Article URL: https://divehealth.com/careers/chief-marketing-officer

Comments URL: https://news.ycombinator.com/item?id=28789105

Points: 1

# Comments: 0

Article URL: https://divehealth.com/careers/chief-marketing-officer

Comments URL: https://news.ycombinator.com/item?id=28789105

Points: 1

# Comments: 0

SIRUM is making medications affordable for all. We’re a small (~30 person) but quickly growing team that’s passionate about our mission of reimagining healthcare access for those in need. We like to work hard, solve tough problems, and are determined to improve healthcare access for families who have trouble affording the medications they need to stay healthy.

We’re currently hiring for both our Palo Alto and Atlanta Offices, as well as some fully remote roles. We have opportunities for lead software developers (and other roles like operations, sales, communication) and are especially interested in anyone with fast-growth startup experience. If you want to work in healthcare, love mission-driven work, and thrive in a startup environment, then we may be a good fit. Check out our open roles at https://www.sirum.org/about#careers.

Comments URL: https://news.ycombinator.com/item?id=28740459

Points: 1

# Comments: 0

One piece off setting up a business, beyond deciding on a name or buying web hosting, is deciding on the business entity. The business entity you choose will affect your business in numerous ways. If you want to know how to use an LLC, then you’ve got to know about business entities.

Your business entity will determine the following with reference to your business:

LLC stands for “limited liability company”. According to Nolo.com:

“An LLC is one type of legal entity that can be formed to own and operate a business. LLCs are very popular because they provide the same limited liability as a corporation, but are easier and cheaper to form and run.”

It “is a popular business structure combining both the liability protection of a corporation and pass-through taxation of a partnership. One advantage of an LLC is the flexibility it offers in terms of management and ownership structure.”

In order to best review what an LLC is, and how it can be helpful to your business, it pays to explain what partnerships and corporations are, including where they converge and where they differ from LLCs. We’ll also look at sole proprietorships.

The IRS recognizes these business entities:

But an LLC is not considered a separate entity by the IRS. As a result, the IRS will follow certain rules depending on the size of an LLC, when it comes to deciding whether to treat it more like a partnership, or a corporation, or a sole proprietorship.

Let’s look at what the various business entities are.

Sole proprietors – per the SBA, this type of structure “can be a good choice for low-risk businesses and owners who want to test their business idea before forming a more formal business.”

There are Limited Partnerships and Limited Liability Partnerships. Limited partnerships have only one general partner with unlimited liability. All other partners have limited liability.

With limited partnerships, partners with limited liability also tend to have limited control over the company. The general partner (the partner without limited liability) must pay self-employment taxes. Limited liability partnerships work a lot like limited partnerships. But they give limited liability to every owner. An LLP protects each partner from debts against the partnership. Plus, partners will not be responsible for the actions of other partners.

C Corporations have a completely independent life separate from their shareholders. If a shareholder leaves the company or sells his or her shares, the C corporation can continue doing business relatively undisturbed. C corporations have an advantage when it comes to raising capital, because they can raise funds through the sale of stock. This can also be a benefit in attracting employees.

C corporations can be a good choice, for medium- or higher-risk businesses.

They can be good for businesses that need to raise money. And they can be good for businesses that plan to go public or eventually be sold. Incorporating (whether a C corporation or an S corporation) is also how to truly build business credit that’s separate from personal.

S Corporations are also called Subchapter S Corporations. An S Corporation is a special type of corporation. It is designed to avoid the double taxation drawback of regular C corps. S corps allow profits, and some losses, to be passed through directly to owners’ personal income, without ever being subject to corporate tax rates. S corporations are subject to certain rules, such as they can only have 100 or fewer shareholders.

Get our business credit building checklist and build business credit the fast and easy way.

Let’s take a look at how legal liability differs among various business entities.

With a sole proprietorship, there are no limits to personal liability. As a result, if the sole proprietorship did it, then so did its one owner. This includes all debts and obligations, and any risks from the actions of employees.

In partnership situations, partners retain full, shared liability. Therefore, partners are not only liable for their own actions, but they are also liable for any business debts and decisions made by the other partners. In addition, all of the partners’ personal assets can be seized to satisfy a partnership’s debt. Limited liability partnerships are an effort to address some of these downsides, like limiting a partner’s liability to just the money he or so put into the business.

