Article URL: https://www.linkedin.com/company/tyltgo/jobs

Comments URL: https://news.ycombinator.com/item?id=24431438

Points: 1

# Comments: 0

Article URL: https://www.linkedin.com/company/tyltgo/jobs

Comments URL: https://news.ycombinator.com/item?id=24431438

Points: 1

# Comments: 0

Come work with us, we’re a pleasant group of people and we’re remote-friendly!

Own everything you see on gravitational.com, both the front-end and the (currently non-existing) back-end.

Specifically, we’re looking for a strong engineer to manage our web properties for Gravitational. You will be charged with keeping us up to date with the latest web technology and implementing pixel perfect designs that run smoothly on Desktop and Mobile devices. You should have very strong technical skills especially in the areas of Javascript, react, CSS, and HTML. We expect you to enforce strict web standards and watch over website SEO using the latest tools.

Apply here:

https://jobs.lever.co/gravitational/4914bfe9-46ed-4711-af70-…

Or just shoot an email to CEO: ev@gravitational.com

Comments URL: https://news.ycombinator.com/item?id=24434206

Points: 1

# Comments: 0

The COVID-19 pandemic caught the world by surprise and turned the economy upside down. If you are a business trying to make it during this time, we can help. The Federal government has approved funding through The CARES Act, including the Paycheck Protection Plan. In addition, many states and local organizations are offering their own COVID-19 relief options. Beyond that, we can help you find the best business line of credit in a recession.

A business line of credit can be an incredible tool for your business, even in a recession. You don’t want just any line of credit however. You want the best one for your business needs.

Not all businesses are the same, and not all lines of credit are best for all businesses. Different limits, rates, and terms work better for some than others. How do you ensure you are getting the best business line of credit in a recession?

It can help to get a quick rundown of exactly what a line of credit is. The most basic definition is that it is a revolving line of credit, similar to a credit card. You have a limit and continuous access to that limit while making payments only on the portion you use each month.

For example, if you have a $10,000 line of credit, you can use however much of those funds you need each month for whatever you want, unless your lender issues some sort of restriction. If you use $2,000, then when you get your statement your payment will be based on $2,000 plus the interest, rather than a payment plus interest on the entire credit line.

If you were to pay $1,000, then spend another $500, you would pay on the $1,500 balance the next month. Your payments change as your balance changes. Just like with a credit card.

Access is most typically granted through checks or a card connected to the line of credit account. Electronic draws and transfers are also popular.

Learn bank rating secrets with our free, sure-fire guide which can even help during a recession.

The question is always asked what the difference is between a line of credit and a credit card, and why is one better than the other? The truth is that in some cases, a credit card may be the better option. There is a choice to make based on several different factors.

The main difference between the two that most borrowers need to know is that a line of credit typically has a consistently lower interest rate. Also, there are no perks like 0% interest or cash back that you sometimes see with credit cards.

What Signifies the Best Business Line of Credit in a Recession?

The best business line of credit in a recession is going to be the one with the best rates and terms that your business can qualify for. That makes finding it a little more involved. You have to know where you stand and what various lenders offer and require.

It will take some leg work on your part to pull together the information needed for application. You will also need to understand that the best business line of credit in a recession may not come from the same place you would have gotten a business line of credit pre-recession. You might have better luck with online lenders or smaller banks over larger traditional banks during an economic downturn.

Before you apply for the best business line of credit in a recession, remember that balance is important. Recession times are by default, hard. A line of credit can ease some of the burden, but be careful not to let the credit line itself become a burden. Know your limits as far as what you can pay.

If you do not make payments on-time, you could end up with more trouble than you already had.

There are several steps to this process.

Figuring this out could be the most vital step in finding the best business line of credit for your needs. You have to understand why you need a credit line in the first place. Here are some examples of how a business may use a line of credit.

Another example of this is a seasonal line of credit for a business that does the majority of its sales during a certain time of the year. A florist does a large percentage of sales during Valentines day, so a seasonal line of credit can come in handy to bridge the cash gap during other times of the year.

