Location: Atlanta

Remote: Yes

Willing to relocate: Yes

Technologies: React, JavaScript, Python, Django, Ruby on Rails

Resume: https://www.dropbox.com/s/u7nm5sm8vdsugv9/Mark%20Harless%20R…

Email: harlessmark404[at]gmail[dot]com

Location: Atlanta

Remote: Yes

Willing to relocate: Yes

Technologies: React, JavaScript, Python, Django, Ruby on Rails

Resume: https://www.dropbox.com/s/u7nm5sm8vdsugv9/Mark%20Harless%20R…

Email: harlessmark404[at]gmail[dot]com

Lazy Lantern (YC S19) | Staff Backend/Data Engineer, Senior FullStack Engineer | Full-time | Remote

Lazy Lantern is an AI-powered product analytics solution – Pure data product with many challenges around AI & Big Data

– Founders with experience at leading Silicon Valley companies

– Several unicorn customers, dataset of billions of events

– Backed by top-tier US & European investors, incl. Y Combinator

Contact: gl@lazylantern.com

Article URL: https://deepsource.io/jobs/director-marketing-us/ Comments URL: https://news.ycombinator.com/item?id=25028979 Points: 1 # Comments: 0

Article URL: https://apply.workable.com/jerry/j/C40F2377E7/ Comments URL: https://news.ycombinator.com/item?id=25027056 Points: 1 # Comments: 0

Article URL: https://apply.workable.com/jerry/j/C40F2377E7/

Comments URL: https://news.ycombinator.com/item?id=25027056

Points: 1

# Comments: 0

The post Jerry, Inc. (YC S17) Is Hiring a Software Engineer appeared first on ROI Credit Builders.

Get a business credit card online in a recession. Here’s how – no matter what is going on with COVID-19.

Per the SBA, small business credit card limits are 10 – 100 times that of personal cards! This shows you can get a lot more money with business credit.

And this also means you can have personal charge cards at stores, and now have an additional card at the same stores for your small business. And you won’t need collateral, cash flow, or financial information in order to get business credit.

Benefits vary, so be sure to choose the benefit you prefer from this range of choices.

Have a look at the Brex Card for Startups. It has no yearly fee.

You will not need to provide your Social Security number to apply. And you will not need to supply a personal guarantee. They will take your EIN.

However, they do not accept every industry.

Also, there are some industries they will not work with, and others where they want more paperwork. For a list, go here: https://brex.com/legal/prohibited_activities/.

To determine creditworthiness, Brex checks a business’s cash balance, spending patterns, and investors.

You can get 7x points on rideshare. Get 4x on Brex Travel. Likewise, get triple points on restaurants. And get double points on recurring software payments. Get 1x points on everything else.

You can have poor credit scores (even a 300 FICO) to qualify.

Find it here: https://brex.com/lp/startups-higher-limits/

Take a look at the Capital One® Spark® Miles for Business. It has an introductory annual fee of $0 for the first year, which after that rises to $95. The regular APR is 18.49%, variable due to the prime rate. There is no introductory annual percentage rate. Pay no transfer fees. Late fees go up to $39.

This card is excellent for travel if your costs don’t fall into common bonus categories. You can get unlimited double miles on all purchases, without any limits. Earn 5x miles on rental cars and hotels if you book through Capital One Travel.

Get an introductory bonus of 50,000 miles. That’s the same as $500 in travel. But you only get it if you spend $4,500 in the first 3 months from account opening. There is no foreign transaction fee. You will need a good to outstanding FICO score to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-miles/

For a terrific sign-up offer and bonus categories, have a look at the Ink Business Preferred℠ Credit Card.

Pay an annual fee of $95. Regular APR is 17.49 – 22.49%, variable. There is no introductory APR offer.

Get 100,000 bonus points after spending $15,000 in the initial three months after account opening. This works out to $1,250 towards travel rewards if you redeem via Chase Ultimate Rewards.

Get 3 points per dollar of the initial $150,000 you spend with this card. So this is for purchases on travel, shipping, internet, cable, and phone services. Plus it includes advertising purchases made with social media sites and search engines each account anniversary year.

You can get 25% more in travel redemption when you redeem for travel through Chase Ultimate Rewards. You will need a great to outstanding FICO score to qualify.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/business-preferred

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines.

For no yearly fee while still getting travel rewards, check out this card from Bank of America. It has no annual fee and a 0% introductory APR for purchases during the first 9 billing cycles. Afterwards, its regular APR is 13.74 – 23.74% variable.

You can get 30,000 bonus points when you make at least $3,000 in net purchases. So this is within 90 days of your account opening. You can redeem these points for a $300 statement credit towards travel purchases.

Get unlimited 1.5 points for each $1 you spend on all purchases, everywhere, every time. And this is regardless of how much you spend.

Likewise get 3 points per every dollar spent when you book your travel (car, hotel, airline) via the Bank of America® Travel Center. There is no limit to the number of points you can earn and points don’t expire.

You will need superb credit scores to get this one (as in, 700s or better).

Find it here: https://www.bankofamerica.com/smallbusiness/credit-cards/products/travel-rewards-business-credit-card/

Check out the Marriott Bonvoy Business™ Card from American Express. It has an annual fee of $125. There is no introductory APR offer. The regular APR is a variable 17.24 – 26.24%. You will need good to exceptional credit to get this card.

You can earn 75,000 Marriott Bonvoy points after using your card to make purchases of $3,000 in the first three months. Get 6x the points for eligible purchases at participating Marriott Bonvoy hotels. You can get 4x the points at United States restaurants and filling stations. And you can get 4x the points on wireless telephone services purchased directly from American service providers and on American purchases for shipping.

Get double points on all other qualified purchases.

Plus, you get a free night every year after your card anniversary. And you can earn another free night after you spend $60,000 on your card in a calendar year.

You get complimentary Marriott Bonvoy Silver Elite status with your Card. Also, spend $35,000 on qualified purchases in a calendar year and earn an upgrade to Marriott Bonvoy Gold Elite status through the end of the next calendar year.

