Article URL: https://jobs.ashbyhq.com/flowclub/1d5b1cf1-bf6b-474d-8328-438c90f3a8a7

Comments URL: https://news.ycombinator.com/item?id=29684770

Points: 1

# Comments: 0

Article URL: https://jobs.ashbyhq.com/flowclub/1d5b1cf1-bf6b-474d-8328-438c90f3a8a7

Comments URL: https://news.ycombinator.com/item?id=29684770

Points: 1

# Comments: 0

Max Verstappen has lost his position on the front row of the grid at the Qatar Grand Prix as a punishment for not slowing for double-waved yellow flags in qualifying.

The post Verstappen gets five-place penalty in Qatar appeared first on Buy It At A Bargain – Deals And Reviews.

Article URL: https://www.workatastartup.com/jobs/42883

Comments URL: https://news.ycombinator.com/item?id=26569914

Points: 1

# Comments: 0

The post Bentocart (YC W19) Is Hiring a Director of Biz Ops – Employee #1 appeared first on ROI Credit Builders.

Businesses have always enjoyed a comfortable position when it comes to planning and preparation.

Sadly, this isn’t the case anymore.

Due to the competitive digital landscape, business owners need to chalk out entire outlines, strategies, and implementation within weeks – or even days.

So if you can’t keep up with this accelerated pace, somebody else will.

The best way to stay ahead in the competition? Having a carefully drafted digital strategy.

Think of the whole thing as the guiding light.

Without it, companies will be stuck with their old-fashioned efforts and won’t be able to take advantage of moving online. Plus, a result-driven approach serves as the basis of digital strategy, which can be very beneficial for your company.

If you think that the ongoing pandemic has changed things, you‘re wrong.

On the contrary, experts at DMEXCO predict that 70% of executives expect the pace of digital strategy to boost further during these unique times.

So yes, you do need a comprehensive digital strategy that works for you.

And what better way to develop this other than enlisting the help of an expert digital strategy consultant who can do a broad set of activities, each of which is directed towards helping you meet your goals.

In this guide, our team at Neil Patel Digital will take you through the whole process of hiring the best consultant, along with the benefits of seeking a consultancy for your business.

Let’s begin!

What is your primary objective for launching a business?

Profit and long-term growth, right?

Well, identifying your digital strategy is the most crucial aspect for attaining both goals.

After all, it’s a high-level overview that defines and outlines where you are currently and where you would want to be. It also includes milestones set throughout a specific course of your journey, making it a reliable long-term plan.

Keeping this in mind, digital strategy consulting can help you recognize new technologies and services suitable for your platform. And hiring a consultant will make sure you‘re taking advantage of everything that’s out there and reaping the profits.

If there’s one thing that companies want, it’s consistent improvement in efficiency. Whether it’s targeting employee collaboration and performance or better delivery to customers and clients – everything counts.

You’ll be able to jumpstart your company‘s efficiency with the help of a digital strategy consultant.

You see, being an expert gives them the knowledge to use cutting-edge digital tools that can ensure precise and fast communication within your company. The data they offer will be more accessible and polished.

Plus, there’s zero risk of anything being lost or repeated due to clear and carefully designed strategies that have been optimized for efficiency.

Getting a consultant can be useful for streamlining client communication too. As a result, you can build long-lasting relationships by giving customers higher value for their investment.

Happier clients translate to higher profit margins and more referrals, so it’s only positives for your company.

Turning digital means you‘ll have several competitors – nay, several tough competitors.

Entering a digital culture means your customers do everything digitally, from transactions to information gathering to investing.

You can stay ahead in your niche industry by offering a unique product that no one else offers, but it still isn’t the endgame.

You have to go beyond your website, electronic device optimization, or implementing best SEO practices.

A consultant will guide you with the digital changes that are happening around us, equipping you with the newest technologies as they arise, and incorporating the latest market developments into your business direction.

Essentially, the expert will make your business digitally competitive right from the start and establish you as a digital leader.

You must already be on the lookout for investments that can maximize ROI – or get rid of bad investments altogether.

But this isn’t a perfect world.

You have to be careful about the decisions you make and how you run your company.

