Best Applicant Tracking Software

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

Here’s a business cliche for you: Employees are the greatest asset for every company.

Precisely why recruitment is so challenging for HRs or recruiters. The process is quite elaborate and comprises several steps ranging from job posting to managing and streamlining applications.

Let’s talk statistics:

A corporate job post receives 250 resumes on an average. And even after that, 45% of employers say that they can’t find candidates with the skills they need.

With the high influx of CVs, it’s crucial for HR specialists to raise their efficiency levels, which brings us to our next stat – recruiters only take six seconds to evaluate the candidate’s resume.

Now, six seconds isn’t necessarily enough for recruiters to make the right decision every time, especially because every business has unique needs when it comes to recruitment.

At the same time, technology is changing how we did things manually, which is why we now have a tool dedicated to automating the process of recruitment and hiring.

An applicant tracking software, also known as ATS software, can help businesses reach a wider pool of qualified applicants as well as manage data from various sources – all at a single platform.

This software is used by departments and hiring managers to carry out internal hiring. Even third parties, such as recruitment and staffing agencies, use an ATS.

According to research:

- 86% of recruiting professionals agree that using ATS software has accelerated their hiring process

- 78% of recruiting professionals found that using ATS software has given them access to higher qualified candidates

So adding top-level talent doesn’t have to be time-consuming and troubling anymore.

In this guide, we’ll review the best applicant tracking software on the market that can help a company employ the most suitable candidate for the job with minimal efforts.

The Top 5 Options For Applicant Tracking Software

- BambooHR – Anchor Link to Subhead Below

- Bullhorn – Anchor Link to Subhead Below

- SAP SuccessFactors– Anchor Link to Subhead Below

- Workable – Anchor Link to Subhead Below

- JazzHR – Anchor Link to Subhead Below

How to Choose the Best Applicant Tracking Software for Your Needs

Every business has unique recruiting and applicant tracking requirements, depending on specific factors like size, niche, and so on.

It also means that no ATS software offers an a-one-size-fits-all solution.

There are a few pointers that can help you determine the best applicant tracking software for your needs, though. Read on as we discuss them in greater detail below.

ATS Software Type

Every ATS software has been conceived to cater to a specific set of needs.

You see, while some software is designed to handle higher volume recruiting, which is typically carried out by enterprises, some are created to help small businesses specifically.

Similarly, you’ll also find software focused on satisfying the needs of staffing and recruitment agencies.

We’ll do a more in-depth assessment of the different types of applicant tracking software later on in this article. (Anchor link to H2 below)

Hiring Frequency and Volume

A business that hires around 20 employees every year won’t have the same requirements as an enterprise that is hiring 20 employees every month. You need to figure out a software that meets your hiring frequency and volume.

Generally, ATS software has a maximum limit or restriction on how many active openings you can have at a time. Moreover, most of the brands offer additional features and tools to help businesses efficiently manage large-scale recruiting, which are understandably far more tricky to manage.

So how do you find software that is suitable for your company?

Ask yourself the following questions:

- How frequently does your company hire new employees?

- What is the average number of employees that you hire at once? Is the volume high or low?

These two questions will help you weed out software that doesn’t fit your needs instantly.

Feature List

Most ATS software offers add-on features to enhance the efficiency of your recruiting strategy. This can include candidate sourcing, applicant tracking, employee onboarding, recruiting analytics, and workforce planning.

Your aim should be to pick software that fulfills your recruiting needs in terms of efficiency and scalability. For instance, small businesses can opt for cloud-based ATS software that is more affordable and doesn’t require an on-site tech support team.

Contrarily, large-sized enterprises don’t need to go cloud-based since they have a higher budget and can afford an in-house support team to cater to their higher hiring frequency.

Budget

Every business has a budget for various processes. Whether its marketing or recruitment, teams have to operate within the constraints.

Try to find an applicant tracking software that fits within your budget while simultaneously helping you improve the efficiency within your organization.

The good news here is you have several options.

You‘ll find software that costs less than $0.50 per employee – provided you opt for an add-on to HR software – and also plans that have a monthly charge of $249.

What are the Different Types of Applicant Tracking Software?

Here, we’ll compare the different types of ATS.

Small Business vs. Midsize Business vs. Enterprise Business

Small business buyers are anywhere between 1-50 employees. Generally, this category doesn’t have a department dedicated to human resources and recruiting initiatives.

On the other hand, mid-size business buyers and enterprise business buyers have employees anywhere between the 51–500 and greater than 500 range, respectively. While the former is headed towards rapid growth, the latter is more developed. Besides that, mid-size businesses often seek to hire an internal recruiter, whereas enterprise business buyers already have a hiring team and a dedicated IT department.

