Article URL: https://mino-games.workable.com/j/69BCF95C8F?viewed=true

Comments URL: https://news.ycombinator.com/item?id=20348327

Points: 1

# Comments: 0

Article URL: https://mino-games.workable.com/j/69BCF95C8F?viewed=true

Comments URL: https://news.ycombinator.com/item?id=20348327

Points: 1

# Comments: 0

Article URL: https://angel.co/company/curebase/jobs/531567-account-executive

Comments URL: https://news.ycombinator.com/item?id=20350305

Points: 1

# Comments: 0

A new business in Idaho is in reach. Have you been wondering: just how do I start a business in Idaho? And more importantly, can I do so no matter what the economic conditions are? Can I start a new business in Idaho during a recession?

Business Insider put Idaho in the middle set of ten states to start a new business in, per a 2016 article. And this is for the whole nation. But its per capita GDP damages its position on the list. The education level and the availability of employees are both on the low end, too. But the state has the third cheapest cost of living. It also has the sixth best opportunity share of new entrepreneurs in the country.

In a 2018 article, Forbes put Idaho at its somewhat covet-worthy 14th spot. But also in 2018, Fit Small Business put Idaho at number 24.

Keep in mind, naturally, the three sites have differing methodologies.

Forbes gives Idaho high praise for its economic climate and regulatory environment. The state also does well when it comes to growth prospects, with above an average labor supply.

Fit Small Business does give Idaho high marks for access to capital (sixth in the nation). Cost of living and quality of life also rank well. But it’s below average for labor market, a measure of location desirability and percent of people with bachelor’s degrees. Hence there may be workers available, but they won’t do so well in more technical disciplines (unless you are willing to pay for continuing education). Plus they ranked Idaho dead last for startup activity.

If you’re starting a trucking business in particular, Idaho could be right up your alley.

For sole proprietors not wishing to have their business’s name be the same as their own, a DBA (“Doing Business As”) status makes a lot of sense. In Idaho, it is called an assumed business name. The proper forms are with the Idaho Secretary of State website.

According to Idaho Commerce, the biggest industries in Idaho are aerospace, recreation technology, and energy. More top Idaho industries are advanced manufacturing, and computer technology and innovation. Also, these are top industries in Idaho: shared services, food production, and travel.

Smart business owners can take advantage of the bigger industries in the area by offering goods or services such as trucking for any industry. They can also offer catering, hospitality, and transportation. Another option is computer services and repairs. Yet another idea is technological innovations, among others.

Here is exactly how to start a new business in Idaho.

Business names in Idaho must have a registration with the Idaho Secretary of State. Find and download the application to reserve a corporate name online at Reserve ab Idaho Corporate Name on the Idaho Secretary of State website. There is a $20.00 filing fee to reserve a corporate name. A business owner must submit the name reservation application form to the office of the Secretary of State in Boise.

There are special naming requirements for Idaho corporations. To incorporate a small business in the state of Idaho, the corporate name that a business owner chooses must include the word “corporation,” “incorporated,” “limited,” “company”. Or it can include an abbreviation of any one of these words.

A website run by the state, called Idaho Biz Help offers a “Business Wizard”. It has a quiz to help you determine which licenses you need.

Idaho Biz Help also keeps a directory of all the Idaho City and Idaho County Clerk or Recorder offices.

Information and forms are with the Idaho Secretary of State.

A vital part of preparing to incorporate a small business in the state of Idaho is choosing a registered agent for the corporation. A company’s registered agent acts as an agent for service of process. They will also be responsible for receiving legal and tax documents for the corporation. A business owner may want to look into using the registered agent services of a corporate service company.

There are various corporate service companies which provide registered agent services for a fee. Go to Idaho Corporate Register Agent on the Idaho Secretary of State website to find more information about companies that provide registered agent services.

Idaho Biz Help also has information about taxes. You must register with the State Tax Commission.

Alliance does not offer virtual office space in Idaho, not even in Boise.

Regus, however, has Idaho virtual business offices in Boise, Nampa, and Meridien.

For other areas of the state, business owners might want to seek out local business owners. Or they could possibly try computer user groups to get help in this area.

Another option may be to seek virtual business office space in neighboring states. These are Montana, Nevada, Oregon, Utah, Washington, and Wyoming.

Business credit is credit in a business’s name. It doesn’t attach to a business owner’s personal credit, not even if the owner is a sole proprietor and the solitary employee of the business.

Thus, an entrepreneur’s business and individual credit scores can be very different.

Because small business credit is distinct from personal, it helps to secure an entrepreneur’s personal assets, in case of court action or business bankruptcy.

Also, with two separate credit scores, a small business owner can get two separate cards from the same vendor. This effectively doubles purchasing power.

Another advantage is that even startups can do this. Visiting a bank for a business loan can be a formula for frustration. But building company credit, when done right, is a plan for success.

Consumer credit scores depend on payments but also other factors like credit use percentages.

But for small business credit, the scores actually only depend on if a business pays its bills promptly.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN.

Building business credit is a process, and it does not happen without effort. A company must proactively work to establish company credit.

That being said, it can be done readily and quickly, and it is much swifter than establishing personal credit scores.

Vendors are a big aspect of this process.

Carrying out the steps out of order will cause repetitive rejections. No one can start at the top with small business credit. For instance, you can’t start with retail or cash credit from your bank. If you do, you’ll get a denial 100% of the time.

A company has to be fundable to loan providers and merchants.

Hence, a company will need a professional-looking website and email address. And it needs to have website hosting bought from a company like GoDaddy.

And, company phone and fax numbers should have a listing on 411.com.

In addition, the business phone number should be toll-free (800 exchange or similar).

A business will also need a bank account devoted only to it, and it has to have every one of the licenses essential for operating.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN.

Visit the IRS website and acquire an EIN for the company. They’re free of charge. Select a business entity such as corporation, LLC, etc.

A business can begin as a sole proprietor. But they will most likely wish to switch to a kind of corporation or an LLC.

This is in order to decrease risk. And it will make best use of tax benefits.

A business entity will matter when it concerns taxes and liability in the event of a lawsuit. A sole proprietorship means the owner is it when it comes to liability and tax obligations. Nobody else is responsible.

If you run a business as a sole proprietor, then at the very least be sure to file for a DBA. This is ‘doing business as’ status.

If you do not, then your personal name is the same as the company name. Consequently, you can wind up being directly responsible for all small business financial obligations.

In addition, according to the Internal Revenue Service, using this structure there is a 1 in 7 chance of an IRS audit. There is a 1 in 50 probability for corporations! Prevent confusion and dramatically decrease the chances of an Internal Revenue Service audit at the same time.

Start at the D&B website and get a free D-U-N-S number. A D-U-N-S number is how D&B gets a company in their system, to generate a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s web sites for the business. You can do this at www.creditsuite.com/reports. If there is a record with them, check it for accuracy and completeness. If there are no records with them, go to the next step in the process.

This way, Experian and Equifax will have something to report on.

First you ought to establish trade lines that report. This is also known as the vendor credit tier. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can begin to get credit in the retail and cash credit tiers.

These types of accounts have the tendency to be for the things bought all the time, like marketing materials, shipping boxes, outdoor work wear, ink and toner, and office furniture.

But to start with, what is trade credit? These trade lines are credit issuers who will give you starter credit when you have none now. Terms are commonly Net 30, versus revolving.

Therefore, if you get approval for $1,000 in vendor credit and use all of it, you need to pay that money back in a set term, such as within 30 days on a Net 30 account.

Net 30 accounts need to be paid in full within 30 days. 60 accounts must be paid fully within 60 days. Compared to with revolving accounts, you have a set time when you have to pay back what you borrowed or the credit you used.

To kick off your business credit profile the proper way, you need to get approval for vendor accounts that report to the business credit reporting bureaus. When that’s done, you can then use the credit.

Then repay what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Not every vendor can help like true starter credit can. These are vendors that will grant an approval with hardly any effort. You also need them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

You want 5 to 8 of these to move onto the next step, which is the retail credit tier. But you may need to apply more than once to these vendors. So, this is to verify you are reliable and will pay on time.