Working with a digital strategy consultant does require investment, but it’s one that has a greater possibility to pay off – in fact, some might say it’s guaranteed too if you have the right man for the job.

They give you access to a lot of crucial information and are ready to do all the hard work to provide you high value in a short period.

And not only that, you get a clear idea of the path you should take for your company to maximize your revenue and ensure success.

Moreover, having a consultant also eliminates the need for other employees, hence, cutting down costs in the long run. This will then contribute towards a boosted ROI in the end.

Partnerships with business and corporations are a necessity for long-term growth, no matter how old your business is.

In fact, you can transform your company vision and enter a new frontier in your niche if you choose your partnerships carefully. This, in turn, can relatively increase your customer base as well as present a lucrative alternative to going solo.

In other words, a consultant will point you in the right direction to become digitally competitive.

You might also receive invites from organizations that want to enter into a mutually beneficial partnership, and ultimately, achieve digital leadership.

Let’s not forget there is also a possibility of turning your competitors into partners that can increase market demand and customer base as a consequence.

Remember all the dinosaur processes that will only be you down today?

Digital transformation will help you bid farewell to all of them, as well as cut down unnecessary costs for employees, products, and services.

Since a consultant makes you more available and accessible for your customers, you’ll be able to maximize user experience, allowing you to climb to the top of your industry.

A digital strategy will lay down the stepping stones that you and your team can follow to become digital relevant.

Good digital strategy consultants have a similar style of working with the odd exceptions as they primarily focus their attention on your customer and company goals.

Before choosing a specific candidate, you need to ask yourself the following questions:

Look for a prospective consultant that can refine your understanding of the above questions further. In addition to this, you should ask to see a list of samples, references, reviews, and case studies to determine their competency.

A consultant won’t be able to create a digital strategy for your company if they don’t have an in-depth understanding of your business.

So the first thing that they do is ask you a lot of questions to gain a clear understanding of how your business functions and its objectives. For instance:

Don’t shy away or get irritated by these probing questions. After all, your digital strategy shows you your current situation, tells you where you’re going, and devises ways to help you get there.

After you answer their questions, you can expect the consultant to show you a cohesive strategy that has been tailor-made to suit your business needs.

The plan should include details about the following:

The expert will show you a proposed digital strategy or examples from previous client campaigns, and how they plan on moving forward with your campaign.

You can use this as an opportunity to evaluate the consultant’s work and skillset. Don’t be afraid to suggest specific tweaks and adjustments if you deem it fit.

Here’s what you can do:

Another alternative would be to pick a specific part of your business, such as advertising or content, and ask the consultant to build a strategy to accommodate a specific goal. This can be to increase sales for the worst-performing products, double the traffic within a month, etc.

If you’re happy with the consultant after analyzing their approach, the next step would be to provide them with necessary documents and give access to things that could help them implement the strategy effectively.

This includes an official agreement, brand content (brochures, flyers, images, logos, content), relevant photography (company photos, portraits of key people, location, office space, event photos), and social proofs.

Having your consultant create an effective digital strategy is crucial, yes. But it isn’t as important as its successful execution.

So just having a great strategy isn’t enough.

Your consultant should have the experience, expertise, and team back up to implement the strategy and produce results.

After execution, you should ask the consultant to collect, analyze, and provide you with useful insights about the launched campaigns. You can incorporate their suggestions and increase your budget to drive results, if required, as well.

Consider this: How will you be able to conclude whether you‘re on the right path without knowing the ROI?

Luckily, figuring out the right KPIs for your business can help you measure the success of a business strategy.

The following are a few KPIs that allow you to analyze the overall performance of your digital campaigns:

Your brand is necessary for building customer loyalty, creating a competitive advantage, and just… long-term survival.

It’s what distinguishes you from your direct competitors.

To properly measure brand engagement on your website, you need to consider the more refined KPIs that provide valuable metrics, such as:

Knowing where your customers come from is key to developing a powerful digital strategy since you know exactly what or who is driving visitors to your website.

For this purpose, you need to consider four main traffic sources:

Of course, you want to see a return on your investment.

However, it can be difficult to see the full potential and value of inbound marketing if you don’t have KPIs. For this purpose, consider the following formula:

ROI = (Sales growth – Marketing Investment) / Marketing Investment

Social media is an integral part of every digital strategy. If your consultant doesn’t include it, know right away that they don’t know what they’re doing.