The hiring frequency and volume for each of these businesses is obviously different.

Staffing agencies, for example, would do well with software plans that offer them sourcing, tracking, and hiring. For corporates, however, hiring may have to be customized further.

It’ll be better for larger companies to opt for plans that allow them to customize their career pages and employee referral portals, followed by pre-screening assessments, e-signature verification and background screening, and lastly, HRMS integration.

In-house Recruiting vs. Recruiting Agency

Some applicant tracking system software is created for in-house recruiting that allows them to enjoy higher personalization and automation. Other software focuses on servicing with recruiting agencies and firms with scalability for high-volume and white labeling for getting clients.

Although you’ll also find ATS software that offers capabilities for both the groups, it’s better to find one that’s right for your company.

All-In-On Option vs. Specialty Tools Availability

Different businesses will require different add-ons depending on their hiring process. While most ATS software does come with additional specialty tools like SEO, payroll, HR, and CRM, some don’t.

SEO tools are useful for all businesses since these make job advertisements more successful. Not only will companies be able to build up wider reach, but they’ll also attract new candidates to their ‘Careers’ page.

Similarly, CRM capabilities are an essential component for inbound recruiting that allows companies to carry out long-term candidate tracking and build their talent pool.

Core Applicant Tracking vs. Full Recruiting Cycle Support

You’ll find two types of ATS products: one that focuses exclusively on tracking candidate’s application materials, and two, that provide support for other aspects of the recruitment life cycle.

You can also differentiate between the software based on feature lists. Interviews, document signing and management, note-taking, scheduling, and integration are some common differentiation points.

After carrying out extensive research and taking demos, we can confidently recommend the following five applicant tracking software to transform the way your company recruits and hires employees.

Keep reading as we discuss the features, benefits, and pricing of each software below:

#1: BambooHR – The Best Overall Applicant Tracking Software

BambooHR can provide the ultimate solution to your human resources department for handling the company’s recruiting and onboarding needs. While it may not be the cheapest option, you do get features that make the investment more than worth it.

The ATS system of BambooHR provides ideal solutions for small and mid-size businesses. It has a well-organized and visually appealing set of tools for handling application information throughout every stage of the hiring process.

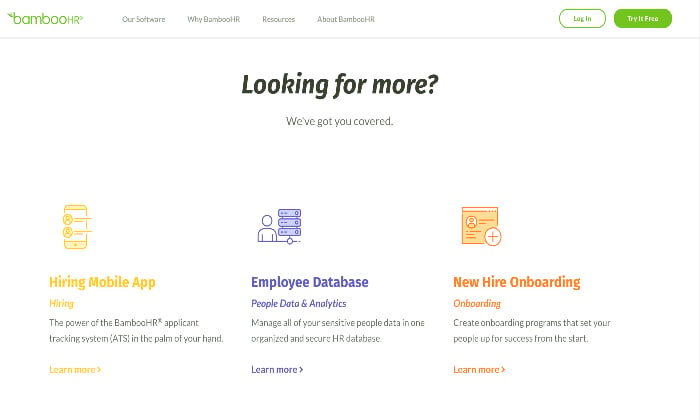

BambooHR allows you to post job positions on the go too. You’ll have access to top-level talent from the leading job boards and sites, such as LinkedIn, Facebook, Indeed, and Twitter – all at your fingertips. The software has a hiring mobile app that is available for both Android and iOS.

Sending offer letters directly within the platform as well as collaborating with your team for recruiting, sending automated alerts, and so on is also possible.

Additionally, since BambooHR is a complete human resource management software, you‘ll be able to manage your new employees for their full duration with your company.

Prominent Features

- User-friendly

- Streamlined processes that are easy to learn, along with easy pre-boarding and onboarding facilities

- Customizable email templates

- Automated emailing system

- Message scheduling to multiple candidates

- Job boards and social media integration

Pricing

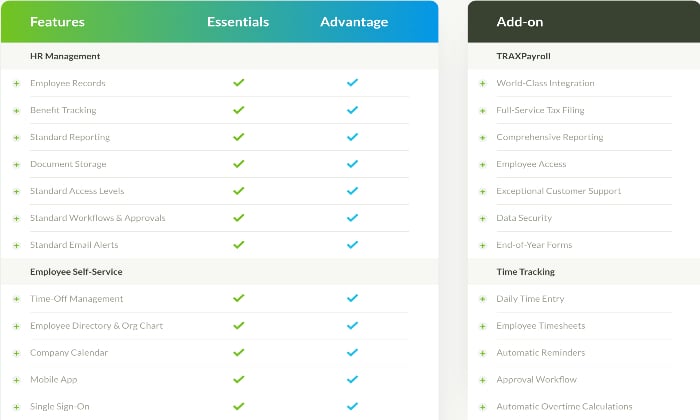

BambooHR offers two packages: Essentials and Advantage.

