Writing a blog post is easy. If you don’t write often, you may feel otherwise, but just follow this and you’ll be good to go when it comes to writing. Or, you can just watch the video below. But still, you write a blog post and then what do you do? Well, I’ll tell you …

Day: November 13, 2019

IEA Sees U.S. Shale Squeezing OPEC Influence

Job as well as Technology Education Department of HISD

Job as well as Technology Education Department of HISD

What concerning a job and also innovation education and learning at Houston Independent School District (HISD)? Well, if you do concur with me, the nature and also every little thing regarding HISD’s occupation as well as modern technology education and learning is after that worth understanding.

Houston Independent School District remains in the top place among the extremely appreciated establishments for job as well as innovation education and learning in Texas. It has actually been offering the general public with the most effective discovering educational programs and also programs that are tailored towards aiding the trainees in ending up being liable as well as efficient participants of their households as well as residents of their nation. As well as, to make every one of their program purposes feasible, the HISD has actually developed its very own Career as well as Technology Education division, which is currently referred to as HISD’s CATE.

The Career as well as Technology Education division of Houston Independent School District is in fact created as well as created to aid trainees create and also improve their capacities and also abilities required to reinforce the social as well as financial structure of the city of Houston. It was likewise established by the organization to supply their pupils the possibility to get technological as well as scholastic abilities that would certainly aid them become part of today’s very requiring international labor force. The division also intends to assist trainees do well and also make it through in life with their selected area.

To make every one of their goals obtainable, the Houston Independent School District has actually enabled their Career and also Technology Education division work together with the normal education and learning peers along with various other divisions inside the establishment itself. This partnership is taken into consideration to make the job as well as innovation preparation, developing, executing as well as analyzing extremely feasible. As well as to make the trainee constant success existing, whatever pertaining to it, consisting of the pupils’ technological abilities and also their sophisticated and also fundamental academics, are considerably incorporated.

The HISD’s Career and also Technology Education division currently keeps a variety of program and also programs that are offered for their trainees to take into consideration. The emphasis of their programs currently consist of professions on farming scientific research modern technology; art, interaction as well as media innovation; service and also advertising and marketing modern technology; wellness scientific research innovation; human advancement, monitoring, and also solutions modern technology; safety and also individual solutions; and also family members as well as customer scientific researches.

Keep in mind that all such discussed focus in HISD’s Career and also Technology Education division are all offered as well as intended from an effective systematic collection naturally that will certainly offer the pupils the opportunity to precisely identify job choices that will certainly change them right into effective as well as very liable residents. Every one of these are kept by the establishment approximately nowadays.

If you desire to have a profession that is focused on innovation education and learning, after that the Houston Independent Schools District’s Career as well as Technology Education division educational programs as well as programs may be the appropriate choices for you to assume around.

What regarding a job and also modern technology education and learning at Houston Independent School District (HISD)? And also, to make all of their program purposes feasible, the HISD has actually developed its very own Career as well as Technology Education division, which is currently recognized as HISD’s CATE.

The Career and also Technology Education division of Houston Independent School District is in fact developed as well as created to aid pupils establish and also boost their capacities and also abilities required to reinforce the social and also financial structure of the city of Houston. To make all of their goals possible, the Houston Independent School District has actually enabled their Career and also Technology Education division team up with the normal education and learning peers as well as various other divisions inside the organization itself.

The post Job as well as Technology Education Department of HISD appeared first on ROI Credit Builders.

My 6-Step Content Marketing Formula That Drives 3,549 Visitors

Writing a blog post is easy.

If you don’t write often, you may feel otherwise, but just follow this

and you’ll be good to go when it comes to writing. Or, you can just watch the

video below.

But still, you write a blog post and then what do you do?

Well, I’ll tell you this… most people forget the “marketing” in content marketing. Most people write content but don’t do a great job of promoting it.

Here’s the thing: I figured out the perfect formula to promoting content.

Best of all, it’s not complex. Heck, it doesn’t even take 30 minutes. It’s so easy that I broke it down into 6 steps.

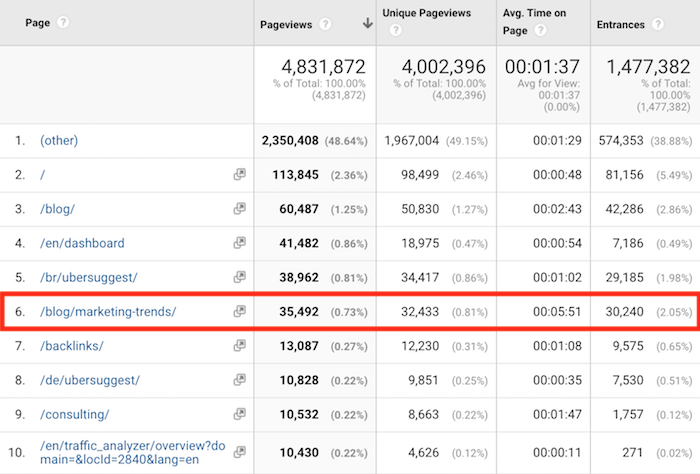

And just to give you an idea before we dive into the formula, it’s so effective here is the traffic to my latest blog post.

35,492 visits in a week isn’t too shabby. The post didn’t do exceptionally well and it didn’t tank. It was just an average post.

Now you probably won’t see the same results as me as I’ve

been doing this for a long time, but your results will be much better than what

you are currently getting. Hence, I used the number of 3,549 in the title as

you should be able to drive 1/10th of what I am generating.

So, let’s dive right into the formula.

Step #1: Optimize your headline

8 out of 10 people will read your headline, but only 2 out of 10 people will click through on your headline to read the rest of your article.

No matter how well written your content is, promoting it won’t

be effective if no one likes your headline.

Now I know what you are thinking… I’ve already published my

article, is it too late to change my headline?

Nope, you can always change your headline, just try not

to change the URL of the article once it is already published. And if you decide

to change the URL, use a

301 redirect.

There’s a really simple way to come up with headlines that work. Heck, it doesn’t even take more than a minute or two.

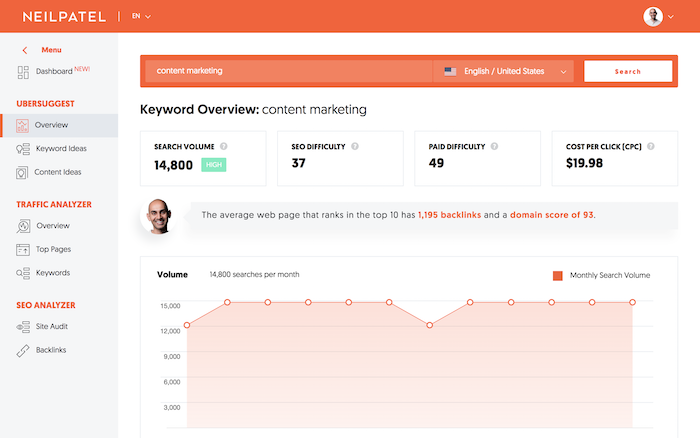

Just head over to Ubersuggest and type in the main keyword or phrase your article is about.