At the same time, simply creating accounts on popular social media platforms isn’t enough for success. In this case, the KPIs are as follows:

You should check whether your landing page is sending your customer on the right path, which is why KPIs are crucial here.

The tricky part here is this metric is a little difficult to measure since the consultant may have a different goal for landing pages. Nevertheless, you can ask the expert to use Google Analytics to gain access to reports that help you measure organic traffic as well as per search traffic.

You can also make changes to your CTA, CTA buttons, revise written content, or add reviews and testimonials depending on the results generated after A/B testing.

If you’re still figuring out how to find the right digital marketing consultant for your company, take a look at our short checklist to know where to start.

Whether it’s setting short-term goals or long-term goals, the digital strategy consultant should have demonstrated knowledge about the market to think of strategies that can enhance your inbound marketing and outbound marketing efforts.

Creating a plan will always differ according to your business. For instance, some businesses require CRMs, while some need ERPs. The expert should know the right way to proceed to help you achieve your business objectives and streamline campaign processes.

We would highly recommend working with industry thought leaders who understand the digital world and have the credentials to back it up.

As mentioned before, knowledge of custom tools is important for delivering satisfactory results. More so, in the ever dynamic landscape of digital marketing.

You want to hire a consultant that uses relevant marketing techniques which include:

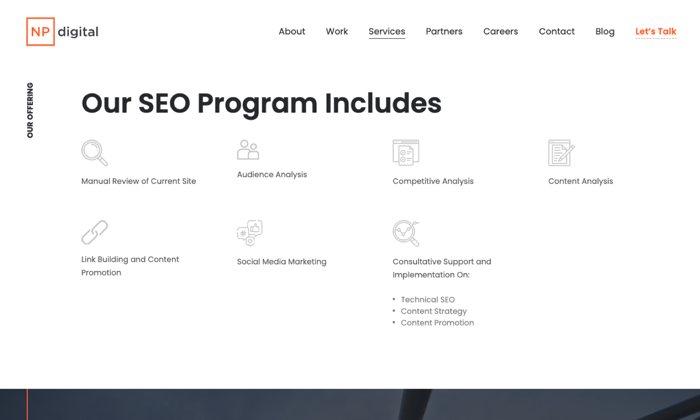

At Neil Patel Digital, for instance, we have an in-house SEO program powered by content marketing, that can be useful for enhancing the effectiveness of digital campaigns.

While it’s true that you can find several freelance digital strategy consultants, your main lookout should be to identify the extent of their experience and expertise.

Yes, they say that they can triple your conversions, but do they have the brain and muscle to back their claims?

It’s best to work with seasoned professionals who understand your current marketing strategy and can identify weak spots that require improvement.

A digital strategy expert must have expertise across several different verticals. The idea here is to make sure the professional knows the technical foundations of different things where they can use their marketing know-how and promote your offerings.

The best way to ensure this is by choosing a consultant who has worked with diverse clients. Working with a reputable digital marketing agency, for instance, will give you access to a team with several specialties that can be beneficial for your campaigns and other operations.

Now more than ever, businesses had to adjust their plans and offerings to meet customer expectations.

Digital strategies that played out over the course of years may now be over in a matter of days, which is why hiring expert help can be useful to keep up with this dynamic arena.

Having the right digital strategy consultant will ensure your company adapts smoothly to rapidly changing markets and remain ahead of your competition.

Thinking of the next steps? Get in touch with our experienced professionals here.

The post Digital Strategy Consulting appeared first on Neil Patel.

Prejudice against ‘popery’ grew out of the English Protestant tradition and took root in America.

The post Everybody Expects the Anti-Catholic Inquisition appeared first on ROI Credit Builders.

Red Balloon Security | New York, NY | Full time and Interns | Onsite | Visa welcome | Undergraduate, Masters, PhD| Rolling start dates/application deadline|redballoonsecurity.com About Us: Red Balloon Security is a venture backed startup cyber security company headquartered in New York City. Our mission is to provide embedded device manufacturers with strong host-based firmware … Continue reading New comment by RedBalloonSec in "Ask HN: Who is hiring? (July 2020)"

Tips For Learning About The Stock Market

There are many methods to start learning more about the securities market. With simply a little bit of study, it ends up being clear that there is tons of day readily available on finding out about the stock exchange.