Once there are 5 to 8 or more vendor trade accounts reporting to at least one of the CRAs, then move onto the retail credit tier. These are companies like Office Depot and Staples.

Only use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, use the business’s EIN on these credit applications.

One good example is Lowe’s. They report to D&B, Equifax and Business Experian. They need to see a D-U-N-S and a PAYDEX score of 78 or better.

Are there 8 to 10 accounts reporting? Then move onto the fleet credit tier. These are service providers like BP and Conoco. Use this credit to buy fuel, and to repair, and maintain vehicles. Only use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, make certain to apply using the small business’s EIN.

One such example is Shell. They report to D&B and Business Experian. They want to see a PAYDEX Score of 78 or more and a 411 company telephone listing.

Shell might say they want a specific amount of time in business or revenue. But if you already have adequate vendor accounts, that won’t be necessary. And you can still get approval.

Learn more here and get started toward building business credit attached to your company’s EIN and not your SSN.

Have you been sensibly handling the credit you’ve gotten up to this point? Then move to the cash credit tier. These are businesses like Visa and MasterCard. Only use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, use your EIN instead.

One such example is the Fuelman MasterCard. They report to D&B and Equifax Business. They need to see a PAYDEX Score of 78 or more. And they also want you to have 10 trade lines reporting on your D&B report.

Plus, they want to see a $10,000 high credit limit reporting on your D&B report (other account reporting).

Also, they want you to have an established business.

These are businesses like Walmart and Dell, and also Home Depot, BP, and Racetrac. These are usually MasterCard credit cards. If you have 14 trade accounts reporting, then these are attainable.

Know what is happening with your credit. Make sure it is being reported and attend to any mistakes ASAP. Get in the habit of checking credit reports and digging into the specifics, and not just the scores.

We can help you monitor business credit at Experian and D&B for only $24/month. See: www.creditsuite.com/monitoring.

Update the data if there are inaccuracies or the info is incomplete.

So, what’s all this monitoring for? It’s to challenge any errors in your records. Errors in your credit report(s) can be fixed. But the CRAs usually want you to dispute in a particular way.

Disputing credit report errors normally means you send a paper letter with duplicates of any proofs of payment with it. These are documents like receipts and cancelled checks. Never mail the originals. Always send copies and keep the originals.

Fixing credit report mistakes also means you specifically detail any charges you contest. Make your dispute letter as crystal clear as possible. Be specific about the problems with your report. Use certified mail so that you will have proof that you sent in your dispute.

Always use credit sensibly! Don’t borrow more than what you can pay off. Track balances and deadlines for repayments. Paying off punctually and in full will do more to raise business credit scores than just about anything else.

Building business credit pays off. Great business credit scores help a company get loans. Your loan provider knows the small business can pay its financial obligations. They understand the business is for real.

The company’s EIN connects to high scores and loan providers won’t feel the need to call for a personal guarantee.

Business credit is an asset which can help your company in years to come.

Learn more here and get started toward opening a new business in Idaho.

Want to start a new business someplace else in America? Then check out our handy guide to starting a business in any state in the country.

The post How to Set Up a New Business in Idaho appeared first on Credit Suite.

Are the Colts being aggressive enough? Can the Jaguars and Titans make up ground? We address the biggest AFC South questions.

Content marketing is not just the most effective forms of online promotion that you can take part in, it’s the foundation of pretty much any other form of digital marketing. It remains stable over time, can be timely or evergreen, is easy to entice traffic with, and is perfect for boosting your SEO. What… Read more »

The post 5 Tools to Bring Your Content Marketing to the Next Level appeared first on Paper.li blog.

They say there are over 200 ranking factors in Google’s algorithm.

But are you going to take the time to optimize your site for each and every single one of them?

Well, you should… but you probably won’t.

See, SEO has changed… it used to be that you could do a handful of things and rank well. Sadly, those days are gone.

Now you have to do every little thing and do it well to dominate Google.

So, I decided to make your job easier and release yet another new feature in Ubersuggest that audits your website for you in less than 3 minutes.

It’s called SEO Analyzer.

If you want to find out what’s wrong with your website, you won’t have to do it manually anymore.

All you have to do is head over to the SEO Analyzer and put in your URL.