Within a C corporation, shareholders’ personal assets get protection. Shareholders can usually just be held accountable for their investment in the stock of the company. But if an employee commits fraud or a felony under the corporation’s direction, then the corporate ‘veil’ can be ‘pierced’. If this happens, then personal assets can be on the line.

An S corporation shareholder’s personal assets, like personal bank accounts, cannot be seized for the purpose of satisfying any business liabilities. Owners of an LLC are called ‘members’, as opposed to the owners of corporations, which are called ‘shareholders’. In an LLC, the LLC members get protection from personal liability for the business decisions or actions of the LLC. If the LLC incurs debt or is sued, the members’ personal assets are often exempt. But not always, hence the term ‘limited liability’.

Get our business credit building checklist and build business credit the fast and easy way.

How do the distributions of costs and shares differ?

In a sole proprietorship, the owner is the company. If it makes money, so does the owner (and their share is 100%). In partnership situations, partner shares vary, and they should be clearly spelled out in the partnership agreement. An LLC works as another type of corporation. The only real difference is liability rather than shares and costs, so it works like other corporations.

A corporation is run by its board of directors. These are usually the owners. Ownership stakes are defined by what percentage of stock everyone owns. If one person has a controlling interest (over 50% of the stock), then their decisions will generally overrule everyone else’s.

If the shareholders have smaller stakes in the corporation, sometimes shareholders will band together to influence decisions or even kick out board members. Profits are generally distributed per share percentages. But board members can take a salary. In an S Corporation, a shareholder working for the company must pay him or herself reasonable compensation. The shareholder has to get fair market value. Otherwise, the IRS may reclassify any additional corporate earnings as wages.

How does taxation differ?

Sole proprietors are the same as their owners, the owner pays taxes on the sole proprietorship’s profits. A partnership does not have to pay income tax. Instead, the business will pass through its profits or losses straight to the partners. Then the partners will include their respective share of the partnership’s income or loss on their personal tax returns.

Sole proprietors are the same as their owners, the owner pays taxes on the sole proprietorship’s profits. A partnership does not have to pay income tax. Instead, the business will pass through its profits or losses straight to the partners. Then the partners will include their respective share of the partnership’s income or loss on their personal tax returns.

C Corporations pay state and federal taxes, they sometimes also pay local taxes. This will include paying income taxes on profits. It is the opposite of partnerships and sole proprietorships.

A corporation can end up paying taxes twice, first when it makes a profit, and the second time when dividends go to the shareholders. This is the case even if there is just one shareholder

Only the wages of any S corporation shareholder who is also an employee are subject to employment tax. Any remaining income is payment to the owner as a distribution. Distributions are taxed at a lower rate, if at all.

Per the IRS, “Generally, an S corporation is exempt from federal income tax other than tax on certain capital gains and passive income. It is treated in the same way as a partnership, in that generally taxes are not paid at the corporate level.”

An LLC is not a separate entity as per the Internal Revenue Service. As a result, it is not taxed directly. Instead, the members pay individual taxes. Members of an LLC have to pay an employment tax on the entire net income of the business.

Get our business credit building checklist and build business credit the fast and easy way.

LLC members get protection from personal liability for the LLC’s business decisions or actions. If the LLC incurs debt or someone sues it, member personal assets are often exempt. LLCs don’t pay the double taxation of standard corporations, and if they ‘pass through’ profits to member tax returns, LLC owners may be able to deduct 20% of their business income with the 20% pass-through deduction established under the Tax Cuts and Jobs Act of 2017.

The IRS (and others) doe not see an LLC as a separate entity, hence it’s not good for fully separating business from personal credit. LLC members end up paying employment taxes on the entire net income of the business. LLCs can’t issue shares so they can’t use the issuance of shares as a form of fundraising.

Annual/biennial renewal fees are often higher than for corporations. Setup fees (as of 2021) run from $40 (Kentucky) to $500 (Massachusetts). And annual/biennial renewal fees run from $0 (Arizona, Idaho, Minnesota, Missouri, New Mexico, Ohio, South Carolina, and Texas), to $800 (California, annually + $20 every other year).