Possibly the very first area to go when finding out regarding the supply market is the Internet. The supply market is possibly one of the largest subjects on the Internet. Of training course, when finding out regarding the supply market, you desire to be particular that all of the details you are collecting is practically appropriate.

To aid ensure that the points you are discovering regarding the supply market are proper, go to well-known websites, like ones funded by the New York Stock Exchange as well as NASDAQ. Some of the info they supply will certainly aid you in discovering regarding the supply market.

If you do not desire to invest cash getting publications on discovering regarding the supply market, document the titles of the bestsellers and also make a see to your regional collection. There will possibly be plenty much more titles on discovering regarding the supply market than the ones you brought with you.

When discovering concerning the supply market as well, be certain to inspect the social networking websites. You will certainly locate a great deal of details concerning the securities market and also individual money at locations like YouTube, Facebook, as well as Twitter.

Whether you are finding out about the stock exchange as a college job or since you believe that you could be thinking about spending, you will certainly discover lots of valuable details is readily available. The securities market mores than 2 a century old as well as individuals have actually been taping details concerning it because it started.

When discovering concerning the supply market is a supply market time line, one of the points you could discover handy. There are a selection of these plan readily available. They have an on-going document of one of the most essential occasions in the background of the stock exchange considering that it started to existing day.

It would possibly be an excellent suggestion to tighten your search, also originally, to ensure that you do not come to be also swamped with info. When learning more about the securities market, you might intend to approach it one topic each time based upon what details most rate of interests you or what details you require to establish.

Whatever your factor, I make certain that you will certainly locate learning more about the stock exchange to be a tough and also satisfying job.

Possibly the initial location to go when finding out regarding the supply market is the Internet. Of program, when finding out regarding the supply market, you desire to be specific that all of the details you are collecting is practically appropriate. To aid assure that the points you are discovering regarding the supply market are right, go to well-known websites, like ones funded by the New York Stock Exchange as well as NASDAQ. Some of the info they offer will certainly aid you in finding out concerning the supply market.

One of the points you could locate practical when discovering regarding the supply market is a supply market time line.

The post Tips For Learning About The Stock Market appeared first on ROI Credit Builders.

As a general rule, if something seems too good to be true, it is. Kabbage offers fast, flexible financing. Approval is easy to obtain, and in most cases, you can have funds in just a few minutes. In addition, their minimum eligibility requirements are much easier to meet than some others. Wondering if Kabbage is right for you? Our in-depth Kabbage review can answer that.

Kabbage is one of several lending companies online. It provides small business funding in the form of a line of credit. Now, I reveal the details about this online lending option in my in-depth Kabbage review.

Kabbage is a venture funded company that is backed by investors which include SoftBank Capital, Thomvest Ventures, Reverence Capital Partners, Mohr Davidow Ventures, the UPS Strategic Enterprise Fund, ING, BlueRun Ventures, Santander InnoVentures, Scotiabank, and TCW/Craton.

The company offers perks for its customers. These include specials from Dun & Bradstreet, UPS, Vonage, and Adobe Creative Cloud among others.

Find out why so many companies use our proven methods to get business loans.

First, they offer lines of credit. This means it is revolving credit you can use as needed. For most, amounts of up to $250,000 are available. You can qualify in as little as 10 minutes. Furthermore, terms are 6, 12, or 18 months. You have to be in business for more than one year, and your business revenue has to be $50,000 annually or $4200 per month over the last 3 months.

In the course of this Kabbage review, I could not find anything concrete about a credit score requirement or credit reporting. I did find other reviewers that had contradicting information. For example, one claimed there was no minimum interest rate requirement. In contrast, another claimed that the minimum interest rate for application approval is 500. Another put the minimum at 560. Whatever the case, it appears that their minimum required credit score is much lower than others in the field. In addition, one reviewer stated that they do not report on-time payments to the credit agencies, but they may report late or missed payments.