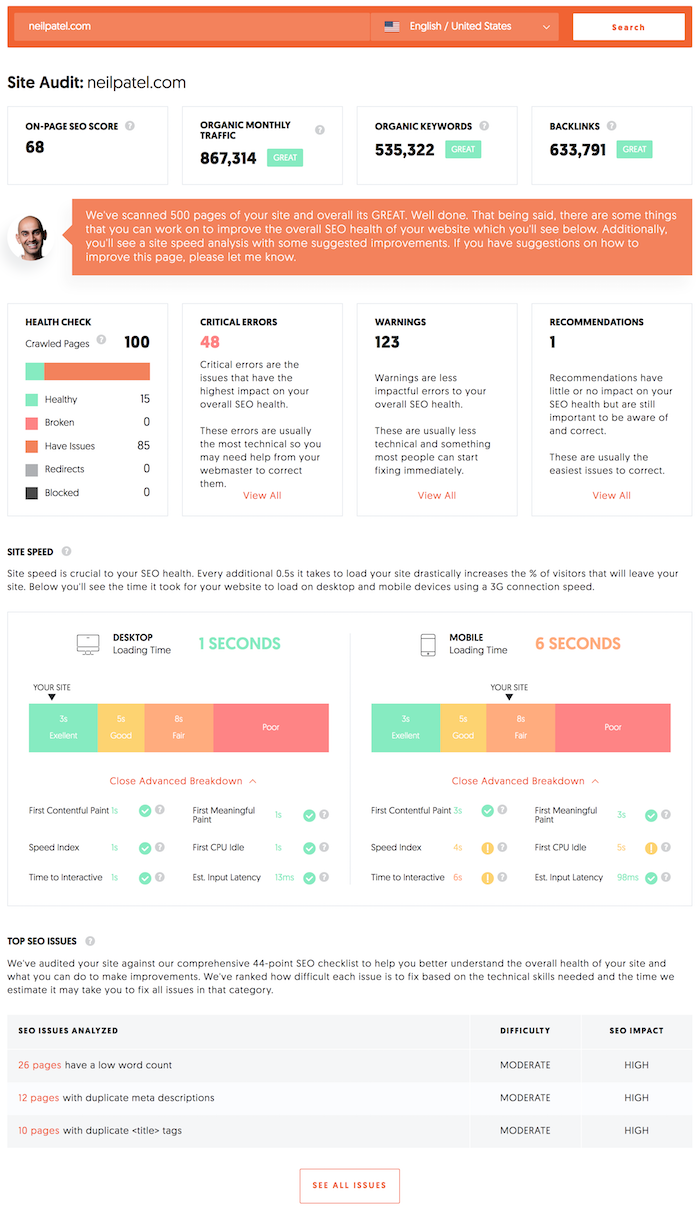

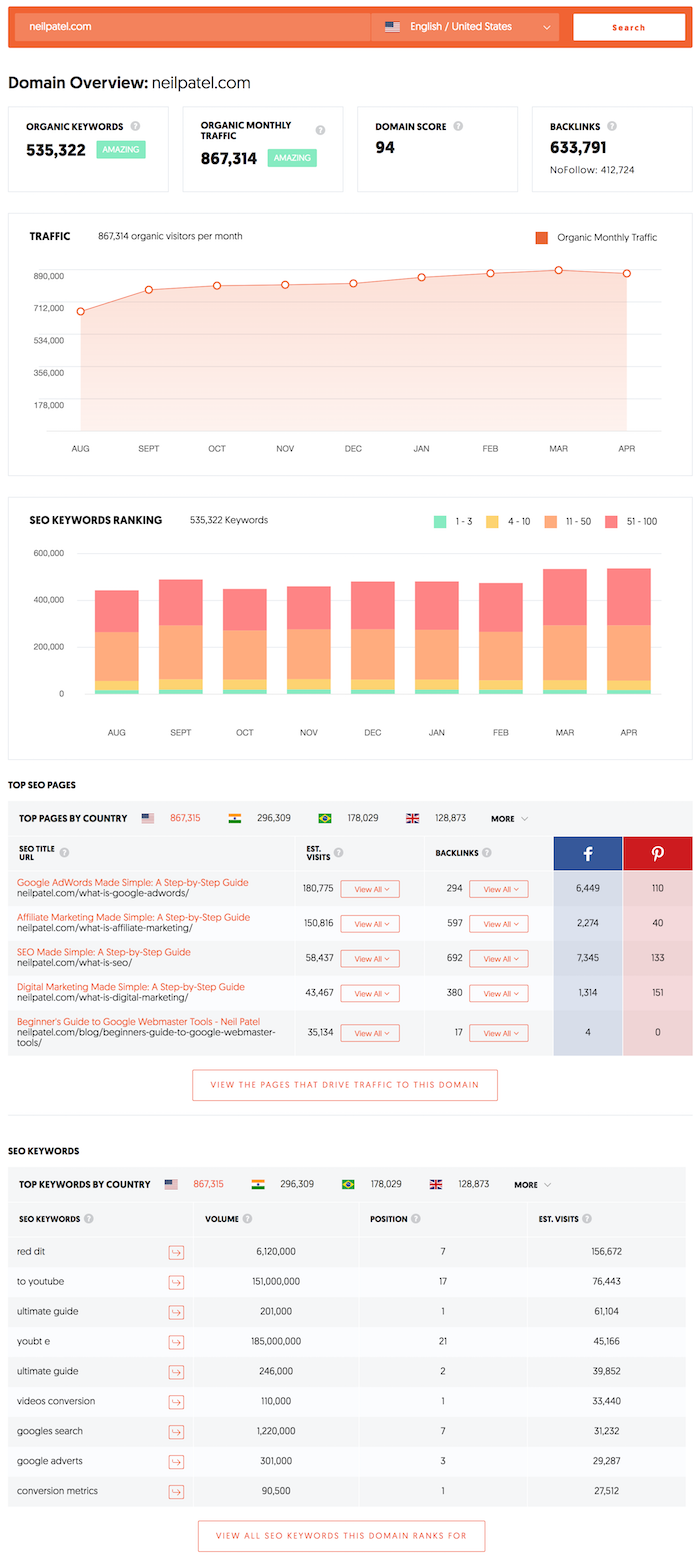

Once you put in your URL, you’ll be taken to a report that looks something like this:

Once the report loads (it typically takes 3 minutes or less), you’ll see an overview like the image above.

The overview is broken down into 3 main sections.

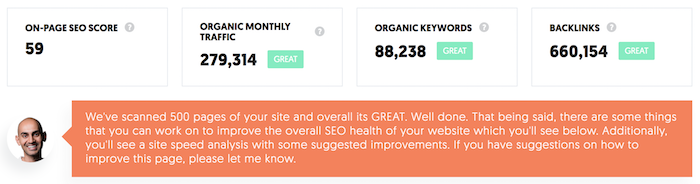

The first section shows you your on-page SEO score (the higher the better), your estimated search traffic, the number of keywords the domain ranks for, and how many backlinks the site has.

You’ll also see a message from me that breaks down how many pages were crawled and any SEO errors that were found.

When you click on any of those 4 boxes, it will take you to a more in-depth report.

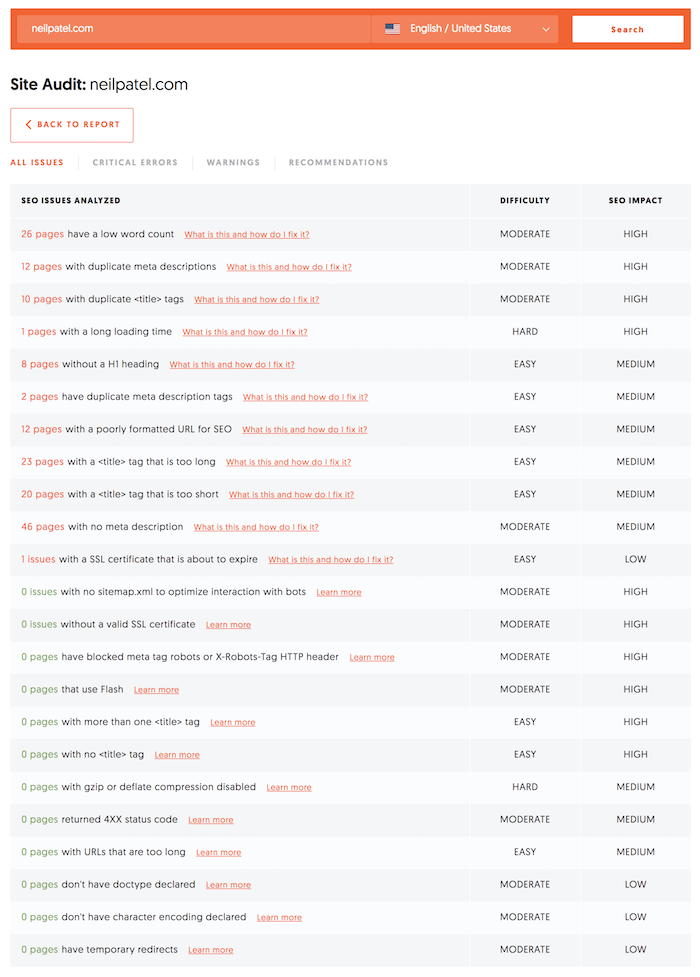

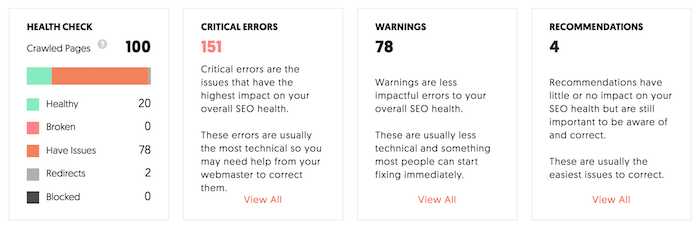

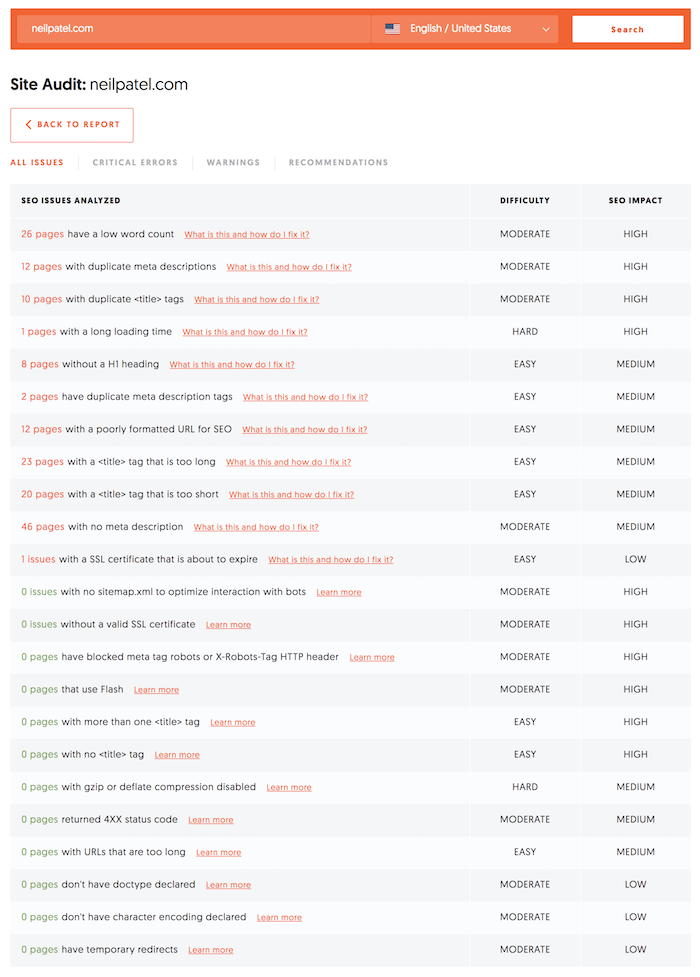

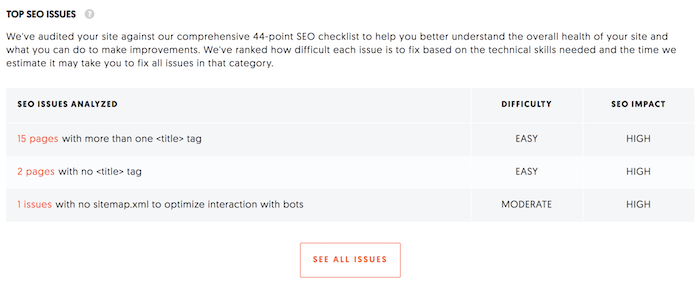

Clicking on the on-page score takes you to a page that lists out your SEO errors. It looks something like this:

Clicking on the organic traffic takes you to a report that shows you how well your site is performing.