If you want to build credit for your business, an LLC will not offer you the protection that a C corporation or an S corporation does. But an LLC is better than a partnership or a sole proprietorship, when it comes to personal liability.

If you want to (potentially) save on taxes, then an LLC might be a good idea. But if your business truly takes off, your personal taxes will be higher, even with a 20% deduction.

The post Why and How to Use an LLC – is it a Good Choice for YOUR Business? appeared first on Credit Suite.

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

Wix takes the prize for simplifying the process of making a website. Its drag-and-drop interface, hundreds of apps, and wider pricing options mean anybody can whip up a website without breaking a sweat.

Squarespace has a better selection of design templates but its customization options require more technical confidence. Squarespace also outperforms Wix’s blogging and ecommerce tools by a very small margin, but the more flexible Wix has something for everyone.

Squarespace’s sleeker, more professional-looking template designs are best for creatives who place a high value on aesthetics. Its grid-style editor requires a little bit of time to get to grips with, making it better for those with technical experience. Turn your ideas into a visually-appealing Squarespace website for free.

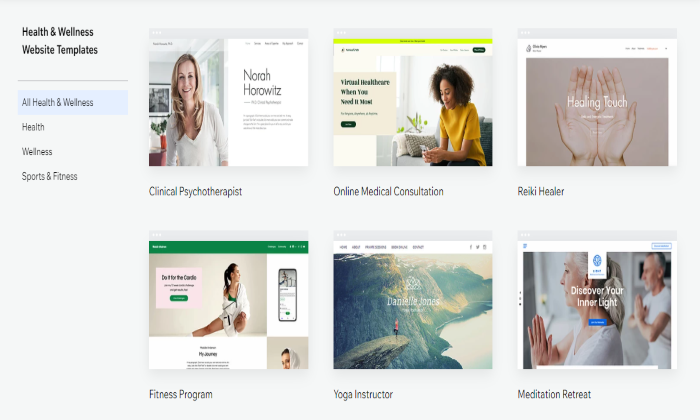

Wix is best for beginners who want an easy way to create a website pronto. It has a drag-and-drop interface so building a website is as straightforward as solving a kiddie puzzle. It also comes with hundreds of templates and features to give users creative freedom regardless of their skill level. Start your own free and stunning Wix website today.

A good website builder spells the difference between an idea that grows into something big and one that fizzles out. To give you a head start, I’ve mustered up my experiences with building websites and reviewed the top website builders that may fit your needs.

Wix has proven once again why it’s considered a major player in the industry. Squarespace, though not included in the list, has its own perks that appeal to those with a specific set of criteria.

Unlimited storage space: All of Squarespace premium plans come with unlimited bandwidth and storage so you can host unlimited files while ensuring media files will download smoothly. While the majority of Wix plans do offer unlimited bandwidth, none of them provide unlimited storage so you can’t just upload any files to your heart’s content.

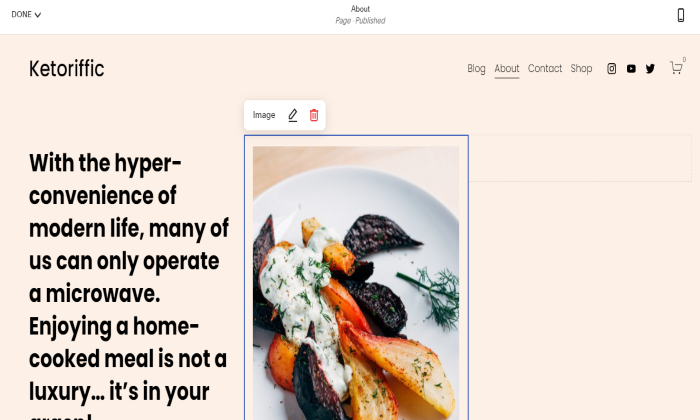

Structured page editor: Squarespace doesn’t have the exact drag-and-drop functionality Wix is famous for. Its page elements are packed inside content blocks which you can move around and snap into rows and columns. Restrictive as it may appear, though, this feature helps you create your page within a more controlled environment, which can help prevent inadvertently sloppy designs.

High-quality, professional-grade template designs: Wix may offer more template choices but Squarespace trumps its competitor in terms of quality. It has over 60 template designs that are not only aesthetically superior but also easier to navigate both for the builder and viewer. Regardless of what template you choose initially, you can customize or replace it with another one anytime.