The only thing concrete I could find from Kabbage themselves is that they do a one-time hard credit pull. A hard credit check will affect your credit score. Also I found this information in the FAQs on the Kabbage website. It wasn’t just out there on a top page.

Kabbage links to your bank or merchant accounts to understand your cash flow and decide what amount you can afford to borrow. Their lines of credit range from $1,000 to $250,000.

For lines of credit up to $200,000, if they are able to automatically get business information and verify your bank account, they can approve a loan in minutes. Amounts over $200,000 must have a manual review. Sometimes, mistakes happen during the sign-up process. Also, they may send small deposits to help confirm your banking information for security purposes. In these cases, it may take longer to get access to funds.

Once everything is settled, they send funds to the account of your choice. If you choose to have your funds deposited to a PayPal account, it takes just a few minutes. However, loans that go to a business checking account can take up to three days to be deposited. It just depends on your bank.

They retain access to your account. This means they can review your revenue faster than other lenders. Still, it also means they have access to your account for the duration and beyond unless you take action.

If you make a draw using the dashboard or app, you have to take a minimum of $500. In contrast, if you use your Kabbage card there is no minimum draw.

Kabbage uses a monthly fee model rather than an annual percentage rate. Fees range from 1.5 – 10%. This sounds fabulous, of course, but you need to look a little closer. First, the fee amount is based on business performance factors. This is similar to how traditional lenders assign interest rates, so not really a big deal.

The problem comes in with how the fee is actually applied. They are forthright about this on their site, but you do have to dig around and do some research to fully understand it. They offer a calculator to help you. Use it. I gave it a shot, and according to the calculator on the Kabbage website, a $30,000 loan paid out over 6-months at a 3% fee would result in a total of $33,300 total being paid back. If you do the math on that, you are paying back an effective 11% interest rate, if it were interest and not a fee.

Three percent of $30,000 is $900. You pay that $900 fee each month for the first two months, and the $375 per month for months 3-6. While I could not find an explanation on the reduction in fee over the last 4-months, it could have to do with the reduction in principal. The issue is, you end up paying way more in fees than it may appear until you dig a little deeper. With fees going up to 10%, it is imperative that you use the calculator to get a true understanding of loan cost on the front end.

Here is how Kabbage explains it on their site:

“Kabbage’s maximum rate for each month is 10%. Third party partners may occasionally charge up to an additional 1.5% for each month. Every month you’ll pay back 1/6 of the total loan (for 6 month loans), 1/12 of the loan amount (for 12 month loans), or 1/18 of the total loan (for 18 month loans) plus the monthly fee. Your actual fee rate if qualified is based on a review of your revenue and credit history. For more details, read about our Rates & Terms.”

Find out why so many companies use our proven methods to get business loans.

The short answer is no. They state that they do not extend credit to those businesses dealing in “marijuana, CBD, firearms, gambling, financial institutions, lending or non-profit organizations.” However, there is a footnote on firearms that states only specific businesses dealing in firearms are excluded. Consequently, some firearms dealers are eligible. If this is you, be sure to do your due diligence.

I never write reviews without checking out the reviews of others. Consequently, this Kabbage review is no different. I find it wise to start at the Better Business Bureau. Kabbage has an impeccable BBB file. They have been accredited since 2014. In addition, they have an A+ rating. Also, there are over 180 reviews and they are overwhelmingly positive. As a result, they have a rating of 4.5 stars. Most of the positive reviews were noting how fabulous customer service is.

The one negative review I found, though I admittedly stuck to the ones in the most recent year, was related to the person not fully reading the information on the website or asking questions. There are 49 complaints on their BBB file, which are separate from reviews. With complaints, Kabbage can respond. From what I can see, they responded each time and either made the situation right, or they answered the issue with how the customer simply did not understand the process as it was clearly written on the website.

In addition to the BBB, I looked at other review sites when conducting my Kabbage review. Other sites had more negative information. Virtually all of the negative reviews were related to either unexpectedly high payments, credit inquiries, or bank account access. It appears that, due to ongoing account access, they can draft payments from your account. While they do disclose this, it seems a lot of borrowers miss it. As you can imagine, this results in some overdrawn bank accounts.