Also, each calendar year you can get credit for 15 nights towards the next level of Marriott Bonvoy Elite status.

Find it here: https://creditcard.americanexpress.com/d/bonvoy-business/

Have a look at the Blue Business® Plus Credit Card from American Express. It has no yearly fee. There is a 0% introductory APR for the initial one year. Afterwards, the APR is a variable 14.74 – 20.74%.

Get double Membership Rewards® points on day to day business purchases like office supplies or client suppers for the first $50,000 spent each year. Get 1 point per dollar afterwards.

You will need good to outstanding credit to qualify.

Find it here: https://creditcard.americanexpress.com/d/bluebusinessplus-credit-card/

Also check out the American Express® Blue Business Cash Card. Note: the American Express® Blue Business Cash Card is identical to the Blue Business® Plus Credit Card from American Express. However its rewards are in cash instead of points.

Get 2% cash back on all eligible purchases on up to $50,000 per calendar year. Then get 1%.

It has no annual fee. There is a 0% introductory APR for the first twelve months. After that, the APR is a variable 14.74 – 20.74%.

You will need good to excellent credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/business-bluecash-credit-card/

Check out the Capital One® Spark® Classic for Business. It has no yearly fee. There is no introductory APR offer. The regular APR is a variable 24.49%. You can earn unlimited 1% cash back on every purchase for your company, without minimum to redeem.

While this card is within reach if you have fair credit, beware of the APR. However if you can pay on schedule, and completely, then it is a bargain.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

Another choice is the Starwood Preferred Guest Business Credit Card from American Express.

This card is for those who stay at Starwood Preferred Guest and Marriott hotels often. Earn six points per dollar of eligible purchases at participating SPG and Marriott Rewards hotels.

And get four points per dollar at American restaurants, US filling stations, and on US purchases for shipping.

Also, earn four points to the dollar on wireless telephone services purchased directly from US service providers. For all other eligible purchases, earn two points per dollar.

Earn 75,000 bonus points when you spend $3,000 in the initial three months of account opening. Benefits include free in-room premium internet access, Sheraton Club lounge access, and purchase protection.

Plus you get car rental loss and damage insurance. And you get baggage insurance. There is also a global assistance hotline. And there is a roadside assistance hotline. And get travel accident insurance and extended warranty coverage.

The most significant issue is the yearly fee. There is a $0 introductory annual fee for the first year, then it’s $95 afterwards. Plus there is no 0% introductory APR. Instead, there is a 17.74 – 26.74% variable APR

Get it here: https://www.americanexpress.com/us/credit-cards/business/business-credit-cards/spg-amex-starwood-credit-card

For average credit, we like the Capital One Spark Classic for Business. It has no yearly fee. There are cash-back rewards. The card gets an unlimited 1% cash back on all purchases. There is an annual fee of $0.

With this card, you will get benefits including an auto rental collision damage waiver, and purchase security. And you also get extended warranty coverage. And you get travel and emergency assistance services.

But BEAR IN MIND: the ongoing APR is 24.74% variable APR. And the penalty APR is even higher, 31.15%. Also, there is no sign-up bonus.

Get this business credit card online in a recession here: https://www.capitalone.com/small-business/credit-cards/spark-classic/

Be sure to check out the Capital One® Spark® Miles for Business card. With this card, you can get 2 miles per dollar on all purchases. When you spend $4,500 within the first 3 months of opening an account, you can earn 50,000 miles. So, that is worth $500 in travel.

Benefits for cardholders include an auto rental collision damage waiver, and purchase security. And they also include extended warranty coverage. And you get travel and emergency assistance services.

Cardholders will pay $0 introductory for first year. But they will pay $95 after that for the annual fee.

There is no 0% APR for purchases or balance transfers with this card. The APR is 18.74% (variable).

Get it here: https://www.capitalone.com/small-business/credit-cards/spark-miles/

Take a look at the Capital One® Spark® Cash for Business. It has an introductory $0 yearly fee for the first year. After that, this card costs $95 annually. There is no introductory APR offer. The regular APR is a variable 18.49%.

You can get a $500 one-time cash bonus after spending $4,000 in the initial three months from account opening. Get unlimited 2% cash back. Redeem any time without any minimums.

You will need great to superb credit to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash/

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines

Check out the Discover it® Business Card. It has no yearly fee. There is an introductory APR of 0% on purchases for year. After that the regular APR is a variable 14.49 – 22.49%.

Get unlimited 1.5% cash back on all purchases, with no category restrictions or bonuses. They double the 1.5% Cashback Match™ at the end of the first year. There is no minimum spend requirement.

You can download transactions| conveniently to Quicken, QuickBooks, and Excel. Keep in mind: you will need great to superb credit to receive this card.

https://www.discover.com/credit-cards/business/

Have a look at the Ink Business Cash℠ Credit Card. It has no annual fee. There is a 0% introductory APR for the first year. Afterwards, the APR is a variable 14.74 – 20.74%. You can get a $500 one-time cash bonus after spending $3,000 in the first three months from account opening.

You can get 5% cash back on the initial $25,000 spent in combined purchases at office supply stores and on internet, cable, and phone services each account anniversary year.

Get 2% cash back on the first $25,000 spent in combined purchases at filling stations and restaurants each account anniversary year. Earn 1% cash back on all other purchases. There is no limitation to the amount you can earn.

You will need exceptional credit scores to get approval for this card.

Find it here: https://creditcards.chase.com/business-credit-cards/ink/cash?iCELL=61GF

Have a look at the Bank of America® Business Advantage Cash Rewards MasterCard® credit card. Get an 0% introductory APR for the initial 9 billing cycles of the account. After that, the APR is 13.74% – 23.74% variable. There is no annual fee. You can get a $300 statement credit offer.