You’ll see a report that looks something like this:

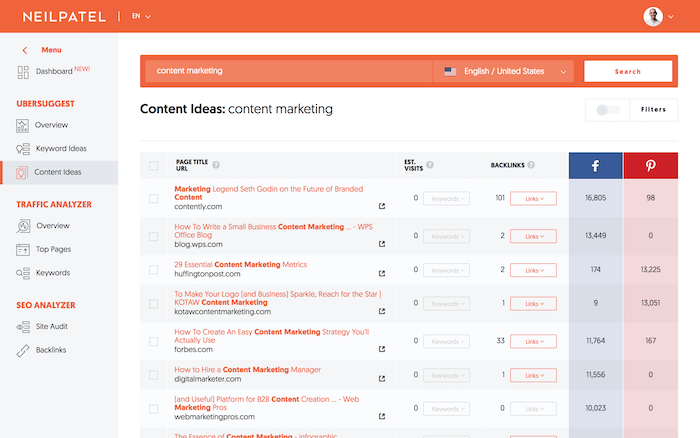

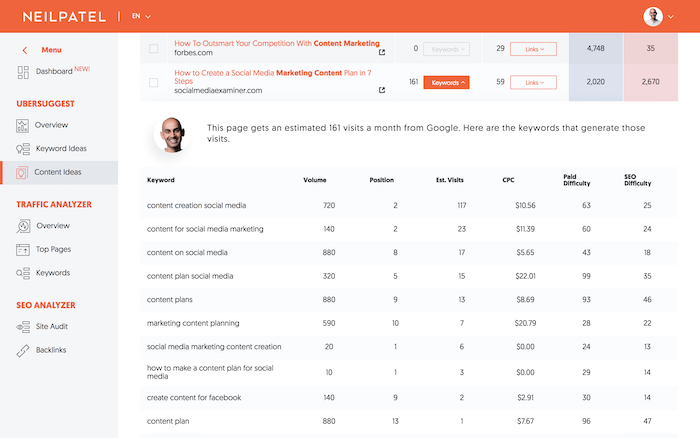

Now I want you to click on “Content Ideas” in the left-hand navigation.

You should now see a report that looks like this:

This report shows you all of the blog posts around the web

that contain your keyword or phrase within their title. And it breaks it down

by social shares, backlinks, and search traffic.

You can use this to see what is working in your space.

Ideally, you want to look for headlines that have thousands of social shares (or hundreds if you aren’t in a popular industry), at least 10 backlinks, and more than 100 estimated visits. Just like the example below.

Making your headlines similar to ones that meet those 3 criteria

will increase your odds of getting more traffic.

Step #2: Add 3 internal links

The easiest way to get your new content more love is to

build links.

Yes, links are hard to build, but internal links are not…

plus they are still effective.

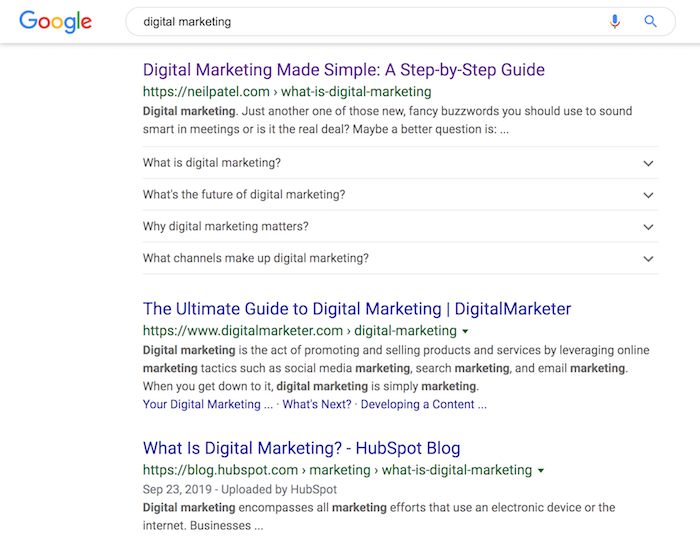

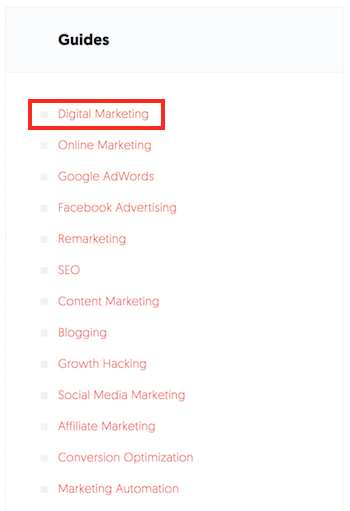

I rank for competitive terms like “digital marketing”…

A lot of it has to do with internal links. I link to my main

digital marketing page within my sidebar and within my content.

Every time you publish a new blog post, I want you to go into your older content that is relevant to your newly published blog post and add a link to it. Do this to 3 of your older blog posts.

This helps with indexing and it also helps your new

content rank higher on Google.

Step 3: Share your content on the social web carefully

The problem with social media marketing is that people think they can just share their content on sites like Facebook or LinkedIn and it will automatically do well.

Sadly, it won’t because billions of URLs have been shared

already.

In other words, we just tend to ignore most of the links

people share.

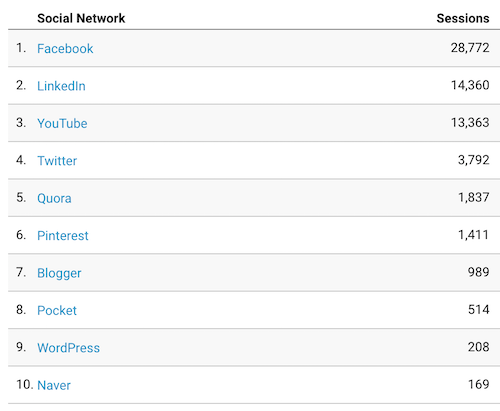

But there is a simple way to stand out and get thousands of visitors from the social web, just like I get.

So, what’s my secret?

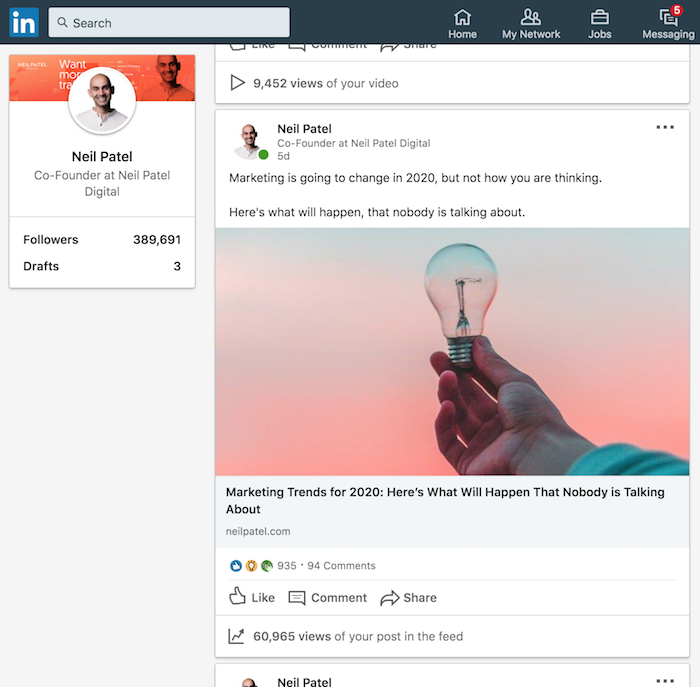

Well, I will give you a hint. Just look at one of my most

recent posts on LinkedIn:

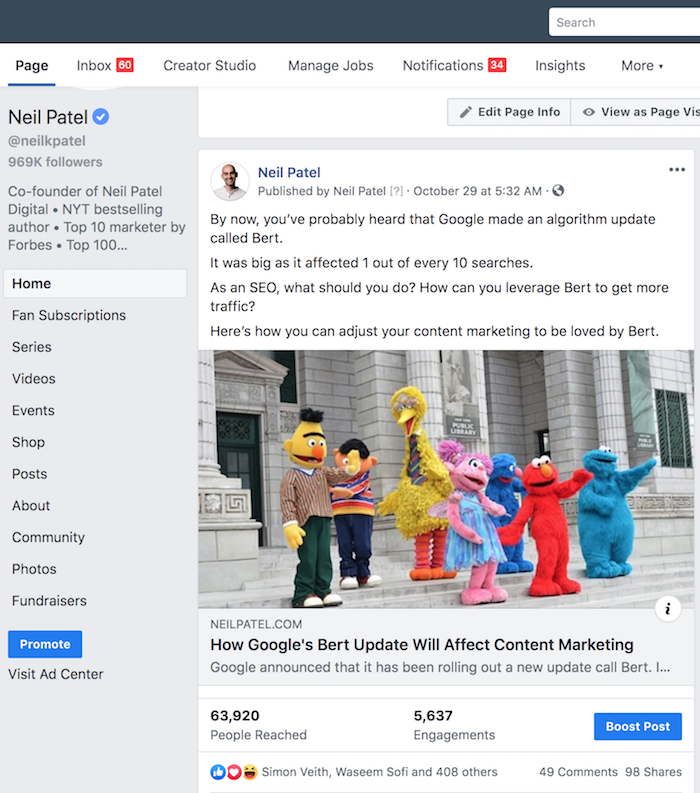

And here is one from Facebook:

Do you notice a pattern?

I’m evoking curiosity. In other words, I am piquing your

interest and if you want to know the “solution” you have to click through to my

site.

With the LinkedIn post, I tell you that marketing is going

to change next year. I also make a point to say how it is going to change in a

way that nobody is talking about.

I do this because we all can assume marketing will change. But

by saying it is in a way nobody is talking about, it evokes curiosity. And if

you want to know how it will change you have no choice but to click through

over to my site to read the rest.

With my Facebook post, I also evoke curiosity. I talk about a Google algorithm update, but I hint that I have an answer to leveraging Google’s latest algorithm update. And if you want to know what it is, you have to click through over to my site.

Whenever you post on the social web, evoke curiosity if you want people to head over to your site.

The easiest way to do this is that every time you share one of your articles on the social web, add a few sentences above the link that helps pique peoples’ interest.

Step #4: Message everyone you link out to

It’s common to link out to other sites within your blog

posts.

Heck, sometimes I even link out to my competition.

If you don’t ever link out to other sites, you are making a

big mistake. It helps with authority and trust.

If you are using stats and data within your article, you

want to cite your sources. This brings credibility to you and it helps brand

yourself as an expert which can help with Google’s medic

update.

Now, when you link out to a site, go and search their email

address. You can typically find their email address on their website.

Or if you can’t find their email address, look for a contact

page on their site, you’ll typically see a form that you can fill out.

Whether you find an email address or contact form, I want

you to message each and every single site you link out to with a message that

goes like this:

Hi [insert their first name],

I just wanted to say, I love your content. Especially your article on [insert the name of the article you linked out to].

I linked to it from my latest blog post [insert URL of your blog post]. It would make my day if you checked it out and even shared it on your favorite social network if you enjoyed it.

Cheers,

[insert your name]

When I send out these emails, I am getting 50 to 60% of the people to respond and share my content. But of course, my blog is popular, so for me, it isn’t too hard. But it hasn’t always been that way, and I’ve been leveraging this tactic for ages.

On the flip side, I also use this tactic on a few of my

blogs that are in other niches and don’t use my name (no one knows I own them)

and I am seeing success rates around 20%.

Just make sure you don’t use this tactic to ask for a link back.

Your success rate will be slim.

Step #5: Send an email blast

These last two tactics produce a large portion of my

results, and you shouldn’t take them for granted, no matter how basic they may

seem.

If you already haven’t, start collecting emails from your

site. You can use free tools like Hello Bar

to create popups or sliders.

Hello Bar will plug into whatever email provider you are

currently using.

Once you are up and running, every time you release a new

blog post, send out an email blast.

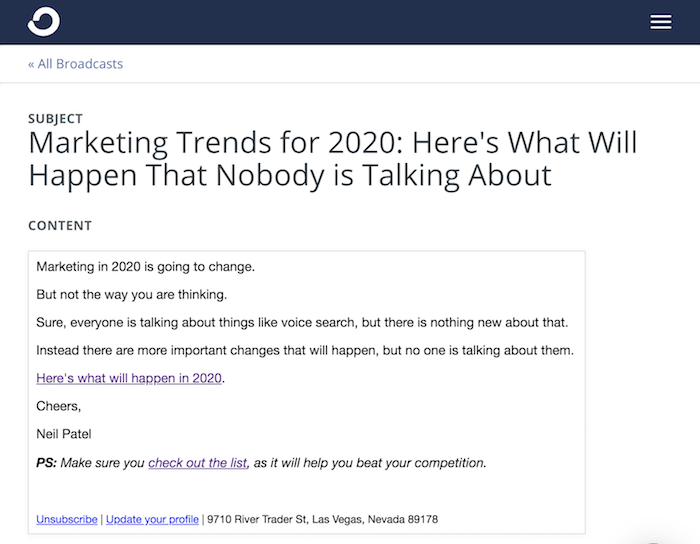

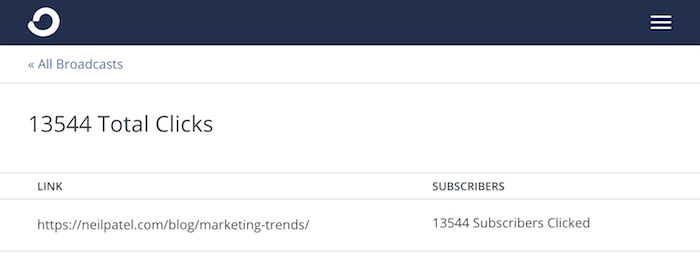

Here’s an example of one of my email blasts.

It’s so effective it generated 13,544 clicks.

I’ve found that you can drive good traffic from emails as

long as you do the following:

- Scrub your list – if someone doesn’t open your emails over the last 30 or 60 days, remove them from your list. It helps keep your emails in people’s inboxes.

- Send text-based emails – if you look at the email I sent, I keep it simple. No images, nothing fancy, just text and a link back to my site. It’s that simple.