My final opinion after my Kabbage review is, they will do in a pinch but try to find something better first. It appears that they truly stand by what they do and offer a legitimate product. They do not lie about anything or misrepresent themselves in any way.

However, the fee model is confusing even to those that work with finances every day, like me. It could be seen as a ploy to make it appear that interest rates are 1.5% to 10%, when in fact there is no actual interest rate, and the fees are much higher than it sounds. The information is all there, but you do have to look for it.

I highly recommend, if you choose to take out a line of credit with Kabbage, you do complete and thorough research. Read through positive and negative reviews on the BBB and on other sites, and read all of the FAQs on the Kabbage website, along with the footnotes.

That’s the million-dollar question isn’t it? Most people use a service like Kabbage because it is easier to get approval with a poor credit score. My Kabbage review convinced me that if you can get funding that costs less, you should. To do this, you need to increase fundability. The truth is, your credit, both business and personal, are only a small piece of the complete fundability of your business.

Find out why so many companies use our proven methods to get business loans.

At its core, fundability is the ability to get funding for your business. When a lender considers lending to your business, do they feel that you are high risk? Do you appear to be a business that can and will pay back the debt? Lenders are in it for the money, and they need to feel they will get a return on their investment. Truly, a high credit risk is not a wise lending choice.

The harder question is how does a business increase their fundability? What makes this answer difficult is that there is so much the answer must cover. As I mentioned, a great business credit score is important. However, there is a lot more to it.

A potential creditor needs to see that your business is legitimate and profitable. Many loan applications are denied approval due to fraud concerns. Others, simply because something didn’t match up and threw up a red flag. Maybe the addresses or phone numbers didn’t match on a couple of reports and it just looks unprofessional.

It has to be set up to appear to be a fundable entity separate from you, the owner. How do you accomplish this? Make sure your business has a fundable foundation. The building blocks of a fundable foundation include:

In addition to a fundable foundation, the following factors affect fundability.

The next piece of the fundability puzzle after the fundable foundation is your business credit report. That is the credit report, much like your consumer credit report, that details the credit history of your business. It is a tool to help lenders determine how credit worthy your business is.

Where do business credit reports come from? There are a lot of different places, but the main ones are Dun & Bradstreet, Experian, Equifax, and FICO SBSS. Since you have no way of knowing which one your lender will choose, you need to make sure all of these reports are up to date and accurate.

In addition to the business credit reporting agencies that directly calculate and issue credit reports, there are other business data agencies that affect those reports indirectly. Two examples of this are LexisNexis and The Small Business Finance Exchange. These two agencies gather data from a variety of sources, including public records. This means they could even have access to information relating to automobile accidents and liens. While you may not be able to access or change the data the agencies have on your business, you can ensure that any new information they receive is positive. Enough positive information can help counteract any negative information from the past.

In addition to the EIN, there are identifying numbers that go along with your business credit reports. When considering what is fundability, you need to be aware that these numbers exist. Some of them are simply assigned by the agency, like the Experian BIN. One, however, you have to apply to get. It is absolutely necessary that you do this.

Dun & Bradstreet is the largest and most commonly used business credit reporting agency. Every credit file in their database has a D-U-N-S number. To get a D-U-N-S number, you have to apply for one through the D&B website.

Your credit history has everything to do with everything related to your credit score. This is a huge factor in the fundability of your business.

Your credit history consists of a number of things including:

The more accounts you have reporting on-time payments, the stronger your credit score will be.

On the surface, it seems obvious that all of your business information should be the same across the board everywhere you use it. However, when you start changing things up like adding a business phone number and address or incorporating, you may find that some things slip through the cracks.

The key to this piece of the business fundability is to monitor your reports frequently.

This encompasses a broad spectrum of things. First, there is the obvious. Both your personal and business tax returns need to be in order. Not only that, but you need to be paying your taxes, both business and personal. However, there is yet another layer.

It is best to have an accounting professional prepare regular financial statements for your business. Having an accountant’s name on financial statements lends credence to the legitimacy of your business. If you cannot afford this monthly or quarterly, at least have professional statements prepared annually. Then, they are ready whenever you need to apply for a loan.

Often tax returns for the previous three years will suffice. Get a tax professional to prepare them. This is the bare minimum you will need. Other information lenders may ask for include check stubs and bank statements, among other things.