One-click color palette customization: Squarespace takes the guesswork out of choosing the right color theme that matches your brand. All you have to do is select a palette and Squarespace will apply it throughout your website.

Like Wix, Squarespace also offers the freedom to pick specific colors for individual elements. But since most users don’t have a design sense, Squarespace’s preselected color schemes take the headache and guesswork out of your site’s aesthetics.

Well-thought-out in-house features: Squarespace may have fewer features than Wix but what it lacks in numbers it makes up for in execution. Its in-house features are meticulously designed and built into its editor so you can manage your website even without installing third-party extensions.

Its restaurant menu editor, for example, uses a markup language so adding items is like filling out a simple form. In contrast, Wix accomplishes the same task through a relatively more tedious process that requires several clicks.

Squarespace’s donation system is likewise superior to Wix’s because it goes beyond providing a donation button by offering donor-specific checkout, donor email receipts, and suggested amounts.

Seamless podcast syndication: Starting a podcast? Squarespace also beats Wix’s basic podcast player by being the only one in the industry to offer syndication. With this feature, you can submit your podcast to Spotify or Apple Podcasts where a legion of potential fans can discover you.

Curated third-party apps: Whatever Squarespace lacks in-house, it offers as a third-party extension. Even Wix’s in-house features that Squarespace doesn’t have can be matched by a third-party counterpart so you won’t miss out on anything.

For example, the Wix Events app enables visitors to book tickets online whereas Squarespace can be integrated with Eventbrite to do the same thing. Similarly, integrating Memberstack with Squarespace accomplishes the same thing as the Wix Members app.

Ready-to-use blogging tools: With Squarespace, you can start blogging and showcase your best content to the world right off the bat. Unlike Wix that requires you to install a separate blog app, Squarespace has built-in blogging tools.

Basic features like post tagging, categories, comment moderation, and drafts will help you create professional-looking blogs regardless of your industry. Working with multiple authors is also a breeze as Squarespace allows you to collaborate with them on a single post or assign them different roles.

Sophisticated ecommerce functionality: When it comes to building your online store, Squarespace gives Wix a run for its money. It offers the same basic features you’ll find in Wix like custom email receipts, point of sale system, and automated cart recovery.

To maximize your profits, however, Squarespace steps up its game by offering features that Wix doesn’t. These include gift cards to help with your brand promotion. You can also use “back in stock” and “low stock” notifications to create a sense of urgency without being too pushy.

24/7 online support: Should you encounter technical issues with your Squarespace website, you can reach out to their customer support team via email, Twitter, or live chat. These online channels allow their team to get to the bottom of your issue faster.

Squarespace has excluded phone support because their existing support channels allow them to troubleshoot your issues comprehensively without the need to put you on hold.

Lacks intuitive drag-and-drop interface. Squarespace’s page editor works like a minimalist grid system so you can’t drag and drop elements as freely as you can. Less freedom means less opportunity to play around with the design. It also takes a longer time to get used to so Squarespace is not as beginner-friendly as Wix.

Limited creative control: Squarespace’s biggest advantage is also its disadvantage. The “structured” editor may enable you to customize a website design within the realm of what’s acceptable but it also means you have less creative control.

The templates are on par with professional designs but you can’t edit, move, resize, or re-color the page elements as easily as you can with Wix. You also can’t display both the site title and logo at the same time.

Limited template designs. Fewer design choices also make it more difficult to stand out. Most photographers, for instance, trust Squarespace to host their portfolio sites.

With limited templates to choose from, they’re more likely to pick the same template. As a result, they may end up with portfolio websites that have the same look and feel as other sites in their industry.

Less generous ecommerce plans: Squarespace outnumbers Wix’s ecommerce features but you won’t benefit as much if you’re only subscribed to its basic plan.

Squarespace’s basic ecommerce features cost $18 per month (Business plan) while its Wix counterpart is a tad higher at $23 per month (Basic Business plan). However, you won’t save as much with a basic plan as Squarespace charges a 3% transaction fee unless you upgrade.

You also won’t have access to some crucial features like abandoned cart recovery if you’re not under the Advanced Commerce Plan that costs $40 per month.