Shop around with various financial institutions to determine which ones offer the best business lines of credit in a recession. You will want to look at factors such as interest rate and credit limit in relation to what you need and can afford.

Check with various types of lenders to get a feel for which ones offer what you need. Check with larger commercial banks, small local institutions and credit unions, and alternative lenders such as those that operate exclusively online.

Pay specific attention to eligibility requirements to avoid wasting your time with those you do not qualify for.

Learn bank rating secrets with our free, sure-fire guide which can even help during a recession.

Your ability to get approval for the best business line of credit in a recession will be directly related to your business credit. Traditional banks pay more attention to personal credit, but they crack down a lot on lending when there is a recession. Non-traditional lenders may also consider income and cash flow. They may, in addition, rely heavily on your business credit score when making an approval decision about a line of credit.

A lower business credit score does not necessarily mean you can’t get approval. It could greatly affect your interest rate and credit limit however.

Consider signing up for a credit monitoring service that lets you keep tabs on your business credit and what is affecting it each month. The one offered by CreditSuite.com is easy to use and cost effective.

Once you have a handle on why you need a business line of credit, what is available, and what you may actually be eligible for, you can make a decision as to where you are going to apply and which product you are going to apply for.

Determining which of these lenders has the best business line of credit in a recession for you goes back to knowing what you need, who has it, and who will approve you for it.

If you are going to need to make payments, a line of credit is a better option. The reason is pretty simple. The credit rate is almost always lower. The few exceptions are those cards that offer 0% APR for a short period of time.

If you are going to use a credit card to make regular purchases you intend to pay off immediately, that’s another story. Especially if you qualify for a card with perks such as cash back. In that case, you may find that you can benefit from using a credit card over a line of credit.

An example would be if you wanted to use your business credit card to make your monthly supplies purchase each month and then pay it off in the following month. You could take advantage of the cash back and reduce your overall cost.

To float a cash flow gap or make significant purchases that you will need to pay out over a short amount of time, a line of credit is almost always the best choice.

Some small businesses will have a hard time getting approval from a traditional lender due to poor credit or a lack of sufficient credit history. We found examples of what alternative lenders are offering currently. Keep in mind these offerings can change, so make sure to visit the lender and verify.

Kabbage offers a credit line of up to $150,000 with no credit score required. The catch is that the interest rate is between 32% and 108%. The business must have been in existence for at least one year and have revenue of at least $50,000.

The interest rate is very high. This is really only an option for those businesses that cannot get financing due to a low or nonexistent credit score and need funding immediately.

There is a credit line available here of up to $100,000. A business must have what they consider to have “reasonable credit.” It also must be in business for at least one year and have more than $25,000 in revenue. Repayment is weekly.

Due to the lower revenue requirement, this is a good option for smaller businesses with okay credit scores but lower annual revenue. Also, the interest rate minimum is lower, with the low end at 9%.

If you have a credit score of at least 600 you can get a credit line of up to $100,000 with OnDeck. There is a $20 per month maintenance fee and weekly repayment. The interest rate is a little higher here than with those that require a higher credit score minimum. It ranges from 13.99% to 39.99%.

Again, due to the higher interest rate, this should only be an option if you cannot meet the higher credit score requirement.

The credit line offered by lending club goes up to a limit of $300,000. It requires a credit score of 600. In addition, at least one year in business and at least $50,000 in revenue are necessary. The repayment term is 25 months, and they require collateral for limits over $100,000.

This is a good option for those that meet the requirement as there is a higher limit available with collateral, and the interest rate can go as low as 6.25%. The repayment terms are much friendlier as well.

A credit line hybrid is revolving, unsecured financing. It allows you to fund your business without putting up collateral, and you only pay back what you use. It even works for startups.

What are the Qualifications?

How hard is it to qualify? It’s probably easier than you think. You do need good personal credit. That is, your personal credit score should be at least 685. In addition, you can’t have any liens, judgments, bankruptcies or late payments. Also, in the past 6 months, you should have less than 5 credit inquiries, and you should have less than a 45% balance on all business and personal credit cards. It’s also preferred that you have established business credit as well as personal credit.