Get 3% cash back in the category of your choice. So these are gas stations (default), office supply stores, travel, TV/telecom & wireless, computer services or business consulting services. Get 2% cash back on dining. So this is for the initial $50,000 in combined choice category/dining purchases each calendar year. Then get 1% after, with no limits.

You will need outstanding credit to qualify.

Find it here: https://promo.bankofamerica.com/smallbusinesscards2/

Check out the Plum Card® from American Express. It has an introductory yearly fee of $0 for the first year. After that, pay $250 per year.

Get a 1.5% early pay discount cash back bonus when you pay within 10 days. You can take up to 60 days to pay without interest when you pay the minimum due by the payment due date.

You will need good to excellent credit scores to qualify.

Find it here: https://creditcard.americanexpress.com/d/the-plum-card-business-charge-card/

Have a look at the Capital One® Spark® Cash Select for Business. It has no annual fee. You can get 1.5% cash back on every purchase. There is no limit on the cash back you can earn. And earn a one-time $200 cash bonus when you spend $3,000 on purchases in the first 3 months. Rewards never expire.

Pay a 0% introductory APR for 9 months. Then pay 14.49% – 22.49% variable APR afterwards.

You will need great to excellent credit to qualify.

Find it here: https://www.capitalone.com/small-business/credit-cards/spark-cash-select/

Establish business credit fast and beat the recession with our research-backed guide to 12 business credit cards and lines

Your outright best company credit cards hinge on your credit history and scores.

Only you can pick which features you want and need. So make sure to do your homework. What is excellent for you could be disastrous for someone else.

And, as always, be sure to develop credit in the recommended order for the best, fastest benefits. The situation with COVID-19 will not last forever.

The post Get a Business Credit Card Online in a Recession appeared first on Credit Suite.

The novel coronavirus has upended our economy. We’re already a recession. If you’ve got less than stellar credit, then you may feel you must put up collateral. But that’s not necessarily so. Here’s the truth about unsecured business loans in a recession.

Unsecured business loans in a recession can save you. Here’s the skinny on this little-known form of funding.

Bad credit does not have to be a dead weight around your company’s proverbial neck. However, it does make it more challenging to obtain a small business loan. For a brand-new small business in particular, your company credit will be poor as a matter of course.

This is because you just will not have the sort of history and seasoning which can make your commercial credit score rise. And, then, make lending institutions want to lend your business funds).

Hence, lenders are not going to be too thrilled about offering your business a business loan. This is because they genuinely have no clue if your small business will be able to repay the loan. But you are still, with good reason wondering how to fund a small business with poor credit.

As a result of this, lenders will typically obtain a UCC blanket lien in case they do give your company a loan. A UCC blanket lien is a notification which goes on your credit report. It says that the lender has an interest in all of your company’s assets until you repay the loan completely. Thus, there could be unfortunate consequences if you need to default.

Plus, most of these loans will also entail personal guarantees.

Check out our credit line hybrid. It’s available for all business owners. Get the benefit of 0% rates cards offer, and the cash out capability of a credit line. Get approvals to $150,000. Pay 0% rates for 6 – 18 months, with normal card rates afterwards. No documentation, no tax returns or bank statements are necessary. This program is ideal for startups, high-risk industries, and those who desire low payments. It also works if you don’t want to supply financials.

Our credit line hybrid is a superb choice during this time of economic uncertainty.

With this form of business financing, you work with a lender who concentrates on securing business credit cards. This is a very unusual, very few know about program which few lending sources offer. They can in most cases get you three to five times the approvals that you can get on your own.

This is because they are familiar with the sources to apply for, the order to apply, and can time their applications so the card issuers won’t decline you for the other card inquiries. Individual approvals frequently range from $2,000 – 50,000.

The end result of their services is that you frequently get up to five cards that simulate the credit limits of your highest limit accounts now. Multiple cards create competition, and this means they will raise your limits, generally within 6 months or less of first approval.

Approvals can go up to $150,000 per entity such as a corporation. They actually get you three to five business credit cards that report solely to the business credit reporting agencies. This is huge, something most lenders don’t offer or advertise. Not only will you get cash, but you build your business credit as well so in three to four months, you can then use your new company credit to get even more money.

You get credit with no security, assets, or collateral. Lender has no collateral to collect in case of default. Because there is no collateral, and they don’t look or care about your cash flow, the only thing that matters is your personal credit.

With a 650 you will get just personal cards. But with a 680 credit score, you will get both company and personal cards.

The lender can also get you low introductory rates, usually 0% for 6-18 months. You’ll then pay normal rates after that, typically 5-21% APR with 20-25% APR for cash advances. And they’ll also get you the best cards for points. So this means you get the best rewards.

Like with anything, there are substantial benefits in working with a source who specializes in this area. The results will be far better than if you try to go at it on your own.

Not enough time in business? Or do you not have enough revenue? Then it’s time to start business credit building.

Small business credit is credit in a company’s name. It doesn’t connect to an owner’s individual credit, not even if the owner is a sole proprietor and the solitary employee of the business.

Accordingly, an entrepreneur’s business and consumer credit scores can be very different.

Given that business credit is distinct from individual, it helps to safeguard a business owner’s personal assets, in the event of legal action or business insolvency.

Also, with two distinct credit scores, a small business owner can get two separate cards from the same vendor. This effectively doubles buying power.

Another advantage is that even start-ups can do this. Going to a bank for a business loan can be a formula for frustration. But building small business credit, when done correctly, is a plan for success.

Consumer credit scores are dependent on payments but also various other components like credit use percentages.

But for business credit, the scores actually merely hinge on whether a small business pays its debts on a timely basis.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet. Save your money during the recession!

Establishing small business credit is a process, and it does not occur without effort. A company will need to actively work to develop business credit.

Nevertheless, it can be done readily and quickly, and it is much more rapid than building consumer credit scores.

Merchants are a big part of this process.

Undertaking the steps out of order will lead to repetitive denials. No one can start at the top with business credit. For instance, you can’t start with retail or cash credit from your bank. If you do, you’ll get a denial 100% of the time.