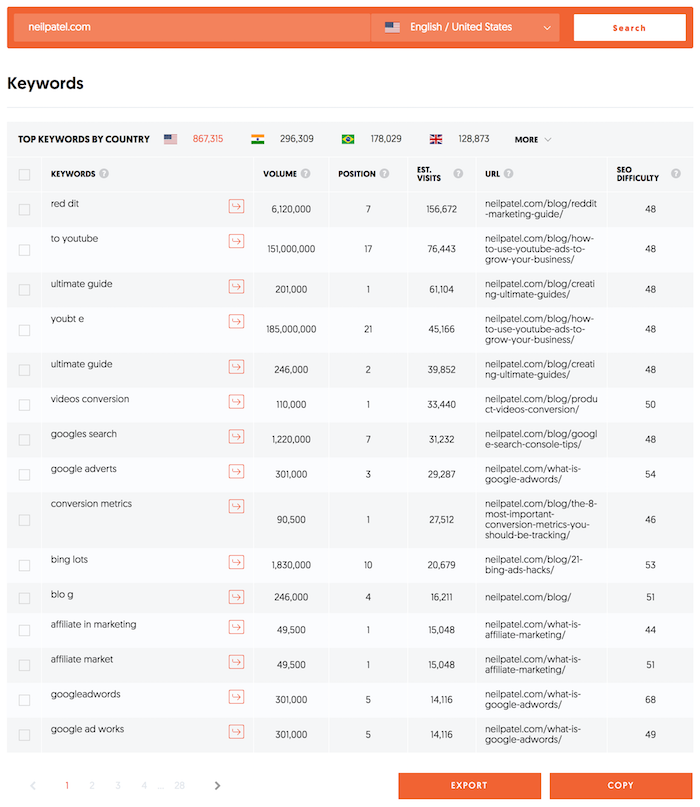

Clicking on the keywords box shows you all of the keywords your website ranks for organically.

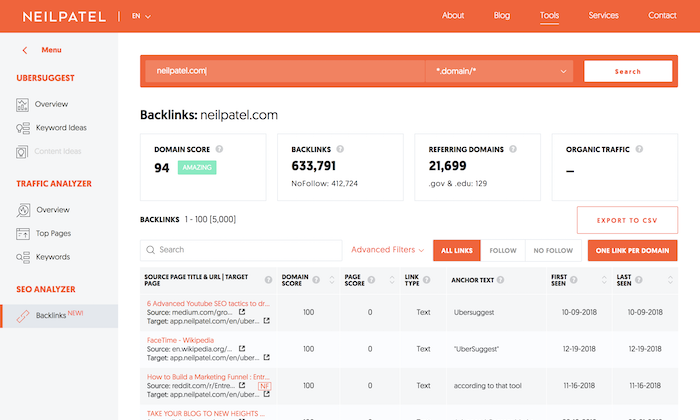

And clicking on the backlinks box shows you all of the sites linking to that domain.

This is my favorite section of the site audit report. This is where you can really dig around and boost your rankings

You can click on any of the four site health boxes and drill down into more reports.

This is important because you’ll want to first focus on clearing up any critical errors. From there, you’ll want to fix any warnings and then, finally, consider doing any of the given recommendations.

The health check box gives you an overview of the healthy pages and the ones that have issues or are broken or blocked or even redirected. By clicking on this box you’ll get taken to a report that lists all your SEO issues in detail.

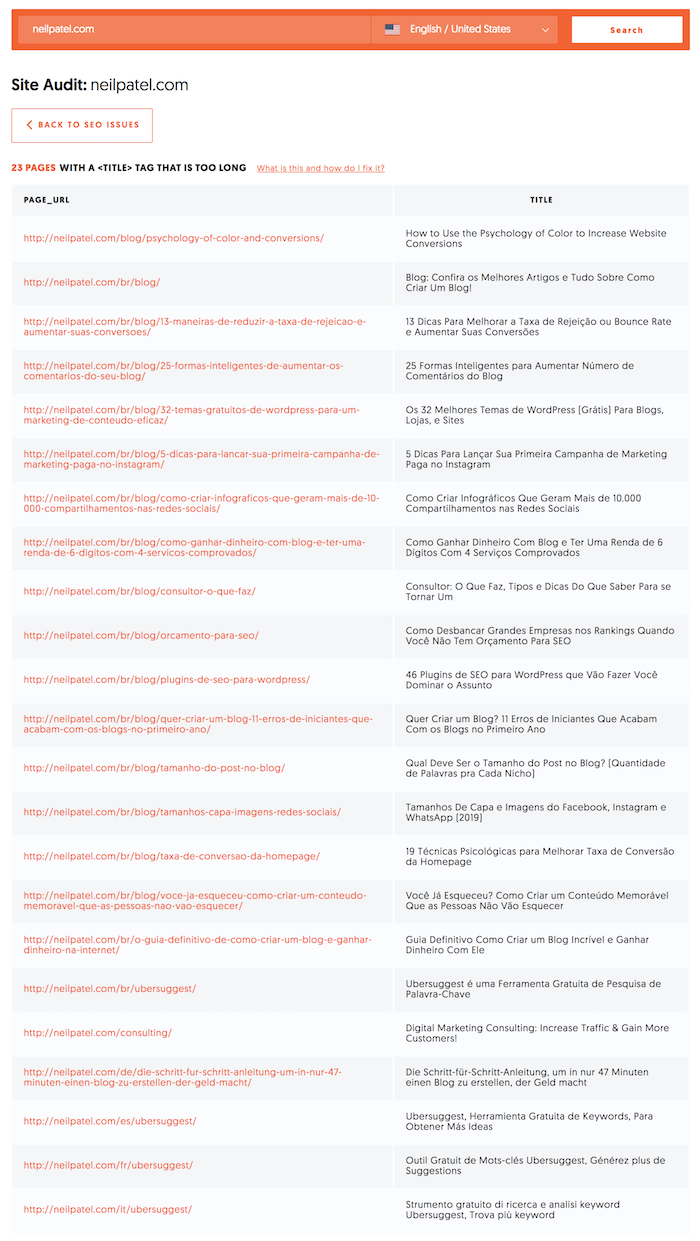

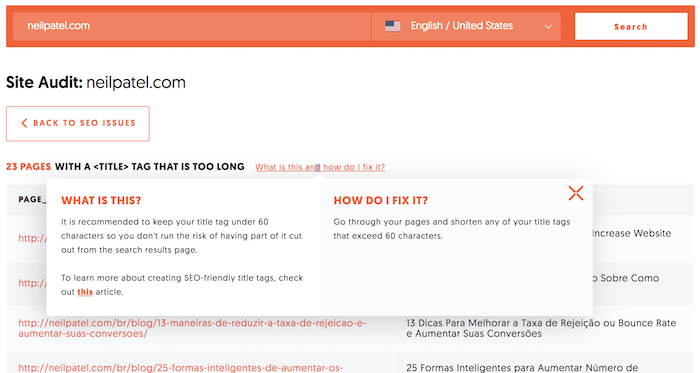

From there you can click on any of those issues and you’ll be taken to the exact pages that contain any SEO errors and what they are exactly. An example of this is pages with too long of a title tag.