If you do not meet all of the requirements, all is not lost. You can take on a credit partner that meets each of these requirements. Many business owners work with a friend or relative to fund their business. If a relative or a friend meets all of these requirements, they can partner with you to allow you to tap into their credit to access funding.

When you apply for the best business line of credit in a recession, consider using your business credit rather than personal credit. Some lenders will require you to use both. If you can get a credit line on your business credit only, that is best. If not, strong business credit can help negotiate better terms and rates.

Learn bank rating secrets with our free, sure-fire guide which can even help during a recession.

Not sure what business credit is, if you have it, or how to get it? Here’s a quick rundown. Business credit is similar to your personal FICO, but it is for your business only. It is not attached to your name or social security number, but rather to your business name and EIN.

The most commonly used business credit reporting agency is Dun & Bradstreet, but there are others. With Dun & Bradstreet however, you must have a DUNS number to have a record with them. If you do not have one, you don’t have a D&B business credit report.

You can get a free DUNS number on the D&B website. Before you do, your business must be incorporated. It also must have dedicated, separate contact information that is not your personal contact information. You can find out more about incorporation options and how to get a free EIN on the IRS website.

A business line of credit is a great financing option. It offers flexibility that isn’t always available with a term loan. Interest rates are often better than those offered by business credit cards. With alternative lenders in the mix, a line of credit is an option for most small businesses even during a recession.

The post How Does Your Garden Grow? Best Business Line of Credit in a Recession appeared first on Credit Suite.

Disclosure: This content is reader-supported, which means if you click on some of our links that we may earn a commission.

What would you do with an extra $1,500 a day?

With a bit of work and the right platform behind you, you can create an online store that generates that kind of revenue (and more).

Shilpi Yadav is an excellent example. She quit her job to start an online clothing store based around her Indian heritage. Despite all the risks, the brand now makes more than half a million dollars a year (averaging around $1,500 per day).

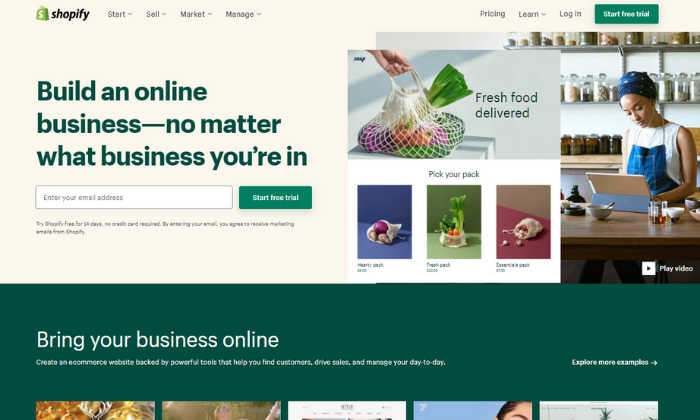

She built her online store using Shopify, one of the best ecommerce platforms on the market. However, there are a ton of different options to choose from depending on what you need.

And the most significant thing standing in the way of your own $500k success story is deciding which ecommerce platform is right for your new store.

So to help you out, I reviewed seven of the best options in the industry, depending on your current situation.

The best ecommerce platform for your business depends on several factors like your experience level, your customization requirements, and the type of products you want to sell.

But choosing the right platform can feel overwhelming because there are countless options to choose from.

To make things easier, I created a list of things to consider as you go through the process.

It may help to start with a list of requirements and the features you need. From there, you can narrow down your choices based on the following criteria.

Digital products are a booming market. But selling and delivering digital products isn’t the same as delivering a physical product to someone’s doorstep.

Different ecommerce platforms handle each type of product differently. And some may not support digital products at all. So it’s important to understand which type you plan to sell before you make a decision.

If you already have a website, the best deployment option is integrating an online store rather than building a brand new website on a new platform.

Furthermore, if you use WordPress, you can add ecommerce functionality via a plugin.

Unless, of course, you want to start with a clean slate.

On the other hand, if you don’t have a website, you probably need a website builder with the capability to create something from scratch. So, think about the route you want to take and choose a platform that offers the right capabilities.