By contrast, Wix charges no transaction fee on any of its ecommerce plans and offers abandoned cart recovery even to those in the basic plan.

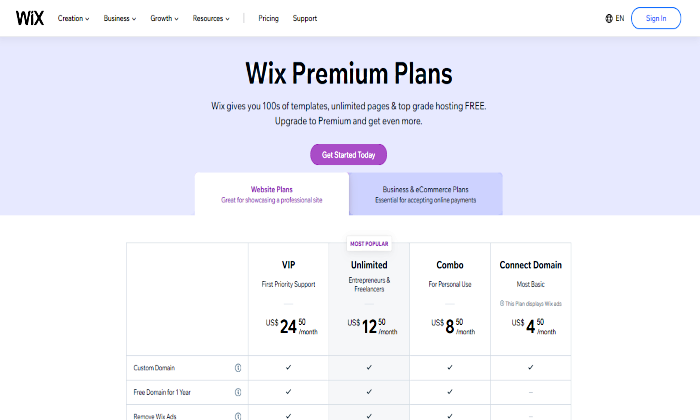

Scalable pricing: Wix has a wider range of pricing options so you can start your website anytime and easily scale as it grows. The free plan is available for beginners who are still learning the ropes and are not bothered by Wix-sponsored ads and subdomains.

If you want a custom domain, you can switch to the most basic plan for only $4.50 a month. From here, you can upgrade to any of the three higher website plans or start an online store for as low as $17 per month for the Business Basic Plan. Squarespace, on the other hand, only offers four pricing tiers starting with the Personal plan at $12 per month. It doesn’t come with a free plan and most of the important features are only available in higher plans.

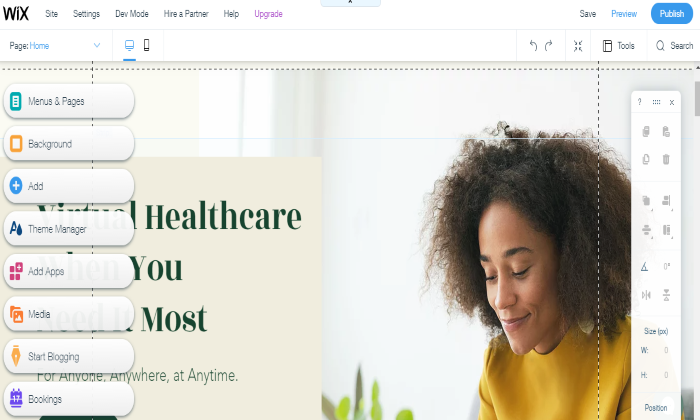

Beginner-friendly interface: Wix’s drag-and-drop editor remains its top selling point. It gives you a template to create a simple website in minutes without learning how to code. Squarespace is also a “no-coding” website builder, but its grid-style editor makes it cumbersome for some beginners. With Wix, you can have full control of the layout and even add functionality by dragging and dropping widgets on your page.

More in-house apps: Name any feature you want your website to have and Wix has an app for it. Do you want to create a forum? Look for Wix Forum in the App Market and install it for free. Planning to add a live chat to connect with your visitors in real-time? Try Wix Chat, another in-house app you can add for free. If none of the built-in Wix apps is what you’re looking for, don’t worry as there are still over 200 free and premium third-party extensions to choose from.

Free email marketing tools: With this built-in feature, you can send email campaigns to your contact list and even create workflows to manage your own sales funnel. Measure how well each of your campaigns is doing through the stats tracker that lets you see how many people open and engage with your emails.

Wix’s email marketing tools are part of the Ascend all-in-one business solution that gives you access to other marketing tools like live chat, social media integration, and SEO tools. The best part is you can have access to a limited number of features for free or upgrade to one of the three paid plans to enjoy the full benefit.

Robust SEO features: Wix has its own game plan to help your content rank high on Google. What’s great is Wix puts all its strategies in one place so users can learn SEO themselves and improve their online presence. The SEO Wiz contains step-by-step tutorials, achievement updates, and tons of other learning materials so you can start improving your site’s visibility even if you never heard about SEO before.