A company has to be fundable to credit issuers and merchants.

For this reason, a business will need a professional-looking website and email address. And it needs to have website hosting bought from a company like GoDaddy.

And also, business telephone and fax numbers must have a listing on ListYourself.net.

Likewise, the business telephone number should be toll-free (800 exchange or similar).

A company will also need a bank account dedicated strictly to it, and it must have all of the licenses necessary for running.

These licenses all must be in the particular, accurate name of the small business. And they need to have the same business address and telephone numbers.

So keep in mind, that this means not just state licenses, but possibly also city licenses.

Visit the IRS web site and acquire an EIN for the company. They’re free of charge. Choose a business entity such as corporation, LLC, etc.

A company can get started as a sole proprietor. But they will more than likely want to switch to a variety of corporation or an LLC.

This is in order to decrease risk. And it will maximize tax benefits.

A business entity will matter when it comes to taxes and liability in the event of litigation. A sole proprietorship means the business owner is it when it comes to liability and taxes. No one else is responsible.

If you operate a company as a sole proprietor, then at the very least be sure to file for a DBA. This is ‘doing business as’ status.

If you do not, then your personal name is the same as the small business name. Consequently, you can wind up being personally liable for all small business debts.

In addition, according to the IRS, by having this structure there is a 1 in 7 chance of an IRS audit. There is a 1 in 50 probability for corporations! Steer clear of confusion and significantly decrease the odds of an IRS audit at the same time.

Start at the D&B website and get a cost-free D-U-N-S number. A D-U-N-S number is how D&B gets a small business into their system, to generate a PAYDEX score. If there is no D-U-N-S number, then there is no record and no PAYDEX score.

Once in D&B’s system, search Equifax and Experian’s sites for the small business. You can do this at www.creditsuite.com/reports. If there is a record with them, check it for accuracy and completeness. If there are no records with them, go to the next step in the process.

By doing so, Experian and Equifax will have something to report on.

First you need to establish trade lines that report. This is also called vendor credit. Then you’ll have an established credit profile, and you’ll get a business credit score.

And with an established business credit profile and score you can begin to get retail and cash credit.

These kinds of accounts tend to be for the things bought all the time, like marketing materials, shipping boxes, outdoor work wear, ink and toner, and office furniture.

But to start with, what is trade credit? These trade lines are credit issuers who will give you starter credit when you have none now. Terms are generally Net 30, rather than revolving.

Therefore, if you get an approval for $1,000 in vendor credit and use all of it, you will need to pay that money back in a set term, such as within 30 days on a Net 30 account.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet. Save your money during the recession!

Net 30 accounts must be paid in full within 30 days. 60 accounts have to be paid fully within 60 days. In contrast to with revolving accounts, you have a set time when you have to pay back what you borrowed or the credit you made use of.

To start your business credit profile the proper way, you ought to get approval for vendor accounts that report to the business credit reporting agencies. When that’s done, you can then make use of the credit.

Then pay back what you used, and the account is on report to Dun & Bradstreet, Experian, or Equifax.

Not every vendor can help like true starter credit can. These are vendors that will grant an approval with a minimum of effort. You also want them to be reporting to one or more of the big three CRAs: Dun & Bradstreet, Equifax, and Experian.

You want 3 of these to move onto the next step, which is retail credit.

Non-Reporting Trade Accounts can also be helpful. While you do want trade accounts to report to at the very least one of the CRAs, a trade account which does not report can yet be of some worth.

You can always ask non-reporting accounts for trade references. Additionally credit accounts of any sort will help you to better even out business expenditures, consequently making financial planning less complicated. These are companies like PayPal Credit, T-Mobile, and Best Buy.

Once there are 3 or more vendor trade accounts reporting to at least one of the CRAs, then move to retail credit. These are service providers which include Office Depot and Staples.

Only use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, use the company’s EIN on these credit applications.

Are there more accounts reporting? Then move onto fleet credit. These are businesses like BP and Conoco. Use this credit to buy fuel, and to repair and maintain vehicles. Just use your SSN and date of birth on these applications for verification purposes. For credit checks and guarantees, make certain to apply using the business’s EIN.

Discover our business credit and finance guide, jam-packed with new ways to finance your business without emptying your wallet. Save your money during the recession!

Have you been sensibly handling the credit you’ve up to this point? Then move to more universal cash credit. These are businesses like Visa and MasterCard. Only use your Social Security Number and date of birth on these applications for verification purposes. For credit checks and guarantees, use your EIN instead.

One example is the Fuelman MasterCard. They report to D&B and Equifax Business. They need to see a PAYDEX Score of 78 or better. And they also want you to have 10 trade lines reporting on your D&B report.

These are commonly MasterCard credit cards. If you have more trade accounts reporting, then these are doable.

Know what is happening with your credit. Make sure it is being reported and address any inaccuracies ASAP. Get in the habit of checking credit reports. Dig into the particulars, not just the scores.

We can help you monitor business credit at Experian and D&B for 90% less than it would cost you at the CRAs.

At Equifax, you can monitor your account at: www.equifax.com/business/business-credit-monitor-small-business.

Update the info if there are errors or the info is incomplete. At D&B, you can do this at: https://iupdate.dnb.com/iUpdate/viewiUpdateHome.htm. For Experian, go here: www.experian.com/small-business/business-credit-information.jsp. And for Equifax, go here: www.equifax.com/business/small-business.

So, what’s all this monitoring for? It’s to challenge any problems in your records. Mistakes in your credit report(s) can be corrected. But the CRAs usually want you to dispute in a particular way.

Get your company’s PAYDEX report at: www.dnb.com/about-us/our-data.html. Get your company’s Experian report at: www.businesscreditfacts.com/pdp.aspx?pg=SearchForm. And get your Equifax business credit report at: www.equifax.com/business/credit-information.