Order management, product creation, tracking orders, and dashboard navigation are important factors of day-to-day ecommerce management.

And it’s important to choose a platform that’s easy to use and manage on a daily basis. It shouldn’t feel like a struggle to create new products, check the status of an order, or update the pages of your website.

Furthermore, it’s important to find the right ratio of flexibility and customization to ease of use. And keep in mind, the more customizable the platform, the harder it is to manage. Why?

Because flexible platforms offer more settings and options to configure.

You can simplify your workload by choosing a platform that offers just enough flexibility without going overboard for your specific needs.

Some ecommerce website builders (like Wix) are truly drag and drop, meaning the customization options are endless. If you can imagine it, you can build it. But, that freedom also makes the platform more difficult to use.

Other platforms integrate into your current site, taking the look and feel of your existing website with very few customization options. For some users, this is perfect.

But others may want more control.

If you’re just starting out, simple designs and ease of use are more important than design flexibility.

However, if you already own a physical store or an established brand, design is more important so you can create a cohesive aesthetic from one touch point to the next.

Do you want to be able to offer discounts or accept payments through different payment processors? Maybe you want to send visitors a reminder email when they exit your website with something in their cart.

Perhaps you’re interested in creating customer profiles and analyzing advanced analytics.

Other advanced ecommerce features include:

Think carefully about what you need and what would be nice to have. Then, you can use your list of requirements to narrow down your list of choices.

There are several different types of ecommerce platforms on this list. And which type you should choose depends on your current situation.

These are all-inclusive website builders that include ecommerce functionality.

This option is best for businesses without an existing website (or those who want to start over from scratch). Website builders also don’t require a lot of design experience to get up and running so it’s an excellent choice for beginners.

If you already have a website, integrating an online store is much easier than starting over on a different platform. Several of the recommendations on this list can be used with an existing website so you don’t have to worry about starting over.

However, these typically require a bit of coding knowledge to customize so they’re not suitable for beginners.

This option is best for users already using WordPress to run their website.

Note: If you don’t know what a WordPress plugin is, this probably isn’t the best option for you (go with a website builder instead).

Wix is a great option if you’re looking for an affordable and flexible ecommerce platform. It’s famous for it’s drag-and-drop interface with complete design freedom to create anything you can imagine.

With Wix, you also get access to more than 500+ prebuilt website templates and plenty of customization options (with no coding required). Or you can create pages from scratch with complete design control.

Furthermore, they have a robust mobile app so you can make changes and manage your store from anywhere in the world.

Wix also includes a wide variety of marketing features, like emails, Facebook ads, and social media posts right from your account dashboard. You can even sell directly via social media.

Their ecommerce plans include powerful features, like:

Plus, if you already use Wix, you can upgrade to an ecommerce plan in just a few clicks within your account dashboard.

Wix offers four ecommerce plans for online shops of different sizes, including:

This is an excellent option if you have a small store or special design requirements. However, If you expect a high order volume and large range of products, you’re better off with BigCommerce or Shopify instead.

Shopify is an all-in-one ecommerce website builder that powers more than one million online stores, making it one of the most popular choices on this list.

However, it’s not as customizable as Wix. But it offers more advanced ecommerce features because it’s built specifically to host online stores. Plus, it’s easy to use with just the right level of flexibility.

It’s also incredibly versatile, powering micro to large stores, and everything in between. Shopify plans include access to an incredible suite of ecommerce features, including:

Plus, with 70+ professional themes (nine of which are free) and 4,100+ apps, you can create a beautiful and highly functional ecommerce store without having to start from scratch. Or write a single line of code.

Combine that with award-winning 24/7/365 customer support and you have an excellent ecommerce platform.

Shopify offers five plans for businesses of all sizes, including:

Shopify Lite is a great option if you want to embed products and “buy” buttons onto an existing website. However, it doesn’t come with the all-inclusive website builder.

Keep in mind that Shopify has its own payment processor. They charge 2.4% – 2.9% + $0.30 depending on the plan you choose. They also charge additional fees (0.5% – 2%) if you use a separate payment processor like PayPal or Square.