While both the packages are feature-rich, the ATS isn’t available with the Essentials plan. So if you want applicant tracking, you have to get the Advantage plan. Keep in mind that this software may not be the best solution for your company if you only want ATS.

Unfortunately, BambooHR doesn’t feature pricing on its website. In case you want a free quote, you‘ll have to contact them.

Pros

- Impressive design

- Easy to set up

- Open API that allows simple integrations with HR tech vendors

- Provides an all-in-one solution for HR departments

Cons

- Pricey

- ATS software isn’t available with the entry-level plan

#2: Bullhorn – The Best Applicant Tracking Software for Large Enterprises

Bullhorn is a powerful, easy-to-use applicant tracking system that helps you streamline all recruitments from a single interface that can either be a desktop, mobile device, or any internet browser. In fact, it’s a tailor-made solution for staffing businesses and traders.

The software allows you to keep track of candidates throughout the recruitment process, along with initiating team member collaboration.

You can use Bullhorn to fill jobs and automate the onboarding process. It offers 100+ pre-integrated solutions for customizing the software to accommodate specific needs. Even calculating bills for time tracking and invoicing are also possible.

All in all, you can manage clients as well as candidates with Bullhorn.

That being said, we would recommend this software for staffing and recruiting agencies only.

Generally speaking, there are better options on the market for internal reporting, making Bullhorn a bit too much for in-house hiring managers and HR departments. Plus, the premium price may be too expensive for smaller businesses who have limited budgets.

Prominent Features

- Automatic candidate tracking on the application system

- Allows you to add new candidate resumes from job boards

- Mobile recruiting software for viewing and managing candidate records

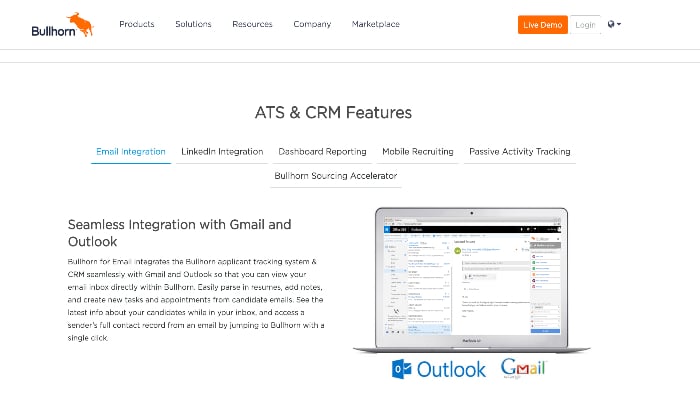

- LinkedIn and email integration

- Dashboard reporting

- Facilitates addition of notes to records

- Real-time updating of records

- Reporting and management options to check the recruiting team’s progress

Pricing

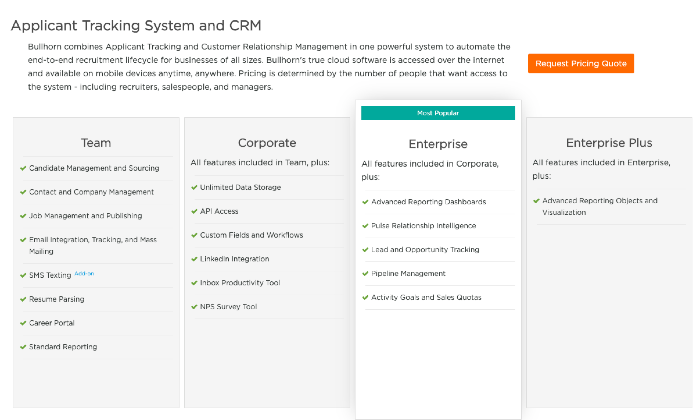

Bullhorn offers three plans: Team, Corporate, and Enterprise.

The rates for Bullhorn plans aren’t available on the website. You’ll have to request a pricing quote to get more details.

Pros

- Excellent user interface

- Gmail and Outlook integration

- Intuitive features like bowling alley layout for easy and efficient data input

- Unlimited customizations

Cons

- Very expensive

- Lacks iOS or Android mobile applications

#3: SAP SuccessFactors – The Best Cloud-Based Applicant Tracking Software

SAP SuccessFactors aims to provide all-inclusive ATS software to give companies wider access to top-level talent with minimal efforts. In fact, in terms of reliability, this software might be one of the best options available to you.