There are several other agencies that hold information related to your personal finances that you need to know about. Everyone knows about FICO. Your personal FICO score needs to be as strong as possible. It really can affect business fundability and almost all traditional lenders will look at personal credit in addition to business credit.

In addition to FICO reporting personal credit, you have ChexSystems. In the simplest terms, this keeps up with bad check activity and makes a difference when it comes to your bank score. If you have too many bad checks, you will not be able to open a bank account. That will cause serious fundability issues.

Your personal credit score from Experian, Equifax, and Transunion all make a difference. You have to have your personal credit in order because it will definitely affect the fundability of your business. If it isn’t great right now, get to work on it. The number one way to get a strong personal credit score or improve a weak one is to make payments consistently on time.

So much plays into this that you may not even think about. First, consider the timing of the application. Is your business currently fundable? If not, do some work first to increase fundability. Next, ensure that your business name, business address, and ownership status are all verifiable. Lenders, even Kabbage, will look into it. Lastly, make sure you choose the right lending product for your business and your needs. Do you need a traditional loan or a line of credit? Would a working capital loan or expansion loan work best for your needs? Choosing the right product to apply for can make all the difference.

If you have no other options and you are desperate, Kabbage can help you out in a pinch. However, you must be sure you know what you are getting into. If you qualify for a good rate with them, you likely qualify for a loan that does not cost as much somewhere else. If your fundability is not up to par, get started working on that now. Start by doing an analysis of fundability and go from there.

The post Is It Too Good to Be True? An In-Depth Kabbage Review appeared first on Credit Suite.

Just how To Plan For Raising Capital With Investors?

In preparing for an effective financing project, you have to reveal your financial investment possibility to sufficient financiers.

The Kugarand Theory of Investing states that for each …

1 financier that spends,

3 state they will certainly spend, as well as

15 capitalists were subjected to your financial investment chance to reach the 3 to reach the one Investor that really spends.

If your firm is increasing $1 million bucks as well as has a minimal financial investment of $25,000, after that your business is looking for 40 financiers,

($ 1,000,000/ $25,000 = 40). For your business to obtain the 40 capitalists to spend, you will certainly require to direct exposure 600 capitalists to your financial investment chance,

( 40 x 15 = 600 financiers).

Learn the amount of capitalists you will certainly require to subject to your chance utilizing this formula.

A = How much cash are you increasing?

B = What is your minimal financial investment quantity?

A/B = C.

C = Number of financial investments required.

C * 15 = Number of capitalists that require to be subjected to your financial investment chance.

Since you recognize precisely the amount of financiers require to be subjected to your financial investment chance, you can intend appropriately.

Capitalist connection projects subject, advertise and also create financial investment possibilities to financiers with calculated preparation of your business’s financial investment chance. Tasks to acquire direct exposure consist of:.

– Participation in capitalist occasions.

– Customized financier occasions.

– Press launches as well as promo.

– Direct mail projects to capitalists.

– Email advertising and marketing projects to capitalists.

– Investor call.

– Web advertising.

– Investor passion write-ups.

– Public on-line financial investment sites.

– Private safe and secure on-line financial investment websites with private financial investment details and also due persistance records.

Capitalist connections project need to consist of the following:.

– Simplified approach to connect chance to capitalists so they will certainly put in the time to find out adequate concerning the possibility to be attracted to spend even more time in finding out more.

– Combination of team discussions and also face to face financier conferences to give a possibility for the customer to “inform their tale”.

– Passive advertising to the passion locations of the financier area via e-mail, news release, as well as meeting on radio as well as TELEVISION programs.

– Direct Mail to get to those financiers that do not react to various other ways of interaction, targeted based upon location as well as market choice.

– System to record financier passion as well as react appropriately.

– Ongoing interaction technique to connect updates to capitalists so they can see the development as well as relocate a semi-interested capitalist to a determined as well as interested financier.

– A central factor of info to ensure that despite exactly how the capitalist initially comes across the chance they have a resource of info they can most likely to.

Find out more at www.launchfn.com.

The post Just how To Plan For Raising Capital With Investors? appeared first on ROI Credit Builders.