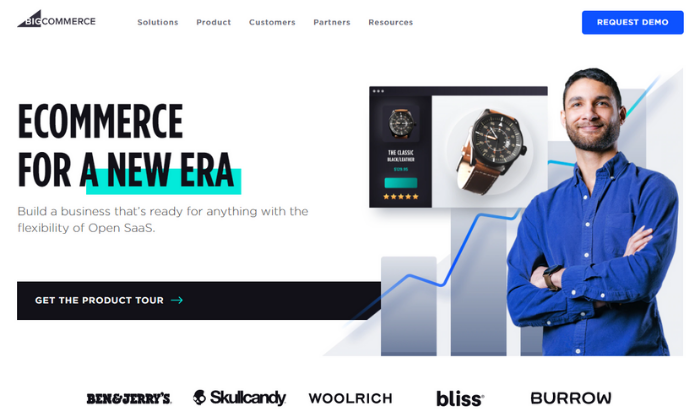

Like Shopify, BigCommerce is an all-in-one ecommerce website builder specifically for large online stores. It includes more advanced ecommerce features suitable for managing high volumes and a large number of products.

With a customer base of 100,000+ stores, including some big names like Ben & Jerry’s and SkullCandy, they’re a smaller player in the industry.

But that doesn’t make the platform any less powerful.

BigCommerce plans include access to powerful, industry-leading features, including:

Plus, all of their plans include unlimited products, file storage, bandwidth, and staff accounts.

And you can choose between 12 free mobile-responsive design templates or opt for a paid template to make your online store stand out from the crowd without touching a single line of code.

BigCommerce offers four paid plans (with a 15-day free trial), including:

If you’re just getting started, BigCommerce is overkill for your online store. However, if you’re an established business or plan to sell high volumes, it’s an excellent choice.

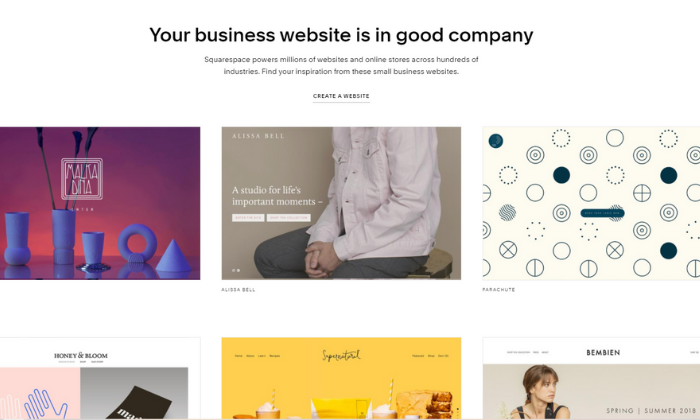

Squarespace is well-known as a website builder, but their higher-tier plans also include ecommerce functionality. Furthermore, their design templates are famous for their ease of use and creativity, making this an excellent choice for creative online stores.

You can also install and customize multiple templates at a time to see which one you like best. And switching between templates takes just a few clicks.

Aside from beautiful templates, Squarespace offers a variety of ecommerce features, including:

Furthermore, Squarespace integrates with most of the popular email marketing and social media platforms so you can sell and market your products like a pro.

And they have fantastic 24/7/365 customer support ready to answer your questions and help you get things set up the way you want to.

Squarespace offers three ecommerce plans (and a personal plan), including:

They also have an enterprise plan with a dedicated account manager, SEO consultations, and prioritized technical support.

And while the Business plan offers ecommerce capabilities, I highly recommend choosing Basic Commerce to start. It’s the cheapest plan with no transaction fees, plus it includes other essential features like, customer accounts and ecommerce analytics.