Disputing credit report inaccuracies normally means you send a paper letter with copies of any proof of payment with it. These are documents like receipts and cancelled checks. Never send the originals. Always send copies and keep the originals.

Fixing credit report errors also means you precisely spell out any charges you contest. Make your dispute letter as clear as possible. Be specific about the problems with your report. Use certified mail so that you will have proof that you sent in your dispute.

Dispute your or your business’s Equifax report by following the instructions here: www.equifax.com/small-business-faqs/#Dispute-FAQs.

You can dispute inaccuracies on your or your business’s Experian report by following the instructions here: www.experian.com/small-business/business-credit-information.jsp.

And D&B’s PAYDEX Customer Service contact number is here: www.dandb.com/glossary/paydex.

Always use credit responsibly! Don’t borrow beyond what you can pay off. Track balances and deadlines for repayments. Paying off in a timely manner and in full will do more to elevate business credit scores than pretty much anything else.

Growing small business credit pays off. Great business credit scores help a business get loans. Your loan provider knows the company can pay its financial obligations. They know the business is for real.

The small business’s EIN links to high scores and credit issuers won’t feel the need to request a personal guarantee.

Business credit is an asset which can help your company for many years to come. Learn more here and get started toward growing business credit.

For each of these alternatives, you will definitely have a preferable rate of interest if your credit score is better than poor. And you will most likely have more options, so you can shop around and compare plans.

If your business can stand by until your credit– either company or personal or both– improves, then your alternatives will significantly improve, too. In the meantime, unsecured business loans in a recession can help. Use this pause in our lives to improve your credit. Because the COVID-19 situation will not last forever.

The post The Truth about Unsecured Business Loans in a Recession appeared first on Credit Suite.

Almost everyone uses email.

But here’s the sweet part.

The people you’re trying to reach or retain already have active email addresses. Heck, most of them used or would use one to sign-up for your service or product.

If you can get into (and stay) in people’s inbox, you can make a ton of money. Data shows companies can generate $38 for every $1 email investment.

Unfortunately, getting into an inbox is not a stroll in the park.

Now that’s where the best email marketing companies come in.

These companies will help you to strategize, collect relevant email addresses, create, and manage email marketing campaigns that drive business growth.

How do I know this?

Our team at Neil Patel Digital vetted hundreds of email marketing companies based on their brand reputation, client portfolio, ratings, and their areas of expertise.

The result?

The very top email agencies you can trust. Not only would they get you into the inbox of your ideal customers, but these companies can keep you in there till you turn prospects into brand advocates.

I’m confident the best email marketing companies listed above and reviewed below are reliable because of their proven track records.

Hire any of them, according to your needs, and they’ll help you to turn email marketing into a growth channel for your business.

Without further ado, let’s explore each of these companies and see for yourself why we consider them the very best.

Email marketing is effective, no doubt. But it has its downside too.

According to two different studies, between 0.19% and 0.52% of your email subscribers would unsubscribe per email you send.

Now, guess what was one of the top three reasons found Jilt, an email marketing software, responsible for why people unsubscribe from emails?

Bad content!

In other words, irrespective of how excellent your email marketing strategy is, writing killer emails that resonate with your prospects and keeps you in their inbox requires excellent content.

And that’s where we, Neil Patel Digital, come in. It is also why clients, from startups to enterprise brands, love working with us.

Email is also an excellent channel for content distribution.

However, he quality of content has to be amazing. If not, your unsubscribes will tank the ROI of your email campaigns.

Again, this is one area we stand out from the crowd.

At Neil Patel Digital, our email content service starts by producing engaging content your customers and prospects will love.

Then, we use email marketing as one of the channels to promote it:

You can check out Neil Patel Digital’s content services here.

For in-house teams looking for rapid email marketing turn around, InboxArmy comes highly recommended.

As a full-service email management company, InboxArmy offers a spectrum of services, including email templates’ design, custom coding, and 360-degree email marketing management:

This agency offers volume-based pricing for companies and white label services for fellow digital marketing agencies, which goes to prove their experience.

And they serve clients from government agencies like Texas Health Resources, to companies such as LandCentral, Airbnb, Jockey, and several others.

When it comes to email marketing, Software as a Service (SaaS) brands have special needs.

First, when new trial users sign-up, they need excellent email onboarding sequences to convert them into happy, paying customers.

And if an existing customer stops using your product or wants to churn, you can retain them with relevant churn email.

Fix My Churn specializes in these two areas:

Fix My Churn collaborates with tech companies with a monthly subscription business model.

The company applies top-notch SaaS copywriting skills to craft relationship-based email sequences to keep customers happy.

Action Rocket needs no introduction in the enterprise email marketing sector.

This company even partners with the top email marketing software brands like MailChimp, Litmus, and Campaign Monitor to drive innovation in the email space.

Action Rocket has years of experience strategizing and executing custom HTML and CSS email and CRM development programs for enterprise companies:

Founded in 2011, the company works with a knit-team of experienced developers who are excellent at strategy, design, and coding of complex and customized email programs.

And their clientele speaks for themselves, including the BBC, Marks & Spencer, Global Radio, and many others.

SmartMail is the Done For You (DFY) email marketing company that comes highly recommended by ecommerce businesses.

This company handles everything ecommerce email marketing for online stores. And excel most at launching campaigns based on automated triggers.

Across the customer lifetime cycle, SmartMail is exceptional at strategizing and executing optimized email marketing campaigns for ecommerce businesses.

And they have a track record and excellent results to show.

SmartMail has generated over $187 million in revenues for ecommerce brands via email, sent billions of emails, and serve over 87 businesses, including Skechers, French Connection, Cotton:On, and others.

What characteristics make an email marketing company great?

They are as follows.

Most companies get buried in strategizing and outlining plans for email marketing.

What they wrongly relegate to the backseat?

The quality of your email’s content goes a long way in determining how effective your email marketing campaigns would be.

A fundamental characteristic of the top email marketing company is to focus on creating engaging content to power your email campaigns.