If you aren’t sure on how to fix any of the issues, just click on “what is this and how do I fix it?” and a box like this will appear:

And if you click on the critical errors, warnings or recommendations boxes, you’ll see reports just like the ones above. They will be broken down by how important they are.

That way you’ll know which fixes have the greatest SEO impact and how hard they are to implement.

You should first focus on the ones that have the highest SEO impact and are the easiest to implement. And I took the liberty to prioritize the table for you, so all you have to do is start at the top and work your way down to the bottom.

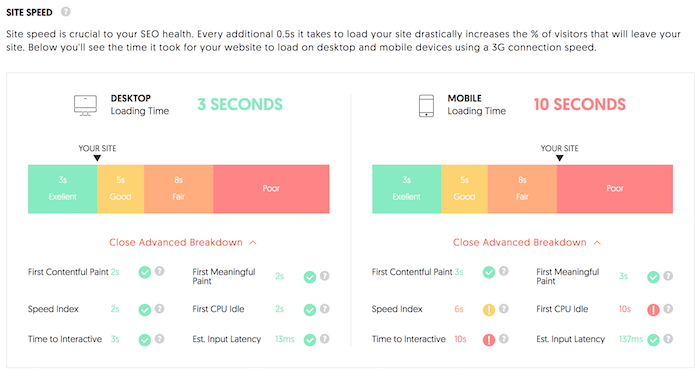

Speed is important. Not only do faster load times help boost conversion rates, but they also help boost your search rankings.

There are two sections to the site speed. The section on the left breaks down your desktop load time and the section on the right breaks down your mobile load time.

Site speed varies drastically by a person’s connection and computer, but the charts give you a rough range of how fast or slow your site loads.

Your goal should be to have your site load in 3 seconds or less for both mobile and desktop.

The report even breaks down which areas are slowing down your site speed.

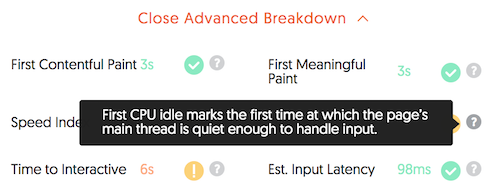

For example, you could have an issue with “First CPU Idle”… and if you aren’t sure what that means, just hover over the question mark and the tool will tell you.

I know I said the report has 3 main sections, but the 4th section is just repeating the site health section.

You’ll see the 3 most important fixes that you should make to your site if you want higher rankings.

If you don’t have the time to fix everything, start off by fixing the 3 issues listed here. Those will give you the biggest bang for your buck.

So, what do you think about the SEO Analyzer report? Do you think it was a good addition to Ubersuggest?

I know I haven’t talked about the SEO Analyzer report much, but we’ve been working on it for 4 months now.

For now, the tool crawls the first 100 pages on your website, and eventually, our goal is to increase the limit to 500 or even 1,000. Technically we can do that fairly easily, but for the launch, I’ve capped it at 100 due to the sheer number of users I have and server load.

Give the SEO Analyzer a try and let me know what you think.

The post How to Perform a Thorough SEO Audit in Less Than 3 Minutes appeared first on Neil Patel.

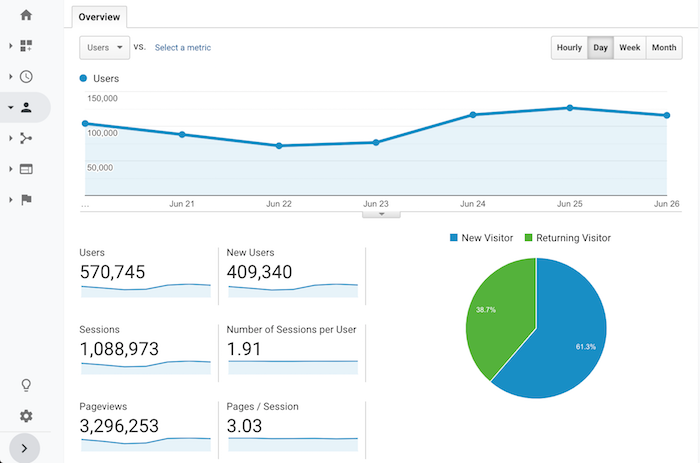

When you log into Google Analytics, what do you look at?

Chances are you see something like the image above that shows you how many people are currently on your blog.

Well, that was easy to guess because that’s the report Google Analytics gives you once you log in. 😉

But which reports do you look at on a regular basis?

I bet you look at two main reports…

The “Audience Overview” report and the “Acquisition Overview” report.

Sure, every once in a while, you may dive into your top pages or the specific organic keywords that drive your traffic. But even if you do that, what are you actually doing with the data?

Nothing, right?

Don’t beat yourself up over it because most content marketers just look at reports and numbers and do little to nothing with the data.

If you want to figure out how to grow your blog and, more importantly, your revenue from your blog, there are 7 reports that you need to start looking at on a regular basis.

Here they are and here is how you use them…

What do you think is easier to accomplish… get new visitors to your blog or getting your visitors to come back?

It’s easier to get people to come back to your blog, yet everyone focuses on new visitors.

I bet less than 99% of your blog readers turn into customers or revenue, so why not focus on getting those people back and eventually converting them?

Before we get into how to get people back to your blog, let’s look at how many people are returning to your blog.

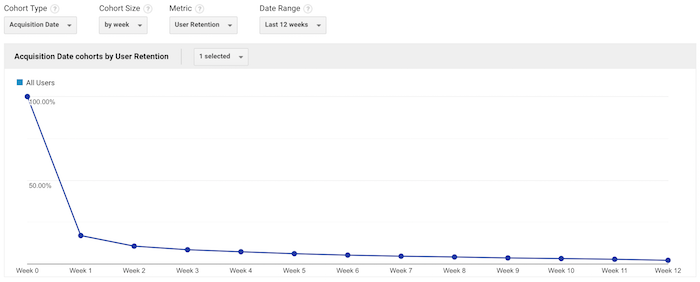

Within the Google Analytics navigation, click on “Audience” and then “Cohort Analysis”.

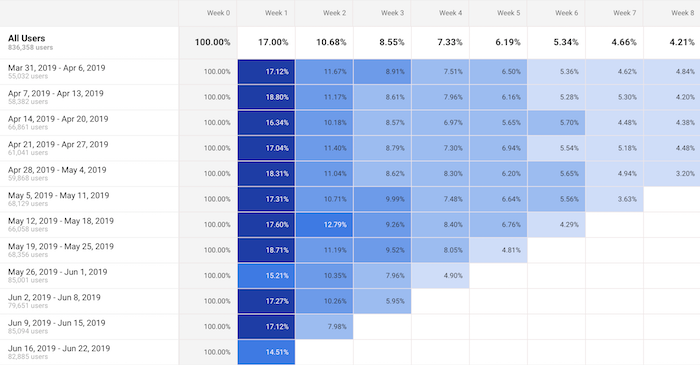

Once you land on that report, you’ll see a graph that looks similar to this:

Under the “Cohort Size” drop-down menu, select “by week”. Under “Date Range”, select “Last 12 weeks”.

Once the data loads, you’ll see a table that looks something like this:

What this table shows is the percentage of your visitors that come back each week.

On the very left it will always show 100%. Then in the columns to the right, you’ll see week 1, week 2, week 3, etc.

This shows the percentage of people who come back to your blog each and every week after their first visit.

For example, if this week you had 100 people visit your blog and in the week 1 column, it shows 17%. That means of the initial 100 people, 17 came back. Under week 2 if you see 8%, that means of the initial 100 people, 8 people came back in week 2.

Naturally, this number will keep getting smaller, but the goal is to get people back as often as possible. That increases trust, social shares, potential people linking to you, and it even increases the odds that the visitor will convert into a customer.