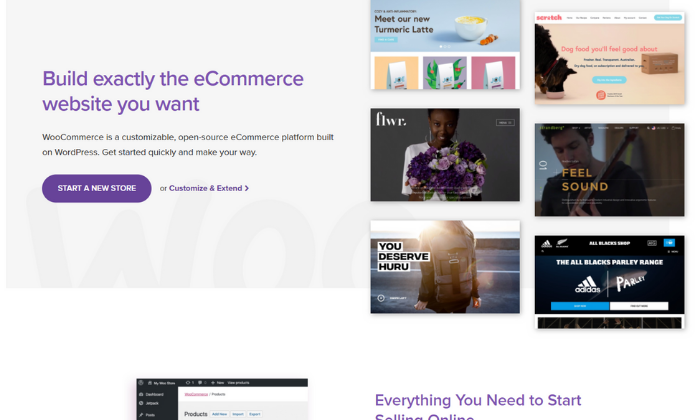

The recommendations thus far are all-in-one website builders. WooCommerce, however, is not. It’s a WordPress plugin built to add ecommerce functionality to existing WordPress websites.

WooCommerce powers approximately 30% of stores online today. And with 80+ million downloads, it’s one of the most popular ecommerce platforms on this list.

Note: if you don’t already have a WordPress website, I don’t recommend going this route. Stick to an all-in-one ecommerce platform, instead.

WooCommerce is a lightweight plugin that adds ecommerce capabilities like accepting online payments, configurable shipping options, product listings, and more. But you have to have an existing website to use it. So, it’s a great option if you already use WordPress.

It includes powerful ecommerce features like:

And the best part? It’s free to download, install, and use. Forever.

However, some of the extensions aren’t free so watch out for that if you start digging into those.

With the power of WordPress behind it, your customization options are only limited to what you can imagine. So, the sky is legitimately the limit with WooCommerce.

But with that said, it’s not the easiest or most intuitive ecommerce platform. So, I don’t recommend it if you aren’t already using WordPress and 100% comfortable with it.

OpenCart is another open source ecommerce platform, much like WooCommerce. However, it’s not limited to WordPress websites. But you do need to have an existing website to use it.

Over 300,000 online stores use OpenCart to confidently sell products of all shapes and sizes online. Plus, most web hosting companies offer one-click installation or will install it for free, so it’s incredibly easy to set up.

Note: I only recommend going this route if you already have a website up and running.

While you can sell products of any kind, the no-fluff interface (and free price tag) makes it an excellent option for selling digital products to make more money with your online business.

All without adding an extra monthly expense because it’s 100% free forever.

OpenCart offers a powerful set of ecommerce features, including:

Plus, with 13,000 modules and themes in the marketplace, you can add any functionality you can imagine including service integrations, conversion modules, email marketing, and more.

Keep in mind that not all of OpenCart’s extensions are free. You may have to pay for more advanced capabilities.

And they don’t currently offer support for free, either.

If you can’t find what you’re looking for on their community forum, you have to pay for dedicated help. Dedicated support starts at $99 per site per month or $99 for a one-time fix.

Like OpenCart and WooCommerce, Ecwid is an ecommerce platform you can use to integrate with your current platform, regardless of what you’re already using.

It integrates with platforms like Weebly, Wix, WordPress, Squarespace, and more. So, if you already have a website set up and want to add ecommerce functionality, Ecwid is an excellent choice.

With that said, they also offer an all-in-one ecommerce website builder if you want to start from scratch. However, there are better website builders to use.

So, I only recommend Ecwid if you want to integrate ecommerce into your existing website.

This ecommerce platform includes a wide range of features, like:

The biggest downside is that you can’t manage your store from inside your website account dashboard. You have to log in to Ecwid instead. So, you need to manage two separate accounts.

But the good news is… you can start on the limited free forever plan to try it out before making any investments.

The free plan only allows up to ten products, so you have to upgrade if you need more. Ecwid also offers three paid plans, including::

As a stand-alone store builder you might be better off with other options (like Wix and Shopify).

But if you already have a website and want to add an ecommerce store, Ecwid is a great alternative to WooCommerce and OpenCart.

My #1 recommendation for most users is Wix. It’s great for users of all experience levels. Plus, it’s easy to use, highly customizable, and affordable as well. But if Wix is too customizable for you, Squarespace is a fantastic alternative.

For large stores, I highly recommend BigCommerce or Shopify.

However, if you already have a website, WooCommerce, OpenCart, and Ecwid are excellent choices depending on what you need.