And a world-class email company will help you blent top-tier content with amazing promotions to also get the conversions that you need. Great companies blend the two seamlessly.

An email marketing company that claims to be among the best must have something to back that claim up.

One of such things is their client portfolio.

Who have they implemented a series of email marketing campaigns for? Were those campaigns successful?

Anyway, you don’t even need to ask a top email marketing company those questions, as you’ll find the answers in their clients’ portfolio.

And looking out for this portfolio-displaying characteristic in top email marketing also does you good.

It helps you to see who they have helped and to decide if they’ll be a good fit for your company.

At Neil Patel Digital, we have a clients you may recognize.

In its 40 years of existence, email marketing has evolved tremendously.

What worked yesterday may not work today. And even if it does work, it may require a different approach.

Due to the always-evolving nature of trends and modern strategies applicable to email marketing, top companies must keep pace with these changes to deliver the best work.

Thought-leadership is how the top email marketing brands keep such needed pace with the industry.

And they do this by sharing new learnings, experiments, emerging strategies, and tactics publicly to retain brand reputation among other professionals.

So, you should do some research and look out for this characteristic, as it is an excellent way to spot a top email marketing company.

Anyone can claim to be the best, but it is what others say about them shows their competence most.

In the business setting, you’ll find how past and existing clients feel and say of a company’s work in the testimonials they leave behind.

The truth is executing a successful email campaign that drives growth for a company is hard.

A notable characteristic of the top email marketing company is the real-life testimonials they receive from clients for their work publicly.

A lot of thought goes into a successful email marketing campaign.

From strategy to the acquisition of email addresses, selection of email marketing software, email copywriting, and campaign management, they all require some different kind of expertise.

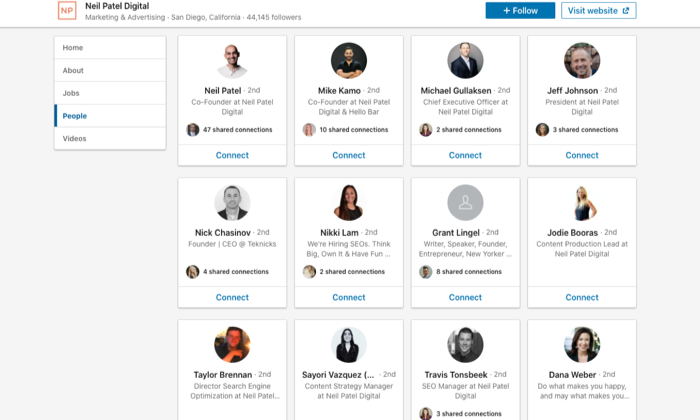

Established email marketing brands are never a one-person show. It is usually a team of experts, collaborating to drive results.

And that’s one characteristic of top email marketing companies: Displaying the entire team that works to plan, execute, manage, and optimize email campaigns:

Ultimately, an exceptional email marketing company to help you turn email into a real business growth channel that:

But to get to these benefits, there are steps to expect before you start working with one. Some of the most notable ones are what follows.

As you saw in the review and categorization of the best email marketing companies based on their areas of expertise above, not all can serve all clients across all industries.

To determine if they can solve your specific problems, excellent email marketing companies start by getting to fill an inquiry form.

Filling this inquiry form allows you to share your challenges and business goals related to email marketing.

After filling this form, expect a discovery session where an expert would talk one-on-one with you to understand your needs better.

A discovery call allows the company to gain more clarity and context about your business needs relevant to email. But, don’t expect them to propose a solution right off the bat.

Top email marketing brands would typically use what you shared with them to delve into research.

From there, they can make sense of how to tackle your challenges and identify the best possible strategies they can deploy to work with you.

Expect to receive a summary of their research and recommendations via email or another call, which usually ends with deciding if you’re fit to work together.

If everything goes well up to this point, and you like their recommendations, expect a contract that outlines what a top email marketing company would do, and what it’ll cost to work with you.

This contract also outlines project timelines and deliverables, legal requirements to work together, and your expected investment.

If the contract, project scope, deliverables, pricing, and others look good, exceptional email marketing companies would have a custom onboarding process to initiate the process of working with your company.

This onboarding process will help you and the company to establish an understanding of how to manage your product, and any other thing necessary for a smooth working relationship.

Don’t make the mistake of starting email marketing later on.

Most businesses recognize the need for social media, SEO, content marketing, and others early on, but they leave emails to the backseat because it is not trending.

Well, you shouldn’t.

A few reasons to take start email marketing from day one are:

Marketers who used email marketing to segment their audience said they saw a 760% increase in revenue.

That’s unreal.

Whether you do email yourself and get help from one of the top email companies, get started today.

The post The 5 Best Email Marketing Companies of 2020 appeared first on Neil Patel.

What are backlinks to search engine optimization? Short version: They’re signals Google uses to determine if your website is a reputable resource worthy of citation. The long and sweet version? The more quality backlinks pointing to your website, the higher your chances of ranking for profitable keywords and competitive search queries that drive sales. You’ll …

The post The 5 Best Link Building Companies of 2020 first appeared on Online Web Store Site.

The post The 5 Best Link Building Companies of 2020 appeared first on Buy It At A Bargain – Deals And Reviews.

As a small business owner, you probably can’t put your hand on enough capital, at least not immediately. And if you are new, then it’s even harder. There will always be more ramp up costs than you think. So if you have ever wondered where to establish business credit, and how to actually get a credit line, it comes from really two areas. Those are business credit cards and loans. Your business needs a recession business credit line: here is how to get one (or more!)

For both types of credit line, it helps to have good business credit. And if you do not have what is considered a good business credit score, or if your company is new and has not yet established its own credit, then creditors will look at your personal credit score.

You want them looking at your business credit score.

But let’s start with recession-era funding.

