

Google to market my programs also though I could. I.

will some will certainly with the lessons I will have will certainly as finished

member of WA. For day-after-day the advantages of being a.

Wealthy Affiliate well-off associate the evaluate I’ve wasted have actuallyThrown away

The post Well-off Affiliate Will Change Your Life appeared first on ROI Credit Builders.

The social web is huge. From Facebook to Pinterest, they all command billions of eyeballs per year.

Which, of course, makes these channels too big to ignore. In other words, you have no choice but to participate in them or else you’ll miss out on traffic and revenue.

But, how much time and money should you devote to each social network?

Which ones produce the best ROI?

How much are 100 social media followers really worth?

To answer these questions and more, I polled 483 companies who are all leveraging Facebook, YouTube, Instagram, Twitter, LinkedIn, and Pinterest.

Each company has been participating in all these social networks for at least 3 years and they have at least 100 social media followers on each platform.

Of the 483 companies, 159 of them were in the B2B space and 324 were B2C companies. And their revenues varied from $10,000 a year to $250,000,000.

Now before we dive into the data, keep in mind all of the stats are broken down based on 100 social followers.

For example, if we looked at traffic, we looked at how many visitors they generate per 100 followers.

And for the purpose of this blog post, we will focus only on organic social media traffic.

So, let’s dive into what we learned:

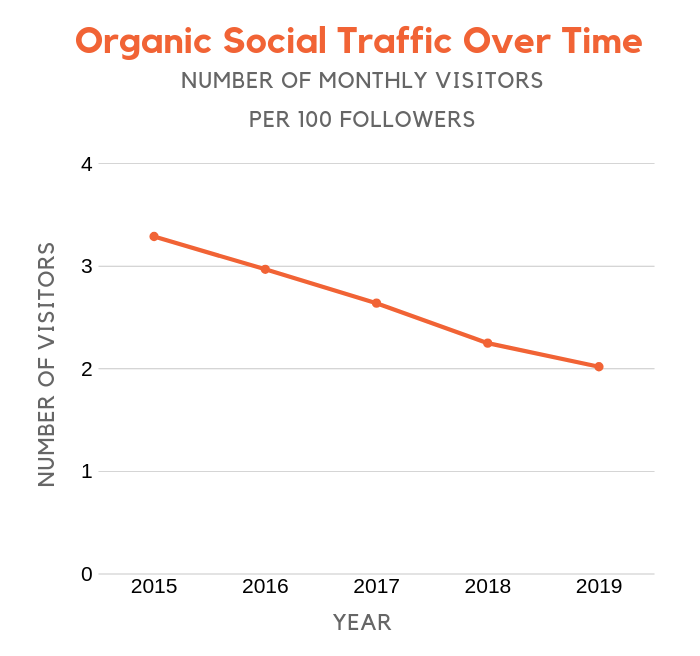

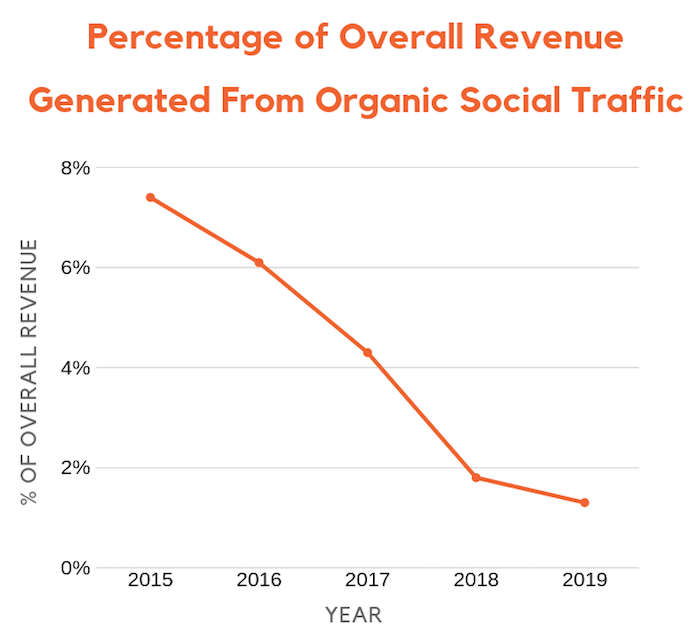

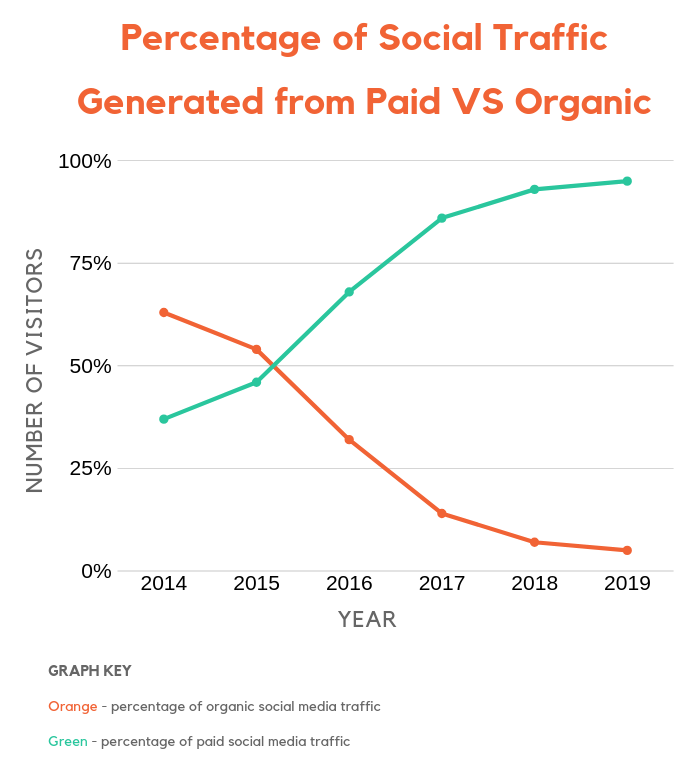

Compared to when each social network originally came out, it’s become much harder to generate organic traffic from each of them.

You can still generate organic visits, but of course, reach has died down. But how much has it died down?

As you can see, it has drastically decreased.

In 2015, you could generate a bit more than 3 visitors a month from the social web for every 100 followers you had, and now it’s dropped down to roughly 2 visitors per month.

I know that data isn’t shocking, but think of it this way, that’s a 38.6% drop in organic social media traffic. And based on the chart, there are no signs of recovery.

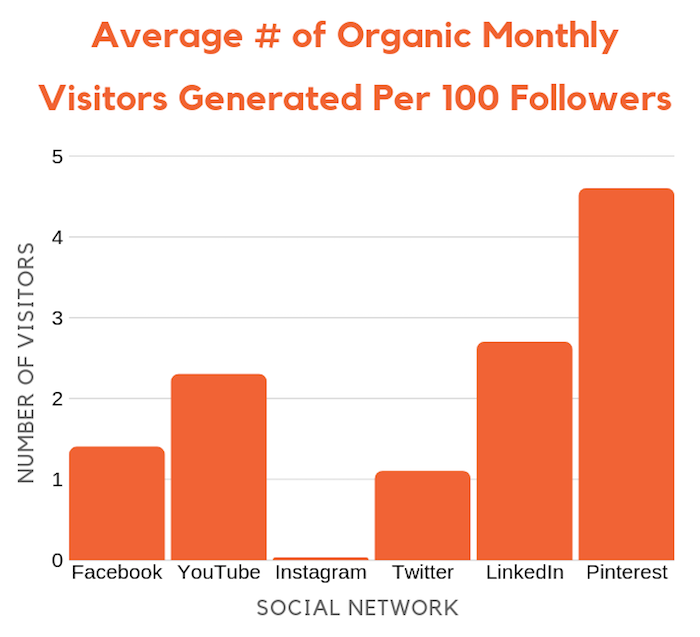

Sure, organic social media traffic might be dying as each network wants you to advertise, but which networks drive the most traffic per 100 followers?

If you had to take a guess, which one do you think it would be?

It’s definitely not a social network owned by Facebook. Both Facebook and Instagram drive the least amount of visitors per 100 followers.

Instagram isn’t much of a shocker, though, as you can only drive traffic through bio links and asking people to swipe up in stories.

But what was surprising is the amount of traffic Pinterest drives. Pinterest was the best performer, followed by LinkedIn and then YouTube.

Here’s the thing to note about YouTube… although it drives a decent amount of visitors per 100 subscribers, most people using YouTube don’t experience much (if any) traffic because they don’t link out to their site within their videos.