- Evoke curiosity – just like how I explained with the social media posts, your emails won’t do well unless you evoke curiosity.

As you write more content you will get more traffic, which will cause your email list to grow. That will also cause you to get more traffic. 🙂

Step #6: Send a push notification

I don’t know why so few sites are leverage push notifications. It’s so effective I believe I will get more traffic from push notifications in 2020 than I will from email marketing.

To give you an idea, when I analyze my competitors in the

marketing arena, only 3 out of 19 use push notifications.

In other industries, the percentage is far worse, which means there is more opportunity for you.

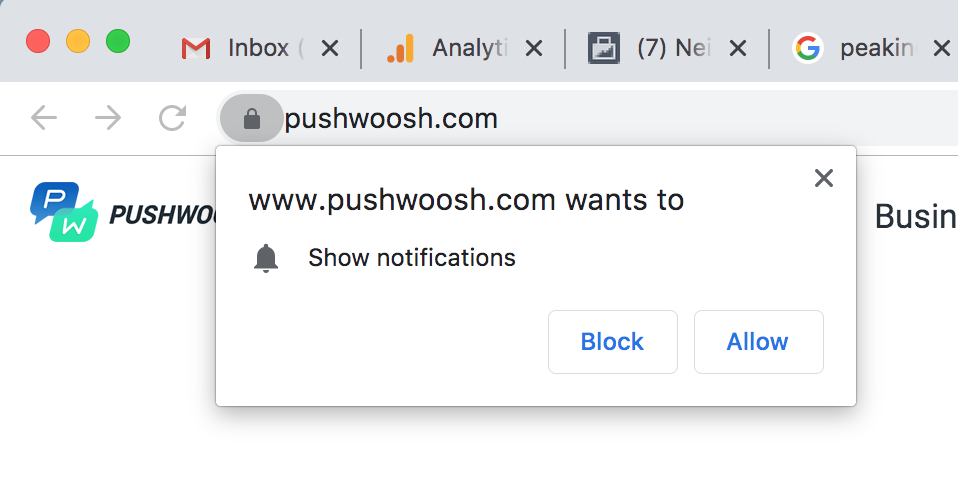

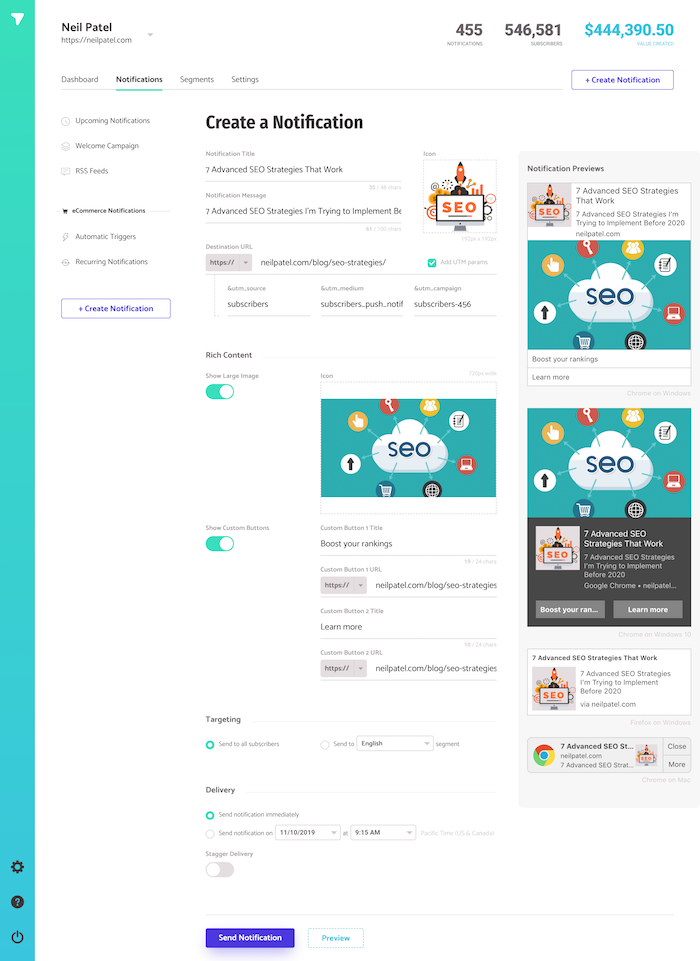

Here’s how push notifications work….

Someone comes to your site and through their browser, they get a message if they want to subscribe to your site.

A portion of your visitors will click “allow”. With NeilPatel.com, roughly 5.4% of visitors are currently clicking “allow”.

You can send push notifications and get subscribers using a

free tool like Subscribers.com.

And then when you write a new blog post, you log into Subscribers.com and click on the “Create Notification” button. From there you will see a screen where you can enter the title and description of your latest post.

As you can see from the image above, you’ll notice that I use an “icon” image, a “large” image, and I show “custom buttons.”

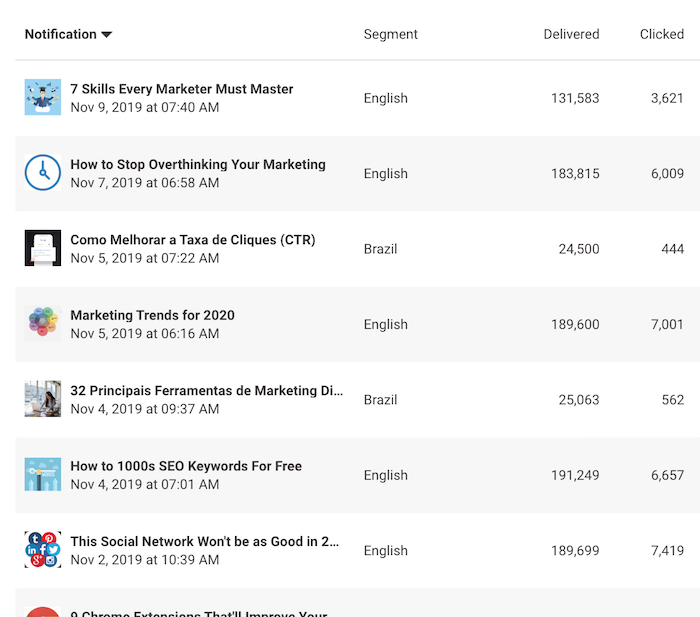

Using those 3 elements is the key to getting the most

traffic from push notifications. Here are some of my stats from using

Subscribers.

I’m getting roughly 6,000 visits from every push notification

I send. That’s not too bad.

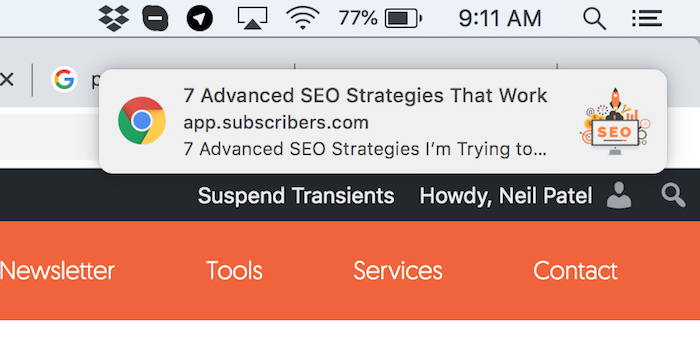

And if you are curious about what a push notification looks like, here’s what people get when I send it out.