The number of US financial institutions as well as thrifts has been decreasing slowly for 25 years. This is coming from consolidation in the market in addition to deregulation in the 1990s, reducing barriers to interstate banking. See: https://www.fundera.com/blog/happened-americas-small-businesses-financial-crisis-six-years-start-crisis-look-back-10-charts

Assets concentrated in ever‐larger banks is problematic for local business owners. Big financial institutions are much less likely to make small loans. Economic downturns imply financial institutions end up being a lot more careful with lending. Luckily, business credit does not rely on financial institutions.

Let’s go over credit lines.

A credit line, or line of credit (LOC), is an agreement between a borrower and a bank or private investor that establishes a maximum loan balance which a borrower can access.

A borrower can access funds from their line of credit anytime, so long as they don’t go over the maximum set in the arrangement, and as long as they meet any other conditions of the financial institution or investor like making prompt payments.

Your business needs a credit line because credit lines deliver many distinct advantages to borrowers including versatility. Borrowers can apply their line of credit and only pay interest on what they use, in contrast to loans where they pay interest on the sum total borrowed. Credit lines can be reused, so as you acquire a balance and pay that balance off, you can use that accessible credit again, and again.

Credit lines are revolving accounts similar to credit cards, and contrast other forms of funding like installment loans. In many cases, lines of credit are unsecured, much the same as credit cards are. There are some credit lines which are secured, and thus easier to get approval for

Credit lines are the most frequently sought after loan type in the business world even though they are popular, true credit lines are unusual, and hard to find. Many are also very difficult to qualify for requiring good credit, good time in business, and good financials. But there are various other credit cards and lines which few know about that are attainable for startup companies, poor credit, or even if you have absolutely no financials.

The majority of credit line varieties that most entrepreneurs imagine come from standard banks and conventional banks use SBA loans as their principal loan product for small business owners. This is because SBA guarantees as much as 90% of the loan in the event of a default. These credit lines are the hardest to get approval for because you must qualify with SBA and the bank.

There are two fundamental sorts of SBA loans you can normally obtain. One type is CAPLines. There are in fact 4 types of CAPLines that can work for your small business.

You can also get a smaller loan amount more quickly using the SBA Express program. The majority of these programs offer BOTH loans and revolving lines of credit.

From the SBA … “CAPLines is the umbrella program under which SBA helps business owners meet short-term and cyclical working capital needs”. Loan amounts are offered up to $5 million. Loan qualification criteria are the same as with other SBA programs.

This one advances against foreseen inventory and accounts receivables. It was designed to assist seasonal businesses. Loan or revolving are on offer.

This one finances the direct labor and material costs of performing assignable contracts. Loan or revolving types are available.

This one was made for general contractors or builders constructing or renovating industrial or residential buildings. This line is for fund direct labor-and material costs, where the building project functions as the collateral. Loan or revolving types are on offer.

Borrowers must use the loan proceeds for short term working capital/operating needs. If the proceeds are used to acquire fixed assets, lender must refinance the portion of the line used to acquire the fixed asset into an appropriate term facility no later than 90 days after lender discovers the line was used to finance a fixed asset.

You can get approval for as much as $350,000. Interest rates vary, with SBA allowing banks to charge as much as 6.5% over their base rate. Loans in excess of $25,000 will need collateral.

To get approval you’ll need great personal and company credit. Plus the SBA says you should not have any blemishes on your report. An acceptable bank score demands you have at least $10,000 in your account over the most recent 90 days.

You’ll also need a resume showing you have business sector experience and a well put together business plan. You will need three years of company and personal tax returns, and your business returns should show a profit. And, you’ll need a recent balance sheet and income statement, thereby showing you have the cash to pay back the loan.

To get approval you’ll need account receivables, but just if you have them. As for the collateral to offset the risk, often all company assets will function as collateral, and some personal assets which also include your home. It’s not unheard of to need collateral equivalent to 50% or more of the loan amount. You also need articles of incorporation, business licenses, and contracts with all third parties, and your lease.

Private investors and alternative lenders also offer credit lines. These are easier to qualify for than conventional SBA loans. They also necessitate much less documentation for approval. These alternative SBA credit lines ordinarily require good personal credit for approval.

Unlike with SBA, many of them don’t require good bank or business credit approval. Most of these sorts of programs call for two years’ of tax returns. Tax returns have to show a profit. Rates can vary from 7% or greater and loan amounts range from $25,000 into the millions.

Loan amounts are normally based on the revenues and/or profits on tax returns. In some cases lenders may ask for other financials such as a profit and loss statement, balance sheets, and income statements.

Merchant cash advances have rapidly become the most popular way to get financing, in large part because of the simple qualification process. Businesses with $10,000 in revenue can get approval, with the business owner having scores as low as 500.

Some sources have now even begun to offer credit lines that accompany their loans. You must have at least $10,000 in revenue for approval. You should be in business for at least one year, however three years is better. Lenders usually want to see a credit score of 650 or better for approval.

Loan amounts are usually about $20,000. Lenders routinely do pull your business credit, so you ought to have some credit already and sometimes lenders will want to see tax returns.

Rates differ, due to the risk for this program, and there aren’t a lot of funding sources who offer it.

You can get financing despite personal credit if you have some form of stocks or bonds. You can also get approval if you have somebody intending to use their stocks or bonds as collateral for financing.

Personal credit quality doesn’t matter as there are no consumer credit criteria for approval. You can get approval for as much as 90% of the value of your stocks or bonds. Rates are commonly lower than 2%, making this one of the lowest rate credit lines you’ll ever see. You can still earn interest as you typically do on your stocks and bonds.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business. Get money even during the worst of a recession.

Credit cards typically offer 0% intro rates for up to two years. This is also very useful for startups especially. And credit lines let you take out more cash at a more affordable rate than do cards. These are the main two differences that will have an effect on you between credit cards and credit line.

Investopedia even says that “lines of credit are potentially useful hybrids of credit cards.”

Both cards and lines are revolving credit. Credit lines are more difficult to qualify for as card approvals are typically very fast, many times automated, while at the same time line require an in-depth underwriting review. Lines usually offer lower rates, according to Bankrate card rates average 13% while lines average 4%.