You can use YouTube annotations to do this.

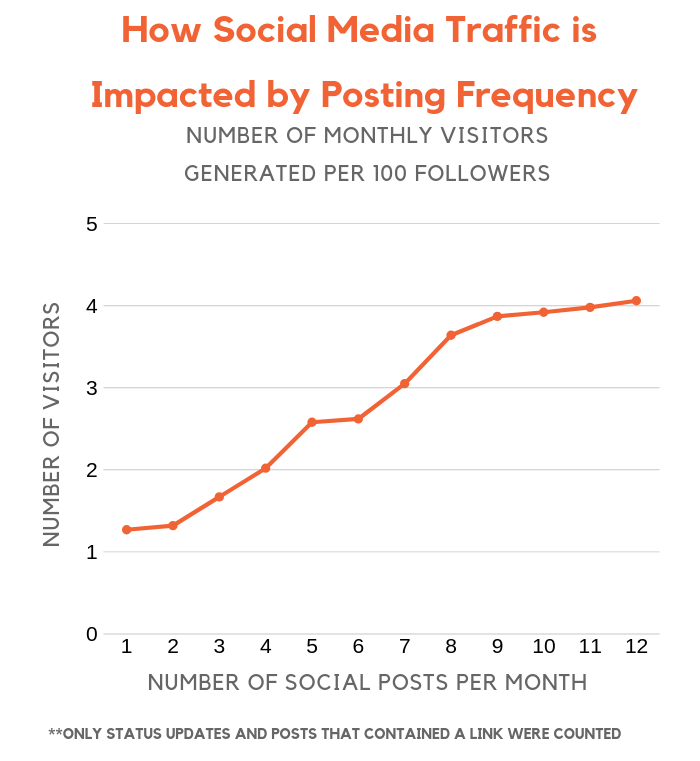

The first chart shows that organic social traffic is slowly dying down, but how about if you increase your posting frequency?

That should increase your organic social media traffic, right?

In general, posting more often does lead to more traffic. But after 8 monthly posts on each social network, the data shows you’ll see diminishing returns.

Why you may ask?

The way most social media algorithms work is that the more people engage with your content, the more of them will see your content as you post it.

So, your goal should be to only post content people love and want to engage with. The moment you start posting mediocre content, it hurts your overall traffic numbers because that means fewer people in the future will see your new content no matter how amazing it is.

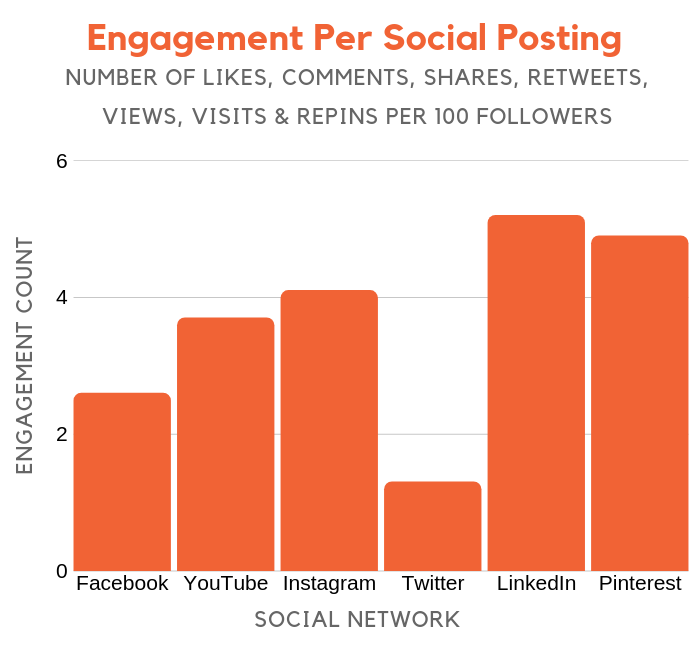

Speaking of engagement, which social networks tend to have the most engaged users?

I was shocked by the engagement stats because I assumed that Pinterest would have won in this battle as they are driving the most traffic per 100 followers to websites.

But I was wrong.

Pinterest did perform really well, but LinkedIn won.

Instagram also did extremely well, which I wasn’t shocked by as most of the people I know who use it do so as a “personal” social network instead of leveraging it for work.