What’s cool about push notification is no matter what

website someone is on, they will see a message similar to the one above, which

will bring people back to your site.

No dealing with spam filters or messages not going through. Plus, if someone isn’t online when you send a push notification, the next time they use their web browser they will see your message.

Conclusion

Promoting your content doesn’t have to be hard.

You don’t need “advanced” tactics or anything that is out of

the box. The basics work well, and I have been using the above formula for

years… literally.

Now, I know there are other things you can do to promote your content, but let’s be realistic: we are all strapped for time. And I’ve found the ones I’ve mentioned above to produce the biggest bang for the buck.

So, what other simple ways do you promote your content?

The post My 6-Step Content Marketing Formula That Drives 3,549 Visitors appeared first on Neil Patel.

The Best Small Business Credit Card of 2019 for Any Situation

fwistAnd How to Be Sure You are Eligible for the Best Small Business Credit Card for Your Situation

When you start wondering what the best small business credit card is, you may be surprised to find out that answer actually can vary. What may be the best credit card for one business may not necessarily be the best small business credit card for another. It all depends on the business and the situation. For example, a business owner that does a lot of travel for his or her business is going to need a different card than one that has a whole fleet of automobiles to manage but doesn’t travel much.

We have done some research to help you find the best small business credit card to fit your specific needs.

Best Small Business Credit Card When You Want 0% APR

Capital One® Quicksilver® Card

This card features flat-rate rewards of 1.5% on all purchases, and there are no limits on cash back rewards. In addition, there is no yearly fee.

New cardholders have a 0% APR on purchases and balance transfers for the first 15 months after starting the account. Afterwards, the rate increases to 14.74 to 24.74% (variable). A cash bonus of $150 is available for those who make at least $500 on purchases within 3 months of account opening.

Also, cash back rewards do not expire for the life of the account. Other benefits include travel accident insurance and an auto rental collision damage waiver. Find out more by going here.

Best Small Business Credit Card When You Want No Annual Fee

Capital One® Spark® Classic for Business

Try the Capital One Spark Classic for Business. It earns an unlimited 1% cash back on all purchases, and you still get the benefits of an auto rental collision damage waiver and purchase security. You also get extended warranty coverage, as well as travel and emergency assistance services.

However, the ongoing APR is 24.74% variable. The penalty APR is even higher at 31.15%. Another drawback is that there is no sign-up bonus. Find out more here.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Best Small Business Credit Card for Students

Discover it® Student Cash Back

Okay, full disclosure. The Discover it® Student Cash Back card is not a business credit card. It’s a personal card, therefore your credit activity is reported on your personal credit and not your business credit. However, as a student, building your FICO will be important to your future as a business owner.

There is a six-month introductory period of 0% APR on purchases. After that, there is an APR of 14.99 to 23.99% variable on all purchases.

One special feature is that it provides an incentive for students to maintain good grades with a $20 statement credit. If students earn a GPA of 3.0 or higher each school year, they get a $20 statement credit per year for up to five years.

You can get 5% cash back at different places each quarter like grocery stores, filling stations, restaurants or Amazon.com up to the quarterly maximum. After that, the credit card offers unlimited 1% cash back on all purchases. Also, in the first year, all cash back rewards are matched 100%.

Although they waive the first late payment fee, a fee of up to $37 applies on all other late payments. There is also a returned payment fee of up to $37. Find more information here.

Best Small Business Credit Card for Mileage Rewards

United MileagePlus Explorer Business Card

Earn 2 miles per dollar with United and at restaurants, filling stations, and office supply stores. All other purchases earn 1 mile per dollar. There is also a 50,000-mile sign-up bonus after spending $3,000 in the first three months from account opening.

Benefits include priority boarding, a free first checked bag for you and a companion on the same reservation. Also, get two United Club passes annually. Hotel and resort perks, including upgrades, are available as well. Additionally, get early check-in and late checkout. An auto rental collision damage waiver is also a benefit.

After the first year, the card has an annual fee of $95. The APR is 17.99% to 24.99%, based on creditworthiness. Find out more here.

Best Small Business Credit Card if You Have Average Credit

Capital One® Spark® Classic for Business

For fair credit, we like the Capital One Spark Classic for Business. It has no yearly fee and cash-back rewards of unlimited 1% cash back on all purchases. Benefits include an auto rental collision damage waiver and purchase security. In addition, extended warranty coverage as well as travel and emergency assistance services are included. Find out more here.

Best Small Business Credit Card if Luxurious Travel is Your Thing

Chase Sapphire Preferred® Card

Earn two points per dollar spent on travel and dining at restaurants, and one point per dollar on all other purchases. Points can be redeemed for cash back, gift cards, or travel. Benefits include trip cancellation insurance, travel and emergency assistance services and an auto rental collision damage waiver. Purchase protection and extended warranty protection are also included.

When you spend $4,000 in the first 3 months from account opening, you will earn 50,000 bonus points. These points are worth $625 if you redeem them for travel through Chase Ultimate Rewards.

You can get an unlimited two points per dollar for travel and dining at restaurants. And then get one point per dollar for all other purchases. Points will transfer equally to 13 leading frequent travel programs with partners. These include British Airways, Southwest Airlines, United, and Marriott.

Unfortunately, there is no 0% introductory APR on purchases or balance transfers. The card’s standard APR is 17.74 to 24.74% variable. In addition, while there is no annual fee the first year, after that it is $95. Go here for more information.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

Best Small Business Credit Card if You Love Uber

Uber Visa Card

Uber is the first ride-sharing service to offer a credit card, in a partnership with Visa and Barclays. The card offers 4% back per dollar spent at restaurants, takeout, and bars. That includes UberEATS orders. Also, earn 3% back on hotel, airfare and vacation home rentals. You can also earn 2% back on online purchases including retailers and subscription services like Uber and Netflix.

Additionally, you’ll earn 1% back on all other purchases. Every percent/point has a value of 1 cent. Redeem points for cash back, gift cards, or Uber credits directly within the app.

There is no yearly fee, and by spending at least $500 in the first 90 days, users can earn a $100 sign-up bonus. Cardholders spending a minimum of $5,000 yearly are eligible to get a $50 credit toward online subscription services.

Also, if you pay your cellphone bill with this card, you are insured up to $600 for cell phone damage or theft.

While they note cardholders have exclusive access to certain events and offers, Uber anticipates the majority of these offers will be available in major cities like New York, San Francisco, Los Angeles, Chicago and DC. If you aren’t in those cities, that perk may not be one you are interested in.

There is no introductory rate, and the APR is a variable 16.99%, 22.74%, or 25.74%, based on your creditworthiness. Cardholders with lower credit will be on the higher end of the range.

Also, there are restrictions on Uber credits. To redeem points as credits within the Uber app, you must have at least 500 points, or $5. Cardholders can convert a maximum of 50,000 points, or $500, in a given day. Find out more here.