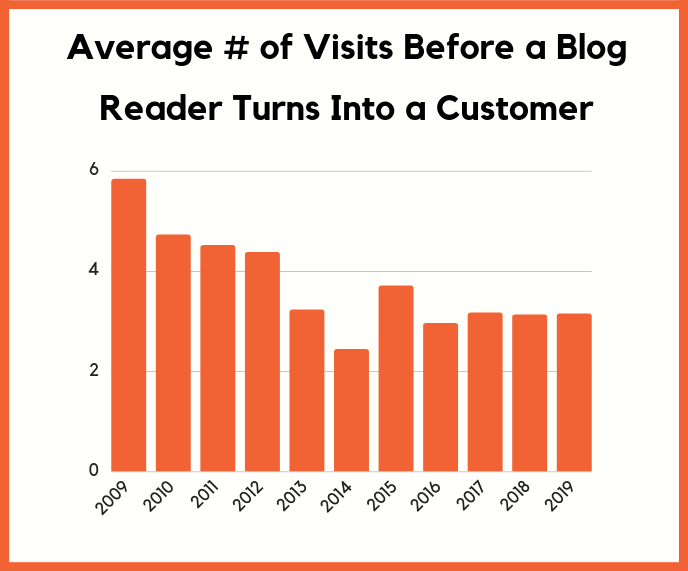

The average blog reader needs to come back 3.15 times before they turn into a customer. That means that you need to retain readers.

Just think of it this way: If you get thousands of new people to your blog each and every single day but none of them ever come back, what do you think is going to happen to your sales?

Chances are, not much.

You need to look at your Cohort Report and continually try to improve the numbers and get people coming back.

So the real question is, how do you get people to come back?

There are 2 simple ways you can do this:

These 2 strategies are simple and they work. Just look at how many people I continually get back to my blog through emails and push notifications.

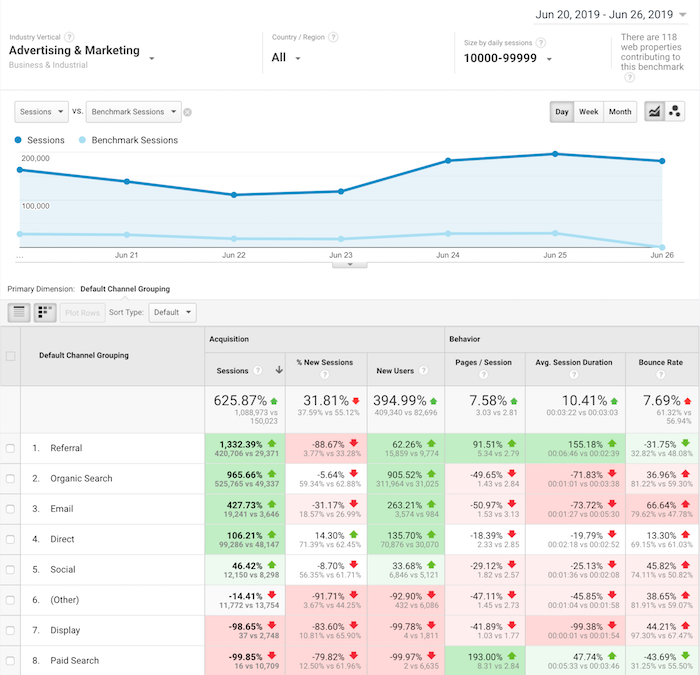

Ever wonder how you are doing compared to your competition?

Sure, you can use tools like Ubersuggest, type in your competitors URL, and see all of the search terms they are generating traffic from.

But what if you want more? Such as knowing what percentage of traffic your competitors are getting from each channel. What’s your bounce rate, average session duration, or even pageviews per channel?

Within Google Analytics navigation, click on “Audiences” then “Benchmarking” then “Channels”.

Once you do that, you’ll see a report that looks like the one above.

Although you won’t have specific data on a competing URL, Google Analytics will show you how you stack up to everyone else within your industry.

I love this report because it shows you where to focus your time.

If all of your competitors get way more social traffic or email traffic, it means that’s probably the lowest hanging fruit for you to go after.

On the flipside, if you have 10 times more search traffic than your competition, you’ll want to focus your efforts on where you are losing as that is what’ll probably drive your biggest gains.

The other reason you’ll want to look at the Benchmarking Report is that marketers tend to focus their efforts on channels that drive the most financial gain.

So, if all of your competition is generating the majority of their traffic from a specific channel, you can bet that channel is probably responsible for a good portion of their revenue, which means you should focus on it too.

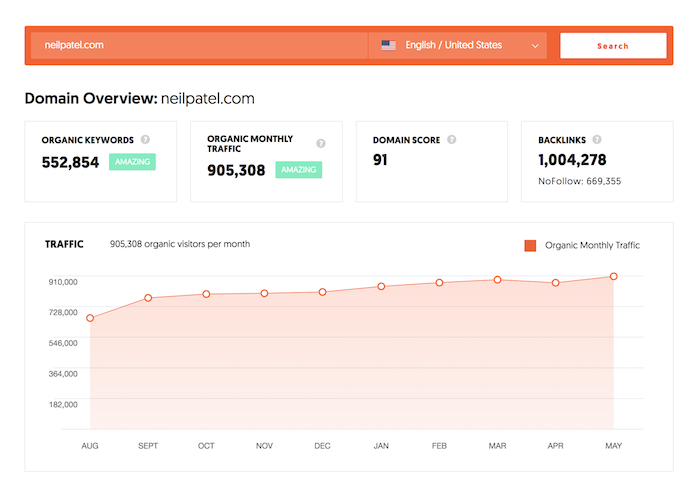

Have you noticed that my blog is available in a handful of languages?

Well, there is a reason for that.

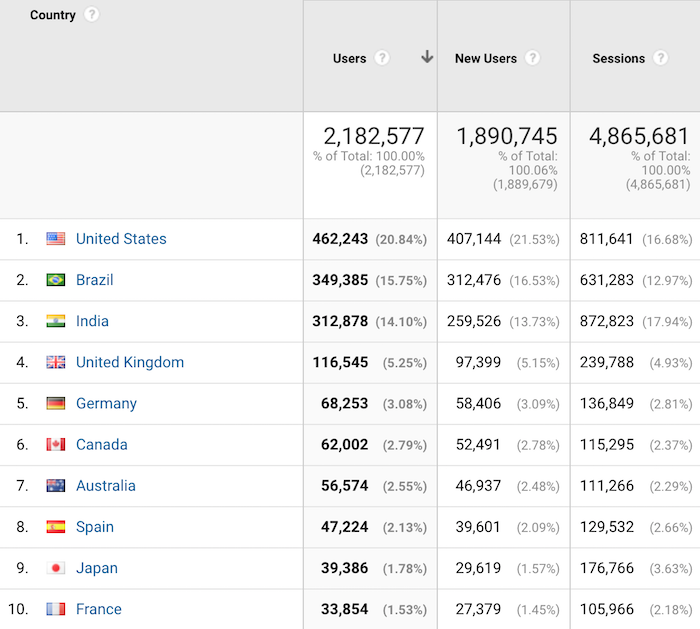

I continually look at the location report. To get to it, click on “Audience” then “Geo” and then “Location”.

This report will tell you where the biggest growth opportunities are for your blog.

Now with your blog, you’ll naturally see the most popular countries being the ones where their primary language is the one you use on your blog.

For example, if you write in English, then countries like the United Kingdom and the United States will be some of your top countries.

What I want you to do with this report is look at the countries that are growing in popularity but the majority of their population speak a different language than what you are blogging on.

For me, Brazil was one of those countries. Eventually, I translated my content into Portuguese and now Brazil is the second most popular region where I get traffic from.

This strategy has helped me get from 1 million visitors a month to over 4 million. If you want step-by-step instructions on how to expand your blog content internationally, follow this guide.