That’s why the engagement is so high on Instagram.

One thing to note is that posts not containing a link, such as images or videos, tend to get the most engagement.

This is also because social sites tend to promote content that keeps people on their social sites as opposed to driving their visitors off to your site.

If you aren’t producing videos, you should definitely consider starting. Even though videos don’t rank well on Google, they are the future.

It’s why I create more video content each week than text-based content.

With video, there are 2 main types of videos… one that you just upload and ones that are live.

Let’s see how the different video types stack up against each other.

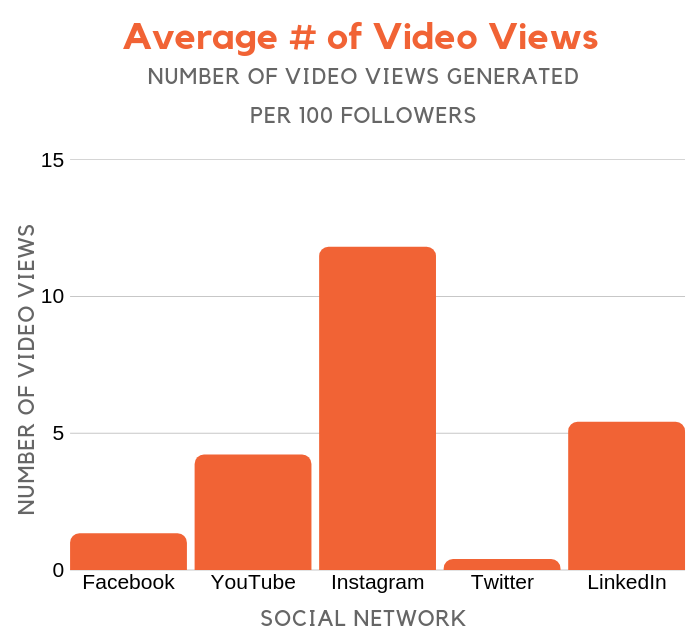

When you look at the chart above, it’s easy to say that Instagram produces the best results for videos. Then come LinkedIn and YouTube.

But there is something that you have to keep in mind… Instagram auto-plays videos while YouTube is much pickier about what they count as a “video view.”

None-the-less, if you’re going to create video content, you should post it on all of the social networks out there, but I would first focus the majority of your efforts on Instagram, LinkedIn, and YouTube.

YouTube won’t provide amazing numbers in the first 24 hours of uploading a video, but through YouTube SEO, you can continually get views while you won’t see that happen on any of the other social networks.

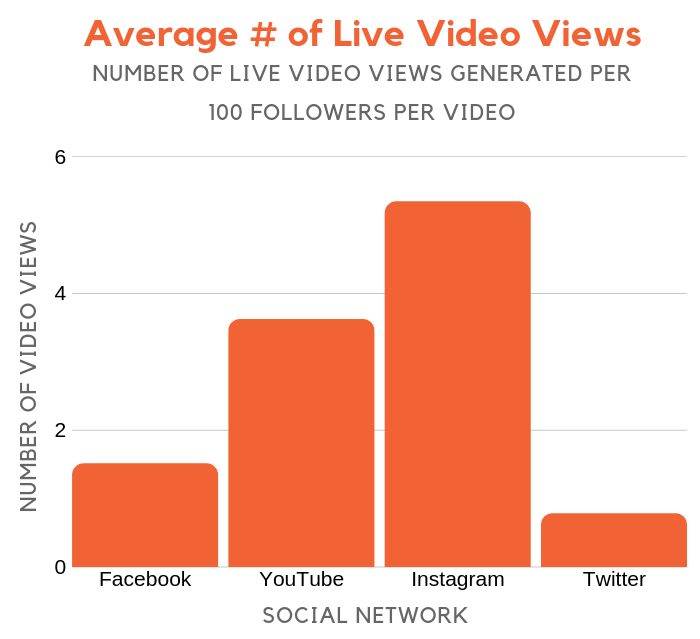

For live videos, the results are similar in which Instagram and YouTube lead the pack.

But what is interesting is that live videos don’t generate as many viewers as just posting and scheduling them.

When we dug into why the main reason wasn’t that social sites don’t want live content, it’s that with non-live videos, businesses spend more time leveraging keyword research and optimizing their videos for the maximum amount of views.

While on the flip side it is a bit harder to do that with live videos.