Best Small Business Credit Card for When You Want to Build Business Credit

This is where it gets a little tricky. The thing is, the only way a card can help you build business credit is if you get it on the merits of your business credit. That means you have to apply with your business information, not your own. It also means you must already have some semblance of business credit to gain approval. Any card in your business name that you handle responsibly will definitely help build existing credit even stronger. However, you cannot get a card to build business credit without already having a business credit score.

How Do You Establish a Small Business Credit Score?

The truth is, any of these best small business credit card options will work to build business credit, but they will all want to see a business credit score before they grant approval. How do you get a business credit score without having credit to begin with? There is a very specific process, and if you follow it, it works like a charm.

It starts with establishing your business as a separate entity from yourself that appears fundable to lenders. How does that happen? Well, first your business needs its own contact information. It’s tempting in the beginning to just use your own address and phone number, but it isn’t wise. Those are identifying factors related to you personally, so anything attached to them will end up on your personal credit report rather than your business credit report.

Other Ways to Make Your Business Appear Fundable to Lenders

- Formally incorporate. You need to organize your business as a corporation, S-corp, or LLC. Start at gov.

- Get an EIN. It works like an SSN, but for your business. You can get one for free on the IRS Be sure to use it instead of your SSN when applying for business credit cards.

- Get a separate business bank account.

- Make sure you have a useable, professionally put together website. Pay for hosting, as the free hosting services make you look unprofessional. Along the same lines, be sure your business email address has the same URL as your website. Free email services such as Yahoo or Gmail are not appropriate for this purpose.

- Get a D-U-N-S number. This is how you establish your record with Dun & That’s important, because they are the largest and most commonly used business credit reporting agency. If you do not have a D-U-N-S number, you cannot have a business credit score with them. It is free to get one on the Dun & Bradstreet website.

Once these things are taken care of, it’s time to start building that business credit score.

Work Through the Credit Tiers

When it comes to building business credit, there are 4 tiers that you must work through. Most often, whatever the best small business credit card is for your needs, it will be in the top tier, known as the cash credit tier.

Before you can qualify for credit in this tier however, you must work through the other tiers. What are the other tiers? I am so glad you asked.

Vendor Credit Tier

This tier is where you will find starter vendors that will extend invoices with net terms without a credit check. You may have to place a few orders with them first, and there may be some minimum time in business or income requirements, but credit will not come into the picture.

Once you get net terms and start making payments, these starter vendors will report those payments to the credit reporting agencies, also knowns as CRAs. If you have set up your business as a separate entity and set up your vendor account with your business information, they will report your payments to the business CRAs. As more and more accounts are reporting, your business credit score will grow and you will be eligible to apply for credit in the other tiers.

Hit the jackpot with our best webinar and its trustworthy list of seven vendors who can help you build business credit.

The Retail Credit Tier

This is where you find store specific cards. They like to see a minimum business credit score, which is why you apply for them after the vendor credit tier. The vendor credit tier is how you establish that initial score. You’ll need to get 8 or so of these accounts reporting your payments to the business CRAs before you can start applying for cards in the next tier.

The Fleet Credit Tier

These are the cards that help you manage fuel and auto maintenance and repair costs. They come from companies like Fuelman and Shell. You’ll need several of these reporting payments along with the cards from the retail credit tier before you can move on to the cash credit tier.

The Cash Credit Tier

This is where pretty much every best small business credit card mentioned above will be found. As you work through the other tiers your credit score will build like a snowball rolling downhill. If you manage your credit properly, you’ll have a strong score that will qualify for any of these cards. It takes time, but if you want the best small business credit card for your business, you must build business credit.

Don’t Let the Best Small Business Card for You Slip Through Your Fingers

If you already qualify for cards in the cash credit tier, then use our research above as a starting point for your own research. If you need to build business credit first, follow our proven process and you will be eligible for any of these cards when the time comes.

The post The Best Small Business Credit Card of 2019 for Any Situation appeared first on Credit Suite.

Get an Amazing Building Business Credit Card

Get the Best Building Business Credit Card

We checked out every building business credit card we could find and did the research for you. So, here are our preferences.

Per the SBA, small business credit card limits are a whopping 10 – 100 times that of personal credit cards!

This reveals you can get a lot more money with small business credit. And it also means you can have personal credit cards at retail stores. So, you would now have an extra card at the same stores for your business.

And you will not need collateral, cash flow, or financials to get small business credit.

Building Business Credit Card Advantages

Perks vary. So, make sure to choose the perk you would prefer from this array of options.

Building Business Credit Cards – Make Your Credit Surge!

Discover it® Student Cash Back

Be sure to check out the Discover it® Student Cash Back card. It has no yearly fee. The credit card also has a six-month introductory period of 0% APR on purchases. And there is an APR of 14.99 – 23.99% variable on all purchases after that period.

One special feature is that it provides an incentive for students to maintain good grades with a $20 statement credit. If students earn a GPA of 3.0 or higher each school year, the card will award the $20 statement credit annually for up to five years.

Details

Use this card to build personal credit. While this is a personal credit card versus a business credit card, for new credit users, their FICO scores will matter. And this credit card offers an excellent way to raise FICO while also getting rewards.

You can get 5% cash back at different places each quarter like grocery stores, gas stations, restaurants or Amazon.com up to the quarterly maximum. After that, this credit card offers unlimited 1% cash back on all purchases.

In the initial year, all cash back rewards are matched 100%.

Downsides include a cash advance fee of either $10 or 5% of the amount of each cash advance, whichever is more. And though they waive the first late payment fee, a fee of up to $37 applies on all other late payments. There is also a returned payment fee of up to $37.

Get it here: https://www.discover.com/credit-cards/cash-back/it-card.html

Secure Business Credit Cards for Average Credit: A Great Alternative to a Building Business Credit Card

Capital One® Spark® Classic for Business

For average credit, we like the Capital One Spark Classic for Business. It has no yearly fee. There are cash-back rewards. The card earns an unlimited 1% cash back on all purchases. There is an annual fee of $0.

With this card, you will get benefits including an auto rental collision damage waiver, and purchase security. And you also get extended warranty coverage. And you get travel and emergency assistance services.

But KEEP IN MIND: the ongoing APR is 24.74% variable APR. And the penalty APR is even higher, 31.15%. Also, there is no sign-up bonus.

Get it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

Ironclad Secured Credit Cards: A Consideration When Looking at a Building Business Credit Card

Wells Fargo Business Secured Credit Card

Have a look at the Wells Fargo Business Secured Credit Card. It charges a $25 annual fee per card (up to 10 employee cards). It also requires a minimum security deposit of $500 (up to $25,000) and it is designed to help cardholders build or rebuild their credit.

Select this card if you wish to get 1.5% per dollar in purchases without any limits or earn one point for every dollar in purchases. You also earn 1,000 bonus points for every month your company makes $1,000 in purchases on the card.

Details

Also, you get free FICO scores every month. There are no foreign transaction fees. It is possible to upgrade to unsecured credit. Your account is regularly reviewed. And you may become eligible for an upgrade to an unsecured card with responsible use over time. Approval is not guaranteed and depends on factors including how you manage this and your other accounts.

APR is the current prime rate plus 11.90%. There is no introductory APR period and no sign-up bonus. This is not a card for balance transfers.