The majority of these cards report to the consumer credit reporting agencies. They all demand a personal guarantee from you. You can get approval typically for one card max as they stop approving you when you have two or more inquiries on your report.

Most credit card providers furnish business credit cards including Capital One, Chase, and American Express. These have rates similar to consumer rates and limits are also similar.

Some of them report to the consumer reporting agencies, some report to the business bureaus. Approval requirements resemble consumer credit card accounts.

Often, when you apply for a credit card you put an inquiry on your consumer report. When other lenders see these, they will not approve you for more credit since they have no idea how much other new credit you have lately obtained.

So they’ll only approve you if you have no more than two inquiries on your report within the most recent six months. Any more will get you refused.

With this form of business financing, you work with a lender who concentrates on securing business credit cards. This is a very unusual, very little know of program that few lending sources offer. They can usually get you three to five times the approvals that you can get on your own.

This is because they are familiar with the sources to apply for, the order to apply, and can time their applications so the card issuers won’t reject you for the other card inquiries. Individual approvals oftentimes range from $2,000 – 50,000.

The end result of their services is that you oftentimes get up to five cards that mimic the credit limits of your highest limit accounts now. Multiple cards create competition, and this means they will raise your limits, frequently within 6 months or fewer of first approval.

Approvals can go up to $150,000 per entity like a corporation. With a hybrid credit line they actually get you three to five business credit cards which report just to the business credit reporting agencies. This is significant, something most lenders don’t offer or advertise. Not only will you get funds, but you build your business credit as well so in three to four months, you can then use your new corporate credit to get even more money.

The lender can also get you low introductory rates, often 0% for 6-18 months. You’ll then pay normal rates after that, typically 5-21% APR with 20-25% APR for cash advances. And they’ll also get you the very best cards for points. So this means you get the very best rewards.

Just like with just about anything, there are HUGE benefits in dealing with a source who specializes in this area. The results will be much better than if you try to go at it alone.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business. Get money even during the worst of a recession.

You must have excellent personal credit right now, preferably 685 or better scores, the same as with all business credit cards. You shouldn’t have any negative credit on your report to get approval. And you must also have open revolving credit on your consumer reports now and you’ll need to have five inquiries or fewer in the most recent six months reported.

All lenders within this space charge a 9-15% success based fee and you only pay the cost off of what you secure. Bear in mind, you get a ton of extra advantages and about three to five times more cash in this program than you could get on your own, which is why there’s a fee, the same as all other lending programs.

You can get approval making use of a guarantor and you can even use a number of guarantors to get even more money. There are likewise other cards you can get utilizing this very same program but these cards only report to the consumer reporting agencies, not the business reporting agencies. They are consumer credit cards versus business credit cards.

They furnish similar benefits which include 0% intro annual percentage rates and five times the amount of approval of a single card but they’re a lot easier to get approval for.

You can get approval with a 650 score and seven inquiries (or fewer) in the most recent six months and you can have a bankruptcy on your credit and other negative items. These are a lot easier to get approval for than unsecured corporate credit cards.

With all previous cards above, you have to have good consumer credit to get approval but what happens if your personal credit is not good, and you do not have a guarantor?

This is the time when building corporate credit makes a great deal of sense even when you have good personal credit, setting up your company credit helps you get even more money, and without having a personal guarantee.

Demolish your funding problems with our rock-solid guide about 27 killer ways to get cash for your business. Get money even during the worst of a recession.

As with personal credit, it seems as if the companies which don’t need credit are the ones which are more likely to get it. But that is banks and creditors doing better and more responsible business for themselves – if your company is at risk of defaulting, they either want to give you more expensive terms, or not extend any credit at all.

Here are a few tips on building and improving better business credit.

One way is to change your business entity. That is, to either incorporate or become a limited liability company (LLC). Get a separate identification number from the IRS, too, in order to really demonstrate there is a difference.

A D-U-N-S number is necessary in order for D&B to start tracking your business’s credit. Dun & Bradstreet requires that you register on their site before they will give you a D-U-N-S number. Registration is simple and, once you have said yes to the Terms and Conditions, then the next screen is a dashboard. This is where you either ask for a D-U-N-S number or you can look up to see if your business is already in the listings. If your company is already in the listings, then click on your business name to make any needed changes.

Another means of establishing business credit is by going to your bank and establishing business credit lines or cards with personal guarantees. This means you are personally responsible in case the business defaults or any loans or bills go into collections. Hence if your company is in a high risk business or a seasonal one, you might find your car on the line.

Make sure when you get these kinds of business credit cards, they have the personal guarantee removal feature built right in. Keep your credit utilization at one third of your credit ceiling or less (that is, don’t use more than about one third of your total available credit). Make certain to pay on time every time.

You can use an SBA loan for funding. Repaying this kind of a loan will help you build your business credit score. Or you can apply for a business credit card from a specific store. Often, these store credit cards do not need a personal guarantee. Make sure to choose a store where your business makes a lot of purchases. And don’t forget about those timely payments!

If your business credit score is good (or if it has improved), then go to your local bank and ask for a credit line. And if you use a particular bank for payroll, you can try that one. If not (or maybe you’re a one-person shop and you don’t really have payroll at all), then you can also take your request to the bank where you do all your personal banking.

Because they already know you, and if they have seen you pay your credit cards on time and keep a good balance in your accounts, they may be more interested in giving your small business a line of credit even without guarantees or a serious credit check. No matter which kind of lending institution you try, go in with good credit as that will make your terms more favorable and it can generally mean the difference between any credit line and none.

Your business can get credit cards and financing, if you know where to look. Learn more here and get started toward establishing business credit. Keep your small business afloat with a credit line.

The post Get a Recession Business Credit Line – Here’s How appeared first on Credit Suite.

The post Get a Recession Business Credit Line – Here’s How appeared first on Buy It At A Bargain – Deals And Reviews.