Multiple customer support channels: Unlike Squarespace, Wix offers phone support so you can rest assured that humans and not bots are handling your concern. Wix also provides support through forums, social media, and email but not through live chat. In case you get stuck or confused while working on the page editor, there are small question marks on the screen that you can also click to get quick solutions without leaving the page.

Automatic backup-and-restore feature: Wix is a proactive website builder that anticipates unfortunate events and has developed a counteracting feature in case they happen.

Through Site History which you can find inside your site Settings, you can restore a previous version of your website. You can restore revised versions of your site regardless if it’s saved manually or automatically.

Best of all, the previously saved version of your site can be restored without affecting published blog posts and changes made in your email list.

Underwhelming template designs: Wix focuses on quantity over quality when it comes to design. Its over 500 customizable templates easily beat Squarespace’s 70+ designs. But with more choices comes more time wasted picking and overanalyzing which one suits a website idea best.

A “quantity over quality” approach also leads to many Wix templates failing to make a great first impression. While there are hidden gems, it takes time to find them as they are outnumbered by generic templates, some of which are downright cheesy.

Unstructured page editor: Wix’s drag-and-drop interface has its own flaws. While it helps even non-pros create websites quickly, the changes you make in the desktop version may not necessarily sync to its mobile version. For instance, when you move an image from the top of the page to the bottom, the same change won’t reflect in the mobile version unless you make the same change twice. With Squarespace’s structured editor, movements are much more restricted but any change you make will reflect in both screens.

Complicated color changes: Wix lacks the preselected color palettes that Squarespace has, so changing text and background colors are not as straightforward. This is the downside of having more freedom to manipulate page elements. You may be free to choose the colors of individual page elements but if you don’t have a background in design, knowing which colors will work best without preset recommendations can be really tough.

Limited bandwidth and storage space: Wix doesn’t have the unlimited resources that Squarespace offers in all its plans. Therefore, the cheaper your Wix plan is, the more restrictions you’ll get on how many files you can store and how much traffic your website can get per day.

Wix’s cheapest plans, Connect Domain and Combo, only offer a bandwidth of 1 GB and 2 GB, respectively. This is enough if your website receives only a handful of visitors per month. However, once a website gets at least 1,000 visitors a day, it will require about 8.5 GB of bandwidth monthly, something that Wix only provides starting with its Unlimited plan that costs $12.50 per month (billed annually).

Mediocre blogging tools: You can create a decent blog with Wix but if you’re looking for more features, you’ll get it from Squarespace. Wix is capable of scheduling posts, adding tags or categories, and saving drafts. However, it doesn’t allow comment moderation so you can’t filter comments and publish only those you approve of. On top of that, Wix doesn’t have a built-in blogging feature. You have to add the free Wix Blog app yourself before you can start creating content.

Limited flexibility for free plans: When you start a free website with Wix, you won’t pay for anything but it comes at the cost of flexibility. The Wix subdomain, ads, and the look of a free site tend to come off a lot less professional. If you want to experiment with a free site, that’s fine, but you’ll have to upgrade to premium Wix plans to really establish your own brand.

Do you want to build a website from scratch without touching any codes? With a website builder, you can do that and more. If you want to get started, here are the best website builders I recommend:

Wix is the undisputed website builder of choice if you want to quickly launch a website even without the technical know-how. Its drag-and-drop interface requires a short learning curve while its hundreds of templates and features allow you to elevate your website any way you want.

But for a more professional site with a stronger design aesthetic and more customization options, especially one you’re willing to take some time to build, Squarespace will be the better choice.

The post Squarespace Vs. Wix appeared first on Neil Patel.

Remote Go Developer

We are looking for a backend engineer to help craft the future of Teamwork Desk. We are a self-funded and privately owned Irish company with employees all over the world.

Check out our role here:

https://careers.teamwork.com/jobs/backenddesk

The post New comment by TJLeahy in “Ask HN: Who is hiring? (October 2020)” appeared first on ROI Credit Builders.

The Only Guaranteed Way To Build Wealth Is To Invest In Yourself Do not Turn to the Financial Media for Advice Occasionally, I’ll check economic information on Reuters, Bloomberg, MSNBC and also so on, not for details to make financial investment choices, however simply for suggestions to compose one more blog site entrance. By many …

The post The Only Guaranteed Way To Build Wealth Is To Buy Yourself appeared first on ROI Credit Builders.