SuccessFactors has a plethora of support and features, such as comprehensive applicant management, onboarding portal, global talent sourcing, and candidate relationship management. You can also avail of performance metrics, employee engagement, and payroll management.

In other words, it’s a holistic, cloud-based HR management system that facilitates all processes of the recruiting cycle.

We particularly like how deeply insightful the software can be for talent acquisition thanks to its analytical reporting and progress tracking features.

Prominent Features

- Centrally managed global job distribution and access

- Effective and efficient candidates relationship management

- E-signature solutions

- Online offer letter and other documentation

- Key insights into 4000 job boards, social media platforms, and campuses spanning across 80 countries

- Responsive career site creation facility

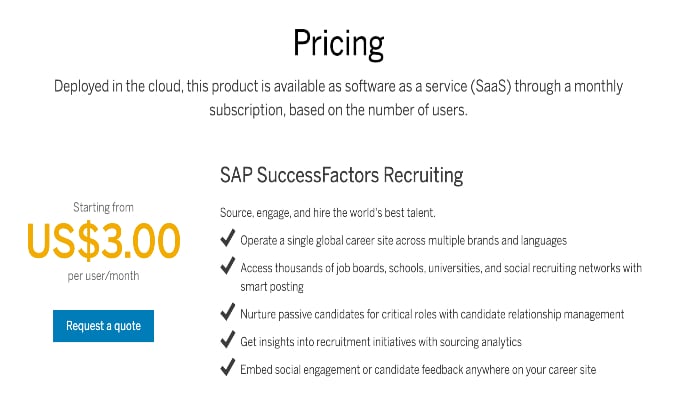

Pricing

SAP SuccessFactors is available as SaaS through a monthly subscription based on the number of users. It‘s priced at $3 per user per month, but you can also avail of the HCM suite that costs $84.53 per user annually.

Pros

- Comes with a great feature list for small to medium-sized businesses

- Intuitive setup wizard

- Provides descriptive video tutorials

- Superb performance tracking features

- Great option for fast-growing companies

Cons

- Steeper price tag than its competitors

- Doesn’t include add-ons offered by rivals

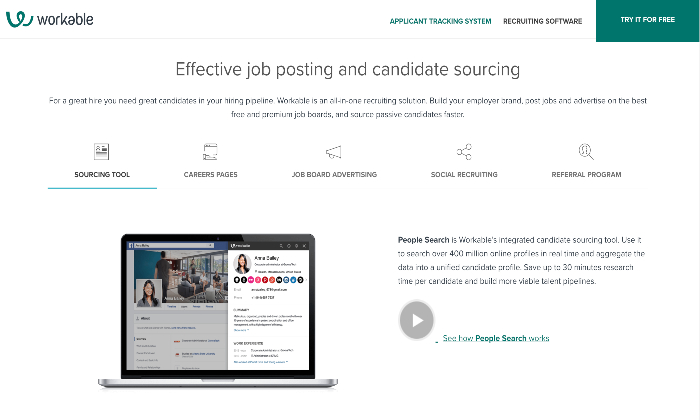

#4: Workable – The Best Applicant Tracking Software for Small and Midsize Businesses

Offering the best value for small and medium-sized businesses, Workable is an easy-to-use recruiting software solution. It’s a holistic tool that can be accessed on mobile devices as well as desktop.

You get a wide array of applicant tracking (AT) solutions, along with access to a large pool of premium job boards. Besides this, you can also customize the dashboard to boost the efficiency of your hiring process further.

Workable aims to help businesses of all sizes find, evaluate, and automate recruitment and hiring.

Companies can fill in their pipeline with one-click job postings on nearly 200 sites through AI-powered search. Moreover, team collaboration for applicant evaluation, gathering feedback, and automating manual tasks like scheduling interviews and getting approvals is also possible.

Workable also has various add-ons that can make your account more functional – provided you‘re ready to pay for them.

Basically, your company can stay on top of the entire recruiting process right from posting ads to onboarding employees. It’s also a good option for scalability since you can upgrade to an annual plan to get access to advanced features like one-click candidate sourcing and applicant tracking tools too.