The post Best Ecommerce Platforms appeared first on Neil Patel.

Statista says 52 percent of global internet traffic is mobile. A third of all mobile searches on Google are local. Microsoft says the same thing — 53 percent of mobile searches on Bing have local intent. This is pretty big on its own. Then we see data showing that local searches are growing 50 percent …

The post How to Choose The Right Local SEO Agency first appeared on Online Web Store Site.

The post How to Choose The Right Local SEO Agency appeared first on ROI Credit Builders.

Toptal | Software Developer | Remote | Contract with a commitment of 40+ hours a week Toptal is adding freelancers even amid the layoffs and furloughs hitting many industries. We provide freelance tech talent to top organizations and are looking for global talent in the following areas: React Native, PHP, Java, Shopify, Angular, React, Unreal …

The post New comment by myudina12 in “Ask HN: Who is hiring? (September 2020)” first appeared on Online Web Store Site.

Statista says 52 percent of global internet traffic is mobile. A third of all mobile searches on Google are local. Microsoft says the same thing — 53 percent of mobile searches on Bing have local intent. This is pretty big on its own. Then we see data showing that local searches are growing 50 percent …

The post How to Choose The Right Local SEO Agency first appeared on Online Web Store Site.

AnotheReality | Milan, Italy | Mid-Senior Game Developer / XR Developer (Unity) & more | On-Site | https://www.anothereality.io/

We’re a VR/AR development studio founded in 2016 based in Milan, coming from the game development industry: we mainly develop B2B applications, but we’re also working on a platform to enable future developers (technical and not) to easily develop and deploy XR applications, with open source code to be used within game engines or through a web interface with an authoring tool.

We’re now looking for a XR Developer (mainly Unity based, but we also welcome people skilled in Unreal Engine) to expand our development team. Min of 3 years of experience, solid coding skills with C#/C++ (and also outside game engines).

See more on the position here: https://www.anothereality.io/company/work-with-us/xr-gamepla…

If you’re interested you can mail directly me (CTO) and ask anything you want at fabio@anothereality.io (add a [HN] in the subject!)

The post New comment by Gounemond in “Ask HN: Who is hiring? (September 2020)” appeared first on ROI Credit Builders.

The post New comment by Gounemond in "Ask HN: Who is hiring? (September 2020)" appeared first on Automation For Your Email Marketing Sales Funnel.

The post New comment by Gounemond in "Ask HN: Who is hiring? (September 2020)" appeared first on Buy It At A Bargain – Deals And Reviews.

Statista says 52 percent of global internet traffic is mobile. A third of all mobile searches on Google are local. Microsoft says the same thing — 53 percent of mobile searches on Bing have local intent. This is pretty big on its own. Then we see data showing that local searches are growing 50 percent …

The post How to Choose The Right Local SEO Agency first appeared on Online Web Store Site.

The post How to Choose The Right Local SEO Agency appeared first on ROI Credit Builders.

The post How to Choose The Right Local SEO Agency appeared first on Buy It At A Bargain – Deals And Reviews.

Fireside | Remote | Full-time

we’re hiring a senior react native developer to help us accelerate building a first-of-its-kind interactive broadcasting platform to promote driving social impact through meaningful conversations at scale. We’ve raised a multi-million dollar seed round from top tier consumer investors and the co-founding team is made up of experienced serial entrepreneurs including Mark Cuban. You’d be joining a small team on the ground floor and will have a huge impact on the platform and community we’re building.

Excellent candidates will have experience building green field applications, integrating with APIs, working with designers and product managers to deliver delightful products through mobile app stores. Perfect candidates would also have experience with streaming media to mobile devices.

Required:

React Native

Javascript / HTML / CSS

GraphQL

Firebase

Ownership and Accountability

– Our team is small, so you will get a lot of responsibility immediately. That also means we’ll be depending on you to deliver.

Superb English written and verbal communication skills

– This is a remote role, so the ability to create and communicate complex and detailed technical specifications is required

Product orientation

– No specification is perfect, so we expect everyone on our team to put themselves in the user’s position and ask questions to make the right decisions on their behalf

falon@firesidechat.com