Article URL: https://www.notion.so/TaxProper-is-Hiring-5a21e3adc5e249aaa3282875936bbfd6

Comments URL: https://news.ycombinator.com/item?id=23827226

Points: 1

# Comments: 0

The terms “business credit” and “fundability” get thrown around a lot. The truth is, a lot of people think they are interchangeable. In fact, they are not. Think of fundability as a puzzle, and all the pieces are different sizes. Business credit is a huge puzzle piece that goes right in the center.

Think about the puzzle analogy and you can see how it isn’t really possible to have complete fundability without business credit. A huge piece of the picture would be missing. On the other hand, you could get a good idea of what the picture is if you have credit in your business name but not all the other pieces of the fundability puzzle. That is how big this piece is. It is huge. You just wouldn’t have all the funding options that you would if you had all the puzzle pieces. Before we can go further, you need to understand what fundability is, and what business credit it.

Keep your business protected with our professional business credit monitoring.

Basically, fundability is the ability of your business to get funding. When lenders consider releasing funds for your business, does it appear to them to be a good idea to make the loan? What do they look at to make that decision?

When a lender considers lending to your business, they are wondering if you are high risk? Do you seem like a business that can and will pay back the debt? Lenders are in it for the money. They need to feel like they are making a good investment. A high credit risk is not a wise lending choice.

The harder question is how does a business get fundability? This is hard, because so many things affect fundability. Sure, a great credit score for your business is important. In addition, many of the aspects necessary for a strong business credit score are necessary for fundability as well.

A potential creditor needs to see that your business is legitimate and profitable. Many loan applications are denied approval due to fraud concerns. Others, simply because something didn’t match up and threw up a warning signal. Maybe the addresses or phone numbers didn’t match on a couple of reports and it just looks unprofessional.

Why do you need separate credit for your business? First, if something bad happens and your personal credit goes down, you need to be able to continue to run and grow your business. If your business has its own strong credit, you can still do that regardless of what is happening with your personal credit.

Why do you need separate credit for your business? First, if something bad happens and your personal credit goes down, you need to be able to continue to run and grow your business. If your business has its own strong credit, you can still do that regardless of what is happening with your personal credit.

While it is true a new business will not have any credit of its own, it doesn’t have to be that way forever. There are ways to build credit for your business quickly so that when the time comes, you can keep your personal credit separate and finance business growth using your business credit. Learning all you can about business credit is the first step in building it.

The great thing is, building credit for your business and building fundability both start the same way, with the foundation.

You have to set up your business properly. It has to have a fundable foundation to build separate credit and to build fundability as a whole. What makes up a fundable foundation?

The first step in setting for fundability is to ensure your business has its own phone number, fax number, and address. That’s not to say you have to get a separate phone line, or even a separate location. You can run your business from your home or on your computer. You don’t even have to have a fax machine.

In fact, you can get a business phone number and fax number pretty easily. They will work over the internet instead of phone lines. In addition, the phone number will forward to any phone you want it too so you can simply use your personal cell phone or landline. Whenever someone calls your business number it will ring straight to you.

Faxes can be sent to an online fax service, if anyone ever happens to actually fax you. This part may seem outdated, but it does help your business appear legitimate to lenders.

You can use a virtual office for a business address. This doesn’t play out how you may think. This is a business that offers a physical address for a cost. Sometimes they even offer mail service and live receptionist services. In addition, there are some that offer meeting spaces for those times you may need to meet a client or customer in person.

The next thing you need to do is get an EIN. It is an identifying number for your business that works similar to how your SSN works for you personally. You can get one for free from the IRS.

Incorporating your business as an LLC, S-corp, or corporation is vital to fundability. It helps your business appear legitimate, and also offers some protection from liability.

You can incorporate as an LLC, S-corp, or full blown corporation. Which option you choose does not matter as much for fundability as it does for your budget and needs for liability protection. The best thing to do is talk to your tax person and your attorney. You are going to lose any time in business that you have. When you incorporate, you become a new entity. You basically have to start over. You’ll also lose any positive payment history you may have accumulated as well.

This is why you have to incorporate as soon as possible. Not only is it necessary for fundability and for building credit for your business, but so is how long you have been in business. The longer you have been in business the more fundable you appear to be. Time in business begins on the date of incorporation, regardless of when you actually started doing business.