Prominent Features

- Data protection with access rights for hiring team

- Confidentiality control

- Organized reporting lines, with role assignment, job creation, and job posting

- Productivity and activity report generation

- One-click postings on multiple job boards

- Interview scheduling with email-calendar synchronization

- Offer letters and single sign-on (SSO)

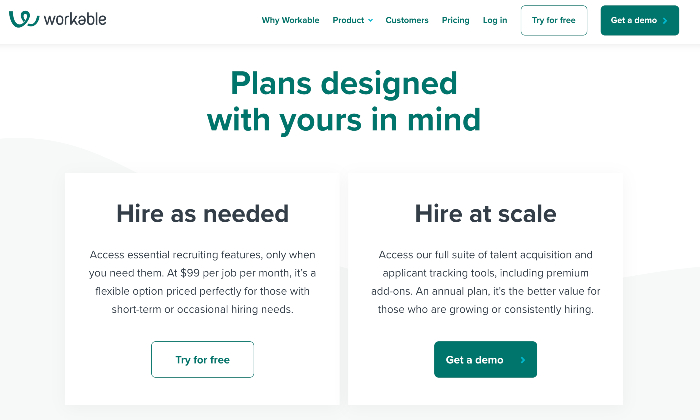

Pricing

Workable has two pricing plans: Hire As Needed and Hire At Scale. While the Hire As Needed plan costs $99 per job, per month, the Hire At Scale plan doesn’t have clear pricing.

You can also take advantage of free demos and a 15-day free trial program to test the software before committing.

Pros

- Easy-to-understand UI

- Robust integration

- Offers great email and interview templates

- Well-organized

Cons

- Not very customizable

- Search across tabs needs to be improved

- Inefficient support functionality

#5: JazzHR – The Best Applicant Tracking Software for Internal Hiring and Staffing Agencies

JazzHR can assure you seamless job requisition, interview scheduling, and other aspects of the hiring process. You can use this software for organizing and tracking all of your job openings, candidates, resumes, customers, and contacts.

This intuitive ATS tool can automate every manual process connected with hiring, allowing recruiters and HR managers to curate recruitment processes and source qualified candidates efficiently and quickly. No wonder it’s trusted by over 5000 organizations across the world!

JazzHR is an excellent option for staffing agencies and internal hiring. It has an unlimited user feature that allows businesses to bill on a per-user basis, which simultaneously eliminates any additional charges.

The software is also highly customizable. You can tailor-make a process to suit your team’s needs and preferences when it comes to recruitment and hiring.

Prominent Features

- Efficient candidate sourcing, along with employer branding facility

- Job posting and syndication

- Collaborative hiring

- Job-specific recruitment teams

- Compliance management and reporting

- Interview scheduling and other assessments

- Job offers and e-signature solutions

Pricing

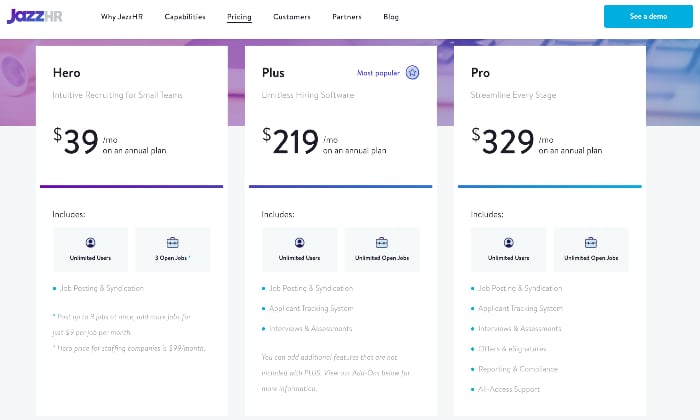

JazzHR has three plans on offer: Hero, Plus, and Pro.

At $39 per month, the Hero plan caps the maximum open jobs at three. While this might be suitable for small teams, it still doesn’t offer an applicant tracking system.

For ATS and other benefits like interviews and assessments, all-access support, and so on, we would recommend the Plus and Pro plans, which cost $219 and $329 per month, respectively,

You can also request a free demo and get a free trial for 21 days.

Pros

- User-friendly and flexible

- Job posting integration and job syndication

- Auto-reject functions for unqualified candidates

- Allows you to keep track of interview notes

Cons

- Reporting feature needs to be improved

- Lacks mobile app support

Wrapping Up

Finding the right talent is crucial – more so because employees serve as the foundation of an organization.

We hope you were able to find an ATS software that suits your companies recruitment and hiring needs from this guide.

Irrespective of your choice, an application applicant tracking software will help you select the best candidates from a talent pool of thousands of people in a surprisingly efficient manner. So, why wait? Get your ATS now.

The post Best Applicant Tracking Software appeared first on Neil Patel.