Get it here: https://www.wellsfargo.com/biz/business-credit/credit-cards/secured-card/

Reliable Low APR/Balance Transfers Business Credit Cards: Important Considerations When Choosing a Building Business Credit Card

Discover it® Cash Back

Check out the Discover it® Cash Back card. There is a 10.99% introductory APR for six months from date of first transfer. So, this is for transfers under this offer which post to your account by January 10, 2019.

After the introductory APR expires, your APR will be 14.99% to 23.99%. So, this is based on your creditworthiness. Your APR will vary with the market, which is based on the Prime Rate.

Details

You can get 5% cash back at different places each quarter. So, these are places like gas stations, grocery stores, restaurants, Amazon.com, or wholesale clubs. But this is up to the quarterly maximum each time you activate. In addition, automatically get unlimited 1% cash back on all other purchases.

You will get an unlimited dollar-for-dollar match of all the cash back you have earned at the end of your first year, automatically.

Get it here: https://www.discover.com/credit-cards/cash-back/it-card.html

Small Business Credit Cards with 0% APR – Pay Absolutely Nothing! Good Accompaniments to a Building Business Credit Card

Bank of America® Business Advantage Travel Rewards World Mastercard® Credit Card

The Bank of America® Business Advantage Travel Rewards World Mastercard® credit card has no annual fee and comes with a 0% introductory APR on purchases for the initial nine months. Afterwards, the card has a 13.24 – 23.24% variable APR

Earn 3 points/dollar spent when you book travel with the Bank of America Travel Center and 1.5 points/dollar on all other purchases. You can earn unlimited points and points never expire.

Details

There is a 25,000-point sign-up bonus when you spend $1,000 within the initial 60 days of starting the account. Cardholders get travel accident insurance, and lost luggage reimbursement.

They also get trip cancellation coverage, trip delay reimbursement and other perks.

There is no introductory rate for balance transfers. Also, bonus categories are limited.

Get it here: https://www.bankofamerica.com/smallbusiness/credit-cards/products/travel-rewards-business-credit-card/

JetBlue Plus Card

Check out the JetBlue Plus Card for another offer of a 0% introductory APR

Earn six points/dollar on JetBlue purchases, two points/dollar at restaurants and grocery stores. And get one point/dollar on all other purchases.

Details

Spend $1,000 in the initial 90 days and pay the annual fee and earn 40,000 bonus points. New cardholders get a 12-month, 0% initial APR on balance transfers made in 45 days of account opening.

Thereafter, the variable APR on purchases and balance transfers is 17.99%, 21.99% or 26.99%, based on creditworthiness. Benefits include a free first checked bag and 50% savings on in-flight purchases.

There is a $99 annual fee for this card.

Get it here: https://cards.barclaycardus.com/cards/jetblue-card/

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Uber Visa Card

Check out the Uber Visa Card. Uber is the very first ride-sharing service to offer a credit card, in a partnership with Visa and Barclays.

The card offers 4% back per dollar spent at restaurants, takeout and bars, including UberEATS. Also, get 3% back on hotel, airfare and vacation home rentals. And earn 2% back on online purchases.

So, this includes retailers and subscription services like Uber and Netflix. And get 1% back on all other purchases. Each percent/point has a value of 1 cent. Redeem points for cash back, gift cards or Uber credits directly within the app.

By spending at least $500 in the first 90 days, users can earn a $100 sign-up bonus. Cardholders spending at least $5,000 yearly are eligible to receive a $50 credit toward online subscription services.

Details

If you pay your cell phone bill with this card, you are insured up to $600 for cellphone damage or theft.

Cardholders are eligible for exclusive access to specific events and offers. Uber anticipates the majority of these offers to be available in major cities like New York, San Francisco, Los Angeles, Chicago and DC. There is no foreign transaction fee.

But there is no introductory rate. The APR is a variable 16.99%, 22.74% or 25.74%, based on your creditworthiness. Cardholders with less than stellar credit will be on the higher end of the range.

Also, there are restrictions on Uber credits. To redeem points as credits within the Uber app, accumulate at least 500 points, or $5. Cardholders can convert a maximum of 50,000 points, or $500, per day.

Get it here: https://www.uber.com/c/uber-credit-card/

Costco Anywhere Visa® Business Card by Citi

Not taking Uber? Then you’ll need to fill your gas tank somehow. Why not do so with the Costco Anywhere Visa® Business Card by Citi?

This credit card earns cash back with every purchase. Get 4% cash back on the first $7,000 spent on eligible gas purchases annually (1% after that). Earn 3% cash back at restaurants and on eligible travel purchases. Also, earn 2% cash back at Costco and Costco.com. And earn 1% cash back on all other purchases.

Note: the $0 annual fee is only for Costco members. And an active Costco membership is required. Cardholders will get access to damage and theft purchase protection, extended warranty coverage and travel accident insurance.

Also, there is no sign-up bonus offered with this card.

Get it here: https://www.citi.com/credit-cards/credit-card-details/citi.action?ID=Citi-costco-anywhere-visa-business-credit-card

Ink Business Cash℠ Credit Card

Check out the Ink Business Cash ℠ Credit Card. Small businesses can earn cash back with every purchase. Spend $3,000 in the first three months from account opening. And you’ll get a $500 bonus cash back.

There is a $0 yearly fee with a 0% introductory APR for 12 months on purchases and balance transfers. Afterwards, the APR is a 15.24 – 21.24% variable.

The credit card features travel and purchase coverage benefits. So, this includes an auto rental collision damage waiver and extended warranty protection.

Details

Earn additional cash back on business categories. So, these include office supply stores, telecommunications, gas stations and restaurants.

Note: this card has a balance transfer fee. Pay 5% of the amount transferred or $5, whichever is more. Also, there is a foreign transaction fee of 3%.

Get it here: https://creditcards.chase.com/small-business-credit-cards/ink-cash

United MileagePlus Explorer Business Card

Get a good look at the United MileagePlus Explorer Business Card.

Earn 2 miles/dollar with United and at restaurants, filling stations and office supply stores. All other purchases earn 1 mile/dollar. Earn a 50,000-mile sign-up bonus after spending $3,000 in the initial three months from account opening.

Benefits include priority boarding, a free first checked bag for you and a companion on the same reservation.

Details

Also, get two United Club passes annually. And get hotel and resort perks including upgrades. In addition, get early check-in and late checkout. And get an auto rental collision damage waiver.

Plus, get baggage delay insurance, lost luggage reimbursement, trip cancellation and interruption insurance. Finally, get trip delay reimbursement, purchase protection, price protection and concierge service.

After the first year, the card has an annual fee of $95. There’s an APR of 17.99% – 24.99%, based on creditworthiness.

Get it here: https://creditcards.chase.com/small-business-credit-cards/united-mileageplus-explorer-business

Starwood Preferred Guest® Business Credit Card from American Express

Another choice is the Starwood Preferred Guest Business Credit Card from American Express.

This card is for those who stay at Starwood Preferred Guest and Marriott hotels often. Get six points per dollar of eligible purchases at participating SPG and Marriott Rewards hotels.