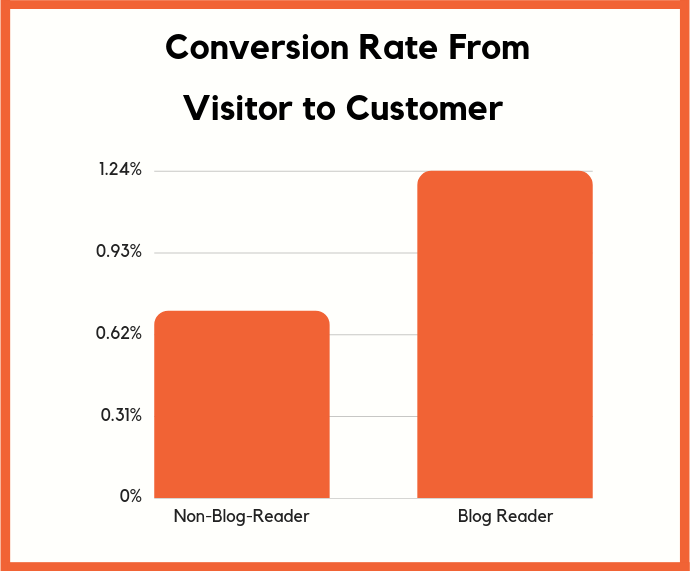

Have you heard marketers talk about how blog readers don’t convert into customers?

It’s actually the opposite.

Those visitors may not directly convert into a customer, but over time they will.

But hey, if you have a boss or you are spending your own money on content marketing, you’re not going to trust some stats and charts that you can read around the web. Especially if they only talk about long-term returns when you are spending money today.

You want hard facts. In other words, if you can’t experience it yourself, you won’t believe it.

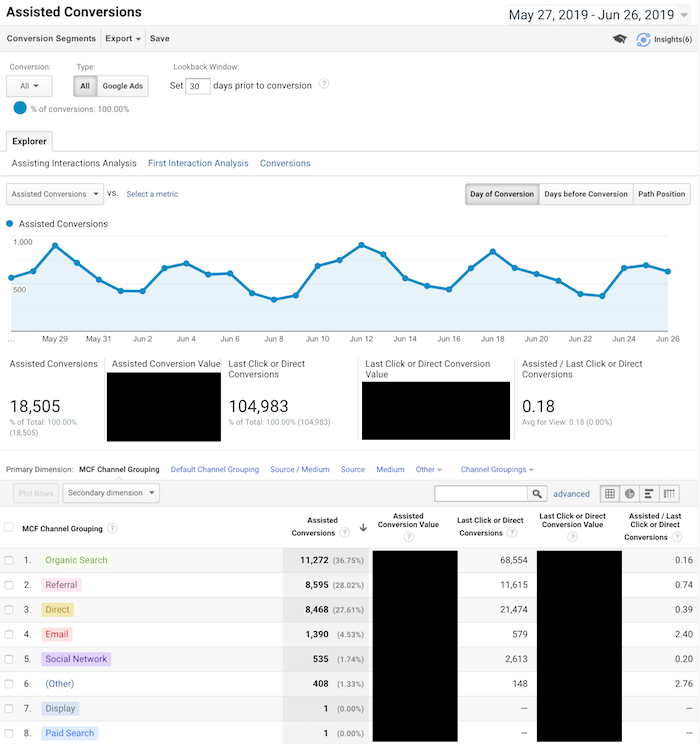

That’s why I love the Assisted Conversions Report in Google Analytics.

In the navigation bar click on “Conversions” then “Multi-Channel Funnels” and then “Assisted Conversions”.

It’ll load up a report that looks like this:

This report shows you all of the channels that help drive conversions. They weren’t the final channel in which someone came from but they did visit your blog from one of these channels.

In other words, if they didn’t visit or even find your blog from one of these sources, they may not have converted at all.

Now when your boss asks you if content marketing is worth it, you can show the Assisted Conversions Report to show how much revenue your blog helps drive.

The other beautiful part about this report is that it tells you where to focus your marketing efforts. You want to focus your efforts on all channels that drive conversions, both first and last touch.

What’s the number one action you want your blog readers to take?

I learned this concept from Facebook. One of the ways they grew so fast is they figured out the most important action that they want people to take and then they focused most of their efforts on that.

For you, it could be someone buying a product.

For me, it’s collecting a lead and that starts with a URL.

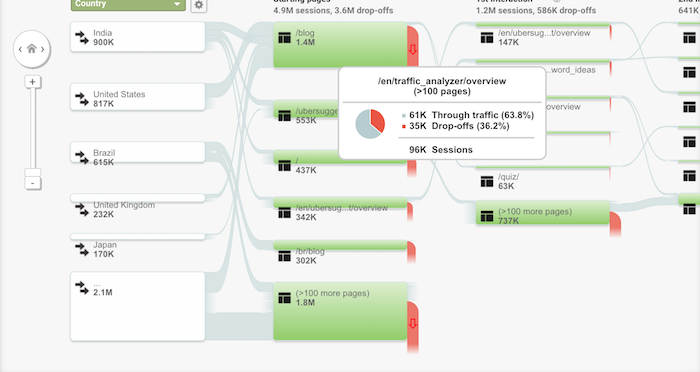

But I found that people interact with my blog differently based on the country they are coming from.

In other words, if I show the same page to a United States visitor and from someone in India or even the United Kingdom, they interact differently.

How did I figure that out?

I ran some heatmap tests, but, beyond that, I used the Users Flow Report in Google Analytics.

In your navigation click on “Audience” and then “Users Flow”.

Within the report, it will break down how people from each country interact with your blog and the flow they take.

I then used it to adjust certain pages on my blog. For example, here is the homepage that people in the United States see:

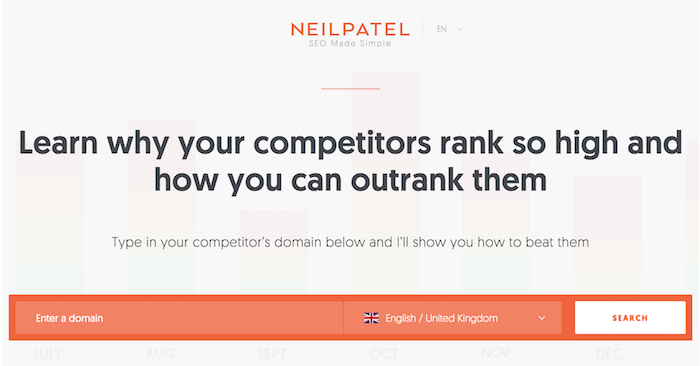

And here is the homepage that people from the United Kingdom see:

The United Kingdom homepage is much shorter and doesn’t contain as much content and that’s helped me improve my conversions there.

And of course, in the United States, my audience prefers something else, hence the homepages are different.

The Users Flow Report is a great way to see how you should adjust your site based on each geographical region.

Blog content can be read anywhere and on any device. From desktop devices to tablets to even mobile phones.

The way you know you have a loyal audience isn’t just by seeing how many of your readers continually come back, but how often are they reading your blog from multiple devices.

For example, you ideally want people to read your blog from their iPhone and laptop.

The more ways you can get people to consume your content, the stronger brand loyalty you’ll build, which will increase conversion.

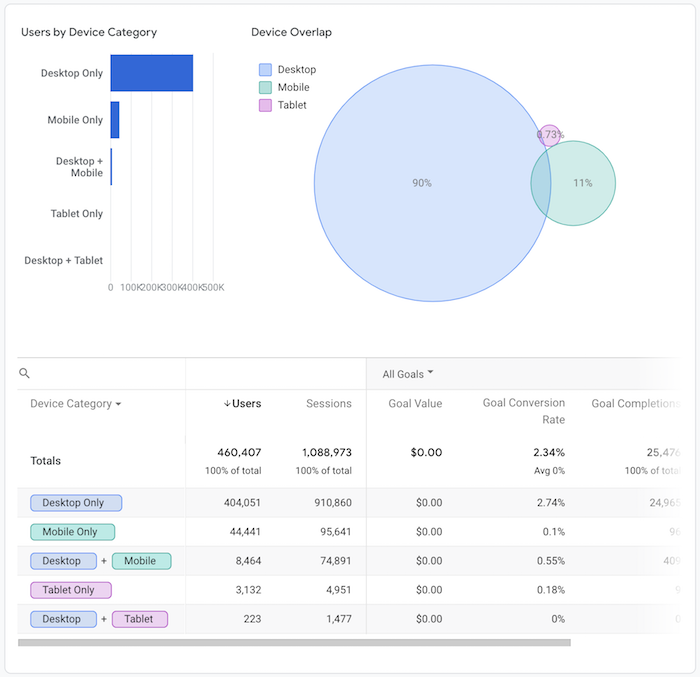

Within the navigation, click on “Audience” then “Cross Device” and then “Device Overlap”.

