The Different Type Of Corporate Structures and Business Entities;

(DBA)= Doing Business As – Usually owned and operated by an individual or group. The Individual or group is 100% personally liable for all actions, taxes, debts, and suits that may occur during the course of conducting business in this manner.

(S-Corp)= Sub-chapter Corporation – Fill out IRS tax form 1244 declaring one individual as the majority shareholder of the company, and assumes the percentage of stock ownership liability.

(LLC)= Limited Liability Company – Limits the liability of an individual or group based on the percentage amount of membership certificates owned in the company.

(C-Corp)= Closed Corporation – Closed Corporation, privately owned and privately held in it’s company stock. The stock of the company may or may not be public record, depending on the venue chosen. Therefore, your ownership of stock, may or may not be disclosed of ownership, depending on the venue chosen.

(NP)= Non-Profit or Not For Profit – Fill out IRS form 501,(c),(3) to become a registered non-profit organization. (or) A Corporate entity that has registered all the legal filings within it’s legal domicile State, but has not issued any of the shares of it’s stock could be considered a not-for-profit-company.

(PC)= Professional Corporation – A group of legal professionals, such as doctors, lawyers, cpa’s, etc…that form an entity to conduct business together as a group or organization.

(LLP)= Limited Liability Partnership – A formed partnership under a corporate structure and agreement divided by membership percentages of ownership.

(PA)= Partnership Agreement – It doesn’t necessarily have to be formed under a corporate structure, but utilizes a partnership contractual operating agreement to designate the role, profit split and liability issues of the business venture.

(LWT)= Living Will Trust =………………………***(Revealed in advance training classes only)

(FT)= Family Trust =………………………………..***(Revealed in advance training classes only)

(CT)= Corporate Trust =……………………………***(Revealed in advance training classes only)

(LT)=Land Trust =……………………………………***(Revealed in advance training classes only)

Debt follows Tax ID or SSN?………………………***(Revealed in advance training classes only)

Piercing the corporate veil?………………………..***(Revealed in advance training classes only)

Why is having a paper trail so important?……***(Revealed in advance training classes only)

To be continued…………..so sign up below NOW, before all the spaces are filled!!!

Your Business Structure Matters!!!

Sign up for our management training special workshop and find out how to maximize this structural formula.

What you will learn?

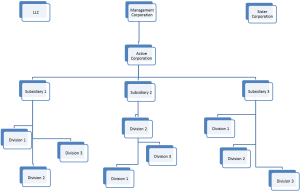

A standard corporate structure consists of various departments that contribute to the company’s overall mission and goals. Common departments include Marketing, Finance, Accounting, Human Resource, and IT. These five divisions represent the major departments within a publicly traded company, though there are often smaller departments within autonomous firms. There is typically a CEO, and Board of Directors composed of the directors of each department. There are also company presidents, vice presidents, and CFOs. There is a great diversity in corporate forms as enterprises may range from single company to multi-corporate conglomerate.[1] The four main corporate structures are Functional, Divisional, Geographic, and the Matrix. Realistically, most corporations tend to have a “hybrid” structure, which is a combination of different models with one dominant strategy.

Importance[edit]

The kind of differentiation and diversity among corporations is of importance to corporate law (for example such difference in corporation type that has impact on corporate structure is the difference between public owned and proprietary companies).[1] Choosing a structure for a company is an important decision and must be strategically thought out because it could either aid or harm the making of business. The structure must also be a good fit for the type of activities, goals, and vision of the company. [3] The organizational structure is a reflection of how convenient business is conducted.

Models[edit]

Functional structure[edit]

This model is commonly used in single-program organizations. It is basically the standard structure mentioned earlier, which is organized around departments. This structure is most appropriate for small organizations.

Divisional structure[edit]

Divisional structures are also called product structures because they are based on a certain product or project. This structure is most common in multi-service organizations. Normally, It based on the departments divided in the firm.

Geographic structure[edit]

Geographic structures are used in multi-site organizations and are frequently used by networks across different geographic areas.

Matrix structure[edit]

The Matrix structure is probably the most complicated model of them all because it is organized around multiple dimensions (e.g. geography and product), typically with more than one supervisor. This structure is commonly used in very large organizations because a greater volume requires greater co-ordination. However, this structure is very difficult to manage so it is usually better to reconsider its use and replace it with a different type of structure, then compensate for the tradeoffs.

Classifications[edit]

In addition to those models, there are other factors that make up the structure of an organization. Depending on the chain of command, a company’s structure could be classified as either vertical or horizontal, as well as centralized or decentralized. A vertically structured organization or a “tall” company describes a chain of management, usually with a CEO at the top delegating authority to lower-level managers through mid-level managers. Horizontal or “flat” companies, however, have almost no middle-managers, which implies that high-level managers get involved in daily tasks and interact with customers and front-line personnel. [4] A centralized organizational structure describes how a company’s direction and decisions are set by one individual only. [5] Centralization compliments companies with “tall” structures to create Bureaucratic organizations. Decentralized organizational structures allow individuals some autonomy at each level of the business, because they join the decision-making process. Evidently, classifying organizations as centralized or decentralized is linked to them being “tall” or “flat”.

Technology[edit]

There is an emerging trend in the way companies shape their organizational structures. More businesses are moving towards a much flatter, decentralized organizational structure. Frank Ostroff’s “The Horizontal Organization”, supports this new trend and asserts that as globalization persists, companies will become more horizontal. Technological developments accelerate these organizational changes as they improve the efficiency of business, causing it to restructure departments, modify position requirements, or add and remove jobs. [6]

References[edit]

- ^ Jump up to:a b Roman Tomasic, Stephen Bottomley, Rob McQueen, Corporation Law in Australia, Federation Press, 2002, pp.167-173

- Jump up^ “Designing an Effective Organization Structure” (PDF). Bain & Company organizational toolkit and Bridgespan analysis. Retrieved 1 April 2014.

- Jump up^ “Organizational Structure: An Overview”. Community Tool Box. Retrieved 1 April 2014.

- Jump up^ Huebsch, Russell. “The Vertical Structure Vs. the Horizontal Structure in an Organization”. Demand Media. Retrieved 1 April 2014.

- Jump up^ Vitez, Osmond. “Organizational Structure”. Demand Media. Retrieved 1 April 2014.

- Jump up^ Archer, Clare. “Technology’s Impact on Organizational Changes”. Demand Media. Retrieved 1 April 2014.

- ****(Ref. From Wikipedia, the free encyclopedia)

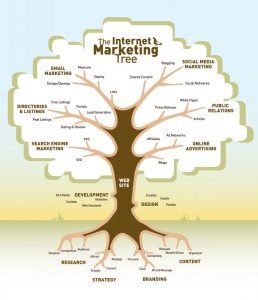

As a bonus, all management associates that sign up early will be able to attend the extra training workshop on the Internet Marketing Family Tree.

This training will surely provide you with the edge to stay one step above the competition. You really don’t want to miss it.

We have even invited one of our leading budget analysis team member as a special guess speaker in the bonus training workshop.

So sign up now for our 05 weeks management training special workshop, as spaces are limited…..