And earn four points per dollar at American restaurants, American filling stations, and on American purchases for shipping.

Also, earn four points to the dollar on wireless telephone services purchased directly from US service providers. For all other eligible purchases, get two points per dollar.

Details

Get 75,000 bonus points when you spend $3,000 in the first three months of account opening. Benefits include free in-room premium internet access, Sheraton Club lounge access, and purchase protection.

Plus, you get car rental loss and damage insurance. And you get baggage insurance. There is also a global assistance hotline. And there is a roadside assistance hotline. And get travel accident insurance and extended warranty coverage.

The biggest issue is the annual fee. There is a $0 introductory annual fee for the first year, then it’s $95 thereafter. Plus, there is no 0% introductory APR. Instead, there is a 17.74 – 26.74% variable APR

Get it here: https://www.americanexpress.com/us/credit-cards/business/business-credit-cards/spg-amex-starwood-credit-card

Terrific Cards for Cash Back: A Complement to a Building Business Credit Card

SimplyCash Plus Business Credit Card from American Express

Check out the SimplyCash Plus Business Credit Card from American Express. There is a $0 annual fee. And there is a 0% APR on purchases. So, this is for the initial 15 months an account is open.

But when the introductory period runs out, the APR for purchases is 14.24 to 21.24%. So, this is variable and based on creditworthiness.

Details

This card has several benefits. These include purchase protection, car rental loss and damage insurance. And they also include a baggage insurance plan, extended warranty coverage and a global assist hotline.

Also, earn 5% cash back at US office supply stores and on wireless telephone services. So, these must be bought from American service providers. But this applies to the initial $50,000 of yearly spending. Then, you earn 1% cash back.

You also get 3% cash back on spending category of your choice. So, this is from eight distinct categories. They include airfare, gas, advertising and computer purchases. But it applies to the first $50,000 of annual spending. Then, you get 1% cash back.

Cash-back bonuses are automatically credited to the customer’s billing statement.

Note: you cannot use this card for balance transfers. There is a foreign transaction fee of 2.7%. The card charges up to $38 in late fees. And the returned check fee is also $38. The penalty APR is 29.99%.

And, it applies if you have two or more late payments within 12 months. It can also apply if you fail to make the minimum payment on time or have a returned payment.

Get it here: https://www.americanexpress.com/us/small-business/credit-cards/simply-cash-plus-business-credit-card/44279

Capital One® Quicksilver® Card

Check out the Capital One® Quicksilver® Card. It offers flat-rate rewards of 1.5% on all purchases. There are no limits to the amount of cash back rewards that cardholders can earn. Also, the card has a $0 yearly fee.

New cardholders have a 0% APR on purchases and balance transfers for the first 15 months after opening the account. Then afterwards they have a 14.74 – 24.74% (variable) APR after that.

A cash bonus of $150 is available for those who make at the very least $500 in purchases in 3 months of account opening.

Details

Also, cash back rewards do not expire for the life of the account. And there is no limit to how much you can earn.

This card also offers travel accident insurance. And you get an auto rental collision damage waiver. There are no foreign transaction fees. And there is extended warranty coverage.

Downsides are the flat reward rate, not allowing for any more than that. And the higher APR after the first 15 months.

Get it here: https://www.capitalone.com/credit-cards/quicksilver/

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Unbeatable Cards for Jackpot Rewards: For When You Graduate from a Building Business Credit Card

Chase Sapphire Preferred® Card

Have a look at the Chase Sapphire Preferred® Card for travel points.

You can get two points to the dollar spent on travel and dining at restaurants. And you can earn one point per dollar on all other purchases. Points can be traded in for cash back, gift cards, or travel.

The card’s benefits include trip cancellation insurance, travel and emergency assistance services. They also include an auto rental collision damage waiver, purchase protection and extended warranty protection.

When you spend $4,000 in the first 3 months from account opening, you will earn 50,000 bonus points. These points are worth $625 if you redeem them for travel through Chase Ultimate Rewards.

Details

You can earn an unlimited two points per dollar for travel and dining at restaurants. And then earn one point per dollar for all other purchases. Points will transfer equally to 13 leading frequent travel programs with partners. So, these include British Airways, Southwest Airlines, United, and Marriott.

There is no 0% introductory APR on purchases or balance transfers. The card’s standard APR is 17.74 – 24.74% variable. Also, the card has an annual fee of $0 introductory for the first year. And then it skyrockets to $95.

Get it here: https://creditcards.chase.com/rewards-credit-cards/chase-sapphire-preferred

Ink Business Preferred ℠ Credit Card

Get a look at the Ink Business Preferred Credit Card from Chase. Cardholders earn 3 points for every dollar spent on travel, shipping, internet, cable, phone and qualifying advertising with the card. So, this is up to $150,000 each year. And all other purchases earn an unlimited one point per dollar spent.

This is a Visa credit card.

Cardholders get benefits like purchase protection, trip cancellation or interruption insurance. They also get cellphone protection. And they get extended warranty coverage. And they get an auto rental collision damage waiver.

Details

Earn 80,000 bonus points when you spend $5,000 in the initial 3 months from account opening. There is an annual fee of $95. You can add employee cards at no additional cost.

This card only offers 3 points per dollar to a limit of $150,000 a year. So, this is for travel, shipping, internet, cable, phone and qualifying advertising. All other purchases earn an unlimited flat rate of one point per dollar. And there is no introductory APR

Get it here: https://creditcards.chase.com/small-business-credit-cards/ink-business-preferred

Establish business credit fast with our research-backed guide to 12 business credit cards and lines.

Hilton Honors American Express Ascend Card

Have a look at the Hilton Honors American Express Ascend Card, which earns hotel rewards points. Earn up to 12 points per dollar of eligible purchases at participating Hilton hotels or resorts.

Automatically get Hilton Honors Gold status. And this includes room upgrades when available, a 5th night free when you book a rewards stay of 5 nights or more.

And get free internet access and late checkout. It also includes a 25% bonus on base points earned with Hilton Honors.

This credit card has a variable purchase APR of 17.74 – 26.74%. There is an annual fee of $95.

Details

Cardholders can get a 125,000-point welcome offer after making $2,000 in eligible purchases in 3 months from account opening. Earn a free weekend night award after making $15,000 in eligible purchases on your card in a calendar year.

Benefits include purchase protection. And there is extended warranty coverage. They also include car rental loss and damage insurance and travel accident insurance.

If you spend $40,000 on eligible purchases with the card within a calendar year, you can earn Hilton Honors Diamond status through the end of the next calendar year. This status includes all the benefits of Gold status.

It also includes a 50% bonus on base points earned with Hilton Honors and exclusive floor lounge access at select properties. But that is awfully high spending required for elite status. Only you can decide if that’s worth it.

Get it here: https://www.americanexpress.com/us/credit-cards/card/hilton-honors-ascend/

The Best Building Business Credit Card for You

Your outright best building business credit card will hinge on your credit history and scores.

Only you can choose which features you want and need. So, be sure to do your homework. What is excellent for you could be disastrous for someone else.

And, as always, make certain to develop credit in the recommended order for the best, fastest benefits.

The post Get an Amazing Building Business Credit Card appeared first on Credit Suite.