I’m in the B2B sector so my mobile traffic isn’t as high as most industries but it is climbing over time.

And what I’ve been doing is continually improving my mobile load times as well as my mobile experience to improve my adoption rates.

I’m also working on a mobile app.

By doing all of these things, people can consume content from NeilPatel.com anywhere, which builds stickiness, brand loyalty, and then causes more assisted conversions.

A good rule of thumb is if you can get the overlap to be over 6%, you’ll have a very sticky audience that is much easier to convert.

That’s at least what I can see with all of the Google Analytics accounts I have access to.

To really understand what makes your blog readers tick, you need to get inside their mind and figure out what their goals are and how you can help them achieve each of those goals.

A great way to do this is through the User Explorer Report.

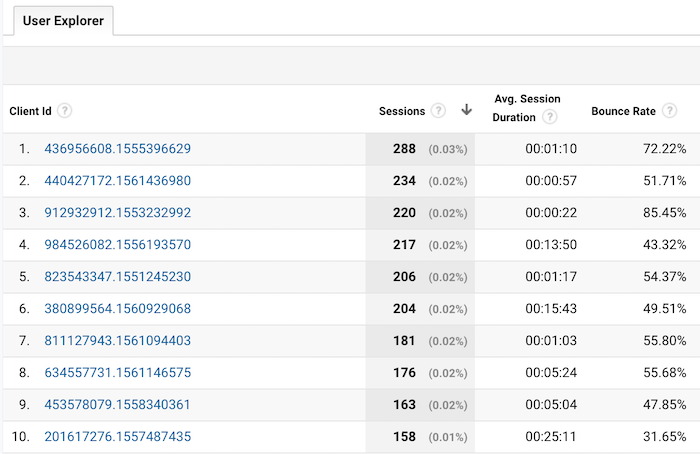

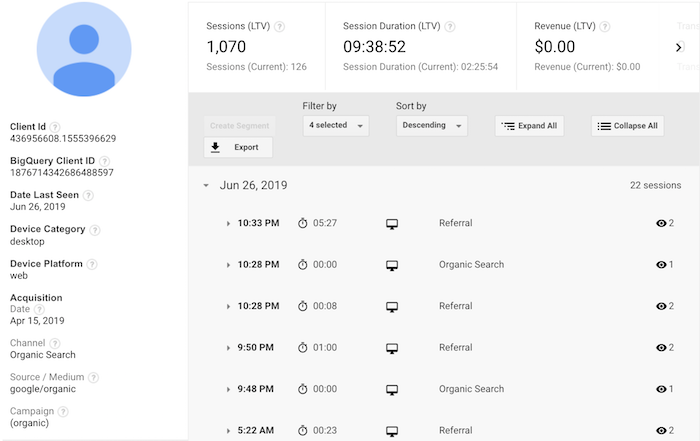

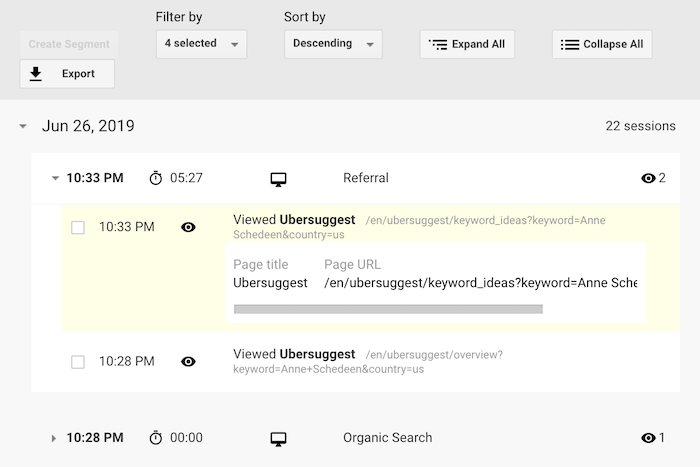

Click on “Audience” and then “User Explorer”. You’ll see a screen that looks like this:

This shows you every user who visits your site and what they did. You can click on a client id to drill down and see what actions each user performed on your blog.

From there, you can click on a time to see exactly what they did each time they visited:

What I like to do with this report is to see how the most popular users engage with my blog. What are they reading? What pages are they spending the majority of their time on? What makes them continually come back? How did they first learn about my blog?

By comparing the most popular blog readers with the least popular, I am typically able to find patterns. For example, my most loyal blog readers typically find my site through organic traffic and then subscribe to my email list.

Then they keep coming back, but the key is to get them to opt into my email list.

That’s why I am so aggressive with my email captures. I know some people don’t like it, but I’ve found it to work well.

So I focus a lot of my efforts on building up my organic traffic over referral traffic and then collecting emails.

Look at the patterns that get your most popular users to keep coming back and then adjust your blog flow so that you can create that pattern more often.

Yes, you should look at your visitor count. But staring at that number doesn’t do much.

The 7 reports I describe above, on the other hand, will help you boost your brand loyalty, your repeat visits, and your revenue.

I know it can be overwhelming, so that’s why I tried to keep it to just 7 reports. And if you can continually improve your numbers in each of those reports, your blog will continually grow and eventually thrive.

So what Google Analytics reports do you look at on a regular basis?

The post 7 Google Analytics Reports That Show How Your Blog is Really Performing appeared first on Neil Patel.

UK Finance for Business

In UK financing for service can be obtained from various resources. UK money for renting a business or company, UK money for financial obligation collection, UK money for Venture Capital can likewise be set up.

UK Finance for equipment financing for the details innovation service is additionally offered in business. If you require info on UK money for devices leasing, home loans and also business financing after that you can come close to business like 1st Leasing Company as well as 1pm. For UK money from ₤ 5,000 upwards you can come close to business like 1pm.

UK Finance for firms in the details innovation field can obtain their funding choices from firms like Corporate Computer Lease Plc in UK. Such firms make IT extra cost effective and also you obtain the UK money for practically any type of modern technology invests.

Business like Corporate Business Finance fund you for Plant, Machinery as well as for various other company monetary solutions. Under such conditions you can come close to firms like these for UK money for your financing needs.

For brand-new begin ups it is hard to obtain money in UK or in other places. Many of the money business will certainly money just the recognized organisations. The group at Oak renting would certainly fund your start-ups as well as for any type of brand-new devices that you require.

Money for huge business is provided by UK financing firms like the Benington Securities. There are numerous firms that give UK money for also people. Firms like Troman money give funds for the people as well as tiny company companies.

UK financing for renting a business or company, UK money for financial debt collection, UK financing for Venture Capital can likewise be organized.

UK Finance for equipment financing for the info modern technology company is additionally readily available in business. If you require info on UK money for devices leasing, home mortgages as well as industrial financing after that you can come close to business like 1st Leasing Company as well as 1pm. UK Finance for firms in the details innovation field can obtain their funding alternatives from business like Corporate Computer Lease Plc in UK. Money for large business is provided by UK money firms like the Benington Securities.

The post UK Finance for Business appeared first on ROI Credit Builders.

Investments – Short Term or Long Term? Numerous locate financial investments to be a high-risk offer not since financial investments of any type of kind call for reasonable quantity of speculative actions for fairly bigger returns, yet since they do not have the expertise regarding what to buy and also when.Investments, regardless of monetary course …