Keep your business protected with our professional business credit monitoring.

You have to open a separate, dedicated business bank account. There are a few reasons for this. First, it will help you keep track of finances. It will also help you keep them separate from personal finances. This is necessary for tax purposes anyway.

In addition, there are several types of funding you cannot get without a business bank account. Many lenders and credit cards want to see one with a minimum average balance. Also, you cannot get a merchant account without a business bank account. Consequently, you cannot take credit card payments. Studies show consumers tend to spend more when they can use a credit card.

For a business to be legitimate it has to have all of the necessary licenses it needs to run. If it doesn’t, warning signs are going to go up everywhere. Do the research you need to do to ensure you have all of the licenses necessary to legitimately run your business at the federal, state, and local levels.

I am sure you are wondering how a business website can affect fundability. Here’s the thing. These days, you do not exist if you do not have a website. However, having a poorly put together website can be even worse. It is the first impression you make on many, and if it appears to be unprofessional it will not bode well for you with consumers or potential lenders.

Spend what you need to in an effort to make sure your website is professionally designed and works. Also, pay for hosting. Don’t use a free service. Along these same lines, your business needs a separate business email address. It should have the same URL as your Website. Don’t use a free service such as Yahoo or Gmail.

What does all of this have to do with separate credit for your business? Before your business can have its own credit, it has to be set up as an entity separate from the owner. The fundable foundation is how you make that happen.

Now that you know what fundability is and how to set up your business to be fundable, you need to know how business credit fits in.

Business credit agencies issue reports much like your consumer credit report. They detail the credit history of your business. It helps lenders determine the creditworthiness of your business.

Where do these reports come from? There are a lot of different places, but the main ones are Dun & Bradstreet, Experian, Equifax, and FICO SBSS. Since you have no way of knowing which one your lender will choose, you need to make sure all of these reports are up to date and accurate.

In addition to the reporting agencies that directly calculate and put out credit reports, there are other business data agencies that affect those reports indirectly. Two examples of this are LexisNexis and The Small Business Finance Exchange. These two agencies gather data from a variety of sources, including public records. This means they could even have access to information relating to automobile accidents and liens. While you may not be able to access or change the data the agencies have on your business, you can ensure that any new information they receive is positive. Enough positive information can help counteract any negative information from the past.

In addition to the EIN, there are identifying numbers that go along with your business’s credit reports. You need to be aware that these numbers exist. Some of them are simply assigned by the agency, like the Experian BIN. One, however, you have to apply to get. It is absolutely necessary that you do this.

Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. To get a D-U-N-S number, you have to apply for one through the D&B website.

Your credit history is the main piece of your credit score. In turn, your credit score is a huge factor in the fundability of your business.

Your credit history consists of a number of things including:

The more accounts you have reporting on-time payments, the stronger your credit score will be.

Keep your business protected with our professional business credit monitoring.

On the surface, it seems obvious that all of your business information should be the same across the board everywhere you use it. However, when you start changing things up like adding a business phone number and address or incorporating, you may find that some things slip through the cracks.

This is a problem because a ton of loan applications are turned down each year due to fraud concerns simply because things do not match up. Maybe your business licenses have your personal address but now you have a business address. You have to change it. Perhaps some of your credit accounts have a slightly different name or a different phone number listed than what is on your loan application. Do your insurances all have the correct information?

The key to this piece of the business fundability is to monitor your reports frequently. This way, you can see if any mistakes are affecting your credit, and get them fixed.

I know, I know, another analogy might be overdoing it. But think about it, you can have a sandwich without turkey, but it’s not a turkey sandwich. It’s something else. You can have all the pieces of fundability without business credit, but it won’t hit the spot.

Without true business credit, even if every other part of fundability is in place, you’ll still be missing out on a ton of funding opportunities. Definitely work on building strong credit for your business. It’s a huge part of fundability. However, don’t let the other facets of fundability slip. You need the whole puzzle to see the big picture and get the big money.

The post How Does Business Credit Fit into The Big Picture of Fundability? appeared first on Credit Suite.

The post WeWork Parent to Name Sandeep Mathrani New CEO appeared first on Buy It At A Bargain – Deals And Reviews.